Gastroesophageal Reflux Disease Market Outlook:

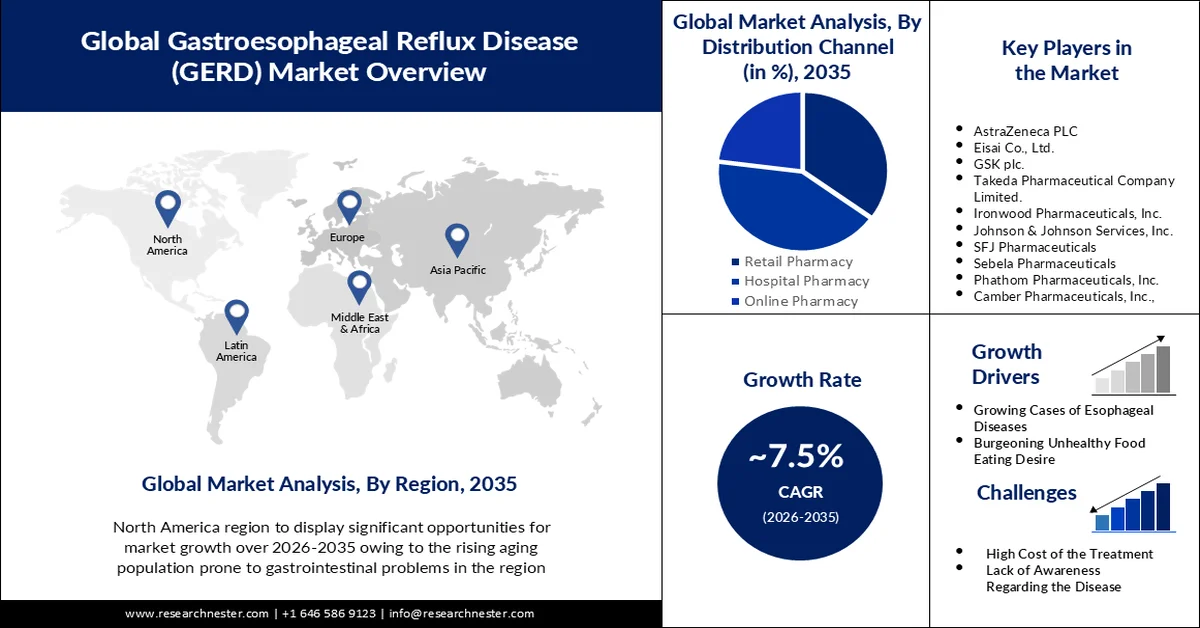

Gastroesophageal Reflux Disease (GERD) Market size was valued at USD 6.24 billion in 2025 and is expected to reach USD 12.86 billion by 2035, registering around 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of GERD is evaluated at USD 6.66 billion.

The rising prevalence of functional gastrointestinal disorders (FGIDs) over the world is set to propel the growth of the market. A survey published by ScienceDirect in January 2021 revealed that over 40% of the world’s population suffered from this condition. Another report from Frontiers, released in September 2022, stated that GERD affected 33% of the total habitats around the globe. Further, risk factors such as older age, obesity, and sedentary lifestyle are proven to enlarge this patient pool. On this note, WHO predicted the number of people aged 60 and over to surpass 2.1 billion worldwide by 2050. Similarly, the World Heart Federation calculated the volume of obese residents to be 1.0 billion by 2030.

Furthermore, the increasing tendency to self-medicate is also positively impacting the growth of the market. Thus, the availability and accessibility of a strong and affordable medication pipeline is required to maintain the sector’s gain. To justify this need, Frontiers published a bibliometric and visualized study on the current scenario of associated R&D culture in September 2022. It highlighted the range of direct annual financial exhaustion to be USD 9.0-10.0 billion in the U.S., most of which was originated from the use of proton pump inhibitors (PPIs) as a first line therapy. This is bringing the focus of global leaders to develop more functionally and economically effective medicines to offer a liable payers’ pricing.

Key Gastroesophageal Reflux Disease (GERD) Market Insights Summary:

Regional Highlights:

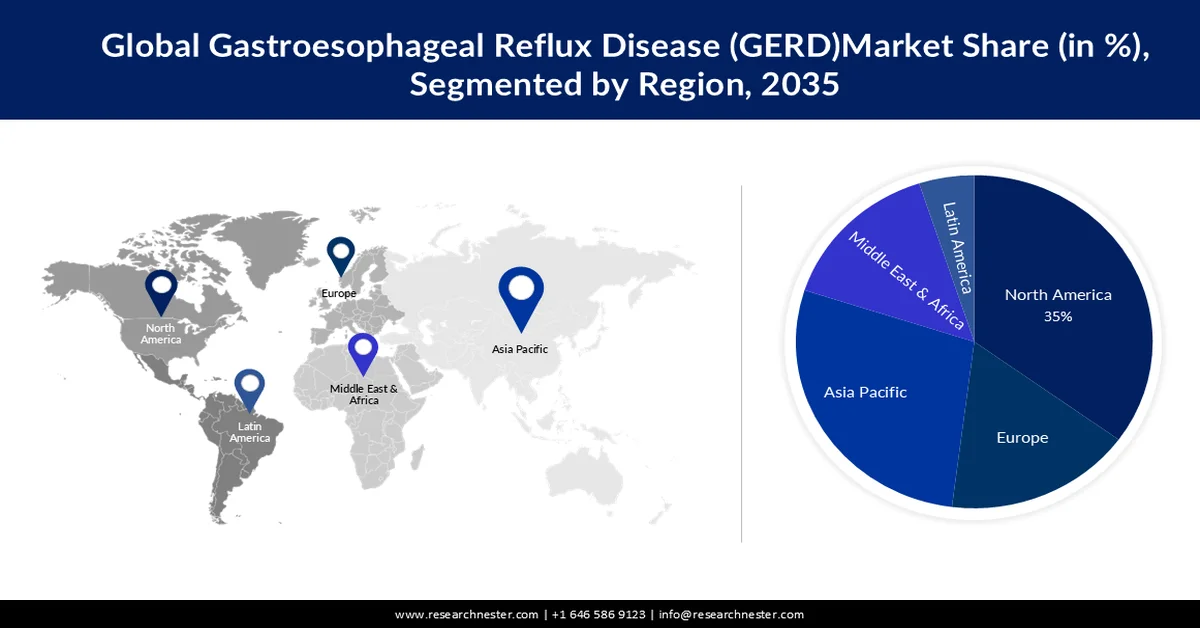

- North America in the gastroesophageal reflux disease market is predicted to hold a 35% share by 2035, driven by the rising patient population prone to gastrointestinal issues.

- The Asia Pacific region is expected to achieve a 24% share by 2035, fueled by increasing health awareness and growing healthcare investments.

Segment Insights:

- The antacids segment in the gastroesophageal reflux disease market is projected to account for 26% share by 2035, owing to the fast and effective relief provided by antacids.

- The hospital pharmacy sub-segment is expected to witness substantial growth by 2035, impelled by the rising number of in-house hospital pharmacies enhancing medication access.

Key Growth Trends:

- Introduction of innovative treatment approach

- Global expansion of over-the-counter (OTC) medicines

Major Challenges:

- Limitations in long-term efficacy and accurate prognosis

Key Players: Passport Inc., BondTraffic Solutions, APCOA Parking Deutschland, TIBA Parking, DELOPT, YourParkingSpace, FlashParking Inc., International Business Machines Corporation, Infocomm Group LLC.

Global Gastroesophageal Reflux Disease (GERD) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.24 billion

- 2026 Market Size: USD 6.66 billion

- Projected Market Size: USD 12.86 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 25 February, 2026

Gastroesophageal Reflux Disease (GERD) Market - Growth Drivers and Challenges

Growth Drivers

-

Introduction of innovative treatment approach: The rising popularity of preventive measures is gaining traction in the gastroesophageal reflux disease (GERD) market. As people gain knowledge and awareness about the importance of early detection and intervention to stop the condition from worsening grows, adoption and development in the diagnosis category increases. For instance, in April 2023, Laborie Medical Technologies introduced a wireless pH-capsule reflux testing system, alpHaONE, to identify GERD and generate monitoring data up to 96 hours. Similarly, the introduction of minimally invasive and endoscopic procedures is creating new long-term options for patients, diversifying the pipeline.

- Global expansion of over-the-counter (OTC) medicines: Besides the improvement in direct-to-customer services, the easy availability of generic solutions is also boosting revenue generation in the market. According to a 2020 NLM article, up to 1,00,000 marketed products in the U.S. belonged to the OTC medications, which saved a total of USD 102.0 billion in the national healthcare expenditure. Medicines from this category, such as antacids and low-dose PPIs, are enhancing public access to disease management, fueling growth in this sector. Moreover, MedTech companies are also creating diagnostic OTC products to mitigate the accessibility issues in this sector from every aspect.

Challenges

-

Limitations in long-term efficacy and accurate prognosis: Despite the growth in availability and accessibility in the market, there are major adverse effects of this scenario. One of them is the misuse of OTC drugs among older citizens. In addition, the use of mainstay treatment such as PPIs for a long-run may cause severe side-effects, such as kidney disease, bone fractures, and gut microbiome disruption. Thus, the growing safety concerns about these products are slowing the global expansion in this field. To mitigate this roadblock, companies must invest more in extensive R&D to develop safer alternatives such as disease modifying therapeutics.

Gastroesophageal Reflux Disease (GERD) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 6.24 billion |

|

Forecast Year Market Size (2035) |

USD 12.86 billion |

|

Regional Scope |

|

Gastroesophageal Reflux Disease (GERD) Market Segmentation:

Drug Type Segment Analysis

The antacids segment value is poised to be the greatest among the others in the gastroesophageal reflux disease market with a share of 26% by 2035. This is due to the fast and effective relief that antacids provide. Antacids are also useful in various related symptoms, including heartburn, acid indigestion, hyperacidity, upset stomach, and others. Furthermore, the widespread awareness about self-medication has led to the higher consumption of antacids rather than visiting healthcare systems. In addition to other benefits, antacids have minimal to no side effects and are even safe for pregnant women. All these factors accumulatively create a positive outlook for segment expansion in the upcoming years.

Distribution Channel Segment Analysis

The hospital pharmacy sub-segment is set to register a significant growth rate in the gastroesophageal reflux disease market over the assessed period. The major factor projected to support in the propagation of this segment is the rising number of in-house pharmacies in hospitals which increases the access to medications for the patients’ visiting. In this regard, an NLM article from November 2022, reported that the proportion of pharmaceutical expenditure in hospitals ranged between 20.0% and 50.0% of the total third-party drug spending in Europe. In addition, the favorable reimbursement policies available in these organizations are estimated solidify its propagation.

Our in-depth analysis of the global gastroesophageal reflux disease market includes the following segments:

|

Drug Type |

|

|

Route of Administration |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gastroesophageal Reflux Disease (GERD) Market - Regional Analysis

North American Market Insights

North America industry is predicted to dominate the gastroesophageal reflux disease market with a majority revenue share of 35% by the end of 2035. The primary factor for the region’s proprietorship is the rising patient population in the region, which is highly prone to gastrointestinal problems. As per an article from NLM, published in October 2023, the rate of GERD prevalence in North America ranged between 18.1% and 27.8%. In addition, the estimated prevalence of heartburn at least once per week in this region ranged from 18% to 28%, with 25% of adults reporting heartburn daily (2023 NLM study). Furthermore, the rising awareness regarding drug therapies and early diagnosis, coupled with rigorous R&D cohorts are bringing new opportunities for global pioneers.

The U.S. market is augmenting with several growth drivers, including the increased cases of obesity and strong presence of pharma developers. For instance, till September 2024, approximately 20.0% of the adults residing across the nation were obese (CDC). The commercial distribution and development of therapeutics are further impelled by the supportive regulatory framework. This can be testified by the New Drug Application (NDA) clearance from the FDA for vonoprazan, attained by Phathom Pharmaceuticals in May 2023. This drug was indicated to treat erosive GERD.

APAC Market Insights

The Asia Pacific gastroesophageal reflux disease market is estimated to grow at a notable pace and holds almost 24% share by the end of the discussed timeframe. The rising awareness about health and fitness among the people in the region and the increase in health spending is considered to be the primary factor for augmentation in this region. In addition, the expenditure on healthcare from foreign investors is increasing access to advanced care and R&D activities, which is favoring the new drug development. On this note, in December 2024, JW Pharmaceutical announced the commercial launch of a combination drug, Rabekhan Duo Tablet, treating GERD and gastric & duodenal ulcers.

With a large consumer base and generic medicine merchandise, India is emerging as an attractive landscape for greater revenue generation in the market. For instance, the OTC healthcare industry in this country is poised to attain USD 11.6 billion by 2026, owing to the increased disposable income and health awareness (International Journal of Pharmaceutical Sciences). The nation’s strong emphasis on the regional progress is also highlighted by the domestic innovations. In this regard, in June 2024, Akums Drugs & Pharmaceuticals Drugs Controller General of India (DCGI)-approved sodium alginate (IP 500mg) + potassium bicarbonate (IP 100mg) chewable tablet for GERD relief.

Gastroesophageal Reflux Disease (GERD) Market Players:

- AstraZeneca PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eisai Co., Ltd.

- GSK plc.

- Takeda Pharmaceutical Company Limited.

- Ironwood Pharmaceuticals, Inc.

- Johnson & Johnson Services, Inc.

- SFJ Pharmaceuticals

- Sebela Pharmaceuticals

- Phathom Pharmaceuticals, Inc.

- Camber Pharmaceuticals, Inc.

Key players in the market are currently engaged in extensive R&D cohorts to expand their pipeline. They are introducing new safer and long-acting alternatives for better consumer satisfaction and wider adoption. For instance, in April 2024, Onconic Therapeutics gained marketing clearance from the Ministry of Food and Drug Safety (MFDS) of Korea for its next-generation potassium competitive blocker (P-CAB), JAQBO (zastaprazan citrate). This new drug is clinically proven to deliver 97.9% healing for adult GERD patients, just within 8 weeks. Similarly, in December 2024, HK inno.N Corporation announced the commercial launch of its K-CAB (tegoprazan) for GERD in 6 additional Latin American countries. Such key players are:

Recent Developments

- In July 2024, Phathom Pharmaceuticals attained clearance from the FDA for its VOQUEZNA (vonoprazan) 10 mg tablets for treating heartburn associated with Non-Erosive GERD. This allowance was based on the positive results from the PHALCON-NERD-301 study, demonstrating fast and significant reduction in symptoms.

- In July 2024, Takeda Pharmaceuticals signed a licensing agreement with Mankind for commercializing Vonoprazan in India. This potassium-competitive acid blocker (P-CAB) medication is intended to treat GERD, oesophagitis, ulcers, and helicobacter pylori, marketed under the Mankind trademark.

- Report ID: 5075

- Published Date: Feb 25, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gastroesophageal Reflux Disease (GERD) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.