Hardware OTP Token Authentication Market Outlook:

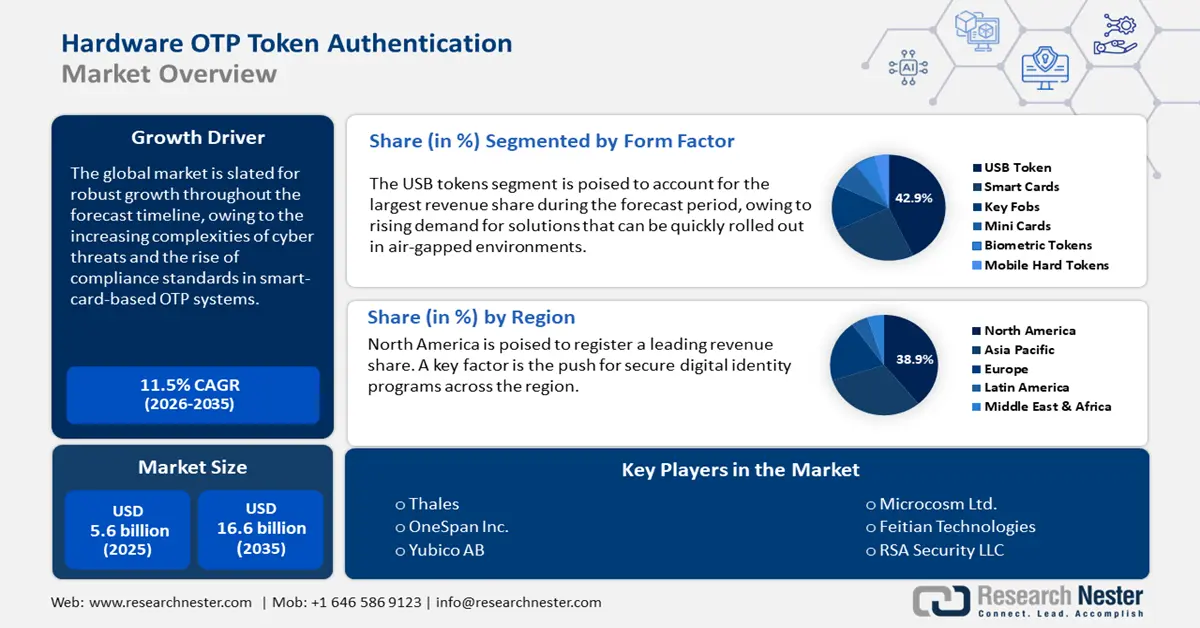

Hardware OTP Token Authentication Market size was valued at USD 5.6 billion in 2025 and is poised to reach USD 16.6 billion by the end of 2035, expanding at a CAGR of 11.5% during the forecast period from 2026 to 2035. In 2026, the industry size of hardware OTP authentication is assessed at USD 6.2 billion.

The market’s growth is impacted by a rise in demand for secure authentication methods. The General Data Protection Regulation (GDPR) and Federal Identity, Credential, and Access Management (FICAM) are also driving the demand for hardware OTP token authentication solutions. The market is characterized by a supply chain that is vertically integrated and spans multiple facets such as secure microcontroller fabrication, B2B distribution via identity management integrators, hardware token assembly, firmware development, and others. At the upstream level of the supply chain, specialized microcontrollers are used in hardware OTP tokens. Additionally, the leading economies in smart card fabrication are Taiwan, Germany, and South Korea.

At the downstream end of the supply chain, the hardware OTP token authentication deployment is associated with the investments in building a secure identity infrastructure. Recent trends highlight that agencies such as the U.S. Department of Homeland Security (DHS) have increased budget allocations for the federal credentialing systems, with figures in 2024 being USD 103.2 billion. Out of this, USD 60.4 billion is flexible funding that is to be used as needed. This budget also aids in protecting the cybersecurity of organizations of all sizes, further driving the use of OTP token authentication.

Key Hardware OTP Token Authentication Market Insights Summary:

Regional Highlights:

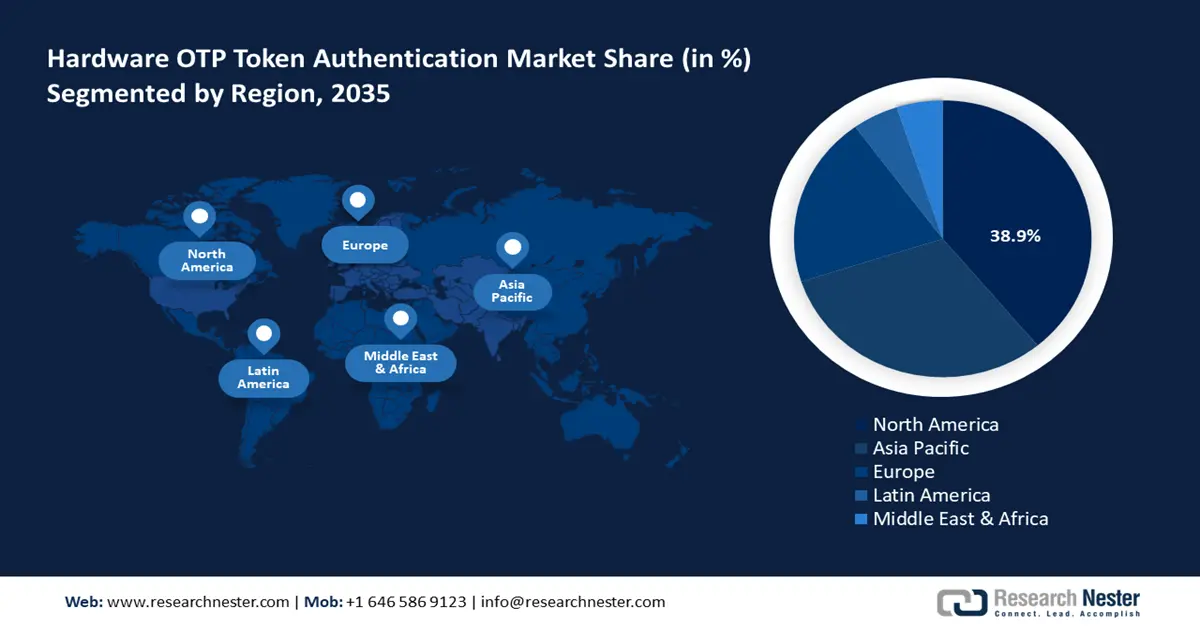

- By 2035, North America in the Hardware OTP Token Authentication Market is projected to command over 38.9% share, underpinned by entrenched deployment across regulated federal, defense, and banking infrastructures as well as sustained government-backed digital identity initiatives.

- APAC is anticipated to grow rapidly with an 18.2% CAGR through 2026–2035, accelerated by tightening cybersecurity regulations and expanding digital identity and banking ecosystems.

Segment Insights:

- By 2035, the USB tokens segment in the Hardware OTP Token Authentication Market is projected to account for around 42.9% share, supported by their robust tamper-resistance profile and seamless deployment in offline or legacy environments.

- By 2035, the TOTP segment is expected to attain a 39.5% share, sustained by standards-based authentication practices and rising adoption across high-frequency, high-security access systems.

Key Growth Trends:

- Surge in remote workforce and cloud adoption

- Rising vendor-specific compliance standards in smart card-based OTP systems

Major Challenges:

- High total cost of ownership (TCO) for large-scale deployments

- Supply chain vulnerabilities in secure element manufacturing

Key Players: Thales Group (Gemalto NV), OneSpan Inc., Yubico AB, Feitian Technologies Co., Ltd., RSA Security LLC, Token2, ActivIdentity (HID Global), Watchdata Technologies, Microcosm Ltd., SecuGen Corporation, Vasco Data Security, Micro Focus International plc, EnTrust Datacard, NITGen, IDPrime (IDEMIA).

Global Hardware OTP Token Authentication Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.6 billion

- 2026 Market Size: USD 6.2 billion

- Projected Market Size: USD 16.6 billion by 2035

- Growth Forecasts: 11.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.9% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Singapore, South Korea, Brazil, United Arab Emirates

Last updated on : 25 September, 2025

Hardware OTP Token Authentication Market - Growth Drivers and Challenges

Growth Drivers

- Surge in remote workforce and cloud adoption: The rapid shift towards remote work has bolstered the hardware OTP authentication market’s growth curve and is estimated to continue to remain one of the key drivers of the sector’s expansion in the coming years. The World Economic Forum (WEF) states that by 2030, digital jobs worldwide are expected to increase by about 25%, reaching over 90 million jobs. The increasing number indicates the escalating demand for hardware OTP authentication solutions.

- Rising vendor-specific compliance standards in smart card-based OTP systems: The adoption is accelerating due to an increase in industry-specific compliance protocols set by large enterprises and identity vendors. For instance, in 2024, industry giants updated their enterprise authentication frameworks to either mandate or recommend FIDO2-compliant hardware tokens in zero-trust environments. The increasing focus on following vendor rules adds both security and challenges. Also, as companies gain from stronger, standard ways to verify users, it helps reduce the risk of security breaches.

- Cybersecurity threats: A major supporting factor in the expansion of the hardware OTP token market is the increase in cyberattacks worldwide. Regulatory measures such as the U.S. Executive Order 14028 and CISA’s Zero Trust Maturity Model mandate have ensured the push for stronger identity assurance through FIPS 140-2 certified hardware tokens. NIST also states that a secure authentication method that prevents impersonation must create a safe and protected connection with the verifier. Thus, rising cyber threats are creating opportunities for companies as investments in token-based systems to curtail any downtime related to cyber breaches increase.

Challenges

- High total cost of ownership (TCO) for large-scale deployments: Despite their benefits, hardware OTP tokens tend to be associated with considerable costs in comparison to software-based authentication solutions. The high cost significantly impairs accessibility to SMEs, hindering the overall market growth. Additionally, industries in price-sensitive sectors and regions are reticent in adopting these solutions due to their high price.

- Supply chain vulnerabilities in secure element manufacturing: The ongoing geopolitical strife has impacted the supply of secure microcontrollers.

The global semiconductor shortage and geopolitical tensions continue to disrupt the supply of secure microcontrollers, critical components used in OTP token fabrication. Moreover, the majority of secure element manufacturing is concentrated in Taiwan and South Korea, increasing dependency risks due to regional instability and logistics constraints. This has created bottlenecks in token availability, particularly for public sector tenders requiring certified hardware.

Hardware OTP Authentication Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 5.6 billion |

|

Forecast Year Market Size (2035) |

USD 16.6 billion |

|

Regional Scope |

|

Hardware OTP Token Authentication Market Segmentation:

Form Factor Segment Analysis

By 2035, USB tokens are projected to take the lead in the global market, securing around 42.9% of total revenue. Their appeal lies in a strong track record of tamper resistance and reliability, especially in environments where high-assurance identity verification is non-negotiable. What gives USB tokens a distinct advantage is their compatibility with older systems and ease of deployment. Unlike smart cards or mobile-based solutions, they are quickly rolled out in offline or air-gapped environments, where security and simplicity need to go hand in hand.

Authentication Method Segment Analysis

The TOTP, or time-based one-time passwords segment, is estimated to account for 39.5% of the market by 2035. This method has been around for a while and follows global standards, including RFC 6238. NIST also backs it under their SP 800-63-3 guidelines. TOTP is based on a simple principle, wherein the codes change every 30 to 60 seconds. The application potential is immense in places where security concerns remain high due to people logging in a lot, such as banks or utility systems. Additionally, with more companies leaning into zero-trust setups, this approach is gaining popularity as it cuts down the window for attackers and does not rely on user memory.

Application Segment Analysis

The banking and financial services segment is projected to capture the largest market share through 2035. The high exposure to cyber threats and regulatory mandates is propelling the application of hardware OTP token authentication in the banking and financial services sector. The robust rise in digital transactions is also accelerating the demand for OTP token authentication solutions. The Federal Reserve Bank of New York reported that in the last quarter of 2024, the return on equity was 10.50% and the return on assets was 1.01%. These figures rose to 11.85% and 1.12% in the fifth quarter of 2025, respectively, due to higher income from trading. The increasing fund transfers are set to open lucrative earning opportunities for hardware OTP token authentication companies.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Form Factor |

|

|

Authentication Method |

|

|

Application |

|

|

Deployment Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hardware OTP Token Authentication Market - Regional Analysis

North America Market Insights

The North America hardware OTP token authentication market is projected to hold a leading revenue share of over 38.9% by 2035. The region’s leading share is estimated to be attributed to how embedded these tokens are in government agencies, defense systems, and banking networks that run under strict regulations. Another key reason for this growth is the push for digital identity programs supported by the government. The U.S. Department of Homeland Security, for example, keeps investing in identity systems that follow FIPS 201-3 rules. These systems require hardware-based multi-factor authentication for federal employees and contractors, which keeps demand strong.

The U.S. hardware OTP token authentication market is predicted to expand its revenue share throughout the anticipated timeline. A key feature is that hardware tokens are being embedded into operations to boost cybersecurity. The regulatory mandates are pushing companies to tighten their cybersecurity vulnerabilities. A major driver of the increase is the push to keep ransomware in check. Additionally, the government has been proactive in pushing for Zero Trust setups, which is tied to Executive Order 14028. The order highlights that an additional security layer is necessary for verification via physical tokens, leading to high demand for hardware token OTP solutions.

The hardware OTP token authentication market in Canada is expected to increase at a high pace, owing to the country’s growing emphasis on cybersecurity and data privacy. The digital transformation initiatives are also contributing to the increasing sales of hardware OTP token authentication solutions. The report by Payments Canada disclosed that in 2023, the total payment transaction volume of the country was calculated at 21.7 billion, out of which credit cards accounted for 33%, debit cards (31%), and online transfers (6%). This indicates that the banks, credit unions, and government agencies are the primary adopters of hardware OTP tokens.

Asia Pacific Market Insights

APAC is poised to be the market exhibiting the fastest expansion, with a CAGR of 18.2% throughout the anticipated timeline. The market's growth curve is fueled by the rise of cybersecurity regulations across lucrative markets in Japan, South Korea, and Singapore. Another factor supporting the expansion is the expansion of digital banking, along with government e-identity programs. In terms of measurable regulatory support, the Digital Personal Data Protection Act of 2023 in India mandated the application of strong user authentication, prompting a surge in the adoption of hardware OTP solutions. Similarly, the My Number identity program in Japan has supported the greater use of hardware token-based identity confirmation.

The China hardware OTP token authentication market is expected to maintain its dominance throughout the forecast timeline. The market is backed by the digital finance ecosystem of China that emphasizes strict security standards. Additionally, the data localization laws of China, along with domestic tech firms integrating authentication hardware, bolster growth opportunities. In 2025, the Cyberspace Administration of China (CAC) announced revisions to its data protection frameworks. The rework has pushed for hardware-based user verification mechanisms, evident in the heightened deployment of USB tokens and smart cards under the aegis of e-government initiatives.

The India hardware OTP token authentication market is estimated to increase at a high pace from 2026 to 2035. The banking and financial services sector is primarily fueling the sales of hardware OTP token authentication solutions. According to the India Brand Equity Foundation (IBEF) report, digital payments have grown significantly due to teamwork between the government and the Reserve Bank of India (RBI). In the financial year 2025 (up to June), Unified Payments Interface (UPI) transactions reached 2,762 in volume, with India making up nearly 46% of all digital transactions worldwide, and as of July 2024, 602 banks were actively using UPI. Thus, investing in India is projected to double the revenues of key players.

Europe Market Insights

The Europe market is anticipated to capture the second-largest revenue share throughout the forecast period. The strict regulatory frameworks and rising cybercrimes are boosting the demand for hardware OTP token authentication solutions. The General Data Protection Regulation (GDPR) and the EU’s Network and Information Security Directive (NIS2) have raised the bar for data protection and identity verification, which directly push organizations to adopt strong multi-factor authentication methods. The digitalization trend is also supporting the overall market growth.

Germany leads the sales of hardware OTP token authentication solutions, owing to its strict regulatory environment and strong industrial base. The rigorous cybersecurity standards enforced by the German Federal Office for Information Security (BSI) are also contributing to the increasing demand for hardware OTP token authentication systems. The rising number of mobile users is also fueling digital transactions and the multi-factor authentication method.

The U.K. hardware OTP token authentication market is foreseen to be driven by the strict financial regulations and cybersecurity concerns. The Financial Conduct Authority (FCA) has mandated stronger authentication for digital banking and payment services, which is directly fueling the widespread application of OTP token authentication. The digital shift in the BFSI sector is further estimated to drive the attention of several international companies in the years ahead.

Key Hardware OTP Token Authentication Market Players:

- Thales Group (Gemalto NV)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- OneSpan Inc.

- Yubico AB

- Feitian Technologies Co., Ltd.

- RSA Security LLC

- Token2

- ActivIdentity (HID Global)

- Watchdata Technologies

- Microcosm Ltd.

- SecuGen Corporation

- Vasco Data Security

- Micro Focus International plc

- EnTrust Datacard

- NITGen

- IDPrime (IDEMIA)

The global market is signified by the dominance of major security tech giants such as Thales Group, Yubico, and OneSpan. These firms are at the forefront of patent filings and the push for integration with cloud-based identity management systems. Additionally, manufacturers in APAC, such as Feitian Technologies, have capitalized on the rise of domestic cybersecurity mandates.

The table below highlights the major players in the market and their revenue shares:

Recent Developments

- In August 2025, HID introduced a new set of FIDO-certified credentials supported by its Enterprise Passkey Management (EPM) solution. These are designed to help companies easily use and manage passkeys on a large scale.

- In February 2025, Thales, a top global technology and security company, launched OneWelcome FIDO Key Lifecycle Management. This new tool helps large organizations easily set up and manage FIDO security passkeys on a large scale.

- Report ID: 2905

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.