Flow Meters Market Outlook:

Flow Meters Market size was valued at USD 9.9 billion in 2025 and is projected to reach USD 20.2 billion by the end of 2035, rising at a CAGR of 7.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of flow meters is assessed at USD 10.6 billion.

The global demand for the market is closely related to the capital investment cycles in water infrastructure, chemical, energy systems, and process manufacturing, all of which are supported by public sector spending and regulatory oversight. According to the U.S. Environmental Protection Agency data in December 2025, the country requires over USD 625 billion in drinking water and wastewater infrastructure investments over 20 years, creating sustained procurement demand for flow measurement equipment across municipal utilities and industrial treatment facilities. Similarly, the IEA 2023 reports that the global energy investment exceeded USD 2.8 trillion in 2023, with oil and gas, power generation, hydrogen, and operational reporting. The government-backed industrial digitization initiatives, including the U.S. Department of Energy industrial efficiency programs, continue to encourage the adoption of advanced flow monitoring to reduce losses and improve process control in energy-intensive industries.

Besides, accurate flow data is required for emission reporting, environmental compliance, and fuel accounting across the power plants, pipelines, and refineries. In Europe, the Water Framework and industrial emissions directives drive the standardized monitoring across utilities and manufacturing sites. On the market demand side, the UNESCO February 2024 report highlights that over 70% of the global freshwater withdrawals are used by agriculture and industry, prompting governments to fund water efficiency and monitoring projects mainly in Africa, the Middle East, and the Asia Pacific. Further, the public investments in the LNG terminal, cross-border pipelines, and renewable fuels support the long-term procurement of flow meters in custody transfer process optimization and safety-critical applications. Moreover, these government-led infrastructure program regulatory frameworks and energy transition investments provide a predictable policy-backed demand environment for the market across the emerging and developed nations.

Key Flow Meters Market Insights Summary:

Regional Highlights:

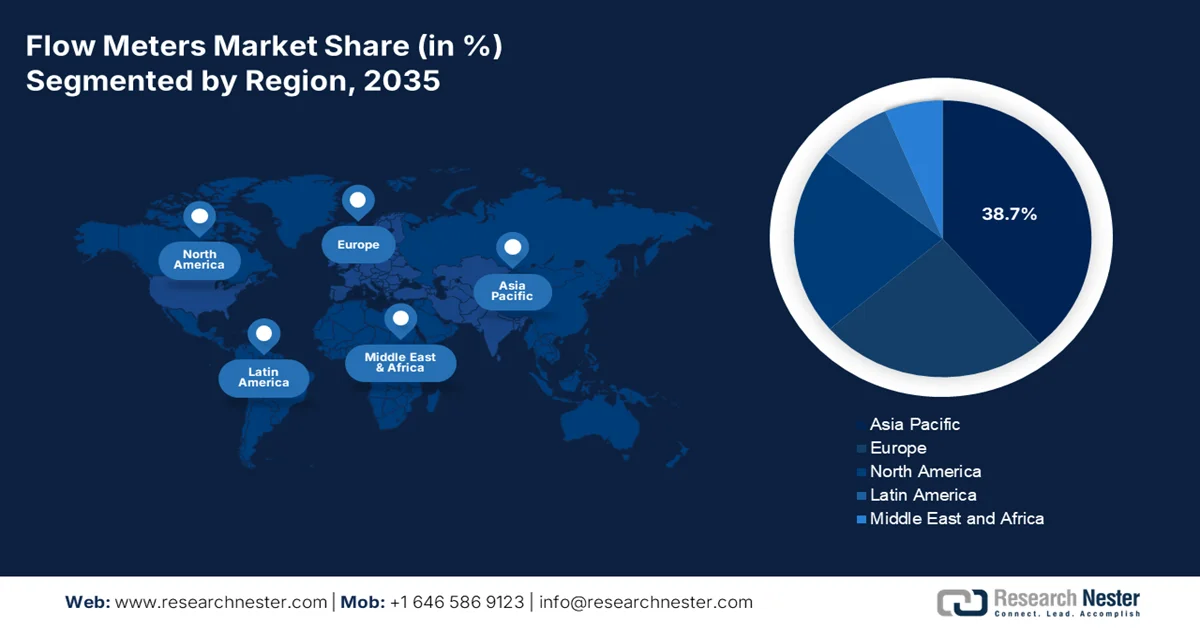

- Asia Pacific is projected to command a 38.7% revenue share of the flow meters market by 2035, underpinned by large-scale infrastructure expansion, rapid industrialization, and government-backed smart water and environmental monitoring initiatives.

- North America is anticipated to register the fastest growth at a CAGR of 4.8% during 2026–2035, supported by infrastructure modernization, industrial decarbonization efforts, and accelerated deployment of IoT-enabled and analytics-driven flow measurement solutions.

Segment Insights:

- The industrial sub-segment in the flow meters market is expected to secure a dominant 80.3% share by 2035, reinforced by stringent regulatory compliance needs and the shift toward smart, connected meters for precise process control and operational efficiency enhancement.

- Smart/intelligent flow meters are positioned as the leading segment through 2035, fueled by Industry 4.0 adoption that emphasizes real-time data visibility, predictive maintenance, and seamless Industrial IoT integration.

Key Growth Trends:

- Oil and gas regulatory reporting and pipeline safety

- Agricultural water management and irrigation programs

Major Challenges:

- Stringent industry-specific certification and compliance

- Price sensitivity in key volume-driven markets

Key Players: Honeywell International Inc. (U.S.), Emerson Electric Co. (U.S.), Siemens AG (Germany), Endress+Hauser Group (Switzerland), ABB Ltd. (Switzerland), Yokogawa Electric Corporation (Japan), Schneider Electric SE (France), KROHNE Group (Germany), Badger Meter, Inc. (U.S.), Azbil Corporation (Japan), SICK AG (Germany), Keyence Corporation (Japan), Itron, Inc. (U.S.)

Global Flow Meters Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.9 billion

- 2026 Market Size: USD 10.6 billion

- Projected Market Size: USD 20.2 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 5 February, 2026

Flow Meters Market - Growth Drivers and Challenges

Growth Drivers

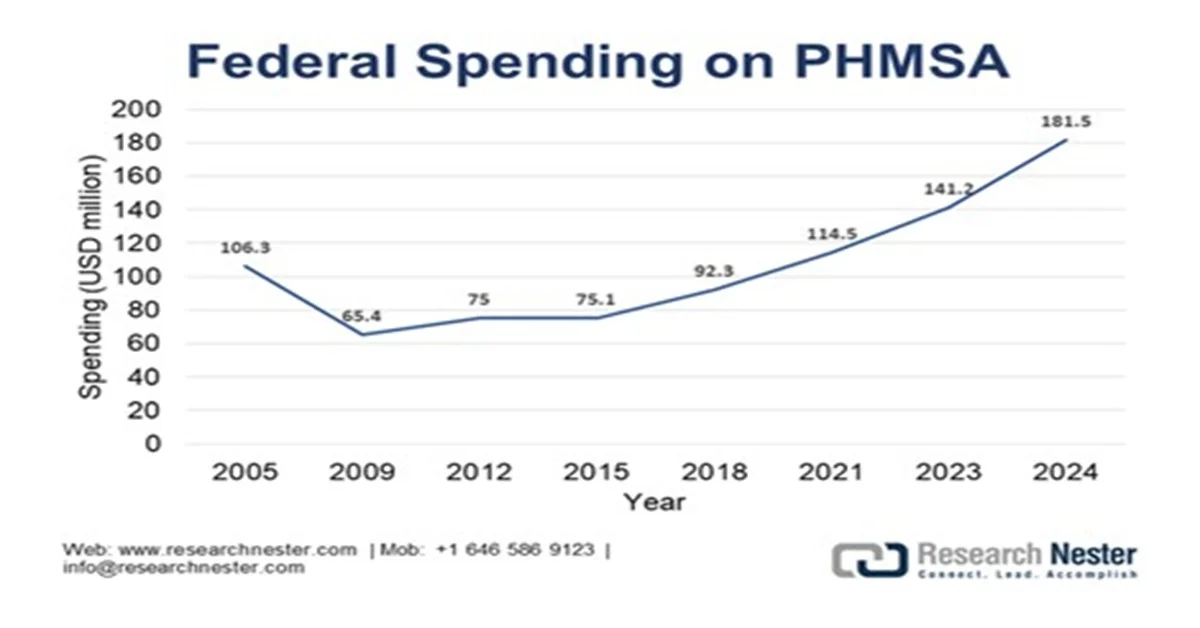

- Oil and gas regulatory reporting and pipeline safety: Despite the ongoing energy transition, the regulatory oversight in the oil and gas sector continues to underpin the sustained demand for the flow meters market. The U.S. agencies, such as the Pipeline and Hazardous Materials Safety Administration, require accurate flow measurement for custody transfer, emissions reporting, leak detection, and operational safety across the hydrocarbon value chain. According to the USA Facts 2024 report, the federal spending on the pipeline and hazardous materials safety administration (PHMSA) program allocated USD 181.5 million in 2024, reinforcing the mandatory inspection, reporting, and monitoring requirements for operators. Flow meters are therefore deployed extensively in upstream production facilities, midstream transmission pipelines, storage terminals, and federally approved LNG export infrastructure.

Source: USA Facts 2024

- Agricultural water management and irrigation programs: Agriculture represents the largest global consumer of freshwater, and governments are funding measurement-driven conservation programs. The FAO 2026 report indicates that over 70% of the global freshwater withdrawals are used by agriculture. The national irrigation modernization programs in China, India, and the U.S. increasingly require flow meters to monitor usage and allocate subsidies. The report from the National Water Withdrawals in February 2023 indicates that India uses 688 10^9 m3 per year of water for agriculture. Moreover, these government-backed programs link subsidy eligibility and compliance reporting directly to verified flow data, stimulating the adoption of the durable field-ready flow meters across canals, pumping stations, and farm-level distribution networks.

Agriculture Water Withdrawal (10^9 m3/yr)

|

Country |

Withdrawal |

|

China |

358 |

|

India |

688 |

|

Russia |

13.2 |

|

Brazil |

31.7 |

|

U.S. |

192.4 |

|

Germany |

0.081 |

Source: National Water Mission, February 2023

- Industrial energy efficiency and emissions monitoring mandates: The governments are increasingly relating the industrial funding and permits to the energy efficiency and emissions monitoring, driving the adoption of flow meters in manufacturing sectors. The U.S. supports the adoption of market efficiency upgrades across the energy-intensive industries, such as cement, chemicals, and metals. According to the U.S. EIA July 2023 data, the industry accounts for nearly 33% of total energy consumption, making flow measurement significant for optimization and reporting. Similar requirements exist under the EU Industrial Emissions Directive. Further, the flow meters are being deployed not only for control but also for auditable emissions and energy reporting. This shift is increasing the demand for high-accuracy, traceable flow meters that can integrate with regulatory reporting systems and withstand third-party audits in decarbonization projects

Challenges

- Stringent industry-specific certification and compliance: Flow meters used in the custody transfer of food beverage, or pharmaceuticals must meet a robust global standard. In the flow meters market, obtaining these certifications is costly and time-consuming. The top players dedicate their entire department to this with the advanced technology designed to meet the strict safety instrumented systems standards. A new entrant may spend years and millions to certify a single product line for one industry, a prohibitive hurdle that protects established players with pre-approved portfolios.

- Price sensitivity in key volume-driven markets: In high volume cost-sensitive segments, such as municipal water in emerging economies, purchase decisions are heavily price-driven. The governments often run tenders selecting the lowest compliant bidder. The dominating companies in the market address this by offering a tiered product line. Further, this reduces the margins, making it difficult for the new suppliers to compete without a low-cost manufacturing base, often driving them to outsource and risk quality perception.

Flow Meters Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 9.9 billion |

|

Forecast Year Market Size (2035) |

USD 20.2 billion |

|

Regional Scope |

|

Flow Meters Market Segmentation:

End user Segment Analysis

The industrial sub-segment is dominating is poised to hold the market share of 80.3% by 2035. The dominance is due to the sector’s complex and urgent need for the precise process measurement across vital applications such as chemical dosing, custody transfer, and utility management. The drive for regulatory compliance, operational efficiency, and sustainability is stimulating the replacement of legacy analog devices with smart and connected meters, which enable predictive maintenance and real-time process optimization. A recent technological advancement is the launch of the S-Flow Ultrasonic flow meter by the Fuji Electric in August 2023. This product is largely used in pharmaceuticals, biopharma, life sciences, semiconductor manufacturing, HVAC (fan coil units), pure water systems, and equipment cooling. Further increasing automation in the industry and the integration of flow meters further reinforces the demand in the industrial segment.

Technology Segment Analysis

The smart/ intelligent flow meters are leading in the flow meters market. Their growth is driven by Industry 4.0, which demands the real time data predictive maintenance and integration with the Industrial IoT platforms. These devices offer digital communication, regulatory diagnostics, and self-calibration which are significant for operational efficiency and regulatory compliance. As per the Industry 4.0: The Future of Smart Manufacturing report in June 2025, the smart energy management solutions reduce the energy consumption by 3% to 5%. This is highly supported by the federal smart manufacturing standards, making intelligent meters vital for modern data-driven industrial infrastructure seeking to minimize downtime and optimize resource use.

Pipe Size Segment Analysis

The medium line sub segment leads the pipe size segment as it encompasses the most common pipelines for in-plant process lines, distribution networks, and mid-scale utility applications in water, oil & gas, and chemical industries. The size range is optimal for a wide variety of flow meter types, including ultrasonic, magnetic, and Coriolis. Growth is heavily influenced by renewal and regulations. For example, the EPA reported that a significant amount is allocated for wastewater and drinking water infrastructure projects. A portion of this involves medium-diameter piping systems for treatment plants and distribution networks, directly driving consistent demand for compatible flow measurement solutions.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Technology |

|

|

Pipe Size |

|

|

Application |

|

|

End user |

|

|

Power Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Flow Meters Market - Regional Analysis

APAC Market Insights

The flow meters market in Asia Pacific is the global growth engine and is expected to hold the regional revenue share of 38.7% by 2035. The dominance is due to the massive infrastructure development, industrialization, and pressing water resource management challenges. The government-led initiatives are driving the market and prioritizing the smart water networks and environmental monitoring. Besides, the rapid industrial expansion in sectors such as semiconductors, chemicals, and pharmaceuticals across countries, including South Korea, Japan, and Southeast Asia, demands high-precision process control instrumentation. The trend is the integration of the IoT-enabled meters, mainly in urban smart city projects. On the other hand, the need for energy efficiency and stringent emission controls in manufacturing further propels the adoption of advanced ultrasonic and Coriolis meters.

The market in India is supported by the sustained central government investment in water infrastructure, energy, and industrial modernization. According to the PIB December 2025 report, the Government of India allocated over INR 3.6 lakh crore up to 2024 under the Jal Jeevan Mission to expand household tap water connections, directly increasing the demand for flow measurement across distributed networks and treatment facilities. Further, the data from the India Water Portal in November 2025 shows that nearly 85% of the total freshwater withdrawals are towards agriculture, reinforcing the need for flow meters in irrigation efficiency and groundwater management. On the other hand, Bharat Petroleum’s November 2025 report indicates 20,334 km of natural gas pipelines have been constructed, which supports the gas distribution, driving the flow meter deployment in regulated energy infrastructure.

The China market is underpinned by the sustained government investment in energy infrastructure and industrial efficiency programs. As per the People’s Republic of China report in January 2026, China has invested nearly CNY 1.28 trillion in water conservancy facilities, marking the fourth consecutive year of trillion yuan spending. The execution of 47,563 water projects nationwide and the expansion of the digital systems for flood drought and river management are driving the demand for the flow meters across the reservoirs, canals, and treatment facilities. Additionally, nearly 1.61 billion cubic meters of water traded via 14,000 transactions on the China Water Exchange underscores the growing need for precise flow measurement to support the water allocation and monitoring mechanisms, reinforcing both the new installation and replacement demand.

North America Market Insights

North America is the fastest growing market and is poised to grow at a CAGR of 4.8% during the forecast period 2026 to 2035. The market is sustained by infrastructure modernization and industrial decarbonization. The advancements in the oil and gas, water management industries, and chemical processing sectors are driving the adoption of flow meters. On the other hand, the technological enhancements, including the IoT-enabled devices, wireless connectivity, and real-time data analytics, are prompting purchasing decisions among operations in the utilities and manufacturing sectors. Besides, trends include the integration of the IIoT for predictive maintenance and the rising demand for accurate custody transfer meters, which is expanding the natural gas pipeline network in North America. Moreover, both recurring replacement demand and new installation activity are reinforcing overall market resilience.

The U.S. flow meters market is supported by the sustained federal and state-level spending across the water infrastructure, energy, and industrial modernization programs. The funding for drinking water, wastewater, and pipeline safety upgrades directly increases the procurement of flow measurement equipment. The advancements, such as the Brooks Instrument's introduction of EtherNet/IP in January 2026, are a new non-invasive clamp-on ultrasonic flow meter that is easy to integrate into bioprocessing applications. On the other hand, the June 2023 launch of a new high-pressure gas flow meter for natural gas distribution by SICK. Together, these product introductions highlight how compliance-driven public infrastructure spending is converging with innovation in digital connectivity and high-pressure measurement to support the regulated utility networks and expanding gas distribution systems in the U.S.

Sustained federal funding for water infrastructure, clean energy, and industrial decarbonization drives the market in Canada. According to the Government of Canada report in January 2025, Infrastructure Canada committed USD 33 billion under the Investing in Canada Infrastructure Program, with a significant share directed towards the drinking water, wastewater, and resilience projects that require certified flow measurement for compliance and reporting. Moreover, the IISD February 2023 report indicates that the federal government allocated USD 9.1 billion via clean energy and industrial emissions reduction programs, driving the flow meter adoption in hydrogen, oil, and gas, and power applications. Additionally, the Government of Canada committed significant billions to the Canada Water Agency and freshwater action plans, reinforcing the monitoring requirements across municipal and industrial water systems.

Europe Market Insights

The Europe flow meters market is propelled by the robust EU directives on industrial emissions, water framework management, and energy efficiency that mandate precise monitoring and reporting. The major investments are towards infrastructure modernization, which includes water network upgrades and the digitalization of utilities. A key trend is the adoption of smart water meters, which is supported by the replacement of meters with smart ones, creating a parallel push in water. The transition to a circular economy and hydrogen initiatives also generate a demand for advanced meters in waste management and new energy carrier measurement. The industrial sector, mainly pharmaceuticals and chemicals, under strict good manufacturing practice, further demand for the high integrity sanitary and Coriolis meters.

The sustained public investment in the water infrastructure, energy transition, and industrial decarbonization is driving the market in Germany. According to the German Climate Finance data in March 2025, nearly EUR 6 billion was allocated for water protection, wastewater treatment, and flood resilience programs, directly increasing the demand for flow measurement in municipal and industrial systems. Additionally, the Federal Ministry of Economic Affairs and Energy data in March 2025 has indicated that smart metering systems are installed in many households in Germany, and it is recorded that approximately 1,158,000 smart meters are installed in the nation, driving the adoption and improving the system resilience. Further, the expanding deployment creates a demand for the regulation-compliant and interoperable flow measurement solutions.

The UK flow meters market is expanding significantly and is driven by the sustained government investment in water infrastructure, energy transition, and industrial emissions. According to the Water UK October 2023 report, nearly 96 billion euros is invested in water and sewage infrastructure investment proposed for 2025 to 2030, representing a 90% increase over the current regulatory period and accounting for over 40% of total water investment in Europe. Further, the program will focus on new reservoirs that reduce the leakage by 25%. The investment of 11 billion euros is allocated to sewer overflow mitigation, which requires accurate flow measurement for leakage detection and performance reporting. The planned installation of advanced technologies reduces the overflows by more than 140,000 incidents annually, reinforcing the demand for certified flow meters.

UK Water Infrastructure Investment

|

Investment Area / Metric |

Statistical Detail |

Relevance to Flow Meters Market |

|

Total proposed water & sewage investment |

£96 billion (2025–2030), ~90% increase vs. current period |

Drives large-scale procurement of flow meters for new installations and network upgrades |

|

Share of European water investment |

>40% of total European water infrastructure investment |

Positions the UK as a high-priority regional market for flow measurement suppliers |

|

Leakage reduction target |

>25% reduction by 2030 |

Requires continuous flow monitoring for leakage detection and performance benchmarking |

|

Sewer overflow mitigation |

£11 billion investment; >140,000 fewer spills per year |

Increases demand for flow meters at sewage works, overflow points, and monitoring stations |

|

New water storage assets |

Construction of 10 new reservoirs |

Requires flow measurement for intake, distribution, and regulatory reporting |

|

Workforce expansion |

>30,000 new jobs; 4,000 apprenticeships |

Indicates long-term project execution and sustained equipment deployment cycles |

Source: Water UK October 2023

Key Flow Meters Market Players:

- Honeywell International Inc. (U.S.)

- Emerson Electric Co. (U.S.)

- Siemens AG (Germany)

- Endress+Hauser Group (Switzerland)

- ABB Ltd. (Switzerland)

- Yokogawa Electric Corporation (Japan)

- Schneider Electric SE (France)

- KROHNE Group (Germany)

- Badger Meter, Inc. (U.S.)

- Azbil Corporation (Japan)

- SICK AG (Germany)

- Keyence Corporation (Japan)

- Itron, Inc. (U.S.)

- Omega Engineering (U.S.)

- Bronkhorst High-Tech B.V. (Netherlands)

- Sierra Instruments, Inc. (U.S.)

- Parker Hannifin Corporation (U.S.)

- Sensirion AG (Switzerland)

- Apator SA (Poland)

- Diehl Stiftung & Co. KG (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc. is the leading player in the market and has strongly positioned its place by deeply integrating its measurement devices with its industry-leading automation and building management platforms. Their initiatives aim at developing a connected and smart ecosystem where the data flow from the various industrial processes directly feeds into the control systems and analytics, enabling predictive maintenance, energy efficient, and enhanced operational performance for clients.

- Emerson Electric Co. competes in the global flow meters market via its Emerson Automation Solution with the required technological leadership, mainly in the ultrasonic meters and Coriolis. The key initiative is the integration of the meters with the Plantweb digital ecosystem, providing clients with the digital transformation tools that process the data into the required insights for optimizing reliability, production, and safety. As of 2025, the company has made a net sale of 18,016 USD million.

- Siemens AG uses its expertise in industrial digitalization to advance in the flow meters market. Their strategic focus is on embedding flow measurement technology into the SiemensMindSphere IoT platform and Xcelarator portfolio. This provides a seamless data flow from the sensor to the cloud, enabling digital twin applications, process optimization, and AI-enabled analytics for the customers in the manufacturing and process sectors.

- Endress+Hauser Group is also one of the top flow meters market players dominating via continuous R&D investment in sensor technology and industry-specific solutions. Their key strategic initiative is the provision of Heartbeat Technology for self-diagnostics and verification, combined with the IIoT ecosystem, to ensure measurement reliability, process transparency, and compliance in life science, food & beverage, and chemical industries. According to the annual report 2024, the company has spent 275.6 million euros in R&D and has launched 81 new products.

- ABB Ltd strengthens its position in the flow meters market by aligning its comprehensive portfolio of electromagnetic Coriolis and ultrasonic meters with its ABB Ability digital suite. Their strategic initiative centers on providing complete cyber secure measurement solutions that enable autonomous operations. By connecting flow data with advanced analytics, ABB helps industries like water mining and power achieve significant gains in resource efficiency and operational sustainability

Here is a list of key players operating in the global market:

The global flow meters market is significantly competitive, fragmented and is defined by the presence of top multinational players and strong regional specialists. The key strategies are the technological innovation, mainly in ultrasonic smart and Coriolis meters, with the IIoT connectivity for data analytics. The major players are actively pursuing growth via strategic acquisition to expand the product portfolio and market reach, and by forming strategic partnerships with automation and software firms to offer integrated solutions. Besides, in February 2024, Process Sensing Technologies, a leading provider of measurement instrumentation and monitoring systems for process-critical applications, finalized the acquisition of Fluid Components International, a specialist manufacturer of thermal mass flow meters and switches. The competitive focus is solely on providing industry specific application in chemicals, water, and wastewater, oil and gas, and pharmaceuticals, where accuracy, lifecycle cost, and reliability are vital factors for purchasing.

Corporate Landscape of the Flow Meters Market:

Recent Developments

- In October 2025, Malema, part of PSG and Dover, announced the global launch of the new Malema M-3100 Series Clamp-On Ultrasonic Flow Meter. It is engineered for precise fluid velocity measurement in liquid-filled closed conduits.

- In September 2024, Swiss headquartered international Baumer Group has acquired Manas Microsystems Pvt. Ltd. Manas Microsystems is one of the largest and technologically leading manufacturers of flow meters in India.

- In August 2025, ABB has launched a streamlined product portfolio, converging on two highly versatile and advanced electromagnetic flowmeters – ProcessMaster and AquaMaster. The new ProcessMaster and AquaMaster combine high performance with modularity and IoT connectivity, enhancing offering to industry and utility segments.

- Report ID: 5102

- Published Date: Feb 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Flow Meters Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.