AI in Computer Aided Synthesis Planning Market Outlook:

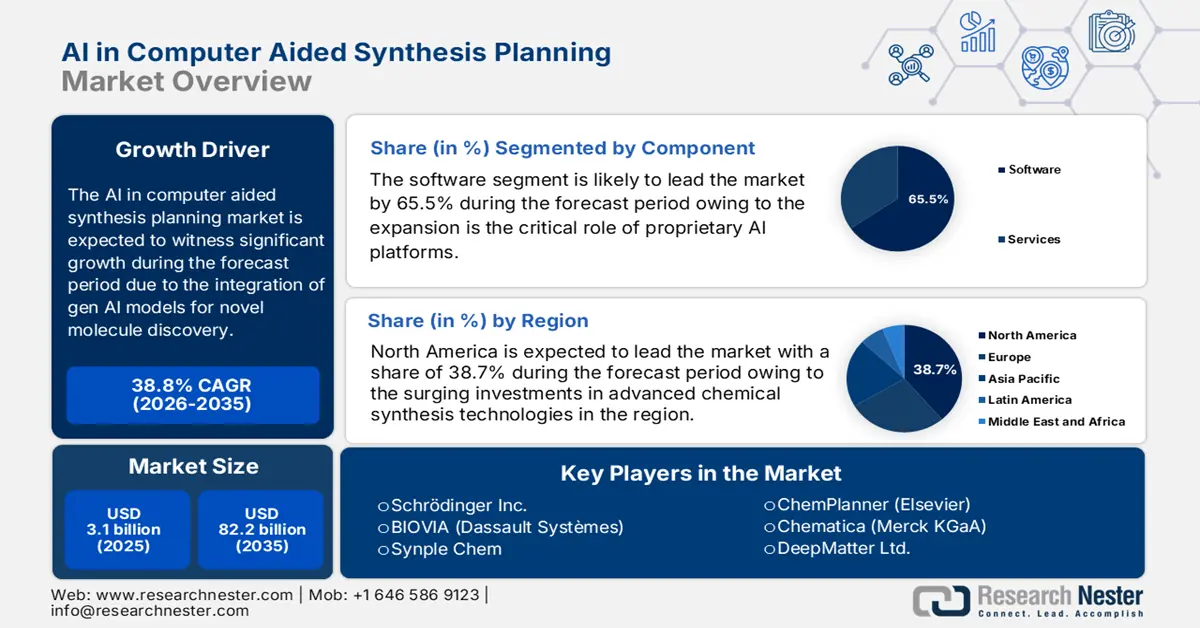

AI in Computer Aided Synthesis Planning Market size was valued at USD 3.1 billion in 2025 and is projected to reach USD 82.2 billion by the end of 2035, rising at a CAGR of 38.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of AI in computer aided synthesis planning is estimated at USD 4.3 billion.

The AI in computer aided synthesis planning sector is slated to experience explosive growth due to the surge in the adoption of deep learning algorithms and retrosynthesis automation across notable domains such as chemical and pharmaceuticals. According to the American Planning Association report in September 2022, the adoption of AI in planning disciplines, which also include chemical process design is poised to grow over 20% in the upcoming years. This rise reflects on the broader shift toward data-driven decision-making in R&D environments. Further, the growth reduces the human error and surges the time to market of the new compound.

Industrial deployment is being shaped by policy frameworks that promotes the adoption of advanced digital technologies. The European Medicines Agency has undertaken a qualification process for new methodologies, creating a route for regulatory approval of innovative tools, such as AI-based techniques for drug discovery. The technological innovation and the increased demand for synthesis procedures have led CASP to become a critical tool for businesses. The market demand for CASP with AI is expected to continue steadily during the forecast period.

Key AI in Computer Aided Synthesis Planning Market Insights Summary:

Regional Highlights:

- The software segment of the AI in computer aided synthesis planning market is projected to account for a 65.5% share by 2035, propelled by the increasing reliance on proprietary AI platforms and algorithms that underpin computer-aided synthesis innovation.

- The small molecule drug discovery segment is anticipated to dominate through 2035, driven by the growing utilization of AI to accelerate therapeutic development and significantly reduce discovery timelines.

Segment Insights:

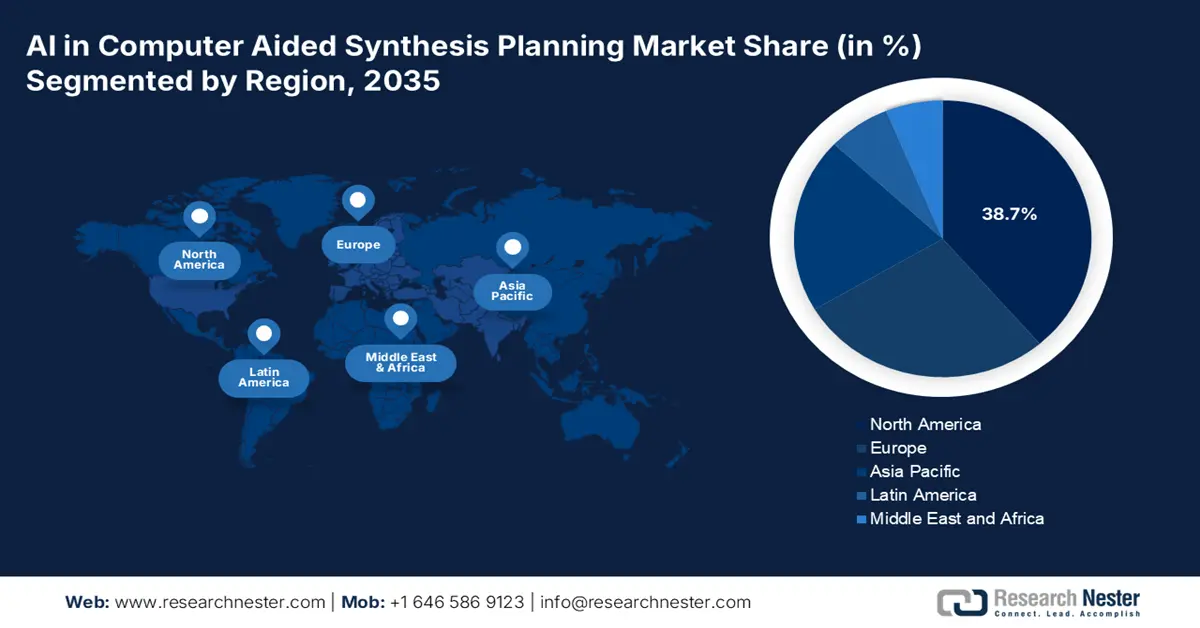

- North America is projected to secure a 38.7% revenue share by 2035 in the AI in computer aided synthesis planning market, owing to substantial investments in advanced chemical synthesis technologies and robust federal funding for AI-based biomedical research.

- Asia Pacific region is expected to expand at the fastest CAGR of 20.0% during 2026–2035, stimulated by increasing adoption of AI-driven drug discovery and innovations in combinatorial chemistry and neural network-based reaction prediction.

Key Growth Trends:

- Rising adoption of AI-driven green chemistry for sustainable routes

- Growing integration of generative AI models for novel molecule discovery

Major Challenges:

- Complexity in balancing scalability with security in AI-driven synthesis platform

- Development cost and uncertain reimbursement

Key Players: Schrödinger Inc., BIOVIA (Dassault Systèmes), Synple Chem, ChemPlanner (Elsevier), Chematica (Merck KGaA), DeepMatter Ltd., Benchling, Synthace, AiCure / Covance, MolPort AI, Lonza, Molecule.one, BioSolveIT, ChemAxon, Menten AI, HitGen, Cloud Pharmaceuticals, Synple Chem Australia, SK Biopharmaceuticals AI Lab, Bioneutra AI Labs

Global AI in Computer Aided Synthesis Planning Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.1 billion

- 2026 Market Size: USD 4.3 billion

- Projected Market Size: USD 82.2 billion by 2035

- Growth Forecasts: 38.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, China, Singapore, Australia

Last updated on : 10 October, 2025

AI in Computer Aided Synthesis Planning Market - Growth Drivers and Challenges

Growth Drivers

- Rising adoption of AI-driven green chemistry for sustainable routes: The regulatory and societal pressure to adopt environmentally sustainable chemical processes has increased in the current decade. This change is a key factor driving the expansion of AI in the CASP market. The use cases of AI algorithms have improved synthesis pathways by predicting the reaction outcomes. Furthermore, the advent of regulatory push, such as the EU’s Green Deal, ties up with the rising demand for AI-powered synthesis planning to reduce the ecological footprint of chemical processes. Additionally, with the rising funding for green chemistry innovations, the demand is predicted to expand by the end of 2035.

- Growing integration of generative AI models for novel molecule discovery: The rapid rise of generative AI models has significantly improved CASP use cases. Gen AI models assist in the autonomous design of novel chemical structures with tailored properties. In terms of measurable impact, the drug discovery timelines have been reduced in specific cases due to the application of AI. For example, the ACS Publications study in 2023 has stated that Insilico Medicine utilized gen AI platform Chemistry42 to identify a novel antibiotic candidate and was successful to combat methicillin-resistant Staphylococcus aureus.

- Government funding for AI in healthcare: Government investment for AI in synthesis planning is a key driver demanding the market. As per the World Economic Forum report in November 2024, the investments of Venture-capital in health AI in the U.S. reached USD 11 billion. These funding create a AI-ready datasets for therapeutic development, including synthesis planning. This non-dilutive funding de-risks early-stage innovation and stimulates market growth by supporting foundational research that private companies can commercialize.

AI-Discovered Small Molecules in Clinical Development

|

Drug Name |

Company |

Indication |

AI Application |

Development Stage |

Timeline Reduction |

|

Baricitinib |

Benevolent AI/Eli Lilly |

COVID-19, RA |

AI literature mining and target network analysis for repurposing |

Approved |

3 months for new indication identification |

|

DSP-1181 |

Exscientia |

Obsessive-compulsive disorder |

AI-driven small-molecule design |

Phase I completed, discontinued |

12 months vs. 4–6 years |

|

Halicin |

MIT/Broad Institute |

Antibiotic-resistant infections |

Deep learning virtual screening |

Preclinical |

N/A (novel mechanism) |

|

EXS-21546 |

Exscientia |

Inflammatory diseases |

AI-guided small-molecule optimization |

Preclinical |

~24 months vs. 5+ years |

|

BEN-2293 |

BenevolentAI |

Atopic dermatitis |

AI target discovery |

Phase I |

~30 months |

Source: NLM August 2025

Challenges

- Complexity in balancing scalability with security in AI-driven synthesis platforms: The surging adoption of AI in CASP has led to the demand for scalable platforms to handle chemical datasets. The surging demand has created an impediment in scaling platforms as they often outpace the cybersecurity training of employees, expanding the vulnerability to complex cyberattacks. Additionally, another challenge to scaling is the requirement to adhere to strict data protection regulations, as it can delay deployment.

- Development cost and uncertain reimbursement: The R&D for durable AI synthesis platforms is expensive, involving multidisciplinary teams. A strong impediment is the lack of well-defined reimbursement codes by payers such as the U.S. Centers for Medicare & Medicaid Services (CMS). In the absence of a well-defined mechanism for the reimbursement of healthcare systems using these products, their uptake is inhibited, thus presenting a large financial hurdle for manufacturers who cannot prove a clear revenue path.

AI in Computer Aided Synthesis Planning Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

38.8% |

|

Base Year Market Size (2025) |

USD 3.1 billion |

|

Forecast Year Market Size (2035) |

USD 82.2 billion |

|

Regional Scope |

|

AI in Computer Aided Synthesis Planning Market Segmentation:

Component Segment Analysis

The software dominates the segment and is poised to hold the share value of 65.5% by 2035. The segment is driven by critical role of proprietary AI platforms and algorithms that form the core intellectual property for computer-aided synthesis planning. The NLM study in August 2025 depicts that the AI software platforms such as DeepChem, RDKit, and OpenEye (open-source and commercial) have democratized access to AI capabilities in drug discovery, enabling researchers to model molecular interactions, optimize drug candidates, and predict ADMET properties efficiently. Further, demand for licensed, scalable software solutions from pharmaceutical and biotechnology companies surges software segment's leading position.

Application Segment Analysis

The small molecule drug discovery in the AI in computer aided synthesis planning market is the most significant application, fueled by the strong demand for new therapeutics and AI capabilities to considerably lower development timelines. According to the NLM study in August 2025, the conventional drug discovery timeline is 10 to 15 years and cost over USD 2.6 billion per drug can be reduced by 30% to 50% in phases involving AI application, especially preclinical discovery. The European Medicines Agency supports the qualification of novel methodologies, including AI tools, for drug development, providing a regulatory pathway for their use. Further, the Association of the British Pharmaceutical Industry indicates that numerous companies are spending on AI to strengthen small-molecule R&D pipelines.

End user Segment Analysis

Pharmaceutical and biotechnology companies lead end-user segment and is expected to hold a considerable share by 2035. The segment is driven due to immense pressure to improve R&D productivity. The German Federal Ministry of Education and Research funds consortia like the Pharmaceutical Initiative which explicitly promotes AI integration for synthesis. Government initiatives like the Life Sciences Vision in the UK require the use of AI to preserve competitive edge, allocating large sums of money to industry adoption.

Our in-depth analysis of the global AI in computer aided synthesis planning market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Application |

|

|

End user |

|

|

Deployment Mode |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

AI in Computer Aided Synthesis Planning Market - Regional Analysis

North America Market Insights

The North America AI in computer aided synthesis planning market is projected to account for a leading revenue share of 38.7% during the forecast timeline. A major driver of the regional market is the considerable investments in advanced chemical synthesis technologies in the region. Additionally, due to the early adoption of AI solutions, the demand for AI-powered CASP platforms has heightened in the region. medicine research, creating a requirement for an AI-powered CASP platform. Federal funding through agencies like the NIH for AI-based biomedical research is a significant growth driver, positioning North America for substantial market expansion through 2035.

The U.S. market for AI in computer aided synthesis planning is projected to expand its major revenue share in North America during the forecast period. The U.S. AI in CASP is characterized by the thriving ecosystem of biotechnology startups and an emphasis on reducing drug development pipelines through the use of AI. As per the NIH report in September 2022, an investment of 130 million was allocated for the use of AI in biomedical research commodities which includes synthesis planning. Additionally, the U.S. market has benefited from venture capital, which has fueled the heightened AI integration in pharmaceutical R&D.

Canada's market is driven by its foundational role in modern AI research and a cohesive national strategy. As per the Government of Canada report in June 2025, USD 300 million is invested in smaller chemical, pharmaceutical, and biotech firms in Canada to implement CASP tools, create AI-powered synthesis workflows, and speed up drug and chemical discovery. In addition, Genome Canada also supports large research studies making use of AI to design synthetic biological pathways, thereby integrating these technologies in the R&D environment

APAC Market Insights

The APAC AI in computer aided synthesis planning market has registered the fastest expansion at a CAGR of 20.0% during the forecast period. The APAC AI in CASP sector’s expansion is supported by the surging demand for AI-driven drug discovery in lucrative sectors such as healthcare and pharmaceuticals. Additionally, South Korea’s AI-driven combinatorial chemistry platforms are able to optimize high-throughput synthesis for biologics, whilst Japan’s bespoke neural networks are predicting stereoselective reactions. Such advancements are poised to ensure the sustained growth of the APAC AI in CASP market.

The China AI in computer aided synthesis planning market is estimated to maintain a significant share in APAC during the forecast period. A major driver of the China market is the thriving AI ecosystem, which is poised to drive the demand for AI-powered CASP platforms. The CKGSB Knowledge report in March 2025 states that the global investors are pouring USD 60 billion in healthcare AI startups to promote development and deployment of advanced technology in the sector. In terms of use cases, the synthetic biology startups in China are leveraging AI to reengineer microbial pathways for rare alkaloid production. The project is projected to support advancements by positioning the country as a premier destination for advancements in the chemical industry, supported by AI.

National government policy and substantial public investment is focused to lead the AI in Computer Aided Synthesis Planning Market in Japan. The Japan Agency for Medical Research and Development is a key player to promote AI-based drug discovery and synthesis planning acceleration. Firms such as Elix and LINC is the first and the pioneering firm to monetize an AI drug discovery platform by harnessing federated learning-based AI models trained with data based on the inputs from 16 pharmaceutical firms, in July 2025. This move accelerates the use of computer-aided synthesis planning tools in the country.

Europe Market Insights

The computer aided synthesis planning AI market in Europe is driven by strong EU-wide funding programs and a robust pharmaceutical R&D industry. European Health Data Space (EHDS) enable data sharing for research, and heavy investment from Horizon Europe, targeting in particular AI in medicine and health. One of the main trends is a combination of scientific research centers, like the European Molecular Biology Laboratory (EMBL), and pharmaceutical companies in the development of open-source AI tools to be used for chemical synthesis.

Germany is the dominant market in Europe and is powered by its globally leading chemical and pharmaceutical industries. According to the GTAI report of 2025, the German digital health market is expected to grow to EUR 57 billion by the end of 2025. This expansion fortifies the country's AI ecosystem, creating data infrastructure, compute power, and regulatory environments that are supportive for adjacent AI application areas such as drug discovery and synthesis planning. Additionally, this foundation places Germany at the forefront of developing AI-powered Computer-Aided Synthesis Planning (CASP) technologies and accelerating innovation in pharma research.

The UK is the second leading country in Europe and is fueled by a powerful life sciences ecosystem and post-Brexit regulatory agility. According to the UK government report in June 2025, a new OpenBind consortium was introduced to make the country lead in AI-driven drug discovery by reducing the cost of drug discovery and development up to £100 billion. On the other hand, the Association of the British Pharmaceutical Industry reports that the UK life sciences sector is attracted in venture capital for AI and data-driven companies in 2023. This convergence of targeted government grants, accessible health data, and strong private investment creates a highly competitive environment for AI in synthesis planning.

Key AI in Computer Aided Synthesis Planning Market Players:

- Schrödinger Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BIOVIA (Dassault Systèmes)

- Synple Chem

- ChemPlanner (Elsevier)

- Chematica (Merck KGaA)

- DeepMatter Ltd.

- Benchling

- Synthace

- AiCure / Covance

- MolPort AI

- Lonza

- Molecule.one

- BioSolveIT

- ChemAxon

- Menten AI

- HitGen

- Cloud Pharmaceuticals

- Synple Chem Australia

- SK Biopharmaceuticals AI Lab

- Bioneutra AI Labs

The AI in computer aided synthesis planning market is projected to remain competitive throughout the forecast timeline. The key players in the market, such as Merck and DeepMatter Group hold lucrative revenue shares. In terms of strategic initiatives, such as partnerships, PostEra’s collaboration with pharmaceutical giants and large-scale R&D investments in the regional market is significant. Emerging players can be noted from APAC, such as Toray Industries, which is steadily expanding its revenue share via localized innovation.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2025, Molecule Maker Lab Institute gets funds from U.S. National Science Foundation, which is a renewed support to research and focus on developing artificial intelligence tools for quick, accessible discovery and synthesis of molecules.

- In April 2024, Lonza introduces AI-enabled route scouting service to accelerate small molecule development. The launch focuses to streamline synthetic route identification for novel APIs by combinin,g in-house expertise with AI technology and Lonza's global chemical supply chain intelligence.

- In December 2023, Merck introduces the first ever AI solution to integrate drug discovery and synthesis. The platform bridges the gap between virtual molecule design and real-world manufacturability via Synthia retrosynthesis software application programing interface (API) integration.

- Report ID: 3809

- Published Date: Oct 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

AI in Computer Aided Synthesis Planning Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.