Freeze-drying Market Outlook:

Freeze-drying Market size was valued at USD 1.6 billion in 2025 and is projected to reach USD 3.4 billion by the end of 2035, rising at a CAGR of 8.9 % during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of freeze drying is estimated at USD 1.7 billion.

The ever-increasing demand across pharmaceuticals, biotechnology, and food preservation techniques is readily fostering upliftment of the market. Besides, the expanding contract manufacturing and outsourcing trends in pharmaceuticals are fueling the need for flexible and efficient freeze-drying solutions. U.S. FDA’s compounding quality center of excellence conducts an outsourcing facilities study on a yearly basis to understand industry challenges, quality practices, and regulatory impacts. It also revealed the study includes surveys and discussions with facilities, helping inform its policies and training programs as of the U.S. FDA October 2025 data.

Furthermore, the escalating investments in research and development, along with the growing awareness of the benefits of freeze-dried products, are providing an encouraging opportunity for adoption across various industries. GEA in September 2022 reported that it is investing a total of €70 million (USD 75 million) in a new pharmaceutical technology center in Germany, focused on freeze-drying solutions for injectable drugs such as vaccines. Besides, the 40,000 m² facility will consolidate operations and support innovation. The move will expand sustainable pharma manufacturing capabilities.

Key Freeze-drying Market Insights Summary:

Regional Highlights:

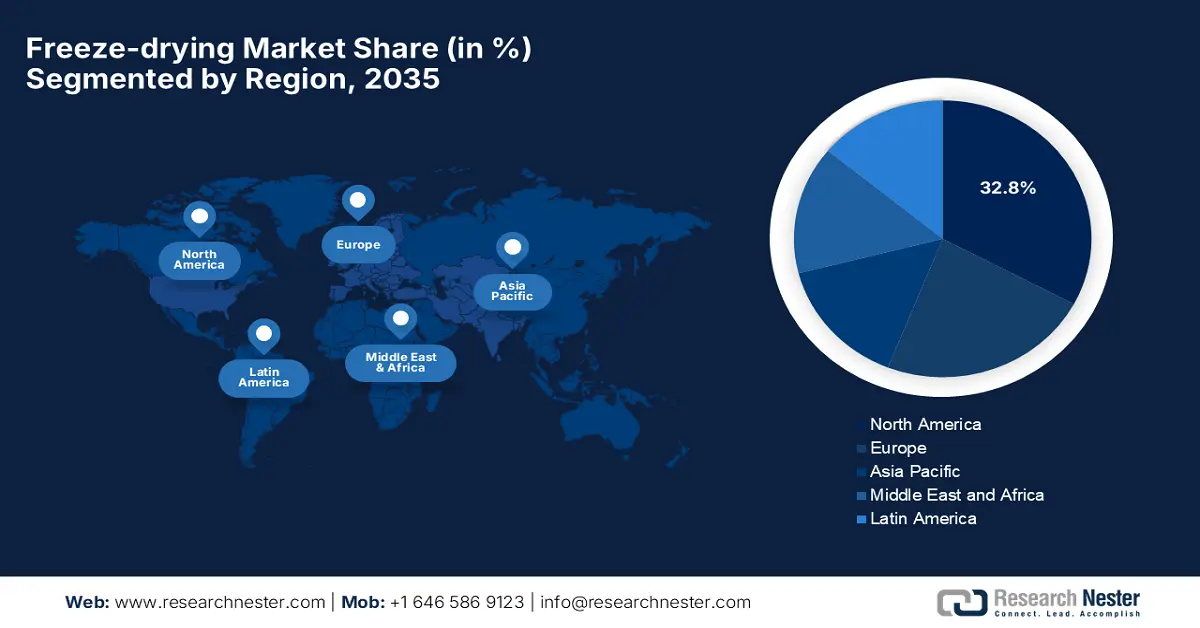

- North America is recognized as the dominating region in the freeze-drying market, capturing a 32.8% share by 2035, owing to advanced manufacturing infrastructure and a strong focus on research and development.

- Asia Pacific is witnessing rapid expansion in the market, impelled by rising demand across pharmaceuticals, food processing, and biotechnology sectors.

Segment Insights:

- Pharmaceutical & biotechnology companies segment is projected to garner the largest revenue share of 55.8% during the forecast period 2026-2035 in the freeze-drying market, owing to robust R&D investments in biologic drugs.

- Tray-style freeze-dryers segment is projected to capture a significant share of 42.6% by 2035, propelled by their versatility and high-capacity processing.

Key Growth Trends:

- Rising demand from pharmaceutical & biotechnology sectors

- Growth in processed and shelf-stable food products

Major Challenges:

- High energy consumption

- Complexity of process and equipment

Key Players: SP Industries, Inc. (U.S.), GEA Group AG (Germany), Azbil Corporation (Japan), Labconco Corporation (U.S.), Millrock Technology, Inc. (U.S.), IMA S.p.A. (Italy), HOF Sonderanlagenbau GmbH (Germany), Martin Christ Gefriertrocknungsanlagen GmbH (Germany), Cuddon Freeze Dry (New Zealand), Biopharma Process Systems Ltd. (UK), Pfeiffer Vacuum GmbH (Germany), Tofflon Science and Technology Co., Ltd. (China), Cryotec Solutions, Inc. (U.S.), Freeze Drying Systems, Inc. (U.S.), Optima Pharma GmbH (Germany), VirTis (U.S.), Yamato Scientific Co., Ltd. (Japan), Kyowa Vacuum Engineering, Inc. (Japan), Ilshin Biobase Co., Ltd. (South Korea), Aseptic Technologies (Belgium).

Global Freeze-drying Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.6 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 3.4 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, China

- Emerging Countries: India, Brazil, South Korea, Australia, Mexico

Last updated on : 23 October, 2025

Freeze-drying Market - Growth Drivers and Challenges

Growth Drivers

- Rising demand from pharmaceutical & biotechnology sectors: The market plays a crucial role in applications such as preserving biologicals, injectables, and vaccines. Therefore, with the rising development of mRNA-based vaccines, personalized medicines, pharmaceutical companies are adopting freeze-drying at a rapid pace. In March 2024, Ghent University reported that, funded by CEPI, it is developing a novel spin-freezing technique to stabilize mRNA vaccines without the need for frozen storage, potentially improving vaccine shelf life and accessibility.

- Growth in processed and shelf-stable food products: Consumers are increasingly preferring healthy, natural, and preservative-free food products, which is efficiently fueling the demand for freeze drying in the food industry. According to the report published by Research Nester, the global processed fruits and vegetables market is growing at a CAGR of over 4.6% from 2026 to 2035. Therefore, this significant growth is expected to boost demand for preservation techniques such as freeze-drying, which is widely used to maintain the quality, nutritional value, and shelf life of these products.

- Technological advancements: The amplifying innovations in freeze drying equipment, such as microwave-assisted drying, atmospheric spray freeze-drying, and energy-efficient systems, are enhancing process efficiency and reducing energy consumption. For instance, in October 2024, GEA announced the launch of its next-generation RAY Plus batch freeze dryers, which are designed for the food industry with enhanced energy efficiency, hygiene, and operational flexibility. These dryers consist of an advanced airflow technology, larger condenser surfaces, and user-friendly controls, enabling high-capacity freeze-drying.

Trade Data for Industrial Lyophilization and Spray Dryers in Poland (2023)

|

Category |

Data (2023) |

|

Exports |

USD 1.04 million |

|

Export Global Rank |

26th out of 71 countries |

|

Share of Global Exports |

0.32% |

|

Top Export Destinations |

Thailand (USD 707k), Belgium (USD 102k), Denmark (USD 87k), Croatia (USD 46.4k), UK (USD 32.7k) |

|

Fastest Growing Export Markets |

Belgium (+USD 101k), Croatia (+USD 34.4k), Switzerland (+USD 11.2k) |

|

Imports |

USD 5.5 million |

|

Import Global Rank |

14th out of 161 countries |

|

Share of Global Imports |

1.69% |

|

Top Import Origins |

Germany (USD 2.79 million), Italy (USD 2 million), China (USD 604k), Netherlands (USD 55k), USA (USD 39.1k) |

|

Fastest Growing Import Origins |

Germany (+USD 2.45 million), Italy (+USD 1.99 million), Netherlands (+USD 53.6k) |

|

Net Trade Balance |

-USD 4.46 million (imports > exports) |

|

Economic Complexity Index (ECI) |

1.09 (Rank 24/132) |

Source: OEC

Challenges

- High energy consumption: This, along with high operational costs, is the factor negatively impacting the growth trajectory of the market. This is an energy-intensive process that requires precise temperature and vacuum control over long cycles, which causes considerable electricity consumption and operational costs as well. The market hosts continued advancements in terms of energy-saving technologies, but still faces these issues, which can limit adoption, especially among smaller manufacturers with tighter budgets.

- Complexity of process and equipment: The process of freeze drying involves numerous stages, such as freezing, primary drying, and secondary drying, wherein each step requires proper monitoring and control. Therefore, this equipment complexity and the need for skilled operators create hesitation among new players to make investments in this field. In addition, the customization requirements for new products complicate the scaling process, hence causing a drawback for the market development.

Freeze-drying Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 1.6 billion |

|

Forecast Year Market Size (2035) |

USD 3.4 billion |

|

Regional Scope |

|

Freeze-drying Market Segmentation:

End user Segment Analysis

Based on end user pharmaceutical & biotechnology companies segment is projected to garner the largest revenue share of 55.8% during the forecast tenure. The dominance of the segment is attributable to the robust R&D investments in biologic drugs, which are often therapeutically sensitive and require lyophilization. Also, the increasing pipeline of monoclonal antibodies and protein-based therapeutics directly expands the demand for freeze-drying capabilities. On the other hand, most of the prominent organizations provide extensive guidelines for pharmaceutical development of lyophilized products, underscoring the regulatory significance.

Product Type Segment Analysis

In terms of product type, the tray-style freeze-dryers segment is projected to capture a significant share of 42.6% by the end of 2035. The segment’s growth in this field is highly subject to the versatility and high capacity, making them ideal for the bulk processing needs of the pharmaceutical and food industries. In June 2024, Labconco Corporation announced that it had launched the lyph-seal tray dryer, which is an innovative freeze-drying solution designed to preserve a wide range of large, irregularly shaped, and individually packaged samples across industries such as pharmaceuticals, materials science, and agriculture.

Trade Segment Analysis

Based on the trade merchant freeze-dryers’ segment is anticipated to attain a lucrative revenue share over the discussed time frame. The capacity of the segment to offer flexible, outsourced freeze-drying services to both small and medium-sized companies lacking in-house capabilities is the key factor behind this leadership. Furthermore, the segment also benefits from cost efficiency and scalability, thereby enabling access to advanced technologies without capital expenditure, hence denoting a wider segment scope.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Product Type |

|

|

Trade |

|

|

Application |

|

|

Operation |

|

|

Processing Stage |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Freeze-drying Market - Regional Analysis

North America Market Insights

North America is recognized as the dominating region in the freeze-drying market, capturing the largest revenue share of 32.8% by the end of 2035. The dominance of the region is effectively attributable to advanced manufacturing infrastructure and a strong focus on research and development. In December 2022, Peak and Prairie Industries, has introduced Canada’s first domestically produced home-based freeze-drying appliance, which is the D-freeze system. The product is designed for both personal and small business use. It offers enhanced energy efficiency, larger batch capacity, and commercial-grade components.

The U.S. is augmenting its leadership in the freeze-drying market, influenced by a combination of factors such as a large pharmaceutical industry, a growing nutraceutical sector, and heightened awareness of food preservation technologies. In August 2025, Glacial Freeze Dry reported that it had acquired Foodynamics to enhance its freeze-dry contract manufacturing and co-packing capabilities. Hence, the move strengthens Glacial’s position in delivering premium, partner-focused freeze-drying solutions.

Canada is also solidifying its position in the regional market owing to increased applications in the food processing and pharmaceutical industries. The market is also supported by government initiatives promoting food safety, quality preservation, and export competitiveness. As of the May 2025 report from the country’s government agencies, such as the Canadian Food Inspection Agency, enforce compliance for both domestic and imported freeze-dried products, while Health Canada sets safety and nutritional standards, supported by scientific risk assessments. Hence, this strong regulatory framework supports consumer trust and positions freeze-dried goods for both local and international markets.

APAC Market Insights

The Asia Pacific region is presenting strong growth in the freeze-drying market, backed by the rising demand in sectors such as pharmaceuticals, food processing, and biotechnology. The expanding urbanization, growing middle class, and changing consumer preferences are prompting a stronger adoption of freeze-drying technology. In addition, the pharmaceutical manufacturing in the country is expanding, whereas the government initiatives supporting food preservation technologies are contributing to the market's development.

China is reinforcing its dominance in the regional freeze-drying market owing to the strong focus on food safety, innovation in pharmaceutical manufacturing, and expansion in functional food production. Domestic companies in the country are readily making investments in modern lyophilization equipment to improve product quality and export potential. In October 2025, Guanfeng Machinery reported that it had launched the high-performance GFD-200S freeze dryer, which is designed for large-scale food processing with a 19-layer heating rack and the ability to process up to 3,000 kg per batch, hence suitable for standard market growth.

India is steadily evolving in the freeze-drying market due to the increasing adoption in the nutraceutical, dairy, and herbal supplement sectors. The country's large agricultural output and rising demand for value-added processed foods are encouraging investment in freeze-drying infrastructure. In February 2025, CryoDry reported that it had partnered with Spinco as its official distributor in India, making advanced freeze-drying technology more accessible to labs, research facilities, and businesses nationwide.

Europe Market Insights

Europe represents an extremely dynamic landscape for the freeze-drying market, productively led by its emphasis on high-quality preservation techniques, especially in sectors such as biologics and nutraceuticals. Also, the pioneers in the region are implementing spectacular strategies to enhance their position in the global dynamics. In this regard, Itema in October 2023 reported that established a joint venture with Tofflon Group, marking a crucial step in advancing lyophilization technology for the pharmaceutical and biotech industries. The Tofflonit, a new company, will manufacture industrial freeze drying systems to serve the region’s market, focusing on products such as vaccines, antibiotics, and biotech compounds.

Germany is the leading contributor to progress in the regional freeze-drying market, facilitated by its robust pharmaceutical manufacturing base and a very strong food processing sector. Besides the country’s focus on technological innovation and automation encourages both the development and integration of these devices. For instance, in November 2024, Adragos Pharma notified that it had acquired Baccinex, enhancing its sterile manufacturing capabilities and expanding its footprint with a sixth manufacturing site. Hence, Baccinex’s expertise in liquid and lyophilized vial production strengthens Adragos’ solutions from development to commercial supply.

The U.K. is also solidifying its position in Europe’s market owing to its dynamic life sciences and biotechnology sectors, which play a pivotal role in shaping demand for lyophilization technologies. In November 2023, ISI notified that it has won funding as part of the Digital Lyo consortium to develop cutting-edge in-situ process analytical technologies, which are aimed at revolutionizing freeze-drying in biopharmaceutical manufacturing. Moreover, the project seeks to reduce cycle times, energy consumption, and product waste by integrating advanced sensors such as impedance and Raman spectroscopy for real-time process monitoring.

Key Freeze-drying Market Players:

- SP Industries, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GEA Group AG (Germany)

- Azbil Corporation (Japan)

- Labconco Corporation (U.S.)

- Millrock Technology, Inc. (U.S.)

- IMA S.p.A. (Italy)

- HOF Sonderanlagenbau GmbH (Germany)

- Martin Christ Gefriertrocknungsanlagen GmbH (Germany)

- Cuddon Freeze Dry (New Zealand)

- Biopharma Process Systems Ltd. (UK)

- Pfeiffer Vacuum GmbH (Germany)

- Tofflon Science and Technology Co., Ltd. (China)

- Cryotec Solutions, Inc. (U.S.)

- Freeze Drying Systems, Inc. (U.S.)

- Optima Pharma GmbH (Germany)

- VirTis (U.S.)

- Yamato Scientific Co., Ltd. (Japan)

- Kyowa Vacuum Engineering, Inc. (Japan)

- Ilshin Biobase Co., Ltd. (South Korea)

- Aseptic Technologies (Belgium)

- GEA Group AG is the international leader in the market, based in Germany. The company is a specialist in both pharmaceutical and industrial freeze-drying systems. The firm is well known for its innovative technologies, such as the LYOAIR cooling system and microwave freeze-drying. It focuses on enhancing energy efficiency and sustainability in lyophilization processes.

- SP Industries (SP Scientific) is one of the prominent players in this field. The firm is based in the U.S. that manufactures laboratory, pilot, and production freeze dryers. Also, the firm is well known for its products such as Virtis and FTS, which serve the life sciences, biotechnology, and pharmaceutical industries with advanced freeze-drying equipment.

- IMA Life is the subsidiary of the Italy-originated IMA Group, which offers integrated aseptic processing and freeze-drying solutions. Besides, the company provides complete production lines, combining vial filling with lyophilization technology, and is highly regarded for its isolator systems that ensure sterile environments.

- Tofflon Science and Technology Co., Ltd. is recognized as a fast-growing manufacturer based in China that specializes both in pharmaceutical freeze dryers and turnkey sterile production lines. The company has successfully expanded into the worldwide markets by delivering the completely integrated lyophilized systems that meet stringent regulatory standards.

- Dara Pharma, headquartered in Spain, has deliberately solidified its position as a leading full-solution provider in freeze-drying by acquiring Coolvacuum. Therefore, this strategic move allows Dara Pharma to offer complete production lines that integrate filling, freeze-drying, and closing processes under a single roof, recognizing its strong manufacturing capabilities and technical expertise.

Below is the list of some prominent players operating in the global market:

The global market is fragmented and extremely competitive, which has both established and emerging entities. Key pioneers in this field are pursuing distinct strategic initiatives to secure their global positions, catering to the evolving demands in different sectors. Mergers and acquisitions are one of the most common strategies to expand portfolios and enter into emerging markets. For instance, in June 2023, Thrive Foods notified that it had signed a definitive agreement to acquire Groneweg Group, which is a global manufacturer of freeze-dried and air-dried ingredients, hence enhancing its product portfolio and global footprint.

Corporate Landscape of the Freeze-drying Market:

Recent Developments

- In July 2024, GEA reported that it showcased major innovations in pharmaceutical freeze-drying at ACHEMA 2024, wherein technologies like the LYOAIR system with natural refrigerants, microwave freeze-drying, and LYOVAC ECO Mode significantly reduce energy consumption and enable continuous processing.

- In June 2024, Dara Pharma declared that it had finalized the acquisition of 100% of Coolvacuum, a specialist in industrial freeze-drying equipment, by purchasing the remaining 49% stake. It became one of the few global manufacturers offering complete, in-house freeze-dried production lines.

- Report ID: 5216

- Published Date: Oct 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Freeze-drying Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.