Disposable Vapes Market Outlook:

Disposable Vapes Market size was valued at USD 8.6 billion in 2025 and is projected to reach USD 25.7 billion by the end of 2035, rising at a CAGR of 11.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of disposable vapes is estimated at USD 9.6 billion.

The global market for electronic cigarettes is defined by the significant regulatory complexity and public health oversight, with a primary focus on restricting youth access while providing alternatives for adult smokers. The regulatory bodies, mainly the US FDA, enforce a pre-market authorization pathway. The report from the FDA in July 2025 indicates that it has authorized 39 menthol-flavored and tobacco e-cigarette products and devices. These products have undergone various strong scientific review such as toxicology assessments, resulting in meeting the statutory public health standards. Further, the enforcement actions are the key market factor, with the FDA and the U.S. Consumer Product Safety Commission collaborating to block the imported unauthorized products. The market is shaped by taxation and shipping restrictions, which impose specific mailing and registration requirements on e-cigarette distributors.

Environmental and public health pressures are reinforcing the regulatory momentum and influencing the procurement decisions across the retail and institutional channels. The report from the CDC in November 2023 shows that nearly 25.2% of students are reported to use e-cigarettes daily. This drives the regulatory pressure on flavor availability and marketing. Further, the disposable nature of these products' availability presents growing environmental concerns. The report from the NIH notes that there is a significant contribution of disposable e-cigarettes to electronic waste containing non-recyclable plastics, heavy metals, and lithium-ion batteries, creating a persistent waste management problem that is expected to enhance the product design regulations and extended producer responsibility frameworks.

Key Disposable Vapes Market Insights Summary:

Regional Highlights:

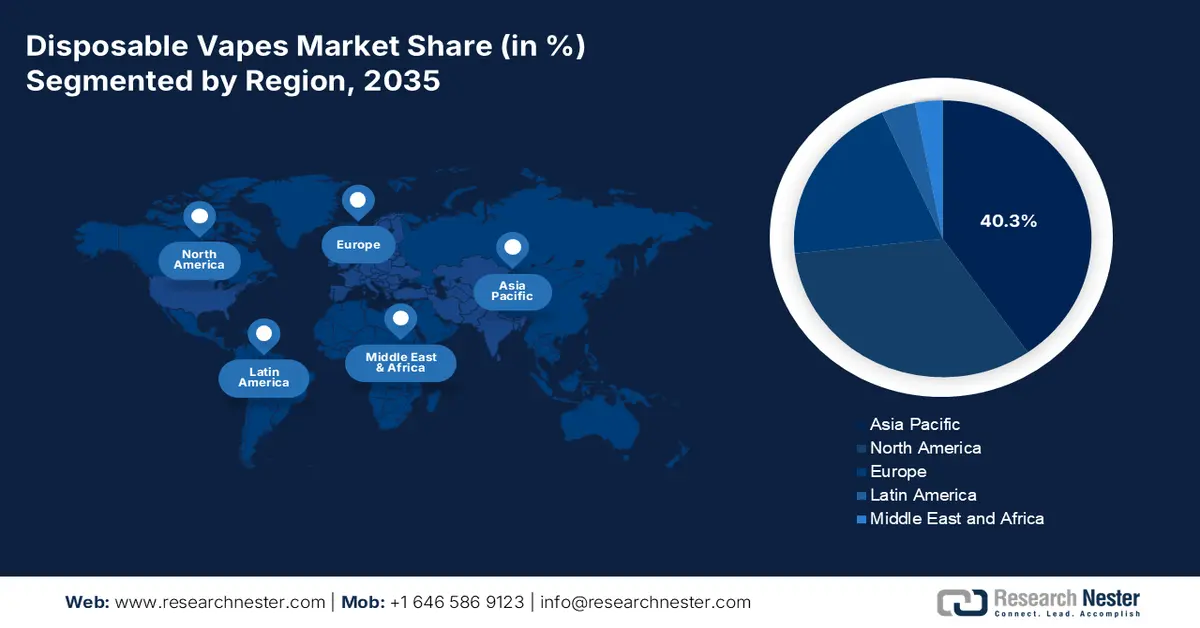

- The Asia Pacific region is projected to command a 40.3% revenue share by 2035 in the disposable vapes market, supported by China’s manufacturing dominance and a large base of adult smokers transitioning to vapor alternatives.

- North America is anticipated to register a CAGR of 6.5% during 2026–2035, underpinned by strong consumer preference for high nicotine strength products within a tightly regulated offline retail framework.

Segment Insights:

- Within the distribution channel, the offline sub-segment is forecast to secure a 65.4% share by 2035 in the disposable vapes market, anchored by immediate product availability and mandatory age-verified purchasing across physical retail outlets.

- The high nicotine strength segment is expected to retain its leading position by 2035, reinforced by nicotine salt formulations that deliver cigarette-like satisfaction and sustain repeat usage patterns.

Key Growth Trends:

- Rising flavor innovation

- Public health endorsement and harm reduction

Major Challenges:

- Intense pricing pressure and thin margins

- Product differentiation and innovation hurdles

Key Players: HQD (China), Bidi Vapor (U.S.), Puff Bar (U.S.), Vuse (U.S.), Blu (UK), NJOY (U.S.), SMOK (China), Geekvape (China), Vaporesso (China), RELX (China), Mojo (UK), Hayati Pro (UK), IGET (China), ElfLiq (China), Zovoo (China), R and M (China), Oxva (China), Japan Tobacco Inc. (Japan), KiK (Malaysia).

Global Disposable Vapes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.6 billion

- 2026 Market Size: USD 9.6 billion

- Projected Market Size: USD 25.7 billion by 2035

- Growth Forecasts: 9.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, South Korea, Canada

- Emerging Countries: United Kingdom, Germany, France, Australia, Italy

Last updated on : 13 January, 2026

Disposable Vapes Market - Growth Drivers and Challenges

Growth Drivers

- Rising flavor innovation: The adult transition remains a core demand factor in the market, with the expansion of diverse appealing flavors serving as the primary market growth driver. The U.S. FDA has consistently identified flavored products such as fruit candy, dessert, and mint as a reason for the use and initiation, creating a contentious link between flavor availability and market expansion. The CDC data in November 2023 shows that the fruit flavor is preferred by most of the e-cigarette users, and the current users are estimated to be 1,280,000. This shows how flavor innovation directly stimulates consumer trial and brand loyalty within key demographics. Consequently, the trajectory of flavor-driven growth is intrinsically tied to the regulatory pendulum, creating a high-risk, high-reward product development axis for manufacturers.

Flavor Type Used Among Current E-Cigarette Users

|

Flavor |

Number of Users |

|

Candy, desserts, or other sweets |

700,000 |

|

Mint |

560,000 |

|

Menthol |

400,000 |

|

Clove or spice |

120,000 |

|

Chocolate |

90,000 |

Source: CDC November 2023

- Public health endorsement and harm reduction: The formal recognition of vaping as a tobacco harm reduction tool serves as a significant, legitimacy-driven growth factor in the market. Public health strategies mainly in the UK explicitly promote e-cigarettes as a less harmful alternative for adult smokers, directly shaping the demand. The UK’s National Health Service notes that vaping is substantially less harmful compared to smoking and incorporates e-cigarettes into its official smoking cessation guidance. This government-sanctioned position reduces the perceived risk among adult smokers and fosters market growth via public health channels. The impact is reflected in Global Action to End Smoking data in September 2024, which reported an estimated 64.9% of the adult vapers were using e-cigarettes as a tool to quit smoking, demonstrating that harm reduction policy directly translates into consumer adoption and market demand.

- Research and development funding priorities: Government grants and public research funding into the nicotine delivery and tobacco harm reduction validate and steer technological development. Studies funded by agencies such as the U.S. NIH or the UK’s NIHR on the relative risks of vaping versus smoking are frequently cited in public health communication. This research underpins regulatory and policy decisions that change the market environment, influencing both consumer confidence and the scientific parameters for product development. Consequently, tracking the allocation and outcomes of these public grants provides an early indicator of future regulatory shifts and potential avenues for compliant product innovation.

Challenges

- Intense pricing pressure and thin margins: The disposable vapes market is very price competitive and is dominated by the high volume, low cost manufacturers, mainly from China. The new entrants face pressure to match the low-price points of established brands such as ELF BAR and HQD, compressing margins. This is exacerbated by government excise taxes, for example, the UK plans to implement a vaping product levy to increase consumer prices. The global market is expected to grow, but profitability for the new players is stifled by this pricing warfare and taxation.

- Product differentiation and innovation hurdles: Differentiating in a saturated market focused on similar formats is difficult. Innovation is constrained by regulations that limit flavor profiles and nicotine strengths in the key markets. On the other hand, the companies are also navigating imminent structural challenges such as the proposed European Commission ban on single-use e-cigarettes as part of the Waste Electrical and Electronic Equipment Directive, as stated by the UK Government in June 2024, which could force a complete redesign of the core disposable product concept.

Disposable Vapes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.6% |

|

Base Year Market Size (2025) |

USD 8.6 billion |

|

Forecast Year Market Size (2035) |

USD 25.7 billion |

|

Regional Scope |

|

Disposable Vapes Market Segmentation:

Distribution Channel Segment Analysis

Under the distribution channel, the offline sub-segment is dominating and is expected to hold a share value of 65.4% by 2035 in the market. The segment is driven by the immediate fulfillment and age-verified purchase requirements vital for a restricted product category. Vape shops offer personalized advice and product sampling while convenience stores provide unparalleled impulse buy accessibility for adult smokers. The channel’s resilience is reflected in FDA enforcement data, which shows a persistent physical retail presence for non-compliant products. For example, the NLM study in September 2024 shows that China made offline retail the only legal channel for the sales of e-cigarettes and has 161 e-cigarette specialty stores. This regulatory framework in the key markets, such as China, enforces the offline dominance by explicitly banning online sales, directly funneling all consumer traffic via physical retail storefronts.

Nicotine Strength Segment Analysis

High nicotine strength is leading the segment in the disposable vapes market. The segment is fueled by the nicotine salt technology, which allows for high concentrations without harshness, delivering a potent and satisfying nicotine hit that closely mimics smoking and aids in transition for adult smokers. The concentration has become an industry standard for disposables. Its prevalence and public health impact are well documented. According to the CDC, November 2023 data, among the current youth e-cigarette users, a staggering 89.4% reported using flavored disposable, and of those, the most commonly used device types are known for their high nicotine strength offering. This creates a potent feedback loop where high nicotine concentration drives user dependency and brand loyalty, ensuring its continued market supremacy despite increasing public health scrutiny and regulatory pressure.

Product Type Segment Analysis

The regular disposable vape remains the leading product type in the disposable vapes market defined by a sealed single-use design with an integrated battery and pre-filled e-liquid. Its market leadership is anchored in extreme user convenience, low upfront cost, and a vast array of flavors and designs, making it the primary entry point for new users. The EPA data on tobacco product waste highlights the dramatic environmental burden, noting that disposable e-cigarettes contribute significantly to plastic and lithium-ion battery waste streams, a direct consequence of their single use high volume design. Further, the segment's commercial success is linked to a linear take-make-dispose economic model, which faces growing sustainability challenges and the potential future regulatory constraints which is aimed at curbing electronic waste.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Flavor |

|

|

Nicotine Strength |

|

|

Puff Count |

|

|

Distribution Channel |

|

|

Demographics |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disposable Vapes Market - Regional Analysis

APAC Market Insights

The Asia Pacific disposable vapes market is dominating and is expected to hold the revenue share of 40.3% by 2035. The market is driven by China’s dual role as the world’s primary manufacturing hub and its own massive domestic consumer base. This concentration creates a unique market dynamic where supply chain control, production costs, and innovation are centrally located. A primary regional driver is the vast population of adult smokers seeking alternatives, mainly in countries such as South Korea and Japan, where heated tobacco products have already paved the way for nicotine and vapor adoption. The market is sharply separated by the regulatory extremes. The future growth trajectory across APAC will be less about uniform expansion and more about how individual national policies evolve.

The China market is driven by its unparalleled dual role as the world’s dominant manufacturing hub and its own colossal domestic consumer base. The NLM study in September 2024 shows that awareness of e-cigarettes has increased among adults in China. The prevalence of e-cigarette usage in China is 1.6% which resulted an estimated 16.9 million adults using them. Further, the e-cigarette domestic retail market was 19.7 billion RMB in 2021, with a YoY rise of 36%. Moreover, the leading e-cigarette company RELX Technology has announced that the company has planned to invest over USD 87 million in the next three years establish 1000 stores globally. This active retail expansion highlights the intense competition to capture market share in a domestic landscape highly regulated by state mandates on flavors and distribution.

The Philippines market operates within a complex and restrictive regulatory framework. The primary driver is the Sin Tax Reform Law, which has imposed excise taxes on e-cigarettes and heated tobacco products, categorizing them as goods similar to tobacco and alcohol. This law has legitimized the market for taxation, but also increased consumer prices. The NLM study in April 2023 indicates that 1 in 4 people in the country use the electronic nicotine delivery systems and have never smoked traditional cigarettes, which highlights the impact that corporate advertising has on public health. Demand persists, driven by adult smokers, but is largely met by a substantial illicit market of untaxed and non-compliant imported products.

North America Market Insights

The North America disposable vapes market is the fastest growing and is expected to grow at a CAGR of 6.5% during the forecast period by 2026 to 2035. The growth is primarily driven by the high nicotine strength preference and established offline distribution via tempered by robust FDA regulations and intense flavor restrictions. The market is fragmented the U.S. faces a constrained legal market dominated by a few authorized products while Canada experiences a growth under a different regulatory framework that permits wider nicotine concentration and flavor availability mainly in adult only retail settings. This divergence in national regulatory strategy creates a complex supply chain and competitive landscape for manufacturers operating across the continent.

The combination of strong retail momentum and federal oversight is driving the U.S. disposable vapes market. The report from the CDC in October 2024 shows the retail tracking, the total e-cigarette unit sales in the brick and mortar stores increased from 15.7 million to 21.1 million units, which is a 34.7% rise, reflecting expanding consumer uptake in the physical retail channels where disposable devices dominate shelf space. This growth has occurred alongside heightened regulatory investment; the FDA’s Center for Tobacco Products now operates with an annual budget enabling expanded enforcement against unauthorized disposable products and reshaping supply dynamics. At the same time, public health expenditure is influencing the demand quality rather than volume alone. The U.S. disposable vapes industry is transitioning from the rapid volume-led expansion toward compliance driven structure where the demand is increasingly concentrated around products that align with the federal authorization and public health cost containment priorities.

U.S. E-Cigarette Sales Statistics (June 2024)

|

Metric |

Value |

|

Total e-cigarette products available |

6,300 |

|

Disposable e-cigarettes share |

58.1% (12.3 million units) |

|

Prefilled cartridges/pod-based share |

41.9% |

|

Non-tobacco flavor sales |

80.6% (17.0 million units) |

|

Total dollar sales |

USD 488.9 million |

Source: CDC October 2024

Canada market is increasing shaped by the regulatory intervention. The Government of Canada, in August 2025, states that the Vaping Products Regulations in July 2021 set the maximum concentration of nicotine levels to 20 mg/mL, which reduced from 60 mg/mL, altering the product mix and the consumption behavior. On the other hand, Health Canada reports that the vaping prevalence among people in Canada is 13% in 2022, with disposable formats maintaining a strong penetration in the convenience and mass retail due to their low upfront cost and ease of access. The market is transitioning toward a lower-nicotine, compliance-led structure, where demand growth is less volume-driven and more dependent on regulatory alignment, authorized distribution, and public-health policy consistency.

Key Disposable Vapes Market Players:

- ELFBAR (China)

- HQD (China)

- Bidi Vapor (U.S.)

- Puff Bar (U.S.)

- Vuse (U.S.)

- Blu (UK)

- NJOY (U.S.)

- SMOK (China)

- Geekvape (China)

- Vaporesso (China)

- RELX (China)

- Mojo (UK)

- Hayati Pro (UK)

- IGET (China)

- ElfLiq (China)

- Zovoo (China)

- R and M (China)

- Oxva (China)

- Japan Tobacco Inc. (Japan)

- KiK (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ELFBAR has risen to a dominant position in the global disposable vapes market via a strategy focused on flavor innovation, sleek device design, and aggressive digital marketing. Its strategic initiatives include rapid product iteration to capitalize on trends and massive investment in social media and influencer partnerships, mainly on platforms such as Instagram and TikTok, to drive consumer appeal and brand recognition among adult smokers. In June 2024, the company won the Best Innovation award at the World Vape Show 2024.

- As a cost-competitive volume leader, HQD has captured a huge global share of the disposable vapes market by prioritizing extensive distribution networks and a vast portfolio of high-puff-count devices. Its key initiatives involve streamlining manufacturing for economies of scale and forging partnerships with distributors worldwide, ensuring its products are ubiquitously available in both traditional retail and online vape shops.

- Operating within the U.S. market, Bidi Vapor differentiates itself with a focus on regulatory compliance and adult-centric marketing. Its primary strategic initiative is the pursuit of the FDA premarket tobacco product application authorization for its Bidi Stick alongside a strict No Minors policy and the recycling program, aiming to establish the legitimacy and sustainability in a highly scrutinized market.

- Puff Bar significantly shaped the modern disposable vapes market by popularizing the sleek non-rechargeable disposable format. Following regulatory challenges, its key initiatives included a major product relaunch with synthetic nicotine to navigate the FDA oversight and a continuous focus on viral youth-oriented marketing, which, while controversial, cemented its brand identity and market presence.

- Vuse, owned by British American Tobacco, leverages its big tobacco resources to compete strategically in the high-value segment of the disposable vapes market. Its initiative centers on heavy R&D investment for consistent product quality, securing FDA marketing grants for its Vuse Alto, and utilizing established tobacco retail channels for dominant shelf space, aiming to convert adult smokers via reliability and legal distribution. The company in 2024 made sales of USD 927 billion for the legal global tobacco and nicotine market.

Here is a list of key players operating in the global market:

The global market is intensely competitive and fragmented, and is dominated by Chinese manufacturers, but with significant brand operations worldwide. The key players compete on flavor innovation, device longevity, and regulatory compliance. Strategic initiatives include heavy investment in the R&D for new nicotine formulations, extensive digital and influencer marketing, and a rapid portfolio rotation to follow trends. Sustainability concerns are prompting the early initiatives into the recycling programs and more eco-conscious product design. For example, in June 2024, Altria Group announced that the product NJOY had received the first FDA authorizations for menthol e-vapor products. The company aims to transition millions of smokers to potentially less harmful alternatives.

Corporate Landscape of the Market:

Recent Developments

- In April 2025, Sikary has launched the CLOUD ZERO, which is not only an e-cigarette, but also a fashionable accessory that's designed to make you stand out at social events.

- In July 2024, RJ Reynolds Vapor Company (RJRVC) introduced Sensa, which is the first disposable zero-nicotine vapor product from a major tobacco company. Sensa sold more than 100,000 units as of September 2024, and has been marketed through several channels.

- In January 2024, FEELM has released the world's first charge-free disposable technology solution for large-puffs, POWER ALPHA 2.0. It is the world's first charge-free solution for over 15,000 puffs, effectively solving the problem of needing repeated charging in the large puffs vapes popular on the market.

- Report ID: 8339

- Published Date: Jan 13, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Disposable Vapes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.