Sanitary Pads Market Outlook:

Sanitary Pads Market size was over USD 26.1 billion in 2025 and is anticipated to cross USD 44.58 billion by 2035, growing at more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sanitary pads is estimated at USD 27.39 billion.

The growth of the market can be ascribed to the rising education of women across the world. According to data published by UNESCO in October 2023, 50 million more girls were enrolled in school in 2022 in comparison with the last decade. Increasing girls' education encourages them to use clean menstrual products to ensure hygiene. Women's literacy is directly related to the increasing awareness among women regarding menstrual hygiene. UNICEF reports also stated that 39% of schools across the globe offer education on menstruation, further bolstering the market growth.

Additionally, the market is getting traction due to rising awareness of menstrual hygiene. For instance, Menstrual Hygiene Day is celebrated every year on May 28, aiming for a period-friendly world. The campaign got 1157 private and public partners in 2024 to propagate the message. Some of the philanthropic partners for the campaign are The Case for Her, Vitol Foundation, Merch Family Foundation, Svenska Postkod Stiftelsen, and Bill & Melinda Gates Foundation.

Key Sanitary Pads Market Insights Summary:

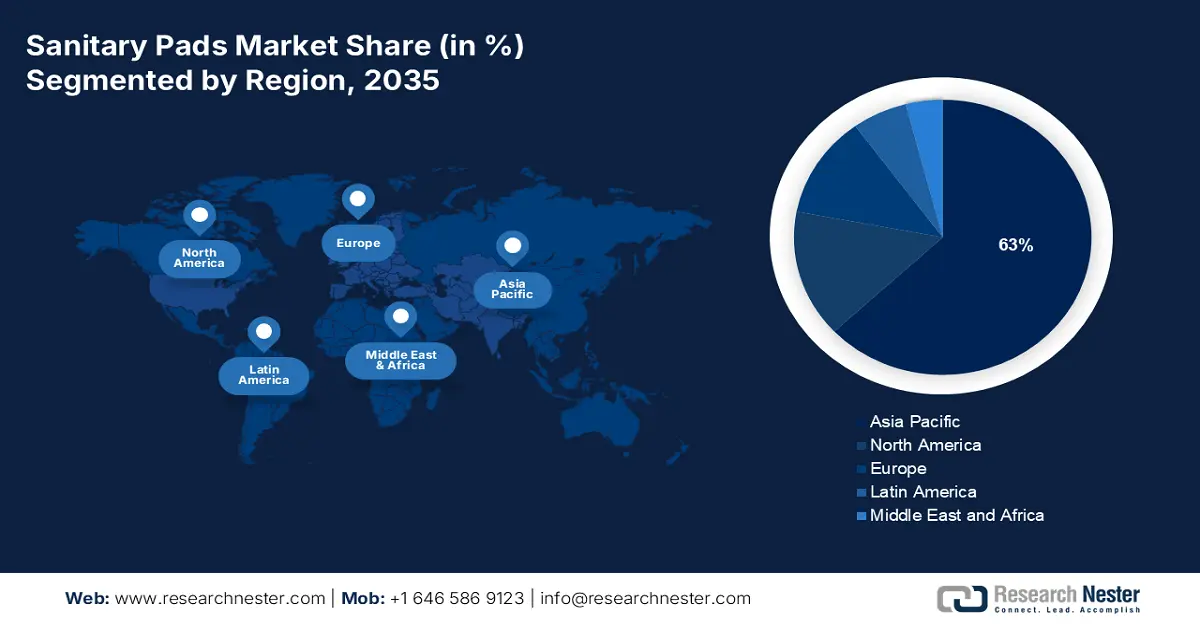

Regional Highlights:

- Asia Pacific sanitary pads market will hold around 63% share by 2035, driven by increasing government efforts to promote menstrual hygiene.

- North America market projects staggering growth during the forecast timeline, driven by robust purchasing power and developed healthcare infrastructure.

Segment Insights:

- The biodegradable segment in the sanitary pads market is projected to hold a significant share by 2035, driven by concerns about plastic waste and innovations in biodegradable pads.

- The pharmacies segment in the sanitary pads market is expected to experience steady revenue growth during 2026-2035, driven by expansion in global pharmacy networks and healthcare spending.

Key Growth Trends:

- Rising efforts from governments worldwide

- Rapid urbanization

Major Challenges:

- Availability of other options

- Discomfort related to the sanitary pads

Key Players: Kimberly Clark Corporation, Kao Corporation, Hengan International Group Company Limited, Edgewell Personal Care Company, Unicharm Corporation, Johnson and Johnson Services Ltd, Lil Lets UK Limited, JNTL Consumer Health (India) Private Limited, Procter & Gamble.

Global Sanitary Pads Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.1 billion

- 2026 Market Size: USD 27.39 billion

- Projected Market Size: USD 44.58 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (63% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 8 September, 2025

Sanitary Pads Market Growth Drivers and Challenges:

Growth Drivers

- Rising efforts from governments worldwide: According to the World Bank, as of May 2022, more than 300 million women worldwide menstruate. Various governments are putting tremendous efforts into making people aware of period hygiene. For instance, according to Alliance for Period Supplies in January 2025, in the U.S., currently 28 states, along with Washington D.C, have passed legislation to ensure students who menstruate have free access to period products while in school. Similarly, in Germany, at the University of Hamburg, 20 pad and tampon dispensers were positioned in women’s washrooms at 15 locations across the campus. These efforts are bolstering the sanitary pads market growth during the forecasted period.

- Rapid urbanization: According to the United Nations Statistics Division, the global population reached 8 billion in November 2022, out of which 55% live in urban areas and is projected to rise to 70% by 2050. In cities, there is higher accessibility to commodities such as sanitary pads due to the presence of adequate infrastructure, such as shopping malls, supermarkets, etc. This leads to higher sales of the sanitary pads, subsequently propelling the growth of the market. According to The Observatory of Economic Complexity in 2023, the global trade of sanitary pads reached USD 18.2 billion.

- Novel launches in sanitary pads: In the last few years, there has been a rise in the usage of organic and natural materials for manufacturing sanitary pads. Manufacturers are finding a viable solution to make nature-friendly sanitary pads. For instance, Prakati India is making Sanitary pads using raw materials such as organic cotton, corn starch, bamboo, and virgin pulp. Similarly, Camesi has used the finest plant-based ingredients so that women experience no rashes or irritation.

Challenges

- Availability of other options: There are various alternatives to sanitary pads available in the market, such as menstrual cups, discs, tampons, sponges, period underwear, etc. Gen Z is switching to greener options and relying on environment-friendly alternatives.

- Discomfort related to the sanitary pads: Wearing a pad can cause redness, itching, and irritation. Also, it can block the airflow of the vaginal area, causing bacterial infections. If the sanitary pad is not fixed properly, it causes movement restrictions.

Sanitary Pads Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 26.1 billion |

|

Forecast Year Market Size (2035) |

USD 44.58 billion |

|

Regional Scope |

|

Sanitary Pads Market Segmentation:

Product Segment Analysis

The biodegradable segment is anticipated to garner a significant share on the back of rising concerns related to the harmful plastic made sanitary napkins. According to a study conducted by the National Institutes of Health, sanitary pads consist of up to 90% plastic and take around 500-800 years to biodegrade. It also found that 1 sanitary pad contains plastic equivalent to 4 supermarket bags. Addressing these concerns, market players are making sanitary pads based on biodegradable raw materials. In November 2023, researchers at Stanford fabricated an open-source process for converting sisal fibers into absorbent material for making biodegradable sanitary pads. Similarly, in April 2024, a team of chemical and biomolecular engineering students from Johns Hopkins University developed “Biofide”. This is to address the issue of the rising number of pads (3.6 tons) ending up in U.S. landfills.

Distribution Channel Segment Analysis

Based on the distribution channel, the pharmacies segment is projected to register steady revenue growth during the assessed time period. The growth of the segment can be attributed to the surge in the establishment of pharmacies across the world. As there is a rise in the focus on preventive healthcare and expansion in healthcare access. Additionally, according to the World Economic Forum in 2021, the global spending on health reached a staggering USD 9.8 trillion. The global spending on healthcare is also acting as a catalyst for the growth of the sanitary pads market.

Our in-depth analysis of the sanitary pads market includes the following segments:

|

Product |

|

|

Source |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sanitary Pads Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region is likely to hold over 63% market share by 2035, driven by the presence of a large consumer base. Additionally, there are increasing efforts by governments in the Asia Pacific to raise awareness among women about menstrual hygiene. For instance, according to the National Institute of Health in 2023, in India, 355 million are in the menstruating phase. Also, a study conducted by the Ministry of Drinking Water and Sanitation showed that women and girls in India use 12 billion pads annually. Also, the Ministry of Health and Family Welfare implements a scheme for establishing over 8700 Janaaushidhi Kendras across the country for providing oxo-biodegradable sanitary napkins. Similarly, in Japan, the government of West Japan’s Hyogo Prefecture is making efforts to provide free sanitary pads to female students.

North America Market Insights

North America is projected to register staggering growth during the assessed period owing to high consumer awareness. Also, the population in the region has robust purchasing power and a well-developed retail infrastructure. Other than this, the increased healthcare spending in the region is propelling the growth of the sanitary pads market. According to the Centers for Medicare & Medicaid Services, U.S. healthcare spending grew 7.5% in 2023, reaching USD 4.9 trillion or USD 14,570 per person. In Canada, the market is witnessing significant growth due to the rising establishment of pharmacies. According to the National Association of Pharmacy Regulatory Authorities, in January 2025, the total number of accredited pharmacies in Canada was 10,432.

Sanitary Pads Market Players:

- Kimberly Clark Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kao Corporation

- Hengan International Group Company Limited

- Edgewell Personal Care Company

- Unicharm Corporation

- Johnson and Johnson Services Ltd

- Lil Lets UK Limited

- JNTL Consumer Health (India) Private Limited

- Procter & Gamble

The competitive landscape of the market is rapidly evolving as established key players, healthcare giants, and new entrants are investing in developing biodegradable products. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In October 2024, Butterfly takes the center stage at the 2024 sanitary pads exhibition at the Beauty World Dubai. The company is committed to quality, comfort, and innovation, and is thrilled to showcase its latest offerings in front of a global audience.

- In May 2024, Edgewell Personal Care announced the expansion of its product portfolio to include not only liners but also pads. The new pads featuring 1st top layer containing VEOCEL Lyocell fibers with dry technology, which is a super soft layer that contributes to a comfortable experience.

- Report ID: 1878

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sanitary Pads Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.