Dry Needling Treatment Market Outlook:

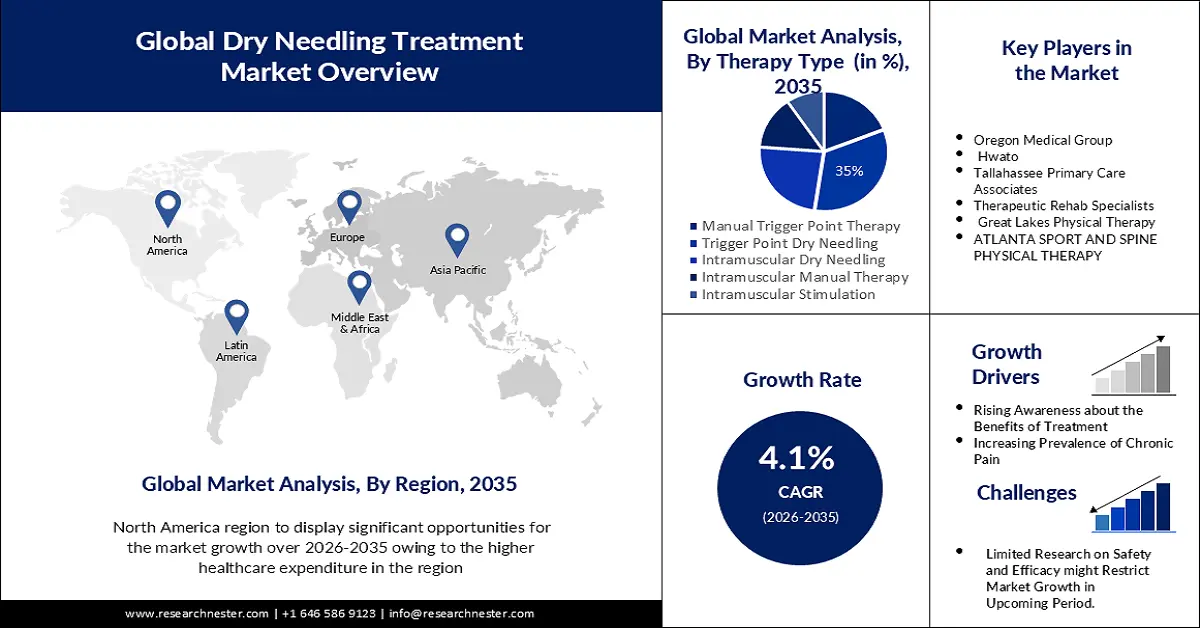

Dry Needling Treatment Market size was over USD 3.23 billion in 2025 and is projected to reach USD 4.83 billion by 2035, witnessing around 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dry needling treatment is evaluated at USD 3.35 billion.

The growth of this market can be primarily driven by the increasing prevalence of chronic pain conditions. Dry needling treatment is highly used in the treatment of chronic pain as it a safe and effective method becoming increasingly popular as a non-pharmacological substitute to medications. As per a data of 2023, the prevalence of new chronic pain cases were accounted to be around 53 cases per 1000 people per year.

In addition to this, rising demand for minimally invasive and non-pharmacological treatments is also accelerating the expansion of the dry needling treatment market in the estimated period. Patients on a large scale are looking for treatments that are invasive and pose fewer side effects than medications. Dry needling is a minimally invasive procedure that does not require surgery or anesthesia and it is often associated with several side effects.

Key Dry Needling Treatment Market Insights Summary:

Regional Insights:

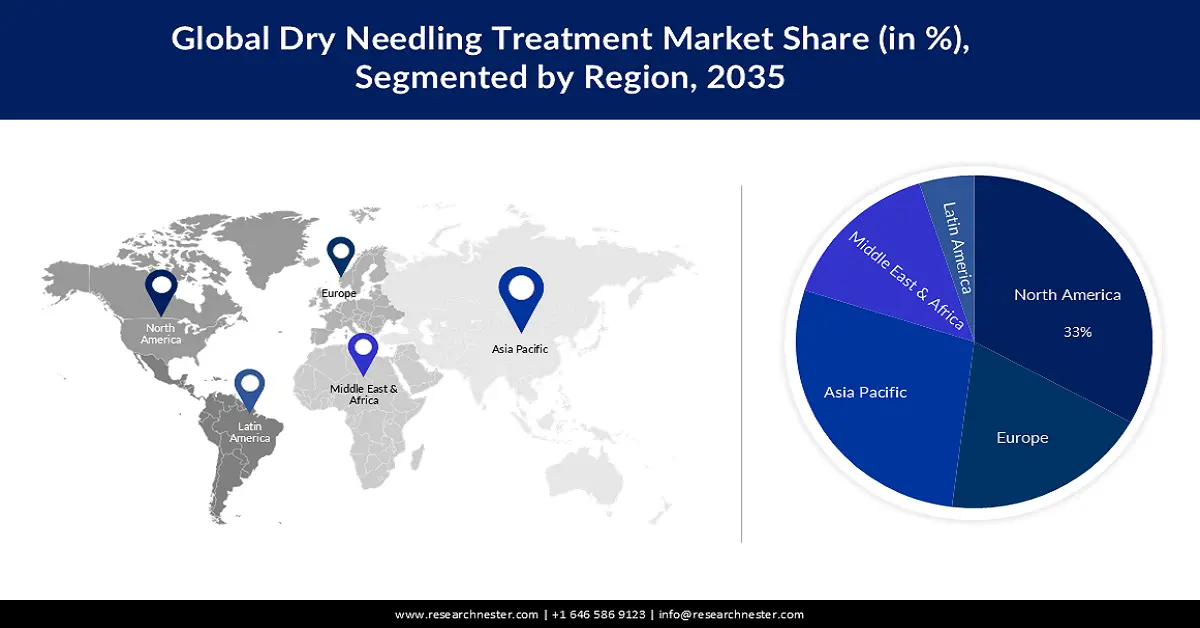

- North America is projected to hold a 33% share by 2035 owing to developing healthcare infrastructure and supportive government policies (impelled by growing healthcare expenditure).

- Asia Pacific market is expected to register significant growth during 2025–2035 due to increasing insurance reimbursement for patients (driven by rising treatment affordability).

Segment Insights:

- Trigger Point dry needling treatment is projected to account for a 35% share by 2035 owing to its safe and effective management of chronic pain and trigger points (propelled by growing research on dry needling).

- Musculoskeletal Pain segment is expected to witness significant growth during 2025–2035 due to the high prevalence of injuries and stress among patients (driven by increasing musculoskeletal pain cases).

Key Growth Trends:

- Growing Geriatric Population

- Growing Awareness of the Benefits of Dry Needling

Major Challenges:

- Lack of Standardization in Training and Practice

- Availability of Alternative Treatments

Key Players: Oregon Medical Group, Hwato, Tallahassee Primary Care Associates, Therapeutic Rehab Specialists, Great Lakes Physical Therapy, ATLANTA SPORT AND SPINE PHYSICAL THERAPY, Langley Fraser Physiotherapy, Grand Island Physical Therapy.

Global Dry Needling Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.23 billion

- 2026 Market Size: USD 3.35 billion

- Projected Market Size: USD 4.83 billion by 2035

- Growth Forecasts: 4.1%

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, Japan, United Kingdom

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 25 November, 2025

Dry Needling Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Growing Geriatric Population – Increasing number of aging population is expected to boost the market growth of dry needling treatment in the forecast period. The aging population is expected to experience muscles pain and other sort of injuries that might demand for adoption of physiotherapy. One in six individuals on the planet will be 60 or older by 2030. By this point, there will be 1.4 billion people over the age of 60, up from 1 billion in 2020. The number of individuals in the world who are 60 or older will double (to 2.1 billion) by 2050.

- Growing Awareness of the Benefits of Dry Needling – Dry needling is a minimally invasive procedure that can be used to treat a variety of conditions, including muscle tension, chronic pain, and headaches. As more people get the education about the advantages of dry needling the demand for this treatment rises rapidly driving the market growth in the projected period.

- Increasing Number of People Joining Sports – In the era of health consciousness more and more people are inkling towards sports and physical activities which is another significant factor behind the growth of this market. This is leading to increasing sports injuries and raising the demand for physiotherapy. This treatment demands dry needling in order to stimulate the muscles and enable healing.

Challenges

- Lack of Standardization in Training and Practice – There is no single standard training program for dry needling practitioners, and there is some variation in how it is practiced. This might lead to inconsistencies in the quality of care and the results of treatment.

- Availability of Alternative Treatments

- Limited Research on Safety and Efficacy of Dry Needling Treatment

Dry Needling Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 3.23 billion |

|

Forecast Year Market Size (2035) |

USD 4.83 billion |

|

Regional Scope |

|

Dry Needling Treatment Market Segmentation:

Therapy Type Segment Analysis

The trigger point dry needling treatment market is set to hold the largest revenue share of 35% during the time period. This is owing to the fact that trigger points are a common cause of pain and trigger point dry needling is a safe and effective treatment for these conditions that are also included in chronic disease management. Furthermore, the segment growth is anticipated by the growing research on dry needling. There is an increasing body of research on the effectiveness of dry needling. This research is helping to validate the use of dry needling and is leading to new applications for this therapy.

Application Segment Analysis

Dry needling treatment market from the musculoskeletal pain segment is estimated to grow significantly during the predicted period. This is due to its high prevalence of people suffering from injuries, and stress, there has been growing musculoskeletal pain among them. Dry needling treatment is a safe and efficient dry needling treatment used to cure musculoskeletal pain. The majority of individuals have gone through one or more transient episodes of musculoskeletal discomfort brought on by trauma or overuse. Between 13.5% and 47% of the overall population are impacted by this.

Our in-depth analysis of the global dry needling treatment market includes the following segments:

|

Therapy Type |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dry Needling Treatment Market - Regional Analysis

North America Market Insights

North America industry is predicted to hold largest revenue share of 33% by 2035, attributed to various factors such as developing healthcare infrastructure, supportive reimbursement policies put forward by the government, and growing healthcare expenditure. The growth of this market in the region can be attributed to various factors such as developing healthcare infrastructure, supportive reimbursement policies put forward by the government, and growing healthcare expenditure. The government in North America region is increasingly investing and spending on the advancement of healthcare facilities in the region that also comprises the integration of dry needling treatment. In 2021, US national health expenditure amounted to 18.3 % of GDP, the second highest in the last ten years and up from 17.1 % by that time.

Asia Pacific Market Insights

The dry needling treatment market in Asia Pacific region is expected to register significant growth during the projected period. Dry needling treatment in the Asia Pacific region is being highly reimbursed by the insurance companies in the Asia Pacific region. This is making it more affordable for patients to receive this treatment leading to increasing growth in the dry needling treatment market in the region.

Dry Needling Treatment Market Players:

- Tanana Valley Clinic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oregon Medical Group

- Hwato

- Tallahassee Primary Care Associates

- Therapeutic Rehab Specialists

- Great Lakes Physical Therapy

- ATLANTA SPORT AND SPINE PHYSICAL THERAPY

- Langley Fraser Physiotherapy

- Grand Island Physical Therapy

- Agupunt

Recent Developments

- Agupant declared to launch a new line of dry needling needles. They are made up of high-quality stainless steel and are designed to be sterile and single-use.

- Hwato has developed a new dry needling technique named micro-needling. The technique uses very fine needles to stimulate the skin that is said to be less painful and more effective than traditional dry needling.

- Report ID: 5247

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dry Needling Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.