Dry-cleaning and Laundry Services Market Outlook:

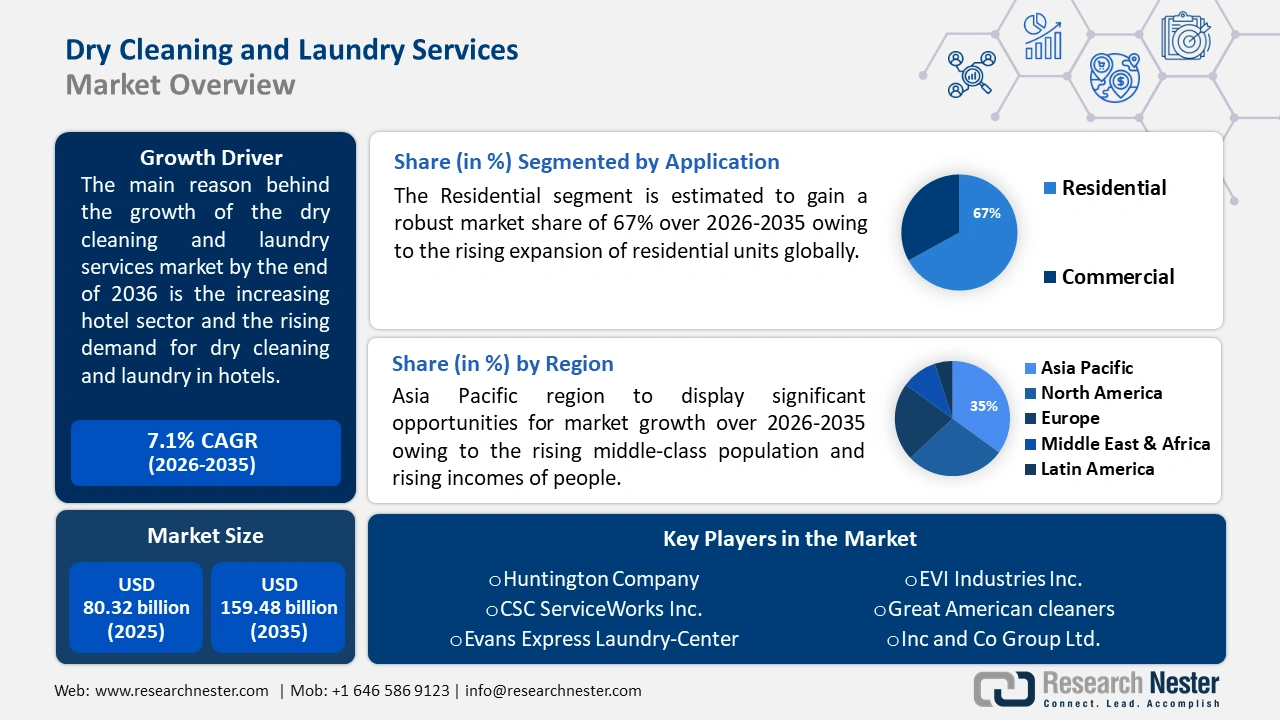

Dry-cleaning and Laundry Services Market size was valued at USD 80.32 billion in 2025 and is likely to cross USD 159.48 billion by 2035, expanding at more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dry-cleaning and laundry services is assessed at USD 85.45 billion.

The primary factor behind the growth is the increasing hotel sector and the rising demand for dry cleaning and laundry in hotels. According to the National Library of Medicine, the travel and tourism sector, which includes hotels and other lodging options, bars, restaurants, cruise ships, casinos, travel agencies, tour operators, and other related businesses, generated over USD 4.5 trillion in consumer expenditure in 2020.

Key Dry Cleaning and Laundry Services Market Insights Summary:

Regional Highlights:

- Asia Pacific dry-cleaning and laundry services market is expected to capture 35% share by 2035, driven by rising middle-class population and incomes, along with healthcare infrastructure investments.

- North America market will achieve significant CAGR during 2026-2035, driven by increasing demand for organic home care products and eco-friendly cleaning solutions.

Segment Insights:

- The residential segment in the dry-cleaning and laundry services market is projected to hold a 67% share by 2035, attributed to the rising expansion of residential units globally.

- The laundry segment in the dry-cleaning and laundry services market is projected to hold a 58% share by 2035, driven by increasing technological advancement in laundry services.

Key Growth Trends:

- Rising tourism sector globally

- The extension of working professionals

Major Challenges:

- Awareness in people related to chemical use in laundry

- Strict government rules to protect the environment

Key Players: Alliance Laundry Systems LLC, Huntington Company, CSC ServiceWorks Inc., Evans Express Laundry-Center, EVI Industries Inc., Great American cleaners, Inc and Co Group Ltd., Lapels Cleaners, Laundry-Town Inc., Marberry Cleaners and Launderers Inc., Nippon Wex, NHK World-Japan, Baluco Laundry Place Yoyogi-Uehara, SAHI SEISAKUSHO CO., LTD.

Global Dry Cleaning and Laundry Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 80.32 billion

- 2026 Market Size: USD 85.45 billion

- Projected Market Size: USD 159.48 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Dry-cleaning and Laundry Services Market Growth Drivers and Challenges:

Growth Drivers

- Rising tourism sector globally - The increased demand from the hotel and tourist industries is driving the global market. To service customers, hotels, restaurants, and resorts need a lot of towels, linens, and uniforms. As a result, there is a constant need for laundry services to guarantee a supply of clean, well-kept textiles.

In line with the World Travel and Tourism Council, the travel and tourism industry's 9.1% GDP contribution in 2023 was up 23.2% from 2022 and just 4.1% less than in 2019. Technological advancements have the power to upend established market, open up new avenues for business, and alter customer behavior. Companies must keep up with technological growth if they wish to remain valid in competition. - The extension of working professionals - It is projected that as a large number of people are now becoming professionals, they get little to no time to clean their own clothes in-house. People emphasize having clean, well-maintained clothes as their lives get busier, which increases the need for professional laundry services.

In 2020, professionals made up 88.4 million workers in a wide range of occupations, accounting for 59.8% of the workforce. All employees falling under the category of "management, professional, and related occupations" are considered to be part of the professional workforce, according to the U.S. Bureau of Labor Statistics (BLS). - Cost-effective and innovative laundry services - Furthermore, the laundry department is expanding its range of services to include not only standard pieces of clothing but also workwear, designer apparel, and outerwear, as well as customized uniforms. The increased demand from the hotel industry, rising disposable income, and rise in dual-income housing are the main drivers of this diversification.

The trend in recent years has been toward non-competitive mergers or the joining of businesses that provide complementary services. By combining knowledge in various laundry sector specialties, these mergers hope to improve service delivery and broaden their dry-cleaning and laundry services market reach without going up against one another.

Challenges

- Awareness in people related to chemical use in laundry - The implementation of harsh chemicals and toxic components is harshly affecting the environment. People are becoming more and more concerned about these cleaning agents.

Solvents like perchloroethylene, or perc, are frequently used in traditional dry-cleaning techniques, although they can be harmful to the environment. These substances have the ability to pollute water, air, and soil. - Strict government rules to protect the environment - Strict environmental restrictions may limit the kind of cleaning solvents and chemicals that may be used, increasing the expense of compliance and perhaps reducing the variety of services that a company can provide.

Intense rivalry within the sector may result in diminished profit margins and price wars. It might be difficult for smaller, independent companies to compete with bigger chains or franchises.

Dry-cleaning and Laundry Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 80.32 billion |

|

Forecast Year Market Size (2035) |

USD 159.48 billion |

|

Regional Scope |

|

Dry-cleaning and Laundry Services Market Segmentation:

Services Segment Analysis

Laundry segment is poised to capture dry-cleaning and laundry services market share of around 58% by the end of 2035. The largest segment of dry-cleaning and laundry services is laundry, with a market value of USD 30.16 billion in 2023. The increasing technological advancement in laundry services will propel this segment to hold the largest market.

Technical solutions for the commercial laundry services sector are still being developed as the business has grown into a profitable one. Optimal services are now more accessible than ever thanks to laundry tracking software and incredibly sophisticated washing machines.

Application Segment Analysis

In dry-cleaning and laundry services market, residential segment is expected to hold revenue share of more than 67% by 2035. This expansion will be noticed because of the rising expansion of residential units globally.

According to the World Bank, currently, more than 50% of people on the planet reside in cities. The global urban population is expected to rise to 6 billion people by 2045, a 1.5-fold increase. In order to accommodate their growing population, city officials must act swiftly to plan for expansion and supply the infrastructure, affordable housing, and essential services.

Our in-depth analysis of the market includes the following segments:

|

Product |

|

|

Application |

|

|

Distribution Channel |

|

|

Type |

|

|

Garments |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dry-cleaning and Laundry Services Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to hold largest revenue share of 35% by 2035. The region’s dry-cleaning and laundry services sector is thriving, because of the rising middle-class population and rising incomes of people. According to the Asian Development Bank, in the past several decades, developing Asia's middle class (USD 2-USD 20) has expanded significantly in comparison to other global areas. Moreover, more than USD 1.8 trillion in total yearly middle-class expenditure added more than 800 million individuals to the middle class.

The market for dry-cleaning and laundry services has expanded in China as a result of the rising population and their inclination towards cleanliness and advanced material in this country. China's population is estimated to have decreased from 1.412 billion in the 2020 census to 1.409 billion in 2023.

The Indian dry-cleaning and laundry services development mainly lies in the rising investment in healthcare infrastructure, and growing spending. India ranks second with 205 million new middle-class citizens and USD 256 billion in yearly middle-class spending.

Japan will also be a significant place in the growth of dry-cleaning and laundry services because of the increasing commercial sector in this region. Japan has more than 5.3 million non-governmental commercial enterprises, according to the country's most recent national census. Private businesses, such as single proprietorships and incorporated firms, made up the bulk of these entities.

North American Market Insights

North America dry-cleaning and laundry services market revenue is projected to grow at a significant rate till 2035 owing to the increasing demand for organic home care products in this region. The demand for cleaning goods, including hand sanitizers, disinfectants, and other household cleaning products, is unprecedented for retailers.

Dry-cleaning and laundry services are especially in actual demand in the U.S., driven by the rising use of eco-friendly solvents for cleaning. The percentage of American products promoted with green chemistry increased to 15.10% in 2020. Highlighting the growing need for and acceptance of green chemistry solutions across a range of sectors.

In Canada, dry-cleaning and laundry services will encounter massive growth because of the increasing presence of online laundry services. Customers may now outsource these tasks as on-demand laundry apps have become popular in Canada. These applications offer doorstep pickup and delivery choices to their users.

Dry-cleaning and Laundry Services Market Players:

- Alliance Laundry Systems LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huntington Company

- CSC ServiceWorks Inc.

- Evans Express Laundry-Center

- EVI Industries Inc.

- Great American cleaners

- Inc and Co Group Ltd.

- Lapels Cleaners

- Laundry-Town Inc.

- Marberry Cleaners and Launderers Inc.

Leading companies are concentrating on enhancing the features and specifications of dry-cleaning and laundry services in addition to forming alliances, mergers, and acquisitions to broaden their product offerings. A few of the key players in the dry-cleaning and laundry services market are:

Recent Developments

- Alliance Laundry Systems LLC manufactured a range of commercial washing machines and dryers for use by establishments including laundromats, motels, and hospitals. The corporation owns a number of well-known laundry industry brands, such as UniMac, Huebsch, and Speed Queen. Heavy-duty industrial laundry equipment for high-volume laundry operations is produced by the firm.

- The Huntington Company with its main office located in Berkley, Michigan, is a multi-concept franchisor committed to providing the greatest retail dry cleaning, laundry, and textile restoration services available worldwide.

- Report ID: 6127

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.