Global Video Surveillance Market

- An Outline of the Global Video Surveillance Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

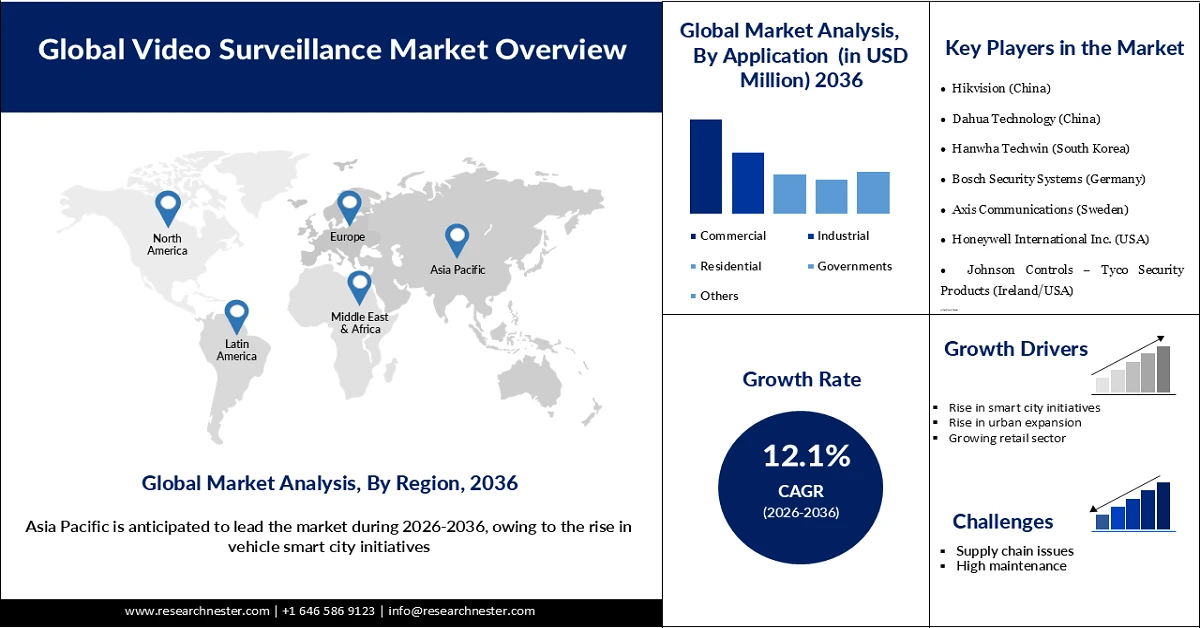

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Video Surveillance

- Recent News

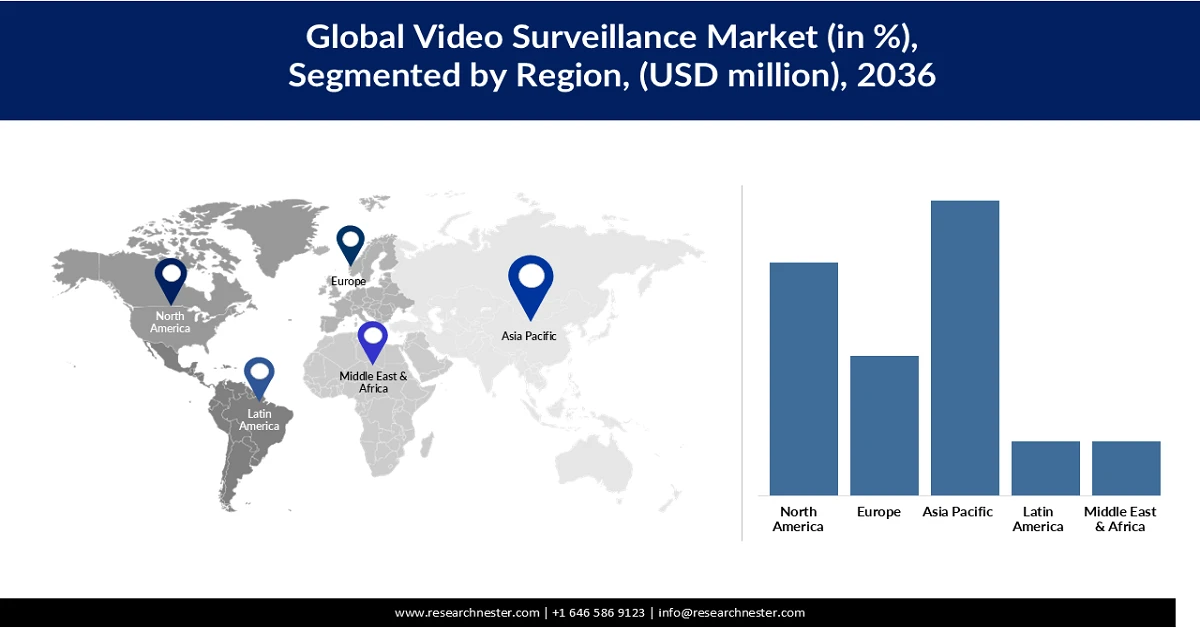

- Regional Demand

- Global Video Surveillance by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Video Surveillance Demand Landscape

- Global Video Surveillance Demand Trends Driven by Safety, Traffic Mitigation and Urban Mobility (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Video Surveillance Porter Five Forces

- PESTLE

- Comparative Positioning

- Video Surveillance – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- Hikvision

- Dahua Technology

- Hanwha Techwin

- Bosch Security Systems

- Axis Communications

- Honeywell International Inc

- Johnson Controls – Tyco Security

- Panasonic Corporation

- FLIR Systems

- Uniview Technologies

- Business Profile of Key Enterprise

- Global Video Surveillance Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Tons), and Compound Annual Growth Rate (CAGR)

- Global Segmentation Video Surveillance Analysis (2026-2036)

- By Hardware

- Camera, Market Value (USD Million), and CAGR, 2026-2036F

- Image, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Systems

- Analouge, Market Value (USD Million), and CAGR, 2026-2036F

- IP, Market Value (USD Million), and CAGR, 2026-2036F

- Hybrid, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Commercial, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Residential, Market Value (USD Million), and CAGR, 2026-2036F

- Governments, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Hardware

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Hardware

- Camera, Market Value (USD Million), and CAGR, 2026-2036F

- Image, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Systems

- Analogue, Market Value (USD Million), and CAGR, 2026-2036F

- IP, Market Value (USD Million), and CAGR, 2026-2036F

- Hybrid, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Commercial, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Residential, Market Value (USD Million), and CAGR, 2026-2036F

- Governments, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Hardware

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Hardware

- Camera, Market Value (USD Million), and CAGR, 2026-2036F

- Image, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Systems

- Analouge, Market Value (USD Million), and CAGR, 2026-2036F

- IP, Market Value (USD Million), and CAGR, 2026-2036F

- Hybrid, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Commercial, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Residential, Market Value (USD Million), and CAGR, 2026-2036F

- Governments, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Hardware

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Million), 2026-2036, By

- By Hardware

- Camera, Market Value (USD Million), and CAGR, 2026-2036F

- Image, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Systems

- Analouge, Market Value (USD Million), and CAGR, 2026-2036F

- IP, Market Value (USD Million), and CAGR, 2026-2036F

- Hybrid, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Commercial, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Residential, Market Value (USD Million), and CAGR, 2026-2036F

- Governments, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Hardware

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2026-2036, By

- By Hardware

- Camera, Market Value (USD Million), and CAGR, 2026-2036F

- Image, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Systems

- Analouge, Market Value (USD Million), and CAGR, 2026-2036F

- IP, Market Value (USD Million), and CAGR, 2026-2036F

- Hybrid, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Commercial, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Residential, Market Value (USD Million), and CAGR, 2026-2036F

- Governments, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Hardware

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2026-2036, By

- By Hardware

- Camera, Market Value (USD Million), and CAGR, 2026-2036F

- Image, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Systems

- Analouge, Market Value (USD Million), and CAGR, 2026-2036F

- IP, Market Value (USD Million), and CAGR, 2026-2036F

- Hybrid, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Commercial, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Residential, Market Value (USD Million), and CAGR, 2026-2036F

- Governments, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Hardware

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Video Surveillance Market Outlook:

Video Surveillance Market size is valued at USD 82.7 billion in 2025 and is forecasted to reach a valuation of USD 290.4 billion by the end of 2036, rising at a CAGR of 12.1% during the forecast period, i.e., 2026-2036. In 2026, the industry size of the video surveillance is evaluated at USD 92.7 billion.

Globally, rising security concerns are driving increased adoption of video surveillance across streets and road infrastructure. Growing threats such as terrorism, vandalism, and theft have heightened public safety concerns, positioning video surveillance as a critical tool for prevention, deterrence, and incident response. In response, governments worldwide are strengthening crime-mitigation strategies through expanded police deployment and the integration of advanced surveillance technologies. Technological advancements, including thermal imaging cameras, 360-degree panoramic systems, and AI-enabled analytics, have significantly expanded the effectiveness and scope of video surveillance solutions. In defense and high-security applications, the integration of complementary technologies such as laser scanners and metal detection systems further enhances situational awareness and threat detection capabilities. These improvements in system performance and operational efficiency are accelerating adoption across critical infrastructure, transportation networks, and public safety sectors.

Key Video Surveillance Market Insights Summary:

Regional Highlights:

- Asia Pacific is anticipated to command a 38% share by 2036 in the video surveillance market, supported by widespread availability of low-cost components, expanding public transport infrastructure, and accelerated AI- and cloud-enabled CCTV deployment across densely populated economies

- North America is projected to secure a 30.20% share by 2036, reinforced by deep integration of cloud computing in smart urban infrastructure, strong presence of camera hardware manufacturers, and heightened security requirements across defense and public spaces

Segment Insights:

- The camera segment is forecast to account for a dominant 55% share by 2036 in the video surveillance market, underpinned by rapid advancements in high-performance cameras with thermal threat detection, 360-degree monitoring, and growing adoption of Wi-Fi–enabled surveillance in residential and commercial settings

- The IP surveillance segment is expected to capture a substantial 66% market share by 2036, fueled by accelerating digital transformation, AI integration, cloud compatibility, and lower operational and maintenance costs compared to traditional systems

Key Growth Trends:

- Rising urban expansion

- Adoption of smart cities

Major Challenges:

- Supply Chain Issues

- High Maintenance

Key Players: Hikvision (China), Dahua Technology (China), Hanwha Techwin (South Korea), Bosch Security Systems (Germany), Axis Communications (Sweden), Honeywell International Inc. (U.S.), Johnson Controls – Tyco Security Products (Ireland/U.S.), Panasonic Corporation (Japan), FLIR Systems (U.S.), Uniview Technologies (China).

Global Video Surveillance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 82.7 billion

- 2026 Market Size: USD 92.7 billion

- Projected Market Size: USD 290.4 billion by 2036

- Growth Forecasts: 12.1% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Vietnam

Last updated on : 4 February, 2026

Video Surveillance Market - Growth Drivers and Challenges

Growth Drivers

- Rising urban expansion: The rising population has increased crime rates and criminal activities, which demand video surveillance for safety and security during movements. Governments and manufacturers are collaborating to enhance the safety of cities by monitoring infrastructure. Public transports, transport corridors, and public parks are often under the surveillance of CCTV that consistently ensure safety and security of the zones. From 2021 to 2024, the Chinese population grew from 63% to 66%, demonstrating the steady rise in urban living, which is fuelling the demand for video surveillance.

- Adoption of smart cities: Globally, smart cities are rapidly increasing, which is fuelling the demand for advanced cameras. Smart cities enhance traffic management, the safety of the residents, and civic management through video surveillance. As municipal areas are expanding, video surveillance has become a core part of urban infrastructure. In March 2025, Beibei district in Chongqing installed more than 27,00 cameras and sensors under its smart city program that would ensure continuous monitoring of the residential areas. Manufacturers are leveraging the falling prices of hardware by reducing the product price, which is further enabling wider adoption.

- Growing retail sector: The rising retail sector is increasing the demand for video surveillance as shops seek stringent monitoring and oversight that enhances the security and safety within the facilities. In October 2025, China experienced a rise in retail sales, where the values rose by more than 2.9%, and the sales grew by 4.3%, which demonstrates the growing retail sector. The sudden growth of the retail sector has increased the adoption of video surveillance and driven significant expansion. The adoption is high within departmental stores and e-commerce-based outlets.

Challenges

- Supply Chain Issues: The video surveillance market is experiencing a decline in sales because of stringent regulations and compliance, which limit the availability of electronic components essential in the production of cameras. Particularly, the foreign-made cameras are being disrupted, which is causing significant challenges in mass adoption.

- High Maintenance: High cost of integrations and frequent servicing enhances the maintenance cost, which disrupts the growth of the video surveillance market. For business such maintenance can increase the operational cost, which prohibits them from adopting CCTV cameras, slowing down the global growth.

Video Surveillance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

12.1% |

|

Base Year Market Size (2025) |

USD 82.7 billion |

|

Forecast Year Market Size (2036) |

USD 290.4 billion |

|

Regional Scope |

|

Video Surveillance Market Segmentation:

Hardware Segment Analysis

The camera segment will hold the highest share of 55% by the end of 2036 owing to the rise in advanced cameras and their use in high-performance environments such as offices, retails and showrooms. Cameras have advanced in terms of threat detection, which can now thermally assess threats and identify objects. Modern CCTV cameras are capable of recording a 360-degree view to enhance the safety and security of the facilities. The growth of safety within residential areas has also powered the growth of Wi-Fi-based cameras, which can record and store videos for a long time, enhancing safety.

System Segment Analysis

The IP surveillance segment is expected to hold the largest share in the market, at 66%, due to the digital transformation and integration of AI. Furthermore, high-quality pictures and video recording that effectively integrate with the cloud platforms. IP cameras cost less and are easier to maintain, which can reduce the stress on operational costs. The cameras receive and transmit signals through IT networks, ensuring consistent connectivity and live video sharing. The hybrid video surveillance system will also present a significant opportunity in the future, owing to the flexible features of both IP surveillance and analogue surveillance. The hybrid cameras can be installed in various environments, including residences and commercial spaces

Application Segment Analysis

The commercial segment will hold the largest share of 35% by the end of 2036, owing to the growth in the retail sector and the rise in showrooms, which demand additional security and monitoring of the premises. Banking and financial offices use IP-based cameras to ensure threat prevention and customer behaviour analysis. Hospitals and healthcare centres also employ cameras that enhance the productivity and safety of patients through closed monitoring. The industrial segment will also hold a significant share owing to usage in manufacturing and warehousing that safeguards the premises from theft and vandalism. The integration of AI and analytics within video surveillance is further enhancing the market scope.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Hardware |

|

|

Systems |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Video Surveillance Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to hold a market share of 38% by the end of the forecast period, owing to low-cost products and inexpensive components, which elevate the demand for cameras and CCTVs, impacting the growth of the market. The growing population of the region is pushing governments to improve traffic management and pedestrian safety, leading to wider adoption of CCTV cameras. The regions adaption to AI and cloud computing has improved the inclusion of AI based camera that allow mobile monitoring and provide scalability in safety measures. The rising population has amplified the public transport network, including metros, trains, and buses, which require cameras for safety that further enhance the adoption of video surveillance.

Low cost of component prices and manufacturing skills is driving the video surveillance market in China. Key players such as HikVision and Dahua have transitioned into cloud-based surveillance, which effectively increases the adoption in the local markets. The rising integration of AI within urban infrastructure is supporting the growth of AI based camera that can successfully keep track of the various activities and detect threats easily. Further, India is witnessing a rise in terrorism, which has advanced the demand for thermal cameras installed within complex environments. The large population base and rising traffic across the cities have fueled the adoption of AI tracking cameras that can predict and support in traffic management, keeping a record of the road safety violators, and reducing the stress on manual operations.

North America Market Insights

North America is expected to hold a market share of 30.20% by the end of 2036, owing to the large-scale adoption of cloud computing in urban infrastructure, which successfully integrates AI-based video surveillance. The region has the presence of popular players, specializing in camera hardware component impacting product price reduction and increasing adoption. Urban population is rising in North America, leading to increased threats and vandalism, which demands video surveillance to maintain safety, propelling the market growth. Video surveillance plays a vital role in the region's defence system. Equipped with AI and laser missile detection systems, the cameras can operate on IP and hybrid modes, enabling constant monitoring.

The FBI has reported that more than 14 million crimes were committed in 2024 in the entire U.S., which demonstrates the strong demand for virtual monitoring. Cities and states within the U.S. are rapidly advancing video surveillance, which is enhancing the demand for the market. The cloud adoption in the region has also accelerated, which is driving the demand for AI-based video surveillance. Canada has taken notable action against the Chinese manufacturer HikVision over national security concerns, reflecting the political tensions leading to a decline in the adoption from low cost brands. The city police use body cameras that keep a video record in case of an event. The wide utilization in the law enforcement and commercial sectors is fuelling the expansion of the market.

Europe Market Insights

The region holds a market share of 17.4% owing to the rise in strict regulations from the government to enhance the safety of retailers and customers. Europe has a strong ecosystem of AI-driven analytics within the public infrastructure, which drives significant growth of video surveillance. Europe is also building itself as a smart city where modern technology, including constant monitoring of the public infrastructure and assets. Certain countries within the region have transitioned into smart cities that employ CCTV cameras to enhance the surveillance and monitoring of various activities. In October 2025, HikVision launched its first 16 mp cameras that strengthen video surveillance even in low light and better WDR, enhancing enterprise-level monitoring for better analysis.

The UK is moving from traditional CCTV cameras to AI-based power cameras to monitor and analyse different behaviours and movement to detect threats effectively. The Mayor’s office in London has invested more than USD 50 million to install AI based camera to enhance security and avert and potetial risk through data-driven analytics. London is also rising as a smart city, which is fueling the demand for the market. Germany prioritises the safety and security of its assets and public infrastructure, which has fueled the demand for advanced cameras. The country has integrated AI-powered cameras, with potential in object tracking, intrusion detection, and video analytics, enhancing the safety of the citizens and assets. Germany is adapting to the smart city initiative, including urban infrastructure development and security enhancement of the streets to minimize crises.

Key Video Surveillance Market Players:

- Hikvision (China)

- Dahua Technology (China)

- Hanwha Techwin (South Korea)

- Bosch Security Systems (Germany)

- Axis Communications (Sweden)

- Honeywell International Inc. (U.S.)

- Johnson Controls – Tyco Security Products (Ireland/U.S.)

- Panasonic Corporation (Japan)

- FLIR Systems (U.S.)

- Uniview Technologies (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hikvision, an electrical and electronic market based in China that is a major manufacturer of video surveillance products, including AI-powered cameras, IP based camera, and digital video recorders. The business is highly engaged in the development of smart cities by delivering application-specific CCTV cameras.

- Dahua Technology is a reputable business that ranks in the top 3 video surveillance manufacturers. It has a wide portfolio of IP, analogue, and thermal cameras. It has stressed intelligent transport solutions that help maintain safety within urban mobility. They have a strong presence in Southeast Asia and the Middle East.

- Hanwha Techwin, the business sells thermal and IP-based cameras and video management systems, which are supplied across the globe. Their cameras are specially made for law enforcement, which can detect license plates with a strong focus on AI-powered analytics.

- Bosch Security Systems is one of the most reputable businesses across the globe. Bosch has developed IP-based and thermal cameras for commercial and residential demand. It specializes in integrated security solutions, enhancing smart city initiatives.

Below is the list of the key players operating in the global market:

The players operating in the global video surveillance market are expected to face intense competition during the forecast timeline. The market is associated with both established key players and new entrants. However, the market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialised manufacturers maintain a competitive landscape in the market. Key players in the market are significantly supported by the governments for research and innovation.

Corporate landscape of the global video surveillance market

Recent Developments

- In April 2025, Bosch introduced AI-powered video solutions with intelligent video analytics that would improve real-time detection and tracking. It will employ deep network-based video analytics to ensure enhanced video quality.

- In December 2025, Panasonic Corporation announced its AI business strategy at CES 2026that would emphasize the strategic capabilities and use AI-enabled hardware and software systems to enhance predictability and production.

- Report ID: 8381

- Published Date: Feb 04, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Video Surveillance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.