Gluten-free Baking Mixes Market Outlook:

Gluten-free Baking Mixes Market size was valued at USD 564.6 million in 2025 and is projected to reach USD 1.24 billion by the end of 2035, rising at a CAGR of 8.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of gluten-free baking mixes is assessed at USD 610.9 million.

The gluten-free baking mixes market growth is supported by the measurable shift in the diagnosed gluten-related disorders and increased institutional attention to food safety and labeling standards. According to the Gastro Journal June 2024 study the celiac disease is common and nearly 1% of the population has it, with diagnosis rates rising due to the enhanced screening protocols in clinical settings. The market expansion is specifically linked to the sustained growth in the diagnosis rates and dietary adoption. The NIH has indicated that the increase in the diagnosed prevalence of celiac disease over the recent decades is due to improved screening and awareness. This translates directly into a stable long-term commercial base. Further, the U.S. government economic data provides insight into the macroeconomic context for ingredient sourcing and consumer spending.

On the other hand, the U.S. Food and Drug Administration confirms that foods carrying a gluten-free label must contain less than 20 parts per million of gluten, a regulatory threshold that has driven the greater adoption of compliant mixes across foodservice, retail bakeries, and contract manufacturers seeking consistent safety standards in procurement. The demand is also boosted by the institutional buyers, such as the schools, hospitals, and public facilities, that integrate specialty diets into procurement policy. Moreover, the distribution channels have evolved, reporting a consistent increase in e-commerce retail sales, a trend that has provided a vital avenue for both established and emerging brands to reach a dispersed consumer base for specialty food products without sole reliance on traditional retail shelf space.

Key Gluten-free Baking Mixes Market Insights Summary:

Regional Highlights:

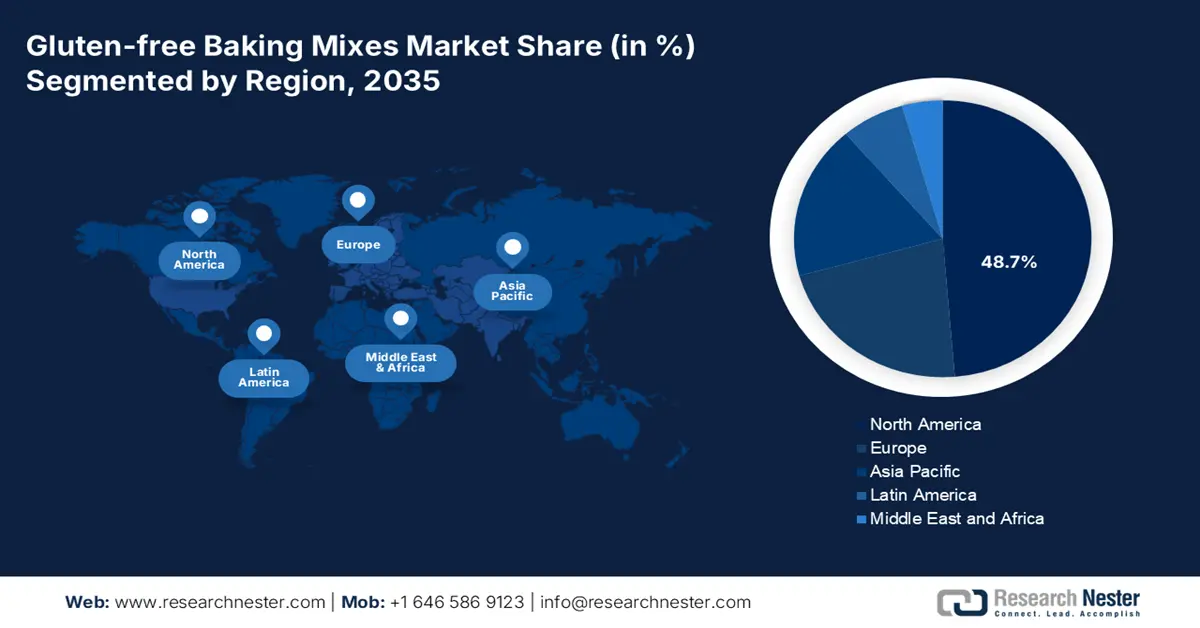

- North America is projected to secure a 48.7% share by 2035 in the gluten-free baking mixes market, reflecting its leadership position, underpinned by high consumer awareness, established celiac diagnosis, mature specialty retail, and mainstream integration of gluten-free offerings into food service and institutional channels.

- Asia Pacific is anticipated to be the fastest-growing region at a CAGR of 10.8% during 2026–2035, shaped by westernized dietary patterns, rising disposable incomes, expanding e-commerce and modern retail, and growing lifestyle-led perceptions of gluten-free as a healthier choice.

Segment Insights:

- Under the form segment, dry mixes are projected to command an 88.6% share by 2035 in the gluten-free baking mixes market, reflecting their strong commercial appeal and broad adoption, catalyzed by superior shelf stability, cost efficiency, shipping convenience, and compatibility with e-commerce distribution.

- By 2035, the household or retail segment is positioned as the leading end-user category as at-home gluten-free baking gains traction, reinforced by consumer priorities around cost management, ingredient transparency, customization, and expanding physical and online retail access.

Key Growth Trends:

- Rising diagnosed celiac disease prevalence

- Expansion of e-commerce and digital grocery infrastructure

Major Challenges:

- Ingredient sourcing and supply chain volatility

- Formulation challenges and product quality parity

Key Players: General Mills, The Hain Celestial Group, Kellogg Company, Bob's Red Mill, Pamela's Products, Conagra Brands, Dr. Schär, Hero Group, Warburtons, Orgran, Freedom Foods Group, Dove's Farm, Barkat, Kinnikinnick Foods, Aleia's, Priméal, Ener-G Foods, Lam Soon, MGP Ingredients, King Arthur Baking Company

Global Gluten-free Baking Mixes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 564.6 million

- 2026 Market Size:USD 610.9 million

- Projected Market Size: USD 1.24 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Australia

- Emerging Countries: India, Japan, China, South Korea, Brazil

Last updated on : 19 December, 2025

Gluten-free Baking Mixes Market - Growth Drivers and Challenges

Growth Drivers

- Rising diagnosed celiac disease prevalence: The demand for gluten-free baking mixes is directly influenced by a steady rise in clinically diagnosed celiac disease cases. The NIH study in June 2022 reported that over 2 million people in the U.S. follow gluten-free diets, and among 300,000 had celiac disease. Improved diagnostic pathways continue to expand the identified patient base. Similar trends are occurring in Europe, though only a smaller percentage of people were currently diagnosed, indicating a sizable latent demand. As diagnosis rates increase, the procurement of gluten-free mixes by hospitals, schools, and food service operators also rises proportionally in the gluten-free baking mixes market. This underscores the critical importance of dedicated production lines and certified supply chains to serve this medically dependent segment, which forms the market's non-negotiable core.

- Expansion of e-commerce and digital grocery infrastructure: The U.S. Census Bureau data in August 2025 reports that the e-commerce sales in Q2 2025 increased 5.3% from Q2 2024. The government data confirms the shift towards online retail, which is a vital channel for gluten-free product sales. The total retail sales in the same period increased by 3.9%, highlighting the rising expansion of the distribution channel in the gluten-free baking mixes market. This infrastructure expansion allows specialty brands to reach geographically dispersed consumers without costly national retail distribution first. Further, a direct-to-consumer strategy is now a viable low-barrier market entry tactic. This channel also facilitates the subscription models for staple mixes, ensuring recurring revenue and valuable consumer data collection for product development and personalized marketing.

- Global food safety and traceability compliance: Food safety requirements mandating traceability and allergy management push institutional buyers to use certified gluten-free baking mixes with transparent sources. The food inspection services in various regions have tightened oversight on allergen declaration and cross-contamination prevention, driving the business toward reliable gluten-free suppliers. The large-scale manufacturers supplying government-funded programs must meet these strict standards, directly increasing the demand for validated gluten-free mixes. Further, the inspection protocols require facilities to maintain documented preventive controls promoting high adoption of certified gluten-free ingredients. As regulatory audits intensify across North America and Europe, the B2B buyer shifts suppliers with measurable gluten control verification systems.

Challenges

- Ingredient sourcing and supply chain volatility: Securing consistent, high-quality quality and cost-effective gluten-free flours is a primary challenge in the gluten-free baking mixes market. These supply chains are susceptible to climate change, geopolitical issues, and commodity price fluctuations. For example, leading players in the market invest heavily in long-term supplier contracts and, in some cases, vertical integration for key grains to minimize the volatility. Further, the almond prices in California saw significant volatility due to the drought conditions directly impacting the input costs for numerous manufacturers reliant on almond flour, a leading sub-segment ingredient.

- Formulation challenges and product quality parity: Achieving texture, taste, and mouthfeel equivalent to conventional baked goods is technically difficult without gluten. This requires extensive R&D in hydrocolloids, starches, and protein blends. Leading players in the gluten-free baking mixes market have strongly built brand loyalty by mastering this science. Failure results in poor consumer reception. Various reports have indicated that taste and texture remain the top factors for repeat purchase of gluten-free foods, making formulation the single biggest barrier to product success.

Gluten-free Baking Mixes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 564.6 million |

|

Forecast Year Market Size (2035) |

USD 1.24 billion |

|

Regional Scope |

|

Gluten-free Baking Mixes Market Segmentation:

Form Segment Analysis

Under the form segment, the dry gluten-free baking mixes market is expected to hold a share of 88.6% by 2035. The segment is driven by their superior shelf stability, cost effectiveness, and shipping convenience. They align perfectly with the consumer demand for the pantry-storable solutions that offer fresh-baked results with minimal effort. The growth of e-commerce as a primary channel for specialty gluten-free products further fuels the demand of the segment, as dry goods are far more logistical and economical to distribute nationally than fresh or frozen alternatives. The U.S. BLS report in September 2025 depicts that the economic importance of shelf-stable goods is clear, with the consumer price index for cereals and bakery products increasing 1.6% over the 12 months ending in September. This data reflects a sustained demand and cost pressure in this staple category that includes dry baking mixes.

End user Segment Analysis

By 2035, the household/retail segment will lead the end user segment, due to the gluten-free baking activity at home. This is fueled by the desire for cost control, ingredient transparency, and the customization of baked goods to meet specific dietary needs within a gluten-free framework. The segment’s growth is intertwined with the expansion of the retail distribution, both in physical stores and online. Supporting this, the U.S. BLS December 2023 report shows that the annual expenditure on cereals and bakery products by U.S. consumers reached USD 712 in 2022. This data highlights the consistent budgetary allocation to this food category for home consumption. The high household expenditure highlights the market's resilience and indicates a significant demand for premium gluten-free baking mixes, providing a health-focused alternative within the established baking category.

Product Type Segment Analysis

In the product type, the cake, muffin, and cupcake mixes are expected to dominate majority gluten-free baking mixes market share through 2035, propelled by the demand for convenient celebratory home baking. This trend is supported by the sustained consumer shift towards at-home food preparation. The key driver is the continued growth of the gluten-free consumer base, which includes both those with medical necessities such as celiac disease and a larger population seeking perceived digestive wellness. For example, the consumer behavior spending on the bakeries and tortilla manufacturing establishments, a proxy for ingredient demand, increased significantly with a rise in the annual sales, indicating a robust ongoing engagement with home baking and related product market. This engagement further indicates that indulgence and treat-oriented baking occasions remain a primary catalyst in the market for first-time and repeat purchases within the gluten-free category, securing its commercial dominance.

Our in-depth analysis of the gluten-free baking mixes market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Distribution Type |

|

|

Source |

|

|

Form |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gluten-free Baking Mixes Market - Regional Analysis

North America Market Insights

Gluten-free baking mixes market is dominating the North American market and is expected to hold the market share of 48.7% by 2035. The market is defined by high consumer awareness, established diagnostic pathways for celiac disease, and a mature retail landscape for specialty foods. The U.S. is the global revenue leader and is driven by significant healthcare spending on autoimmune disorders and a strong culture of dietary self-management. Canada follows with robust government-backed food labeling standards and public health guidance. A key driver is the integration of the gluten-free options into the mainstream food service and institutional procurement, supported by the dietary accommodation laws. The trend is moving beyond the medical necessity toward lifestyle adoption with the demand for clean label, nutrient-dense dense and premium ingredient mixes.

The U.S. gluten-free baking mixes market is actively shaped by the federal nutrition program funding and rising medically certified dietary accommodation requests. According to the USDA June 2023 report, the total federal spending on food and nutrition programs reached USD 166.4 billion, expanding the volume of regulated foods purchased under the federal standards, including gluten-free mixes. Further, the ACAAI 2025 report indicates that nearly 6% of U.S. adults and children have food allergies, which reinforces institutional demand for allergen-managed bakery ingredients. With the public schools, healthcare facilities, and government-supported foodservice programs required to follow strict accommodation protocols, suppliers of gluten-free baking mixes gain sustained B2B traction through 2025.

In Canada, the demand for the gluten-free baking mixes market is boosted by the allergen management regulations and expanded federal monitoring of foodborne and dietary health risks. The Government of Canada reported in May 2021 that almost 6% of children and 3% to 4% of adults reported a food allergy, supporting an increase in the procurement of allergen-controlled mixes across commercial and institutional bakeries. Further, gluten-free products are the fastest growing sector in Canada and are expected to grow at a CAGR of 2% from 2023 to 2027, based on the University of British Columbia report in March 2024. Moreover, the rising bakery product manufacturing establishments in Canada increase the potential B2B customer pool for gluten-free baking mix suppliers. Rising bakery outlets create a higher likelihood of product diversification, including gluten-free lines.

Number of Bakery Manufacturing Establishments (2022)

|

Region |

Number of Establishments |

|

Ontario |

545 |

|

British Columbia |

258 |

|

Quebec |

231 |

|

Alberta |

140 |

|

Manitoba |

49 |

|

Nova Scotia |

31 |

|

New Brunswick |

28 |

|

Saskatchewan |

22 |

|

Newfoundland and Labrador |

9 |

|

Prince Edward Island |

8 |

Source: The University of British Columbia March 2024

APAC Market Insights

Asia Pacific is the fastest-growing gluten-free baking mixes market and is expected to grow at a CAGR of 10.8% during the forecast period 2026 to 2035, driven by the westernization of diets, increasing disposable incomes, and gradual health awareness. The demand is less driven compared with the Western markets, mainly by the diagnosed celiac disease. The perception of gluten-free is known as a healthier option the influenced by global dietary trends. The key growth markets include Australia, Japan, and India. The trend is moving toward product localization with varieties of regional flours such as rice, millets, and sorghum. E-commerce and modern retail expansion in urban centers are critical distribution drivers, though price sensitivity remains a significant barrier to widespread adoption.

China exhibits a strong growth potential in the gluten-free baking mixes market and is driven by the urban consumers adopting western dietary trends and the rising focus on digestive health. The demand is largely based on a lifestyle oriented with gluten-free products perceived as the premium and healthier, rather than driven by medically diagnosed celiac disease, which has a low reported prevalence. The per capita consumption of baked items in China is 7.2 kg/year, indicating the rising demand for flour-based products, based on the MOFPI 2024 report. This demand increases the potential for product diversification, including gluten-free baked goods and gluten-free baking mixes. The expansion of modern retail and premium supermarket chains facilitates the availability. The significant driver is the government's emphasis on food safety and health.

In India, the gluten-free baking mixes market is expanding rapidly and is fueled by a massive population exploring wheat alternatives due to perceived intolerance and a growing wellness movement. The primary trend is the indigenization of products using locally sourced millets, chickpea, and almond flours, aligning with the government’s National Initiative for Promoting Millets to boost the nutritional security and farmer income. This creates a unique cost cost-effective supply chain for mix manufacturers. Urbanization and the growth of modern trade are the key distribution drivers. The gluten-free baking mixes market remains highly price sensitive, with most demand concentrated in metropolitan areas. The MOFPI 2024 report indicates that the bakery products market reached USD 532.6 billion in 2024, and the gluten-free baking mixes represent a niche within the larger bakery products economy. Further, the report also depicts that the U.S. is the largest importer of bakery products that including gluten-free baking mixes worth USD 109.90 million in 2024.

Top Importers of Indian Bakery Products (2024)

|

Importing Country |

Value Exported in 2024 (USD million) |

Share in India’s Exports (%) |

Share of India in Partner’s Imports |

|

United States of America |

109.90 |

31% |

0.0013 |

|

United Arab Emirates |

48.29 |

14% |

0.0012 |

|

United Kingdom |

35.75 |

10% |

0.0086 |

|

Canada |

33.30 |

10% |

0.0106 |

|

Saudi Arabia |

23.17 |

7% |

0.0615 |

|

Australia |

20.71 |

6% |

0.0236 |

|

Dominican Republic |

19.08 |

5% |

0.0340 |

|

South Africa |

15.40 |

4% |

0.0018 |

|

Kenya |

15.19 |

4% |

0.0030 |

|

Nepal |

14.97 |

4% |

0.0276 |

Source: MOFPI 2024

Europe Market Insights

Europe is a highly regulated and mature sector in the gluten-free baking mixes market and is underpinned by robust EU labelling laws that define gluten-free and very low gluten thresholds, ensuring consumer trust. The demand is driven by a relatively high and well-diagnosed prevalence of celiac disease. The market is defined by the strong private label penetration in major retail chains and the dominance of dedicated specialist brands such as Dr.Schar. A key trend is the shift towards the clean label and nutritionally enhanced formulations, with the products incorporating the ancient grains such as quinoa and teff to improve nutrient profiles beyond the simple starch bases. Cross-border e-commerce within the EU single market facilitates brand expansion. The public health initiatives, such as those promoted by the European Commission's Health and Food Safety Directorate, emphasize improved diagnosis and management of food-related chronic diseases, indirectly supporting market education and growth.

Germany gluten-free baking mixes market is projected to maintain highest revenue share by 2035, due to its health-conscious consumer base, high disposable income, and robust quality expectations that align with the gluten-free certification. The growth is fueled by the demand for organic gluten-free products, integrating two major consumer trends. Further, the active mergers and acquisitions are expanding the market; for example, Smart Organic, the leading producer of organic snacking products, announced the acquisition of the German food startup Naughty Nuts GmbH. Moreover, the data from the Federal Ministry of Food and Agriculture actively promotes the quality of food production and transparent labeling, creating a favorable environment for trusted gluten-free claims. Furthermore, research institutes contribute to public understanding of nutrition and food technology, supporting the development of higher-quality, nutritious gluten-free options that drive premiumization in the market.

The UK will maintain a steady revenue share in the gluten-free baking mixes market in Europe, driven by the combination of high consumer awareness, and robust retail private label sector, and strong patient advocacy from organizations such as Coeliac UK. The key growth factor is the continuous product innovation by the UK brands, focusing on health trends such as high-protein and keto-friendly baking mixes. For example, the gluten-free food supplier such as the Juvela has announced the launch of a bakery brand called Oaf and invested £1.5m in allergen-free production sites. The government-supported data is pivotal and provides ongoing clinical guidelines for the diagnosis and management of coeliac disease, ensuring an informed patient base. The trend toward free-from aisles in all major supermarkets guarantees mainstream accessibility and competition

Key Gluten-free Baking Mixes Market Players:

- General Mills (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Hain Celestial Group (U.S.)

- Kellogg Company (U.S.)

- Bob's Red Mill (U.S.)

- Pamela's Products (U.S.)

- Conagra Brands (U.S.)

- Dr. Schär (Italy)

- Hero Group (Switzerland)

- Warburtons (UK)

- Orgran (Australia)

- Freedom Foods Group (Australia)

- Dove's Farm (UK)

- Barkat (UK)

- Kinnikinnick Foods (Canada)

- Aleia's (U.S.)

- Priméal (France)

- Ener-G Foods (U.S.)

- Lam Soon (Malaysia)

- MGP Ingredients (U.S.)

- King Arthur Baking Company (U.S.)

- General Mills via its brand Betty Crocker, is a dominant player in the market. The company's key strategy is to leverage its unparalleled retail distribution and brand trust to make gluten-free options accessible. By incorporating these mixes into mainstream supermarket aisles and routinely marketing them alongside traditional items, General Mills successfully demystifies gluten-free baking for the ordinary consumer, boosting category development through convenience and familiarity.

- The Hain Celestial Group competes with other competitors in the gluten-free baking mixes market with a strategic focus on organic and natural ingredients, catering to the health-conscious segment. Through brands such as Arrowhead Mills and Rudi’s Gluten Free Bakery, it highlights the clean label formulation. The company’s initiative involves organic pantry items targeting the natural food channel to build a brand identity that resonates with dedicated free-from consumers. According to the annual report 2024, the sales outside the U.S. reported 50%, 46% and 43% during the fiscal 2025, 2024, and 2023, respectively.

- Kellogg Company approaches the gluten-free baking mixes market by aligning with active lifestyles and nutritional density. Its strategy moves beyond mere gluten removal to fortification and protein inclusion. Kellogg's uses its strong brand recognition in nutrition to launch the baking mixes that are marketed not just as alternatives but as positive nutritional choices, often using integrated marketing campaigns that link the mixes to wellness and fitness communities.

- Bob’s Red Mill is a heritage player in the market and is distinguished by its dedicated gluten-free facility and wide variety of whole-grain stone-ground options. Its strategic initiative is built on deep consumer trust and education. The company invests in detailed labelling, nutritional transparency, and recipes that teach consumers how to bake from scratch.

- Conagra Brands engages with the gluten-free baking mixes market primarily via its acquisition and expansion of the Glutino brand, a well-established name in the gluten-free sector. Its core strategy is one of portfolio optimization and brand leverage. Conagra integrates Glutino’s baking mixes into its vast distribution and supply chain network, ensuring widespread retail availability. The company has witnessed a high net income during the year 2025, reporting USD 1,152.5 million, which is extremely high compared to the previous year.

Here is a list of key players operating in the global gluten-free baking mixes market:

The gluten-free baking mixes market is fragmented and features large CPG conglomerates and specialized niche players. The competition is intensifying and is driven by the rising global demand for health-conscious and free-from products. The key strategic initiatives include extensive portfolio diversification beyond the basic flour blends into artisan and keto mixes, such as almond and coconut flour. The major players use robust omnichannel distribution while the small brands focus on direct-to-consumer e-commerce and regional organic sourcing. Strategic acquisitions of innovative startups and collaborations with the retail private labels are also common tactics to expand the market reach and consumer base rapidly. For example, in August 2024, Saco Foods announced the acquisition of Ancient Harvest and Pamela’s. These companies aim for gluten-free food products.

Corporate Landscape of the Gluten-free Baking Mixes Market:

Recent Developments

- In December 2025, FREEE, a leading brand in gluten-free foods has launched the UK’s first gluten-free Dumpling Mix, a free-from aisle first, alongside new crumble and Yorkshire pudding mixes.

- In December 2025, Antonina’s Gluten-Free Bakery, a Sumner, Washington-based innovator in allergen-friendly baked goods, has announced the launch of its groundbreaking Lemon Streusel Muffins, marking the company’s first gluten and dairy-free muffin offering.

- In August 2024, Mightylicious, a company that makes various flavors of gluten-free cookies, has launched a line of gluten-free baking mixes. The superfine rice flour is the key ingredient in the item for a neutral taste.

- Report ID: 8326

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gluten-free Baking Mixes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.