Carbon Capture and Storage Market Outlook:

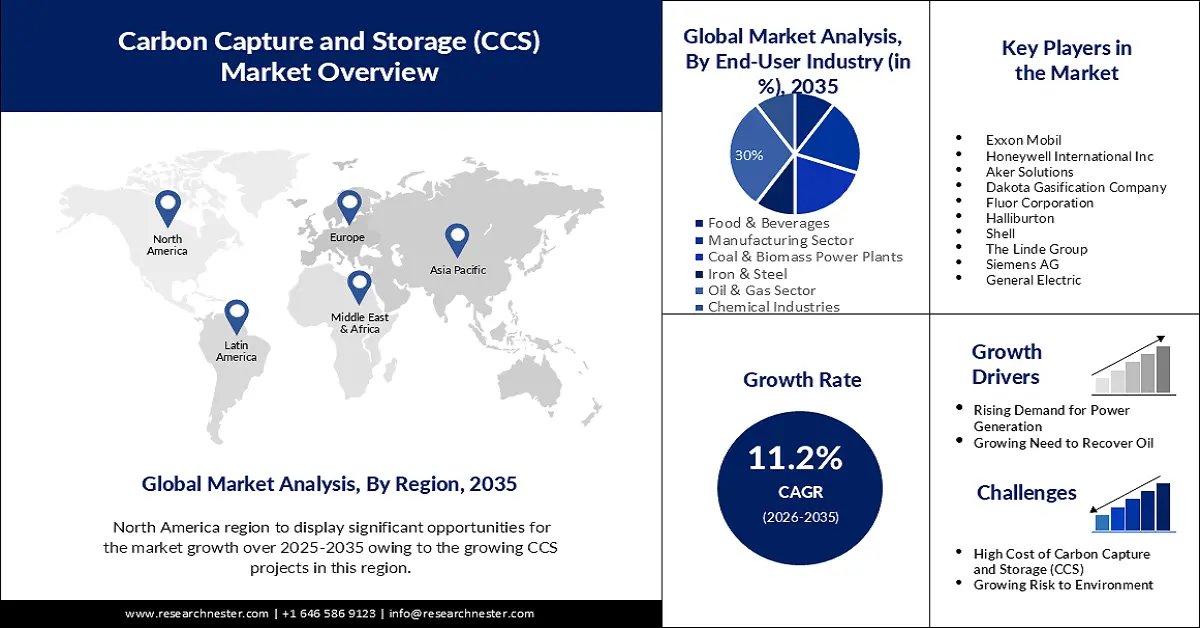

Carbon Capture and Storage Market size was valued at USD 7.85 billion in 2025 and is likely to cross USD 22.69 billion by 2035, expanding at more than 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carbon capture and storage is assessed at USD 8.64 billion.

According to the Global CCS Institute, the 2023 Global Status of CCS Scaling Up Through 2030 report, in July 2023, the total CO2 capture capacity of CCS projects in development, construction and operation was 361 Mtpa, an increase of almost 50% compared to that reported in the 2022 Global Status of CCS report. The IEA, in World Energy Investment 2024 Middle East, stated that the Middle East, which is home to five of the world’s top oil producers, has allocated only 20 cents to clean energy investment for every 1 USD invested in fossil fuels.

With rising environmental concerns and increasing regulatory pressure, CCS has emerged as a crucial solution for mitigating carbon emissions. For instance, in 2024, the European Union allotted nearly USD 1.5 billion to CCUS projects under the Innovation Fund, and more than USD 500 million to CO2 transport and storage projects under its Connecting Europe Facility programme. Similar government funding and initiatives, worldwide, are projected to boost the market growth significantly.

Key Carbon Capture and Storage Market Insights Summary:

Regional Highlights:

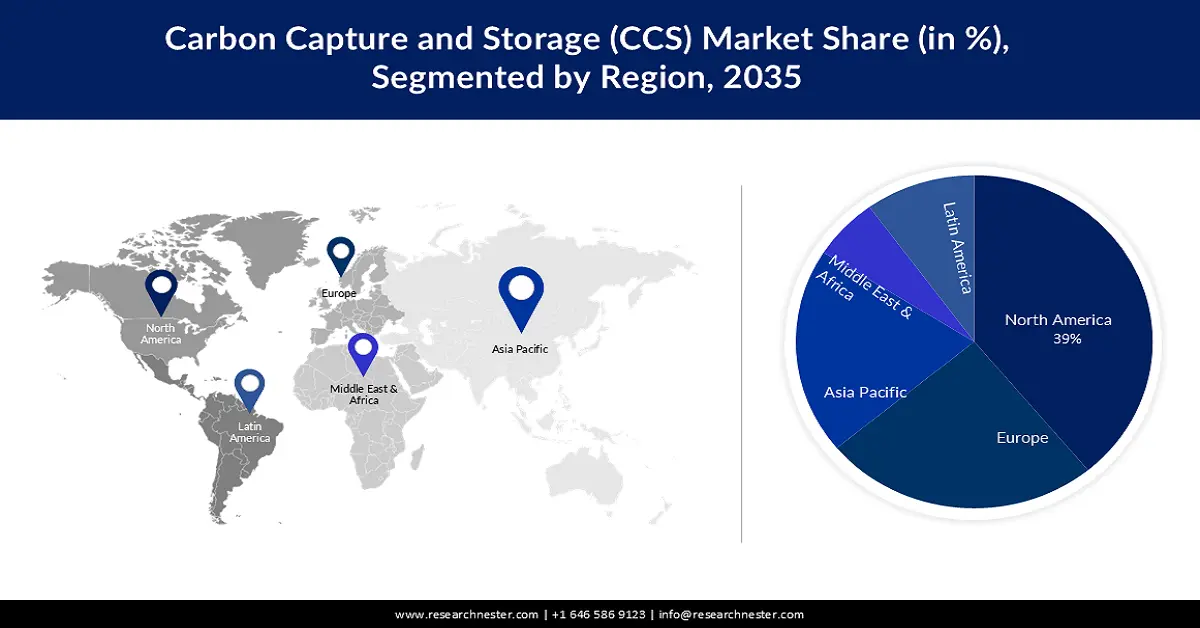

- The North America carbon capture and storage market is anticipated to secure a 39% share by 2035, driven by increasing clean energy investments and legislative support.

- The Asia Pacific market is poised for significant growth over the forecast period 2026–2035, driven by industrialization and rising investments in manufacturing and power facilities.

Segment Insights:

- The oil & gas sector segment in the carbon capture and storage market is expected to capture a 30% share by 2035, driven by rising demand for natural gas and crude oil across multiple sectors.

Key Growth Trends:

- Policy and funding support

- Technological advancements

Major Challenges:

- Infrastructure gaps

Key Players: Exxon Mobil, Honeywell International Inc., Aker Solutions, Dakota Gasification Company, Fluor Corporation, Halliburton, Shell, The Linde Group, Siemens AG, General Electric.

Global Carbon Capture and Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.85 billion

- 2026 Market Size: USD 8.64 billion

- Projected Market Size: USD 22.69 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Canada, United Kingdom, Germany

- Emerging Countries: China, Japan, South Korea, Australia, Canada

Last updated on : 8 September, 2025

Carbon Capture and Storage Market Growth Drivers and Challenges:

Growth Drivers

- Policy and funding support: Strong government backing through climate policies, emissions targets, and financial incentives is a major driver for the market. In April 2024, five countries from northern Europe, including Norway, Denmark, Belgium, the Netherlands, and Sweden, established an arrangement allowing cross-border transport and geological storage of captured CO2. Tax credits, subsidies, and dedicated funding programs are also encouraging industries to invest in carbon capture solutions. These measures not only lower the financial barriers to adoption but also signal a long-term regulatory commitment, boosting investor confidence and accelerating project development.

- Technological advancements: Rapid innovation in capture, transport, and storage technologies is enhancing the efficiency, reliability, and affordability of CCS systems. New methods, such as direct air capture and improved geological monitoring, are expanding the scope and safety of carbon storage. For instance, in September 2021, Climeworks announced the launch of Orca, the world’s first and largest direct air capture and storage plant, easing carbon dioxide removal on a large scale. The facility consists of eight collector containers, with an annual capture capacity of 500 tons each. These advancements are making CCS a more viable and scalable option for legacy industries and emerging clean energy applications.

Challenge

- Infrastructure gaps: This presents a major hurdle for the widespread adoption of carbon capture and storage. The lack of extensive pipeline networks to transport captured CO2 from emission sources to storage sites limits the feasibility of large-scale projects. Additionally, there are relatively few operational storage facilities that are adequately mapped, licensed, and monitored for long-term use. The scarcity makes it difficult to plan and implement CSS systems across industrial regions, especially in areas far from suitable geological formations, increasing both logistical complexity and overall project costs.

Carbon Capture and Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 7.85 billion |

|

Forecast Year Market Size (2035) |

USD 22.69 billion |

|

Regional Scope |

|

Carbon Capture and Storage Market Segmentation:

Technology Segment Analysis

The post combustion capture segment in the carbon capture and storage market is poised to witness substantial demand by the end of 2035. Since PCC can often be integrated into already-existing industrial units and power stations without significantly affecting the original facility, post-combustion recapture is the most common research focus. In September 2024, Mitsubishi Heavy Industries started operations in Europe’s first post-combustion carbon capture plant, with MHI Technology as part of the Ravenna CCS Project, Phase 1, which is Italy's first carbon capture and storage project for exclusively environmental purposes.

End User Industry Segment Analysis

The oil & gas sector segment is set to dominate the carbon capture and storage market with approximately 30% share by 2035. The oil and gas sector has expanded as a result of a rising need for both natural gas and crude oil across multiple sectors, boosting the market growth. In October 2021, Saudi Arabian Oil Company (Aramco), announced its ambition to achieve net-zero greenhouse gas emissions by 2050, surpassing the government’s 2060 net-zero target.

Moreover, the development of carbon capture and storage projects could be significantly aided by expanding investments in the oil sector to meet rising energy demands while focusing on reducing greenhouse gas emissions. For instance, in 2023, Aramco announced a capital expense goal of USD 45-55 billion in the fiscal year to upsurge oil production to 13 (mmbpd) (crude oil) by 2027.

Our in-depth analysis of the global carbon capture and storage market includes the following segments:

|

Service |

|

|

Technology |

|

|

Applications |

|

|

End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carbon Capture and Storage Market Regional Analysis:

North American Market Insights

North America region is expected to account for more than 39% market share by 2035, driven by growing investment in clean energy technologies. For instance, in March 2025, the Government of Canada contributed more than USD 11 million in funding, mainly through the Clean Energy for Rural and Remote Communities (CERRC) program. Major funding initiatives and legislative support have also boosted project development, especially in sectors including cement, steel, and power generation. The IEA stated that the U.S. announced investments worth USD 1.7 billion for carbon capture demonstration projects in 2023. Additionally, growing initiatives of net zero will influence the market growth.

The U.S. is witnessing robust policy incentives and active participation from major energy companies. Tax credits have significantly increased the financial attractiveness of CCS projects, while federal infrastructure programs continue to stimulate innovation. According to the Congressional Budget Office, in December 2023, about 15 CCS facilities were operating in the U.S., as of September 2023, which, when combined, can capture about 22 million metric tons of CO2 per year, or 0.4 percent of the United States’ total annual emissions of CO2. The focus is largely on decarbonizing power generation and industrial emissions, with new projects emerging across various states.

APAC Market Insights

The Asia Pacific carbon capture and storage market is set to have significant growth over the forecast period due to the growth in industrialization and rising investments in the expansion of manufacturing facilities. Additionally, the rapid construction of gas and coal power plants and coal mining to meet the region's rising energy demand is anticipated to further hasten the expansion of the Asia Pacific market. In June 2022 National Energy Investment Group, CNOOC, announced the completion of equipment construction for China’s first CO2 offshore storage project. Post operation, the annual CO2 storage was projected to range up to 300 kt.

A study, titled Carbon Capture, Utilisation, and Storage Policy Framework and its Deployment Mechanism in India, was published by NITI Aayog in November 2022. It stated that the NDC aims to achieve 50% of its overall installed capacity from energy sources that are non-fossil-based, a 45% decrease in emission concentration by 2030, and initiating steps towards accomplishing Net Zero by 2070. It further highlights the significance of CCUS as a reduction strategy to attain decarbonization from the hard-to-abate sectors.

Carbon Capture and Storage Market Players:

- Exxon Mobil

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Aker Solutions

- Dakota Gasification Company

- Fluor Corporation

- Halliburton

- Shell

- The Linde Group

- Siemens AG

- General Electric

Key players in the market are adopting strategies such as partnerships with energy and industrial players, investing in technological innovation to reduce costs and improve efficiency, and expanding infrastructure for large-scale carbon storage. Many are also aligning with government incentives and climate regulations to secure funding and accelerate deployment, while some are integrating CCS with low-carbon hydrogen production and enhanced oil recovery to enhance commercial viability. Some of these players are:

Recent Developments

- In January 2025, Fugro, in partnership with Eco Carbon Engineering Solutions Limited in association with Visakha Pharma City Limited, and the Environmental Geotechnology Laboratory, Department of Civil Engineering, IIT Bombay, launched its first Carbon Capture and Storage (CCS) project in India.

- In July 2023, Fluor Corporation signed an MOU with Carbfix, intending to lower climate change impacts by decarbonizing hard-to-abate industries with high greenhouse gas emissions, such as cement, steel, and aluminum.

- In February 2022, the Directors of Dakota Gas approved the construction of the Dakota Carbon Pipeline, a 6.8-mile pipeline that transports collected CO2 from the Great Plains Synfuels Plant to a long-term geologic storage reservoir close to the plant.

- Report ID: 936

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carbon Capture and Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.