Dimethyl Ether Market Outlook:

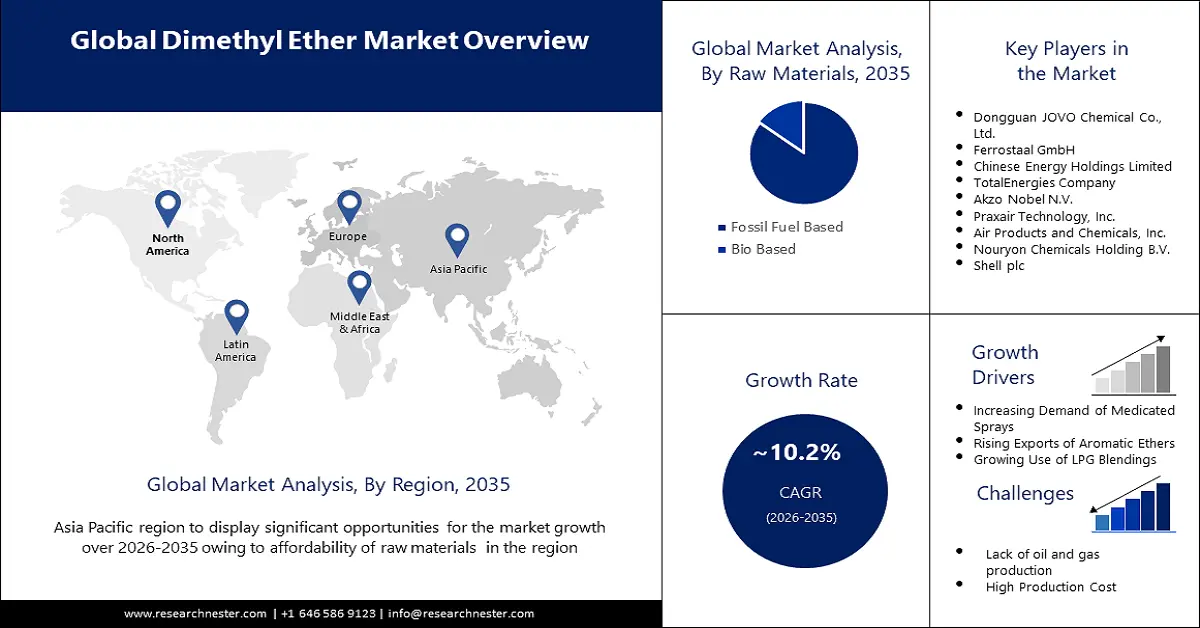

Dimethyl Ether Market size was over USD 10.28 billion in 2025 and is projected to reach USD 27.15 billion by 2035, witnessing around 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dimethyl ether is evaluated at USD 11.22 billion.

The surging applications of dimethyl ether in LPG blending, and as a power plant gasoline are propelling the market growth. Dimethyl ether is blended with LPG as an alternative fuel additive to improve combustion, reduce harmful emissions, and limit reliance on LPG. By 2050, the UK government is required by law to attain net zero carbon dioxide emissions. This is anticipated to necessitate a reduction in CO2 emissions from the UK industrial sector, representing a dip from 78.2 x 106 tons in 2019 to between 3.2 and 10.2 x 106 tons by 2050. Similar standards have also been established by other major economies, including the U.S., China, Japan, and the EU.

In partnership with industry and academic institutions, Perkins Engines Company Limited (PECL) recognized the Red Diesel Replacement Phase 1 competition as a chance to accelerate the development of renewable DME (rDME) as a possible low carbon alternative fuel choice. Flogas Britain Limited (Flogas) is interested in investigating rDME as a fuel and expanding its customer base beyond its primary off-grid liquid energy clients. Owing to its long-standing research partnership with Perkins, Loughborough University was eager to contribute its prior knowledge of alternative fuels to the project and upgrade Perkins-specific engine test cells to accommodate alternative fuel testing.

In a broader sense, the prospects for rDME development as an off-highway engine fuel have also been evaluated. Although there isn't any rDME available in the UK right now, research indicates that global output will rise sharply in the upcoming years, reaching 39 million Tpa by 2050. Several important advantages of using rDME as a fuel have been identified, even though there are still obstacles to overcome, including the creation of regulatory pathways for certifying DME-fueled engines, competition for supply of the fuel and its feedstocks, and the cost of rDME in comparison to fossil diesel without low carbon fuel incentives. Among these are its limited emissions and compression ignition performance, the ease with which engines might be converted to use it, and-most importantly-its capacity to drastically cut WTW CO2 emissions. According to Flogas, rDME's designation as a "development fuel" under the RTFO is a critical first step in promoting its use as a transportation fuel and enabling the realization of these advantages.

Key Dimethyl Ether Market Insights Summary:

Regional Highlights:

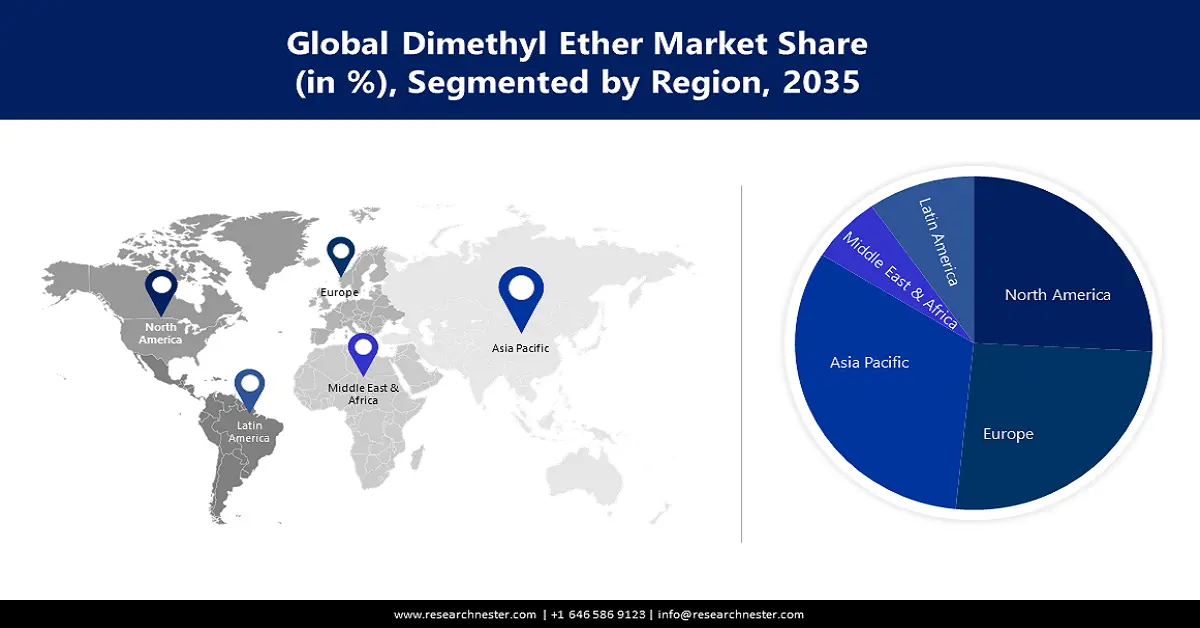

- Asia Pacific dimethyl ether market will secure around 61% share by 2035, driven by the affordability of raw materials, rising utilization of dimethyl ether in transportation fuel, and government support in the region.

- Europe market will register significant growth during the forecast timeline, fueled by rising demand for cleaner fuels, including dimethyl ether, and regulatory incentives promoting alternative fuels.

Segment Insights:

- The lpg blending (application) segment in the dimethyl ether market is projected to capture the highest market share by 2035, driven by increased usage of DME with LPG to enhance combustion and reduce hazardous emissions.

- The fossil fuel-based (raw materials) segment in the dimethyl ether market is expected to hold the largest share by 2035, driven by its compatibility with conventional internal combustion engines without substantial modifications.

Key Growth Trends:

- Shifting focus on utilizing biomass to produce DME

- Stable propane costs and subsequent rise in LPG supply

Major Challenges:

- Impact of environment on O&G production

Key Players: Mitsubishi Corporation, Air Products and Chemicals, Inc., Nouryon Chemicals Holding B.V., Shell plc, Praxair Technology, Inc., Akzo Nobel N.V., Dongguan JOVO Chemical Co., Ltd., Ferrostaal GmbH, Chinese Energy Holdings Limited, TotalEnergies Company.

Global Dimethyl Ether Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.28 billion

- 2026 Market Size: USD 11.22 billion

- Projected Market Size: USD 27.15 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (61% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 9 September, 2025

Dimethyl Ether Market Growth Drivers and Challenges:

Growth Drivers

- Shifting focus on utilizing biomass to produce DME: The current research based on oil palm empty fruit bunch (OPEFB) for generating dimethyl ether is still in its primitive phase. Indonesia is emphasizing mitigating the dependence on LPG imports by assessing ex-factory DME costs, transportation expenditure, and depot fees, particularly in the Kalimantan area plant. Its daily capacity is 994 tons OPEFP, which can lead to a corresponding production of 92 tons DME as of January 2023. From a financial perspective, the internal rate of return (IRR), net present value (NPV), and payback period (PP) are 17%, USD 93.1 million, and 10 years, considering 30 years of plant life and an investment of USD 185.4 million. Roughly, 57% of the DME-LPG mix distributed can suffice Kalimantan’s yearly requirements, while annual import budget savings are USD 5.81 million.

- Stable propane costs and subsequent rise in LPG supply: The U.S. propane wholesale prices have remained fairly stable, with slight variances since 2023 and to date. As of 3rd February 2025, the weekly and annual pricing analysis of wholesale propane suggests that the dollars per gallon was 1.206, signifying a 0.040 drop from a week ago and 0.101 surge from the previous year. Several governments are subsidizing LPG to meet the supply-demand gap and aiding 400 million marginalized households. In Ecuador, LPG refill costs for residential purposes are discounted point of sale (∼$0.67/kg, 90% market cost). Similarly, in India subsidies (∼$0.33/kg, 45% market cost) are deposited into customers’ bank accounts.

Challenge

- Impact of environment on O&G production: Since the shortfall of investment in the oil and gas industry has been growing, clean energy sources have been gaining traction. Moreover, increasing demand for electric vehicles is another factor that is estimated to hamper the market growth over the forecast period.

Dimethyl Ether Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 10.28 billion |

|

Forecast Year Market Size (2035) |

USD 27.15 billion |

|

Regional Scope |

|

Dimethyl Ether Market Segmentation:

Raw Materials Segment Analysis

The fossil fuel segment will hold the largest dimethyl ether market share as it is suitable for direct utilization in conventional internal combustion engines (ICs) without requiring substantial alterations. Moreover, the increasing exports of internal combustion piston engines are expected to further augment the segment growth by the end of 2035. OEC reported that the U.S. exported internal combustion piston engines worth USD 8.39 billion in 2022 of an overall trade of USD 45.4 billion.

Application Segment Analysis

The LPG blending segment in dimethyl ether (DME) market is anticipated to have the highest market share in the forecast year. This can be found in the increased usage of dimethyl ether with LPG to improve combustion and reduce the emission of hazardous gases. Growing research and development for blending ratio is considered to be the major factor driving the growth of this segment. To reduce hazardous emissions, enhance combustion, and limit the dependency on LPG, dimethyl ether is combined with LPG. For instance, around 15-25% of dimethyl ether is being used with higher ratio blends.

Our in-depth analysis of the global dimethyl ether market includes the following segments:

|

Raw Material |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dimethyl Ether Market Regional Analysis:

APAC Market Insights

Asia Pacific dimethyl ether market is set to account for the largest revenue share of 61% by 2035. Backed by the affordability of raw materials, rising utilization of dimethyl ether in transportation fuel, and LPG blending. Moreover, government support to expand the chemical industry in the region is further expected to drive dimethyl ether sales in the region during the forecast period. For instance, within the Union Budget 2022-23, the Indian government allocated approximately USD 27 million to the Department of Chemicals and Petrochemicals.

In June 2023, India developed its novel DME-fueled tractor on- and off-road applications, marking a new chapter in the country’s alternate sustainable fuel-based transport system. The project was backed by the Science and Engineering Research Board (SERB) and the DME-fueled engines showcased brake thermal efficiency. It generated negligible soot while prominently reducing HC, CO, and CO2 emissions. India was among the top exporters, valued at USD 7.66 million in 2022 of the world trade of USD 33.8 million, with an outbound CAGR of 5.6%. According to the 2020 NITI report by the Government of India, DME blending with LPG and DME blending with diesel is expected to register a CAGR of 6% between 2023 and 2030. Diesel demand in India is anticipated at 129.8 million tons and DME at 0.32 million tons, with DME’s blending ratio of 5%.

Projected India’s Demand for DME (in million tons)

|

Period April to March |

Demand for blending with LPG |

Demand for blending with diesel |

Total demand |

|

2023-24 |

0.677 |

Nil |

0.677 |

|

2029-30 |

0.96 |

0.32 |

1.28 |

|

2035-35 |

1.28 |

0.43 |

1.71 |

|

2039-40 |

1.71 |

0.58 |

2.29 |

Source: NITI

Europe Market Insights

The Europe dimethyl ether (DME) market is anticipated to grow at a significant rate by the end of 2035, owing to the rapid rise in the automobile industry in the region. Additionally, the utilization of dimethyl ether in the household also boosts the development and acts as a growth driver of this market. The European Union has set ambitious targets to reduce greenhouse gas emissions, increasing demand for cleaner fuels in the region. Dimethyl ether is a clean burning fuel with low emissions and an attractive alternative to conventional fuels. Demand for clean and alternative fuels in Europe is expected to boost the growth of the dimethyl ether market in the region. Regulatory initiatives and incentives are increasing the use of alternative fuels in Europe.

Germany was the largest exporter of dimethyl ether in 2022, with outbound trade of USD 8.29 million and accounted for an export share of 24.5%. The growth is underscored by the presence of some of the largest producers in the country, including Ferrostaal GmbH, Grillo WerkeAG, and Shell Deutschland Oil GmbH. The Shell plant at Wesseling is a prominent methanol manufacturer and 99.99% is used for DME.

Dimethyl Ether Market Players:

- Mitsubishi Corporation

- SWOT Analysis

- Regional Presence

- Recent Development

- Risk Analysis

- Key Performance Indicators

- Financial Performance

- Key Product Offerings

- Business Strategy

- Company Overview

- Air Products and Chemicals, Inc.

- Nouryon Chemicals Holding B.V.

- Shell plc

- Praxair Technology, Inc.

- Akzo Nobel N.V.

- Dongguan JOVO Chemical Co., Ltd.

- Ferrostaal GmbH

- Chinese Energy Holdings Limited

- TotalEnergies Company

The companies have identified key opportunity areas of sustainability and are focused on alternative fuels. They are engaging in strategic initiatives like new launches, partnerships and collaborations, and geographical expansions to strengthen their market positioning. Some of them include:

Recent Developments

- In May 2024, Lummus Technology declared the commercial availability of the latest dimethyl ether technology that is enhanced through catalytic distillation. The company aims to provide clean, cost-effective, and flexible solutions that help meet the future demands.

- In July 2023, the Department of Science and Technology in India stated that the country’s 1st dimethyl ether fueled tractor heralded a new age of clean fuel applications. Researchers developed a 100% DME fueled engine exhibiting lower emissions and higher thermal efficiency.

- Report ID: 3501

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dimethyl Ether Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.