Gonorrhea Treatment Market Outlook:

Gonorrhea Treatment Market size was USD 1.39 billion in 2025 and is estimated to reach USD 2.8 billion by the end of 2035, expanding at a CAGR of 7.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of gonorrhea treatment is evaluated at USD 1.49 billion.

The global gonorrhea treatment market is continually expanding, and according to the WHO, in 2020 approximately 82.4 million new cases were reported worldwide. Based on the report of the Centers for Disease Control and Prevention, there is a gradual increase in the reported cases in tshe U.S., with 710,151 cases registered in 2021, which is 214 cases per 100,000 individuals. This highly growing patient population impacts the gonorrhea treatment market demand for antibiotics and diagnostic tools, alternatively increasing the pressure on the supply chain for active pharmaceutical ingredients and medical products. The supply chain is highly reliant on raw materials sourced from hubs in Asia, especially in China and India.

Reported Cases and Rates of Reported Cases by State, Ranked by Rates, the U.S., 2021

|

Rank |

State |

Cases |

Rate per 100,000 Population |

|

1 |

Mississippi |

12,617 |

427.7 |

|

2 |

South Dakota |

3,258 |

363.9 |

|

3 |

Louisiana |

16,390 |

354.5 |

|

4 |

Alabama |

16,191 |

321.3 |

|

5 |

South Carolina |

16,052 |

309.2 |

|

6 |

Georgia |

31,996 |

296.3 |

|

7 |

North Carolina |

28,612 |

271.2 |

|

8 |

Arkansas |

8,176 |

270.2 |

|

9 |

Nevada |

8,488 |

270.0 |

|

10 |

Alaska |

1,977 |

269.8 |

|

11 |

Tennessee |

18,768 |

269.1 |

|

12 |

Oklahoma |

10,273 |

257.7 |

|

13 |

Missouri |

15,714 |

254.8 |

|

14 |

Arizona |

18,426 |

253.2 |

|

15 |

Illinois |

30,454 |

240.3 |

|

16 |

New Mexico |

5,080 |

240.1 |

|

17 |

Ohio |

27,838 |

236.3 |

|

18 |

California |

91,461 |

233.1 |

|

19 |

North Dakota |

1,735 |

223.9 |

|

20 |

Texas |

64,623 |

218.9 |

|

21 |

Michigan |

21,954 |

218.4 |

|

22 |

New York |

43,048 |

217.0 |

|

— |

US TOTAL |

710,151 |

214.0 |

Source: CDC

Key Gonorrhea Treatment Market Insights Summary:

Regional Highlights:

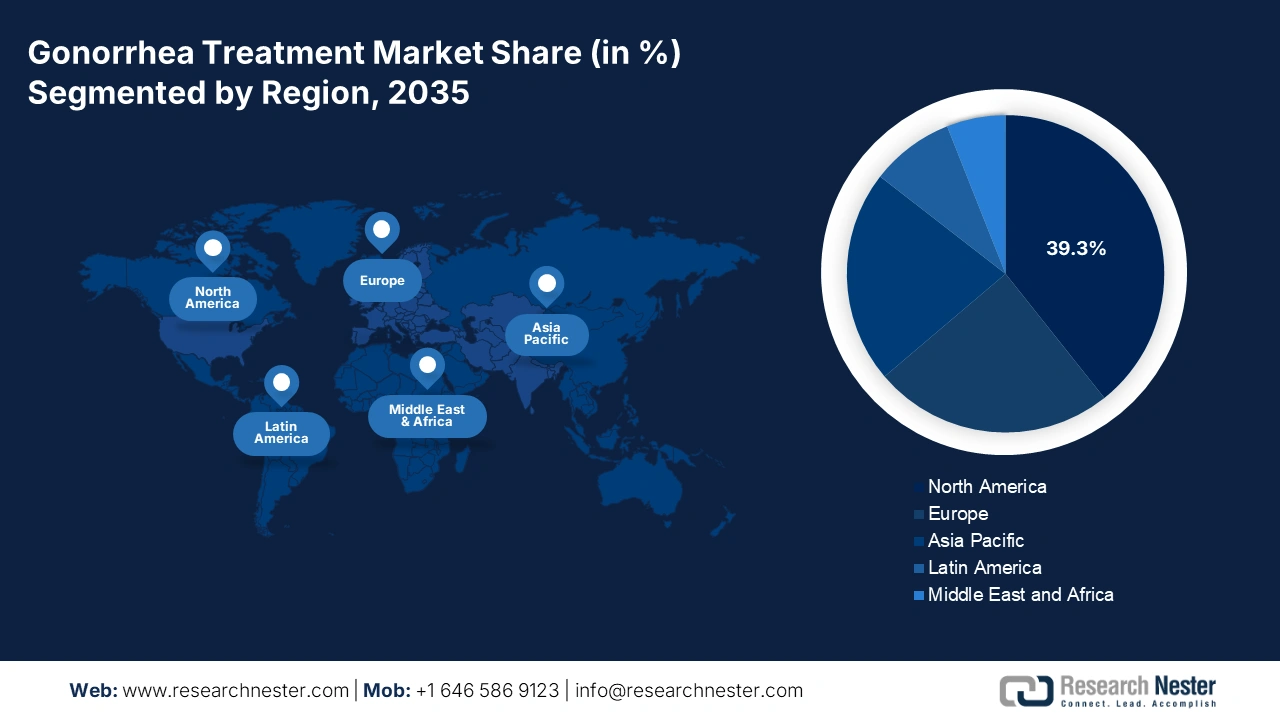

- North America is projected to hold a 39.3% share, driven by rising antimicrobial-resistant gonorrhea cases and increased adoption of advanced diagnostics and treatment regimens.

- Europe is expected to be the fastest-growing region with a 24.3% share by 2035, owing to increasing antibiotic resistance, higher STI prevalence, and strengthened public health interventions.

Segment Insights:

- Antibiotics segment is projected to hold a 65.2% share globally by 2030, propelled by evolving clinical efficacy and widespread adoption of agents like cephalosporins and macrolides.

- Dual therapy segment is expected to capture a 55.2% share, owing to its proven effectiveness against multidrug-resistant Neisseria gonorrhoeae strains.

Key Growth Trends:

- Rising prevalence and expanding patient pool

- Government and Medicare spending on treatment for drug development and clinical trials

Major Challenges:

- Pricing restraints by government health systems

Key Players: Pfizer Inc. (USA), GlaxoSmithKline plc (UK), Merck & Co., Inc. (USA), F. Hoffmann-La Roche Ltd. (Switzerland), Astellas Pharma Inc. (Japan), Sanofi S.A. (France), Bayer AG (Germany), AbbVie Inc. (USA), Takeda Pharmaceutical Co. Ltd. (Japan), Cipla Ltd. (India), Sun Pharmaceutical Industries Ltd. (India), Hikma Pharmaceuticals (UK/Jordan), Dr. Reddy’s Laboratories Ltd. (India), Daiichi Sankyo Co., Ltd. (Japan), Lupin Ltd. (India), Celltrion Inc. (South Korea), Biocon Ltd. (India), CSL Limited (Australia), Aurobindo Pharma (India), Pharmaniaga Berhad (Malaysia)

Global Gonorrhea Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.39 billion

- 2026 Market Size: USD 1.49 billion.

- Projected Market Size: USD 2.8 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Canada, Germany, France, U.K.

- Emerging Countries: Spain, Italy, Australia, Japan, South Korea

Last updated on : 3 October, 2025

Gonorrhea Treatment Market - Growth Drivers and Challenges

Growth Drivers

-

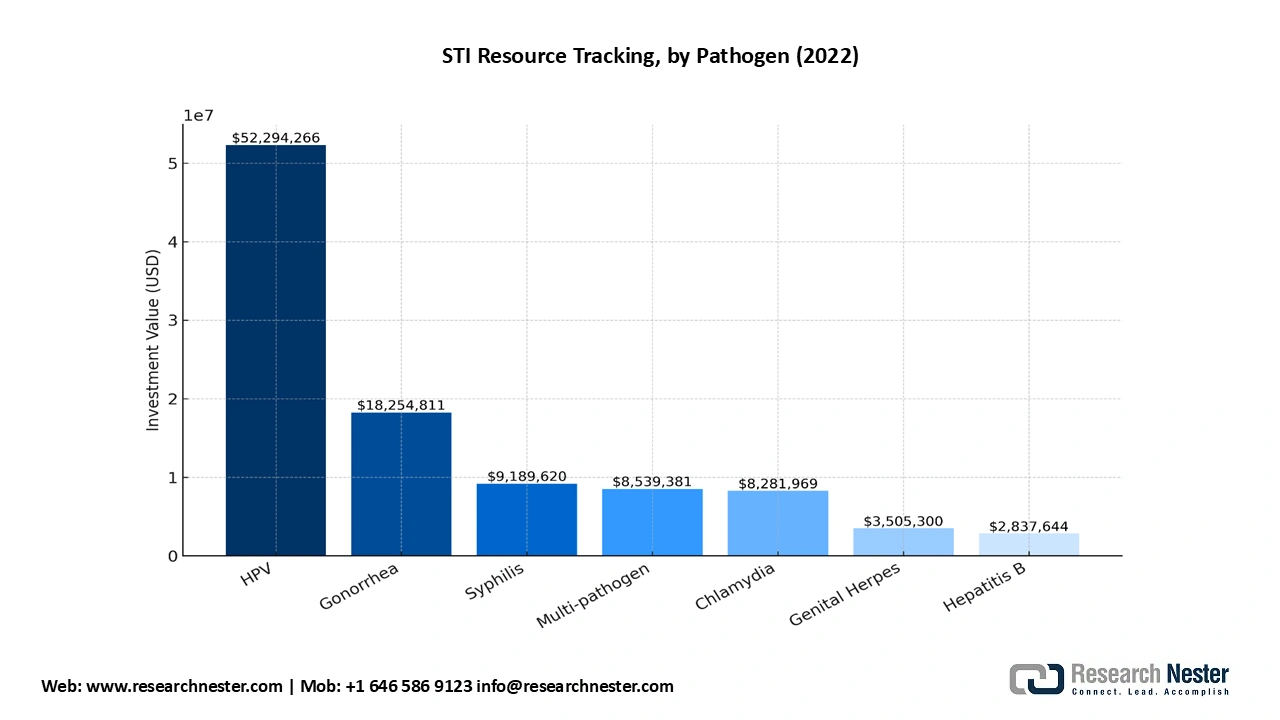

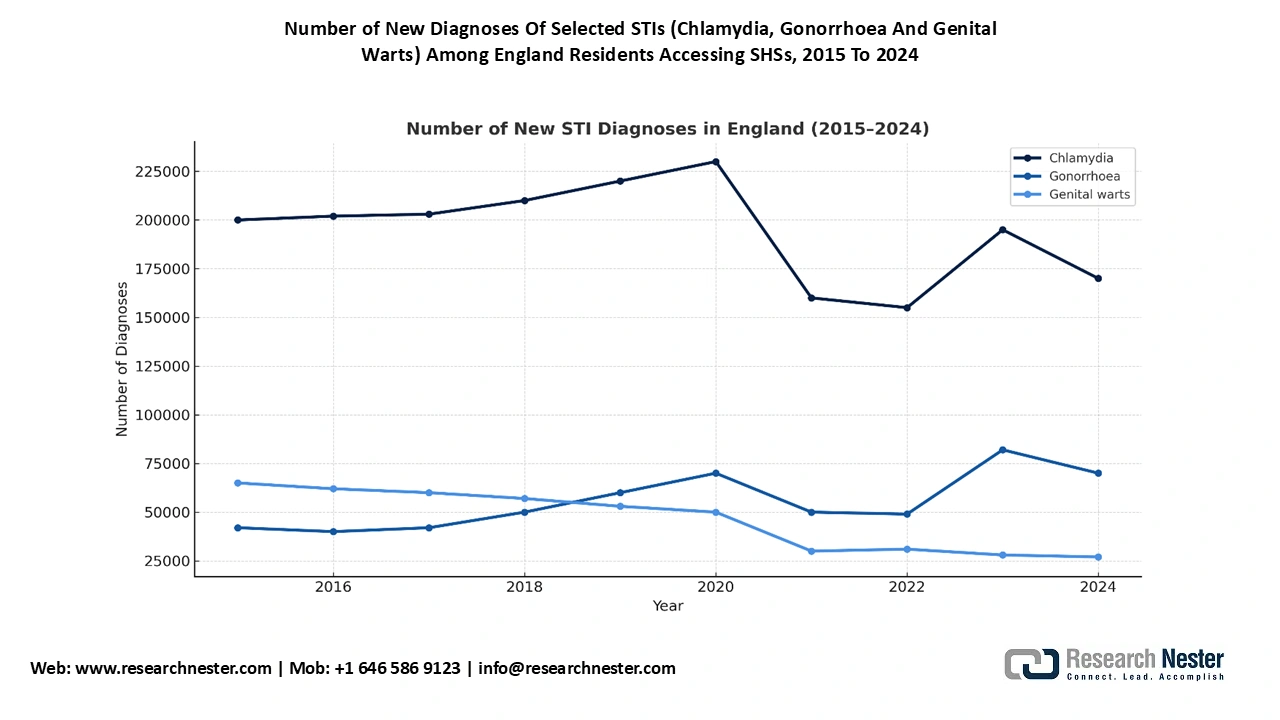

Rising prevalence and expanding patient pool: Before the COVID-19 pandemic, chlamydia incidence rates increased by 1% per month (95% CI: 1.01-1.01, RR = 1.01) and were 3% higher per additional $1,000 in ICD funding (95% CI: 1.01-1.06, RR = 1.03) per capita. Gonorrhea rates rose by 1 % quarterly (95 % CI: 0.98-1.05, RR = 1.01) and in ICD per capita investment was 6 % (95 % CI: 1.01–1.11, RR = 1.06) more. Higher chlamydia rates reflect a smaller decrease in chlamydia in public health units (PHUs). The U.S. National Institutes of Health (NIH) and the Bill & Melinda Gates Foundation are among the largest investors in healthcare R&Ds and track funding trends in product pipeline and vaccine and diagnostics research for common STIs, such as gonorrhea, syphilis, chlamydia, hepatitis B, human papillomavirus (HPV), genital herpes, and trichomoniasis. According to the AVAC 2024 report, major funding (51%) was dedicated to HPV R&D, with gonorrhea and syphilis accounting among the top funded in 2022.

Interrupted time series of quarterly confirmed gonorrhea cases among adolescents aged 13-19 years during the COVID-19 pandemic in Ontario, Canada.

|

Variables |

aRR |

95 % CI |

|

Time |

1.01 |

0.98, 1.05 |

|

Pandemic |

0.51 |

0.04, 7.22 |

|

Time and Pandemic |

1.01 |

0.91, 1.13 |

|

ICD funding |

1.06 |

1.01, 1.11 |

|

ICD funding and time |

1.00 |

0.99, 1.00 |

|

Level change: ICD funding and pandemic |

1.11 |

0.92, 1.33 |

|

Slope change: Time, Pandemic and ICD funding |

0.99 |

0.99, 1.00 |

- Government and Medicare spending on treatment for drug development and clinical trials: As per the AVAC 2024 report, USD 18 million was spent on gonorrhea vaccine R&D, USD 50 million on HPV vaccine, USD 9 million on syphilis vaccine, USD 3.5 million on genital herpes vaccine, USD 8 million on chlamydia vaccine, and USD 2.8 million on Hepatitis B vaccine. Of the total diagnostic investment, 66% commitment was for multi-pathogen R&D (including gonorrhea, chlamydia, syphilis, genital herpes). USD 103 million was dedicated to STI diagnostic and vaccine research, of which USD 6.8 million or 7% was for diagnostic research, whereas USD 93 million or 90% was for vaccine R&D. The NIH ascribed for a staggering 73% of the diagnostic R&D investments. Furthermore, the Institute for Biomedical Sciences’ Center for Translational Immunology at Georgia State University received a five year federal grant of USD 4.9 million in September 2022 to study Neisseria gonorrhoeae and nutritional immunity that prevents microbial growth by starving invading pathogens.

Gonorrhea treatment medications are considered under the Part D drugs by Medicare. 25% of the cost as coinsurance is paid by the customer for both generic and brand-name medications until the out-of-pocket indicative procurement spending or payer's pricing reached USD 2,000 in 2025 and the estimated USD 2100 during 2026 covered Part D drugs.

Source: AVAC

Clinical Trial Summary

- NCT04010539 (Gepotidacin vs Ceftriaxone + Azithromycin)

|

Field |

Detail |

|

Official title |

A Phase III, Randomized, Multicenter, Open-Label Study in Adolescent and Adult Participants Comparing the Efficacy and Safety of Gepotidacin to Ceftriaxone Plus Azithromycin in the Treatment of Uncomplicated Urogenital Gonorrhea Caused by Neisseria gonorrhoeae |

|

Sponsor / Responsible party |

GlaxoSmithKline (GSK) |

|

Study type |

Interventional (Clinical trial) |

|

Phase |

Phase 3 |

|

Design (overall) |

Randomized, multicenter, open-label, parallel assignment |

|

Allocation |

Randomized |

|

Primary purpose |

Treatment |

|

Condition / indication |

Uncomplicated urogenital gonorrhea (Neisseria gonorrhoeae) |

|

Interventions / arms |

Experimental: Gepotidacin - oral: 3000 mg (4 × 750 mg tablets) at Baseline (Day 1) at site; second 3000 mg oral dose (4 × 750 mg) self-administered 10-12 hours later. |

|

Primary outcome measure |

Number of participants with culture-confirmed bacterial eradication of N. gonorrhoeae from the urogenital site at the Test-Of-Cure (TOC) visit (Day 4-8). (Measured Baseline → TOC) |

|

Key secondary outcome measures |

Culture-confirmed bacterial eradication from rectal site (TOC Day 4-8); from pharyngeal site (TOC Day 4-8); number of participants with any TEAEs and any SAEs (up to 21 days); changes from baseline in hematology and clinical chemistry parameters; urinalysis results; vital signs. |

|

Eligibility - Ages |

≥ 12 years |

|

Eligibility - Sexes |

All sexes eligible |

|

Enrollment (actual) |

628 participants (actual) |

|

Study start (actual) |

2019-10-21 |

|

Primary completion (actual) |

2023-10-10 |

|

Study completion (actual) |

2023-10-10 |

|

Number of sites/ locations |

51 locations (countries listed in record include: the U.S., Australia, Germany, Mexico, Spain, United Kingdom - multiple cities per country as provided) |

|

Key exclusion examples |

Current epididymitis/orchitis; suspected/confirmed Chlamydia trachomatis infection requiring treatment that cannot be postponed; BMI ≥40 or ≥35 with comorbidity; known hypersensitivity to study drugs; immunocompromised status; significant renal/hepatic impairment; recent investigational product exposure; QT prolongation or use of QT-prolonging drugs; pregnancy/breastfeeding. |

|

Notable inclusion examples |

Clinical suspicion of urogenital gonococcal infection (or recent positive culture/NAAT up to 5-7 days prior); willing to avoid sexual activity or use condoms through TOC; body weight >45 kg; able to give informed consent/assent. |

|

Safety monitoring |

TEAEs / SAEs captured up to 21 days; labs, urinalysis, vitals, ECG screening / QTc specification in exclusion criteria. |

|

Results posted / dates |

Results first submitted: 2024-05-01; Results first posted: 2024-05-30; Last update posted: 2024-05-30; Last verified: 2024-04 |

|

Regulatory / jurisdiction note |

Studies a U.S. FDA-regulated drug product (record flag) |

|

Other identifiers |

Other Study ID Numbers: 116577; EudraCT Number: 2018-001780-23 |

|

Comments / additional notes (from record) |

Open-label non-inferiority Phase 3 trial; comparator regimen used IM ceftriaxone 500 mg + azithromycin 1000 mg single doses; results and supporting documents (protocol, SAP) are available via the ClinicalTrials.gov record and sponsor data-sharing portal. |

Source: ClinicalTrials.gov

2. NCT05027516 (ResistAZM)

|

Field |

Value |

|

Study title (short) |

Trial Comparing Ceftriaxone Plus Azithromycin Versus Ceftriaxone for the Treatment of Gonorrhea (ResistAZM) |

|

Official title |

An Open Label Randomized Controlled Trial Comparing the Effect of Ceftriaxone Plus Azithromycin Versus Ceftriaxone for the Treatment of Neisseria gonorrhoeae on the Resistome |

|

Sponsor / Responsible party |

Institute of Tropical Medicine, Belgium |

|

Study type |

Interventional |

|

Phase |

Phase 4 |

|

Study status (from record) |

Completed (Results posted) - last update posted 2024-08-02 |

|

Brief summary |

Randomized controlled trial enrolling 42 men with N. gonorrhoeae at the ITM STI/HIV clinic; randomized 1:1 to ceftriaxone alone or ceftriaxone + azithromycin; follow-up at day 14 to assess cure and monitor microbiome/resistome. Primary outcome is difference in abundance of resistance-conferring genes in rectal microbiome at day 14. |

|

Conditions |

Neisseria gonorrhoeae (gonorrhea) |

|

Other Study ID Numbers |

ITM202101 |

|

Study start (actual) |

2022-01-17 |

|

Primary completion (actual) |

2022-05-09 |

|

Study completion (actual) |

2022-05-09 |

|

Enrollment (actual) |

42 |

|

Number of locations / country |

1 location — Institute of Tropical Medicine, Antwerp, Belgium |

|

Ages eligible |

18 years and older |

|

Sexes eligible |

Male (inclusion: male sex at birth) |

|

Healthy volunteers accepted? |

No |

|

Gender-based eligibility |

Yes - inclusion restricted to male sex at birth |

|

Allocation |

Randomized |

|

Interventional model |

Parallel Assignment |

|

Masking |

Quadruple (Participant; Care Provider; Investigator; Outcomes Assessor) |

|

Primary purpose |

Supportive Care |

|

Interventions / arms (details) |

Arm 1 (Active Comparator - Rocephin): Ceftriaxone 1 g + lidocaine 35 mg, intramuscular injection (single dose). |

|

Primary outcome measure |

Macrolide Resistance Determinants: Ratio of mean macrolide-resistance determinant read counts in day-14 anorectal samples between the Ceftriaxone/Azithromycin group and the Ceftriaxone group. Time frame: Day 14. |

|

Key secondary outcome measures |

Read count of resistance determinants for each non-macrolide antibiotic class (Day 14); acquisition of phenotypic resistance to azithromycin by N. gonorrhoeae in morbidostat upon exposure to commensal Neisseria DNA extracts from each treatment group (Day 0 and Day 14). |

|

Inclusion highlights (from record) |

Able and willing to provide written informed consent; male sex at birth; ≥ 18 years; confirmed diagnosis of urethritis, proctitis or pharyngitis due to N. gonorrhoeae (symptomatic or asymptomatic) by positive NAAT or (for urethritis) positive gram/methylene blue stain. |

|

Exclusion highlights (from record) |

Use of any macrolide antibiotics in previous 6 months; known contraindications/allergy to ceftriaxone, azithromycin or lidocaine; presence of other condition/other STI likely to require another antibiotic at enrollment as assessed by treating physician. |

|

IPD sharing plan |

No (Plan for Individual Participant Data: No) |

|

Results reporting dates (from record) |

Results first submitted: 2023-06-05; Results first submitted that met QC criteria: 2024-02-15; Results first posted: 2024-08-02; Last update posted: 2024-08-02; Last verified: 2024-02. |

|

Notes / comments (from record) |

Primary outcome focuses on resistome (macrolide resistance determinants) in anorectal samples at day 14; small RCT (n=42) designed to evaluate microbiome/resistome impact of adding azithromycin to ceftriaxone therapy. |

Source: ClinicalTrials.gov

Challenges

-

Pricing restraints by government health systems: Government related pricing ceilings restrict profitability in various developed markets. The statutory insurance program in Germany has restricted the reimbursement limits on antibiotics, and minimizing the profit margins for suppliers. These challenges make the manufactures difficult to recoup R&D investments. On the other hand, focusing on control public expenditure, such pricing regulations disincentivize gonorrhea treatment market entry and innovation. According to the European Commission, these policies particularly hinder new drug launches in therapeutic areas like STIs.

Gonorrhea Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 1.39 billion |

|

Forecast Year Market Size (2035) |

USD 2.8 billion |

|

Regional Scope |

|

Gonorrhea Treatment Market Segmentation:

Drug Class Segment Analysis

Antibiotics lead the gonorrhea treatment market with a 65.2% share globally in 2030. The gonorrhea treatment market is mainly driven by the constant evolution of clinical efficacy and global endorsement of agents like cephalosporins and macrolides. As per the reports of the WHO and CDC, these agents are widely used in dual therapy regimens due to the rising antimicrobial resistance. The innovation in the development of new drugs is shaping the gonorrhea treatment market and future treatment landscapes, mainly for multidrug-resistant cases.

Treatment Type Segment Analysis

Dual therapy dominates and is expected to gain a gonorrhea treatment market share of 55.2%, mainly in the combination of ceftriaxone and azithromycin. Dual therapy remains the front line for gonorrhea treatment due to its proven efficacy against strains of Neisseria gonorrhoeae. Based on the WHO and CDC report, the regimen addresses the rising challenge of antimicrobial resistance by utilizing two different mechanisms of action, hence reducing the risk of reinfection and treatment failures.

Our in-depth analysis of the global gonorrhea treatment market includes the following segments:

|

Segment |

SubSegment |

|

Drug Class |

|

|

Treatment Type |

|

|

Route of Administration

|

|

|

Infection Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gonorrhea Treatment Market - Regional Analysis

North America Market Insights

North America leads the gonorrhea treatment market and is expected to reach 39.3% due to the rising number of patients reporting antimicrobial-resistant gonorrhea. As the patient pool rises, the requirement for greater investment necessitates effective diagnostics and treatment regimens. With the increase in the adoption of Nucleic Acid Amplification Tests, investments in cephalosporin-based and dual therapy antibiotics place North America at the forefront in the treatment innovation. Both the U.S. and Canada are witnessing a rise in the number of cases of antimicrobial-resistant gonorrhea.

The U.S. gonorrhea treatment market is expanding rapidly, with the increase in incidence rates, with 714,000 cases in 2021. According to the CDC, the STI-related funding is increased under public health preparedness and R&D initiatives. The U.S. Congress appropriated USD 1.39 billion to STD prevention in 2023. NAATs remain the gold standard in diagnosis, accounting for a significant share of all clinical lab testing. The PhRMA and the NIH partnered with the U.S. government to fast-track the development of dual antibiotic therapies and enhance drug-resistance surveillance.

Europe Market Insights

Europe is the fastest-growing nation in the gonorrhea treatment market and is expected to have a share of 24.3% by 2035. The Europe gonorrhea treatment market is expanding, especially due to the increase in antibiotic resistance, rising sexually transmitted infection prevalence, and strengthened public health interventions. Some innovations and trends in this market, such as the adoption of digital health platforms and e-prescriptions, are enhancing treatment accessibility among youth and high-risk groups. Further, the involvement among national health authorities is rising, aiding in boosting the penetration across hospitals, clinics, and online pharmacies.

Source: Gov. UK

The UK is expected to lead the gonorrhea treatment market with 24.4% revenue share in 2035. According to the Local Government Association, in 2021, there was 4,002,827 consultations at the National Sexual and Reproductive Health (SRH) services, exhibiting a 15.7% surge compared to 2020 and a 36% rise since 2013. Additionally, there were 1,949,940 sexual health screens, including diagnostic tests for gonorrhoea, chlamydia, syphilis, and HIV in 2021 delivered by SRHs. This underscored 18.7% hike compared to 2020, and 29% growth relative to 2013. The gonorrhea treatment market in the UK is driven by the continued improvement in public investments and rapid adoption of digital health services. The UK remains the largest gonorrhea treatment market in Europe, due to the rise in STI prevalence, particularly among individuals aged from 16 to 30.

Key Gonorrhea Treatment Market Players:

- Pfizer Inc. (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline plc (UK)

- Merck & Co., Inc. (USA)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Astellas Pharma Inc. (Japan)

- Sanofi S.A. (France)

- Bayer AG (Germany)

- AbbVie Inc. (USA)

- Takeda Pharmaceutical Co. Ltd. (Japan)

- Cipla Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Hikma Pharmaceuticals (UK/Jordan)

- Dr. Reddy’s Laboratories Ltd. (India)

- Daiichi Sankyo Co., Ltd. (Japan)

- Lupin Ltd. (India)

- Celltrion Inc. (South Korea)

- Biocon Ltd. (India)

- CSL Limited (Australia)

- Aurobindo Pharma (India)

- Pharmaniaga Berhad (Malaysia)

The global gonorrhea treatment market is highly competitive and various players are addressing on the innovative antibiotics, combination therapies and diagnostics. Some leading players like Pfizer, GSK, and Merck lead the gonorrhea treatment market by investing on dual therapy development and expand their capabilities. Meanwhile, manufacturers from India like Cipla and Sun Pharma dominate the space by supporting accessibility in developing areas. Moreover, the competency among leading innovators is creating diverse opportunities across the value chain.

Here is a list of key players operating in the gonorrhea treatment market:

Recent Developments

- In May 2025, Roche announced the launch of its phase 3 trial of zosurabalpin. This trial is anticipated to commence in 2026.

- In April 2024, the U.S. FDA approved Zevtera for injection (ceftobiprole medocaril sodium) or ceftriaxone , catering both adult and pediatric demographics with community-acquired bacterial pneumonia (CARP).

- Report ID: 7808

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gonorrhea Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.