Fluid Sensors Market Outlook:

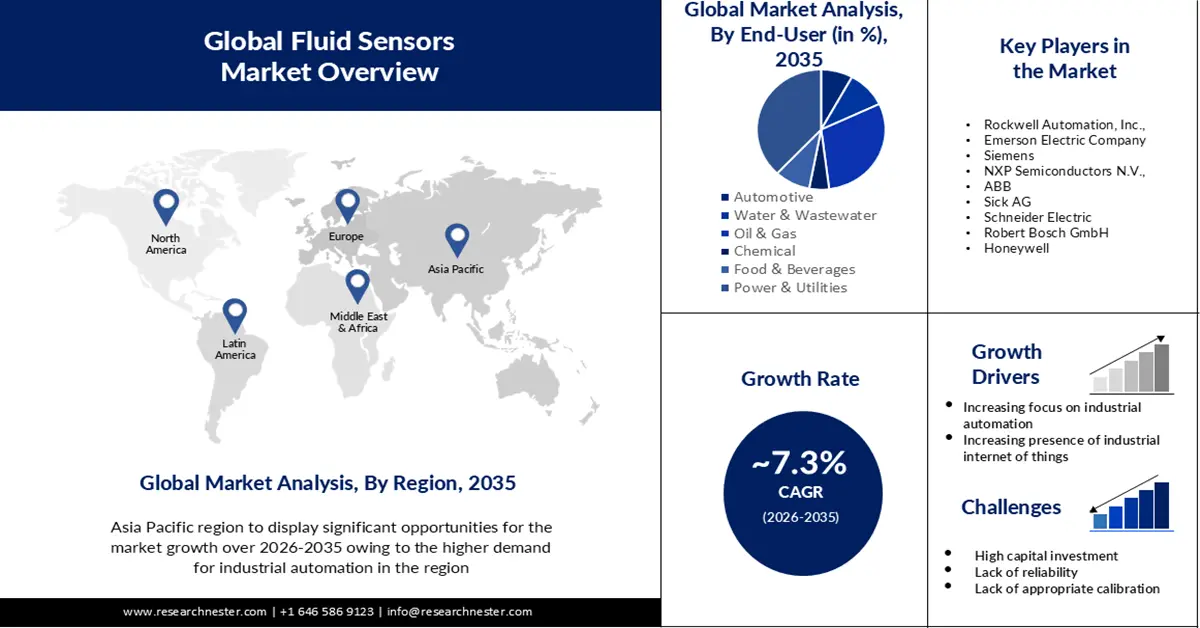

Fluid Sensors Market size was over USD 17.46 Billion in 2025 and is anticipated to cross USD 35.32 Billion by 2035, growing at more than 7.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fluid sensors is assessed at USD 18.61 Billion.

The growth of the market is due to cutting-edge methods for the detection and analysis of fluids that have become an increasingly important factor in fast-paced industrialization and urbanization. These sensors ensure that all the activities and procedures associated with liquids are performed in such a manner as to not require human intervention. Today there are around 56% of the world's population living in cities, with 4.4 billion inhabitants. This trend is expected to continue, given that by 2050 the number of people living in urban areas will more than double its present size and almost 7 out of 10 will live in cities.

The growth of the market is due to rising demand in the petroleum and gas sectors for a number of applications, including tank level monitoring and oil quality tests, fluid sensors are estimated to be needed significantly over the forecast period. As a result of increased mobility and industrialization, the demand for crude oil and natural gas is increasing. In oil and gas, there has become an increased demand for reliable and top-quality sensors due to the severe and difficult conditions. The world's oil production is around 4 billion tons a year, with the Middle East accounting for close to 50 % of proven reserves.

Key Fluid Sensors Market Insights Summary:

Regional Highlights:

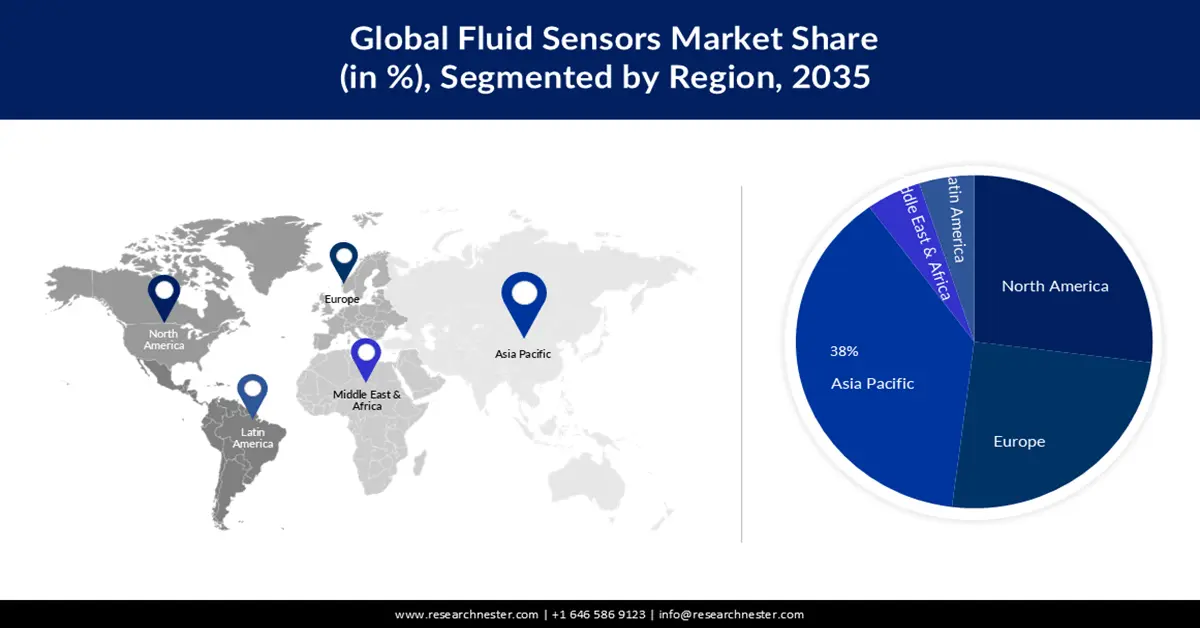

- The Asia Pacific fluid sensors market will dominate more than 38% share by 2035, attributed to increasing rate of industrial production in emerging countries.

- The North America market will account for 27% share by 2035, fueled by thoroughly developed oil, gas, and power industries.

Segment Insights:

- The flow sensor segment in the fluid sensors market is forecasted to hold a 62% share by 2035, attributed to rising demand for advanced flow sensors in petroleum and automotive sectors.

- The power & utilities segment in the fluid sensors market is forecasted to grow significantly by 2035, driven by increased electricity demand and benefits of fluid sensors in power generation.

Key Growth Trends:

- An Increasing Focus on Industrial Automation

- Increasing the Presence of Industrial Internet of Things (IIOT)

Major Challenges:

- An Increasing Focus on Industrial Automation

- Increasing the Presence of Industrial Internet of Things (IIOT)

Key Players: Rockwell Automation, Inc., Emerson Electric Company, Siemens, NXP Semiconductors N.V., ABB, Sick AG, Schneider Electric, Robert Bosch GmbH.

Global Fluid Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.46 Billion

- 2026 Market Size: USD 18.61 Billion

- Projected Market Size: USD 35.32 Billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Thailand, Indonesia, Mexico

Last updated on : 11 September, 2025

Fluid Sensors Market Growth Drivers and Challenges:

Growth Drivers

- An Increasing Focus on Industrial Automation- In order to support the expansion of the global market for fluid sensors, it is projected that industrial automation will become increasingly important. In fields like automotive, manufacturing, chemical, medical, oil & gas, and power generation, manual measurements of fluid parameters like temperature, fluid pressure, and humidity as well as fluid acceleration are no longer necessary due to advancements in measurement technologies like optical sensing, vibrating or tuning fork, ultrasonic sensors, capacitance sensing, and others. Furthermore, the expansion of the automobile industry and the development in disposable income have resulted in a growing demand for highly efficient automation solutions that guarantee comfort and safety. In 2023, around 72% of industries worldwide have integrated industrial automation within their production processes a sign that manufacturing is switching to more efficient and technology-intensive methods.

- Increasing the Presence of Industrial Internet of Things (IIOT)- The benefits of fluid sensors, such as the remote availability of devices and technicians who can control them from distant locations, are expected to be driven by market trends like the implementation of an industrial Internet of Things. If there is a strong probability that an equipment will fail, the system can predict when sensor maintenance must be performed. In order to improve the efficiency of operations, mass customization, remote diagnostics and so on, this feature is likely to bring benefits. The new scope for opportunities in the fluid sensors market is expected to be opened by these factors.

- Increasing Technological Advancement- Technological advances in the sensor market would help to make water sensors available across a wide range of industrial sectors. The development of wireless communication technologies has made it possible to communicate in a more holistic way between different devices and allows for the management of all system characteristics. Ongoing improvements in the electronics and semiconductors sectors have enabled the development of robust sensors that are able to withstand hostile environments. The development of smart sensors that can adapt to their surroundings, as well as provide extremely accurate readings, would contribute to the expansion of the market.

Challenges

- Capital-Intensive Nature of Fluid Sensors Technology- There may be an obstacle to the market's growth, due to excessive costs associated with research, design, and use of sensors for measuring a variety of parameters like pressure, temperature, level control, volume or any other. As a result of the growing market for Fluid Sensors, there can be some restraints on the R&D investment required to develop and implement this technology which monitors various parameters like velocity, temperature, pressure, level control, volume etc.

- One of the main challenges that may be a threat to growth in this sector is lack of reliability and poor communication associated with Wireless sensors for fluids.

- Growth in this region will be harmed by the lack of appropriate calibration facilities, together with political instability.

Fluid Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 17.46 Billion |

|

Forecast Year Market Size (2035) |

USD 35.32 Billion |

|

Regional Scope |

|

Fluid Sensors Market Segmentation:

End-User Segment Analysis

The power & utilities segment in the fluid sensors market is projected to show the highest share of about 38% during the forecast period. The need for additional electricity has been driven by an increase in production capacities and a significant energy demand at businesses because of the world's increasing population, which is also supporting the expansion of power and utility subsegments. The use of fluids sensors for power generation units such as heat and hydro plants has benefits, e.g. ensuring that emissions are lowest possible by means of a flow sensor. The ammonia NH3 gas output rate from chimneys shall be monitored by means of sophisticated flow meters and a number of different installation choices with regard to the flow measurement equipment. In line with the anticipated timeframe, these elements are expected to support subregions of growth.

Type Segment Analysis

Fluid sensors market from the flow sensor segment is attributed to hold the largest share with about 62% during the projected period. As a result, in the petroleum and automotive sectors there is increasing demand for advanced feature flow sensors. In order to control liquid flow in the pipes it is becoming more and more important to use flow sensors. For the year 2021, motor vehicle production rose by 3 per cent, which would amount to approximately 80 million global vehicles produced on a yearly basis.

Our in-depth analysis of the global fluid sensors market includes the following segments:

|

Type |

|

|

Technology |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fluid Sensors Market Regional Analysis:

APAC Market Insights

Fluid sensors market in Asia Pacific is expected to hold the largest share of about 38% by the end of 2035. The market in the region is growing as a result of an increasing rate of industrial production in these developing and emerging countries, given that Chinese, Indian, Japanese, or South Korean are primary producers of industrial fluid sensors. The strong use of fluid sensors in sectors such as water and sewage, chemicals, food, and beverages, and others are another factor that contributes to rapid economic development within the Asia Pacific region. Government initiatives like the National Mission for Clean Ganga (NMCG) also place demands on the level and flow detection sensors, which is good for the market's expansion. There are around 3 million sewage discharges a day into the Ganges, and about half of them have not been treated.

North American Market Insights

Fluid sensors market in North America is estimated to hold the second largest share of about 27% during the forecast period. As a result of the thoroughly developed industries in oil, gas, chemicals, and power generation. In 2017, it was expected that North American renewable energy production would continue to invest significantly in new projects. The US Department of Energy expects that by 2050, the hydropower sector will have increased its capacity from today's 101 GW to about 150 GW.

Fluid Sensors Market Players:

- Texas Instruments

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rockwell Automation, Inc.,

- Emerson Electric Company

- Siemens

- NXP Semiconductors N.V.,

- ABB

- Sick AG

- Schneider Electric

- Robert Bosch GmbH

- Honeywell

Recent Developments

- ABB has invested 1.1 million USD in a new, state-of-the-art sensor production line at its Brno Instrument Transformers and Sensors factory in the Czech Republic. At 15,000 sq. meters, Brno is already the world’s largest facility of its kind. The new production line will ramp up the scale and pace of Medium Voltage (MV) sensor production by almost 100 percent, to reach 100,000 units per annum by 2026.

- Digi-Key and Schneider Electric signed a distribution agreement. The new relationship will expand Digi-(Thief Key's River Falls, Minnesota) present range of electronic components and automation products by allowing it to sell a variety of Schneider Electric's power, automation, control, and sensor solutions.

- Report ID: 5326

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fluid Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.