Environment Controllers Market Outlook:

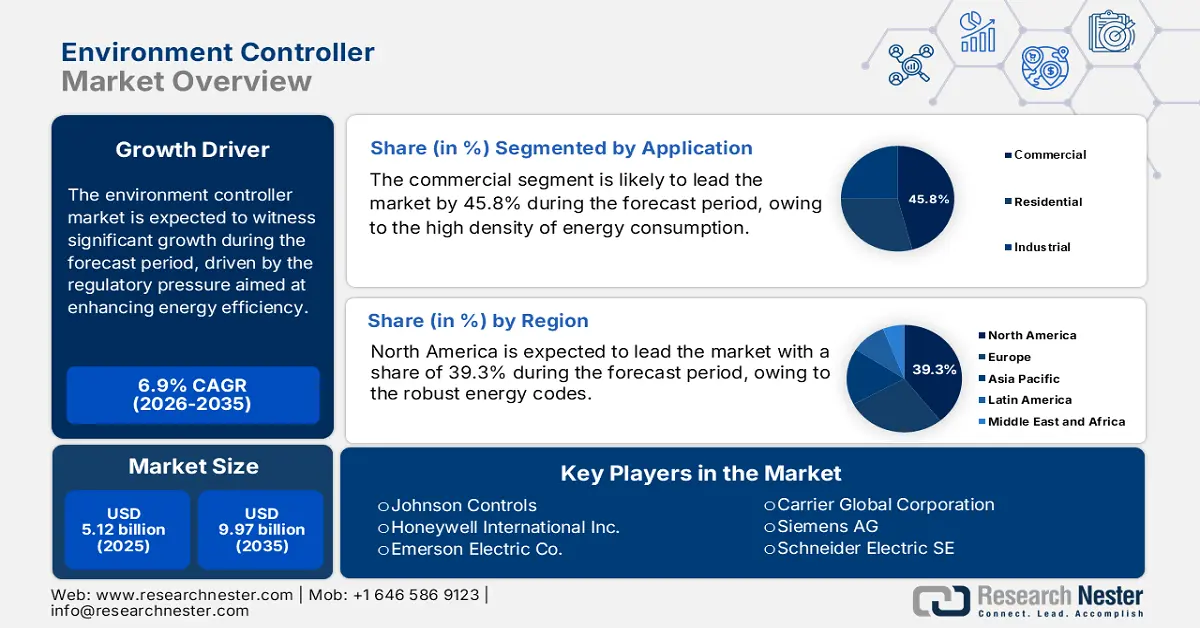

Environment Controllers Market size was valued at USD 5.12 billion in 2025 and is projected to reach USD 9.97 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the environment controllers is estimated at USD 5.47 billion.

The primary growth driver for the environment controllers market is regulatory pressure aimed at enhancing energy efficiency and reducing greenhouse gas emissions from the built environment. Government mandates are creating a non-discretionary demand for the advanced building management and control systems. The U.S. Department of Energy report in August 2023 notes that buildings account for approximately 74% of the nation’s electricity use and 35% of its total primary energy use. In response, federal and state energy codes are becoming increasingly robust, compelling building owners and operators to invest in advanced control systems for HVAC, lighting, and overall building automation to comply. This regulatory push is amplified by initiatives such as the Federal Building Management Plan, which mandates the performance improvement for federal facilities, creating a substantial policy-driven market for environmental control in federal facilities, resulting a verifiable energy savings.

The market’s supply chain is vulnerable to fluctuations in raw material costs, particularly for semiconductors, metals, and specialized components. The U.S. imported USD 591,677 million of electronic products in 2023 from China, Mexico, Taiwan, Vietnam, and other countries, as per the data from USITC 2023. In response, there is a strategic trend toward nearshoring and expanding domestic manufacturing capacity to reduce the supply chain risks. This reliance increases the exposure to trade disruptions, pricing volatility, and logistics delays. Federal initiatives supporting semiconductor and electronics manufacturing are further reinforcing this transition by encouraging localized component fabrication, assembly operations, and strategic inventory management. Further, these measures aim to reduce the supply chain risks while boosting the long-term production resilience and operational continuity.

Electronic Products: U.S. General Imports by Selected Trading Partners

|

Year |

Imports Value |

|

2019 |

483,429 |

|

2020 |

482,606 |

|

2021 |

570,630 |

|

2022 |

629,432 |

|

2023 |

591,677 |

Source: USITC 2023

Key Environment Controller Market Insights Summary:

Regional Insights:

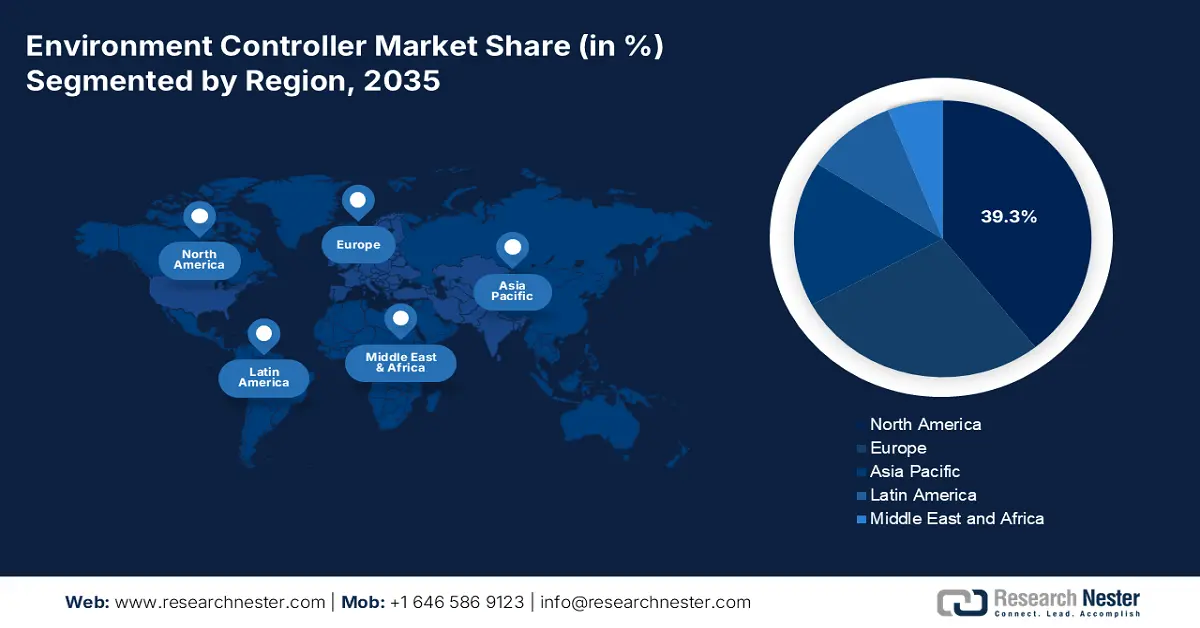

- By 2035, North America is expected to command a 39.3% share of the environment controller market, upheld by robust energy codes and the modernization of aging building stock owing to stringent governmental efficiency standards.

- By 2035, Asia Pacific is anticipated to be the fastest-expanding region with a 2026–2035 CAGR of 9.2%, supported by massive urban construction and stringent new energy policies propelled by rapid industrial automation.

Segment Insights:

- By 2035, the commercial segment in the environment controller market is set to capture a 45.8% share, reinforced by high energy-consumption density and strong economic incentives to reduce operational expenditures via advanced environmental controls.

- By 2035, the software sub-segment is expected to dominate applications, supported by the adoption of IoT-enabled building management platforms and cloud-based optimization systems stimulated by regulatory pressure for higher energy efficiency.

Key Growth Trends:

- Government decarbonization programs

- Spending by the public sector on smart building

Major Challenges:

- High R&D investment and technological complexity

- Intense competition from established incumbents

Key Players: Honeywell International Inc. (U.S.), Emerson Electric Co. (U.S.), Carrier Global Corporation (U.S.), Siemens AG (Germany), Schneider Electric SE (France), Danfoss A/S (Denmark), Legrand S.A. (France), Belimo Holding AG (Switzerland), Mitsubishi Electric Corporation (Japan), Daikin Industries, Ltd. (Japan), Fujitsu General (Japan), LG Electronics (South Korea), Samsung Electronics (South Korea), Seeley International (Australia), Blue Star Limited (India), Green Ocean Corporation Berhad (Malaysia), Trane Technologies plc (Ireland), Lennox International Inc. (U.S.), Delta Controls (Canada).

Global Environment Controller Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.12 billion

- 2026 Market Size: USD 5.47 billion

- Projected Market Size: USD 9.97 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, United Arab Emirates

Last updated on : 2 December, 2025

Environment Controllers Market - Growth Drivers and Challenges

Growth Drivers

- Government decarbonization programs: Government climate targets are actively increasing the investment in digital energy management and automated environment control systems. The U.S. Federal Building Performance Standard requires agencies to minimize the energy use intensity and emissions in federal buildings, driving the procurement of advanced control platforms. The European Heat Pump Association data in February 2024 states that the EU’s Fit for 55 package mandates a minimum of 49% reduction in building emissions by 2030, requiring a large-scale deployment of smart controllers, integrated HVAC automation, and renewable-ready building infrastructure. Countries such as Japan and South Korea are also increasing the public sector spending on carbon reduction technologies to align with the nation's net-zero plans. This results in the global market demand, which is increasingly tied to national climate budgets and government-led retrofitting programs, with Europe projected to see strong capital deployment through 2030.

- Spending by the public sector on smart building: Public sector modernization programs are driving the rapid expansion in the integration of building automation and environmental control systems. The U.S. General Services Administration manages one of the world's largest building portfolios and has allocated billions under the Inflation Reduction Act for energy upgrades, automation layers, and advanced building controls. The U.S. GSA report in August 2023 depicts that GSA has received USD 3.4 billion for low-emission building technologies, HVAC automation, and energy management infrastructure. Similarly, the EU’s Recovery and Resilience Facility supports digital building retrofits across the member states, creating a strong pipeline for control system procurement. These initiatives create a predictable, multi-year government demand, boosting the supplier revenues and manufacturing stability.

- Incentives for domestic manufacturing and semiconductor supply security: The global semiconductor dependence significantly impacts the costs and lead times for environment controllers. The governments are responding with manufacturing incentives focused on strengthening the supply resilience. The Israel Public Policy Institute data in May 2025 depicts that the U.S. CHIPS and Science Act allocates USD 52.7 billion to expand the domestic semiconductor foundries supporting sensor, microcontroller, and connectivity module production, critical to environmental control systems. Further, the European Chips Act adds €43 billion to expand the production capacity. These investments minimize the supply chain risks and stabilize the pricing for downstream environment controller manufacturers.

Challenges

- High R&D investment and technological complexity: Developing an environment controller requires a huge amount of investment in R&D for hardware durability, software algorithms, and IoT connectivity. The need for supporting multiple communication protocols, like BACnet, Modbus, and LoRaWAN, adds layers of complexity and cost. As an example, Johnson Controls invests a substantial amount in R&D to advance its OpenBlue platform, which is a barrier that few new entrants can hope to match. In other words, the continuous innovation cycle that is significant yet financially draining works to the advantage of established players who are usually well-endowed with deep pockets and existing patent portfolios that stifle competition from innovative startups.

- Intense competition from established incumbents: The market is dominated by the giants such as Siemens, Schneider Electric, and Honeywell, who have deep-rooted relationships, tried and tested portfolios that are low risk for specifiers. For example, Honeywell’s brand recognition and long-term service contracts make it the default choice for many top players in the market, creating a significant incumbency advantage that locks out the newcomers who cannot demonstrate a substantial proven performance differential.

Environment Controllers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

5.12 billion |

|

Forecast Year Market Size (2035) |

9.97 billion |

|

Regional Scope |

|

Environment Controllers Market Segmentation:

Application Segment Analysis

Under the application segment, the commercial is leading the segment in the environment controllers market and is poised to hold the share value of 45.8% by 2035. The segment is driven by the high density of energy consumption and strong economic incentives to reduce operational expenditures via advanced environmental controls. Following the COVID-19 pandemic, a major additional driver has emerged, such as the vital need the monitor and ensure superior Indoor Environmental Quality, including the ventilation rates and air purity to safeguard occupant health and meet new wellness standards. The scale of this market is evident U.S. Census data in February 2024, which showed that the value of the construction put in place reached USD 1,978.7 billion, with a significant portion of new builds incorporating smart controls from the outset.

Component Segment Analysis

By 2035, the software is expected to be the dominant sub-segment as it forms the intelligence layer that transforms the raw data from the hardware into actionable insights and automated control. This shift towards IoT-enabled building management systems and cloud-based platforms is surging this trend, allowing for predictive maintenance, fault detection, and real-time optimization of energy use across building portfolios. A primary driver is the regulatory push for energy efficiency; for instance, the software is critical for complying with modern energy codes. The U.S. government highlights this focus with the Department of Energy reporting that the building energy management software and services were a key part of achieving a reduction in site energy use in the connected commercial building, highlighting its immediate financial and sustainability impact.

System Segment Analysis

Building management systems are forecasted to lead the system segment as they provide the essential integrated platform that unifies all other subsystems, such as the HVAC, lighting, security, and fire, into a single and manageable interface. The primary driver is the compelling return on investment from the centralized energy management, mainly in large commercial and industrial facilities where energy costs are a major operational expense. The push for net-zero buildings and the need to meet the robust environmental, social, and governance criteria further propels the adoption of the BMS. The critical role of the control system is highlighted by the U.S. Department of Energy report in April 2024, which shows that the commercial building consumed 17.6 quadrillion British thermal units of energy in 2022, representing a massive opportunity for savings via optimized BMS control, hence making it a top investment priority.

Our in-depth analysis of the environment controllers market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

System |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Environment Controller Industry - Regional Synopsis

North America Market Insights

North America is dominating the environment controllers market and is expected to hold the revenue share of 39.3% by 2035. The market is driven by the robust energy codes and modernization of the existing building stock. The key drivers of the market are the U.S. Department of Energy’s building efficiency standards and Canada’s Greening Government Strategy, mandating net-zero carbon federal buildings. The trend is shifting from hardware to integrated cloud-based Building Management Systems that enable predictive maintenance and grid interactivity. Investments are focused on retrofitting commercial real estate and improving the grid resilience with significant spending on IoT-enabled controls to meet the federal and corporate sustainability targets, ensuring a steady market growth.

The U.S. environment controllers market is primarily driven by the regulatory mandates and the strategic shift towards Grid-Interactive Efficient Buildings. In this regard, the U.S Department of Energy funds technologies that enable buildings to dynamically manage energy utilization. Further, in June 2023, the U.S. Energy Information Administration estimates that the total energy consumption in commercial buildings was nearly 6,787 trillion British thermal units, highlighting a massive savings potential via advanced controls. This driver, together with tax incentives from the Inflation Reduction Act, is fueling sustained demand for smart interoperable control systems that can assure verifiable energy savings along with grid services. Being increasingly crucial for managing the growing load due to building electrification, these systems are giving prime importance to the development of controllers with strong demand response capability and seamless integration with utility programs in order to tap into this growing market segment.

Major Fuel Consumption by the End use in the U.S. Commercial Building

|

End use |

Percentage |

|

Space Heating |

32 |

|

Other |

16 |

|

Ventilation |

11 |

|

Lighting |

10 |

|

Cooling |

9 |

|

Cooking |

7 |

|

Refrigeration |

5 |

|

Water Heating |

5 |

|

Computing |

4 |

|

Office Equipment |

1 |

Source: EIA June 2023

The Canada environment controllers market is characterized by its focus on deep decarbonization and resilience in a harsh climate. The federal government’s Greening Government Strategy, which targets net-zero carbon federal buildings, is a key driver pushing the adoption of all-electric systems and advanced building management systems. This policy direction is aided by the tangible investment. For example, the Government of Canada data in January 2025 depicts that in 2022, the Federal Budget committed USD 150 million to the Canada Green Buildings Strategy to spur the market transformation. This building, alongside robust provincial building codes, creates a stable policy-driven market for high-performance environment controllers capable of managing the complex heat pump and HVAC systems for both efficiency and extreme weather adaptation.

APAC Market Insights

Asia Pacific is the fastest growing environment controllers market and is projected to grow at a CAGR of 9.2% during the forecast period 2026 to 2035. The market is driven by the massive urban construction, the stringent new government energy policy, and rapid industrial automation. China’s push for the Dual Carbon goals is mandating smarter building controls, while India’s ambitious green building certification system, GRIHA, and its Smart Cities Mission are creating sustained demand. The key trend is the leapfrogging to cloud-based and IoT solutions, mainly in India and China, where developers are integrating smart controls directly into the new commercial and residential projects. For example, the funding allocated for the urban infrastructure upgrades includes intelligent environment control systems. The market is highly competitive, with strong local players emerging alongside global giants, all vying for a share in this unprecedented infrastructure boom.

The China is leading the environment controllers market in APAC and is driven by the national Dual Carbon policy mandating peak carbon emissions by 2030. This has led to the swift implementation of stricter building energy codes across all provinces, pushing the use of advanced building management systems in new constructions and major retrofits. The scale of this initiative is vast. According to the People’s Daily Online data report released in December 2023, the value of the construction work completed in 2023 was more than 31 trillion Yuan, highlighting the immense policy-driven demand for energy-efficient environment control technologies to manage this massive stock and meet the national climate goals. This policy framework compels provincial and municipal governments to actively enforce these standards, creating a consistent, top-down regulatory driver for the entire building supply chain to adopt intelligent environment control solutions.

The Japan environment controllers market is defined by a focus on technologically advanced and resilience driven by the need to modernize an aging building stock and improve energy security. The primary trend is the integration of environment control systems with disaster preparedness and response features such as automated ventilation control during the seismic events or power outages this is aided by the government policy for example, the Ministry of Economy Trade and Industry data in April 2024 states that it has allocated ¥72.5 billion in this 2023 budget for projects related to the building energy efficiency and smart community development directly funding the adoption of next gen resilient controllers.

Europe Market Insights

The Europe environment controllers market is defined by the robust regulatory drivers, most notably the EU’s Energy Performance of Buildings Directive and Renovation Wave Strategy, which mandates a climate-neutral building stock by 2050. This creates a powerful non-discretionary demand for retrofitting existing buildings with advanced HVAC and building management systems. The market is transitioning towards holistic building automation, integrating energy efficiency with indoor environmental quality monitoring for health and productivity. A prime trend is the rise of the digital building logbooks and smart readiness indicators as promoted by the European Commission, which values buildings based on their technological capacity. For instance, the European Union’s Recovery and Resilience Facility has allocated a significant amount in loans and grants, a portion of which is directed towards green building renovations, directly fueling the market for modern environmental controls.

Germany’s environment controllers market is the largest in Europe and is driven by the ambitious Energiewende policy and the robust Building Energy Act. The dominant trend is the integration of the lighting controls with on-site renewables and storage to create nearly self-sufficient buildings. This is heavily aided by the government subsidies. For example, the state-owned KfW Bank Group, via its energy-efficient construction and refurbishment program, committed €21.6 billion in promissory lending in 2022 alone to support building modernization, as per the SEC data in December 2023, financing directly on the adoption of advanced connected environment control systems that are mandatory to qualify for this public funding.

France market is uniquely shaped by its pioneering Reglementation Environnementale RE2020, which regulates a building’s full lifecycle carbon footprint, aiming beyond mere operational energy. This has created a strong demand for controllers that optimize complex hybrid systems, including low-carbon heating and dynamic shading. Public investment is the key driver, with the national agency ADEME playing a central role. In its performance plan for the 2023 to 2027 ADEME was allocated a significant budget for 2023 to surge the ecological transition funding, innovation, and deployment of the very building control technologies required for RE2020 compliance. This regulatory pressure ensures that advanced, data-driven environment controllers are no longer optional but a fundamental component of all new construction projects across the country.

Key Environment Controllers Market Players:

- Johnson Controls (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc. (U.S.)

- Emerson Electric Co. (U.S.)

- Carrier Global Corporation (U.S.)

- Siemens AG (Germany)

- Schneider Electric SE (France)

- Danfoss A/S (Denmark)

- Legrand S.A. (France)

- Belimo Holding AG (Switzerland)

- Mitsubishi Electric Corporation (Japan)

- Daikin Industries, Ltd. (Japan)

- Fujitsu General (Japan)

- LG Electronics (South Korea)

- Samsung Electronics (South Korea)

- Seeley International (Australia)

- Blue Star Limited (India)

- Green Ocean Corporation Berhad (Malaysia)

- Trane Technologies plc (Ireland)

- Lennox International Inc. (U.S.)

- Delta Controls (Canada)

- Johnson Controls is the global leader shaping the environment controllers market via its OpenBlue digital platform. This initiative incorporates advanced building management systems with AI and cloud connectivity, shifting the company’s focus from hardware to data-driven outcome-based services. By using the environment controllers market for predictive maintenance and energy optimization across entire building portfolios, the company creates a smarter and more sustainable, and autonomous environment for clients.

- Honeywell International Inc. is a dominant player in the environment controllers market and advanced via its Honeywell Forge enterprise performance management platform. Their initiative aims to integrate operational technology and information technology data from building controllers to provide holistic insights. The company has witnessed a 5% growth in annual sales from 2023 to 2024.

- Emerson Electric Co. competes aggressively in the commercial environment controllers market with the Copeland brand and building automation solutions. A key strategic initiative is the deep integration of environment controllers with the variable speed compressors and an IoT gateway for refrigeration and HVAC systems. This allows Emerson to use the market to provide precise, data-optimized climate management and reduce energy consumption, and ensure operational integrity.

- Carrier Global Corporation is executing a digital-first strategy within the environment controllers market. Their major initiative is the Abound platform and Health Buildings Program that unites environment controllers for HVAC, air quality, and fire safety into a single analytics-driven interface. In 2024, the company performed a net sales of USD 22.5 billion by providing safe, intelligent, and efficient products.

- Siemens AG is a powerhouse in the Europe environment controllers market, renowned for its Desigo building automation platform. Their primary strategic initiative involves creating a fully cloud native open system that connects IoT-enabled environment controllers with the enterprise IT systems. The company uses its leadership to drive the strategic vision for a seamless and data-driven, centric building to optimize energy usage.

Here is a list of key players operating in the global market:

The competitive landscape of the environment controllers market is intensely fragmented and is defined by the global technology players competing with specialized regional players. The key strategies for market leadership revolve around technological innovation, mainly in IoT integration, AI-driven predictive control, and energy efficiency. The major players, such as Siemens, Johnson, and Honeywell, are aggressively pursuing growth via strategic mergers and acquisitions to expand their geographic footprint. For example, Nordomatic has acquired Building Environment Control Ltd. (BEC) in October 2025, based in Newcastle-under-Lyme, UK. On the other hand, there is a significant focus on developing open protocol interoperable systems to cater to the smart building ecosystem. Partnerships with software firms and a strong emphasis on sustainability and data analytics are now central to gaining a competitive edge and delivering integrated solutions beyond the basic hardware.

Corporate Landscape of the Environment Controllers Market:

Recent Developments

- In April 2025, Axis has announced the launch of its first environmental sensors, indoor air quality sensors to support cost-effective air quality monitoring and management, including the detection of vaping and smoking.

- In April 2024, Onsemi has introduced the next-generation electrochemical sensor solution for industrial, environmental, and healthcare applications. The launch helps to create a versatile and compact solutions such as air and gas detection, food processing and agricultural monitoring as well as medical wearables such as continuous glucose monitors.

- Report ID: 3517

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Environment Controller Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.