Gene Panel Market Outlook:

Gene Panel Market size was valued at USD 3.76 billion in 2024 and is projected to reach USD 31.3 billion by the end of 2037, rising at a CAGR of 17.7% during the forecast period, 2025 to 2037. In 2025, the industry size of the gene panel is estimated at USD 4.43 billion.

In the U.S., the patient pool for the multigene panels includes people with having inherited risk of ovarian cancers. The National Cancer Institute reported that various genomic screening pilot programs in the U.S. conducted sequencing of 109 genes across 25,100 patients during 2016-2020. The diagnostic throughput gets support from the Medicare coverage policies. Various government and pharmaceutical companies are investing in conducting personalized treatment. The inclusion of the AI-enabled panel optimization is expected to lower the costs.

The supply chain for the gene panel supply includes reagents, software, etc, that need to remain compliant with the FDA regulations. The supply chain is volatile due to numerous interconnected factors, such as technological dependencies, regulatory hurdles, and shifting demand patterns. Also, there is a dependency on limited suppliers, and various single-source bottlenecks lead to shortages. Countries are overcoming this by including biotech funding to lower their foreign reliance. For instance, in China, “Made in China 2025” is promoting local sequencing technologies to remain less reliant on variable factors.

Gene Panel Market - Growth Drivers and Challenges

Growth Drivers

-

Government spending and reimbursement policies: There has been an increase in approvals from the government organization, which is further accelerating the adoption. For instance, the Medicare spending on gene panels reached USD 1.21 billion in 2023, fueled by widespread coverage for the testing of hereditary cancer. Additionally, in Germany, G-BA is now reimbursing 81% of the cancer panels based on NGS is further increasing patient access. Companies are aligning with the value-based reimbursement models to secure coverage. Also, the recognition of blood biomarker tests is increasing, resulting in higher investment.

-

Rising disease prevalence and patient pool expansion: The cases of genetic disorders are mushrooming across the world. For instance, in Germany, the rare disease patient pool reached 4.1 million at the beginning of 2025. The National Health Service in the UK is planning to sequence 500,100 genomes by 2025, promoting the adoption. Also, there has been an increased newborn screening program, and prenatal testing cases are increasing the adoption of gene panels for early diagnosis. Precision medicine initiatives, such as oncology panels for targeted therapy selection for rendering personalized care, are propelling the clinical adoption.

- Technological innovations and integration: The advancements in the multi-cancer screening through cell-free DNA and AI-enabled analytics are in high demand. The next-generation sequencing is considered to be the backbone of the modern gene panels for enabling high throughput. Also, the amalgamation of AI and ML is revolutionizing the interpretation of the variants and reducing the turnaround time. The adoption of the liquid biopsy-based gene panels is allowing cancer detection through blood samples. These factors are bolstering the market growth during the forecasted period.

Historical Gene Panel Patient Growth (2010–2020)

|

Country |

2010 Patients (Millions) |

2020 Patients (Millions) |

Growth (%) |

|

USA |

1.1 |

5.8 |

384% |

|

Germany |

0.61 |

2.9 |

382% |

|

France |

0.42 |

2.1 |

424% |

|

Spain |

0.32 |

1.4 |

366% |

|

Australia |

0.21 |

1.1 |

451% |

|

Japan |

0.7 |

3.6 |

352% |

|

India |

0.51 |

3.8 |

661% |

|

China |

1.01 |

7.5 |

652% |

Revenue Feasibility Models for Gene Panel Market

|

Country |

Feasibility Model |

Revenue Growth (%) |

Time Period |

|

India |

Public-private partnership with diagnostic labs and insurance schemes (e.g., Ayushman Bharat) |

12% |

2022–2024 |

|

USA |

CMS-approved reimbursement pathways for oncology and rare disease gene panels |

15% |

2020–2023 |

|

France |

National Genomic Medicine Plan using decentralized lab networks and digital health registries |

18% |

2021–2024 |

|

China |

Volume-based procurement (VBP) plus regional government co-funding for genetic screening |

16% |

2021–2023 |

|

South Korea |

AI-enabled genomic panels integrated into public hospitals under the K-genome project |

13% |

2022–2024 |

|

Germany |

Digital health application (DiGA) registry with fast-track approvals for precision diagnostics |

11% |

2021–2023 |

Challenges

- Pricing restraints and reimbursement barriers: Payers and governments impose stringent price caps to limit the profitability and access to the market. For instance, Medicaid in the U.S. covers only 35.2% of the eligible patients for the hereditary cancer panels owing to the exorbitant costs of the treatment. Similarly, in Germany, price negotiation via G-BA forces Illumina to lower the panel costs by almost 21% in 2023.

- Regulatory delays and complex approvals: The complex approval methods slow down the entry into the market. For instance, in Japan, the Pharmaceuticals and Medical Devices Agency took 8 months to approve in 2022 to approve Foundation Medicine’s pan-cancer panel.

Gene Panel Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

17.7% |

|

Base Year Market Size (2024) |

USD 3.76 billion |

|

Forecast Year Market Size (2037) |

USD 31.3 billion |

|

Regional Scope |

|

Gene Panel Market Segmentation:

Design Segment Analysis

The predesigned gene panels segment is anticipated to garner 45.3% of the market share by 2037. The segment growth is fueled by strong adoption from the hospitals and widespread usage for cancer risk screening. Their standardized formats are fostering the speedy regulatory approval and implementation in public healthcare. The bulk purchasing from the hospitals and labs is further fueling the segment's growth. The pre-optimized assays need less validation, which is fostering the widespread adoption in labs. Also, the advent of the AI-curated panels and liquid biopsy-based panels is further accelerating adoption.

Technique Segment Analysis

The amplicon-based NGS panels segment is anticipated to register 35.4% market share owing to the faster turnaround time and its suitability for high-volume labs. The amplicon-based panels need fewer DNA inputs and have less complex library preparation in comparison with the hybrid capture. Also, these panels are ideal for the small to medium gene sets and well-suited for the focused panels. The amplicon PCR usability is increasing due to its same-day library preparation and capability to lower the downtime by 3-5 days.

Our in-depth analysis of the gene panel market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Technique |

|

|

Design |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

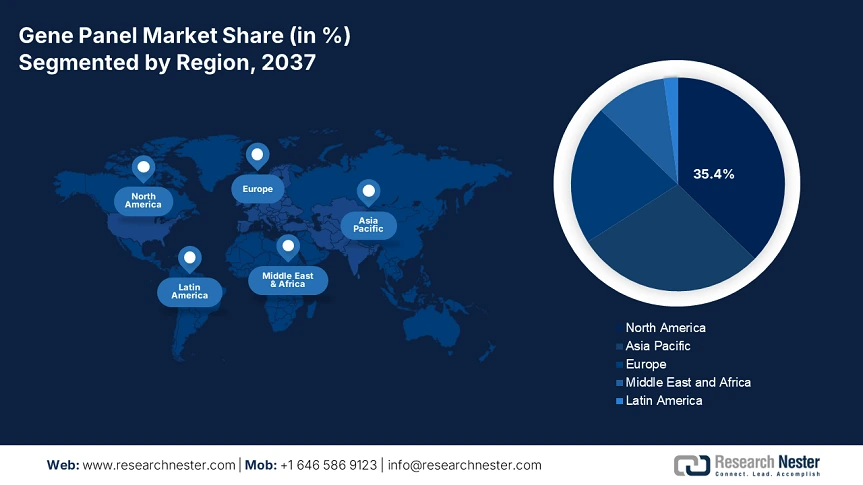

Gene Panel Market - Regional Analysis

North America Market Insights

The gene panel market is anticipated to hold 35.4% of the share of the global market by 2037, driven by sustained development in oncology and newborn screening. The increased federal funding, coupled with the supportive policies under Medicaid and Medicare, is boosting the adoption. The market in the U.S. is witnessing remarkable growth owing to robust federal investment and expanding reimbursement frameworks. In 2023, the genomic sequencing for disease surveillance has received USD 5.1 billion in funding. Also, the technological advancements are the crucial drivers for the machine learning based gene interpretation.

The market in Canada is set to witness staggering growth, anchored by burgeoning investments from the provincial as well as federal governments in the country. The government has infused USD 3.1 billion in 2023 for diagnostics in genomics and diagnostic domains. Hereditary cancer panels are in demand, with 30.2% of breast or ovarian cancer cases associated with mutations in genes. The execution of programs such as Care4Rare uses whole-exome gene panels for various undiagnosed diseases. Companies have launched AI-enabled variant interpretation to upgrade the diagnostic yield.

Asia Pacific Market Insights

The market in Asia Pacific is growing, registering 14% of the CAGR during 2025-2037, owing to a surge in the prevalence of genetic disorders and various genomics initiatives by the government. In China, the National Medical Products Administration (NMPA) is making aggressive regulatory reforms to manage the rising patient pool. The 14th 5-year plan allocated USD 9 billion to precision medicine and genomics. The national GeneBank in the country supports more than 100,000 whole genome sequences every year, bolstering the panel adoption.

India’s gene panel market is witnessing rapid growth owing to rising awareness and advancements in genomic technologies. The Ministry of Health in 2023 stated that Thalassemia and sickle cell anemia cases affect more than 15.1 million people in the country, further propelling the demand for carrier screening panels. Also, Ayushman Bharat & state health schemes are incorporating genetic testing for diagnosing disease in the high-risk populations. Private labs such as MedGenome are widely spreading the cost-efficient gene panel offerings.

Government Investment & Advancements in Gene Panel Market

|

Country |

Gov. Investment in Gene Panel |

Key Advancements (2020–2024) |

|

Japan |

12% of national health budget (~$3B in 2024) |

Nationwide genomic screening under the "Initiative on Rare and Undiagnosed Diseases" (IRUD) |

|

Australia |

$500M invested under Genomics Health Futures Mission (GHFM) through 2024 |

cancer and rare disease screening projects across NSW, VIC |

|

South Korea |

$1.2B allocated to precision medicine and genomics by MOHW by 2023 |

"Korean Genome Project"; over 1.1M NGS tests |

|

Malaysia |

20% increase in gov. funding from 2013–2023 |

Introduction of rare disease and cancer gene panel programs at public hospitals |

Europe Market insights

Europe is anticipated to register a significant market share of the market, driven by the robust government investment and policy harmonization. The expanding cancer and rare disease screening programs and the presence of real-time data infrastructure are fueling the market growth. The EU’s initiatives have enabled broader gene panel access in oncology and the management of infectious diseases. In Germany, the government has invested USD 4.1 billion in gene panel testing and building the infrastructure in 2024. The German Medical Association emphasizes that the gene panels are considered to be standard in diagnostics under the public insurance.

Also, in the UK, the National Health Service (NHS) has infused 8.1% of its healthcare budget in 2023 to upgrade its gene panel technologies. The biobank in the country has genomic data of over 500,100 participants, which is used in conducting clinical trials to refine the level of accuracy. The government has joined hands with Genomic England to extend access to the underserved people, aligning with the equity goals of the NHS. In the post-Brexit era, regulatory flexibility is allowing faster approvals, further propelling the market growth.

Key Gene Panel Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The competitive landscape of the market is rapidly evolving as established key players, healthcare giants, and new entrants are investing in including novel medicines. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position.

Top 20 Global Manufacturers in the Gene Panel Market:

|

Company Name |

Country of Origin |

2024 Market Share |

|

Illumina, Inc. |

USA |

16.1% |

|

Thermo Fisher Scientific |

USA |

12.5% |

|

Roche Diagnostics |

Switzerland |

9.9% |

|

Qiagen N.V. |

Germany |

8.2% |

|

BGI Genomics |

China |

6.8% |

|

Invitae Corporation |

USA |

xx% |

|

Myriad Genetics |

USA |

xx% |

|

Agilent Technologies |

USA |

xx% |

|

Foundation Medicine (Roche) |

USA |

xx% |

|

Bio-Rad Laboratories |

USA |

xx% |

|

Genetron Health |

China |

xx% |

|

Macrogen Inc. |

South Korea |

xx% |

|

CENTOGENE N.V. |

Germany |

xx% |

|

GENEWIZ (Azenta Life Sci.) |

USA |

xx% |

|

Eurofins Scientific |

France |

xx% |

|

DNA Nexus |

USA |

xx% |

|

Genesis Healthcare |

Japan |

xx% |

|

Genetic Technologies Ltd. |

Australia |

xx% |

|

MedGenome |

India |

xx% |

|

Neoscience Sdn Bhd |

Malaysia |

xx% |

Below are the areas covered for each company in the market:

Recent Developments

- In March 2024, Illumina launched TruSight, which is an FDA-approved pan-cancer companion diagnostic panel. The company procured 15.2% of the additional market in the U.S. oncology panel segment. Also, the panel has been adopted by the Mayo Clinic and MD Anderson for the conduct of the precision oncology program.

- In May 2024, BGI Genomics launched the Hereditary Cancer Panel with 51% cost reduction. The company sold 200,100 tests in China within 3 months and witnessed 31 revenue growth in Asia Pacific for the preventive genomics sector.

- Report ID: 3634

- Published Date: Jul 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gene Panel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert