Microencapsulated Pesticides Market Outlook:

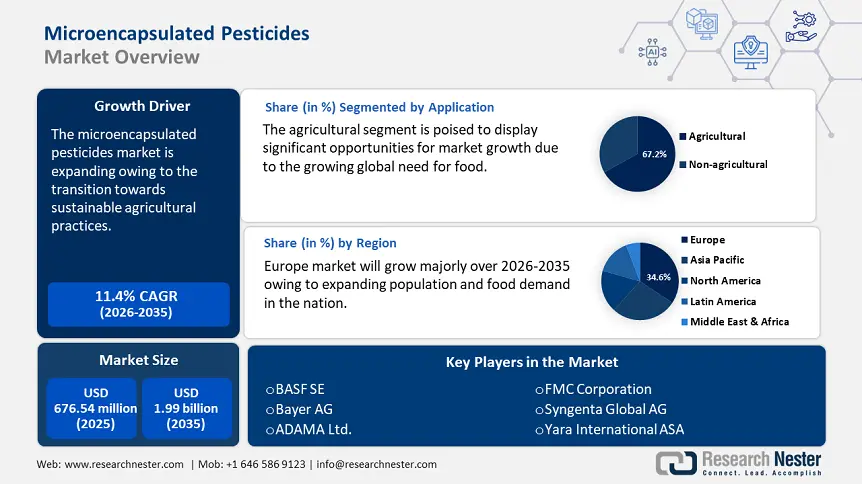

Microencapsulated Pesticides Market size was valued at USD 676.54 million in 2025 and is expected to reach USD 1.99 billion by 2035, expanding at around 11.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of microencapsulated pesticides is evaluated at USD 745.95 million.

The microencapsulated pesticides market is expected to experience growth driven by a transition toward sustainable agricultural practices. Farmers and agricultural producers are increasingly seeking methods to reduce their environmental impact while optimizing crop yields. The increasing awareness of the adverse effects associated with traditional pesticide usage on ecosystems, human health, and food safety is driving this transition. Microencapsulated pesticides present a viable alternative by enabling the precise delivery of active ingredients, thereby reducing environmental exposure while enhancing efficacy.

The U.S. Department of Agriculture reported that by 2020, agricultural land area, which includes land used for permanent pasture for grazing cattle as well as land used for rainfed and irrigated crops, will have grown by 7.6% to 4.76 billion hectares, or 32% of the world's total land area.

The need for effective farming methods that produce greater yields with less input is growing as the population continues to increase. Microencapsulated formulations are a major driver of microencapsulated pesticides market expansion as a result of their capacity to increase pesticide effectiveness, prolong action, and decrease treatment frequency—all of which are aligned with the tenets of sustainable agriculture. Additionally, regulatory pressures to adopt more environmentally friendly farming methods make microencapsulated pesticides more appealing, which promotes adoption among growers who adhere to strict agricultural regulations and seek certifications that demonstrate their dedication to sustainability.

Key Microencapsulated Pesticides Market Insights Summary:

Regional Highlights:

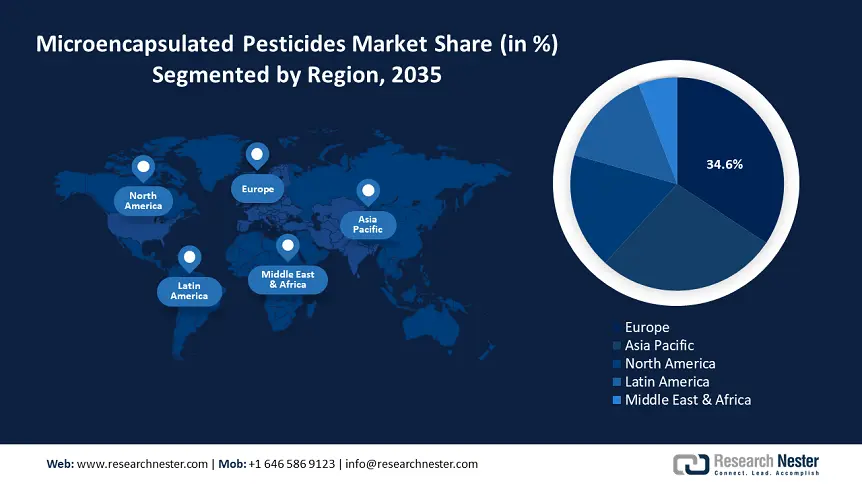

- Europe leads the Microencapsulated Pesticides Market with a 34.6% share, driven by rising agricultural output and expanding population increasing food consumption, fostering growth through 2035.

- Asia Pacific's Microencapsulated Pesticides Market is projected to grow significantly by 2035, propelled by growing population driving food demand and adoption of microencapsulation technology.

Segment Insights:

- The Agricultural segment is projected to hold more than a 67.2% share by 2035, fueled by rising food consumption and increased agricultural activity.

Key Growth Trends:

- Increasing crop protection and food safety awareness

- Technological innovations

Major Challenges:

- Higher production costs

- Stringent regulations

- Key Players: BASF SE, Bayer AG, ADAMA Ltd., FMC Corporation, Syngenta Global AG, Yara International ASA, Israel Chemicals Ltd., Arysta LifeScience Corporation, Nufarm, GAT Microencapsulation AG.

Global Microencapsulated Pesticides Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 676.54 million

- 2026 Market Size: USD 745.95 million

- Projected Market Size: USD 1.99 billion by 2035

- Growth Forecasts: 11.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (34.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, France, United States, China, Japan

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 12 August, 2025

Microencapsulated Pesticides Market Growth Drivers and Challenges:

Growth Drivers

- Increasing crop protection and food safety awareness: The microencapsulated pesticides market is being driven mostly by customers' increased awareness of crop protection and food safety. There is a growing need for safer and more efficient pest management methods as customers' concerns about food product quality and possible chemical residues grow. Farmers can achieve these criteria by using microencapsulated pesticides, which enable precise application and lessen the possibility of contamination and pesticide drift. By encouraging agricultural producers to engage in cutting-edge pest management techniques, this emphasis on food safety not only ensures adherence to safety regulations but also boosts consumer confidence in agricultural products.

- Technological innovations: Advancements in microencapsulation technology have enabled the development of more effective and efficient pesticide formulations that integrate multiple delivery systems to enhance stability and performance. These innovations not only improve the stability and controlled release of active components but also facilitate the creation of customized treatments tailored to specific pest challenges and agricultural contexts. Furthermore, this technology supports the formulation of microencapsulated pesticides that pose less risk to non-target organisms, thereby promoting their adoption across various agricultural practices.

Challenges

- Higher production costs: Microencapsulated pesticides are particularly challenging to produce for both agricultural and non-agricultural uses because of the high expense of the process, which makes the finished product unaffordable. Additionally, while traditional synthetic pesticides are more affordable than microencapsulated ones, consumers prefer them due to their lower cost. The technology employed has a significant impact on the cost of microencapsulation, which varies widely. While some methods do not require specific equipment, others do. Some techniques have employed costly chemicals for operations, while others have used incredibly cheap ingredients.

- Stringent regulations: Growing knowledge of the possible negative effects these pesticides may have on the environment and human health is what is driving these rules. The technique of microencapsulation involves encasing pesticides in minuscule capsules, which are subsequently diluted with water and sprayed over crops. Although this approach has received praise for its ability to effectively manage pests, worries have been raised about the possibility of water contamination, as the tiny pesticide capsules can frequently be carried away by irrigation or rainfall. Concerns have also been raised over the potential for pests to become resistant to these compounds and the long-term consequences of these pesticides on creatures that are not their intended targets. Regulations governing the use of microencapsulated insecticides are, therefore, becoming more stringent globally.

Microencapsulated Pesticides Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.4% |

|

Base Year Market Size (2025) |

USD 676.54 million |

|

Forecast Year Market Size (2035) |

USD 1.99 billion |

|

Regional Scope |

|

Microencapsulated Pesticides Market Segmentation:

Application (Agricultural, Non-agricultural)

Agricultural segment is set to hold more than 67.2% microencapsulated pesticides market share by 2035. The growing global need for food is the reason for its large share. The most important human need has always been food. In recent years, food consumption has increased due to the world's expanding population. Global agricultural activity has been stimulated by rising food output as a result of rising food consumption.

Type (Insecticides, Herbicides, Rodenticides, Fungicides, Others)

The insecticides segment in microencapsulated pesticides market is anticipated to garner a significant share during the assessed period. Its increasing use to eradicate insects that could damage crops in agricultural fields is the main factor contributing to its high share. The most practical way for farmers to protect their crops from insect attacks is to use insecticides. Over the anticipated years, the market is expected to rise as a result of expanding agricultural operations and the cheap cost of pesticides.

Our in-depth analysis of the microencapsulated pesticides market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Microencapsulated Pesticides Market Regional Analysis:

Europe Market Statistics

Europe microencapsulated pesticides market is expected to capture revenue share of over 34.6% by 2035. The rising agricultural output in European nations is driving the market growth. The main drivers of the European market's expansion have been the region’s expanding population and increased food consumption. Wheat, rice, maize, potatoes, soybeans, and other crops are all produced primarily in Europe. Over the coming years, Europe's need for microencapsulated pesticides is probably going to increase due to growing agricultural activity.

Furthermore, in the UK, increased crop production has heightened the need for effective pest control solutions, leading to a greater adoption of microencapsulated pesticides. These formulations offer controlled release of active ingredients, improving efficacy and reducing environmental impact. Additionally, growing awareness of sustainable agricultural practices and stringent regulations on pesticide use have prompted farmers to seek safer alternatives, further driving the demand for microencapsulated pesticides in the region.

Additionally, in Germany, the presence of major companies such as Bayer AG and BASF SE, which are investing in research and development of microencapsulation technologies, supports microencapsulated pesticides market expansion. Furthermore, the increasing demand for sustainable and efficient crop protection methods aligns with the benefits provided by microencapsulation pesticides, contributing to their growing popularity in the agricultural sector.

Asia Pacific Market Analysis

The Asia Pacific microencapsulated pesticides market is expected to grow at a significant rate during the projected period. The region's growing population has played a significant role in driving up food demand, which in turn has stimulated agricultural production. Farmers commonly use pesticides to protect their crops from insect attack. On the other hand, pesticides are thought to be harmful to the environment as a result of their dangerous nature; yet, due to their polymer cover, microencapsulated insecticides offer a slight increase in safety. As a result, they are consumed in large quantities throughout Asia Pacific and are predicted to continue growing.

Moreover, China’s rapidly increasing population prompted the adoption of advanced agricultural technologies to improve crop yields. Microencapsulation technology offers controlled-release formulations that improve pesticide efficacy, reduce environmental impact, and minimize harm to non-target organisms, aligning with sustainable and organic agriculture practices.

In India, growing emphasis on sustainable farming practices and integrated pest management is driving the microencapsulated pesticides market growth. Also, government initiatives such as the Pradhan Mantri Krishi Sinchai Yojana (PMKSY) promote advanced agricultural techniques, encouraging the adoption of innovative solutions such as microencapsulated pesticides.

Key Microencapsulated Pesticides Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bayer AG

- ADAMA Ltd.

- FMC Corporation

- Syngenta Global AG

- Yara International ASA

- Israel Chemicals Ltd.

- Arysta LifeScience Corporation

- Nufarm

- GAT Microencapsulation AG

Major microencapsulated pesticides market participants are willing to invest heavily in new product development and production facility expansion. Innovation in quality assurance and product design has been fueled by rapid R&D operations. Due to the agricultural industry's high demand for microencapsulated pesticides, manufacturers now face intense competition, which is likely to deter new competitors. Among the leading companies in the worldwide microencapsulated pesticides market are:

Recent Developments

- In March 2023, BASF introduced the most recent developments in its agricultural innovation pipeline, including crop protection, seeds and characteristics, and digital solutions. Their primary goal is to give farmers much-needed solutions to address local and crop-specific pest pressures, climate problems, changing regulatory requirements, and expanding consumer demands.

- In January 2023, Bayer established a collaboration with the French company M2i Group to deliver pheromone-based biological crop protection products to fruit and vegetable growers worldwide. Bayer will become the exclusive distributor of select M2i products that target lepidoptera pests in crops such as stone and pome fruits, tomatoes, and grapes.

- Report ID: 7512

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Microencapsulated Pesticides Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.