Gene Therapy Cell Culture Media Market Outlook:

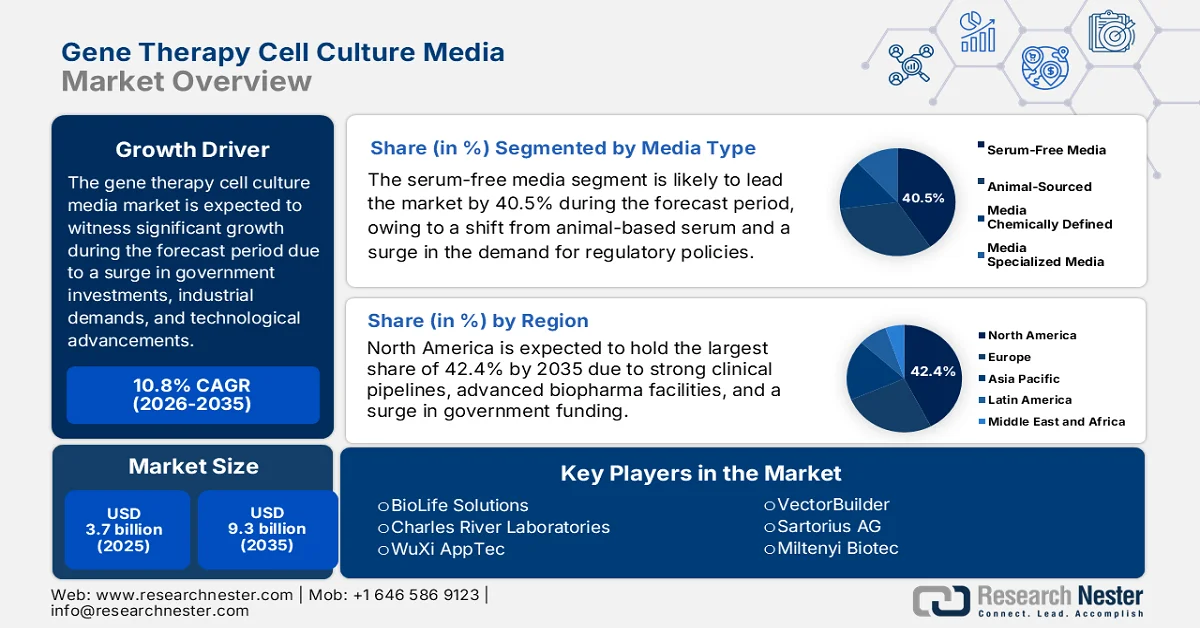

Gene Therapy Cell Culture Media Market size was over USD 3.7 billion in 2025 and is estimated to reach USD 9.3 billion by the end of 2035, expanding at a CAGR of 10.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of gene therapy cell culture media is assessed at USD 4.1 billion.

The worldwide market is gradually entering a transformative phase, readily shaped by both distinct growth drivers and emerging trends. These include industrial practices, technological adoption, an increase in investments, and stimulating cellular responses. According to official statistics published by the Journal of Medicine, Surgery, and Public Health in August 2024, the net payer’s pricing of executing a robotic surgery program can reach almost CAD 3.5 million for more than 7 years. Besides, as per an article published by NLM in October 2022, the electroencephalogram sensors assist in activating nerves in the brain that produce electrical impulses with amplitudes in the microvolt range and frequencies ranging from 8 Hz to 50 Hz. Therefore, with increased focus on technological implementation in therapies, the market is gaining increased exposure.

Furthermore, the integration of artificial intelligence in media optimization, a rise in modular bioprocessing systems, and sustainability in media production are current trends that are proliferating the gene therapy cell culture media market globally. As stated in an article published by Trends in Biotechnology in May 2025, as part of the biomanufacturing sector, the valuation of Zymergen plummeted from USD 4.8 billion to a sale price amounting to USD 300 million. Besides, in February 2026, Novartis successfully delivered high single-digit sales growth and achieved 40% core margin and further made advancements in the pipeline. This caters to positive clinical trials and FDA-approved ianalumab, Itvisma, Pluvicto, and Rhapsido. Besides, this resulted in boosting organizational sales, thereby making it suitable for bolstering the market’s growth and expansion.

Novartis’s Sales Growth Analysis (2024-2025)

|

Components |

Q4 2025 (USD m3) |

Q4 2025 (USD m3) |

% Change |

FY 2025 |

FY 2024 |

% Change |

|

Net Sales |

13,336 |

13,153 |

1 |

54,532 |

50,317 |

8 |

|

Operating Income |

3,616 |

3,530 |

2 |

17,644 |

14,544 |

21 |

|

Net Income |

2,404 |

2,820 |

-15 |

13,967 |

11,939 |

17 |

|

EPS |

1.2 |

1.4 |

-11 |

7.2 |

5.9 |

22 |

|

Free Cash Flow |

1,655 |

3,635 |

-54 |

17,596 |

16,253 |

8 |

|

Core Operating Income |

4,929 |

4,859 |

1 |

21,889 |

19,494 |

12 |

|

Core Net Income |

3,889 |

3,933 |

-1 |

17,411 |

15,755 |

11 |

|

Core EPS |

2.0 |

1.9 |

3 |

8.9 |

7.8 |

15 |

Source: Novartis

Key Gene Therapy Cell Culture Media Market Insights Summary:

Regional Highlights:

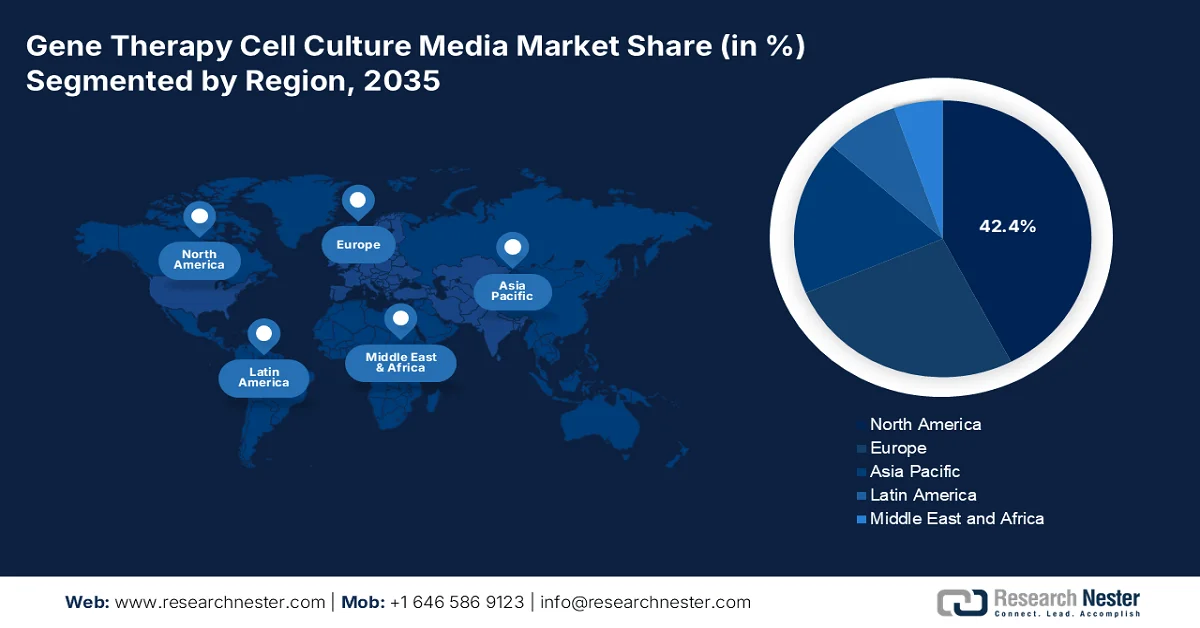

- North America is projected to capture a dominant 42.4% share of the gene therapy cell culture media market by 2035, propelled by strong government funding, advanced biopharma infrastructure, and expanding clinical pipelines.

- Asia Pacific is poised to witness the fastest growth in the gene therapy cell culture media market over 2026–2035, fueled by rising adoption of innovative therapies, expanding patient populations, and increasing government investments.

Segment Insights:

- In the gene therapy cell culture media market, the serum-free media sub-segment is anticipated to command a leading 40.5% share by 2035, driven by the transition away from animal-derived serum to meet regulatory requirements and ensure reproducibility and contamination control.

- The therapeutic applications segment is expected to secure the second-largest share in the gene therapy cell culture media market by 2035, impelled by the expanding pipeline of gene therapies targeting oncology, rare genetic disorders, and regenerative medicine.

Key Growth Trends:

- Expansion in clinical trial pipelines

- Government incentives for biopharma manufacturing

Major Challenges:

- High manufacturing costs and scalability

- Regulatory complexity and compliance burden

Key Players: Thermo Fisher Scientific (U.S.), Lonza Group (Switzerland), Merck KGaA / MilliporeSigma (Germany/U.S.), FUJIFILM Irvine Scientific (Japan), Cytiva (U.S.), Takara Bio (Japan), BioLife Solutions (U.S.), Charles River Laboratories (U.S.), WuXi AppTec (China), VectorBuilder (U.S.), Sartorius AG (Germany), Miltenyi Biotec (Germany), Biological Industries (Israel), PromoCell GmbH (Germany), CellGenix GmbH (Germany), Corning Life Sciences (U.S.), HiMedia Laboratories (India), Innovative Medicines Australia (Australia), Samsung Biologics (South Korea), Malaysian Bioeconomy Corporation (Malaysia).

Global Gene Therapy Cell Culture Media Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.7 billion

- 2026 Market Size: USD 4.1 billion

- Projected Market Size: USD 9.3 billion by 2035

- Growth Forecasts: 10.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: Australia, South Korea, Singapore, India, Canada

Last updated on : 11 February, 2026

Gene Therapy Cell Culture Media Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in clinical trial pipelines: An increase in gene therapy clinical trials globally is directly enhancing the need for specialized cell culture media. According to official statistics published by NLM in July 2025, India comprises a population of 1.4 billion, accounting for almost 20% of the international population. This significantly caters to just 1.5% of international clinical trials that are conducted in this particular country. Besides, fewer regulatory clinical trials have been registered under the Clinical Trials Registry of India in comparison to academic non-regulatory trials, with 21.4% are primarily industry-sponsored. Moreover, 41% of clinical trials have been registered in the Clinical Trials government registry, thereby making it suitable for boosting the market.

- Government incentives for biopharma manufacturing: Governments are significantly providing infrastructure support, grants, and tax incentives for strengthening domestic biopharma capabilities. Based on government estimates published by the PIB Government in February 2026, the Biopharma SHAKTI has been proposed under the Union Budget 2026-2027, along with an outlay of Rs. 10,000 crores for more than 5 years. This is aimed at expanding India’s ecosystem for producing biosimilars and biologics that are responsible for driving the market. This particular initiative has effectively aligned to shift India into a notable international biopharma sector and generously capture 5% of the worldwide biopharmaceutical market share, thus proliferating the market’s growth.

- Patient-centric healthcare approaches: The sudden transition towards personalized medicine is effectively driving the demand for tailored media formulations that significantly support individualized therapies. For instance, in January 2025, NVIDIA has partnered to successfully transform the USD 10 trillion healthcare and life sciences sector. This is possible by escalating drug discovery, pioneering innovative healthcare services, and escalating drug discovery with generative and agentic AI. Therefore, this AI convergence has enhanced biological and computing data, and is also turning healthcare into the highest technological sector. Besides, healthcare-based leaders, such as Mayo Clinic, Illumina, and IQVIA, are utilizing the newest NVIDIA technologies for developing solutions that tend to advance human health.

Challenges

- High manufacturing costs and scalability: The production of the gene therapy cell culture media market requires stringent GMP compliance, advanced bioreactors, and specialized raw materials. Serum-free and chemically defined media, while safer and more reproducible, are significantly more expensive compared to traditional formulations. Scaling up from research-grade to clinical-grade production adds layers of cost due to validation, sterility testing, and regulatory audits. This cost burden limits accessibility for smaller biotech firms and academic institutions, concentrating market power among large biopharma players. Moreover, supply chain disruptions in raw materials, such as recombinant proteins and growth factors, further inflate expenses.

- Regulatory complexity and compliance burden: Gene therapy products face some of the most stringent regulatory frameworks globally, with agencies such as the FDA, EMA, and Health Canada requiring extensive safety, efficacy, and reproducibility data. Cell culture media, being integral to therapeutic production, must meet GMP standards and undergo rigorous validation. Regulatory delays often extend commercialization timelines, with approvals taking years due to complex clinical trial requirements. Additionally, evolving guidelines on serum-free and animal-free media create uncertainty for manufacturers, forcing continuous adaptation of processes. Compliance costs covering audits, documentation, and facility upgrades are substantial, particularly for small-scale firms, thereby causing a hindrance in the market.

Gene Therapy Cell Culture Media Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.8% |

|

Base Year Market Size (2025) |

USD 3.7 billion |

|

Forecast Year Market Size (2035) |

USD 9.3 billion |

|

Regional Scope |

|

Gene Therapy Cell Culture Media Market Segmentation:

Media Type Segment Analysis

The serum-free media sub-segment, which is part of the media segment, is anticipated to garner the largest share of 40.5% in the gene therapy cell culture media market by the end of 2035. The sub-segment’s upliftment is highly driven by the transition away from animal-derived serum is driven by regulatory requirements, reproducibility concerns, and contamination risks. Serum-free formulations provide a controlled environment for cell growth, ensuring consistency in therapeutic outcomes and compliance with GMP standards. This is particularly critical for gene therapy applications, where variability in media can directly impact viral vector yield and patient safety. Advances in chemically defined serum-free media have further enhanced scalability, enabling biopharma companies to streamline production while reducing batch-to-batch variability.

Applications Segment Analysis

By the end of the forecast period, the therapeutic applications segment in the overall application is projected to hold the second-largest share in the gene therapy cell culture media market. The segment’s growth is highly fueled by the expanding pipeline of gene therapies targeting oncology, rare genetic disorders, and regenerative medicine. Cell culture media play a pivotal role in producing viral vectors and engineered cells used in these therapies. Federal funding initiatives, such as NIH grants and HHS programs, have accelerated clinical trials, while reimbursement policies under Medicaid and Medicare have expanded patient access. The America Society of Gene & Cell Therapy (ASGCT) underscores the importance of robust therapeutic pipelines, with maximum active clinical trials globally.

Cell Type Segment Analysis

The stem cell segment is expected to account for the third-largest share in the gene therapy cell culture media market. The segment’s development is highly propelled by the aspect of permitting long-lasting gene expression throughout self-renewal, thus ensuring corrected genetic material to persist in newly generated cells. According to official statistics published by Biomedical Engineering Advances in June 2025, the aspect of successfully stenting acute myocardial infarctions, the targeted injection of CD133+ stem cells has been aimed at successfully stented acute myocardial infarctions, which has significantly led to a suitable 8.7% increase in left ventricular ejection fraction. This has been suitable during a 4-month follow-up duration for patients with compromised cardiac function, thereby proliferating the segment’s expansion.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Media Type |

|

|

Applications |

|

|

Cell Type |

|

|

Formulation |

|

|

End users |

|

|

Manufacturing Process |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gene Therapy Cell Culture Media Market - Regional Analysis

North America Market Insights

North America market is anticipated to account for the highest share of 42.4% by the end of 2035. The market’s growth is largely driven by government funding, innovative biopharma infrastructure, and robust clinical pipelines. According to official statistics published by NLM in March 2023, Congress offered USD 200 million in the newest federal funding line for the public health information systems (PHIS) infrastructure in the U.S. Additionally, the CDC also received another USD 100 million for its data modernization initiative, denoting a 10-year USD 1.1 billion effort to upgrade core data and surveillance facility across the state and federal public health landscape. Besides, the government-passed Build Back Better Act, as of November 2021, originally comprised USD 7 billion, especially for core public health infrastructure, thereby bolstering the market’s growth.

The gene therapy cell culture media market in the U.S. is growing significantly, owing to growth in Medicare expenditure, expansion in reimbursement policies, an increase in elderly patient accessibility, and a surge in administrative programs. Based on government estimates published by the NIH Government in June 2025, almost 82% of NIH funding has been awarded for extramural research through nearly 50,000 competitive grants to over 300,000 researchers across more than 2,500 medical schools, research institutions, and universities. Moreover, an estimated 11% of the NIH budget readily supports projects that are conducted by 6,000 scientists in laboratories. Besides, the yearly NIH budget also reflects the sum of the enacted discretionary budget of more than USD 46.1 billion, which is received under the Consolidated Act, 2023, thereby making it suitable for uplifting the market in the country.

The existence of provincial governments, patient beneficiary services, expansion in funding for advanced therapies, and industrial associations are readily driving the market in Canada. As per an article published by Drug Discovery Today in October 2025, Canada-based regulatory requirements for cell and gene therapies frequently require additional quality control testing, significantly accounting for 17% to 45% of overall developmental expenses. Besides, Beqvez, which is a gene therapy, has been approved in the country as of 2023 to aid hemophilia B, further amounting to a payer’s pricing of CAD 4,773,595 per treatment, thereby making it the most expensive drug across different nations. Moreover, cell and gene therapies in the country are effectively eligible for 8 years of market exclusivity under section C.08.004.1 of the Food and Drug Regulations, thus bolstering the market’s exposure.

APAC Market Insights

The Asia Pacific gene therapy cell culture media market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly attributed to a rise in the adoption of innovative therapies, expansion in the patient population, and an increase in government investments. According to official statistics published by the Cytotherapy in August 2024, there has been an increase in investigational new drug applications in China from an average of 1.5 per year to 55 every year, along with an average yearly growth rate of 57%. Besides, as per a data report published by the Asia Society Organization in 2024, Australia comprises one of the highest mortality and incidence rates, owing to cancer, with almost 165,000 newly diagnosed cases as of 2023, along with an estimated 51,300 deaths, thereby making it suitable for bolstering the market demand in the region.

The gene therapy cell culture media market in China is gaining increased traction, owing to a surge in the elderly population, government-funded healthcare policies, streamlining approval pathways for innovative therapies, and encouraging rapid commercialization. As stated in an article published by NLM in October 2025, an overall 167 advanced drugs have been significantly approved in the country, comprising 58.1% of small molecules, 31.1% of biologics, and 10.8% of localized medicines. In addition, 86.8% of domestic drugs have dominated the country, and further continued to grow as of 2024. These drugs have been concentrated in 43.7% of oncology, especially in 55.8% of biologics. Besides, 90.4% of oncology-based drugs are accepted based on surrogate end-point evidence, thereby denoting an optimistic outlook for the market’s growth and expansion.

The aspect of government funding, expansion in biotech infrastructure, along with an increase in patient demand, are effectively fueling the market in India. Based on government estimates published by the PIB Government in October 2024, there has been an upsurge in the Government Health Expenditure (GHE) share in the gross domestic product (GDP) from 1.1% to 1.8% as of 2022. Besides, in terms of share in the General Government Expenditure, there has also been an increase from 3.95 to 6.1% within the same year. Moreover, GHE has significantly tripled from Rs. 1,108 to Rs. 3,169, deliberately indicating a suitable increase in healthcare investments and ensuring that generous resources are available per person for healthcare services. Therefore, with such increase in government-based expenditures, there is a huge growth opportunity for the market in the country.

Europe Market Insights

The market in Europe is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by regional strategies, including the EU5Health, as well as centralized EMA regulatory frameworks, and stringent government support. According to official statistics published by the Europe Commission in 2025, health in the region is considered an investment, with an initial €5.3 billion budget for the 2021 to 2027 duration. This has readily been lowered to €4.4 billion after revising the project timeline, with the EU4Health program as an unparalleled financial support in the health industry. Besides, as per an article published by Cell Stem Cell in August 2023, 25 advanced therapy medicinal products have been approved by the EMA in June 2023, of which 68% caters to gene therapy medicinal products, and 16% are tissue-engineered products, thus fueling the market’s exposure.

The gene therapy cell culture media market in Germany is gaining increased exposure, owing to enabling patient accessibility, emphasis on genomic medicine integration, robust research and development infrastructure, innovative biopharma hubs, and regulatory policies. As stated in an article published by The Lancet Public Health in April 2025, at present, the 95 different compulsory health insurance funds readily cover healthcare for an estimated 90% of citizens in the country. Besides, the healthcare system in the country offers nearly universal health coverage, but it is comparatively expensive, with 7.8 hospital beds per 1,000 population, 4.5 physicians, and 12.0 nurses. Besides, the statutory health insurance funds are considered the highest providers of funds for disease prevention in the nation, with a yearly spending of almost €167 million for setting-oriented programs, thus driving the market’s growth.

The aspects of governmental research and development, the presence of rare and oncology disorder therapies, and the NHS England significantly prioritizing innovative therapies in its funding directions are responsible for boosting the gene therapy cell culture media market in the UK. Based on government estimates published by the UK Government in March 2025, as per the Secretary of State for Health and Social Care, the Annex A1 direction has specified the overall capital resource utilization limit, amounting to £205,111 million, as well as £4,857 million. Besides, the NHS England is recommended to exercise its functionalities with a view to enabling the overall revenue resource utilization not to surpass £205,111 million, thus driving the market’s expansion.

Relevant Revenue Resource Utilization Limit Imposed by UK-based Directions (2025)

|

Line |

Revenue Resource Utilization Limits |

Total (£ Million) |

Revenue Departmental Expenditure Limit (Excluding Impairments and Depreciation) |

Revenue Departmental Expenditure Limit (Impairments and Depreciation) |

Revenue Annually Managed Expenditure (£ Million) |

|

6A.1 |

Overall relevant resource use limitation |

200,861 |

199,968 |

393 |

250 |

|

6A.1.1 |

Spending by commissioners with NHS providers that funds depreciation costs |

4,375 |

4,375 |

- |

- |

|

6A.1.2 |

Indivisual placement support and NHS talking therapies |

111 |

111 |

- |

- |

|

6A.2 |

Total administration limit |

2,024 |

1,842 |

182 |

- |

|

6A.2.1 |

NHS England administration limit |

871 |

760 |

111 |

- |

Source: UK Government

Key Gene Therapy Cell Culture Media Market Players:

- Thermo Fisher Scientific (U.S.)

- Lonza Group (Switzerland)

- Merck KGaA / MilliporeSigma (Germany/U.S.)

- FUJIFILM Irvine Scientific (Japan)

- Cytiva (U.S.)

- Takara Bio (Japan)

- BioLife Solutions (U.S.)

- Charles River Laboratories (U.S.)

- WuXi AppTec (China)

- VectorBuilder (U.S.)

- Sartorius AG (Germany)

- Miltenyi Biotec (Germany)

- Biological Industries (Israel)

- PromoCell GmbH (Germany)

- CellGenix GmbH (Germany)

- Corning Life Sciences (U.S.)

- HiMedia Laboratories (India)

- Innovative Medicines Australia (Australia)

- Samsung Biologics (South Korea)

- Malaysian Bioeconomy Corporation (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Thermo Fisher Scientific is a global leader in life sciences, offering advanced cell culture media solutions tailored for gene therapy applications. Its portfolio emphasizes serum-free and chemically defined formulations, widely adopted in GMP-compliant manufacturing.

- Lonza Group is a key supplier of biopharmaceutical manufacturing solutions, including specialized media for viral vector production. The company’s strong presence in contract development and manufacturing services (CDMO) makes it a critical partner for gene therapy firms.

- Merck KGaA, through MilliporeSigma, provides innovative cell culture media and reagents designed for consistency and scalability in gene therapy production. Its focus on chemically defined media supports regulatory compliance and reproducibility.

- FUJIFILM Irvine Scientific specializes in serum-free and customized media formulations for advanced therapies. Its expertise in supporting stem cell and viral vector production positions it as a strong player in the gene therapy supply chain.

- Cytiva delivers integrated solutions for bioprocessing, including cell culture media optimized for gene therapy. Its emphasis on scalability and process development makes it a preferred partner for both research and commercial manufacturing.

Here is a list of key players operating in the global market:

The international gene therapy cell culture media market is highly competitive, dominated by multinational biopharma suppliers and specialized niche players. Companies, such as Thermo Fisher, Lonza, and Merck, lead with diversified portfolios and global distribution networks, while regional innovators in the Asia Pacific and Europe strengthen localized supply chains. Strategic initiatives include mergers & acquisitions, research and development investments in serum-free and chemically defined media, and partnerships with CROs and academic institutions. Besides, in June 2025, Klotho Neurosciences, Inc. declared its progress in processing and manufacturing the development work for preparing clinical trials of KLTO-202, which is the organization’s gene therapy for amyotrophic lateral sclerosis, thereby making it suitable for boosting the gene therapy cell culture media industry globally.

Corporate Landscape of the Gene Therapy Cell Culture Media Market:

Recent Developments

- In February 2026, Ultragenyx Pharmaceutical Inc. notified the latest long-lasting data from clinical studies for evaluating UX111, which is an investigational AAV9 gene therapy for Sanfilippo syndrome Type A.

- In February 2025, AskBio Inc. announced that the investigational gene therapy AB-1005 for aiding Parkinson’s disease has been granted Regenerative Medicine Advanced Therapy (RMAT) designation from the U.S. Food and Drug Administration (FDA).

- In February 2025, PHC Corporation has significantly signed a Master Collaboration Agreement with CCRM to jointly operate for developing primary T-cell expansion culture processes that tend to accelerate the manufacturing of cell and gene therapy products.

- Report ID: 8391

- Published Date: Feb 11, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.