Generator Circuit Breakers Market Outlook:

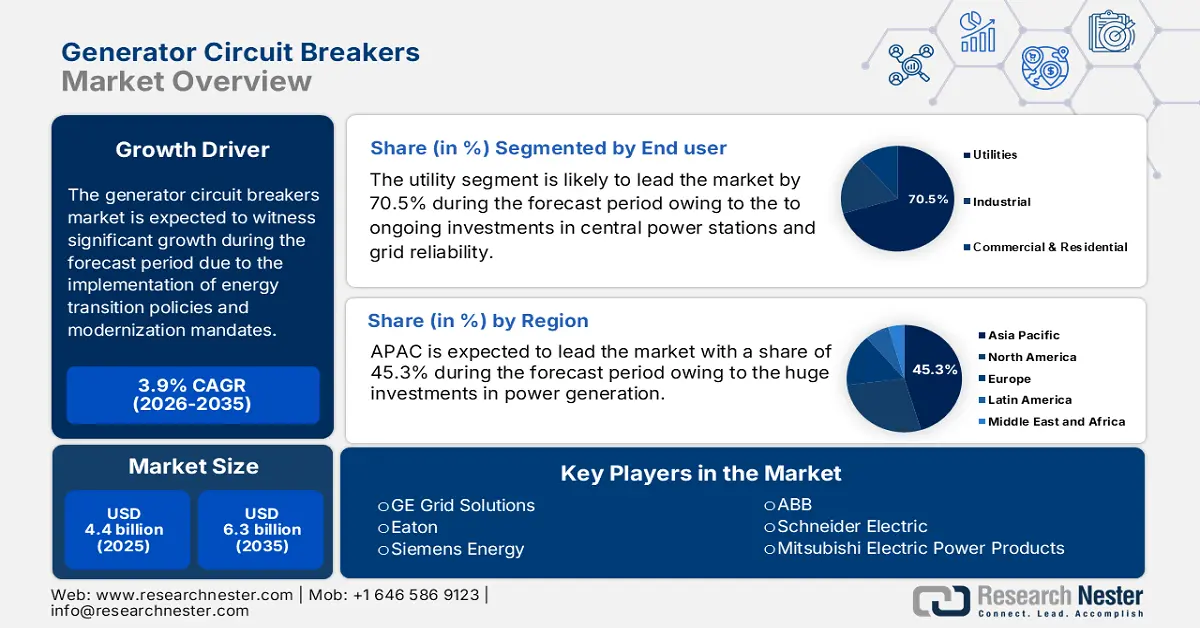

Generator Circuit Breakers Market size was valued at USD 4.4 billion in 2025 and is projected to reach USD 6.3 billion by the end of 2035, rising at a CAGR of 3.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of generator circuit breakers is assessed at USD 4.5 billion.

The generator circuit breakers market is growing at a steady pace globally in the sectors of utilities, industry, and infrastructure. This growth is largely attributed to the implementation of modernization mandates, energy transition policies, and grid reliability requirements. As a result of the comprehensive grid modernization effort, the U.S. electric power industry has been upgrading its high-voltage switchgear systems, including GCBs, consecutively over the past several years. As per the Edison Electric Institute data in 2025, the investor-owned electric companies in the U.S. have planned to spend more than USD 158 billion on transmission construction. This substantial amount of investment connects to the implementation of circuit protection systems for renewable integration and substation automation.

The Grid Deployment Office of the Department of Energy is mainly focusing on resilience and reliability, with GCBs playing a vital role in fault isolation and generator protection. In 2024, nuclear energy contributed 17.8% to the U.S. electricity mix, while natural gas contributed 42.5%, both being heavily dependent on generator-side protection systems, based on the EEI report in 2025. These numbers highlight the operational importance of maintaining uptime and safety in the generation assets. Nonprofit organizations have stated that the transition to solid-state and hybrid GCB technologies is a way of addressing the evolving grid architectures. This has resulted in a considerable R&D activity and several pilot projects in North America and Europe, thus fueling the generator circuit breakers market demand.

Key Generator Circuit Breakers Market Insights Summary:

Regional Highlights:

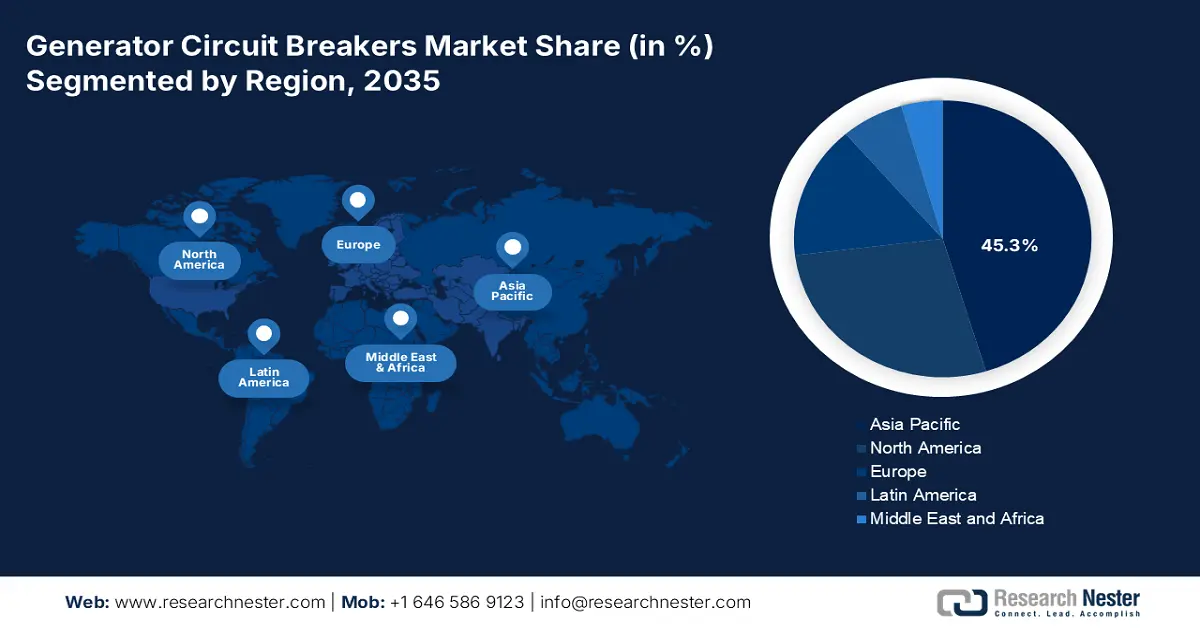

- Asia-Pacific is projected to hold a 45.3% share by 2035 in the generator circuit breakers market, propelled by massive investments in power generation infrastructure.

- North America is expected to grow at a CAGR of 3.8% by 2035, impelled by aging grid infrastructure replacement and renewable energy integration.

Segment Insights:

- The utility segment in the generator circuit breakers market is projected to account for 70.5% share by 2035, driven by ongoing investments in central power stations and grid reliability.

- The new installation sub-segment is gaining prominence due to global investments in new power generation capacities.

Key Growth Trends:

- Grid modernization and resilience funding

- Integration of intermittent renewable energy

Major Challenges:

- High upfront capital investment

- Long and complex sales cycles in GCB

Key Players: GE Grid Solutions (U.S.), Eaton (U.S.), Siemens Energy (U.S.), ABB (U.S.), Schneider Electric (France), Mitsubishi Electric Power Products (European operations), Toshiba Energy Systems & Solutions (European operations), CG Power & Industrial Solutions (part of Italy's Remac Group), Alstom (France), Mitsubishi Electric Corporation (Japan), Toshiba Corporation (Japan), Fuji Electric Co., Ltd. (Japan), Meidensha Corporation (Japan), Powell Industries (Australia), Hyosung Heavy Industries (South Korea), LS Electric (South Korea), Bharat Heavy Electricals Limited (India), Larsen & Toubro (India), CG Power & Industrial Solutions (India), Sime Darby Berhad (Malaysia).

Global Generator Circuit Breakers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.4 billion

- 2026 Market Size: USD 4.5 billion

- Projected Market Size: USD 6.3 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia-Pacific (45.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Brazil, South Korea, Mexico, Australia, Saudi Arabia

Last updated on : 27 October, 2025

Generator Circuit Breakers Market - Growth Drivers and Challenges

Growth Drivers

- Grid modernization and resilience funding: Direct government spending is the key driver, which is mainly focused on hardening electrical infrastructure against extreme weather and cyber threats. The U.S. DOE data in December 2024 depicts that USD 7.6 billion in funding was announced by the GDO. This funding is aimed at enhancing the electricity grid across all 50 states and D.C. Many of these grid modernization and resilience projects involve new substations, transmission upgrades, and generator connections, all of which require high-voltage GCBs to protect generators, transformers, and critical circuits from faults.

- Integration of intermittent renewable energy: The rapid deployment of utility-scale solar and wind farms necessitates the new grid infrastructure, including GCBs at collector substations and interconnection points. These initiatives need GCBs to handle the unique fault current features of inverter-based resources. The European Commission data in June 2025 depicts that REPowerEU plan of the European Union, with an investment target of €300 billion, is designed to speed up the integration of renewables, thus driving the demand for specialized protection equipment.

- Retirement of aging thermal power fleet: Many developed economies are facing the simultaneous retirement of old coal and nuclear plants. The conventional power fleet is replaced by renewables, new natural gas-fired plants that are often built as flexible and dispatchable capacity. These new facilities require a full suite of new GCBs. Japan's Green Transformation (GX) strategy, for instance, includes investments in new carbon-captured thermal power plants, guaranteeing the demand for high-capacity GCBs will continue to grow in tandem with the increase of renewable energy sources.

Government-Led Energy Transition Investments

|

Country |

Initiative / Law |

Investment Value |

Key Focus Areas |

|

U.S. |

Inflation Reduction Act (IRA) |

USD 369 Billion |

Clean energy tax credits, electric vehicles, grid modernization, domestic manufacturing |

|

European Union |

REPowerEU Plan |

USD 300 Billion |

Energy efficiency, renewable energy rollout, hydrogen infrastructure, diversifying energy supplies |

|

Japan |

Green Transformation (GX) |

USD 1.1 Trillion (from public & private) |

Renewables, nuclear restart, hydrogen, carbon recycling |

|

India |

Production Linked Incentive (PLI) for Solar PV |

Rs. 19,500 Crore |

Domestic manufacturing of high-efficiency solar PV modules |

Source: UN Trade and Development August 2022, European Commission June 2025, Climate Integrate April 2023, Government of India October 2025

Challenges

- High upfront capital investment: Due to the complex engineering and relatively low volume products, manufacturers of GCBs are required to spend heavily on R&D and production. Such a high capital expenditure stands as a major obstacle to the entrant's side. As a result, from a government or utility payer perspective, this translates into prohibitively high purchase prices, reducing the adoption, mainly in developing nations. For example, the cost of a single high-voltage GCB may run into millions, which is a significant proportion of a utility's annual capital budget. This barrier causes the replacement of the aging, less reliable equipment with new, safer ones to be delayed, thus affecting the overall grid reliability and modernization process.

- Long and complex sales cycles in GCB: The sales cycles are targeting large EPC firms, and it entail detailed technical evaluations, feasibility studies, and different stages of approvals. In the case of government-owned utilities, the procedure becomes even longer due to public tender regulations and budget cycles. This prolonged period puts pressure on the working capital of new suppliers and postpones the deployment of necessary infrastructure. Hence, it creates a considerable obstacle to getting into the generator circuit breakers market, which is a privilege for the players who have already been established and have financial stability and a good relationship with customers for a long time.

Generator Circuit Breakers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 4.4 billion |

|

Forecast Year Market Size (2035) |

USD 6.3 billion |

|

Regional Scope |

|

Generator Circuit Breakers Market Segmentation:

End user Segment Analysis

The utility dominates the segment in the generator circuit breakers market and is poised to hold the share of 70.5% by 2035. The dominance is due to ongoing investments in central power stations and grid reliability. According to the US DoE data in December 2024, the Grid Deployment Office is in charge of a USD 10.5 billion portfolio aimed at boosting the Grid Resilience and Innovation Partnerships (GRIP) Program to improve the flexibility and resilience. The surges are to replace the aging power fleet infrastructure to improve protection and operational efficiency.

Installation Segment Analysis

The new installation sub-segment is the major factor in the generator circuit breakers market. The segment is driven by the global investments in new power generation capacities. This comprises the building of natural gas-fired power plants to provide a stable supply when balancing intermittent renewables, solar and wind farms at utility scale, and new nuclear units, all of which need GCBs as standard devices for protection from the very beginning. This trend is supported by significant government-led initiatives, for instance, the U.S. Infrastructure Investment and Jobs Act, which allocated a huge amount for next-generation energy projects, thereby new installations will continue to be the main growth driver over retrofits.

Voltage Segment Analysis

Medium Voltage (15-40 kV) GCBs hold the largest share in the voltage segment as they correspond to the standard generator output voltages for vast power plants, ranging from large gas turbines to mid-sized renewable and industrial facilities. Various International Electrotechnical Commission (IEC) standards, for instance, IEC 62271-37-013, are designed to define the requirements and the conditions for AC generator circuit-breakers in this voltage range, based on IEEE data in October 2021, thus being the most recognized in the whole industry. As a result, medium voltage becomes the standard main source of generator protection in most conventional and renewable settings, thus securing its position as the leading generator circuit breakers market player.

Our in-depth analysis of the generator circuit breakers market includes the following segments:

|

Segment |

Subsegments |

|

Voltage |

|

|

Type |

|

|

Installation |

|

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Generator Circuit Breakers Market - Regional Analysis

APAC Market Insights

The Asia-Pacific is the dominating region in the generator circuit breaker market and is expected to hold a share of 45.3% by 2035. Massive investments in power generation infrastructure drive the region. The key drivers are the rapid industrialization, urbanization, and the necessity to provide energy security. China and India are leading the way with continuous additions of coal, nuclear, and renewable energy capacity. One of the main trends is the use of GCBs combined with smart grid technologies to make the grid more stable and reliable. Further, strong environmental rules are leading to the adoption of SF6-free GCB technologies.

China is leading the APAC generator circuit breaker market, fueled by huge investments in power generation. According to the EnerData report in January 2024, State Grid Corporation of China has announced an investment of CNY500 billion that is committed to grid network construction in 2024 for the development of ultra-high voltage (UHV) lines to stabilize power supply and to facilitate renewable power consumption in China. Besides, the National Energy Administration's (NEA) 14th Five-Year Plan is heavily emphasizing the increase of coal power capacity along with a huge deployment of renewable energy sources such as wind and solar bases, which will require extensive grid infrastructure and protection. This double strategy thus guarantees a continuously high demand for GCBs.

India's generator circuit breakers market is largely driven by the country's rapidly increasing energy demand and government programs such as Make in India and the Green Energy Corridors. The PIB report in May 2023 states that the National Electricity Plan by the Central Electricity Authority (CEA) highlights the significant capacity additions that are in the pipeline, among which renewable energy targets of 500 GW by 2030 are the most prominent. Thus, there is an immediate and direct requirement for GCBs in newly built power plants and substations. The Power Grid Corporation of India, which is a central transmission utility, is actively implementing various projects to strengthen the national grid, driving market growth.

North America Market Insights

North America is the fastest-growing region in the generator circuit breakers market and is expected to grow at a CAGR of 3.8% by 2035. The region is driven by the aging grid infrastructure replacement and the integration of renewable energy. As per the Curtis Power Solutions data in 2025, circuit breakers are 80% or 100% rated circuits that can be operated either manually or electrically. A key trend is the retrofit and replacement of old equipment in existing power facilities to enhance reliability.

The U.S. generator circuit breakers market is driven by federal investments in grid modernization and the replacement of aging infrastructure. According to the U.S. Department of Energy report in November 2022, the Biden-Harris Administration, via the U.S. Department of Energy, has announced USD 13 billion of new financing opportunities to expand and modernize the nation's electric grid. This directly increases demand for GCBs at power plants that have been upgraded. The vacuum interruption technology research, which is funded by the National Science Foundation, is one of the factors aiming to enhance the grid's sustainability and reliability in the future.

The generator circuit breakers market in Canada is shaped by the nation's commitment to clean energy and the need to modernize the existing hydro power infrastructure. A primary trend involves high-capacity GCBs for generator protection projects at huge hydroelectric plants, like the ones by Ontario Power Generation, that require the use of high-capacity GCBs for generator protection. Government strategy, as outlined by Natural Resources Canada, emphasizes building a more interconnected and resilient grid to support decarbonization and transmit clean power. As a result, this is opening up the market for GCBs in new substations and interties.

Europe Market Insights

The generator circuit breakers market in Europe is driven by the energy transition goals that come along with the necessity of replacing the old power infrastructure. The elimination of standard thermal power plants is creating a demand for new renewable energy facilities, whereas the continuous need for grid stability necessitates the modernization of existing assets. One of the main trends is the fusion of GCBs with smart grid technologies to improve system reliability and make it easier to connect distributed energy resources. Besides, robust EU rules on SF6 gases are surging the adoption of eco-friendly, SF6-free circuit breaker technologies.

Germany is expected to be the largest revenue source in the generator circuit breakers market by 2035. This will be mainly due to its ongoing investments in clean energy and the automation of the power grid. Testifying this, the Federal Government report in 2025 has depicted that the German Federal Ministry for Economic Affairs and Climate Action has allocated 1.5 billion euros for smart grid upgrades, which includes the installation of high-voltage gas circuit breakers. This change requires a huge modernization of the grid, and new gas-fired power plants will be needed as a transitional technology, requiring generator circuit breakers.

France is the second largest country in the generator circuit breakers market. The country is driven by the need to both extend the life of its existing nuclear fleet and invest in new nuclear capacity. The France 2030 program, as per the data from the government's official website, explicitly allocates resources for pioneering small modular reactors (SMRs) as well as for the modernization of nuclear parks. This long-term, state-backed commitment to nuclear power ensure consistent, high-level demand for large-capacity Generator Circuit Breakers.

Key Generator Circuit Breakers Market Players:

- GE Grid Solutions (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eaton (U.S.)

- Siemens Energy (U.S.)

- ABB (U.S.)

- Schneider Electric (France)

- Mitsubishi Electric Power Products (European operations)

- Toshiba Energy Systems & Solutions (European operations)

- CG Power & Industrial Solutions (part of Italy's Remac Group)

- Alstom (France)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Corporation (Japan)

- Fuji Electric Co., Ltd. (Japan)

- Meidensha Corporation (Japan)

- Powell Industries (Australia)

- Hyosung Heavy Industries (South Korea)

- LS Electric (South Korea)

- Bharat Heavy Electricals Limited (India)

- Larsen & Toubro (India)

- CG Power & Industrial Solutions (India)

- Sime Darby Berhad (Malaysia)

- GE Grid Solutions is a major player leveraging its long-term power experience. The company is committed to the integration of its GCBs with advanced digital substation technologies, thus enhancing the grid's reliability and protection capacity for big power plants. Their program features smart GCBs, which incorporate essential data for the prediction of maintenance, thus giving the operators a tool to prevent expensive breakdowns and to use the critical generation assets at their maximum efficiency, thus guaranteeing their place in the competitive market.

- Eaton is a player in the generator circuit breaker market by highlighting the production of strong and reliable electrical components for industrial and commercial power systems. The company records an 8% organic growth in 2024. Their strategy is to provide tailored solutions for GCB in different fields, such as data centers and manufacturing facilities. Eaton is committed to a safety-first approach in arc flash mitigation and thus becomes a key differentiator in the market and attracting a wider customer base who are looking for reliable power protection.

- Siemens Energy is one of the major innovators in the generator circuit breakers market, providing top-tier solutions for the most challenging applications in utility and industrial power generation. Their strategy is mainly based on technological leadership, especially in the creation of GCBs that can open extremely high fault currents in large generators.

- ABB is a major player in the generator circuit breakers market and is known for its technological expertise and worldwide network. They have invested USD1.5 billion in R&D to generate innovation and become the market leader. The company's strategic moves are mainly about leading the way to the use of eco-efficient interruption technologies like vacuum-based GCBs to replace SF6 gas that is used traditionally.

- Schneider Electric positions itself as a contender in the generator circuit breakers market, using its strength in integrated comprehensive energy management and automation solutions as a differentiator. Their strategy centers on offering GCBs as the main factor of economically and safely electrical architectures in commercial and industrial buildings. Schneider commits to connectivity and interoperability; thus, their GCBs are compatible with other smart grid and building management systems without any issues.

Here is a list of key players operating in the global generator circuit breakers market:

The generator circuit breaker market is propelled by a highly technical landscape in Europe, the U.S., and Japan. Companies such as ABB, Siemens Energy, and GE are leading the market with technological innovations, a critical need for protecting expensive power generation assets, and reliability for protecting expensive power generation assets. Players are actively adopting strategic initiatives mainly focused on developing advanced vacuum and SF6 alternative interpretation technologies to address the environmental regulations. For example, in January 2025, Onsemi announced its acquisition of the Silicon Carbide Junction Field-Effect Transistor technology business, which includes the United Silicon Carbide subsidiary, from the Qorvo for cash of USD 115 million.

Corporate Landscape of the Generator Circuit Breakers Market:

Recent Developments

- In April 2025, GE Vernova officially launched its generator circuit breakers, that is designed for new and refurbished power plants with capacities ranging from 50 MW to 1,500 MW. The product range combines advanced safety, reliability, and energy efficiency, supporting global modernization and digitalization of power infrastructure.

- In April 2025, ABB launched a new circuit breaker solution for next-generation wind turbines. The solution offers high industry power with an advanced 7200A Emax 2 air circuit breaker.

- In September 2024, Hitachi, Ltd. officially announced that it received an order for 5 units of Hitachi Energy’s sulfur hexafluoride (SF6)-free EconiQ 300 kilovolt (kV) circuit-breaker from Chubu Electric Power Grid.

- Report ID: 8194

- Published Date: Oct 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Generator Circuit Breakers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.