Digital Lending Platform Market Outlook:

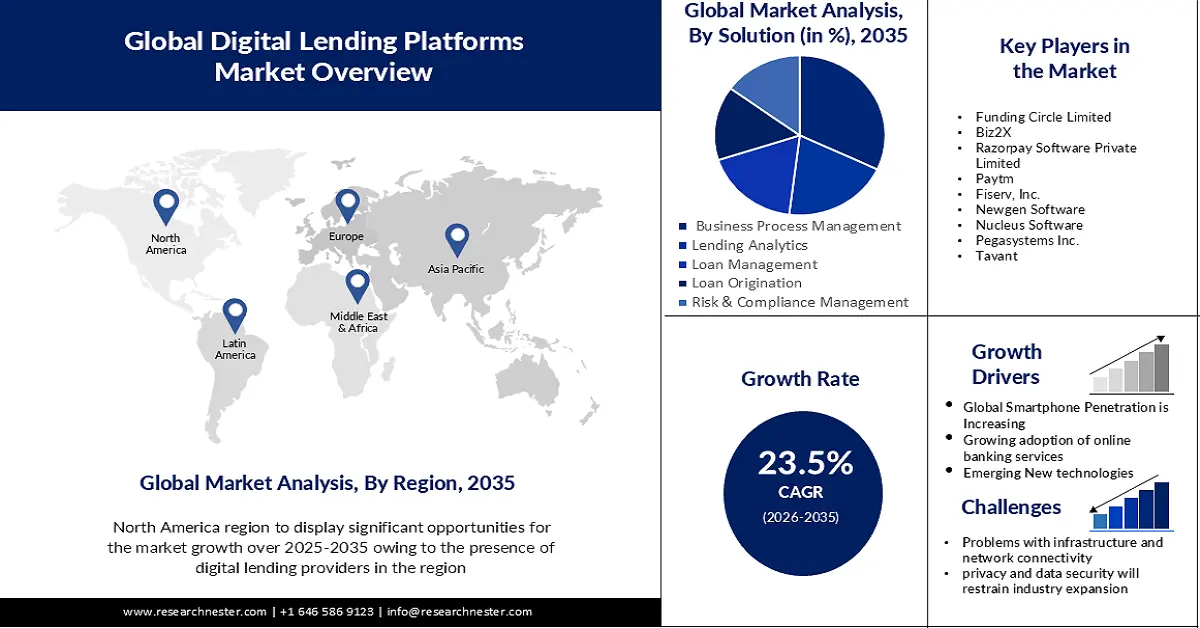

Digital Lending Platform Market size was over USD 23.28 billion in 2025 and is poised to exceed USD 192.16 billion by 2035, growing at over 23.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digital lending platform is estimated at USD 28.2 billion.

The ongoing advancement of cutting-edge technologies like cloud computing, network analytics, and the Internet of Things is significantly propelling the market for digital lending platform. Since 2018, the amount spent on IoT globally has increased annually by at least USD 40 billion. Furthermore, spending reached USD 1.1 trillion in 2023, maintaining the higher annual growth rate.

In addition, it is anticipated that blockchain technology will become more significant among digital loan providers because of its capacity to move documents quickly and with great integrity. Regulators, auditors, and other lending process participants may quickly follow transactions and verify identities thanks to blockchain technology. For example, Figure Lending LLC and Apollo closed a deal in March 2022 that involved ownership transfers and blockchain-based digital mortgage loans.

It is anticipated that the mortgage sector will become more transparent and efficient as a result of this safe and efficient mortgage loan registry.

Key Digital Lending Platform Market Insights Summary:

Regional Highlights:

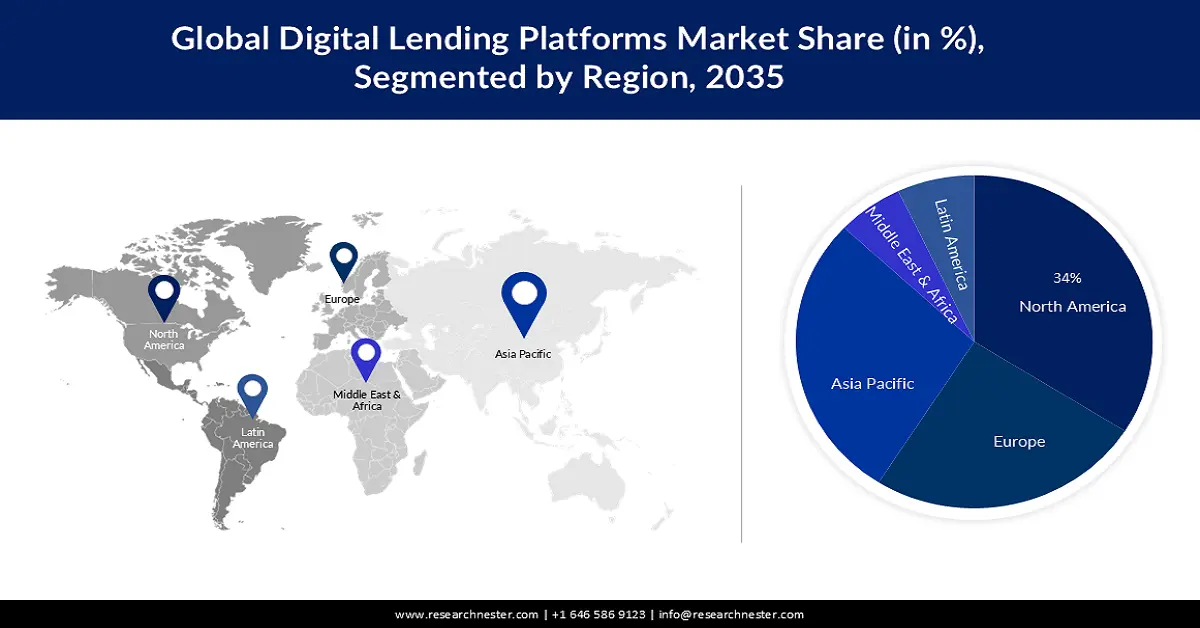

- North America digital lending platform market will dominate more than 34% share by 2035, driven by the presence of significant digital lending providers and a strong demand for digital financial solutions driven by technological adoption.

- Asia Pacific market will attain a 28% share by 2035, attributed to regulatory frameworks supporting innovation and the digital financial services market in countries like Singapore.

Segment Insights:

- The design & implementation segment in the digital lending platform market is forecasted to hold a 33% share by 2035, driven by the need for frameworks to facilitate digital lending platform integration.

- The business process management segment in the digital lending platform market is projected to capture a 32% share by 2035, influenced by the ability to reduce operating costs and boost productivity in lending.

Key Growth Trends:

- Global smartphone penetration is increasing

- Growing adoption of online banking services

Major Challenges:

- Global smartphone penetration is increasing

- Growing adoption of online banking services

Key Players: Reserve Bank of India (RBI), Funding Circle Limited, Biz2X, Razorpay Software Private Limited, Paytm, Fiserv, Inc., Newgen Software, Nucleus Software, Pegasystems Inc., Tavant.

Global Digital Lending Platform Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 23.28 billion

- 2026 Market Size: USD 28.2 billion

- Projected Market Size: USD 192.16 billion by 2035

- Growth Forecasts: 23.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Digital Lending Platform Market Growth Drivers and Challenges:

Growth Drivers

- Global smartphone penetration is increasing - In addition to offering the convenience of e-signatures and simple accessibility, DLP is becoming more popular due to rising smartphone usage and internet penetration rates. As of 2024, there are 6.93 billion smartphone users worldwide, or 85.74% of the global population, who own a smartphone.

Furthermore, because DLP needs less paperwork and lowers the possibility of human error, the increased emphasis on digital automation supports the growth of the global industry. The digital lending platform market is expanding as a result of numerous businesses incorporating cutting-edge technologies like blockchain, artificial intelligence (AI), machine learning, and analytics to reduce fraud.

Moreover, the growing frequency of cyberattacks is accelerating its worldwide adoption. According to cybersecurity data, there are 2,200 cyberattacks every day, or one every 39 seconds on average. - Growing adoption of online banking services - The digitization of lending procedures is happening swiftly as a result of globalization and the growing usage of online banking services. This is one of the main factors influencing how the banking, financial services, and insurance (BFSI) industry uses DLP to save a significant amount of money, improve client experiences, and make better decisions.

In addition, financial institutions across the globe are swiftly employing digital platform to extend credit and manage pandemic challenges amidst the COVID-19 outbreak. - Emerging new technologies - It is expected that emerging technologies such as blockchain, AI, and machine learning will enhance the functionality of digital lending platform and open up new business opportunities. By using these technologies, the loan-raising process can be made simple, quick, and transparent. Due to AI and machine-learning-based technologies that process loan applications in a matter of seconds, approval timeframes are scalable. Additionally, by eliminating middlemen or intermediaries from the loan process, the blockchain-based lending platform establishes a direct line of communication between lenders and borrowers.

Challenges

- Problems with infrastructure and network connectivity - The world's poor and underdeveloped countries continue to rely on antiquated telecommunications infrastructure that is unable to provide high-capacity, low-latency connectivity. A bad customer experience can result from slow internet. Because digital lending companies provide all of their services online, poor service quality will result from a slow connection.

Digital lending solutions are extremely challenging to adopt in areas without high-speed internet. Despite the lengthy approval delays, businesses in these nations rely more on offline lending choices since in-person contacts offer a better understanding and customer experience. - It is anticipated that privacy and data security will restrain industry expansion. Numerous governments worldwide have initiated measures to tackle apprehensions over data security and privacy protection linked to digital lending platform.

- One of the main factors that could prevent the digital lending platform market from growing is the increased reliance on traditional lending techniques.

Digital Lending Platform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.5% |

|

Base Year Market Size (2025) |

USD 23.28 billion |

|

Forecast Year Market Size (2035) |

USD 192.16 billion |

|

Regional Scope |

|

Digital Lending Platform Market Segmentation:

Service Segment Analysis

Based on service, the design & implementation segment dominates the digital lending platform market and is expected to generate a share of 33% during the forecast period. To facilitate the use of digital platform, financial institutions require a framework for design and implementation. For instance, the framework can assist financial institutions in effectively conducting their lending business activities.

To provide easy integration with a range of lending solutions and maintain regulatory compliance, organizations are providing these implementation services within their lending platform. The design and implementation segment offers advantages, including operational cost savings and an adaptable and nimble administration approach.

Solution Segment Analysis

Based on the solution, the business process management segment in the digital lending platform market is anticipated to hold a share of about 32% during the forecast period. The segment is growing due to its ability to drastically reduce operating costs and boost productivity. Business process management has grown in popularity. Simultaneously, the benefits of business process management in lending, including enhanced customer satisfaction and employee efficiency, reduced errors, and lessened paper usage, are also anticipated to be the primary drivers of the digital lending platform market growth.

Furthermore, the efficiency of business process management is being driven, in particular, by developments in big data and cloud computing. Increasing IT spending is also encouraging for the business process management market's growth throughout the projection period. Global IT spending is expected to increase by 5.5% from 2022 to around USD 4.6 trillion in 2023.

Our in-depth analysis of the global digital lending platform market includes the following segments:

|

Service |

|

|

Solution |

|

|

Deployment |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digital Lending Platform Market Regional Analysis:

North American Market Insights

The digital lending platform market in the North American region is attributed to holding the largest revenue share of about 34% during the forecast period. The growth of the market in this region is due to the existence of significant digital lending providers throughout the nation. Additionally, the area has embraced cutting-edge technologies, which have led to a persistently strong demand for digital, end-to-end financial solutions in North America.

Financial institutions in the area are being especially prompted to digitize their services and improve the customer experience due to a sizable mobile workforce. To obtain a significant competitive advantage, financial institutions in the area are attempting to set themselves apart from their rivals by launching cutting-edge digital services. According to recent information, in total, 72% of the world’s largest tech companies are based in the United States.

APAC Market Insights

The digital lending platform market in the Asia-Pacific region is projected to hold a revenue share of about 28% during the projected period. Certain Asian nations have regulatory frameworks that are conducive to the advancement of innovation and digital financial services. For instance, a legislative framework known as The Singapore Variable Capital Company (VCC) was developed for digital lending platform operating in Singapore, which offers operational efficiencies, regulatory clarity, and flexibility.

Additionally, it has put into place the "Fintech Regulatory Sandbox," which enables fintech businesses, including online lending platform, to test their creative business concepts in a safe setting. Due to this, an atmosphere has been established that promotes the development and growth of digital lending platform, drawing in both domestic and foreign participants.

Digital Lending Platform Market Players:

- Reserve Bank of India (RBI)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Funding Circle Limited

- Biz2X

- Razorpay Software Private Limited

- Paytm

- Fiserv, Inc.

- Newgen Software

- Nucleus Software

- Pegasystems Inc.

- Tavant

Recent Developments

- RBI - The Reserve Bank of India (RBI) announced its plans to launch its new pilot project for digital lending for a public tech platform meant for 'frictionless credit.’ The platform is being established by the Reserve Bank Innovation Hub (RBIH), a solely owned central bank subsidiary.

- Biz2X - Biz2X, a leading digital lending SaaS platform subsidiary of Biz2Credit, partnered up with TruBoard, a protuberant company in asset performance management, which operates on the Maadhyam platform. The partnership is focused on addressing the increasing worry of Non-Performing Assets (NPAs) in retail and small business loans. It authorizes Maadhyam customers to manage their folders while considerably reducing NPAs competently and working as a substitute for better monetary inclusivity for SMEs.

- Report ID: 5597

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digital Lending Platform Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.