Feminine Hygiene Wash Market Outlook:

Feminine Hygiene Wash Market size was valued at USD 9.9 billion in 2025 and is projected to reach USD 16.8 billion by the end of 2035, rising at a CAGR of 5.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of feminine hygiene wash is assessed at USD 10.4 billion.

The rising awareness of intimate care hygiene and expanding digital and offline distribution channels are key factors propelling extensive growth in the feminine hygiene wash market. According to an article published by the WHO in August 2024, along with the UN Human Rights Council, it affirmed that menstrual health is a fundamental human right, encouraging widespread access to safe and affordable hygiene products, improved wash infrastructure, and adequate menstrual education. It also encourages governments to integrate menstrual hygiene into public health, hence positively impacting market expansion.

Furthermore, the expanding female workforce and urbanization are readily bolstering the demand for these hygiene washes across almost all nations. As evidence, initiatives such as NPCI’s UPI for her, which was launched in 2024, are expanding women’s participation in India’s digital economy, which is also enabling enhanced access to online marketplaces and digital payments. Therefore, this digital empowerment, coupled with rising female workforce participation, is prompting increased e-commerce adoption for feminine hygiene products.

Key Feminine Hygiene Wash Market Insights Summary:

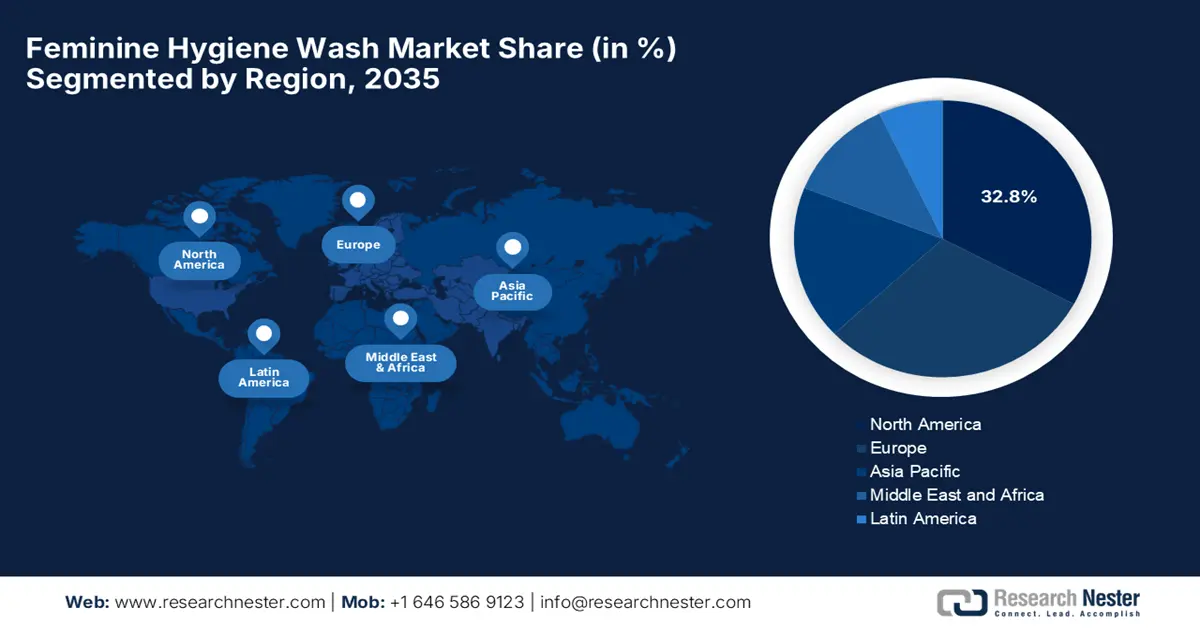

Regional Highlights:

- North America is projected to hold a 32.8% share by 2035 in the feminine hygiene wash market, sustained by heightened consumer awareness and preference for premium offerings.

- Asia Pacific is expected to register the fastest growth from 2026–2035, supported by rising hygiene awareness and increasing disposable incomes.

Segment Insights:

- Offline segment is estimated to command a 64.7% share by 2035 in the feminine hygiene wash market, reinforced by strong consumer trust and accessibility across physical retail channels.

- Medium price category segment is forecasted to secure a 43.2% share by 2035, enabled by its value-driven balance of quality, safety, and affordability.

Key Growth Trends:

- Shift towards natural and organic products

- Government initiatives

Major Challenges:

- Social stigma

- Safety concerns

Key Players: Procter & Gamble Co. (U.S.), Kimberly-Clark Corporation (U.S.), Unilever (UK/Netherlands), Essity AB (Sweden), Johnson & Johnson (U.S.), Unicharm Corporation (Japan), Lion Corporation (Japan), Reckitt Benckiser Group plc (UK), Edgewell Personal Care (U.S.), Ontex Group NV (Belgium), Hengan International Group Company Limited (China), Kimberly-Clark Professional (U.S.), Bella (TZMO SA) (Poland), Lactacyd (Sanofi) (France), Vagisil (Combe Incorporated) (U.S.), Good Clean Love (U.S.), Lola (U.S.), Herbivore Botanicals (U.S.), Southern Lion Sdn. Bhd. (Malaysia), Sofy (Unicharm) (Japan)

Global Feminine Hygiene Wash Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.9 billion

- 2026 Market Size: USD 10.4 billion

- Projected Market Size: USD 16.8 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries:I ndia, South Korea, Brazil, Indonesia, Mexico

Last updated on : 31 October, 2025

Feminine Hygiene Wash Market - Growth Drivers and Challenges

Growth Drivers

- Shift towards natural and organic products: Consumers are increasingly preferring products that are free from harsh chemicals and synthetic fragrances, which is the major driving factor for this landscape. For instance, in March 2021, Piramal Pharma Limited notified the launch of its i-feel gentle intimate wash, which is free from sulfates, parabens, and alcohol. The product contains natural ingredients such as lactic acid along with Neem, Tulsi, and Tea Tree oil to maintain vaginal pH and prevent infections, hence attracting more players to make investments in this field.

- Rising disposable incomes: The rapid urbanization and increasing disposable incomes, particularly in emerging nations, are increasing access to personal care products such as hygiene washes. As per the August 2025 government economic reports, easing inflation and sustained GDP growth are increasing disposable incomes across India, which is improving household purchasing power. This favorable economic environment, supported by government initiatives, is enabling greater consumer spending on personal care products, which in turn is accelerating growth in the market due to enhanced affordability and accessibility.

- Government initiatives: The administrative bodies across almost all nations are undertaking numerous initiatives to educate adolescent girls about menstrual hygiene, which is fostering a favorable business environment for this market. The Supreme Court in November 2024 reported that it had directed the Center to assess the ground situation regarding menstrual hygiene in schools before implementing its national policy due to concerns over improper data and inadequate facilities. Therefore, this focus on menstrual hygiene will increase the overall market demand for female hygiene products.

Challenges

- Social stigma: The existence of cultural stigma & taboo remains a persistent hurdle in the market to capture the desired capital base. In most of the regions, such as Asia, Africa, and the Middle East, menstrual and intimate hygiene a major taboos. Therefore, this cultural resistance limits the widespread adoption, coupled with very low consumer education and awareness, hence restricting market expansion.

- Safety concerns: There is growing skepticism regarding the safety of synthetic chemicals used in some intimate wash products is creating hesitation among consumers. Also, the concerns about irritation, allergic reactions, and disruption of the natural vaginal flora have led to increased demand for more natural and organic alternatives. Therefore, balancing product effectiveness with consumer concerns about ingredients is a major challenge for manufacturers in this field.

Feminine Hygiene Wash Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 9.9 billion |

|

Forecast Year Market Size (2035) |

USD 16.8 billion |

|

Regional Scope |

|

Feminine Hygiene Wash Market Segmentation:

Distribution Channel Segment Analysis

Based on the distribution channel offline segment is expected to garner the largest revenue share of 64.7% in the feminine hygiene wash market during the forecast duration. The dominance of the segment is effectively attributable to the emergence of channels such as pharmacies, supermarkets, and specialty trusts. Also, consumer trust, easy accessibility, and preference to buy personal care products in physical stores are constantly driving the adoption of this subtype. Furthermore, the in-store promotions coupled with pharmacist recommendations are also driving sales, hence denoting a positive market outlook.

Price Category Segment Analysis

In terms of price category medium segment is projected to attain a significant revenue share of 43.2% in the market by the end of 2035. The value for money in terms of quality and branding is the key factor behind the subtype’s leadership. Also, the products are pH-balanced, gynecologist-tested for safety, and utilize natural ingredients, which makes them more affordable and accessible to a larger audience group. Additionally, the segment also benefits from widespread distribution, thereby driving its adoption among price-conscious consumers.

Product Type Segment Analysis

Based on product type liquid wash segment is anticipated to gain a lucrative revenue share of 47.5% in the feminine hygiene wash market over the analyzed timeframe. Their gentle cleansing properties, pH-balanced formulations, and compatibility with sensitive skin are driving the subtypes' growth. In January 2024, Compass Diversified announced that it entered into a strategic partnership with The Honey Pot Company, which is a leading better-for-you feminine care brand, for an enterprise value of USD 380 million. The Honey Pot Co. offers plant-derived, clinically tested feminine care products across hygiene, menstrual, and wellness categories.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Distribution Channel |

|

|

Price Category |

|

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Feminine Hygiene Wash Market - Regional Analysis

North America Market Insights

North America market is predicted to hold the highest share of 32.8% throughout the discussed tenure. The leadership is primarily driven by a high level of consumer awareness and a preference for premium products. In July 2022, Ontex reported that it had inaugurated a 250,000-square-foot manufacturing facility in Stokesdale, North Carolina, marking a major expansion in the regional dynamics market, thus strengthening the company’s bi-coastal supply chain.

The U.S. is solidifying its position in the feminine hygiene wash market owing to the growth of e-commerce, which is making it easier for consumers to purchase feminine hygiene washes online. Testifying this, the U.S. Census Bureau in August 2025 released a quarterly retail e-commerce sales report, estimating second-quarter e-commerce sales at USD 304.2 billion, which is a 1.4% increase from the previous quarter and accounts for 16.3% of total retail sales. Besides, e-commerce sales rose 5.3% when compared to the second quarter of 2024. The total retail sales increased 3.9%, reflecting continued growth in online shopping, thereby underscoring the expanding role of digital retail in the country’s economy.

Canada has reaped lucrative growth opportunities from the market due to the rising awareness of personal hygiene among consumers and substantial funding grants. WaterAid Canada and WaterAid Nigeria in September 2025 reported that it has launched the five-year EmpowerHer project in Bauchi State, with funds received by the country’s government through Global Affairs Canada. Besides, the initiative aims to enhance women’s leadership in WASH governance, improve sexual and reproductive health, and build climate-resilient community services, directly benefiting over 100,000 people.

APAC Market Insights

Asia Pacific is recognized as the fastest-growing landscape of the feminine hygiene wash market from 2026 to 2035. The region’s upliftment in this field is effectively attributed to increasing awareness of personal hygiene and rising disposable incomes. The women from younger generations are more informed about the organic products, which is prompting increased utilization of hygiene products. This, in turn, has led to manufacturers introducing organic cotton-based sanitary pads, tampons, and pantyliners, which cater to the growing preference for natural alternatives, hence positively impacting market growth.

China is readily blistering growth in the market owing to the growing participation of women in sports, which has contributed to increased awareness of feminine hygiene needs. Both domestic and international companies are introducing innovative products that include eco-friendly and high-quality options to meet the increasing demand among urban and middle-income women. Moreover, the booming e-commerce and livestreaming platforms have become key channels for product launches and promotions.

India is evolving in the feminine hygiene wash market, owing to the government initiatives, such as the ASHA program, which aims to distribute free sanitary towels to rural secondary school girls, promoting menstrual hygiene and increasing product adoption. As per an article published by MOSPI in August 2025, personal care and effects, the index on July 24 (final) ranged from 199.8 to 201.3, increasing to provisional values of 229.8 to 231.9 on July 25. Further, this corresponds to inflation rates between 15.02% and 15.20. Therefore, the increase reflects changes in market demand and cost adjustments in the sector.

Europe Market Insights

Europe is likely to retain its strong position in the feminine hygiene wash market over the analyzed time frame, fueled by increasing consumer focus on personal care, wellness, and intimate hygiene. Besides, consumers in this region are encouraging brands to innovate with plant-based ingredients and environmentally friendly formulations on account of heightened demand. In February 2025, GreenCore Solutions Corp. reported that it had launched FemCare UltraThin, which is its first tree-free feminine care line in Europe, to meet eco-conscious consumer demand, hence suitable for standard market growth.

Germany is gaining momentum in the regional market due to a huge focus on sustainability, eco-conscious packaging, along broader national trends in environmental responsibility. In August 2022, Mondi reported that it had launched new feminine care packaging in collaboration with Essity and Dow, in the region that combines renewable materials, post-consumer recycled content, and by-products from paper making. Therefore, this reduces reliance on fossil-based materials, hence denoting a positive market outlook.

The U.K. is growing exponentially in the regional market owing to the increasing awareness of harmful chemical additives in hygiene products. The country also benefits from e-commerce platforms, social media, and influencer marketing, which play a major role in shaping consumer choices, especially among younger demographics. Besides, the brands in the country are leveraging campaigns that are focused on confidence and empowerment, thereby making personal care a part of broader wellness narratives.

Key Feminine Hygiene Wash Market Players:

- Procter & Gamble Co. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kimberly-Clark Corporation (U.S.)

- Unilever (UK/Netherlands)

- Essity AB (Sweden)

- Johnson & Johnson (U.S.)

- Unicharm Corporation (Japan)

- Lion Corporation (Japan)

- Reckitt Benckiser Group plc (UK)

- Edgewell Personal Care (U.S.)

- Ontex Group NV (Belgium)

- Hengan International Group Company Limited (China)

- Kimberly-Clark Professional (U.S.)

- Bella (TZMO SA) (Poland)

- Lactacyd (Sanofi) (France)

- Vagisil (Combe Incorporated) (U.S.)

- Good Clean Love (U.S.)

- Lola (U.S.)

- Herbivore Botanicals (U.S.)

- Southern Lion Sdn. Bhd. (Malaysia)

- Sofy (Unicharm) (Japan)

- Procter & Gamble Co., a company based in the U.S., is leveraging its flagship brands called Always and Tampax. The company primarily focuses on product innovation, introducing biodegradable and reusable products to meet the growing demand for sustainable options. On the other hand, the company also emphasizes menstrual health education and community engagement to strengthen brand loyalty and expand its consumer base.

- Kimberly-Clark Corporation, the company has a most prominent brand name and is best known for its comfort and reliability. The firm readily makes investments in the high-absorbency products and supports educational initiatives to enhance access to female hygiene products, especially in terms of developing economies.

- Unicharm Corporation is based in Japan, and its Sofy brand is quite popular in the markets of the Asia Pacific and the Middle East. The firm specializes in its products according to the domestic requirements, underscoring its focus on both comfort and discretion. Through different educational projects, it aims to educate rural users about menstrual hygiene, while its investments are in female-led micro-enterprises.

- Essity AB (Sweden): It is one of the most prominent players in this field, leveraging the brand called Libresse. The company deliberately emphasizes sustainability, using sustainable fiber sourcing and ergonomic design, attracting environmentally conscious consumers.

- Johnson & Johnson Services, Inc. has a well-known brand called Stayfree, which offers a range of feminine hygiene products catering to both value and premium segments. The company also focuses on comfort and lifestyle messaging, regularly introducing differentiated day and night pads to meet diverse consumer needs.

Below is the list of some prominent players operating in the global market:

The global feminine hygiene wash market is witnessing intense competition among established multinational corporations and emerging regional players. The leading pioneers, such as Procter & Gamble, Kimberly-Clark, and Unilever, are leveraging huge distribution networks, whereas emerging firms are focusing on mergers & acquisitions. For instance, in January 2021, RB announced the acquisition of Queen V, which is a US-based feminine wellness brand, to strengthen its USD 7 billion female intimate hygiene portfolio. Queen V focuses on vaginal health through an inclusive, purpose-driven approach, hence allowing the expansion into new wellness adjacencies through this strategic move.

Corporate Landscape of the Market:

Recent Developments

- In August 2024, Laurier, under Kao Corporation, launched a feminine foaming wash, introducing advanced technology for superior freshness and hygiene. The product comprises a special pressing pump that produces rich, dense foam for gentle and effective cleansing, helping prevent odor and stuffiness for daily comfort.

- In August 2023, Medinova announced the launch of Gynoflorelle, which is a next-generation intimate care line developed in partnership with Belgian biotech company YUN Probiotherapy, which are designed to strengthen and restore the vaginal microbiome naturally.

- Report ID: 8201

- Published Date: Oct 31, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Feminine Hygiene Wash Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.