Cleaning Services Market Outlook:

Cleaning Services Market size was valued at USD 447.2 billion in 2025 and is projected to reach USD 850.2 billion by the end of 2035, rising at a CAGR of 7.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cleaning services is assessed at USD 480.2 billion.

The international market is representing consistent progress owing to the increasing awareness of hygiene, health, and workplace safety across both residential and commercial sectors. Factors such as improvements in cleaning technologies, administrative policy updates, and automation solutions are reshaping service delivery in this field. ISSA, the Association for Cleaning and Facility Solutions, announced its 2026 policy priorities with a prime focus on strengthening innovation, workforce development, and sustainability in the cleaning industry. It has been building on recent wins such as tax reforms, the WIPPES Act, and hygiene access initiatives, wherein ISSA aims to expand training programs, support EPA functions, and promote even cleaner, healthier spaces. Hence, the presence of such priorities highlights the industry’s essential role in public health and economic growth, with leaders encouraged to participate in supportive summits.

Furthermore, the regulations on cleaning products also stimulate revenue in the market, increasing demand for safer alternatives. According to data published by the U.S. Environmental Protection Agency in October 2025, greener cleaning products are highly essential for maintaining healthy indoor environments, which efficiently reduce risks to human health and ecosystems. It’s a safer choice and proper design for the environment programs certify products that meet strict standards for safer ingredients, in turn helping consumers avoid any type of misleading greenwashing claims. It also mentioned that by adopting certified green products and proper training in their use, households, institutions, and janitorial services can remarkably minimize pollution, conserve energy, and protect both workers and the environment, hence increasing the growth potential of the market in the upcoming years.

Key Cleaning Services Market Insights Summary:

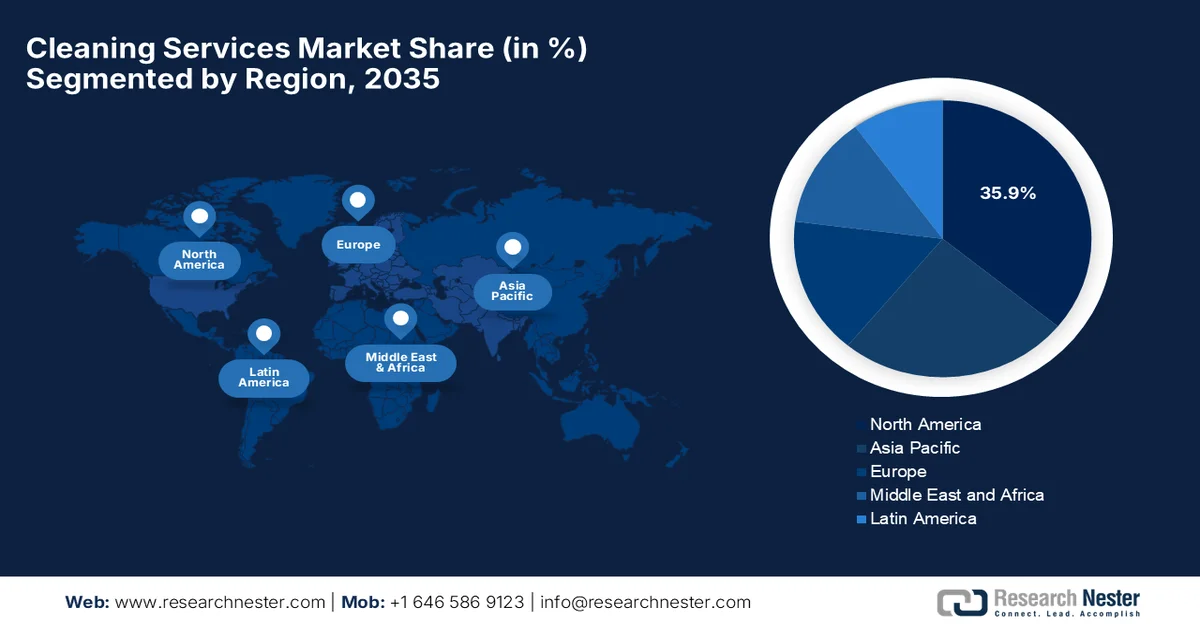

Regional Highlights:

- In the cleaning services market, North America is projected to capture a leading 35.9% share by 2035, underpinned by widespread outsourcing across corporate facilities and hospitality operators and accelerated by technology-led automation and sustainability-focused cleaning innovations.

- Asia Pacific is expected to witness consistent expansion through 2035, supported by rapid urbanization, industrial growth, and heightened public health awareness and reinforced by government-backed sanitation initiatives and rising institutional procurement of professional cleaning services.

Segment Insights:

- In the cleaning services market, floor care is projected to account for a dominant 38.6% share by 2035, supported by its universal application across commercial, residential, and institutional settings and sustained by continuous innovation and premium product adoption strengthening routine maintenance demand.

- Commercial cleaning is anticipated to secure a considerable share by 2035, underpinned by long-term contractual outsourcing across businesses, healthcare, and educational institutions and reinforced by stringent hygiene compliance and expanding service scope requirements.

Key Growth Trends:

- Post-pandemic hygiene awareness

- Technological improvements

Major Challenges:

- Labor shortages and workforce retention

- Quality standards and regulatory compliance

Key Players: ABM Industries Incorporated U.S., ISS A/S Denmark, ServiceMaster Global Holdings Inc. U.S., Sodexo S.A. France, Compass Group PLC UK, Aramark Corporation U.S., Jani-King International Inc. U.S., Stanley Steemer International Inc. U.S., Anago Cleaning Systems Inc. U.S., CleanNet U.S. Inc. U.S., Chem-Dry Harris Research Inc. U.S., Pritchard Industries Inc. U.S., Helpling Germany, AEON Delight Japan, Mitie Group PLC UK, Maclean Services Sdn Bhd Malaysia, CleanHero M Sdn Bhd Malaysia, Atalian Global Services S.A.S. France, Urban Company UrbanClap India, AKS Facilities India.

Global Cleaning Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 447.2 billion

- 2026 Market Size: USD 480.2 billion

- Projected Market Size: USD 850.2 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, Canada

- Emerging Countries: China, India, South Korea, Australia, Singapore

Last updated on : 5 February, 2026

Cleaning Services Market - Growth Drivers and Challenges

Growth Drivers

- Post-pandemic hygiene awareness: Businesses and households are prioritizing health and safety compliance, leading to recurring service contracts, which are bolstering the market’s adoption. On the other hand, cleanliness has become a core expectation across industries such as hospitality, healthcare, and education, which is also driving consistent revenue in this sector. Based on the UK government data, its National Standards of Healthcare Cleanliness 2025, published by NHS England in February 2025, stated that it set out mandatory and recommended requirements for cleaning across all of the NHS healthcare settings by replacing the 2021 standards. Besides these standards, leverage collaboration between clinical and non-clinical staff, transparency through star ratings, and compliance with legal and infection prevention requirements. Furthermore, they apply to all NHS trusts, such as ambulance facilities, and are designed to support governance and continuous improvement, thus benefiting the market growth across government sectors.

- Technological improvements: Automation and robotics play a key role in reshaping the growth dynamics of the cleaning services market since they are being deployed to address labor shortages and improve efficiency. Also, the smart cleaning equipment allows providers to scale operations while maintaining quality, which attracts both consumers and investors to operate in this field. For instance, in May 2025, Pudu Robotics announced that it had launched an AI-based autonomous cleaning robot called CC1 pro, which is especially designed for large commercial environments. This CC1 pro has been built on the original CC1 with advanced AI that enables real-time dirt detection, adaptive cleaning strategies, and automated re-cleaning. The presence of such ongoing developments by the national & international players is creating optimistic opportunities for the market’s progression in the years ahead.

- Commercial sector expansion: Growth in terms of office spaces, retail outlets, and healthcare facilities is efficiently fueling demand for professional services. Simultaneously, the facility management outsourcing is rising, driving growth in the market. Government-backed data from the Ministry of Housing & Urban Affairs, which was published in December 2024 the Smart Cities Mission has successfully transformed 100 cities in India with sustainable infrastructure and technology-based solutions. It also notes that around 91% of projects were completed with an investment of ₹1.47 lakh crore (approximately USD 17.7 billion), delivering smart roads, classrooms, water systems, and solid waste management improvements by December 2024. Therefore, this expansion of urban infrastructure and facilities directly boosts demand for outsourced services, which is a core part of facility management contracts.

Challenges

- Labor shortages and workforce retention: The cleaning services market faces a major challenge in terms of labor shortages owing to the high turnover rates, low wages, and physically demanding work. Therefore, most of the cleaning companies find it difficult to attract workers since it is seen as low-skilled. Retaining experienced staff is also a major hurdle, especially with aging workforces in management and training roles. In addition, the aspect of cultural and language diversity adds another layer of complexity, as effective communication and consistent quality standards are harder to maintain. Furthermore, companies are making investments in terms of training, incentives, and technology to attract and retain talent, yet competition from other service sectors and rising labor costs continue to strain operations.

- Quality standards and regulatory compliance: Maintaining consistent quality is yet another critical challenge in the market, especially for companies that are operating across multiple regions or internationally. Clients expect high hygiene standards, particularly in healthcare, foodservice, and industrial sectors, whereas regulations continue to evolve regarding chemical use, waste disposal, and workplace safety. Therefore, companies in this field need to implement monitoring systems and document compliance, which increases operational complexity, wherein failing to meet standards can lead to legal penalties. Meanwhile, to address this, players are focusing on digital platforms, but integrating these solutions across teams and client sites is again resource-intensive and requires ample investment in technology and human capital.

Cleaning Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 447.2 billion |

|

Forecast Year Market Size (2035) |

USD 850.2 billion |

|

Regional Scope |

|

Cleaning Services Market Segmentation:

Service Type Segment Analysis

In the cleaning services market, floor care is expected to be the largest service sub-segment with a share of 38.6% due to the universal and frequent need for floor maintenance across commercial, residential, and institutional environments. Also, hard surfaces require routine cleaning for safety and appearance, keeping demand very strong during the forecast duration. In this context, Hindustan Unilever Limited in December 2024 announced that it has launched the Vim Ultrapro floor cleaner, which has an advanced Ultrapro technology that penetrates deep into stains for 100% removal. The product combines science and nature to deliver superior cleaning with long-lasting spa-like fragrances. Furthermore, such instances effectively strengthen premium product penetration in the floor care subtype, driving category value through innovation-led differentiation.

Application Segment Analysis

The commercial cleaning is anticipated to command a considerable share of the cleaning services market since businesses, healthcare facilities, schools, and other institutions require professional sanitation to meet regulatory and workplace health standards. Besides the commercial cleaning consists of a wide range of essential services such as trash removal, disinfecting, floor care, window cleaning, and others that are systematically contracted out to ensure safe environments. In October 2025, Imperial College London reported that it had appointed Mitie as its new cleaning services provider under a 5-year contract, which is beginning in February 2026. It is set to cover 37 room types across the South Kensington campus. The agreement replaces Bidvest Noonan and introduces advanced equipment, ICT systems, and a people-first approach, thereby denoting a huge growth opportunity for the sub-segment during the discussed timeframe.

Mode Segment Analysis

By the conclusion of 2035, the contractual services based on mode are expected to gain a significant share in the cleaning services market. The growth of the subtype is mainly propelled by ongoing outsourced contracts that offer recurring revenue, stable hygiene compliance, and integration with facility management systems. Simultaneously business across the world are opting for routine maintenance by professional providers to ensure consistent cleanliness and meet regulatory standards. Moreover, these contractual agreements also support the adoption of tech and automation, such as sensors, reporting dashboards, and robotics, which improve long-term service quality and efficiency, making them more attractive when compared to standalone one-off projects. Thus, the presence of all of these factors positions the subtype as a core revenue driver in the cleaning services industry.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Service Type |

|

|

Application |

|

|

Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cleaning Services Market - Regional Analysis

North America Market Insights

The North America cleaning services market is anticipated to hold the largest share of 35.9% by the end of 2035. The market’s upliftment in the region is mainly attributed to improvements in cleaning technologies coupled with a stronger focus on sustainability. Most of the corporate facilities in the region are outsourcing cleaning to specialized providers to enhance operational efficiency, whereas consistent growth in the hospitality sector and rising consumer expectations for cleanliness have boosted the need for professional cleaning solutions. In this context, iRobot made its largest-ever product launch in March 2025 with a new suite of advanced Roomba floor cleaning robots featuring higher suction, AI-based navigation, and enhanced mopping capabilities. The lineup includes innovative technologies such as DustCompactor, PrecisionVision AI, and AutoWash docks, thereby offering greater automation and convenience, hence benefiting the overall market growth.

The U.S. cleaning services market is showcasing tremendous growth owing to the heightened hygiene awareness and the effect of the COVID-19 pandemic. Government support, such as local grants for small cleaning businesses, competitive pay, and the rising adoption of eco-friendly cleaning practices, is also efficiently boosting the market development in the country. In this context, the U.S. EPA finalized updates to the Safer Choice and Design for the Environment (DfE) Standard in August 2024, thereby strengthening criteria for safer chemical ingredients in cleaners, detergents, and disinfectants to help consumers identify sustainable options without any compromise on performance. It also mentioned the key changes, which include a new certification for cleaning service providers, bans on PFAS in packaging, enhanced sustainable packaging with recycled content, do not flush labels on wipes, and optional energy efficiency incentives, hence driving innovation in safer products.

Government-Backed Employment and Wage Profiles for Janitors and Cleaners in Leading States, 2022

|

State |

Employment |

Employment per Thousand Jobs |

Location Quotient |

Hourly Mean Wage (USD) |

Annual Mean Wage (USD) |

|

California |

246,850 |

14.00 |

0.96 |

18.95 |

39,420 |

|

New York |

188,270 |

20.67 |

1.42 |

19.63 |

40,830 |

|

Texas |

176,800 |

13.61 |

0.94 |

13.82 |

28,740 |

|

Florida |

124,950 |

13.57 |

0.93 |

14.01 |

29,150 |

|

Illinois |

93,150 |

15.83 |

1.09 |

17.01 |

35,380 |

Source: U.S. Bureau of Labor Statistics

There is a huge opportunity for Canada market due to strong government backing, increased demand for sanitation, and the adoption of professional cleaning services. Increasing adoption is witnessed in commercial, residential, and institutional sectors in cities such as Toronto, Vancouver, and Montreal. In this context, the Correctional Service of Canada has issued a request for proposal (RFP 21120-26-5105955) for cleaning services at its Regional Treatment Centers in Bath and Millhaven, Ontario, which runs from April 2026 to March 2027 and has potential renewals. It also stated that this contract requires 7-day-per-week housekeeping to maintain sanitary and hygienic conditions in healthcare facilities for offenders, supporting CSC’s compliance with Health Canada and Accreditation Canada standards. Moreover, the solicitation is open to suppliers in the country, which includes indigenous businesses under the procurement strategy for indigenous business, and follows multiple trade agreements such as CFTA, CETA, and CPTPP, hence bolstering market growth in the upcoming years.

APAC Market Insights

The Asia Pacific cleaning services market is expected to represent consistent growth owing to the heightened demand for cleaning services fueled by rapid urbanization, industrial expansion, and growing public health awareness. Simultaneously, government initiatives across China, Japan, and India’s Swachh Bharat Abhiyan strongly emphasized the role of professional cleaning services, driving increased adoption in this field. In this context, in January 2026, the Japan Organization of Occupational Health and Safety issued a government procurement notice for building cleaning services at Akita Rosai Hospital, covering the time period from April 2026 to March 2029. It also mentioned that eligible suppliers must meet the qualifications that are set by the Ministry of Health, Labor and Welfare, which include prior experience and service grades in the Tohoku. Therefore, this multi-year contract highlights ongoing demand for professional cleaning services in institutional and healthcare settings in this region.

China cleaning services market is progressing on account of a rise in disposable income, government backing, and a structural shift from labor-intensive to tech-driven solutions such as commercial floor care, specialized disinfection, and smart, automated cleaning solutions. The country witnessed increased use of cleaning robots and AI-based, automated equipment, which is boosting efficiency in terms of services. Testifying this in April 2024, the Changchun Luyuan Economic Development Zone Management Committee issued a negotiation announcement for a 2024-2025 cleaning service project, which invites eligible suppliers to provide cleaning of domestic and construction waste, daily maintenance of park roads, and Fuxing Park within the zone. Besides, the procurement was conducted through the government procurement cloud platform, with a one-year contract and the possibility of renewal as well. Hence, such a project stimulates market growth, thereby creating a steady demand for professional cleaning services and encouraging the domestic service providers.

The cleaning services market in India is undergoing significant transformations owing to the rapid urbanization, expansion in terms of commercial and residential infrastructure, and awareness of hygiene and sanitation. Also, government initiatives and campaigns promoting cleanliness are an asset for the country’s market, thereby supporting extensive expansion. As per an article published by the PIB government of India in September 2024, Swachh Bharat Mission (SBM) has revolutionized India's sanitation, achieving ODF status through over 100 million toilets in rural areas during Phase I and advancing waste management in Phase II (2019-2025). Simultaneously, the urban efforts under SBM-U built 63 lakh households and 6.3 lakh public toilets by September 2024, whereas the rural progress includes 587,000 ODF Plus villages with solid/liquid waste systems and is successfully backed by Rs. 1.40 lakh crore (USD 16.87 billion) investment. Furthermore, the Swachhata Hi Seva 2024 campaign emphasizes sustained cleanliness with a prime focus on permanent hygiene nationwide.

Europe Market Insights

Europe cleaning services market has aquired prominent position in the worldwide landscape, which is primarily fueled by strict hygiene regulations, such as the hygiene of foodstuffs regulation have increased demand in food processing plants, healthcare facilities, and public spaces. In addition, the mutually profitable collaborations between players, acquisitions, and rising interest in eco-friendly cleaning, spurred by initiatives such as the European Green Deal, are also supporting market expansion. In August 2025, zvoove, a leading software and AI provider for staffing, security, and cleaning industries, announced that it had acquired CleanManager to expand into the Scandinavian and UK markets. Therefore, the acquisition strengthens Zvoove’s digital platform, complementing its existing tools such as fortytools in Germany, and supports AI-driven innovation in cleaning operations, hence denoting a positive market outlook.

Germany cleaning services market is making a shift from labor-intensive to technology-based solutions, wherein there is a strong demand in commercial, manufacturing, and transportation sectors for hygiene-focused cleaning services. The country is witnessing a strong trend toward sustainability, cleanliness campaigns, and automation, which is shaping the market upliftment. In January 2026, the official data from Berlin District Center reported that Berlin-Mitte's Mittemachtsauber 2025 campaign successfully boosted cleanliness through civil society clean-ups, educational events, and district office actions at sites such as Alexanderplatz, Soldiner Kiez, and Weinbergspark. Besides, 31 BSR neighborhood days collected 228 tons of bulky waste and 25 tons of reusables from 15,000 visitors, a waste festival at Leopoldplatz for 1,500 attendees, school competitions, a second waste summit, expanded bulky waste collections, CSD prevention measures, and a garbage task force issuing fines. Furthermore, the campaign continues in 2026 with citizen-administration collaboration to sustain neighborhood livability, thus denoting a positive impact on the market’s expansion.

The UK cleaning services market is also significantly growing as businesses and households are strongly prioritizing hygiene and maintenance. There has been a growth of offices, retail spaces, and healthcare facilities, increasing the commercial demand in this sector, whereas residential cleaning services see steady uptake from households. In addition, innovation is also efficiently shaping the country’s market, as digital tools, smart cleaning devices, and automation improve service quality. NHS Shared Business Services in November 2024 reported that it has launched three agreement frameworks for linen and laundry, grounds maintenance, and security services, with a main focus on streamlining soft facilities management across NHS estates. It also notes that these agreements provide pre-approved suppliers, which include SMEs, by ensuring efficient, safe, and sustainable operations while supporting NHS hygiene goals. These initiatives simplify procurement and promote environmentally conscious services, thereby highlight growing demand for professional cleaning and facilities services in the UK healthcare sector.

Key Cleaning Services Market Players:

- ABM Industries Incorporated (U.S.)

- ISS A/S (Denmark)

- ServiceMaster Global Holdings, Inc. (U.S.)

- Sodexo S.A. (France)

- Compass Group PLC (UK)

- Aramark Corporation (U.S.)

- Jani‑King International, Inc. (U.S.)

- Stanley Steemer International, Inc. (U.S.)

- Anago Cleaning Systems, Inc. (U.S.)

- CleanNet U.S., Inc. (U.S.)

- Chem‑Dry (Harris Research, Inc.) (U.S.)

- Pritchard Industries, Inc. (U.S.)

- Helpling (Germany)

- AEON Delight (Japan)

- Mitie Group PLC (UK)

- Maclean Services Sdn Bhd (Malaysia)

- CleanHero (M) Sdn Bhd (Malaysia)

- Atalian Global Services S.A.S. (France)

- Urban Company (UrbanClap) (India)

- AKS Facilities (India)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABM Industries Incorporated is identified as the leader in facility management and cleaning services, which operates across multiple sectors, such as commercial, aviation, healthcare, and education. The company makes a differentiation through integrated facility solutions by combining cleaning with maintenance, energy management, and technical services, hence strengthening its footprint across North America and select international markets.

- ISS A/S is yet another major facility services powerhouse that has a strong presence in Europe, Asia, and the Americas. The company is mainly focused on innovation, especially in terms of technology-driven solutions, i.e., automated cleaning systems and data analytics for resource optimization. Furthermore, ISS is also prioritizing sustainability, workforce training, and compliance with international quality standards, which are allowing it to maintain very strong client relationships.

- ServiceMaster Global Holdings, Inc. is one of the best-known firms for its cleaning brands, such as Merry Maids and ServiceMaster Clean. The firm specializes in terms of residential and commercial cleaning, disaster restoration, and specialty cleaning services. In addition, ServiceMaster is making extensive investments in employee training, eco-friendly cleaning practices, and technically advanced equipment to improve efficiency.

- Sodexo S.A. is a central player in this field, which is serving corporate offices, healthcare, schools, as well as remote sites. The company’s competitive advantage concentrates around aspects of international scale, strong operational processes, and sustainable cleaning practices. Moreover, by combining cleaning with holistic facility services, Sodexo strengthens client retention and creates value in the extremely competitive markets.

- Compass Group PLC is a multinational foodservice and support services provider that has a significant footprint in both of the commercial and industrial cleaning. On the other hand, its cleaning services are often bundled with catering, workplace support, and facilities management, thereby offering integrated solutions for clients. Profitable partnerships and acquisitions further readily enhance its market presence in the cleaning services sector.

Below is the list of some prominent players operating in the global market:

The international market is extremely competitive, fragmented, and is dominated by both facility management and contract cleaning firms. These firms benefit from extensive geographic reach and diversified service offerings. Companies such as ISS A/S, ABM Industries, Sodexo, and Compass Group mostly focus on long-term contracts across commercial, industrial, and institutional sectors, sometimes bundling cleaning with broader facilities services. Leading players in this sector are mostly concentrating on technology adoption, sustainability, and automation, implementing green cleaning solutions and digital platforms for efficient service delivery. In November 2025, FacilityApps and Cleaning Workx together reported that they had formed a strategic joint venture to expand their digital solutions for the cleaning industry in the Netherlands and internationally. In addition, the collaboration combines FacilityApps’ software expertise with Cleaning Workx’s virtual reality training, thereby addressing challenges such as labor shortages, language barriers, rising costs, and quality demands.

Corporate Landscape of the Cleaning Services Market:

Recent Developments

- In August 2025 Taskrabbit, TaskRabbit announced that it is available in all 50 states in the U.S., followed by a major expansion, thereby bringing its home cleaning services to a larger number of households and creating encouraging work opportunities.

- In June 2025, the Riverside Company announced that it had acquired Maid Brigade, which is a residential cleaning franchisor, integrating it into its Evive Brands portfolio, now making five service-focused brands across nearly 1,000 U.S. and Canadian franchise territories.

- Report ID: 6069

- Published Date: Feb 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cleaning Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.