Global Uniform & Workwear Market

Chapter 1: Executive Summary

Market Snapshot

Key Trends

Increasing focus of employee comforts

Global & Segmental Market Estimates & Forecasts, 2016-2025 (USD Billion)

Global Workwear & Uniform Industry, By Region 2016-2025 (USD Billion)

Global Workwear & Uniform Market, By Type 2016-2025 (USD Billion)

Global Workwear & Uniform Industry, By End Use Industry 2016-2025 (USD Billion)

Chapter 2: Global Uniform & Workwear Market Definition & Scope

Objective of The Study

Market Definition

Scope of the Study

Years Considered for The Study

Currency Conversion Rates

Chapter 3: Global Uniform & Workwear Industry Dynamics

Uniform & Workwear Market Growth Prospects

Drivers

Increasing trends of fashionable and functional clothing

Focus on improving service levels

Challenges

Availability of counterfeit products

Opportunity

Increasing focus of industries on workers’ safety.

Industry Analysis

Porter’s 5 Force Model

Porter’s 5 Force Model, Impact Analysis (2015-2025)

PEST Analysis

Chapter 4: Global Workwear & Uniform Industry by Type

Market Snapshot

Global Workwear & Uniform Industry by Type Performance - Potential Analysis

Global Workwear & Uniform Industry Estimates & Forecasts by Type 2015-2025 (USD Billion)

Global Workwear & Uniform Industry, Sub Segment Analysis

Anti-Flaming Workwear & Uniform

Market estimates & forecasts, 2015-2025

Regional breakdown estimates & forecasts, 2015-2025

Anti-Acid/Chemical Protective Workwear and Uniform

Market estimates & forecasts, 2015-2025

Regional breakdown estimates & forecasts, 2015-2025

Others

Market estimates & forecasts, 2015-2025

Regional breakdown estimates & forecasts, 2015-2025

Chapter 5: Global Workwear & Uniform Industry by End-User

Market Snapshot

Global Workwear & Uniform Industry by Type Performance - Potential Analysis

Global Workwear & Uniform Industry Estimates & Forecasts by End-User 2015-2025 (USD Billion)

Global Workwear & Uniform Industry, Sub Segment Analysis

Manufacturing Industry

Market estimates & forecasts, 2015-2025

Regional breakdown estimates & forecasts, 2015-2025

Service Industry

Market estimates & forecasts, 2015-2025

Regional breakdown estimates & forecasts, 2015-2025

Mining Industry

Market estimates & forecasts, 2015-2025

Regional breakdown estimates & forecasts, 2015-2025

Agriculture & Forestry Industry

Market estimates & forecasts, 2015-2025

Regional breakdown estimates & forecasts, 2015-2025

Transportation Industry

Market estimates & forecasts, 2015-2025

Regional breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Others

Market estimates & forecasts, 2015-2025

Regional breakdown estimates & forecasts, 2015-2025

Chapter 6: Global Uniform & Workwear Market, Regional Analysis

Uniform & Workwear Market, Regional Market Snapshot

North America Uniform & Workwear Market

U.S. Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Canada Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Europe Uniform & Workwear Market

UK Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Germany Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Rest of Europe Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Asia Pacific Uniform & Workwear Market

China Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

India Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Japan Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Rest of Asia Pacific Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Latin America Uniform & Workwear Market

Brazil Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Mexico Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Rest of Latin America Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Rest of the World Uniform & Workwear Market

Market estimates & forecasts, 2015-2025

Type breakdown estimates & forecasts, 2015-2025

End-User breakdown estimates & forecasts, 2015-2025

Transportation Industry breakdown estimates & forecasts, 2015-2025

Chapter 7: Competitive Intelligence

Top Market Strategies (2017/2018)

Company Profiles

ALSICO NV

Bare Bones

Cintas Corporation

Dickies (UK) Limited

Engelbert strauss

Fristads AB

HaVeP

Hejco Yrkeskläder

Johnson’s Apparelmaster

Carhartt

Chapter 8 Research Methodology

Research Process

Data Mining

Analysis

Market Estimation

Validation

Publishing

Research Attributes

Research Assumption

Workwear and Uniform Market Outlook:

Workwear and Uniform Market size was valued at USD 93.96 billion in 2025 and is expected to reach USD 160.5 billion by 2035, expanding at around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of workwear and uniform is assessed at USD 98.61 billion.

The growth of the market can be attributed to the rising number of people getting into the workforce. According to the International Labor Organization in 2023, the global labor force participation rate was 60.8%. The rising number of laborers across the world instills the requirement for adequate dress, which is further propelling the growth of the market.

Also, there is a rising number of work-related diseases and occupational accidents in the workplace. There is an increased demand for effective workwear to reduce work-related diseases. A workwear with antimicrobial qualities prevents fungi, bacteria, and viruses from growing on the surface of the fabric. For instance, according to research conducted by the International Labor Organization in November 2023, nearly 3 million people died of work-related accidents and diseases. These factors are propelling the growth of the market during the forecasted period.

Key Workwear and Uniform Market Insights Summary:

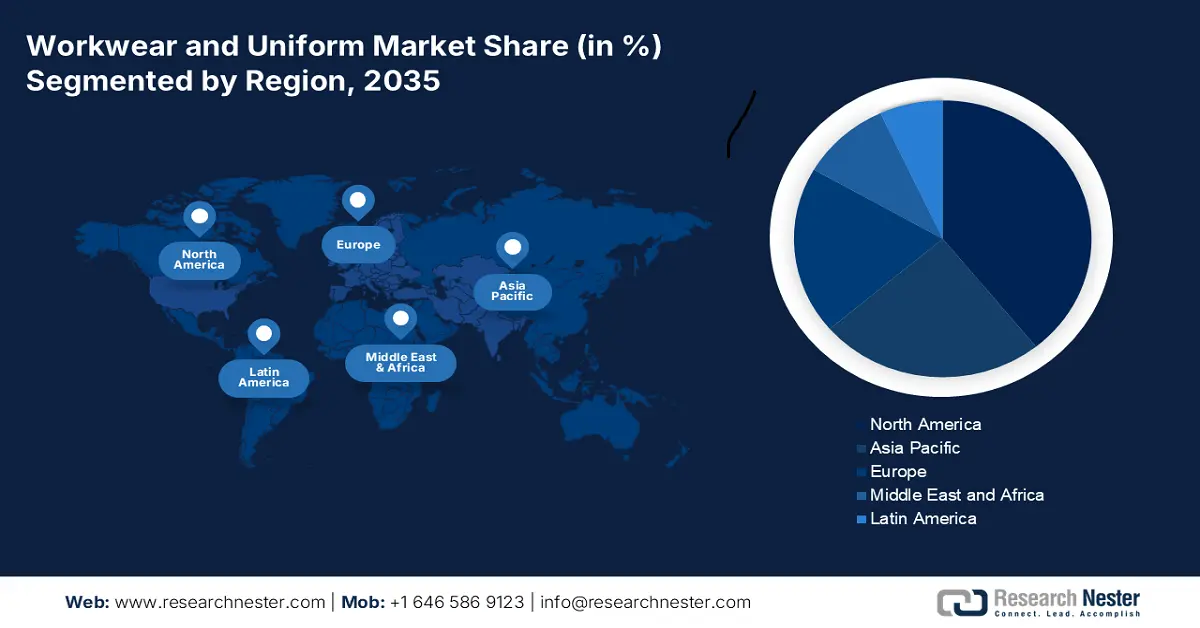

Regional Highlights:

- North America workwear and uniform market will hold around 40% share by 2035, driven by stringent safety rules at workplaces.

Segment Insights:

- The apparel segment in the workwear and uniform market is expected to capture the largest share by 2035, fueled by rising demand for temperature-resistant and lightweight workwear.

- The corporate workwear segment in the workwear and uniform market is projected to achieve significant growth during 2026-2035, fueled by workplace fashion trends and corporate sector growth across industries.

Key Growth Trends:

- Rising manufacturing industry

- Increasing marketing efforts

Major Challenges:

- Availability of low-quality fabrics

- Exorbitant cost of the specialized workwear

Key Players: VF Corporation, Alsico NV, Barebones Workwear, Inc., Cintas Corporation, Williamson-Dickie Mfg. Co., LLC, Engelbert Strauss GmbH & Co. KG, Fristads AB, VP Capital, Hejco Yrkesklader, Johnson Service Group PLC..

Global Workwear and Uniform Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 93.96 billion

- 2026 Market Size: USD 98.61 billion

- Projected Market Size: USD 160.5 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 8 September, 2025

Workwear and Uniform Market Growth Drivers and Challenges:

Growth Drivers

- Rising manufacturing industry: The global manufacturing sector has been showing robust growth in recent years, and a emerging as an integral pillar for the world’s economic growth. In developing countries such as India, there is a humongous labor involved in the sector. For instance, according to the India Brand Equity Foundation in February 2025, there were almost 27.3 million workers involved in the manufacturing sector. The burgeoning manufacturing sector instills the demand for quality workwear for the workers to protect them from hazardous wastes, chemicals, etc. An efficient workwear also protects from the risk of concussions, cuts, and accidents.

- Increasing marketing efforts: In the current world, marketing has become extremely crucial for driving sales and revenue growth. Companies are investing heavily in company uniforms, considering them as a tool for marketing the brand. Various companies are adopting a uniform for their business to encourage a code of conduct, increase productivity, and improve brand identity. Top-notch brands such as McDonald’s are keeping uniforms for their workers and reflecting the company’s ideology to the buyers. According to World Record Academy in November 2024, McDonald's has become the largest fast food restaurant chain and serves over 69 million customers daily in over 100 countries. The exemplary success of the company is instigating other players to also adopt workwear or uniform for the market players.

- Rising enrollment in schools: Governments all across the world are investing in programs encouraging school education even to marginalized sections of society. For instance, in May 2022, the government of India declared that 1.5 million government schools were given free uniforms. Such practices are encouraging market players to invest in the workwear and uniform market and fulfill the huge demand from educational institutes.

Challenges

- Availability of low-quality fabrics: There is a huge availability of poor, low-quality fabric that may pose a challenge as a counterfeit product in the market. The sale of counterfeit products hampers the sale of genuine products and discourages the investor.

- Exorbitant cost of the specialized workwear: The production of high-performance and flame-resistant workwear is costly, making it extremely difficult for the small business to purchase. The stringent safety standards from the government add more difficulty for the seller as well as buyers.

Workwear and Uniform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 93.96 billion |

|

Forecast Year Market Size (2035) |

USD 160.5 billion |

|

Regional Scope |

|

Workwear and Uniform Market Segmentation:

Product Segment Analysis

The apparel segment is anticipated to hold the largest market on account of the growing demand amongst manufacturing companies to provide workwear apparel. Moreover, there is a rising demand from enterprises for apparel that can withstand different temperatures and fabrics that weigh less to suit different work environments. According to the Bureau of Labor Statistics, there were 5,283 fatal work injuries recorded in the United States in the year 2023. Safe work apparel can help in preventing mishaps and ensure the protection of the worker. A well-manufactured apparel acts as a protective kit for the worker. Market players are making smart workwear with sustainable fabrics and customizing the workwear according to the demand of the industry.

Type Segment Analysis

The corporate workwear segment is anticipated to grow at a significant pace owing to the growing trends of workplace fashion and the availability of varied options for dressing. The growth can also be attributed to the burgeoning expansion of the corporate sector and the availability of large-scale job growth in education, agriculture, digital commerce, and trade. According to data published by The Future of Jobs Report for 2023-2027, jobs in the education industry are projected to grow by 10%. Also, job growth is forecasted to reach 4 million in domains such as e-commerce specialists, digital transformation specialists, strategy specialists, and digital marketing.

Our in-depth analysis of the global workwear and uniform market includes the following segments:

|

Type |

|

|

Product

|

|

|

Services

|

|

|

Demography |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Workwear and Uniform Market Regional Analysis:

North America Market Insights

The workwear and uniform market in the North America region is anticipated to garner significant growth due to rising stringent safety rules at work. For instance, in the U.S., the Occupational Safety and Health Administration reported in 2021, about 120,000 workers died from the occurrence of occupational diseases. These incidents are leading to increased concern for the employer’s safety at the workplace. Additionally, in Canada, workplace uniforms are emphasized as they help in protecting the employees in ensuring safety while they are at work. Also, people are wearing smart wearables, including the Internet of Things, for tracking workers’ movement and confirming the safety of the workers.

Asia Pacific Market Insights

traction in the Asia Pacific region due to rising demand from the oil, gas, manufacturing, and construction sectors. For instance, according to the Press Information Bureau in January 2025, 0.6 million people were working in the petroleum industry in India. The government is making stringent rules for the safety of workers and ensuring the availability of workwear from the owner. Company owners are also purchasing smart workwear having sensors for tracking movement and health checks. Similarly, in Japan, organizations such as the Japan Industrial Safety and Health Association make strict rules for worker safety in mushrooming automation and robotics factories.

Workwear and Uniform Market Players:

- Carhartt Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- VF Corporation

- Alsico NV

- Barebones Workwear, Inc.,

- Cintas Corporation

- Williamson-Dickie Mfg. Co., LLC

- Engelbert Strauss GmbH & Co. KG

- Fristads AB, VP Capital

- Hejco Yrkesklader

- Johnson Service Group PLC.

The competitive landscape of the market is rapidly evolving as established key players, manufacturing giants, and new entrants are investing in launching modern products. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In March 2025, Cintas Corporation reported results for its fiscal 2025 3rd quarter ended February 2025. Revenue growth in the quarter of fiscal year 2025 was USD 2.61 billion compared to USD 2.41 billion in last year’s 3rd quarter.

- In January 2022, The Johnson Service Group PLC launched a refreshed sustainability strategy, “The Johnsons Way”. The Johnsons' way sets out the framework that underpins the approach to sustainability and sets out a vision for a better future.

- Report ID: 1991

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Workwear and Uniform Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.