Dry Granulation Excipients Market Outlook:

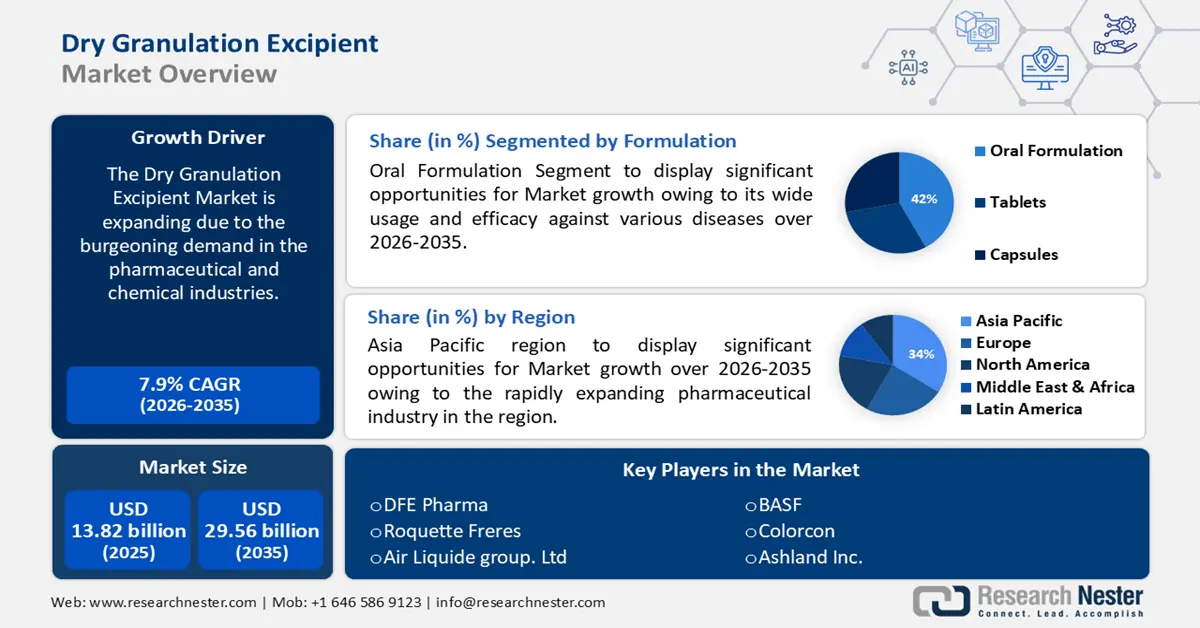

Dry Granulation Excipients Market size was valued at USD 13.82 billion in 2025 and is set to exceed USD 29.56 billion by 2035, expanding at over 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dry granulation excipients is estimated at USD 14.8 billion.

The growth of dry granulation excipients growth is due to the burgeoning demand in the pharmaceutical and chemical industries. For instance, there are more than 20,000 pharmaceutical companies spread over more than 200 nations. Better stability and shelf life are provided for pharmaceutical formulations by dry granulation. The granules generated by dry granulation have improved chemical stability due to reduced exposure to moisture, making the finished product last longer and be of higher quality. Hence, over time dry granulation excipients have gained popularity in the pharmaceutical industry.

In addition, a high demand for generic drugs due to generic drugs having nominal pricing than branded drugs boosting the number of drugs sold in the market. Which would support the pharmaceutical industry and accelerate dry granulation excipients market expansion during the projection period.

Key Dry Granulation Excipients Market Insights Summary:

Regional Insights:

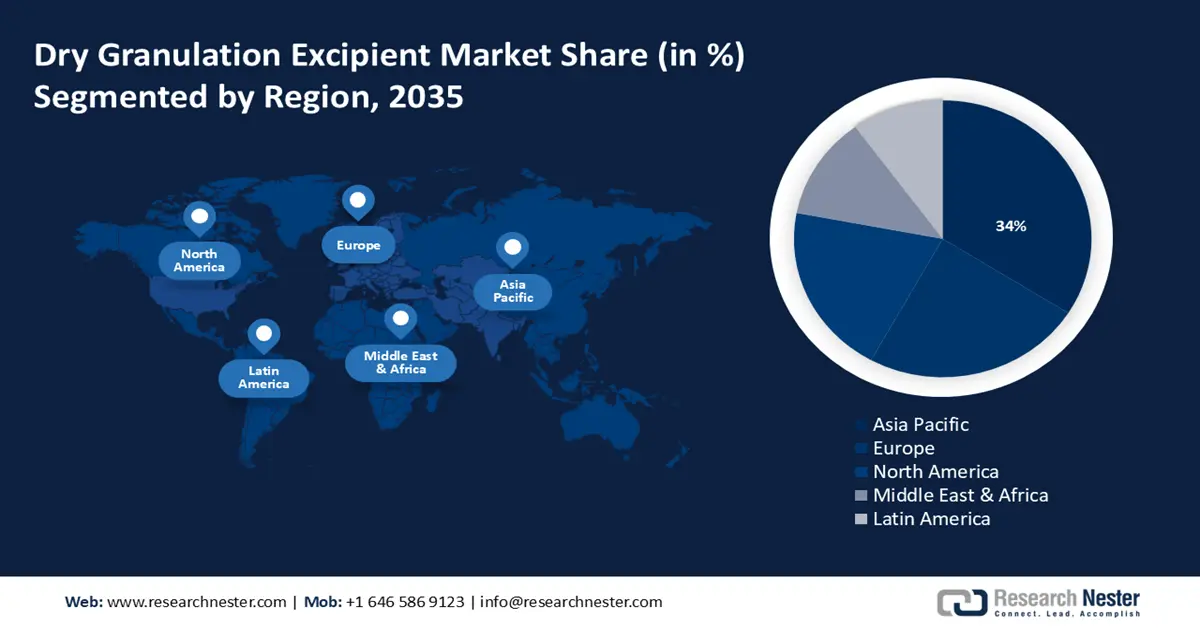

- By 2035, the Asia Pacific region is expected to capture a 34% share in the dry granulation excipients market, underpinned by the swift expansion of its pharmaceutical industry.

- Europe is projected to account for about 24% share by 2035, supported by its rising focus on high-quality generic pharmaceuticals.

Segment Insights:

- The oral formulations segment in the dry granulation excipients market is projected to command about 42% share by 2035, supported by its extensive usage and efficacy across diverse diseases.

- The lubricants and glidants segment is anticipated to secure nearly 18% share by 2035, bolstered by their essential role in enhancing powder flow and manufacturing efficiency in oral solid dosage production.

Key Growth Trends:

- Rising Healthcare Expenditure

- Technological Advancements in Drug Manufacturing

Major Challenges:

- Delay in Approval

Key Players: DFE Pharma, Gattefosse, BASF, MultiMedia Pharma Sciences, LLC, Colorcon, GEA Group, Aktiengesellschaft, Ashland Inc., Roquette Freres.

Global Dry Granulation Excipients Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.82 billion

- 2026 Market Size: USD 14.8 billion

- Projected Market Size: USD 29.56 billion by 2035

- Growth Forecasts: 7.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Brazil, South Korea, Indonesia, Mexico, Turkey

Last updated on : 1 December, 2025

Dry Granulation Excipients Market - Growth Drivers and Challenges

Growth Drivers

- Rising Healthcare Expenditure: Healthcare costs are rising at an exceptional rate due to factors like the high cost of treatment, increasing drug prices, and growth in medical enrollment which has increased the need for highly efficient and low-cost drugs in the market. Increased expenditure allows producers of excipients to fund research and development initiatives to create novel excipients suited to particular needs of the dry granulation procedure for creating affordable drugs in the market. According to research, in 2021 the global healthcare expenditure was 9.7% of the global GDP.

- Technological Advancements in Drug Manufacturing: Technological advancements in dry granulation techniques, such as roller compaction involves compacting dry powders between two rollers to form a dense sheet, which is then milled into granules. This process offers advantages such as increased uniformity of granule size and improved flow properties, resulting in more consistent drug delivery. and slugging which involves compressing powder blends into large tablets or "slugs," which are then broken down into granules. Slugging offers advantages such as simplicity and scalability, making it suitable for both small-scale and large-scale production. These innovations are enhancing the efficiency and effectiveness of drug formulation processes, leading to the expansion of dry granulation excipients.

- Improved Access to Healthcare: Enhanced healthcare access drives a surge in demand for pharmaceuticals. As more individuals obtain vital medications, the need for pharmaceuticals rises. This increased demand extends to solid oral dosage forms, which rely on specific dry granulation excipients. Consequently, there is an expansion in the market for pharmaceutical manufacturers, resulting in a rise in the demand for excipients crucial in producing tablets and capsules.

Challenges

- Delay in Approval: New excipient approval processes can be drawn out, costly, and complicated. Pharmaceutical businesses may find it more difficult to justify their investment in developing new medicines due to the high capital costs involved and the potential for further delays in the time to market for novel excipients. Furthermore, the FDA and other regulatory bodies must approve new excipients before they may be used in pharmaceutical products. Thus, negatively affecting the market expansion

- Lengthy manufacturing process due to the production of excipients in large quantities to meet the needs of the pharmaceutical industry is expected to hinder market growth.

- Several technical issues regarding the process of dry granulation can also impede the market growth in the forecast period.

Dry Granulation Excipients Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 13.82 billion |

|

Forecast Year Market Size (2035) |

USD 29.56 billion |

|

Regional Scope |

|

Dry Granulation Excipients Market Segmentation:

Formulation Segment Analysis

The oral formulations segment in the dry granulation excipients market is estimated to gain the largest revenue share of about ~42% in the year 2035. The segment growth can be attributed to its wide usage and efficacy against various diseases. For instance, 361.3 million medications are administered or prescribed annually, and 76.2% of consultations involve drug therapy. This high usage of oral formulations can be attributed to their convenience, ease of administration, and patent compliance. Dry granulation excipients play a vital role in formulating these dosage forms, as a result driving growth in the oral formulation segment.

Product Segment Analysis

The lubricants and glidants in the dry granulation excipients market are estimated to gain a significant share of about ~18% in the year 2035. The segment growth can be attributed to the high utilization in manufacturing of oral solid dosage forms which are the most popular form of dosage. Lubricants and glidants play a crucial role in dry granulation by improving the flow properties of powders and reducing friction between particles and equipment surfaces. This leads to smoother processing, reduced equipment wear, and increased manufacturing efficiency, driving the demand for lubricants and glidants in the dry granulation excipient market.

Our in-depth analysis of the dry granulation excipient market includes the following segments:

|

Products |

|

|

Formulation |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dry Granulation Excipients Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is anticipated to hold largest revenue share of 34% by 2035, as a result of rapidly expanding pharmaceutical industry in the region. The market growth in the region is also expected on account of the rapidly expanding pharmaceutical industry in countries like China, Indonesia, India, Japan, and South Korea. Studies show that there are 3000 FDA-approved pharmaceutical companies in India additionally in South Korea, there were 653 pharmaceutical companies in 2022. This growth of the pharmaceutical industry can be attributed to the rising prevalence of chronic disease due to unhealthy lifestyles and high population rates in the region. Furthermore, countries in the Asia Pacific region like India which has one of the largest pharmaceutical industries in the world are hubs for generic drug manufacturing. This is due to the presence of major key players in the region, catering to both domestic and international markets. Dry granulation excipients are essential for formulating generic drugs, and the region's growing focus on generic pharmaceuticals contributes to the demand for these excipients.

European Market Insights

The European dry granulation excipients market is estimated to be the second largest, registering a share of about ~24% by the end of 2035. The market’s expansion can be attributed majorly to the growing emphasis on superior generic pharmaceutical products due to economic pressure and healthcare cost containment efforts. For instance, currently, generic drugs account for around 50% of the European market by volume. Furthermore, the demand for oral solid dosage formulations in the region's growing aging population and the rising prevalence of chronic disease is also expected to propel the market growth. Moreover, the European region offers a conducive environment for the growth of the dry granulation excipient market, driven by stringent regulatory standards, increasing demand for oral solid dosage forms, advancements in pharmaceutical manufacturing, focus on patient compliance, high-quality drug delivery system, outsourcing trends, and innovation in drug delivery systems.

Dry Granulation Excipients Market Players:

- DFE Pharma

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Air Liquide group.

- BASF

- MultiMedia Pharma Sciences LLC

- Colorcon

- GEA Group

- Wacker Chemie AG

- Ashland Inc.

- Roquette Freres

Recent Developments

- For particular industrial areas, the WACKER Group released its silicone-based product solutions. silicone gels for wound care, self-adhesive liquid silicone rubber grades that stick to polycarbonate and other high-performance plastics, and non-post-curing liquid silicone rubber for the food sector and medical technology are the main areas of attention. The focus is also on resource-efficient silicones and products for electromobility applications.

- Ashland launched KlucelTM xtend, a controlled release matrix former made of hydroxypropyl cellulose (HPC), to provide the highest level of process versatility and release profile efficiency. It was the most recent product to be added to the company's KlucelTTM range, which broadens its portfolio of controlled releases.

- Report ID: 5979

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dry Granulation Excipients Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.