Enterprise Communication Infrastructure Market Outlook:

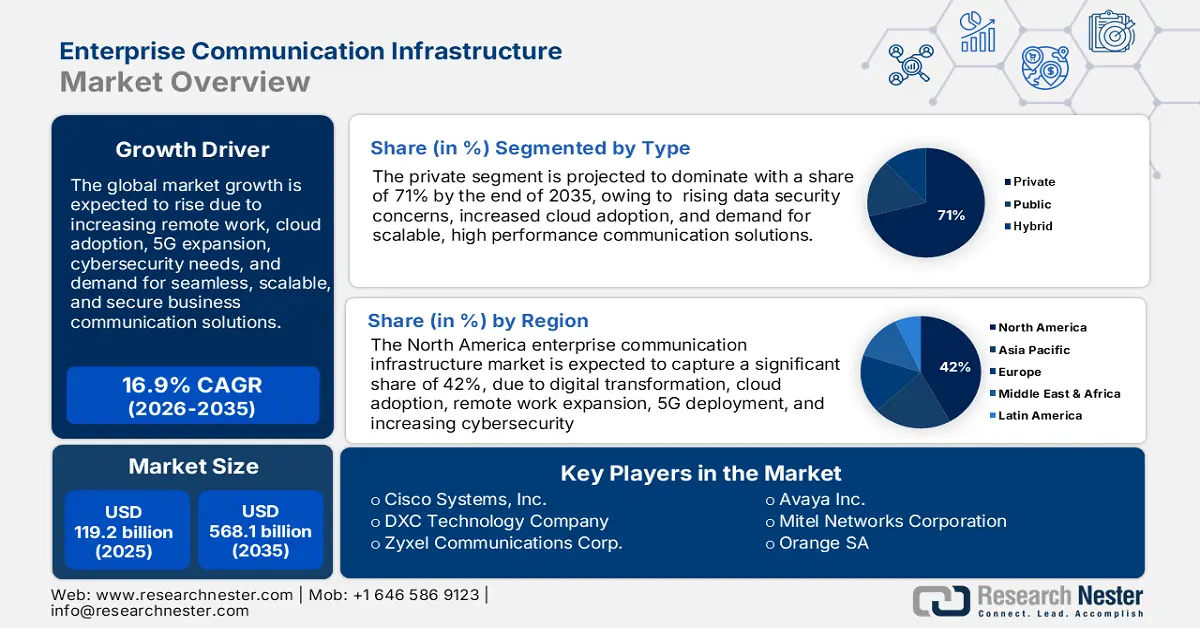

Enterprise Communication Infrastructure Market size was over USD 119.2 billion in 2025 and is anticipated to cross USD 568.1 billion by 2035, witnessing more than 16.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of enterprise communication infrastructure is assessed at USD 137.33 billion.

The market growth is driven by worldwide increasing IT expenditure of companies. For instance, global IT expenditure is projected to hit approximately USD 4.9 trillion in 2023, a 5% from 2022. Moreover, escalating ratio of data will boost the market demand.

In addition, the enterprise communication infrastructure market revenue is propelled by rise in the adoption of new technologies such as IoT, cloud reparation, and so on in enterprise communication. These emerging technologies are efficient in faster communication and network within the applications. For instance, around 15% of new enterprise IT infrastructure is estimated to deploy edge computing by the end of 2023. In addition, the dynamic surge in the adoption of edge computing is estimated to propel the market growth.

Key Enterprise Communication Infrastructure Market Insights Summary:

Regional Highlights:

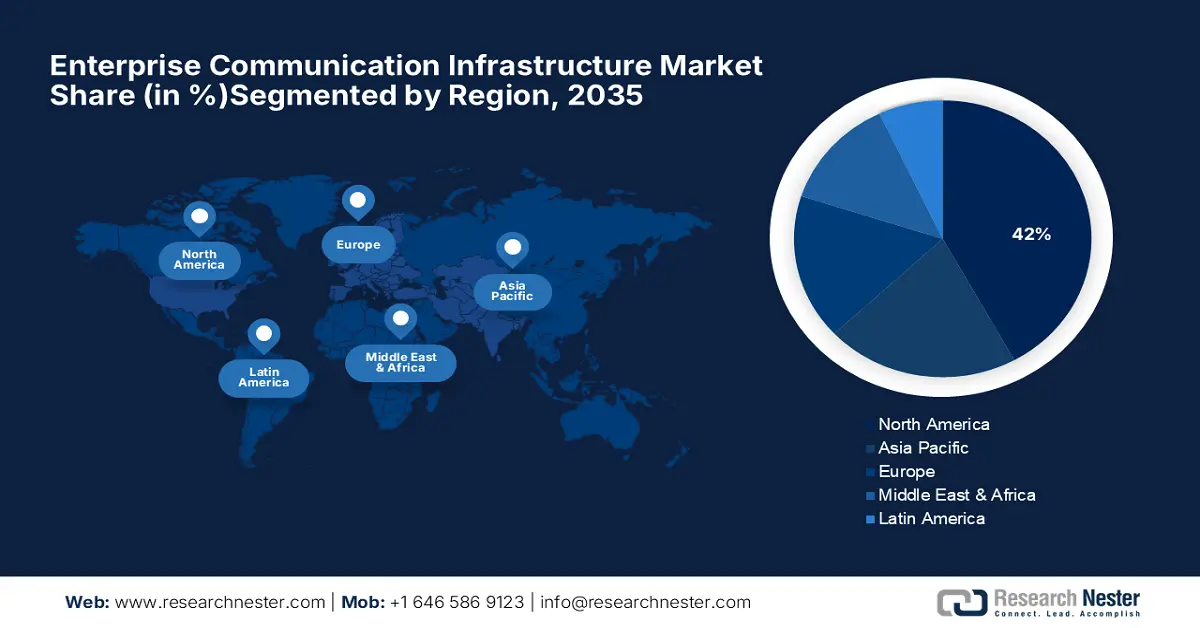

- North America enterprise communication infrastructure market is poised to capture 42% share by 2035, driven by early tech adoption and expanding 5G deployments in IT services.

- Asia Pacific market will secure 21% share by 2035, fueled by rapid IT advances and widespread 5G adoption in the region.

Segment Insights:

- The private type segment in the enterprise communication infrastructure market is expected to achieve a 71% share by 2035, fueled by demand for secure, customizable private networks.

- The on-premises deployment segment in the enterprise communication infrastructure market is expected to capture a 65% share by 2035, attributed to preference for in-house IT solutions with full hardware/software control.

Key Growth Trends:

- Worldwide Growing Penetration of Smartphones

- Massive Surge in the Adoption of Artificial Intelligence

Major Challenges:

- Rise in Data Security Threats Across the Globe

- Poor IT Infrastructure in Developing Regions

Key Players: Microsoft Corporation, Cisco Systems, Inc., DXC Technology Company, Zyxel Communications Corp., VMware, Inc., The International Business Machines Corporation (IBM), Avaya Inc., Mitel Networks Corporation, Orange SA, 8x8, Inc.

Global Enterprise Communication Infrastructure Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 119.2 billion

- 2026 Market Size: USD 137.33 billion

- Projected Market Size: USD 568.1 billion by 2035

- Growth Forecasts: 16.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Enterprise Communication Infrastructure Market Growth Drivers and Challenges:

Growth Drivers

-

Worldwide Growing Penetration of Smartphones - Smartphones have become an important part of everyday life. People without a smartphone are severely hindered in their potential to engage in the full range of today's economic and societal activities. Individuals all across the world can now use mobile to not only communicate more effectively, but also make payments, purchase, and even remotely operate gadgets in their homes. Therefore, the globally increasing penetration of smartphones is estimated to drive market growth further in the coming years. For instance, the total number of smartphone users in the world is around 6.97 billion by the first half of 2023, representing nearly 87.25% of the global population.

-

Massive Surge in the Adoption of Artificial Intelligence - The implementation of human intelligence functions by machines, particularly computer systems, is known as artificial intelligence. These machines are programmed to think and imitate humans. It is mostly employed for learning and problem-solving. In the context of enterprises, AI is rapidly becoming a useful resource for data analytics and data scientists. Furthermore, artificial intelligence has proved to be one of the least expensive methods of maintaining and enhancing communication speeds. Hence, such broad benefits are estimated to expand the adoption of artificial intelligence in enterprise communication infrastructure during the projected time frame. For instance, approximately 40% of enterprises are considering the use of AI while around 39% of businesses are already utilizing it.

- Surging Adoption of Bring Your Own Device (BYOD) Policy - Bring Your Own Device (BYOD) has emerged as a major trend for various companies worldwide, which increases the productivity of the workplace. An effective BYOD policy entails a sound investment in communication infrastructure and security. Hence, the surging adoption of the BYOD policy is also projected to fuel market growth over the forecast period. For instance, globally approximately 86% of organizations have implemented some form of BYOD policy.

- Growing Implementation of Wi-Fi 6 Technology - Wi-Fi 6 is a major improvement over early versions of Wi-Fi which is also known as 802.11ax. It enables quicker connection rates. Wi-Fi 6, makes Wi-Fi technology more convenient and faster for commercial use, voice and data connections, and industrial internet of things technologies. Hence, it is boosting the demand and adoption of this latest technology. This, as a result, is anticipated to fuel the market growth over the forecast period. As per a report, more than 2 billion Wi-Fi 6 devices and 360 million Wi-Fi 6E devices were estimated to be available to consumers in 2022.

- Surging Incorporation of IoT – For instance, IoT technology is currently estimated to have embraced by approximately 88% of organizations.

Challenges

-

Rise in Data Security Threats Across the Globe – As of the growing number of employees who work remotely, data transfer between corporate and personal devices is probably inevitable. Storing sensitive data on personal devices drastically elevates the risk of cyber-attacks. For instance, currently, every day around 35,000 websites are hacked throughout the world. Moreover, nearly 66% of organizations globally have been exposed to at least one type of cyber-attack. Therefore, this factor is anticipated to hinder market growth in the coming years.

-

Poor IT Infrastructure in Developing Regions

- Lack of Awareness About Data Breaches in Emerging Nations

Enterprise Communication Infrastructure Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.9% |

|

Base Year Market Size (2025) |

USD 119.2 billion |

|

Forecast Year Market Size (2035) |

USD 568.1 billion |

|

Regional Scope |

|

Enterprise Communication Infrastructure Market Segmentation:

Type Segment Anlysis

The private segment is estimated to gain largest market share of about 71% by 2035, attributed to potential of lowering the dependence on a specific service provider, along with delivering full control over operating processes. In addition, a private network fulfills the best requirements of an organization regarding security concerns. For instance, in the third quarter of 2022, the worldwide ratio of organizations and government departments deployed private networks exceeded around 978, up from 884 at the end of June and 728 at the end of 2021. Moreover, the advantage of customization as per the requirements of an organization is another major factor that is projected to gain the traction of businesses for the increased implementation of the private network.

Deployment Segment Analysis

The on-premises segment share in the enterprise communication infrastructure market is expected to reach 65% by 2035. The segment growth can be attributed to dynamically rising preference for in-house IT solutions, along with having full-fledged control over hardware and software platforms for upgradation, and configuration.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Deployment |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Enterprise Communication Infrastructure Market Regional Analysis:

North American Market Insights

The North American enterprise communication infrastructure market share is anticipated to surpass 42% by 2035. The market growth is impelled by early adoption of technologies in the United States, the high implementation of the cloud, and rising investments in innovating and adding additional services to the offerings by IT companies in the region. For instance, as of now, more than 50% of government organizations in the United States are using the cloud. The public spending on cloud in the country was also evaluated to rise by more than 17% by the end of 2021. In addition, the strong presence of major market players, coupled with the expanding deployment of 5G technology is will propel the market revenue.

APAC Market Insights

The Asia Pacific enterprise communication infrastructure market is set to hold share of over 21% during the forecast period. The market growth is propelled by rapid technological advancements in the IT sector, and the rising adoption of 5G in numerous nations of the region. For instance, South Korea gained the greatest 5G accessibility in the Asia Pacific region in 2022, with users connected to 5G grossing nearly 31.8% of the time. Moreover, the growing establishment of technological startups and robust rate of industrialization in the region will fuel the market size. In addition, the surging ratio of cloud computing, and the growing trend of BYOD in organizations will impel the market growth in the region.

Europe Market Insights

The market in the European region is estimated to register substantial CAGR till 2035. The market growth is driven by increasing penetration of the internet, coupled with the surging deployment of advanced networking solutions by enterprises. Moreover, numerous organizations have been using managed IT solutions in the European region and this ratio is estimated to rise more in the upcoming years.

Enterprise Communication Infrastructure Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cisco Systems, Inc.

- DXC Technology Company

- Zyxel Communications Corp.

- VMware, Inc.

- The International Business Machines Corporation (IBM)

- Avaya Inc.

- Mitel Networks Corporation

- Orange SA

- 8x8, Inc.

Recent Developments

-

Cisco Systems, Inc. has partnered with NTT Ltd. to develop the technology and manage services that would help enterprise customers to successfully implement Private 5G and improve objectives. By employing Intel hardware and NTT's first-to-market Managed Private 5G solution, the organizations hope to boost edge connection.

-

Avaya Inc. disclosed its strategic collaboration with ALE International to enhance the cloud migration of its clients. This partnership is anticipated to broaden the availability of Avaya's OneCloud CCaaS (Contact Center as a Service) configurable services to ALE's worldwide client base, and also the same is estimated to provide ALE's digital networking solutions available to Avaya customers globally.

- Report ID: 3461

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Enterprise Communication Infrastructure Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.