Equity Management Software Market Outlook:

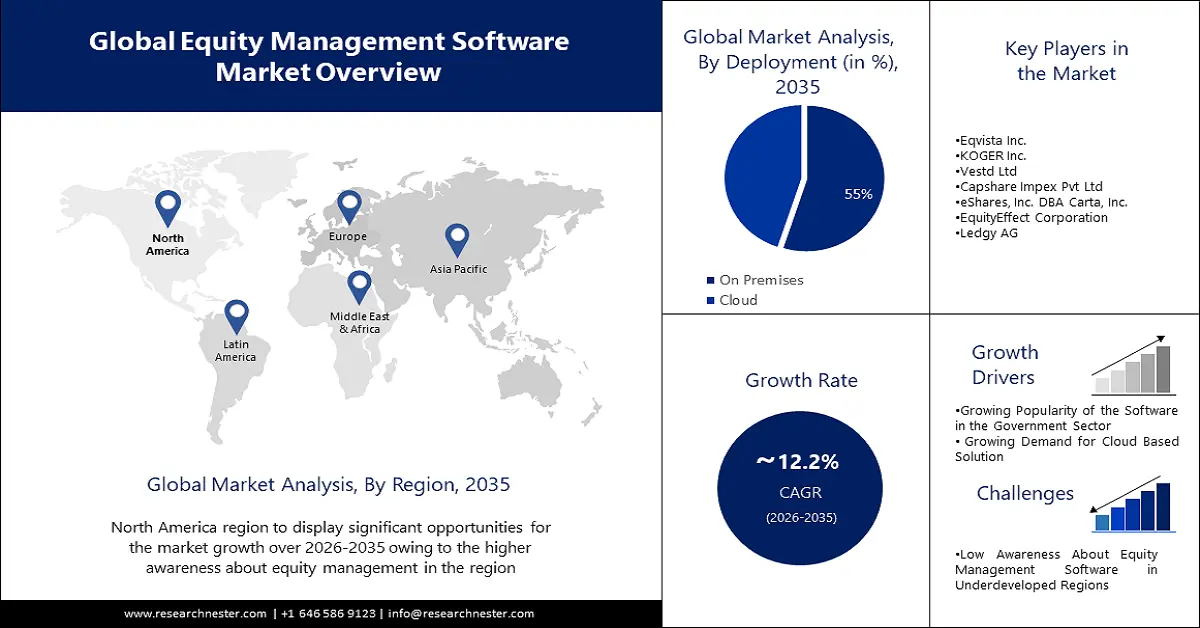

Equity Management Software Market size was over USD 823.2 million in 2025 and is projected to reach USD 2.6 billion by 2035, growing at around 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of equity management software is evaluated at USD 913.59 million.

The growth of this market is driven by the growing demand for equity management software in the administration department. It has been observed that the demand for this product have been seem to increase in large-scale organizations as they offer effectiveness to them. According to a poll, 87% of businesses are either contemplating using digital solutions to administer their equity compensation plans or have already done so.

Governments are managing their equity compensation schemes with Equity Management Software, which can help assure fairness, transparency, and compliance. According to a survey, 41% of respondents from the public sector were already utilizing Equity Management Software, and 35% planned to do so within the next 12 months.

Key Equity Management Software Market Insights Summary:

Regional Highlights:

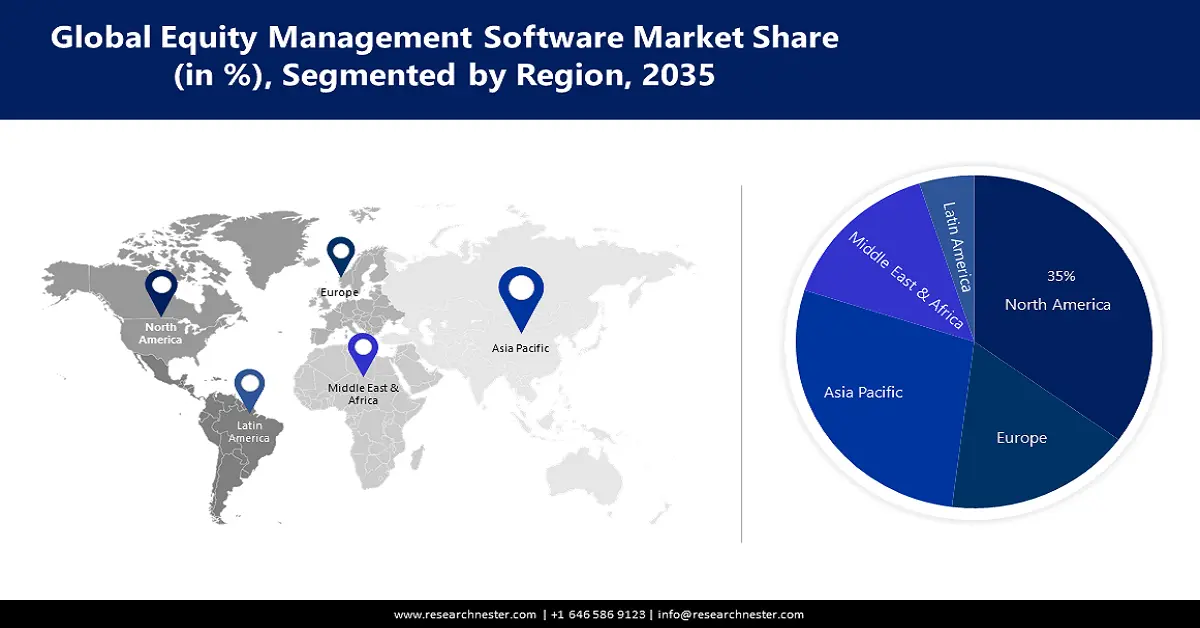

- North America equity management software market achieves the highest revenue by 2035, attributed to high awareness of equity management benefits and strong government adoption.

Segment Insights:

- The on-premise segment in the equity management software market is expected to achieve a dominant share by 2035, fueled by demand for customized and secure equity management software solutions.

- The start-ups segment in the equity management software market is anticipated to experience significant growth during 2026-2035, driven by the rising trend of startup formation and increased venture capital investment.

Key Growth Trends:

- Increasing Focus on Employment Engagement

- Growing Demand for Real-Time Analytics

Major Challenges:

- Increasing Focus on Employment Engagement

- Growing Demand for Real-Time Analytics

Key Players: Certent, Inc., Eqvista Inc., KOGER Inc., Vestd Ltd, Capshare Impex Pvt Ltd, eShares, Inc. DBA Carta, Inc., EquityEffect Corporation, Ledgy AG, Gust Equity Management, Capdesk ApS, eShares, Inc. DBA Carta, Inc., Insight software.

Global Equity Management Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 823.2 million

- 2026 Market Size: USD 913.59 million

- Projected Market Size: USD 2.6 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, India

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 9 September, 2025

Equity Management Software Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Focus on Employment Engagement - Employee engagement and retention can be enhanced with equity management software that offers a user-friendly interface and simple access to their equity pay programs. Software for equity management can enable firms and their employees to communicate openly, which can increase engagement and trust. Employees can access their equity compensation plans and monitor their advancement in real-time, which can increase their sense of belonging to the business.

- Growing Demand for Real-Time Analytics - Real-time data analytics and insights provided by equity management software are gaining popularity. This is so that businesses can improve their equity compensation programs and make better-informed judgments.

- Rising Adoption of Cloud-based Systems - The adoption of cloud-based inventory management solutions is increasing owing to their cost-effectiveness, flexibility, and scalability. According to one report, 78% of large-scale organization makers say cloud-based technology in equity management solutions has improved their organization's agility.

- Rising Shift towards Digitalization and Technological Advancement – Day by day the world is shifting towards digitalization, as businesses are growing and every day some or other technologies are being invented worldwide, thus, increasing technological advancement in software is making it easy to handle the complex equity structure in an efficient easy way. Equity management software has developed in recent times with the adoption of new techs such as equity plan self-administration, simplified compliance, investor and employee access, secured cap table management, and others.

Challenges

- Complexity in Equity Management Software - Equity management involves a complex range of tasks such as managing equity plans, financial reporting, tax compliance, and communicating with stakeholders. These tasks can be time-consuming and require a high degree of expertise. As a result, businesses can struggle to find the right stock management software that meets their specific needs.

- Data Security Concern

- Less Awareness About Equity Management Software in Underdeveloped Economies

Equity Management Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 823.2 million |

|

Forecast Year Market Size (2035) |

USD 2.6 billion |

|

Regional Scope |

|

Equity Management Software Market Segmentation:

Application Segment Analysis

Based on application, the start-ups segment in the equity management software market is anticipated to observe significant growth by the end of 2035. The growing trend of creating startups and retaining transparent stock management among investors, owners, and enterprises in order to emphasize the key business idea and expand the business are major factors in this segment. Global venture capital investment in startups reached a record USD 643 billion in 2021 from USD 335 billion in 2020, according to the report. As startups raise more capital, the need for equity management software solutions is growing. Management plans for stock options and other stock compensation are also on the rise leading to the segment’s growth.

Deployment Segment Analysis

In terms of deployment, the on-premise segment is expected to dominate the equity management software market throughout the forecast period. One of the key benefits is that companies have greater control and customization options. One can customize the software to your specific needs and have complete control over your data and security. The expansion of this segment is driven by the demand for customized and secure equity management software solutions, especially in industries such as finance, healthcare, and government that require strict regulatory compliance.

Our in-depth analysis of the global equity management software market includes the following segments:

|

Equity Type |

|

|

Application |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Equity Management Software Market Regional Analysis:

APAC Market Insights

The equity management software market in Asia Pacific is predicted to experience noteworthy growth over the estimated period. This can be attributed to the increasing adoption of cloud-based solutions, and the emergence of IoT in the region, especially in China and India. China’s total spending on cloud infrastructure was valued at around USD 10 billion in 2019, which increased to USD 20 billion in the year 2020. In addition, an increasing number of small and medium-sized enterprises that are implementing Equity Management Software are also assumed to propel the market value in the region in the coming years.

North American Market Insights

The North America equity management software market is estimated to experience the highest revenue during the projected timeframe. Regional growth can be ascribed to the high awareness of the benefits of equity management and the growing usage of software in the government sector of the region. Besides this growth can also be attributed to considering the excellent financial potential of the region that allows companies and authorities to invest in such new technologies and software that make the business work more efficiently with ease and at the same time is beneficial for financial expansion.

Equity Management Software Market Players:

- Certent, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eqvista Inc.

- KOGER Inc.

- Vestd Ltd

- Capshare Impex Pvt Ltd

- eShares, Inc. DBA Carta, Inc.

- EquityEffect Corporation

- Ledgy AG

- Gust Equity Management

- Capdesk ApS

- eShares, Inc. DBA Carta, Inc.

- Insight software

Recent Developments

- eShares, Inc. DBA Carta, Inc., announced that it has launched its mobile application ‘Carta Carry’ which would allow venture fund investors to initiate fund administration tasks on the go, and further track the progress of these tasks.

- Insight Software announced that it has acquired Certent, Inc. to expand its portfolio of financial disclosure management and equity management services.

- Report ID: 3867

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Equity Management Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.