Copper Fungicides Market Outlook:

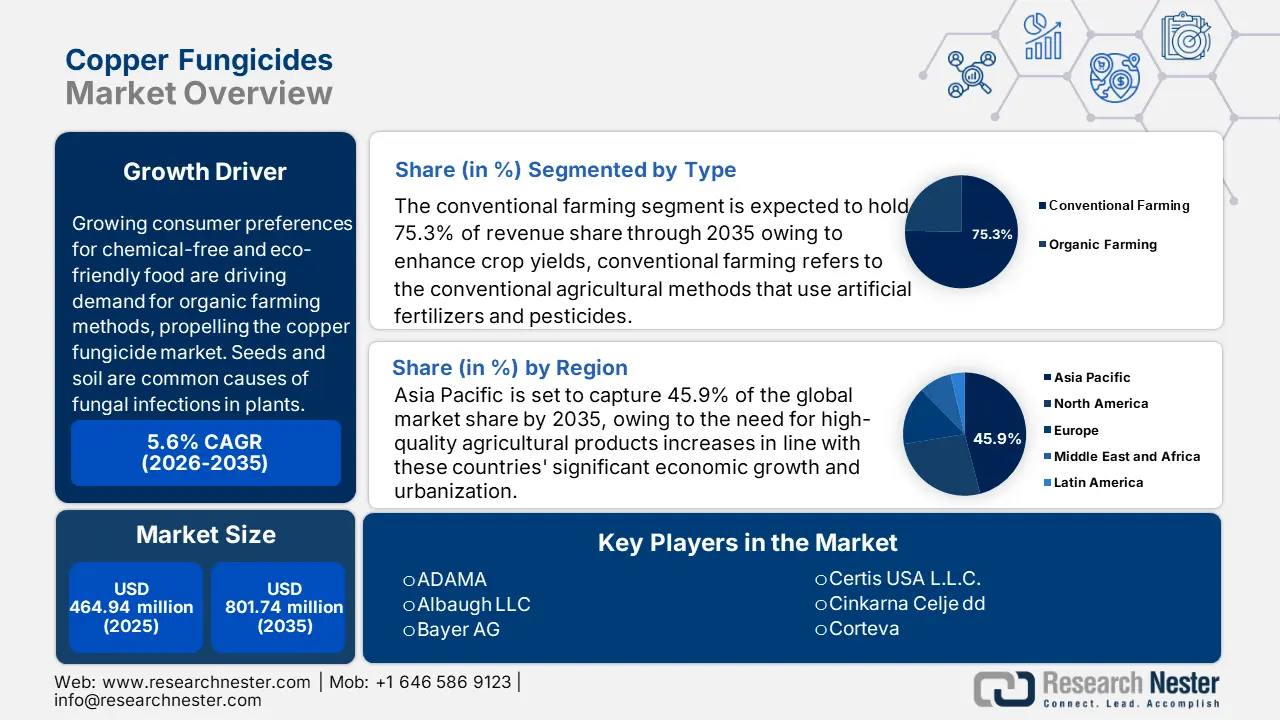

Copper Fungicides Market size was valued at USD 464.94 million in 2025 and is likely to cross USD 801.74 million by 2035, expanding at more than 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of copper fungicides is assessed at USD 488.37 million.

Growing consumer preferences for chemical-free and eco-friendly food are driving demand for organic farming methods, propelling the copper fungicides market. Widely used in organic farming, copper fungicides are highly regarded for their ability to effectively control fungal diseases while meeting organic certification requirements. The efficiency, stability, and environmental safety of copper fungicides have also been improved by developments in fungicide formulation technology, which has increased their appeal for modern farmers.

About 187 nations practice organic farming, and 72.3 million hectares of land are managed organically by at least 3.1 million farmers. Argentina (3.63 million hectares), Spain (2.35 million hectares), and Australia (35.69 million hectares) have the most organic agricultural land. The amount of land utilized for organic farming has grown in all regions.

The rise of invasive fungal species, changes in the global climate, and the increasing demand for more robust fungal resistance in crops are some of the causes of the rise in fungal diseases among plants. The majority of significant plant diseases, especially in vegetables, are caused by fungi, the largest category of plant pathogens. Seeds, soil, weeds, agricultural trash, and nearby crops are common causes of fungal infections in plants.

Key Copper Fungicides Market Insights Summary:

Regional Highlights:

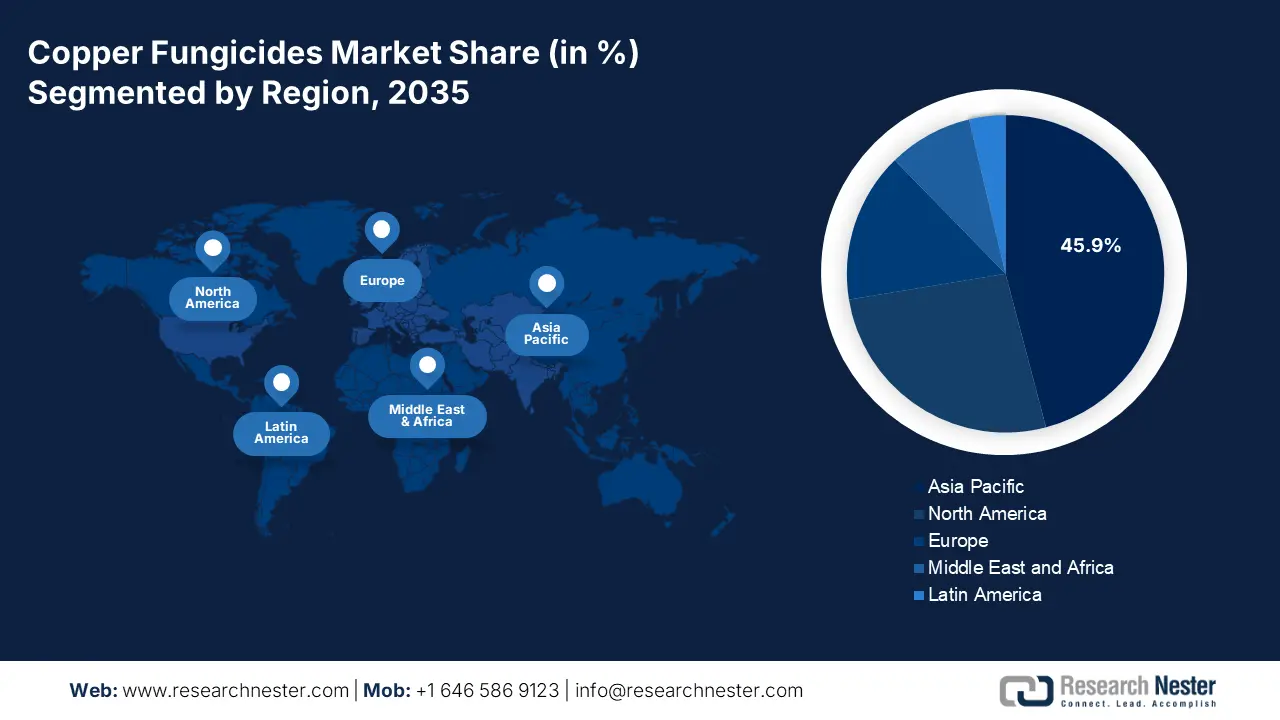

- Asia Pacific holds a leading 45.9% share in the Copper Fungicides Market, driven by the fast rate of industrialization and urbanization throughout the region, positioning it for significant growth through 2035.

Segment Insights:

- The Conventional Farming segment is projected to hold a 75.3% share by 2035, driven by the effectiveness of copper fungicides in controlling fungal infections and increasing crop output.

- The copper oxychloride segment is forecasted to hold a noteworthy share by 2035, driven by its broad-spectrum antifungal effectiveness, long-lasting protection, and cost-efficiency.

Key Growth Trends:

- Rising adoption of Integrated Pest Management (IPM)

- Integration with precision agriculture

Major Challenges:

- Variability in weather and phytotoxicity

- Environmental pollution and toxicity

- Key Players: Certis USA L.L.C., Cinkarna Celje dd, Corteva, Cosaco GmbH, Isagro S.p.A., MAT Holding, Inc., Nordox AS, Nufarm, QUIMETAL, UPL, and Zhejiang Hisun Group Co. Ltd.

Global Copper Fungicides Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 464.94 million

- 2026 Market Size: USD 488.37 million

- Projected Market Size: USD 801.74 million by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Copper Fungicides Market Growth Drivers and Challenges:

Growth Drivers

- Rising adoption of Integrated Pest Management (IPM): Integrated pest management (IPM) is an ecosystem-based approach that uses a variety of methods to prevent diseases and pests over the long term. Due to their effectiveness in controlling bacterial and fungal infections, as well as possible negative effects on the environment, copper fungicides in IPM need to be used and applied carefully. Copper fungicides, such as copper hydroxide or copper formate and data, are broad-spectrum protectant fungicides that work well against a range of bacterial and fungal diseases, including bacterial spots, downy mildew, and blights. In IPM, they are frequently employed as a component of a more comprehensive plan to reduce disease pressure.

- Integration with precision agriculture: The emergence of precision agriculture technology, including predictive disease modeling and drone-based spraying, offers a new way to maximize the use of copper fungicides. Farmers can reduce waste and environmental concerns by using copper fungicides just where and when needed by combining targeted application techniques with real-time disease monitoring. Improved cost-effectiveness and alignment of copper fungicide use with cutting-edge, data-driven farming practices are made possible by this combination. The copper fungicides market can grow by partnering with agri-tech businesses to promote their effective, site-specific application as farmers use precision equipment more and more. According to the UN's most recent estimate, there are 7.3 billion people, with a possible increase to 9.7 billion by 2050. The demand for food is increasing globally as a result of this expansion and rising affluence in developing nations. By 2050, the demand for food is predicted to rise by 59% to 98%.

Challenges

- Variability in weather and phytotoxicity: Phytotoxicity from high copper concentrations might show up as leaf burns, discoloration, or decreased plant vigor, especially when applied excessively or in certain environmental circumstances such as high humidity. Furthermore, copper fungicides work best when used as preventative rather than curative methods, so timing is crucial. Excessive rains can remove copper residues, decreasing their protective effectiveness and requiring reapplication, raising expenses and environmental hazards. Climate change may result in an 18% to 23% decrease in soy and corn production by 2050 in the Brazilian state of Mato Grosso, one of the most significant agricultural regions globally. Extreme heat may also significantly reduce agricultural productivity in the Midwestern U.S. and Eastern Australia, two additional globally significant locations.

- Environmental pollution and toxicity: Since copper fungicides are persistent, they have the potential to contaminate soil and water over time. Frequently applied copper can accumulate in the soil and be harmful to plants, earthworms, and important soil microorganisms. If copper-laden runoff reaches water bodies, this buildup can damage aquatic ecosystems, impair soil fertility, and disturb soil health. Concerns about the environmental impact of copper are reflected in some regions' regulatory restrictions on its use.

Copper Fungicides Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 464.94 million |

|

Forecast Year Market Size (2035) |

USD 801.74 million |

|

Regional Scope |

|

Copper Fungicides Market Segmentation:

Type (Conventional Farming and Organic Farming)

The conventional farming segment in copper fungicides market is projected to gain a 75.3% share through 2035. To enhance crop yields, conventional farming refers to the conventional agricultural methods that use artificial fertilizers and pesticides. Due to their ability to effectively control fungal infections and increase crop output, copper fungicides are commonly used in conventional agricultural systems.

By shielding crops from a variety of fungal diseases, including rust, mildew, and blight, these fungicides help conventional agricultural operations produce higher-quality and more abundant crops. Due to their established effectiveness and broad farmer acceptability, copper fungicides continue to be in high demand in conventional farming, even in the face of increased interest in organic farming methods.

Organic farming has become more and more popular as a result of growing consumer demand for organic goods and growing awareness of the detrimental effects that chemicals have on the environment and human health. As organic farming has spread throughout the world, there is an increasing need for bio-based and ecologically friendly pest control management solutions.

Chemistry (Copper Oxychloride, Copper Hydroxide, Cuprous Oxide, Copper Sulfate, and Others)

Based on the copper oxychloride, the chemistry segment in copper fungicides market is likely to hold a noteworthy share by the end of 2035. A popular copper-based fungicide, copper oxychloride is well-known for its ability to effectively control fungal infections in a variety of crops. By preventing the germination and proliferation of fungal spores, it shields plants from diseases brought on by pathogens, including leaf spots, blight, and mildew. Copper Oxychloride is popular due to its broad range of activity, long-lasting protection, and low cost when compared to other copper-based fungicides.

Copper Oxychloride is a recommended option for disease management in the agriculture industry due to its shown effectiveness and simplicity of use, which appeals to farmers and producers. Copper Oxychloride continues to dominate the market due to its broad acceptance and dependability in crop protection, even in the face of competing copper-based fungicides such as Copper Hydroxide, Cuprous Oxide, and Copper Sulfate.

Our in-depth analysis of the global copper fungicides market includes the following segments:

|

Type |

|

|

Chemistry |

|

|

Formulation |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Copper Fungicides Market Regional Analysis:

Asia Pacific Market Analysis

The Asia Pacific is expected to dominate the copper fungicides market with a share of 45.9% during the forecast period. The fast rate of industrialization and urbanization throughout the region is one important contributing element. The need for high-quality agricultural products increases in line with these countries' significant economic growth and urbanization, which raises the use of copper fungicides to shield crops from fungal infections. Opportunities for producers of copper fungicides are anticipated to arise from the growth of industries including food and beverage.

In China, copper fungicides market find a significant industry due to the widespread production of fruits and vegetables, such as citrus fruits, apples, and grapes. The growing amount of land utilized for organic farming is expected to further increase demand in the area. Various policies are being undertaken to enhance the agricultural industry to improve working conditions and increase agricultural productivity.

In India, the high demand for organic products has made it necessary for farmers to include biological crop protection techniques in their pest control plans. Growing demand for organic food products, more emphasis on sustainable agricultural methods, and advancements in pest control technology are all benefiting the industry. India accounts for 30% of global organic production, with 2.30 million hectares. In total, there are 27,59,660 farmers (11,60,650 PGS and 15,99,010 India Organic), 1703 processors, and 745 traders in the organic industry. In recent years, there has been a significant nationwide growth in the amount of land used for organic farming.

North America Market Statistics

North America copper fungicides market is undergoing significant transformation, influenced by increasing farmers' understanding of crop protection and yield-boosting techniques. The need for crop protection agents including copper fungicides has increased as a result of the region's growing agricultural operations brought on by rising food demands.

The U.S. leads from the forefront due to its industrial operations and wastewater treatment are placing a greater emphasis on environmental preservation and the enhancement of water quality. A novel approach to maximizing the use of copper fungicides is provided by the development of precision agriculture technology, such as drone-based spraying and predictive disease modeling. The average annual growth in organic retail sales in the U.S. was 8%. In 2021, it was anticipated that organic retail sales would surpass USD 52 billion, or roughly 5.5% of global retail food sales. In 2021, the value of organic products generated by American farms and ranches was approximately USD 11 billion. Additionally, imports are assisting in satisfying consumer demand.

In Canada, the easy and sufficient access to raw ingredients needed to manufacture these compounds, such as copper sulfate. This area also produces copper hydroxide, copper oxychloride, and cuprous oxide, among other copper-based compounds. It is predicted that the thriving grape market, which is a result of rising wine production and consumption, will accelerate the expansion of the copper fungicide industry in the region during the coming years. Growing crop production brought on by rising food demand in the region offers enormous growth potential for crop protection agents such as copper fungicides.

Key Copper Fungicides Market Players:

- ADAMA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Albaugh LLC

- Bayer AG

- Certis USA L.L.C.

- Cinkarna Celje dd

- Corteva

- Cosaco GmbH

- Isagro S.p.A.

- MAT Holding, Inc.

- Nordox AS

- Nufarm

- QUIMETAL.

- UPL

- Zhejiang Hisun Group Co. Ltd.

Key players are investing in research and development to produce high-quality, sustainable, and effective copper fungicides that meet the evolving needs of industries such as food and beverage, and agriculture. Leading firms are expanding their market presence through acquisitions and collaborations. Moreover, there is a growing emphasis on environmental responsibility, with manufacturers focusing on products that are resistant to environmental effects. This approach not only meets regulatory standards but also appeals to environmentally conscious consumers.

Here are some leading players in the copper fungicides market:

Recent Developments

- In March 2023, Corteva Agriscience declared that Adavel Active went on sale. This new fungicide has just been registered as a product in South Korea, Canada, and Australia. Adavel Active stands out due to its distinct mode of action, which guards against several illnesses that can have a major effect on crop output.

- In December 2021, Provivi and CABI cooperated on the BioProtection Portal to raise crop protection awareness. Through the use of current science, Provivi helps farmers safeguard crops organically and sustainably. Their objective is to create safer, more scalable pest control solutions by utilizing cutting-edge technologies.

- Report ID: 7643

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Copper Fungicides Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.