Fan Coil Unit Market Outlook:

Fan Coil Unit Market size was valued at USD 5.5 billion in 2025 and is projected to reach USD 9.2 billion by the end of 2035, rising at a CAGR of 5.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of fan coil unit is evaluated at USD 5.8 billion.

Public sector building energy efficiency mandates are the primary drivers shaping the fan coil unit market globally. The data from IEA in July 2023 reported that buildings account for nearly 30% of the total final energy consumption worldwide, with space heating and cooling representing the largest share of this load. In the U.S., the Department of Energy Information Administration in June 2023 estimated that the commercial buildings consumed over 6.8 quadrillion BTUs of energy, with HVAC systems responsible for a significant energy use. These figures are stimulating the investment in system upgrades across hospitals, government offices, education campuses, and transit infrastructure. The federal funding under programs such as the U.S. Infrastructure Investment and Jobs Act and DOE’s Better Buildings Initiative is directing billions of dollars toward the retrofits that prioritize zoned temperature control and lifecycle operating cost reductions, conditions that favor distributed airside systems in mid-rise and large-footprint facilities.

Besides, in Europe, the European Commission data in July 2023 reports that the renovation of the public building must achieve a minimum of 3% annual energy efficiency improvement rate under the Energy Efficiency Directive, directly increasing the replacement cycles for legacy HVAC assets in municipal and institutional estates. These policies are translating into a measurable procurement demand from public works departments, healthcare authorities, and defense infrastructure agencies. Further, the fan coil unit market expansion is propelled by the urbanization trends and the focus on the indoor environmental quality in the workplaces, healthcare, and hospitality sectors. The EPA data in April 2025 shows that the people in the U.S. spend nearly 90% of their time indoors, where pollutant levels can be higher than outdoors, placing greater emphasis on effective ventilation and climate control systems.

Key Fan Coil Unit Market Insights Summary:

Regional Highlights:

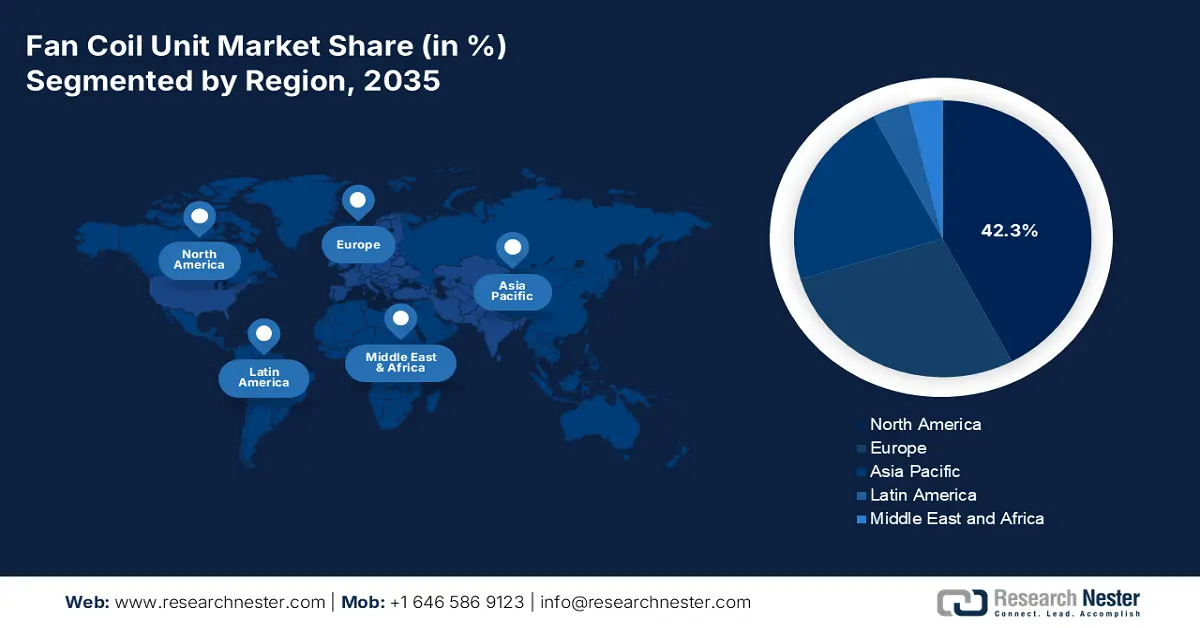

- North America is anticipated to secure a 42.3% revenue share by 2035 in the fan coil unit market, reflecting strong uptake across healthcare, education, and commercial retrofit projects, underpinned by strict energy regulations and public infrastructure upgrades, owing to stringent energy codes and large-scale building retrofit initiatives.

- Asia Pacific is projected to emerge as a high-impact region over the 2026-2035 period, supported by expansive commercial and residential construction across major economies and accelerating modernization of HVAC systems, fueled by rapid urbanization and government-led energy efficiency programs.

Segment Insights:

- The commercial sub-segment is forecast to command a 75.6% revenue share by 2035 within the application category of the fan coil unit market, reflecting its widespread deployment across offices, hospitals, hotels, and retail facilities, underpinned by stringent indoor air quality norms and efficiency-focused retrofits, propelled by the adoption of modern building energy codes.

- Four pipe FCUs are expected to retain a leading position by 2035 under the type segment, supported by their ability to deliver simultaneous heating and cooling across multiple zones in large nonresidential buildings, reinforced by compliance requirements for advanced building performance and green certification standards.

Key Growth Trends:

- Sustained government investment in non residential construction

- Advancement in building automation & IoT integration

Major Challenges:

- High initial capital & R&D investment

- Need for robust distribution & after-sales service network

Key Players: Carrier Global Corporation (U.S.), Trane Technologies plc (U.S.), Johnson Controls International plc (U.S.), Daikin Industries, Ltd. (Japan), Mitsubishi Electric Corporation (Japan), LG Electronics (South Korea), Samsung Electronics (South Korea), Gree Electric Appliances, Inc. (China), Midea Group (China), Lennox International Inc. (U.S.), Systemair AB (Sweden), FläktGroup Holding GmbH (Germany), Swegon (Sweden), Aermec S.p.A. (Italy), Trox GmbH (Germany), CIAT Group (France), Hitachi, Ltd. (Japan), Fujitsu General (Japan), Dunham-Bush (Malaysia), Rhoss S.p.A. (Italy).

Global Fan Coil Unit Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.5 billion

- 2026 Market Size: USD 5.8 billion

- Projected Market Size: USD 9.2 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Vietnam, Indonesia, Thailand, Malaysia

Last updated on : 14 January, 2026

Fan Coil Unit Market - Growth Drivers and Challenges

Growth Drivers

- Sustained government investment in non residential construction: The public and private non-residential construction spending directly correlates with the fan coil unit procurement. The government infrastructure bills, such as the U.S. Infrastructure Investment and Jobs Act, allocate billions to public buildings, hospitals, and educational facilities, all key FCU end users. The CMAA in January 2026 shows the annual rate of total construction spending reached USD 1.03 trillion, with the public non-residential construction adding nearly 0.2%. This sustained investment pipeline ensures a stable long term demand for mechanical equipment, making it a critical market indicator for the fan coil unit market manufacturers and suppliers, with multi-year federal funding cycles providing predictable visibility for production planning and inventory management.

- Advancement in building automation & IoT integration: The expansion of the smart building technology drives the demand for the fan coil unit market with native connectivity and advanced controls. The government facilities themselves are leading the adopters of Building Automation Systems for energy management. The FCUs that act as the intelligent endpoints within the BAS enable precise zone control, predictive maintenance and significant operational savings. This trend is pushing the market away from standalone products towards integrated system solutions, favoring manufacturers with strong controls and software capabilities, and is creating new service-based revenue streams through performance contracts and data analytics.

- Multilateral financing for public building retrofits: The international development banks are increasingly funding the HVAC upgrades as part of urban sustainability and public sector efficiency programs. The World Bank report in 2023 indicates that it committed over USD 29.4 billion in climate-related projects, a portion of which supports energy efficiency in public buildings across emerging markets. Similarly, the European Bank for the Reconstruction and Development channels funds into municipal infrastructure modernization in Eastern Europe, Central Asia, and the Balkans, where the HVAC replacement is a recurring line item. Further, engaging early with the EPC contractors and consultants working on the multilaterally funded projects can secure FCU specification before tenders are finalized, improving win rates in donor-backed fan coil unit markets.

Challenges

- High initial capital & R&D investment: Establishing production lines for diverse FCU types, such as two pipe, four pipe, and smart-enabled, requires substantial capital. Compounding this, the R&D costs for energy efficient low noise and IoT-integrated units are escalating to meet the new global standards. A new entrant must invest millions before securing a single order, creating a significant barrier in the fan coil unit market. For example, the top players consistently invest some percentage of their annual revenue into R&D to stay ahead of the scale difficulty for new players to match.

- Need for robust distribution & after-sales service network: The fan coil units are not simple off-the-shelf products; they require specification by consultants, installation by trained technicians, and reliable maintenance. Building a competent network of distributors wholesales and service partners is slow and costly. Daikin uses its extensive global network of Daikin Solution Centers and certified dealers, providing training and support that new entrants cannot quickly replicate, creating a formidable barrier to customer trust and fan coil unit market penetration.

Fan Coil Unit Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 5.5 billion |

|

Forecast Year Market Size (2035) |

USD 9.2 billion |

|

Regional Scope |

|

Fan Coil Unit Market Segmentation:

Application Segment Analysis

The commercial sub segment is projected to maintain its dominant revenue share of 75.6% by 2035 within the application segment in the fan coil unit market. The segment is driven by its extensive use in office towers, hospitals, hotels, and retail spaces. These environments demand the precise zoned temperature and ventilation control that fan coil units provide, aligning with the robust indoor air quality and energy standards. The sector’s growth is directly tied to nonresidential construction activity and the retrofit of existing buildings for improved efficiency. A key driver is the adoption of modern building energy codes. For instance, the data from the EIA in June 2023 indicates that space heating accounts for nearly 32% of energy use in commercial buildings in the U.S. This data shows the huge market for efficient HVAC solutions, such as the advanced fan coil unit, to manage this significant energy load.

Type Segment Analysis

Under the type segment, the four pipe FCUs are leading in the fan coil unit market. The segment is driven by its superior flexibility and energy efficiency in providing simultaneous heating and cooling to different building zones. This capacity is vital for large commercial buildings such as hotels and hospitals, where the rooms have diverse and fluctuating thermal requirements. By using separate chilled and hot water supply and return pipes, these systems eliminate the energy waste related to changing over a single coil, offering significant operational savings. Their adoption is heavily influenced by the building performance standards. The 2026 Unilux HVAC Industries indicates that they provide residents with year-round heating, cooling, and ventilation with 4-pipe vertical stack fan coils. This feature is increasingly mandated in green building certifications like LEED to achieve high energy performance scores.

Business Type Segment Analysis

The new sales sub-segment leads the business type segment in the fan coil unit market and is fueled by the new construction and the development of large-scale commercial and high-end residential projects globally. This growth is mainly pronounced in emerging economies undergoing rapid urbanization and in regions with updated building codes that mandate modern, efficient HVAC installations from the outset. While the replacement market is steady, it is eclipsed by the volume of new installations. Government data on construction spending is a reliable indicator. The consistent global investment in infrastructure and real estate ensures a robust and continuous demand pipeline for original equipment manufacturers. Further, the integration of smart and sustainable technologies in new builds creates a premium market for an advanced connected FCU system that older retrofit projects.

Our in-depth analysis of the fan coil unit market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Capacity |

|

|

Application |

|

|

Business Type |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fan Coil Unit Market - Regional Analysis

North America Market Insights

The North America fan coil unit market is dominating and is poised to hold the revenue share of 42.3% by 2035. The market is driven by commercial building retrofits, stringent energy codes, and high healthcare and education construction. The U.S. Infrastructure Investment and Jobs Act funds public facility upgrades, directly boosting the demand. The trend is toward high-efficiency smart-enabled units integrated with Building Automation Systems for predictive maintenance and energy savings. The standards, such as LEED certification, push the adoption of advanced four-pipe and low-GWP refrigerant models. The replacement cycle in existing buildings is a steady demand driver, outweighing slower new commercial construction growth. In Canada, the federal initiatives, such as the Green Buildings Strategy, complement provincial codes, focusing on deep energy retrofits and electrification to meet the net zero targets, favoring heat pump integrated fan coil unit solutions.

The U.S. fan coil unit market is being shaped by the parallel investment in commercial HVAC modernization and mission-critical cooling infrastructure, with recent product launches signaling broader capital flow into advanced airside systems. The Airedale by Modeine’s November 2023 launch of AireWall ONE, manufactured in part of the U.S. for global distribution, highlights the country’s role as both a production hub and demand center for high-efficiency air movement technologies supporting the data centers, healthcare campuses, and large institutional estates. While the AireWall ONE serves the critical cooling segment rather than the core, its U.S.-based manufacturing reflects sustained investment in domestic HVAC supply chains aligned with federal priorities on energy resilience and infrastructure reliability. This momentum coincides with the rising public sector spending on building upgrades.

Recent Advancements in the Fan Coil Unit Market in U.S

|

Year |

Company Name |

Advancements |

|

October 2025 |

YSE Company |

Launched a new improved 130mm ultra, thin exposed chilled, water fan coil unit |

|

April 2025 |

Foster International |

Announced the launch of its own HVAC brand, FOSTER |

|

April 2025 |

Panasonic |

Launched the FK1, its first water fan coil unit featuring cutting-edge nanoe X technology |

|

December 2024 |

Daikin |

Launch of the new FWC-D 3x3 (900 x 900) cassette fan coil unit |

Source: YSE Company, Foster International, Panasonic, Daikin

The dominant trend in the Canada fan coil unit market is driven by the shift toward electrification and cold climate heat pump integration within the fan coil unit systems, propelled by the national net-zero 2050 goal. This is stimulated by the provincial building step codes, such as British Columbia’s, which mandate significant increases in the energy efficiency of new and substantially renovated buildings. This is mandated by the strong provincial energy step codes and supported by the federal funding, such as the Canada Infrastructure Bank’s commitment of USD 2 billion for its Building Retrofits Initiatives, as announced in the Investors' Confidence Project report in July 2023. This initiative aims to modernize the public and community buildings, directly creating a demand for high-efficiency electric-based HVAC solutions, such as advanced FCU systems, to meet the ambitious 2030 emissions reduction targets.

APAC Market Insights

The Asia Pacific fan coil unit market is the global powerhouse and is defined by rapid urbanization, massive new construction, and an intense focus on energy efficiency. The primary demand driver is the unprecedented scale of commercial and residential building development in major economies such as China and India, fueled by population growth and economic expansion. Concurrently, the government-led sustainability initiatives and strong green building codes, such as China’s Three Star System, India’s ECBC, and Japan’s Top Runner Program, are stimulating the shift from basic HVAC systems to high-efficiency fan coil units. A key trend is the rapid integration of smart and inverter-controlled FCUs driven by the demand for better indoor air quality and lower operational costs in sectors such as IT offices, healthcare, and hospitality.

The China fan coil unit market is driven by the state-led green building mandates and massive new construction. The NLM study in May 2022 indicates that the national guidance developed during the COVID-19 emphasized fresh air dominance, extended ventilation operation, minimum per capita air supply of 30 m3/h, and stricter management of fan coil systems including the rules that allow FCUs to operate only when serving single enclosed rooms, while discouraging shared return air configurations across multiple spaces. These measures have a lasting impact on how offices, markets school hospitals, and temporary facilities approach HVAC retrofits, shifting the procurement priorities toward terminal systems that support zoned operation, independent room control and capability with 100% fresh air strategies. As China continues to embed epidemic-preparedness into building standards, the fan coil unit market is transitioning from a cost-driven segment to a compliance and resilience-led retrofit market.

The Japan fan coil unit market in high buildings is driving the market, with the buildings accounting for nearly 37% of the total national energy consumption, based on the NLM study in July 2023, indicating HVAC efficacy is a strategic priority for both public and private stakeholders. This energy profile is stimulating the retrofit activity across offices, hospitals, hotels, and government facilities, where reducing operating costs and carbon exposure has become central to asset management strategies. As HVAC systems represent the largest controllable energy load in commercial buildings, demand is shifting toward terminal-level upgrades that enable zoned temperature control, lower fan energy use, and compatibility with low temperature heating and cooling systems. Fan coil units are benefiting from this transition as they support incremental efficiency gains without full system replacement, aligning with Japan’s focus on practical decarbonization pathways in an energy-constrained environment.

Europe Market Insights

The Europe fan coil unit makret is a mature but steadily evolving sector primarily driven by the region’s ambitious energy efficiency and decarbonization goals. Stringent regulations such as the Energy Performance of Buildings Directive, which mandates that all new buildings be zero emission by 2030, are powerful drivers for retrofitting existing HVAC systems with high-efficiency fan coil units. The market is shifting towards smart connected units that integrate with Building Management Systems for optimal energy use and predictive maintenance. The growth is particularly strong in the healthcare, hospitality, and office retrofit sectors, where indoor air quality and precise climate control are vital. While Southern Europe’s demand is linked to new residential and tourism construction, Western and Northern Europe’s growth is more focused on the replacement and modernization of aging building stock.

Germany fan coil unit market is increasingly shaped by the federal government’s heating decarbonization support scheme. The data from the Clean Energy Wire in August 2024depicts that the scheme includes all groups of building owners, including companies, landlords, and municipalities. With the subsidies covering 30% of investment costs rising to 70% for owner-occupiers and more than 93,000 application filled, the program is stimulating the large-scale replacement of gas and oil heating systems with heat pumps, biomass heating, and district heating connections. These low-carbon heat sources rely on hydronic distribution within the buildings, directly increasing the demand for fan coil units in apartment blocks, offices, public buildings, and mixed-use developments. The impact is reinforced by Germany’s heating law requiring new buildings to use at least 65% of renewable energy, which favors low-temperature heating systems where the FCUs are operationally efficient.

The UK fan coil unit market is being shaped by the growing policy and commercial focus on reducing the operational carbon in existing non-domestic buildings, where the heating, cooling, and power account for around 19% of the national carbon footprint, based on the UK GBC data in January 2025. The UK Green Building Council’s Whole Life Carbon Roadmap, which targets a 49% reduction in non-domestic energy intensity by 2040, is stimulating investment in HVAC optimization across offices, healthcare facilities, retail assets, and public sector estates. The HVAC systems represent one of the largest controllable energy loads in commercial buildings, and persistent issues around inefficient operation, high maintenance costs, and shortened asset lifecycles are pushing the asset owners toward terminal-level upgrades rather than full systems replacements. Fan coil units are increasingly specified in retrofit programs because they support zoned temperature control, improved indoor air quality, and lower lifecycle operating costs, aligning with both carbon-reduction goals and occupier wellbeing standards.

AI-Driven Building Energy Optimization Solutions

|

Company |

Solution overview |

Building types |

Building systems controlled |

Stage of development |

|

BrainBox AI |

AI-driven HVAC optimisation platform using cloud-connected thermostats, Niagara Framework, BACnet, and cloud integrations |

Industrial, office, retail, social infrastructure |

HVAC |

Deployed in 14,900 buildings across 20+ countries |

|

Elyos Energy |

Edge-connected solution enabling anomaly detection and automated HVAC scheduling control, including ventilation optimization based on weather and occupancy conditions |

Offices, hotels, shopping centres, universities, leisure centres, schools, data centres, government buildings, warehouses |

HVAC and distributed energy systems (EVs, solar, smart thermostats) |

Active in 400+ buildings |

|

Hank (by JLL) |

AI-based optimisation layer over existing BMS using digital twins, forecasting, intelligent alarms, and 24/7 engineering support through Hank Edge device and cloud UI |

Office, retail, industrial, new build, refurbishment |

HVAC |

Commercial deployments (scale not publicly disclosed) |

Source: UK GBC January 2025

Key Fan Coil Unit Market Players:

- Carrier Global Corporation (U.S.)

- Trane Technologies plc (U.S.)

- Johnson Controls International plc (U.S.)

- Daikin Industries, Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- LG Electronics (South Korea)

- Samsung Electronics (South Korea)

- Gree Electric Appliances, Inc. (China)

- Midea Group (China)

- Lennox International Inc. (U.S.)

- Systemair AB (Sweden)

- FläktGroup Holding GmbH (Germany)

- Swegon (Sweden)

- Aermec S.p.A. (Italy)

- Trox GmbH (Germany)

- CIAT Group (France)

- Hitachi, Ltd. (Japan)

- Fujitsu General (Japan)

- Dunham-Bush (Malaysia)

- Rhoss S.p.A. (Italy)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Carrier Global Corporation is a titan in the fan coil unit market, driving advancements via its integration of advanced HVAC controls and building management systems. The company strategically embeds smart connected technologies into its FCU offerings, enabling data-driven optimization of indoor air quality and energy use. This initiative transforms FCUs from simple climate devices into intelligent nodes within healthy, efficient, and sustainable building ecosystems. In 2024, the company witnessed an organic growth of 3% with net sales of USD 22.5 billion.

- Trane Technologies plc has significantly shaped the fan coil unit market by pioneering high-efficiency, sustainable climate solutions. Their strategic focus is on innovating FCU designs that utilize lower global warming potential refrigerants and feature advanced acoustical engineering for ultra-quiet operation. This emphasis on sustainability and occupant comfort positions their FCUs as a critical component in meeting the stringent green building standards and enhancing the user experience in commercial spaces. Based on the 2024 annual report, the total revenue made by the company was USD 19.8 billion.

- Johnson Controls International plc advances the fan coil unit market via its strategic OpenBlue digital ecosystem. By integrating FCUs with AI-powered building analytics and cloud-based platforms, they enable predictive maintenance and dynamic zone control. This digital initiative ensures FCUs operate at peak efficiency, reducing the lifecycle costs and contributing to intelligent buildings that proactively adapt to occupancy and environmental conditions.

- Daikin Industries, Ltd. is a global leader in the fan coil unit market, renowned for its strategic innovation in inverter and VRV technology. The company leverages its expertise to produce extremely precise and energy-efficient FCUs that integrate seamlessly into multi-zone systems. This focus on technological refinement and system compatibility ensures optimal comfort control, cementing Daikin’s position in the premium segment of the global FCU landscape.

- Mitsubishi Electric Corporation has made pivotal advancements in the fan coil unit market via its strategic development of compact, ultra-thin, and whisper-quiet designs. Their initiative centers on maximizing performance while minimizing the spatial and acoustic footprint, which is vital for modern architectural design, such as renovation and high-end installations. This engineering philosophy addresses the core market demands for discreet, powerful, and flexible indoor climate solutions.

Here is a list of key players operating in the global fan coil unit market:

The global fan coil unit market is moderately fragmented, featuring a mix of multinational HVAC giants and strong regional specialists. The competition is driven by the energy efficiency regulations, indoor air quality demands, and smart building integration. The key strategic initiatives include extensive investment in inverter-driven low noise and connected FCU technologies. The major players are expanding via acquisitions to gain market share and enhance their product portfolios in emerging regions such as APAC. For example, in April 2024, Mitsubishi Electric Subsidiaries announced the acquisition of French A/C Maker AIRCALO. Further sustainability drives the innovation in eco-friendly refrigerants and recyclable materials, while companies strengthen the service networks and customized solutions for the commercial and hospital sectors.

Corporate Landscape of the Fan Coil Unit Market:

Recent Developments

- In March 2025, Daikin strengthens its position in indoor climate solutions with the launch of the new FWT-HTV wall-mounted fan coil unit series, delivering advancements in occupant comfort, energy efficiency, and best-in-class indoor air quality within a single integrated platform.

- In May 2025, British heating and cooling equipment specialist Diffusion officially launched its new Highline 275 Modular Fan Coil range to its customers at an exclusive event held at historic Great Scotland Yard, London.

- In July 2024, Samsung announced the launch of its latest innovation, the new WindFree Air Conditioners in the Chilled Water Indoor category. This new range features the Wind-Free and 360o Bladeless Technology in Chilled Water-based Cassette Units, designed to offer a superior cooling experience without the discomfort of direct cold draft for the user.

- Report ID: 8344

- Published Date: Jan 14, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fan Coil Unit Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.