Fiber Optic Labels Market Outlook:

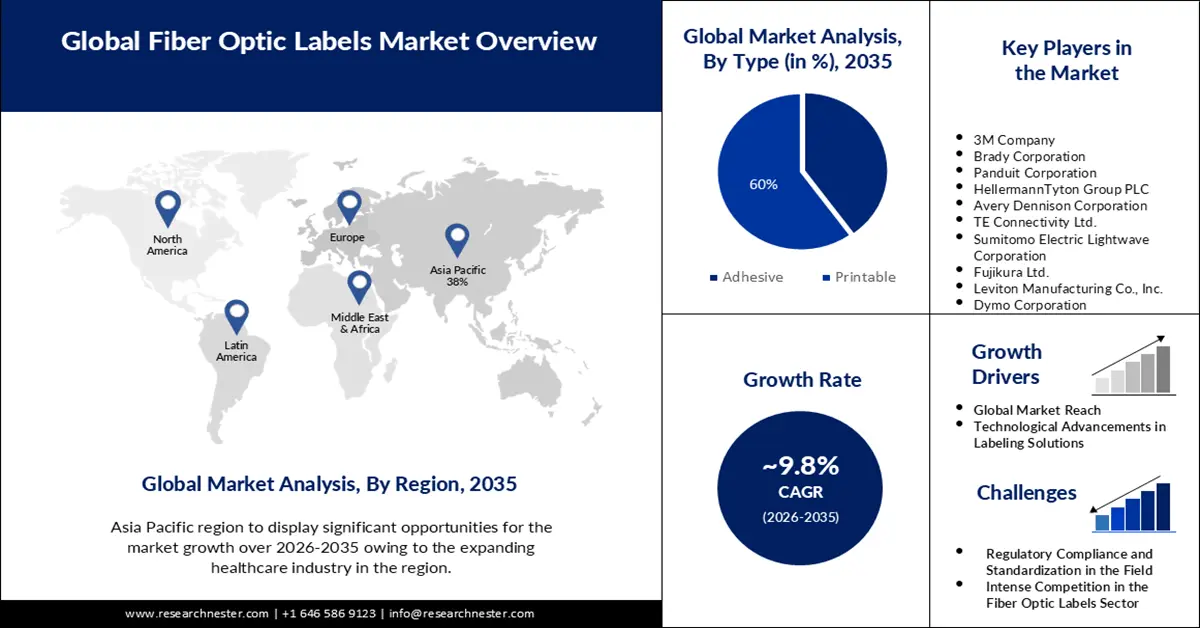

Fiber Optic Labels Market size was over USD 846.14 million in 2025 and is poised to exceed USD 2.16 billion by 2035, growing at over 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fiber optic labels is estimated at USD 920.77 million.

The increasing demand for high-speed data transmission and internet connectivity drives the deployment of fiber optic networks, increasing the need for fiber optic labels. The market is not limited to any specific region and has a global presence, with demand driven by telecommunications infrastructure development and data center expansion worldwide.

The fiber optic labels market is a niche sector within the broader telecommunications and network infrastructure industry. Fiber optic labels play a crucial role in identifying and managing optical fiber cables, connectors, and other components in various applications, including data centers, telecommunications networks, and industrial settings. Several companies specialize in manufacturing and supplying fiber optic labels, tags, and related products. These companies often offer customized solutions to meet the specific needs of their customers.

Key Fiber Optic Labels Market Insights Summary:

Regional Highlights:

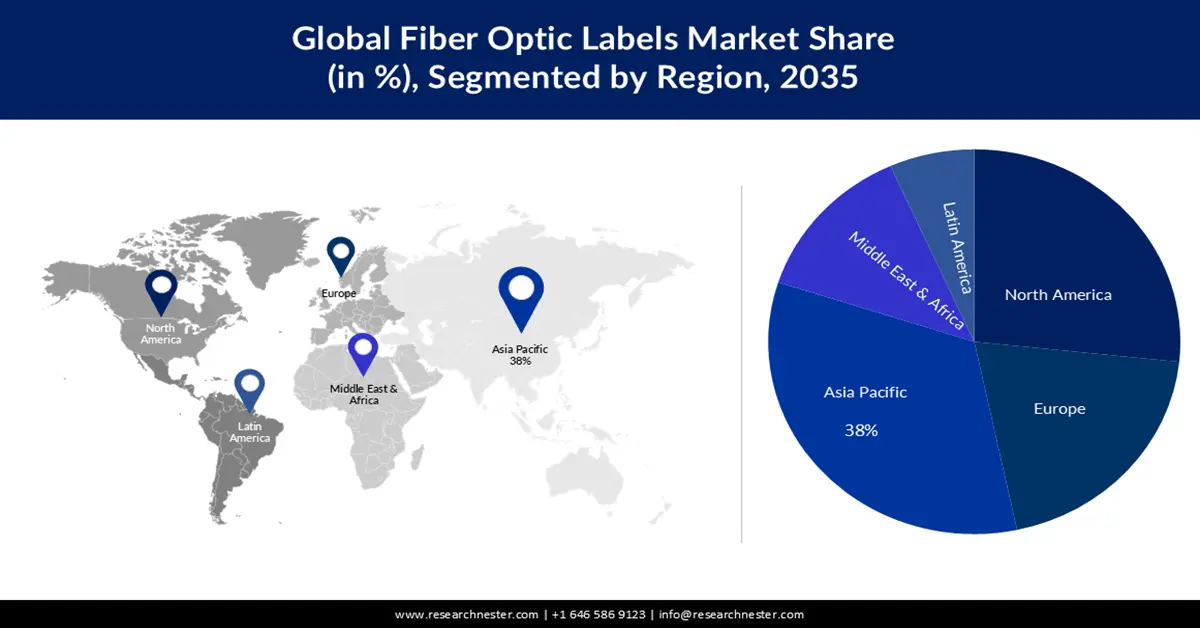

- By 2035, the Asia Pacific region in the fiber optic labels market is anticipated to secure a 38% share, attributed to substantial investments in telecommunications infrastructure, including the deployment of optical fiber networks.

- The North America region is expected to hold the second-largest share by 2035, bolstered by the rollout of 5G networks in North America necessitating extensive fiber optic infrastructure to support high-speed data transmission.

Segment Insights:

- By 2035, the printable segment in the fiber optic labels market is projected to command a 60% revenue share, fueled by the global expansion of fiber optic networks and the need for efficient labeling solutions ensure a broad market reach for printable labels.

- The healthcare segment is anticipated to attain a significant share by 2035, supported by fiber optic labels being essential for the accurate identification and management of optical cables within these devices.

Key Growth Trends:

- Accelerating Demand for High Speed Data Transmission

- Technological Advancements in Labeling Solutions

Major Challenges:

- Rapid Technological Advancements

- Regulatory Compliance and Standardization in the Field

Key Players: 3M Company, Brady Corporation, Panduit Corporation, Hellermann Tyton Group PLC, Avery Dennison Corporation, TE Connectivity Ltd.

Global Fiber Optic Labels Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 846.14 million

- 2026 Market Size: USD 920.77 million

- Projected Market Size: USD 2.16 billion by 2035

- Growth Forecasts: 9.8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Vietnam

Last updated on : 25 November, 2025

Fiber Optic Labels Market - Growth Drivers and Challenges

Growth Drivers

- Accelerating Demand for High-Speed Data Transmission: According to a report, global IP traffic is expected to nearly triple from 2018 to 2023, with a growth rate of 26 percent. The relentless surge in data consumption, driven by streaming, cloud computing, and the Internet of Things (IoT), necessitates the expansion of fiber optic networks. Fiber optic labels play a vital role in identifying and managing these networks, ensuring reliable data transmission.

- Global Market Reach: The demand for fiber optic labels is not limited to a particular geographic area. Companies operating in this sector have a global market presence, serving the needs of telecommunications and data center infrastructure worldwide.

- Technological Advancements in Labeling Solutions: Advancements in labeling technologies, including RFID and laser marking, have enhanced the precision and efficiency of fiber optic labels. These innovations streamline network management and reduce human error.

Challenges

- Rapid Technological Advancements: The rapid evolution of fiber optic technology can create challenges for label manufacturers. New types of connectors, cables, and materials require labels that can adapt to changing industry standards.

- Regulatory Compliance and Standardization in the Field

- Intense Competition in the Fiber Optic Labels Sector

Fiber Optic Labels Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 846.14 million |

|

Forecast Year Market Size (2035) |

USD 2.16 billion |

|

Regional Scope |

|

Fiber Optic Labels Market Segmentation:

Type Segment Analysis

The printable segment in the fiber optic labels market is estimated to gain the largest revenue share of 60% in the year 2035. The demand for printable fiber optic labels is not limited to a specific region. The global expansion of fiber optic networks and the need for efficient labeling solutions ensure a broad market reach for printable labels. The global fiber optic sales are projected to reach nearly USD 6.8 billion by the year 2025.

End User Segment Analysis

The healthcare segment is expected to garner a significant share in the year 2035. The healthcare industry relies heavily on medical devices, many of which incorporate fiber optic technology for precise diagnostics and treatments. Fiber optic labels are essential for the accurate identification and management of optical cables within these devices, contributing to the growth of this segment. The global medical device sales are expected to reach USD 612.7 billion by the year 2025.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fiber Optic Labels Market - Regional Analysis

APAC MMarket Insights

The fiber optic labels market in the Asia Pacific region is projected to hold the largest market share of 38% by the end of 2035. The Asia Pacific region is experiencing substantial investments in telecommunications infrastructure, including the deployment of optical fiber networks. Fiber optic labels play a crucial role in managing and organizing these networks, supporting the growth of this market.

North American Market Insights

The fiber optic labels market in the North America region is projected to hold the second-largest share during the forecast period. The rollout of 5G networks in North America necessitates extensive fiber optic infrastructure to support high-speed data transmission. Fiber optic labels are essential for identifying and managing optical fiber cables and connectors within these networks, driving demand in the region.

The North American region is at the forefront of 5G deployment, with estimates indicating that it will account for a significant share of global 5G subscriptions. North America is witnessing significant investments in telecommunications infrastructure, with the Fiber Optic Connectors sales expected to reach USD 5.9 billion by 2027. Investments in telecommunications infrastructure are driving the deployment of optical fiber networks. Fiber optic labels are integral to managing and organizing these networks, supporting the growth of the market in the region.

Fiber Optic Labels Market Players:

- 3M Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Brady Corporation

- Panduit Corporation

- HellermannTyton Group PLC

- Avery Dennison Corporation

- TE Connectivity Ltd.

- Sumitomo Electric Lightwave Corporation

- Fujikura Ltd.

- Leviton Manufacturing Co., Inc.

- Dymo Corporation

Recent Developments

- Brady Corporation announced that it had agreed to acquire Akrivia, a provider of industrial marking and traceability solutions. The acquisition is expected to close in the second quarter of 2023.

- Brady Corporation announced that it had acquired Label Safety, a provider of industrial safety products. The acquisition is expected to close in the fourth quarter of 2022.

- Report ID: 5251

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fiber Optic Labels Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.