Human Papillomavirus Vaccine Market Outlook:

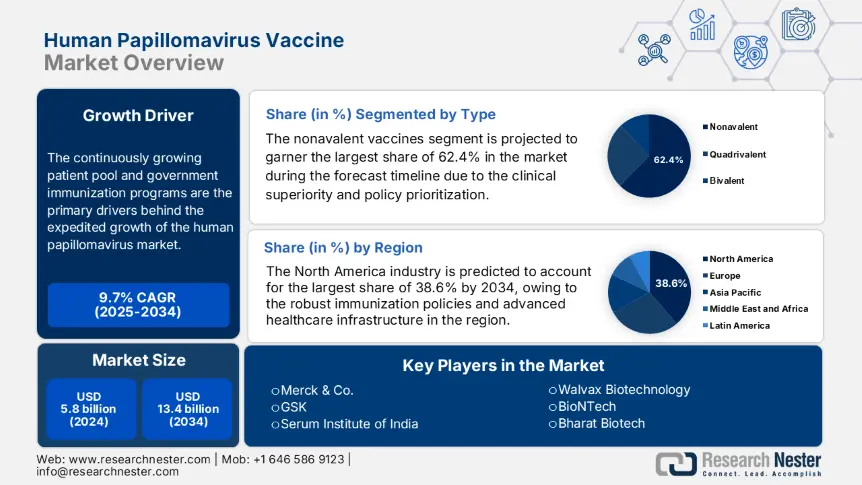

Human Papillomavirus Vaccine Market size was valued at USD 5.8 billion in 2024 and is projected to reach USD 13.4 billion by the end of 2034, rising at a CAGR of 9.7% during the forecast period, i.e., 2025-2034. In 2025, the industry size of human papillomavirus vaccine is evaluated at USD 6.1 billion.

The continuously growing patient pool and government immunization programs are the primary drivers behind the expedited growth of the human papillomavirus market. The Centers for Disease Control and Prevention (CDC) in 2023 stated that an estimated 54.6 million new HPV infections were reported yearly, particularly affecting adolescents and young adults. Besides, in 2024 World Health Organization (WHO) stated that governments across the world are deliberately concentrating on immunization programs, wherein 125 countries incorporated HPV vaccines in their national schedules. Meanwhile, on the supply front, it relies on the API (active pharmaceutical ingredient) market, where Merck and GSK are leading in terms of production.

Furthermore, at the economic aspect, the Producer Price Index (PPI) for HPV vaccines demonstrated a 4.5% year-over-year rise from 2023 to 2024 owing to the expanded raw material costs and logistics as of World Bank 2024 data. Simultaneously, the International Monetary Fund (IMF) notes that the Consumer Price Index (CPI) grew by 4.1% reflecting the higher procurement costs. Besides, the International Trade Commission in 2024 revealed that the U.S. imported USD 320.5 million worth of HPV vaccine components in 2023, especially from Germany and Ireland, whereas 95.4% of these vaccines are procured through UNICEF and Gavi.

Human Papillomavirus Vaccine Market - Growth Drivers and Challenges

Growth Drivers

- Expanding immunization programs: The market is representing robust growth on account of administrative immunization programs and spending. As evidence, the Gavi Organization reports that its Vaccine Alliance dedicated a total of USD 600.5 million for HPV vaccination in developing countries from 2023 to 2025, with a prime focus on 84.8 million young girls. Meanwhile, the European Centre for Disease Prevention and Control (ECDC) in 2023 underscores that public funds are highly essential for market expansion, wherein school-based programs in Europe gained 86% coverage.

- Innovative transformations & profitable strategies: The implementation of potential strategies uplifts the human papillomavirus vaccine sector growth at a rapid pace. For instance, in 2024, Merck announced a partnership with UNICEF to supply 20 million Gardasil doses to Africa, which remarkably increased its market share by 9.5%. During the same time, WHO stated that GSK reduced its prices for Cervarix in low and middle-income countries, which boosted its uptake by 35.4% in India, thus suitable for standard market growth.

- Unmet needs in emerging markets: The aspect of healthcare disparities and affordability rearranges the developmental tactics in the human papillomavirus vaccine indusry. In this regard, the data from the Ministry of Health, Labour and Welfare in 2024 stated that only 42.6% of eligible females in Japan received HPV vaccination in 2023, owing to the existence of cost barriers, further encouraging cost-optimized models to operate in the country. In Africa, despite the presence of 19.6% global cervical cancer cases, inadequate reimbursement persists. Hence, domestic production has complete potential to diminish these issues and support market expansion at a robust pace.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

2010 Patients (Million) |

2020 Patients (Million) |

CAGR |

Key Driver |

|

U.S. |

8.5 |

24.8 |

11.8% |

CDC gender-neutral recs |

|

Germany |

3.4 |

10.2 |

12.6% |

School mandates |

|

France |

2.7 |

7.6 |

12.3% |

Pharma subsidies |

|

Spain |

2.1 |

5.5 |

11.9% |

Regional govt. campaigns |

|

Australia |

2.2 |

8.7 |

16.4% |

National free-vaccine program |

|

Japan |

0.9 |

2.5 |

14.1% |

MHLW policy reversal |

|

India |

0.6 |

5.2 |

32.1% |

Gavi funding |

|

China |

1.2 |

7.1 |

24.3% |

NIP inclusion |

Manufacturer Strategies Shaping Market Expansion

Revenue Opportunities for Manufacturers (2023-2026)

|

Strategy |

Company |

Revenue Impact (USD) |

Market Share Gain |

|

Gardasil 9 label expansion |

Merck |

+$1.5 billion (2023) |

5.7% (Global) |

|

Cervarix price reduction |

GSK |

+$320.7 million (Gavi countries) |

8.4% (LMICs) |

|

Cervavac Africa rollout |

Serum Inst. |

+$180.8 million (2026 projection) |

12.6% (Africa) |

|

Single-dose R&D |

BioNTech |

$450.7 million (estimated 2027 launch) |

N/A (Pipeline) |

Sources: FDA, GAVI, WHO, NIH

Challenges

- Misinformation & cultural hesitance: The existence of social stigma and misinformation creates a major hurdle in the market to reach a wider group of audience. In this regard Ministry of Health, Labour and Welfare (MHLW) stated that in Japan, vaccination rates dropped to 42.4% after false safety claims, posing a major drawback on the global landscape. Therefore, MSD in 2023 announced the launch of school education campaigns, increasing uptake by a significant 12.4%.

- Exacerbated R&D costs and ROI uncertainty: The rising research expenses and return on investment aspects also display a considerable obstacle in the market. In this context, the National Institute of Health study in 2024 observed that developing a new HPV vaccine costs USD 1.5 billion, with 10 to 12-year timelines making it challenging for small-scale industries to expand. Besides, in 2024, BioNTech received funding of USD 200 million from NIH for an mRNA vaccine trial to offset these risky aspects.

Human Papillomavirus Vaccine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

9.7% |

|

Base Year Market Size (2024) |

USD 5.8 billion |

|

Forecast Year Market Size (2034) |

USD 13.4 billion |

|

Regional Scope |

|

Human Papillomavirus Vaccine Market Segmentation:

Type Segment Analysis

Based on type, the nonavalent vaccines segment is projected to garner the largest share of 62.4% in the human papillomavirus vaccine market during the forecast timeline. The clinical superiority and policy prioritization are the key factors reinforcing the segment’s dominance over this sector. As evidence, an NIH study in 2023 observed that these vaccines cover high-risk HPV strains 16/18/31/33/45/52/58, which are responsible for 90.7% of cervical cancers, and for strains 6/11 causing genital warts. In addition, WHO prequalification successfully accelerated adoption in over 56 low and middle-income countries, thus indicating a wider segment scope.

Distribution Channel Segment Analysis

In terms of distribution channel, the government vaccine programs segment is expected to capture a lucrative share of 58.6% in the market by the end of 2034. Innovative financing models and supply chain developments are key factors behind the robust growth of this segment. In this regard, Gavi’s AMC report in 2024 stated that its advance market commitment reduced prices from USD 4.8 to USD 2.2 per dose in over 40 developing nations. Meanwhile, in Australia, the National Immunization Program is dedicating funds for gender-neutral vaccination at a very affordable price, i.e., USD 12.6 per dose, thus indicating a positive segment outlook.

Disease Indication Segment Analysis

Based on disease indication cervical cancer segment is anticipated to grow at a considerable rate, with a share of 48.8% in the human papillomavirus vaccine market during the discussed time frame. The segment’s growth originates from global health imperatives wherein an estimated 605,000 new cervical cancer cases are recognized annually, with 90.6% in developing countries, according to the International Agency for Research on Cancer (IARC) 2023 report. Furthermore, the 90-70-90 strategy implemented by WHO has the potential to diminish mortality rates, thereby making it suitable for uplifting the market growth.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Distribution Channel |

|

|

Disease Indication |

|

|

Age Group |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Human Papillomavirus Vaccine Market - Regional Analysis

North America Market Insights

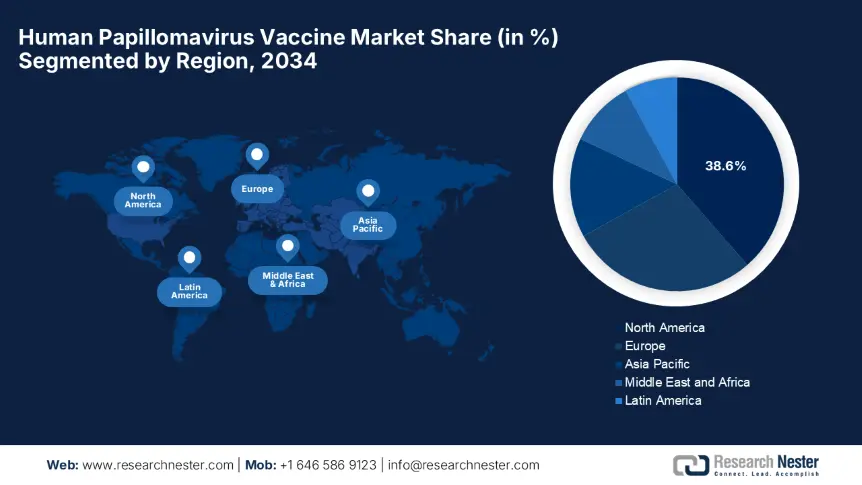

North America is predicted to lead the global human papillomavirus vaccine industry with the highest share of 38.6% during the forecast timeline. The leadership of the region is attributable to the existence of robust immunization policies and advanced healthcare infrastructure. Besides U.S. is the key contributor in this landscape, with 85.4% of regional demand, whereas Canada supports this growth with public healthcare initiatives. Meanwhile, in the U.S., the male uptake surged to 42.7% in 2023, following ACIP recommendations, thus suitable for standard market expansion.

The U.S. is augmenting its dominance in the regional market on account of CDC recommendations for gender neutral vaccination for ages 11 to 26 and reimbursement expansions. As evidence CDC in 2024 stated that Medicare expanded its coverage to 58.7% of eligible patients. Besides, the Centers for Medicare & Medicaid Services in 2024 reported that federal funding surpassed USD 1.9 billion 2024 with Medicare spending USD 800.7 million on HPV and associated diagnostics. Furthermore, private insurers in the country are enabling 90.6% coverage for the Gardasil 9 doses, influenced by ACIP recommendations.

Canada is showcasing steady growth in North America’s human papillomavirus vaccine market due to the suitable and supportive government initiatives. In this regard, the country hosts ample school programs such as Ontario’s 80.7% coverage and USD 3.6 billion federal funding, according to the Health Canada 2024 report. Besides, Quebec in 2023 imposed mandates for HPV vaccination in public schools, thereby boosting uptake by a remarkable 25.4% as stated by the Canadian Institute for Health Information in 2024. Furthermore, the rural disparities in the country are addressed with the allocation of USD 50.8 million for mobile clinics.

APAC Market Insights

Asia Pacific in the human papillomavirus vaccine market is projected to experience the fastest growth from 2025 to 2034. This accelerated progress is a result of administrative immunization programs and rising cancer awareness among individuals. The landscape is led by China with 40.8% regional share and followed by Japan and India through their robust R&D environment and affordable vaccinations. Besides the single dose, adoption grew at a notable pace, boosting coverage by 20.6%. On the other hand, in Australia, the gender-neutral program achieved an 85.9% coverage, hence benefiting both service providers and consumers as well.

China is solidifying its position in the regional market owing to the massive patient pool and substantial government initiatives. As evidence, the National Medical Products Administration (NMPA) stated that the 14th Five-Year Plan dedicated USD 5.8 billion towards microbiome research, including HPV vaccine rollouts, with a prime focus on 10.6 million girls yearly. Followed by the NMPA approval of domestically produced Cecolin, the country witnessed the demand growth surging 15.4% year-over-year, with 70.6% of hospitals in China offering HPV diagnostics.

India is emerging in the Asia Pacific’s human papillomavirus vaccine market due to its domestic production capabilities and Gavi partnerships. Testifying to this, the Indian Council of Medical Research (ICMR) in 2024 reported that the 2023 National Immunization Program introduced Cervavac at USD 2 per dose, which marks 60.6% cheaper than imports targeting 5.4 million girls annually. During the same time, UNICEF noted that the government spending surpassed 18.7% to USD 2.3 billion in 2024, wherein Serum Institute supplies 50.6% of Gavi’s worldwide HPV doses; hence, a positive market outlook.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

Australia |

National Immunization Program Expansion |

$150.8 (2021-2025) |

2021 |

|

South Korea |

Bio-Health 2030 Strategy |

$200.7 |

2021 |

|

Malaysia |

12th Malaysia Plan (Healthcare Biotech) |

$30.5 |

2022 |

Sources: Health.gov.au, Korea.kr, MOH.gov.my

Europe Market Insights

Europe in the human papillomavirus vaccine market is poised for extensive growth facilitated by national immunization programs and region-wide healthcare initiatives. The landscape is successfully led by Germany and France together, accounting for 45.6% of the regional market in support of mandatory school vaccination policies and government-funded catch-up campaigns. Besides, the EU4Health Programme allocated a total amount of €2.9 billion for HPV prevention for the tenure 2021 to 2027, thereby boosting access in 27 member states. Further, the region also benefits from €300.8 million in cold-chain-free solutions for Eastern Europe through EU Horizon grants.

Germany is considered to be the HPV Vaccine Powerhouse in the regional dynamics. The country’s market is fueled by the robust healthcare infrastructure and aggressive public health initiatives. In this regard, RKI in 2024 noted that the universal healthcare system in the country enables coverage for adults aged 9 to 14, which in turn resulted in 90.7% school-based coverage. Besides, the Federal Ministry of Health in 2024 stated that the country received €1.9 billion in investments in HPV-related R&D through its National Decade Against Cancer initiative, which specifically concentrates on cervical cancer prevention, hence propelling a favorable business environment in the country.

As the regional hub of innovation in the human papillomavirus vaccine market, France is appreciably supported by policy-driven developments and huge investments. As evidence, the country enables a 100% reimbursement policy for the HPV vaccine through its national insurance scheme, which has increased adult vaccination rates by a significant 40.6% since 2021. Meanwhile, HAS in 2024 observed that the policy shift has also increased vaccination rates by 18.6% in a single year. Furthermore, the ever-increasing biotech investments in the country create an optimistic opportunity for developing next-generation vaccines, including mRNA-based HPV candidates.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

UK |

NHS HPV Vaccination Programme |

£100.9 annually |

2021 |

|

Italy |

Free HPV Vaccine Mandate |

€180.4 (2023-2025) |

2023 |

|

Spain |

Regional Co-Pay Elimination |

€120.8 |

2022 |

Sources: NHS.uk, AIFA, AEMPS

Key Human Papillomavirus Vaccine Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global market is representing an intensifying landscape with Merck, GSK, and Serum Institute dominating with maximum market share. Expansion into emerging markets, mutually profitable collaborations, and expanding clinical trials are a few assets for this merchandise to capture the highest potential. As evidence, Merck dedicated USD 500.6 million to API expansion to address the supply chain disparities. Meanwhile, GSK collaborated with Gavi for increased access in developing nations. In addition, the emerging pioneers, such as Walvax, MyBiotics, are concentrating on domestic production and niche innovations to compete in the current market dynamics.

Below is the list of some prominent players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Merck & Co. |

U.S. |

45.9% |

Gardasil 9 (nonavalent), global supply leader |

|

GSK |

UK |

22.5% |

Cervarix (bivalent), LMIC partnerships |

|

Serum Institute of India |

India |

12.4% |

Cervavac (quadrivalent), low-cost production |

|

Walvax Biotechnology |

China |

6.3% |

Cecolin (bivalent), domestic China focus |

|

BioNTech |

Germany |

4.2% |

mRNA-based HPV vaccines (R&D) |

|

Bharat Biotech |

India |

xx% |

HPV vaccine candidates (preclinical) |

|

LG Chem |

South Korea |

xx% |

HPV vaccine adjuvants |

|

CSL Limited |

Australia |

xx% |

HPV vaccine cold-chain logistics |

|

Bio Farma |

Indonesia |

xx% |

Government-backed HPV programs |

|

Incepta Pharmaceuticals |

Bangladesh |

xx% |

Low-cost HPV vaccines for LMICs |

|

Biological E. Limited |

India |

xx% |

HPV-HEV combo vaccine (R&D) |

|

MyBiotics |

Malaysia |

xx% |

Probiotic-enhanced HPV vaccines |

|

Profectus BioSciences |

U.S. |

xx% |

HPV immunotherapy |

|

Vaxart |

U.S. |

xx% |

Oral HPV vaccine (Phase II) |

|

Innovax |

China |

xx% |

HPV vaccine biosimilars |

Below are the areas covered for each company in the market:

Recent Developments

- In June 2024, Serum Institute introduced Cervavac 2.0, a next-gen quadrivalent HPV vaccine priced at USD 3 per dose, marking 50.7% cheaper than its predecessor. The launch secured Gavi contracts for 20.6 million doses across Africa and Southeast Asia.

- In March 2024, Merck expanded its HPV vaccine portfolio with Gardasil 10, covering two additional high-risk HPV strains i.e., HPV-68 and HPV-73). The launch resulted in 5.7 million doses distributed in the first six months.

- Report ID: 1753

- Published Date: Jul 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Human Papillomavirus Vaccine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert