Hardware-in-the-Loop Market Outlook:

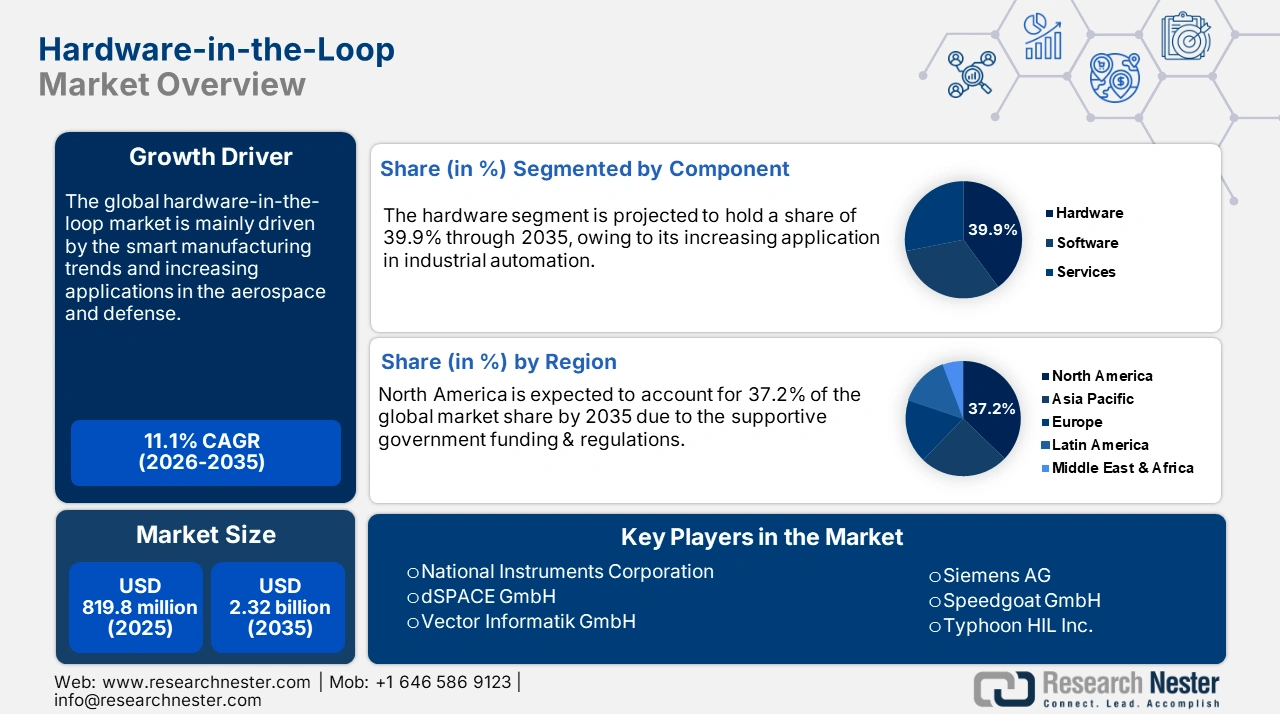

Hardware-in-the-Loop Market size was USD 819.8 million in 2025 and is estimated to reach USD 2.32 billion by the end of 2035, expanding at a CAGR of 11.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of hardware-in-the-loop is assessed at USD 910 million by 2026.

The hardware-in-the-loop (HIL) production is focused on the supply chain of high-precision electronics, software platforms, digital equipment, and embedded solutions. The steady supply of these systems reflects a positive influence on the trade of hardware-in-the-loop components. The majority of raw materials imported by Western manufacturers, particularly from the U.S., are from Asia Pacific countries such as Japan, Taiwan, and South Korea. The analysis by OEC states that in 2024, the U.S. imported semiconductor devices worth USD 22.6 billion, ranking them as the country’s 20th most imported product out of 1,227 categories. The leading countries of these imports were Vietnam (USD 5.64 billion), Thailand (USD 3.5 billion), Malaysia (USD 3.26 billion), India (USD 1.62 billion), and Cambodia (USD 1.35 billion).

The report by the U.S. Geological Survey (USGS) also suggests that China is the largest producer and exporter of global rare earth exports. This underscores that the trade of raw materials vital for the production of hardware-in-the-loop components is dominated by the Asia Pacific. Furthermore, the public investments in the HIL-aligned technologies in the energy sector are set to gain traction in the coming years. Thus, the public funding moves are estimated to play a vital role in accelerating the adoption of hardware-in-the-loop solutions.

Key Hardware in the Loop Market Insights Summary:

Regional Highlights:

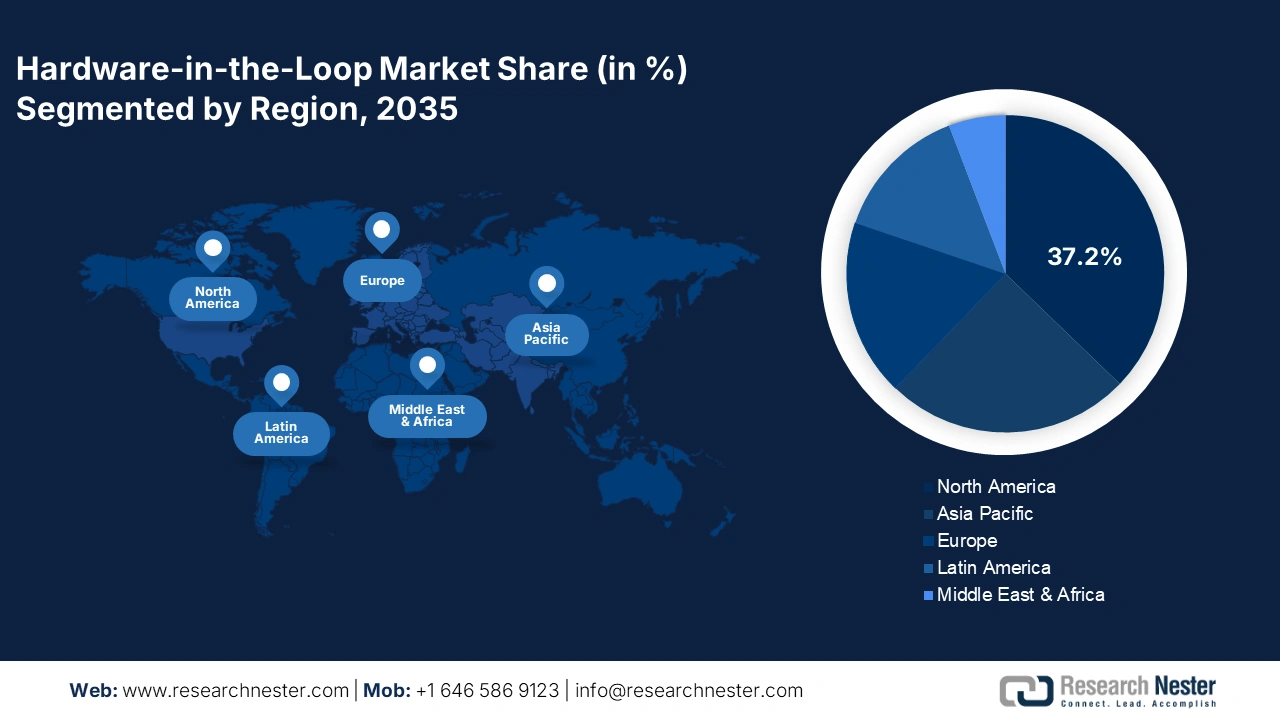

- North America is estimated to hold a 37.2% share of the hardware-in-the-loop market by 2035, owing to the growing adoption of real-time system simulation across aerospace, automotive, and industrial automation sectors.

- Asia Pacific is anticipated to register a robust CAGR of 10.7% between 2026 and 2035, propelled by the adoption of HIL platforms driven by automation, digitalization trends, and technological precision in Japan and South Korea.

Segment Insights:

- The automotive segment is projected to capture 42.8% of the hardware-in-the-loop market by 2035, driven by rising ADAS adoption, autonomous driving, and electric vehicle demand.

- The hardware segment is expected to account for 39.9% market share by 2035, owing to industrial automation, smart manufacturing, and the need for robust real-time processors for validation.

Key Growth Trends:

- Aerospace and defense modernization

- Industry 4.0 & digital twin integration

Major Challenges:

- Cross-border data transfer limitations

- Infrastructure gaps

Key Players: dSPACE GmbH, Vector Informatik GmbH, OPAL-RT Technologies Inc., Siemens AG, Speedgoat GmbH, Typhoon HIL Inc., AVL List GmbH, ETAS GmbH (Robert Bosch GmbH Subsidiary), Keysight Technologies, MathWorks Inc., IPG Automotive GmbH, LHP Engineering Solutions, Tata Elxsi Ltd., DreamEDGE Sdn. Bhd., Yokogawa Electric Corporation, Hitachi Astemo Ltd., Honda R&D Co. Ltd., Mitsubishi Electric Corporation, Fujitsu Limited.

Global Hardware in the Loop Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 819.8 million

- 2026 Market Size: USD 910 million

- Projected Market Size: USD 2.32 billion by 2035

- Growth Forecasts: 11.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, South Korea, France

- Emerging Countries: China, India, Brazil, Canada, Italy

Last updated on : 30 September, 2025

Hardware-in-the-Loop Market - Growth Drivers and Challenges

Growth Drivers

- Aerospace and defense modernization: The HIL solutions are in demand in the aerospace and military sectors owing to their advanced capabilities in avionics, navigation systems, and flight control. Initiatives, such as the European Space Agency’s 2024–2030 Horizon Defense Roadmap, the U.S. Air Force Digital Twin Initiative, and NASA’s Artemis, drive a high demand for real-time validation systems. The swift rise in digital transformation is also expected to fuel the adoption of hardware-in-the-loop components in the years ahead. Furthermore, the high defense budgets aimed at enhancing digitalization are creating a profitable environment for HIL manufacturers.

- Industry 4.0 & digital twin integration: The smart manufacturing trend is propelling the employment of hardware-in-the-loop solutions in various industries such as automotive, energy, and aerospace. Digital twin and Industry 4.0, coupled with HiL systems, are estimated to gain traction during the foreseeable period. Germany, Japan, and South Korea are expected to drive the adoption of hardware-in-the-loop components owing to their leadership in innovations.

- Autonomous driving / ADAS, safety & regulatory compliance: As cars become more autonomous, there is a need for strict testing of sensors, perception and decision architectures, and control algorithms. Regulatory bodies are increasingly mandating safety and performance standards, which require exhaustive validation. HIL is needed in recreating scenarios, including rare or dangerous ones, in controlled, repeatable environments. For instance, in March 2024, Rohde & Schwarz partnered with IPG Automotive to improve automotive radar HIL testing, aiming to shift more of autonomous driving testing from outdoor tracks to lab/controlled environments. This is aimed at boosting test coverage, compliance, and speeding development.

Challenges

- Cross-border data transfer limitations: The strict regulations aimed at protecting the personal data of consumers from cross-border transfers are expected to limit the hardware-in-the-loop solution sales to some extent. The EU's General Data Protection Regulation (GDPR) and the Digital Personal Data Protection Act (2023) of India are some of the polices that restrict the flow of data internationally, which limits the production and improvement of cloud-based HIL solutions. Overall, the strategic collaborations with public entities or other industry giants are expected to aid in combating this challenge.

- Infrastructure gaps: The installation of hardware-in-the-loop solutions is a complex process and requires advanced infrastructure. The unavailability of digital technologies and robust connectivity networks in the budget-constrained markets is estimated to challenge the revenue growth of the HIL manufacturers. However, the industry giants are considering such regions as high-potential markets and expanding their facilities to capitalize on high opportunities from untapped markets.

Hardware-in-the-Loop Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.1% |

|

Base Year Market Size (2025) |

USD 819.8 million |

|

Forecast Year Market Size (2035) |

USD 2.32 billion |

|

Regional Scope |

|

Hardware-in-the-Loop Market Segmentation:

Application Segment Analysis

The automotive segment is expected to capture 42.8% of the global hardware-in-the-loop market share by 2035. The increasing popularity of advanced driver assistance systems (ADAS) and autonomous driving is estimated to fuel the adoption of hardware-in-the-loop systems. The evolving mandatory regulations, including the EU’s Road Safety Programme (2021–2030) and the U.S. Department of Transportation’s AV policy updates (2023), are accelerating the employment of automotive HIL platforms. In addition, the increasing demand for electric vehicles is expected to fuel the adoption of HIL solutions in the coming years.

Component Segment Analysis

The hardware segment is projected to account for 39.9% of the global market share throughout the study period. The industrial automation and smart manufacturing trends are fueling the application of real-time processors and I/O modules in HIL testing. The key factors driving this growth are the rising adoption of digital twin technology and predictive maintenance solutions. The rise of electric and autonomous vehicles demands powerful hardware platforms to validate powertrain, battery, and ADAS systems under dynamic conditions. This growth is also supported by industries like aerospace and energy, where safety-critical systems need robust real-world interfacing.

Moreover, hardware upgrades enable integration with digital twins and cloud-based testing frameworks, enhancing scalability and precision. For example, in May 2025, OPAL-RT Technologies introduced its OP1400-BM Power-HIL system, made to provide cost-efficient, real-time hardware for testing power electronics and control systems in both academic and industrial applications.

End use Segment Analysis

The OEM segment is expected to register rapid growth during the forecast period, as automotive, aerospace, and industrial equipment manufacturers rely on HiL systems to reduce prototyping costs and accelerate time-to-market. The segment growth can be attributed to the surge in electric vehicles, autonomous driving systems, and stricter safety regulations, all of which demand extensive real-time validation. OEMs benefit from HiL by copying thousands of test scenarios, including rare edge cases, without risking physical prototypes. This not only enhances product reliability but also assures compliance with evolving global standards.

Our in-depth analysis of the hardware-in-the-loop market includes the following segments:

|

Segments |

Subsegments |

|

Component |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hardware-in-the-Loop Market - Regional Analysis

North America Market Insights

The North America hardware-in-the-loop market is estimated to hold 37.2% of the global revenue share through 2035. The growing adoption of real-time system simulation in the aerospace, automotive, and industrial automation sectors is contributing to the high sales of HIL solutions. The supportive government policies are also accelerating the employment of HIL solutions. These investment moves are expected to lay the groundwork for technologies, including HIL. The telecom and automotive industries are driving high sales of HIL platforms.

The market for hardware-in-the-loop in the U.S. is projected to capture a notable share by the end of 2035. The ongoing research and development activities in the defense, automotive, and semiconductor industries are set to fuel the employment of HIL platforms in the coming years. The rapid rise in digital infrastructure and industrial automation is creating a profitable environment for hardware-in-the-loop components manufacturers. The swift expansion of the telecommunication sector is also playing a vital role in the commercialization of the HIL solutions.

The sale of HiL solutions in Canada is expected to increase throughout the forecast period. The digitalization of industrial infrastructure and automotive innovation are fueling the HIL solution trade in the country. The market is witnessing growth as industries like clean energy, power transmission, and utility grid infrastructure increasingly require real-time validation for control and protection systems. Regulatory pressure, plus the shift toward electrification and renewable energy, is pushing utilities and OEMs in Canada to adopt HiL to avoid costly failures and accelerate deployment.

Additionally, technology innovation centres, simulation facilities, and government grants are supporting local HiL adoption, making it more accessible to SMEs and large enterprises alike. Hitachi Energy Canada received USD 21.59 million from the federal government for constructing a new HVDC simulation centre in Montreal and to modernize its transformer factory in Varennes. This facility will enable real-time simulation of HVDC systems to test control and protection systems before actual installation.

APAC Market Insights

The Asia Pacific hardware-in-the-loop market is anticipated to increase at a robust CAGR of 10.7% between 2026 and 2035. The strong presence of end users such as automotive, electronics, aerospace, and energy is propelling the adoption of hardware-in-the-loop platforms. The automation and digitalization trend is accelerating the demand for HIL solutions in the region. Japan and South Korea’s precision in technological advancements are set to drive the sales of innovative HIL solutions.

China, being a hub for semiconductor and other electronic component manufacturing, is likely to drive the sales of HIL solutions in the years ahead. The government's digital transformation strategies are expected to open new opportunities for hardware-in-the-loop component manufacturers in the country. Furthermore, the government's efforts to streamline hardware-software integration through standards and subsidies are estimated to boost the adoption curve.

The India market for hardware-in-the-loop is expected to expand notably through 2035. The rise in public-private investments for R&D, advancements in semiconductor manufacturing, and booming automotive trade are set to increase the revenue shares of HIL manufacturers. The auto makers are increasingly using HIL platforms for EV powertrain testing purposes. The Digital India and Semicon India initiatives are also contributing to the overall market growth. The modernization of the aerospace and defense sector is poised to offer profits to HIL producers in the years ahead.

Europe Market Insights

Europe is expected to register rapid growth during the forecast period owing to stringent automotive safety and emissions regulations, strong aerospace & defense sectors, and commitment to electrification & renewable energy. The regulatory regimes, such as Euro NCAP, EU CCAM roadmaps, and emissions directives, demand extensive testing, including edge cases, which pushes OEMs and Tier-1 suppliers to adopt HIL. Also, many European countries subsidize R&D, and there is a solid base of skilled engineering workforce and centres of excellence. The rise of electric vehicles mandates testing of battery, inverter, and thermal management systems under varied loads, which HIL enables more cheaply, reliably, and early. In February 2024, NORDEX SE in Europe introduced a new power Hardware-in-the-Loop (PHIL) test bench developed by R&D Test Systems, to do grid compliance testing of electric drivetrains, allowing simulation of diverse grid conditions and fault scenarios in the lab instead of field testing.

The UK HiL market is growing rapidly as the country pushes toward a low-carbon automotive future, greater electrification, and deployment of connected/autonomous vehicle systems, and the need to secure telecoms and infrastructure. Government funding, labs, test facilities, and policy initiatives are helping firms and universities build better HIL infrastructure. Also, efforts to increase domestic testing and lower dependence on overseas proving grounds motivate investment in local lab infrastructure. For instance, in May 2024, Fortescue acquired a UK automotive test lab in Banbury, previously owned by Arrival, to bolster its in-house prototype R&D and testing for electrification. The site includes test cells, battery development area, EMC chamber, etc., which are relevant for HIL-type testing of drive units, control units, etc.

Germany remains one of the leading HIL markets in Europe, driven by its large automotive OEMs, strong Tier-1 supplier base, and robust industrial and automotive R&D ecosystem. German firms are at the forefront of electrification, autonomous driving, ADAS sensor development, and aerospace systems, all of which require extensive hardware-software integration testing in real-time. In addition, the country’s push in industrial automation, robotics, and mechatronics further supports the growth of HIL systems.

Key Hardware-in-the-Loop Market Players:

- National Instruments Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- dSPACE GmbH

- Vector Informatik GmbH

- OPAL-RT Technologies Inc.

- Siemens AG

- Speedgoat GmbH

- Typhoon HIL Inc.

- AVL List GmbH

- ETAS GmbH (Robert Bosch GmbH Subsidiary)

- Keysight Technologies

- MathWorks Inc.

- IPG Automotive GmbH

- LHP Engineering Solutions

- Tata Elxsi Ltd.

- DreamEDGE Sdn. Bhd.

- Yokogawa Electric Corporation

- Hitachi Astemo, Ltd.

- Honda R&D Co., Ltd.

- Mitsubishi Electric Corporation

- Fujitsu Limited

The prime companies in the hardware-in-the-loop market are employing various organic and inorganic strategies such as technological innovations, mergers & acquisitions, new product launches, partnerships & collaborations, and regional expansion to uplift their sales and position. Germany and the U.S.-based players are entering into strategic collaborations with automotive and aerospace companies to boost their dominance in particular sectors. The growth in public-private investments is also expected to fuel the revenue shares of industry giants in the years ahead.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, Tata Elxsi, a global leader in design and technology services, and Suzuki Motor Corporation, a Japan-based multinational mobility company, officially opened the SUZUKI–TATA ELXSI Cloud HIL Center in Trivandrum, India. This facility marks Suzuki’s first full-vehicle, cloud-enabled HIL validation center and is the second engineering center under the Tata Elxsi–Suzuki collaboration, after the Offshore Development Center (ODC) in Pune.

- In March 2025, Emerson announced the launch of a novel software solution, NI LabVIEW+ Suite for HIL, designed to address the rising needs of developing and testing embedded software. This suite offers tailored solutions, including test, validation, and data analysis tools for hardware-in-the-loop (HIL) customers.

- Report ID: 3831

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hardware in the Loop Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.