Food Grade Carbon Dioxide Market Outlook:

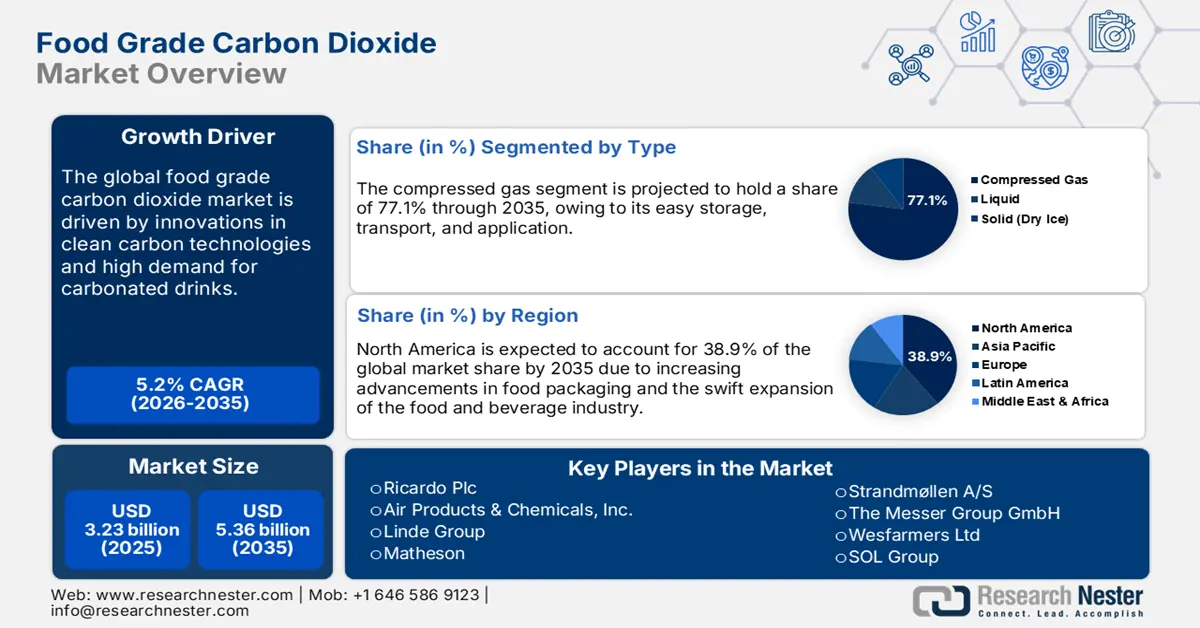

Food Grade Carbon Dioxide Market size was valued at USD 3.23 billion in 2025 and is expected to reach USD 5.36 billion by 2035, registering around 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of food grade carbon dioxide is evaluated at USD 3.38 billion.

The swift shift towards modern lifestyles in both developed and developing economies sis increasing the trade of processed, packaged, and ready-to-eat food products. This trend is more prominent in the developing regions such as Asia Pacific, Latin America, and the Middle East & Africa. The urban dwellers’ increasing interest in Western lifestyles is fueling the adoption of packaged and frozen food diets, contributing to the use of food grade carbon dioxide in packaging and carbonation. For instance, the study by the International Institute of Refrigeration (IIR) states that the global frozen food market is poised to increase at a steady 4.6% CAGR through 2037. Europe, the U.S., and Japan are dominating the global landscape owing to food price inflation.

The e-commerce platforms, particularly those focused on food and grocery delivery, are amplifying the sales of convenient and ready-to-eat food items and directly boosting the consumption of food grade carbon dioxide. The increasing use of food delivery apps by consumers at large are representing lucrative opportunities for food and beverage marketers. The continuous growth in food delivery services is poised to propel the need for efficient and effective food preservation methods, further increasing the application of food grade CO2. The report by the Power to Persuade Organization reveals that the online food delivery services are expected to attain a market valuation of USD 200 billion in 2025. The same source also estimates that the populations of the U.S., Australia, Mexico, Canada, and the U.K. are prime consumers of outside home meals.

Key Food Grade Carbon Dioxide Market Insights Summary:

Regional Highlights:

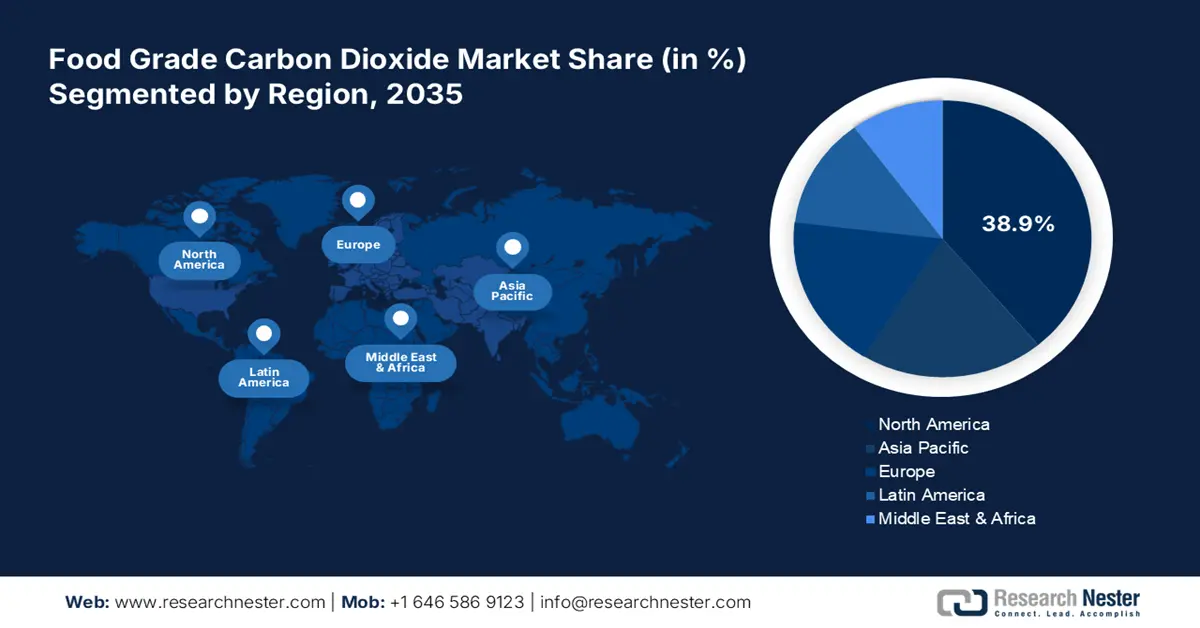

- North America dominates the Food Grade Carbon Dioxide Market with a 38.9% share, driven by high consumption of beer, food delivery apps, and clean tech, fueling robust growth prospects through 2026–2035.

- Asia Pacific's food grade carbon dioxide market is projected to achieve the fastest CAGR by 2035, attributed to demand for frozen foods, carbonated drinks, and clean carbon innovations.

Segment Insights:

- Compressed Gas segment is projected to achieve a 77.1% share by 2035, driven by its ease of storage and use in packaged food freshness.

- Beverages segment are expected to capture a 40.20% share by 2035, driven by increasing consumption of beer and other alcoholic beverages boosting CO2 demand.

Key Growth Trends:

- Advancements in carbon storage and processing technologies

- Advancements in food packaging

Major Challenges:

- Environmental concerns major issue

- Clean trend to lower carbonated drink consumption

Key Players: Air Liquide, Bluebox Energy Ltd, Woodtek Engineering Ltd, Ricardo Plc, Air Products & Chemicals, Inc., and Linde Group.

Global Food Grade Carbon Dioxide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.23 billion

- 2026 Market Size: USD 3.38 billion

- Projected Market Size: USD 5.36 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 12 August, 2025

Food Grade Carbon Dioxide Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in carbon storage and processing technologies: The increasing implementation of strict regulations is necessitating manufacturers to invest in clean carbon technologies. The adoption of sustainable food grade carbon dioxide manufacturing technologies is expected to drive the profit growth of food grade carbon dioxide market players. The leading companies are investing in technologies that can use CO2 in a more eco-friendly manner, such as by enhancing carbon capture and storage methods and by improving their food grade applications, contributing to the circular economy models.

- Advancements in food packaging: The high applications of modified atmosphere packaging (MAP) and vacuum packaging (VP) to extend the shelf life of foods are set to significantly contribute to the overall food grade carbon dioxide market growth. The advancements in the MAP technologies are expanding the applications of the food grade gases such as oxygen, nitrogen, and carbon dioxide in food packaging and also aiding in reducing the spoilage of food freshness. The increasing demand for freshness in packaged foods is uplifting the sales of advanced food grade gas packaging technologies.

Challenges

- Environmental concerns major issue: The greenhouse gas emissions associated with the production of food grade carbon dioxide are a significant drawback to the revenue growth of key players. Environmental concerns are driving the implementation of stricter regulations and increased scrutiny. These further lead to high operational costs and limit the profit margin of the manufacturers. To overcome these issues, many food grade carbon dioxide market players are investing in sustainable manufacturing technologies to mitigate their carbon footprint.

- Clean trend to lower carbonated drink consumption: The increasing awareness of consumers of what goes in their food items is emerging as a major challenge for food grade carbon dioxide producers. The increasing health and wellness awareness among consumers in the developed markets is lowering the consumption of carbonated beverages. This clean trend is anticipated to negatively influence the demand for food grade carbon dioxide, particularly in those markets where carbonated drinks form a major portion of its use.

Food Grade Carbon Dioxide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 3.23 billion |

|

Forecast Year Market Size (2035) |

USD 5.36 billion |

|

Regional Scope |

|

Food Grade Carbon Dioxide Market Segmentation:

End use (Beverages, Dairy & Frozen Products, Meat, Poultry, Bakery & Confectionery, Others)

Beverages segment is expected to dominate around 40.2% food grade carbon dioxide market share by the end of 2035. The increasing consumption of beer and other alcoholic beverages is driving the use of food grade carbon dioxide in the carbonation process. The craft beer industry is likely to boost the demand for food grade CO2 in production. The carbonated and fortified drinks, such as soda, sparkling water, and fizzy beverages, are gaining traction across the world and are significantly contributing to the sales of food grade CO2.

Type (Compressed Gas, Liquid, Solid (Dry Ice))

By 2035, compressed gas segment is projected to hold more than 77.1% food grade carbon dioxide market share. Compressed gas is easy to store, transport, and use compared to other counterparts, which makes it more popular. The growing demand for convenient, ready-to-eat, and packaged foods is increasing the use of CO2 gas in packaging to maintain the quality and freshness of the products. This gas is also finding high applications in fresh-cut salad, deli meats, and pre-packaged foods. In the coming years, the developing regions are estimated to fuel the sales of food grade CO2 gas owing to the increasing popularity and consumption of carbonated drinks.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Mode of Supply |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Food Grade Carbon Dioxide Market Regional Analysis:

North America Market Forecast

North America in food grade carbon dioxide market is expected to hold more than 38.9% revenue share by 2035. The high consumption of beer and other alcoholic beverages is positively influencing the sales of food grade CO2. The increasing use of food delivery apps for outside home meals is poised to propel the demand for food grade carbon dioxide. The continuous investments in clean carbon technologies are further set to fuel the trade of cleaner food grade carbon dioxide in the years ahead. The strong presence of chemical manufacturers is also anticipated to drive the food-grade CO2 trade across the U.S. and Canada.

The U.S. is witnessing high consumption of fortified drinks and frozen foods, which is directly influencing the sales of food grade carbon dioxide. The increasing expansion of the food and beverages market in the country is estimated to offer high earning opportunities for food grade carbon dioxide manufacturers in the coming years. The U.S. Department of Agriculture (USDA) states that meat processing is the largest segment of the U.S. food and beverage manufacturing in terms of sales, value added, and employment. Also, there are over 42,708 food and beverage processing establishments in the country. This represents how lucrative the U.S. is for the food grade carbon dioxide manufacturers.

The swiftly expanding chemical trade is expected to offer lucrative opportunities to food grade carbon dioxide manufacturers in Canada. The swift expansion of e-commerce in the food and grocery segment is poised to double the revenues of food grade carbon dioxide producers, owing to the high use of CO2 in food packaging and preservation. The swift rise in the consumption of outdoor meals and packaged food items is likely to propel the sales of food grade carbon dioxide in the years ahead.

Asia Pacific Market Statistics

The Asia Pacific food grade carbon dioxide market is likely to increase at the fastest CAGR between 2025 to 2035. The existence of international and domestic specialized chemical manufacturers is set to drive a positive trade of food grade CO2. China and India, owing to high demand for frozen and packaged foods, are likely to lead the sales of carbon dioxide solutions. While ahead in innovations, Japan and South Korea are expected to introduce advanced clean carbon storage and transport technologies in the years ahead. The increasing popularity of carbonated drinks is also set to drive the applications of food grade carbon dioxide during the foreseeable period.

China’s dominance in the chemical sector is set to drive innovations in the food grade carbon dioxide solutions. The Information Technology & Innovation Foundation (ITIF) states that the country accounted for 44.0% of the global chemical market share in 2022. The know-how tactic is majorly propelling the food grade carbon dioxide trade in the country. Supportive patent polices and high R&D funding are set to drive the overall market growth in the years ahead. The robust meat and poultry item trade in the country is also increasing the sales of food grade carbon dioxide.

The continuous positive curve growth in India’s food and beverage market is likely to fuel the sales of food grade carbon dioxide in the years ahead. The India Brand Equity Foundation (IBEF) report states that the food processing market of the country is projected to reach USD 1274 billion by 2027. The strong presence of food and dairy companies is also set to increase the consumption of food grade carbon dioxide. For instance, Amul holds a dominant position as a food and dairy brand in the Brand Finance Food & Drink 2024. The country also attains the 6th rank in the global food and grocery sector. Thus, continuous technological innovations and increasing demand for food and beverage items are estimated to offer double-digit percent revenue growth to the food grade carbon dioxide manufacturers.

Key Food Grade Carbon Dioxide Market Players:

- Air Liquide

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bluebox Energy Ltd, Woodtek Engineering Ltd

- Ricardo Plc

- Air Products & Chemicals, Inc.

- Linde Group

- Matheson

- Carbonic Systems

- ACAIL GÁS

- Greco Gas Inc.

- Sicgil India Limited

- Strandmøllen A/S

- The Messer Group GmbH

- Wesfarmers Ltd

- SOL Group

- Gulf Cryo

- Air Water, Inc.

- Massy Group

- PT Aneka Industry

- National Gases Limited

- Cryogenic Gases

- Les Gaz Industriels Ltd.

- Aditya Air Products

- Sidewinder Dry Ice & Gas

- Axcel Gases

- Chengdu Taiyu Industrial Gases Co., Ltd

- Yingde Gas Group Ltd

The leading companies in the food grade carbon dioxide market are employing various organic and inorganic tactics to hold a strong position in the global landscape. They are investing heavily in clean carbon manufacturing and storage technologies to mitigate their carbon footprint. The industry giants are forming strategic partnerships with other players and raw material suppliers to earn high profit margins and maximize their reach. Implementation of merger and acquisition strategies is aiding them in expanding their portfolio. The food grade carbon dioxide market players are also investing in regional expansion strategies to boost their production and to grab untapped opportunities.

Some of the key players include:

Recent Developments

- In November 2024, the International District Energy Association (IDEA) revealed that the new gas-fired power plant located in Nottinghamshire is converting planet-warming carbon dioxide into an ingredient for fizzy drinks. This 10-megawatt project uses waste heat to capture and clean the gas rather than being disposed of in the environment.

- In September 2024, the consortium of Bluebox Energy Ltd, Woodtek Engineering Ltd, and Ricardo Plc designed and installed a heat and power demonstrator plant that transforms sustainable wood waste to clean energy, heat, food-grade carbon dioxide, and biochar. The use of realistic carbon-negative technology is aiding the plant to meet the net-zero targets of the companies.

- Report ID: 7522

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Food Grade Carbon Dioxide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.