E-commerce Market Outlook:

E-commerce Market size was valued at USD 37.2 trillion in 2025 and is projected to reach USD 215.2 trillion by the end of 2035, rising at a CAGR of 19.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of E-commerce is estimated at USD 44.3 trillion.

The global market is expanding in the retail and wholesale trade sectors. The United States Census Bureau data in August 2025 indicated that the total retail E-commerce sales for the second quarter of 2025 were approximately 15.5% of the total sales. This data provides a witness to the steady growth with the rising internet penetration, adoption of digital payment, and mobile commerce dominance. The growth is aided by the public investment in digital infrastructure. This expansion is further promoted by federal initiatives such as the Infrastructure Investment and Jobs Act, which allocates funding for broadband deployment, enabling rural and underserved communities to participate in digital commerce. The Federal Trade Commission (FTC) enforces compliance in digital advertising and consumer protection, ensuring transparency in online transactions.

The global E-commerce expansion is further driven by the supportive international trade policies. Organizations are facilitating digital trade agreements aimed at simplifying cross-border transactions and establishing consistent data flow regulations. This regulatory harmonization minimizes the barriers for startup businesses in the field, further allowing them to access a global customer base more efficiently. Advancements in supply chain technologies and logistics, aided by public-private partnerships, are enhancing the delivery speed and reliability. These combined factors of infrastructure investment and logical innovation create a stable and scalable environment for sustained market growth and deeper commercial integration worldwide.

Key E-commerce Market Insights Summary:

Regional Highlights:

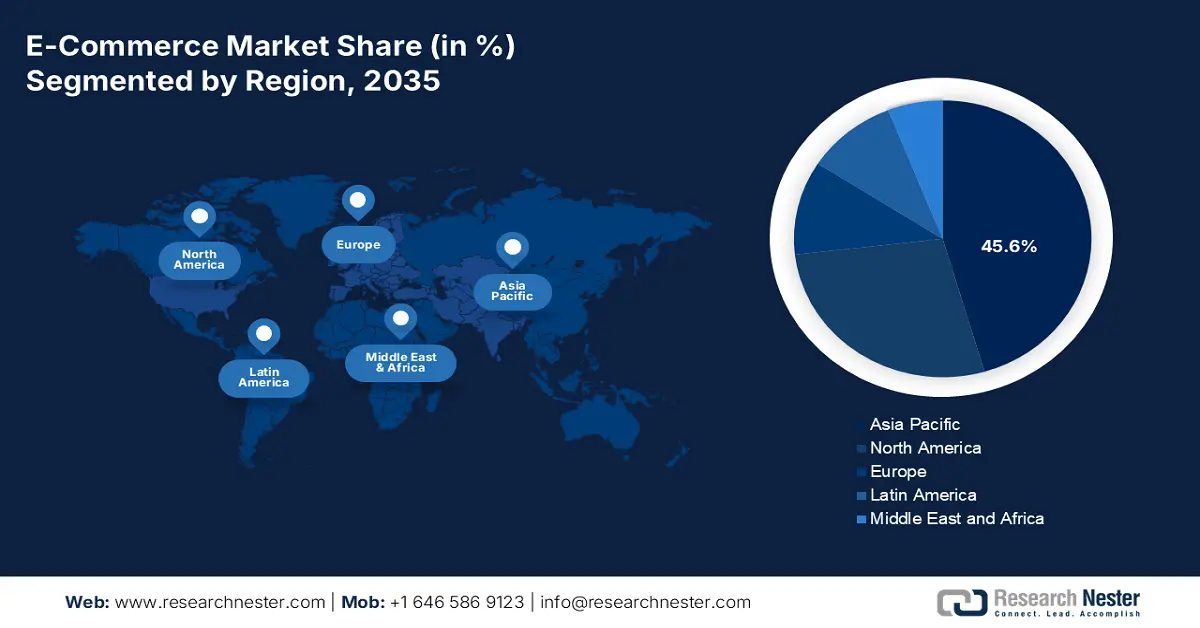

- Asia Pacific is expected to command a 45.6% share by 2035 in the e-commerce market, rising due to expanding internet penetration and advanced logistics infrastructure.

- North America is projected to grow at a 7.5% CAGR during 2026–2035, accelerating owing to high mobile commerce adoption and strong logistics capabilities.

Segment Insights:

- Smartphones in the device segment are anticipated to hold a 75.4% share during 2026–2035 in the e-commerce market, propelled by universal smartphone penetration and high data speed.

- The business-to-consumer model type is set to dominate through 2026–2035, sustained by direct-to-consumer brand strategies and the rapid rise of mobile shopping.

Key Growth Trends:

- Proliferation of mobile-first and super app ecosystem

- Rise of social media platforms and live streaming

Major Challenges:

- Data security and payment fraud

- Complex logistics and fulfillment demand

Key Players: Amazon (U.S.), JD.com (China), Alibaba Group (incl. Tmall, AliExpress) (China), Apple (U.S.), Walmart (U.S.), Shopify (Canada), Pinduoduo (China), eBay (U.S.), Best Buy (U.S.), Home Depot (U.S.), Zalando (Germany), Rakuten (Japan), Coupang (South Korea), Target (U.S.), Flipkart (India), Wayfair (U.S.), Otto Group (Germany), Meesho (India), Sea Limited (Shopee) (Singapore), Costco (U.S.)

Global E-commerce Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 37.2 trillion

- 2026 Market Size: USD 44.3 trillion

- Projected Market Size: USD 215.2 trillion by 2035

- Growth Forecasts: 19.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Indonesia, Brazil, Mexico, South Korea

Last updated on : 13 November, 2025

E-commerce Market - Growth Drivers and Challenges

Growth Drivers

- Proliferation of mobile-first and super app ecosystems: Smartphones are the primary growth drivers of the market. The growth is defined by the integration of shopping into social media and super apps, mainly in Asia. Various platforms such as WeChat and GoJek have redefined themselves from messaging or ride-hailing apps to a platform where users can pay bills, shop, and use other services without leaving the applications. This creates a seamless demand and impulse-driven purchasing environment. For retailers, a mobile-optimized presence is no longer an option it is a baseline that requires investments in progressive web apps and mobile-specific user experience design.

- Rise of social media platforms and live streaming: Social commerce has evolved from product discovery to a direct sales channel. Social commerce is a booming market in India, and nearly 40 million small businesses and entrepreneurs benefit from social commerce, as per the DPIIT Startup India data in April 2023. On the other hand, Chinese platforms such as Douyin generate billions in sales via live streams. TikTok Shop and Instagram Shopping are rising with the latest trends in shopping. Further, brands are now reshaping their marketing strategy and are building influencer partnerships and creating authentic video content to drive immediate purchase within the social platform.

- Growth of cross border E-commerce accessibility: Advancements in technology and logistics are making international shopping as easy as domestic purchases. Companies simplify the cross-border payments, tariffs, and shipping for merchants. Government trade agreements also play a vital role. The Digital Economy Partnership Agreement among the countries focuses on the established digital trade rules that spur SME cross-border activity. For sellers, this opens a massive new revenue stream without establishing a physical presence abroad, provided they partner with the right technology enablers.

Challenges

- Data security and payment fraud: Manufacturers handling online transactions are highly targeted by cyber criminals and are often pushed to cyber-attacks and payment fraud. This consistent threat of data breaches needs a huge investment to maintain strong cybersecurity measures. Various consumers have reported on online shopping fraud, which resulted in high losses. To avoid this, companies are actively integrating strong fraud detection systems such as Signifyd. This platform uses machine learning to analyze the transactions and provide a guaranteed payment for the consumers, protecting businesses from losses.

- Complex logistics and fulfillment demand: Consumers nowadays expect quick and free shipping costs. This is the major burden in the market. Building a dedicated fulfillment network is expensive. To overcome this, many small and mid-sized manufacturers rely on third-party logistics providers to deliver the goods or use the Fulfillment by Amazon outsourcing storage, packing, and shipping to achieve the delivery speed required to compete, albeit at the cost of reduced control and margin.

E-commerce Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

19.2% |

|

Base Year Market Size (2025) |

USD 37.2 trillion |

|

Forecast Year Market Size (2035) |

USD 215.2 trillion |

|

Regional Scope |

|

E-commerce Market Segmentation:

Device Segment Analysis

In the device segment, smartphones are dominating the segment and are expected to hold the share value of 75.4% during the timeline of 2026 to 2035. This dominance is fueled by the universal smartphone penetration and high data speed, which have made the segment the default choice for online shopping. According to the Invest India data in August 2024, almost 660 million people use smartphones in India, which raises the penetration rate to 46.5%. The convenience of anytime and anywhere shopping surges the demand for the market. Further, the social media integration in the market has made a strategic shift. According to data from the U.S. Census Bureau, the proportion of E-commerce transactions originating from mobile devices has shown consistent, robust growth year-over-year, solidifying the smartphone not just as a communication tool, but as a primary sales channel.

Model Type Segment Analysis

Under the model type, business-to-consumer is leading the segment and is driven by the direct-to-consumer brand strategies and the global rise of mobile shopping. Nowadays, brands are using social media platforms to reduce the consumer purchase path and turn engagement into immediate sales. The U.S. Census Bureau’s report highlights that B2C retail trade is significantly driving the total retail growth. Further, innovations in logistics, such as next-day delivery, have aided the global leaders, have conditioned consumers to expect the convenience that only the B2C model provides at scale, solidifying its market leadership.

Payment Method Segment Analysis

Digital wallets hold the largest share value in the payment method segment due to its superior convenience and enhanced security. According to the NIC data in April 2023, nearly 10% of the transactions are made digitally in India. This method is used by most consumers as it stores the payment and information, which addresses the card abandonment issues. Further, the expansion of fintech, new payment apps mainly in the APAC markets, has surged the adoption. Government financial authorities, such as the Consumer Financial Protection Bureau, monitor and provide frameworks for these payment systems, hence ensuring their reliability and security, which in turn builds trust among consumers and cements their leading position.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Model Type |

|

|

Product Type |

|

|

Payment Method |

|

|

Device |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

E-commerce Market - Regional Analysis

APAC Market Insights

Asia Pacific is dominating the market and is expected to hold the market share of 45.6% by 2035. The rising internet penetration, advanced logistics, and strong consumer purchasing power drive the market. Further, live stream shopping and the integration of augmented reality for product visualization, and the strategic expansion of omnichannel retailing with Buy Online, Pick Up In-Store, drive the market growth. Sustainability and same-day delivery are becoming critical competitive differentiators. According to the International Trade Administration data in 2024, the APAC holds the largest share in the B2B market and has risen to 79.3% in 2024 from 78.9% in 2023. Further, the rapid digitalization of small and medium enterprises (SMEs) across emerging Asian economies accelerates the region’s E-commerce ecosystem and cross-border trade efficiency.

China is the largest E-commerce market and is driven by the integrated ecosystem, such as Alibaba’s Taobao and Tmall, and JD.com’s logistics-centric model. The key driver is the fusion of entertainment, social media, and shopping via live streaming platforms such as Douyin have become the major sales channels. According to the People’s Republic of China data in April 2024, the total retail sales of consumer goods accounted for 12,032.7 billion yuan in the first quarter, which is a rise of 4.7% YoY. The government aids this digital economy via initiatives outlined by the Ministry of Industry and Information Technology, aiming to upgrade the digital infrastructure and cross-border ecommerce zones to sustain growth and international competitiveness in the sector.

The E-commerce market in India is experiencing rapid growth due to the expansion of internet penetration in tier-2 and tier-3 cities, and also the widespread adoption of the Unified Payment Interface. The market is defined by the heavy competition between the regional Flipkart and the global giant Amazon. On the other hand, quick commerce and social commerce startups also drive the market growth. According to the International Trade Administration data in 2024, India ranks first among 20 countries in retail ecommerce with a compound annual growth rate of 14.1%. Further, the Invest India data in October 2025 depicts that India plans to increase the E-commerce export by USD 200 to USD 300 billion by 2030. This data highlights the massive infrastructure build-out out including logistics and warehousing, to serve a huge consumer base, which is supported by the Digital India Mission.

North America Market Insights

North America is the fastest-growing E-commerce market and is expected to grow at a CAGR of 7.5% during the forecast period, 2026 to 2035. The market is propelled by the high adoption of mobile commerce and strong logistics infrastructure. The United States Census Bureau report in August 2025 has revealed that the total retail E-commerce in the U.S. reached USD 292.9 billion in Q2 2025, which is a 6.2% rise in the first quarter. This data is based on the non-adjusted basis, clearly states there is a continuous expansion of online retail activities, reflecting strong consumer confidence and spending behavior in the digital marketplace. Further, the broader trade is also surging mainly between the U.S. and Canada. Businesses are actively investing in AI platforms to enhance customer engagement and efficiency, also to lead the global market.

The U.S. market is characterized by the rapid growth of social commerce. The major trend is the supply chain resilience and fulfillment speed, with most of the retailers investing in micro fulfillment centers to make same-day delivery. The United States Census Bureau revealed in August 2025 that the total retail sales for the second quarter of the year accounted for USD 1,865.4 billion. Further, the government spending via the FCC's Affordable Connectivity Program addresses the digital gap and ensures wider market access. This government initiative is significant for expanding the addressable market for E-commerce companies. Investment in supply chain resilience ensures that this growing online demand can be met with unprecedented speed and efficiency.

U.S. Total Retail Trade Sales

|

Quarter |

Total Store and |

Total |

|

4th quarter 2024 |

1,944,449 |

345,872 |

|

3rd quarter 2024 |

1,819,936 |

284,795 |

|

2nd quarter 2024 |

1,818,605 |

278,255 |

|

1st quarter 2024 |

1,681,698 |

261,108 |

Source: United States Census Bureau revealed in August 2025

The E-commerce market in Canada is booming due to the digital transformation initiatives by the government, which enable the cross broader trade. The International Trade Administration stated in July 2025 that the market reached USD 65.5 billion in 2024. The government aids in digital commerce via Innovation, Science and Economic Development Canada, which funds small and medium enterprises' digitalization and enhances broadband access. The market is also shifting with the integration of AI in factors such as personalization, subscription commerce, and environmentally friendly packaging initiatives. Overall, Canada’s E-commerce landscape is shaped by government-backed digital infrastructure, consumer trust, and cross-border integration.

Europe Market Insights

The Europe E-commerce market is mature and is defined by a strong digital market strategy from the EU and distinct national consumer preferences. The key drivers of the market are the sustained shift in mobile shopping, demand for the cross broader convenience within the EU, and rising consumer focus on data privacy and sustainability. The significant trend is that physical stores are integrating online platforms for click-and-collect services. According to the Eurostat data in February 2025, 94% of individuals aged 16-74 years, and nearly 77% of people in the respective age range, have made an online purchase. The integration of AI and cybersecurity directly impacts E-commerce resilience.

Internet Users Ordering Goods Online in 2024

|

Age |

Percentage of Individuals |

|

16-24 |

83 |

|

25-34 |

89 |

|

35-44 |

86 |

|

45-54 |

78 |

|

55-64 |

67 |

|

65-74 |

53 |

Source: Eurostat data February 2025

Germany is leading the E-commerce market in Europe and is dominated by the robust economy and deep online shopping culture, which is supported by the internet penetration rate. According to the Internet Society Pulse data in 2025, 92% of the population uses the internet, which is the key driver of the market. Further, the International Trade Administration data in August 2025 depicts that the total revenue reached USD 100.6 billion, which is a 3.8% rise compared to 2023. This growth is fueled by the increasing role of social media platforms. Further, mobile commerce has a strong demand for sustainable products and transparent supply chains, a focus intensified by Germany's Supply Chain Due Diligence Act. Here are some leading E-commerce sites in Germany:

Popular E-commerce Site in Germany

|

Rank |

Online Retailer (Germany) |

Net Sales (USD Billion, 2024) |

|

1 |

amazon.de |

15.76 |

|

2 |

otto.de |

4.54 |

|

3 |

zalando.de |

2.71 |

|

4 |

mediamarkt.de |

1.89 |

|

5 |

ikea.com |

1.50 |

Source: International Trade Administration data in August 2025

The UK market is defined by the high consumer confidence in digital transactions, and the country is one of the world’s most advanced last-mile delivery networks. According to the Office for National Statistics data in October 2025, the UK accounted a 27.5% of the total retail sales in September 2025. The main driver is the countless innovations in fintech, with the rising adoption of buy now and pay later services and one-click checkout solutions that are streamlining the purchasing process. The market is seeing strong competition in the rapid grocery delivery sector and a growing consumer focus on the ethical retail and sustainability, which influences the brand strategies and logistics operations.

Key E-commerce Market Players:

- Amazon (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- JD.com (China)

- Alibaba Group (incl. Tmall, AliExpress) (China)

- Apple (U.S.)

- Walmart (U.S.)

- Shopify (Canada)

- Pinduoduo (China)

- eBay (U.S.)

- Best Buy (U.S.)

- Home Depot (U.S.)

- Zalando (Germany)

- Rakuten (Japan)

- Coupang (South Korea)

- Target (U.S.)

- Flipkart (India)

- Wayfair (U.S.)

- Otto Group (Germany)

- Meesho (India)

- Sea Limited (Shopee) (Singapore)

- Costco (U.S.)

- Amazon is leading the market with its vast logistics network and unparalleled data analytics. Purchasing data, search trends, and Prime memberships are integrated to optimize its inventory management and personalize customer interaction. This approach ensures rapid delivery and customizes user experience, solidifying its position as the top shop for everything right from groceries to digital services. According to Amazon’s 2024 annual report, the total revenue has increased by 11% during the year 2024.

- JD.com is placed in a significant position in the market with a highly efficient technology-based logistics model. The company integrates E-commerce market sales to its nationwide network of warehouses and autonomous delivery systems. This use of data ensures superior inventory allocation and same or next-day delivery in China. This builds an immense consumer trust and competitive landscape based on the speed, commitment, and reliability of authentic products.

- Alibaba Group is the global leader in the market via its asset-light platform model, connecting many businesses and consumers. It uses vast market data from its Tmall and Taobao platforms to fuel its advertising services and provide sellers with deep consumer insights. This data helps Alibaba to enable transactions, drive merchant success via targeted reach, and expand new services. Alibaba in 2024 generated a free cash flow of USD 21.6 billion, deploying it to maximize shareholder value.

- Apple is the premium segment within the E-commerce market and integrates the hardware, software, and services seamlessly. It’s a direct consumer sales channel from the Apple Store app and website, using market data on device accessories and purchase preferences to personalize the marketing and manage its global supply chain. This ensures customers remain within the Apple universe for their digital needs.

- Walmart transforms its business by merging its physical strength with a powerful digital E-commerce market presence. The company uses the online sales data from the website to optimize the in-store product assortment and fulfillment options, such as curbside pickup. This approach fuels the E-commerce market insights and allows to use of its vast store network as the distribution hub.

Here is a list of key players operating in the global market:

The global market is very competitive and is dominated by the leading giants, such as Amazon and Alibaba, that use a vast logistics network and ecosystem integration. The key strategic initiatives such a pivot to profitability over pure growth with heavy investment in AI for personalization and logistics. The rise of social commerce and live streaming is a major battleground, mainly in Asia. Further, retailers such as Best Buy and Walmart are following omnichannel strategies, helping to blend the online convenience with physical store advantages. Moreover, the factors such as fast delivery, subscription services, and expansion are surging the market to focus areas for sustainable growth. For example, in January 2025, eBay acquired Caramel to provide a safe online vehicle transaction experience. The acquisition builds trust among the vehicle buyers and brings the process of identity verification, insurance, and financing together seamlessly.

Corporate Landscape of the E-commerce Market:

Recent Developments

- In October 2025, DoorDash, Inc. has announced that the boards of directors of DoorDash and Deliveroo plc had agreed on the terms of a final cash offer for acquiring the entire share capital of Deliveroo. The acquisition was carried out via Court-sanctioned scheme of arrangement under Part 26 of the UK Companies Act.

- In May 2025, Authentic Brands Group has entered into a definitive agreement to acquire American Heritage Brand Dockers. The focus of this acquisition is to expand the portfolio through brands with strong heritage, loyal consumers and global recognition.

- In July 2024, JD Sports Fashion Plc has officially announced the completion of its acquisition of Hibbett, Inc. The primary objective of this acquisition is to expand our presence in North America and reinforce our community concepts.

- Report ID: 8233

- Published Date: Nov 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

E-commerce Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.