Healthcare Virtual Assistants Market Outlook:

Healthcare Virtual Assistants Market size was valued at USD 1.7 billion in 2025 and is projected to reach USD 19.5 billion by the end of 2035, rising at a CAGR of 30.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of healthcare virtual assistants is estimated at USD 2.1 billion.

There is an immense exposure for the market, which is appreciably transforming the delivery of healthcare services by enhancing operational efficiency. Since there has been a constant rise in the adoption of digital health technologies, healthcare providers are also increasingly opting for these assistants. For instance, in June 2025, Calm Health reported that it is expanding globally, starting with the UK and Canada, with its exclusive application that provides enhanced access to mental health support. The firm also underscored that the move aims to help bridge care gaps, boost engagement with employers and health benefits, and support multinational workforces.

Furthermore, the existing demand for personalized healthcare experiences and widespread adoption of telemedicine is also elevating the potential in this landscape. In May 2025, Curative Health Insurance Company introduced Curative Telehealth, which is a new $0 virtual care service available across all nations. The firm also reported that the service aims to transform the healthcare experience by enabling earlier intervention and reducing costs. This innovative platform offers members instant access to healthcare anytime and anywhere, thereby positively influencing market growth.

Key Healthcare Virtual Assistants Market Insights Summary:

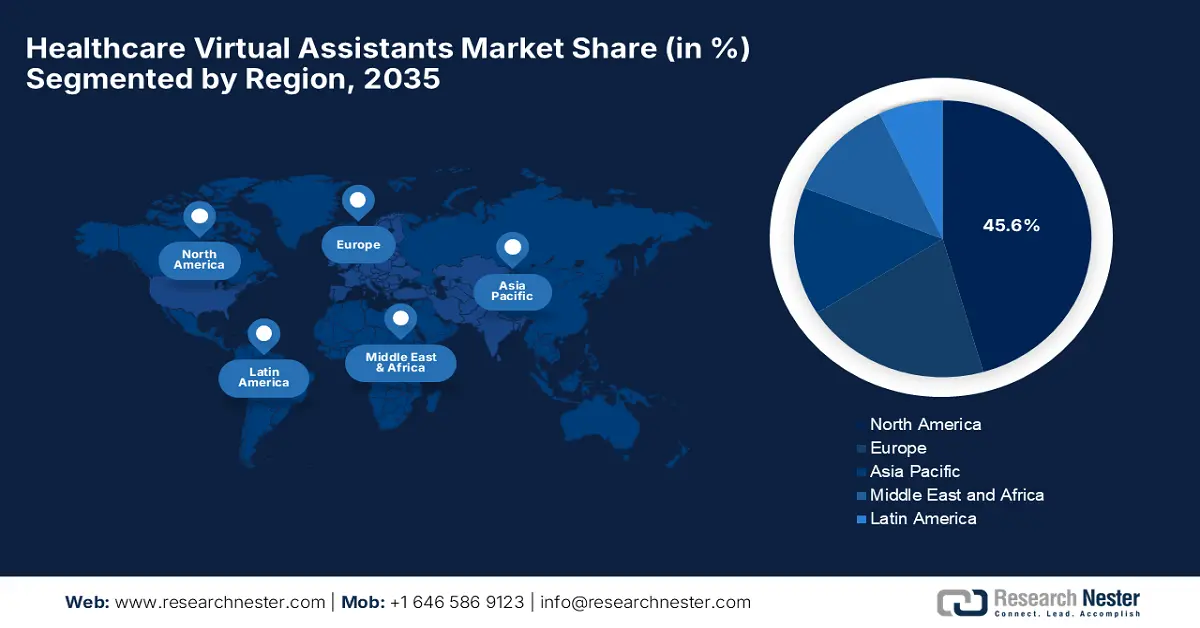

Regional Highlights:

- By 2035, North America in the healthcare virtual assistants market is set to secure a 45.6% share, underpinned by its advanced digital health infrastructure and strong AI uptake.

- Across 2026–2035, Asia Pacific is anticipated to emerge as the fastest-expanding region, bolstered by rising digital health adoption and government-backed healthcare innovation.

Segment Insights:

- By 2035, the cloud-based solutions segment in the healthcare virtual assistants market is projected to hold a 55.5% share, reinforced by its HIPAA-compliant scalability and interoperability.

- By 2035, the AI-powered voice assistants segment is expected to capture a 42.3% share, fueled by the expanding role of telemedicine and EHR documentation.

Key Growth Trends:

- Continued demand for efficient patient management

- Advancements in AI & natural language processing

Major Challenges:

- Data Privacy Concerns

- Integration with established systems

Key Players: Nuance Communications (Microsoft), IBM Watson Health, Amazon Web Services (AWS), Google Health (DeepMind), Suki AI, Sensely, Orbita, Babylon Health, SOPHiA GENETICS, Ada Health, Infermedica, Samsung SDS, LG CNS, Practo, DocDoc (HCAH), Telstra Health.

Global Healthcare Virtual Assistants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.7 billion

- 2026 Market Size: USD 2.1 billion

- Projected Market Size: USD 19.5 billion by 2035

- Growth Forecasts: 30.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 25 August, 2025

Healthcare Virtual Assistants Market - Growth Drivers and Challenges

Growth Drivers

-

Continued demand for efficient patient management: This aspect creates encouraging business opportunities for players involved in the market. The virtual assistants help with 24/7 support and appointment scheduling, which makes it widely preferable. In August 2025, the WHO notified that it partnered with the Society of Robotic Surgery to expand equitable access to virtual care and telesurgery, with a prime focus on underprivileged regions. Also, the collaboration aims to leverage cutting-edge surgical technology to improve health outcomes across the world.

-

Advancements in AI & natural language processing: The AI technologies enable virtual assistants to understand and respond more accurately, which is a principal driving factor in this landscape. In this regard, Outcomes4Me, in May 2025, stated that it secured $21M for to boost the AI-driven cancer care platform and to enhance personalized treatment and global reach. The company also stated that with over 280,000 users, the platform empowers patients with real-time insights to navigate their care journey, hence a positive market outlook.

-

Growing emphasis on reducing healthcare expenses: The virtual assistants remarkably help lower operational costs by automating routine tasks, thereby reducing the administrative burden. For instance, in March 2025, Emirates announced its collaboration with Parsys Telemedicine to incorporate advanced telemedicine equipment on 300 aircraft. Besides this new system features HD video conferencing, remote assessment, and ECG capabilities for emergency care during flights, hence benefiting overall market expansion.

Global Diabetes Prevalence by Region (2024)

|

Region |

Number of Diabetes Cases (Millions) |

|

North America and the Caribbean |

56 |

|

South and Central America |

35 |

|

Europe |

66 |

|

Middle East and North Africa |

85 |

|

South-East Asia |

107 |

|

Western Pacific |

215 |

Source: International Diabetes Federation (IDF) Diabetes Atlas 2024

Patient Portal Access by Healthcare Provider Type in the U.S. (2022)

|

Category |

Percentage |

Key Insights |

|

Primary Care Provider's Office |

63% |

Most common portal access, reflecting strong adoption in routine healthcare |

|

Other Healthcare Provider |

50% |

Indicates significant use across specialists/hospitals (multiple selections allowed) |

|

Insurer |

32% |

Suggests growing integration of insurance records with patient portals |

|

Clinical Laboratory |

29% |

Highlights direct access to lab results, bypassing provider intermediaries |

|

Pharmacy |

26% |

Ties to prescription management and refill services |

|

No Online Medical Record or Portal |

23% |

Nearly 1 in 4 individuals lack digital access, signaling gaps in adoption |

|

Other (Unspecified) |

22% |

May include telehealth platforms or employer health programs |

Source: ASTP

Challenges

-

Data Privacy Concerns: Despite the rapid growth rate, the market still faces issues in terms of sensitive patient data, representing privacy as the major concern. Also, the service providers must comply with the stringent administrative bodies to protect user information. Besides, the implementation of strong encryption and secure authentication is extremely expensive and complicated, creating hesitation among players to operate in this field.

-

Integration with established systems: This is yet another factor negatively influencing upliftment in the market. The need to work smoothly with the existing health records, systems in healthcare facilities, and insurance databases makes it challenging as well. But as the healthcare IT environments are often fragmented, they use different standards, making integration difficult. Therefore, the lack of proper integration, virtual assistants struggle to delivering their full potential, thus hindering adoption.

Healthcare Virtual Assistants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

30.1% |

|

Base Year Market Size (2025) |

USD 1.7 billion |

|

Forecast Year Market Size (2035) |

USD 19.5 billion |

|

Regional Scope |

|

Healthcare Virtual Assistants Market Segmentation:

Deployment Segment Analysis

The cloud-based solutions segment is projected to garner the largest revenue share of 55.5% in the market during the forecast timeline. The HIPAA-compliant scalability and interoperability are the key factors behind this robust dominance. In February 2025, Royal Philips announced that it expanded to Europe with its cloud-based HealthSuite Imaging services on Amazon Web Services, which was followed by successful deployments across over 150 sites in North and Latin America. Therefore, this move accelerates cloud adoption across Europe’s healthcare systems, offering scalable, secure imaging solutions, hence a wider segment scope.

Type Segment Analysis

The AI-powered voice assistants segment is expected to gain a significant share of 42.3% in the market by the end of 2035. The growth in the segment originates from the evolution of telemedicine and EHR documentation. In July 2024, Suki declared that it is partnering with Federally Qualified Health Centers (FQHCs) and Community Health Centers across the U.S., including Utah Navajo Health System, Access Health Louisiana, and others, to address care gaps in underserved populations. The firm also noted that by automating clinical documentation with voice AI, Suki reduces provider burnout and enables clinicians to focus more on patients during visits.

End user Segment Analysis

The hospitals & clinics segment is anticipated to grow at a considerable rate in the market during the discussed timeframe. The workforce shortages and operational efficiency are readily fueling the subtypes' growth in this field. In March 2025, AvaSure introduced a new Virtual Care Assistant that is built using Oracle Cloud Infrastructure (OCI) and NVIDIA AI tools to enhance hospital care and clinical workflows. The product remarkably addresses communication gaps and prioritizes patient needs in real-time, and the AI-driven assistant is integrated into AvaSure’s Intelligent Virtual Care Platform.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Deployment |

|

|

Type |

|

|

End user |

|

|

Product |

|

|

Application |

|

|

Technology |

|

|

User Interface |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Healthcare Virtual Assistants Market - Regional Analysis

North America Market Insights

North America is the dominating region in the healthcare virtual assistants market, which is expected to capture the largest revenue share of 45.6% by the end of 2035. The region’s digital health infrastructure, widespread AI adoption, and high telehealth emergence are key factors behind this dominance. For instance, in July 2025, Google Research introduced new multimodal models in its MedGemma collection, which are especially designed to advance health AI development. The firm further stated that these lightweight, open models support complex medical text and imaging tasks while preserving privacy and efficiency, hence a positive market outlook.

The U.S. is showcasing its leadership in the regional healthcare virtual assistants market, which is effectively supported by the presence of major pioneers. In July 2025, the White House declared its initiative with pioneers such as Amazon, Google, and Apple to create a patient-centric healthcare ecosystem. Besides, the plan focuses on improving data interoperability, enabling secure sharing, and user-friendly digital health tools. Hence, such initiatives reinforce the country’s captivity in this field, thereby fostering a favourable business environment.

Medicare Telehealth Services Originating Site Facility Fee (Q3014)

|

Year |

Medical Economic Index (MEI%) |

Facility Fee Amount |

|

2025 |

3.5% |

$31.01 |

|

2024 |

4.6% |

$29.96 |

|

2023 |

3.8% |

$28.64 |

|

2022 |

2.1% |

$27.59 |

Source: Centers for Medicare & Medicaid Services

Canada in the healthcare virtual assistants market is gaining enhanced traction as a result of technological adoption and substantial funding grants for digital health integration. In January 2025, Cboe Canada Inc. declared that the public listing of a diagnostic software company, Light AI. Besides, the Vancouver-based firm develops AI-powered software to detect bacterial and viral infections. Therefore, such milestones support Light AI’s growth and innovation in healthcare diagnostics, hence creating an optimistic market opportunity.

APAC Market Insights

Asia Pacific in the healthcare virtual assistants market is likely to exhibit the fastest growth during the forecast period. The increasing digital health adoption and government support for healthcare innovation are key factors behind this leadership. For instance, in August 2022, Carlyle stated that it acquired a significant minority stake in CureApp through a JPY 7 billion Series G investment, bringing its total funding to JPY 13.4 billion. The company further stated that this is the first prescription digital therapeutic for hypertension, hence benefiting the overall market.

China in the healthcare virtual assistants market is gaining enhanced momentum owing to its push toward digital health transformation. Besides the huge investments in AI technologies and the development of smart hospitals is fueling assets of this landscape. In June 2025, Ant Group launched its new AI healthcare app called AQ that offers over 100 AI-powered features, such as doctor recommendations, report analysis, and personalized health advice. Besides, it also connects users to services from more than 5,000 hospitals and nearly 1 million doctors, hence facilitating greater revenue in this field.

India is rapidly growing in the healthcare virtual assistants market due to rising healthcare digitization and the government's emphasis on improving access to care across diverse regions. In August 2025, the Government of India proclaimed that over 79.91 crore (799.1 million) Ayushman Bharat Health Accounts have been created, enabling citizens to securely access and share digital health records. Also, the ABDM has established a strong digital health infrastructure with 4.18 lakh (~4.19 million) health facilities and 6.79 lakh (~6.80 million) healthcare professionals registered, hence emphasizing privacy, consent, and digital empowerment.

eSanjeevani National Telemedicine Service: Key Performance Metrics (2025)

|

Metric |

Value |

|

Total Patients Served |

402,865,185 |

|

Providers Onboarded |

224,967 |

|

Health Centers (Spokes) |

134,577 |

|

Speciality Hubs Established |

17,663 |

|

Medical Specialities Covered |

150 |

Source: MoHFW

Europe Market Insights

Europe is also displaying notable progress in the global market, with extended support from investments and growing adoption of technologies in the healthcare systems. As per a WHO report published in October 2024, all 53 member states adopted the Regional Digital Health Action Plan, making progress across 18 key focus areas. The report further underscored that over 100 institutions from 24 countries joined the Strategic Partners’ Initiative, wherein more than 30 countries participated in capacity-building programs on telemedicine, big data, and health information systems, hence suitable for market expansion.

German market is poised for sustainable upliftment, highly attributed to its push for hospital digitization and improved patient engagement. In this regard, Bayer in December 2024 announced its plan to acquire HiDoc Technologies and commercialize the Cara Care app, which is a digital, evidence-based therapeutic option for irritable bowel syndrome (IBS). This application deliberately integrates pharmacological, dietary, and psychological treatments in a patient-centered approach, thereby benefiting the country’s market.

The U.K. also holds a strong position in the healthcare virtual assistants market, which is gaining recognition as a result of the National Health Service (NHS) and private providers looking to modernize services through AI and automation. In June 2025, the country’s government announced that the NHS App is being transformed to give every patient equal access to personalized healthcare information and choices, helping to reduce health inequalities across the country’s territory. The report also stated that since the middle of 2024, these innovations have saved millions of clinical hours and over £600 million by improving efficiency and reducing missed appointments.

Key Healthcare Virtual Assistants Market Players:

- Nuance Communications (Microsoft)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IBM Watson Health

- Amazon Web Services (AWS)

- Google Health (DeepMind)

- Suki AI

- Sensely

- Orbita

- Babylon Health

- SOPHiA GENETICS

- Ada Health

- Infermedica

- Samsung SDS

- LG CNS

- Practo

- DocDoc (HCAH)

- Telstra Health

The worldwide healthcare virtual assistants market is readily dominated by the U.S.-based technological pioneers such as Nuance, IBM, and AWS, who are emphasizing AI and cloud infrastructure. Nuance leads the overall market with a great focus on ambient clinical documentation, whereas IBM Watson Health is targeting oncology. Meanwhile, the Japan-based players such as SoftBank and Hitachi are focusing on robotics along with hospital automation. Therefore, these competitive dynamics will ensure a profitable business atmosphere in this landscape.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In August 2024, My Mountain Mover notified that it reached a milestone, deploying 1,000 highly skilled Filipino medical virtual assistants to healthcare organizations located across all nations. The company also noted that it leverages AI-driven recruitment and advanced technology.

- In February 2023, Ada Health Inc. announced the launch of its first digital condition-based care journey in collaboration with Pfizer to help users clearly analyze their risk of progression in terms of COVID-19 and connect with healthcare providers for evaluation and treatment as well.

- Report ID: 5276

- Published Date: Aug 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.