Electrosurgery Generators Market Outlook:

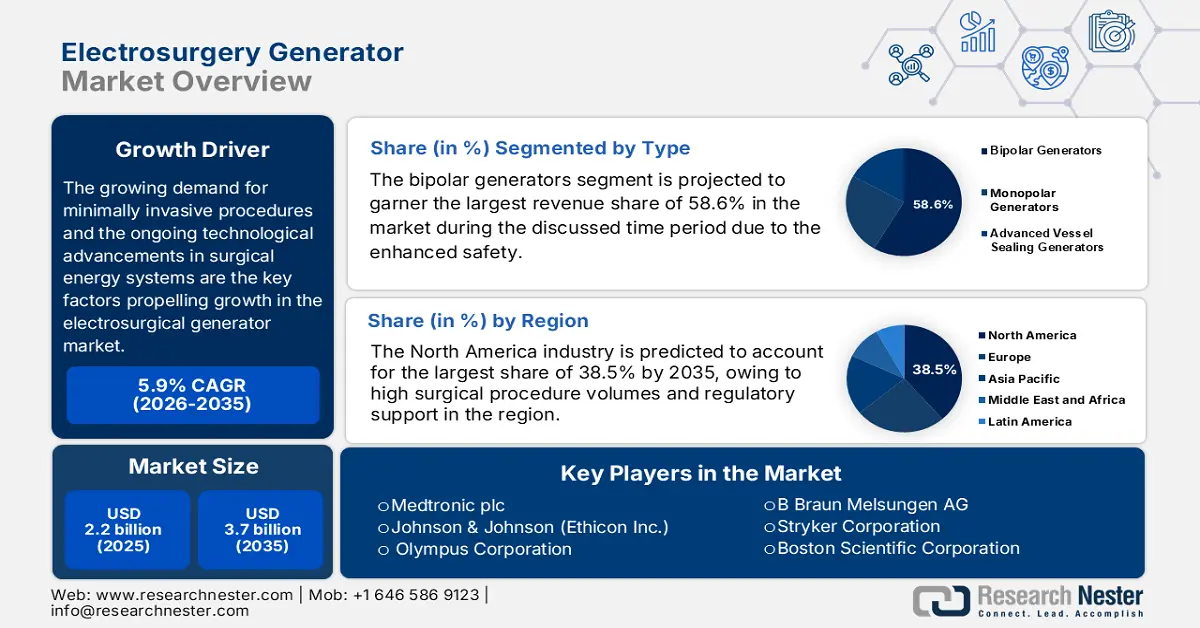

Electrosurgery Generators Market size was valued at USD 2.2 billion in 2025 and is projected to reach USD 3.7 billion by the end of 2035, rising at a CAGR of 5.9% during the forecast period, i.e., 2025‑2035. In 2026, the industry size of electrosurgery generators is estimated at USD 2.4 billion.

The growing demand for minimally invasive procedures and the ongoing technological advancements in surgical energy systems are the key factors propelling growth in the electrosurgery generators market. In this regard, the article published by the National Institute of Health in January 2024 revealed that India’s total surgical rate was 1,385.28 surgeries per 100,000 people, wherein the major surgeries accounted for 355.94 per 100,000 in a year, hence denoting the presence of a reliable consumer base in this field.

Furthermore, the industry is extensively favored by the coverage policies and reimbursement frameworks since both the public and private payers are supporting huge adoption in specialties such as urology, gynecology, and oncology. Testifying to this, the NIH in January 2024 reported that a study at Tata Memorial Centre in India revealed that the average cost of breast surgery was ₹25,075 (USD 343), wherein 74.4% of patients received some form of financial aid, thereby encouraging healthcare systems to implement value-based care models.

Key Electrosurgery Generators Market Insights Summary:

Regional Insights:

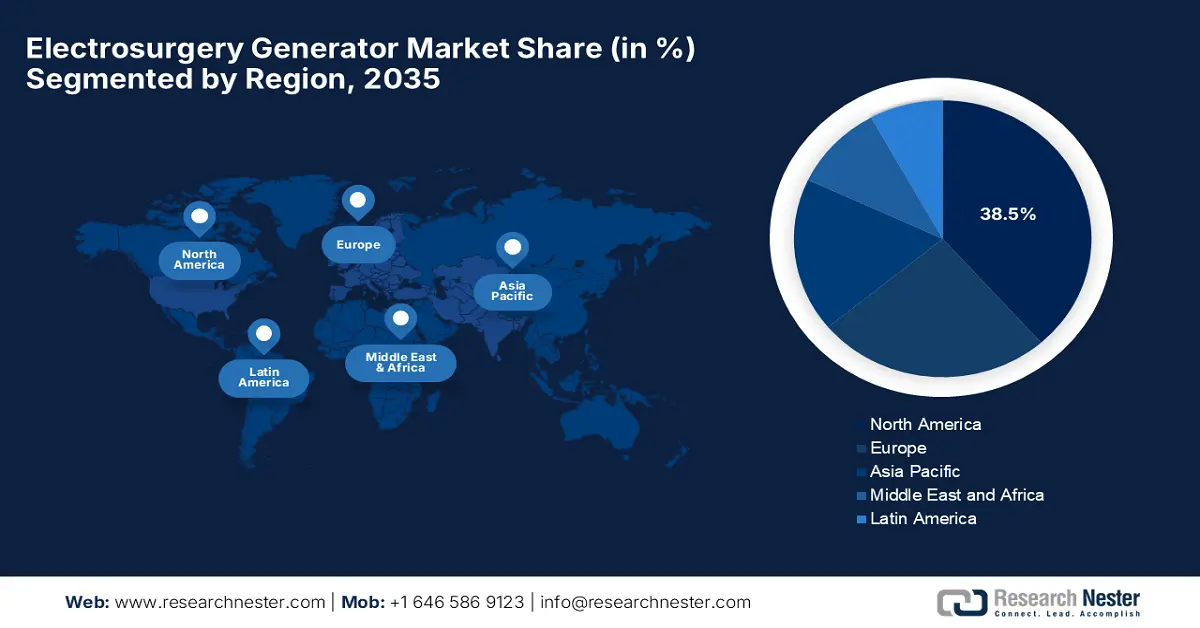

- North America is projected to secure a 38.5% share in the Electrosurgery Generators Market by 2035, fueled by high surgical procedure volumes and supportive regulatory initiatives.

- Europe is anticipated to retain the second-largest position by 2035, sustained by stringent regulatory standards and an increasing focus on minimally invasive procedures.

Segment Insights:

- The bipolar generators segment is projected to hold a commanding 58.6% share in the Electrosurgery Generators Market by 2035, propelled by superior safety features, reduced collateral tissue risk, and precision in complex surgical procedures.

- The hospitals segment is expected to account for a notable 45.3% share by 2035, underpinned by the rising number of surgical procedures and significant investments in operating room infrastructure.

Key Growth Trends:

- Amplifying demand for minimally invasive surgeries

- Cutting-edge technological breakthroughs

Major Challenges:

- Surgeon knowledge disparities

- Exacerbated costs and limited access

Key Players: Medtronic plc, Johnson & Johnson (Ethicon Inc.), Olympus Corporation, B Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, CONMED Corporation, Erbe Elektromedizin GmbH, Smith & Nephew plc, BOWA-electronic GmbH & Co. KG, CooperSurgical, Inc., KLS Martin Group, Symmetry Surgical Inc., Utah Medical Products, Inc., Soering GmbH, Zimmer Biomet Holdings, Inc., Mindray Medical International Limited, OmniGuide Holdings, Inc., Apyx Medical Corporation, Ellman International, Inc.

Global Electrosurgery Generators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.2 billion

- 2026 Market Size: USD 2.4 billion

- Projected Market Size: USD 3.7 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 1 October, 2025

Electrosurgery Generators Market - Growth Drivers and Challenges

Growth Drivers

- Amplifying demand for minimally invasive surgeries: This is the major driving factor for the electrosurgery generators market since both the patients and healthcare providers increasingly prefer surgical procedures that are less traumatic, with smaller incisions, less blood loss, reduced postoperative pain, and faster recovery. In this regard, the American Heart Association in 2025 reported that in a span of three years, 127.9 million adults in the U.S., which is 48.6% of the total, had some form of cardiovascular disease. Hence, this is the evidence for a wider market scope, indicating the huge necessity for surgical interventions.

- Cutting-edge technological breakthroughs: Continuous innovation in terms of integrating feedback loops, tissue monitoring, energy modulation, hybrid energy modalities, and digital interfaces is making the electrosurgery generators market increasingly productive. In March 2024, Intuitive reported that it had received FDA 510(k) clearance for its fifth-generation da Vinci 5 robotic system that comes with a highly functional design, which marks a significant leap in robotic-assisted surgery.

- Expansion of healthcare infrastructure: governments across different nations and the private sector are readily making investments in expanding healthcare facilities, upgrading operating rooms, and improving surgical capacities, which is reshaping the foundation of this sector. In June 2025, the NSW Government announced a USD 7.5 million investment to upgrade the Milton Ulladulla Hospital, which will start with a modernized medical imaging department and the installation of a new CT scanner, denoting a positive market outlook.

Country-wise Surgical Procedure Rates per 100,000 Population

|

Country/Region |

2021 |

2022 |

2023 |

|

Albania |

2,001 |

- |

- |

|

Bhutan |

- |

2,909 |

- |

|

Canada |

6,928 |

- |

- |

|

Estonia |

- |

14,832 |

- |

|

Finland |

- |

15,870 |

- |

|

Germany |

- |

19,124 |

- |

|

Spain |

- |

- |

6,953 |

|

Mauritius |

- |

4,051 |

- |

|

Sweden |

- |

14,380 |

- |

Source: World Bank - Lancet Commission on Global Surgery (2025)

Major Acquisitions and Product Launches in the Electrosurgery Generators Market

|

Year |

Company/Entity |

Event Description |

|

2024 |

LSR Healthcare Pty Ltd |

Registered Mindray UP700 Ultrasonic Surgical & Electrosurgical Energy Platform (diathermy/ultrasonic) |

|

2022 |

Aspen Surgical & Symmetry |

Aspen Surgical acquired Symmetry Surgical, expanding its portfolio of electrosurgery and surgical devices |

|

2021 |

GE Healthcare & BK Medical |

Completed $1.45 billion acquisition of BK Medical to expand into surgical visualization and ultrasound therapy |

Source: Company Official Press Releases, TGA

Challenges

- Surgeon knowledge disparities: One of the major challenges that has hindered growth in the electrosurgery generators market is the existence of safety risks, improper use, and insufficient understanding of electrosurgical principles among healthcare professionals. Despite the continued advancements in the field, complications such as insulation failure, capacitive coupling, and stray currents remain common, particularly in minimally invasive surgeries, making it challenging for manufacturers to capture an optimum consumer base.

- Exacerbated costs and limited access: This is yet another restraint causing a significant barrier to adoption in the electrosurgery generators market. These systems are often integrated with digital connectivity, multiple energy modalities, and safety features, which are often financially high-end, creating hesitation among smaller healthcare facilities to make investments in this field. In addition, the costs associated with consumables, maintenance, and skilled professional training further cause obstacles to deployment.

Electrosurgery Generators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 2.2 billion |

|

Forecast Year Market Size (2035) |

USD 3.7 billion |

|

Regional Scope |

|

Electrosurgery Generators Market Segmentation:

Type Segment Analysis

Based on type, the bipolar generators segment is projected to garner the largest revenue share of 58.6% in the electrosurgery generator market during the discussed time period. The segment’s dominance in this field is effectively attributed to its superior safety, reduced risk of collateral tissue damage, and precise energy delivery for delivering complex procedures such as neurosurgery and oncology. On the other hand, their adoption is highly essential in minimizing surgical complications, which makes it highly preferable among both service providers & consumers.

End user Segment Analysis

In terms of the user hospitals segment, it is expected to gain a lucrative share of 45.3% in the electrosurgery generator market by the end of 2035. The high volume of surgical procedures and increasing investments in operating room infrastructure are the key factors behind this leadership. In this regard, the Journal of Taibah University Medical Sciences in June 2023 revealed that there is an urgent need for formal electrosurgery training and periodic re-evaluation of surgeons' competencies, highlighting a strong market opportunity for systems with built-in safety features and training tools.

Application Segment Analysis

Based on the application, the general surgery segment is predicted to gain a share of 25.4% in the electrosurgery generator market during the forecast timeline. The growth in the segment originates from the high volume of common procedures such as cholecystectomies, hernia repairs, and colectomies that utilize electrosurgical tools. For instance, in October 2022, ZEISS reported that it had received FDA 510(k) clearance for its MTLawton disposable bipolar forceps, which are designed to improve efficiency and safety during electrosurgical procedures.

Our in-depth analysis of the electrosurgery generators market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

End user |

|

|

Application |

|

|

Product |

|

|

Power Output |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Electrosurgery Generators Market - Regional Analysis

North America Market Insights

North America is recognized as the dominant landscape for the electrosurgery generator market, capturing a share of 38.5% by the end of 2035. The dominance of the region is attributable to the high surgical procedure volumes and regulatory support. In May 2024, US Medical Innovations reported that it had received FDA 510(k) clearance for its Canady Helios Cold Plasma Ablation System, which is a non-thermal electrosurgical innovation designed for soft tissue ablation during tumor removal, hence benefiting the overall market growth.

The U.S. is continuing its growth trajectory in the regional electrosurgery generator market due to the strong investments in medical technology, high incidence rates of chronic and surgical‐necessitating conditions such as cancer, cardiovascular, and neurological disorders, and favorable reimbursement policies. In November 2024, Halma announced the acquisition of Lamidey Noury Medical, which is a well-known manufacturer of high-quality electrosurgical instruments that are highly essential for precise tissue cutting and bleeding control during surgeries.

Canada is also portraying notable growth in the electrosurgery generator market owing to the existence of its public healthcare system and strong government support for medical device procurement and digital operating room modernization. For instance, in February 2025, Aspen Surgical Products announced a distribution partnership with Andau Medical to cover its full portfolio of surgical products across the country, which includes. This includes Olsen electrosurgery devices and other key surgical instruments.

U.S. Medical Device Imports to Honduras and Exchange Rates

|

Year |

Total Imports (USD million) |

Imports from the U.S. (USD million) |

Exchange Rate (HNL per USD) |

|

2020 |

112.0 |

49.0 |

24.73 |

|

2021 |

122.2 |

55.0 |

24.25 |

|

2022 |

128.1 |

58.0 |

24.68 |

|

2023(Estimated) |

127.1 |

57.0 |

24.70 |

Source: ITA

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the electrosurgery generator market during the analyzed tenure. The extensive growth in this region is driven by the growing healthcare infrastructure, rising surgical volumes, and increasing adoption of minimally invasive procedures. On the other hand, countries such as Japan, Australia, China, and India are readily making investments in the upgradation of existing medical facilities, which is contributing to a stronger demand for both generator units and associated accessories. Further medical tourism is a pivotal driving point for this landscape, allowing a steady cash influx.

China is the prominent player in the regional electrosurgery generator market, which is effectively fueled by the government-led modernization of hospitals and expansion into under‑served healthcare centres. In June 2025, ShouLiang-med reported that it had successfully topped out its new 35,000 m² R&D and production facility in Nanjing, which will boost innovation in electrosurgical energy instruments and localize advanced medical technologies.

India is also maintaining a strong position in the Asia Pacific’s electrosurgery generator market, primarily shaped by government policies and continued product innovation, including more advanced energy sources. For instance, in March 2025, Zydus Lifesciences notified that it had acquired an 85.6% stake in medical device company Amplitude Surgical for €256.8 million, which will enable the company to expand in the medical device industry, particularly in surgical technologies for lower-limb orthopedics.

Mean Outpatient (OP) and Inpatient (IP) Bed-Day Costs by Surgical Specialty in India 2022

|

Surgical Speciality |

Mean OP Cost (USD) |

Mean IP Bed-Day Cost (USD) |

|

General Surgery |

3.10 |

21.70 |

|

Obstetrics & Gynaecology |

3.20 |

16.30 |

|

Ophthalmology |

4.10 |

35.60 |

|

Orthopaedics |

2.80 |

13.40 |

|

ENT |

2.60 |

35.30 |

Source: NIH

Europe Market Insights

Europe is likely to retain its position as the second-largest shareholder in the global electrosurgery generator market, owing to the stringent regulatory standards and growing emphasis on minimally invasive procedures. In January 2025, Johnson & Johnson MedTech reported that it had received CE mark approval for its Dual Energy THERMOCOOL SMARTTOUCH SF Catheter, which is designed to treat cardiac arrhythmias with advanced irrigated, contact-force sensing technology, benefiting the overall market development.

Germany is reinforcing its dominance over the regional electrosurgery generator market, backed by the robust healthcare system and well-established medical technology industry. In this regard, firms are making proactive collaborations to strengthen the country’s ecosystem. In June 2023, B. Braun Medical and Borns Medical Robotics reported that they formed a strategic partnership to accelerate innovation and standardization in robotic surgery, which will integrate B. Braun’s surgical instruments with Borns’ robotic systems.

The U.K. is gaining traction in the regional electrosurgery generator market, wherein there is a growing demand for advanced surgical technologies. The National Health Service (NHS) and private healthcare providers are increasingly adopting electrosurgical systems to meet the rising volume of surgical procedures, which provides an encouraging opportunity for the pioneers to capitalize on in the country. On the other hand, the country’s regulatory environment prefers device safety and efficacy, fostering a great trust among patients.

Key Electrosurgery Generators Market Players:

- Medtronic plc

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson (Ethicon Inc.)

- Olympus Corporation

- B Braun Melsungen AG

- Stryker Corporation

- Boston Scientific Corporation

- CONMED Corporation

- Erbe Elektromedizin GmbH

- Smith & Nephew plc

- BOWA-electronic GmbH & Co. KG

- CooperSurgical, Inc.

- KLS Martin Group

- Symmetry Surgical Inc.

- Utah Medical Products, Inc.

- Soering GmbH

- Zimmer Biomet Holdings, Inc.

- Mindray Medical International Limited

- OmniGuide Holdings, Inc.

- Apyx Medical Corporation

- Ellman International, Inc.

The electrosurgery generator market is extremely consolidated, wherein the top five players have captured the maximum revenue share. There has been an intensifying competition in the landscape owing to factors such as technical discoveries, mergers & acquisitions, and a strong focus on research & development. Besides the industry pioneers such as Medtronic, Johnson & Johnson, and Olympus, there is rivalry in launching next-generation generators that offer enhanced safety profiles integrated with robotic and endoscopic platforms.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In April 2025, Erbe announced the launch of VIO 3n and VIO seal electrosurgical systems, which are designed to deliver tailored, high-performance workflows across surgical and endoscopic procedures.

- In March 2025, Johnson & Johnson MedTech reported that it had launched the DUALTO Energy System, which is an integrated surgical platform combining monopolar, bipolar, ultrasonic, and advanced bipolar energy modalities into one unit for open and minimally invasive procedures.

- In June 2023, Olympus announced the launch of its next-generation ESG-410 Electrosurgical Generator, which is designed to enhance treatment efficiency for bladder cancer and benign prostatic hyperplasia (BPH).

- Report ID: 8164

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Electrosurgery Generators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.