Business Process Management Market Outlook:

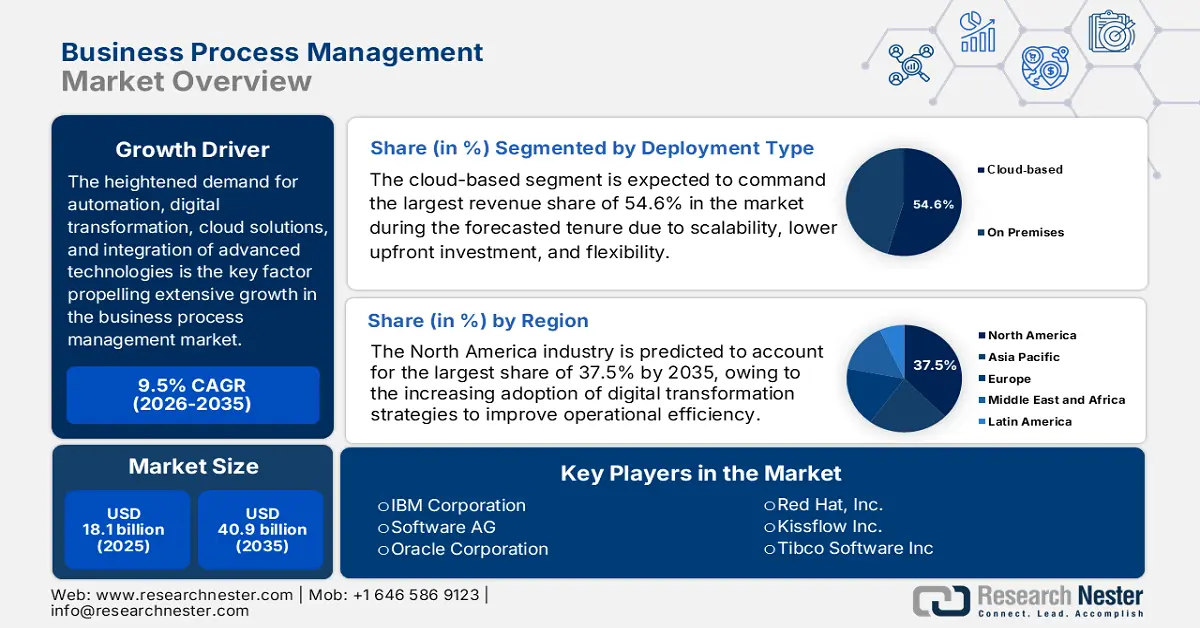

Business Process Management Market size was valued at USD 18.1 billion in 2025 and is projected to reach USD 40.9 billion by the end of 2035, rising at a CAGR of 9.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of business process management is evaluated at USD 19.8 billion.

The heightened demand for automation, digital transformation, cloud solutions, and integration of advanced technologies is the key factor propelling extensive growth in the business process management market. In this regard, GSA in December 2024 reported that the Technology Modernization Fund announced a substantial USD 19.67 million to modernize core retirement and immigration case-processing systems at OPM and DOJ’s EOIR. It also stated that the funding supports replacing legacy, manual workflows with automated processes that improve efficiency and reduce long-term maintenance costs. In addition, OPM will receive USD 18.3 million to remodel its old retirement systems by serving 2.8 million beneficiaries, whereas EOIR will use USD 1.34 million to automate document intake and streamline address-change workflows across justice and homeland security functions.

Furthermore, the technology modernization fund also highlights the federal government’s commitment to improving process efficiency and accountability through targeted technology investments, making it extremely beneficial to the business process management market. It made over USD 1.05 billion investment across 70 projects in 34 agencies, wherein its initiatives focus on modernizing workflows, reducing duplication, and improving end-to-end service delivery, core BPM outcomes. In addition, the program’s emphasis on reusable solutions, incremental funding tied to milestone progress, and cross-government lessons learned underscores growing demand for scalable process-automation and workflow-management capabilities in the public sector, thereby positively impacting business process management market growth in the upcoming years.

Key Business Process Management Market Insights Summary:

Regional Insights:

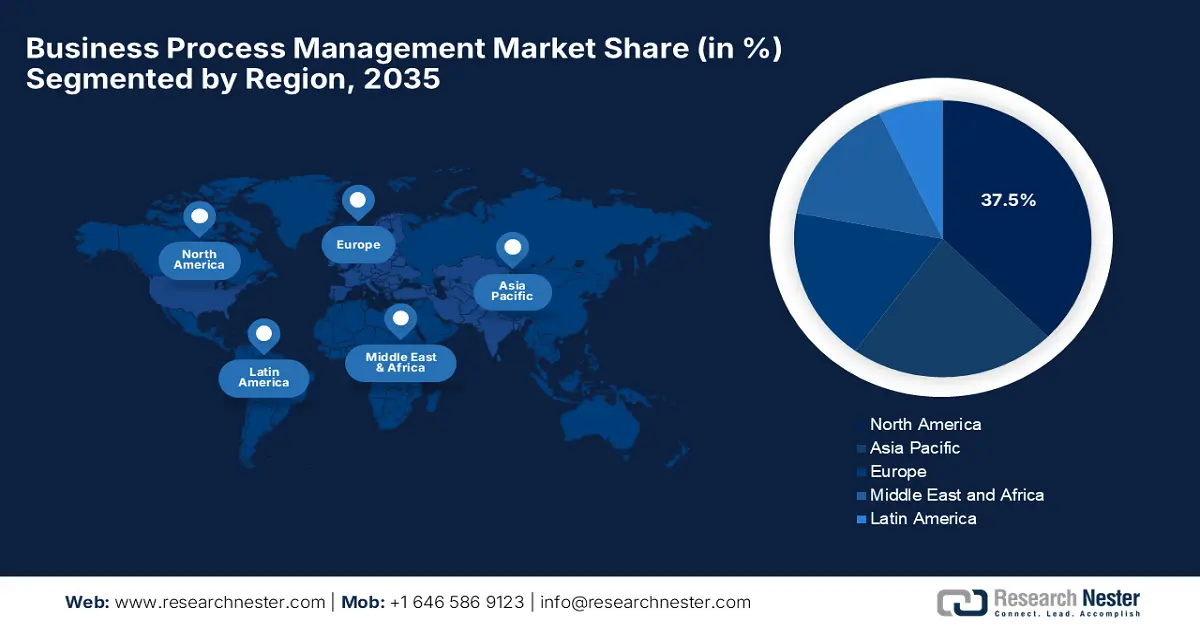

- North America is projected to command a 37.5% share in the business process management market by 2035, owing to rising enterprise digital transformation initiatives that enhance operational efficiency.

- Europe is anticipated to maintain a leading regional share by 2035, underpinned by organizations standardizing processes to comply with stringent regulatory frameworks across industries.

Segment Insights:

- The cloud-based deployment segment in the business process management market is expected to capture a 54.6% share by 2035, propelled by expanding demand for scalable and flexible digital infrastructure.

- The automation segment is set to secure a significant revenue share by 2035, supported by enterprises’ shift toward eliminating repetitive manual work to improve process performance.

Key Growth Trends:

- Integration of hyperautomation

- Demand for operational efficiency

Major Challenges:

- Skill gaps and talent shortages

- Resistance to change within organizations

Key Players: Software AG (Software GmbH) (Germany), Oracle Corporation (U.S.), Red Hat, Inc. (U.S.), Kissflow Inc. (U.S.), Tibco Software Inc. (U.S.), OTRS AG (Germany), Infosys Limited (India), HCL Technologies Limited (India), Newgen Software Technologies Limited. (India), PolariseMe (UAE), Appian Corporation Inc. (U.S.), Opentext, Inc. (Canada), Microsoft Corporation (U.S.), Accenture (Ireland), Persistent Systems (India), Centric Consulting (U.S.), CMW Lab. (U.S.), Bizagi (U.S.), Pegasystems Inc. (U.S.).

Global Business Process Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.1 billion

- 2026 Market Size: USD 19.8 billion

- Projected Market Size: USD 40.9 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Singapore, South Korea, Malaysia

Last updated on : 3 December, 2025

Business Process Management Market - Growth Drivers and Challenges

Growth Drivers

- Integration of hyperautomation: This, coupled with the emergence of AI, ML, and robotic process automation, is readily driving the growth of the business process management market. As per an article published by DCMS in January 2022, there has been an increased adoption of AI in the UK is currently concentrated among larger businesses, with around 68% of large companies, 34% of medium firms, and 15% of small businesses using at least one AI technology. The study also observed that adoption is highest in IT, telecommunications, and legal sectors, whereas hospitality, health, and retail are following with minimal adoption rates. In addition, the report outlined that spending on AI technologies and associated labor is rising rapidly, with projected growth reaching more than £30 billion (USD 37.9 billion) by the end of 2025. By the conclusion of 2040, around 1.3 million UK businesses are expected to adopt AI, with total AI-related spending exceeding £380 billion (USD 475 million), hence denoting a positive business process management market outlook.

AI Adoption and Expenditure Trends in UK Businesses (2020-2040)

|

Category |

2020 |

2025 (Projected) |

2040 (Projected) |

Notes |

|

Businesses using AI |

432,000 (15%) |

699,000 (22.7%) |

1.3 million (34.8%) |

Adoption grows faster in larger companies |

|

AI technology spends |

£16.7 billion (USD 20.9 billion) |

£30.3 billion (USD 37.9 billion) |

£83.5 billion (USD 104.4 billion) |

Central scenario CAGR ~12.6% to 2025 |

|

Labor spent on AI |

£46.0 billion (USD 57.5 billion) |

£88.7B (USD 110.9 Billion) |

£304.2 billion (USD 380.3 billion) |

Includes AI development, operation, and maintenance |

|

Businesses piloting AI |

62,000 |

— |

— |

2% of total firms in 2020 |

|

Businesses planning AI adoption |

292,000 |

— |

— |

10% of total firms in 2020 |

|

Adoption by sector (2020) |

IT/Telco 29.5%, Legal 29.2% |

— |

— |

Hospitality, health, retail <12% |

Source: DCMS

- Demand for operational efficiency: Both the public and private organizations across all nations are accelerating their digital transformation since there is a growing demand for systems that can streamline business processes. Testifying to this, a new report from the IBM Center for the Business of Government in 2024 revealed that the implementation framework provides a proper roadmap for modernizing public sector business processes. The study effectively distinguishes between incremental modernization, which is focused on operational efficiency, and full-scale transformation, which redefines service delivery. It also champions technologies such as robotic process automation for automating repetitive tasks. It further underscored that this framework allows government leaders to navigate legacy system debt and evolving citizen expectations to achieve improvements in service delivery as well as operational effectiveness.

- Shift towards cloud-based and SaaS solutions: The cloud deployment is making the business management solutions more accessible, scalable, and cost-effective, especially for small and medium enterprises. In November 2024, NTT DATA announced that it had acquired Niveus Solutions, which is one of the leading Google Cloud engineering companies, adding 1,000 GCP experts to strengthen its cloud capabilities and industry-specific solutions across the globe. Therefore, the acquisition enhances NTT DATA’s Google Cloud business unit, enabling accelerated AI-driven digital transformations across sectors, including financial services, manufacturing, and retail. Furthermore, building on its strategic partnership with Google Cloud, NTT DATA aims to deliver highly scalable, secure, and innovative cloud and genAI solutions to meet growing global demand, hence positively impacting business process management market growth.

Challenges

- Skill gaps and talent shortages: This is one of the major drawbacks associated with the business process management market. Adoption is increasingly influenced by skilled professionals who understand process design, automation tools, process mining, and analytics. In this context, organizations are facing challenges such as a shortage of talent that is capable of bridging business strategy and technical execution. Also, all employees may not be familiar with low-code or no-code platforms, AI integration, or advanced analytics required for intelligent process optimization. Therefore, training existing staff can be time-consuming and expensive, whereas hiring experts adds on burgeoning costs to the organization, hence restricting widespread adoption in this field.

- Resistance to change within organizations: The business process management market often necessitates transformations in how generally the processes are executed, creating resistance among employees who are accustomed to traditional workflows. Also, staff may fear job displacement due to automation or worry that new process controls will increase monitoring and accountability. Simultaneously, the aspects of poor communication, lack of proper executive sponsorship, and insufficient training can make it challenging for the business process management market to witness widespread adoption. Furthermore, delays, incomplete adoption, or workarounds that hinder process improvements can hamper growth even in the most advanced BPM implementations.

Business Process Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 18.1 billion |

|

Forecast Year Market Size (2035) |

USD 40.9 billion |

|

Regional Scope |

|

Business Process Management Market Segmentation:

Deployment Type Segment Analysis

The cloud-based deployment segment is expected to command the largest revenue share of 54.6% in the business process management market during the forecasted tenure. The segment is leading, acquiring multiple advantages such as scalability, lower upfront investment, flexibility, and remote access, making it especially attractive in an era of distributed work, global operations, as well as rising demand for agility. In November 2025, Microsoft announced that it had expanded its AI and cloud services in Indonesia by enabling organizations to build AI-powered solutions locally with Azure App Services, AI infrastructure, and Microsoft 365 Copilot. This move efficiently supports the frontier firms in accelerating innovation, along with scaling and improving productivity with the help of cloud and AI tools. The firm further underscored that since its launch, the region has witnessed increased adoption by companies such as Petrosea and Vale Indonesia, leveraging local infrastructure to modernize operations and enhance data governance.

Component Segment Analysis

In terms of the component segment, the automation is expected to lead to capturing a significant revenue share in the business process management market by the end of 2035. The growth in the segment is effectively attributable to the growing demand for process efficiency and cost reduction, wherein organizations are preferring to eliminate repetitive, manual tasks. Simultaneously, most of the firms are digitalizing and scaling, especially those large enterprises and regulated sectors, wherein the automation delivers consistent performance and scalability. In October 2025, Ricoh Company, Ltd. announced that it had launched RICOH Intelligent Automation, which is an AI-powered SaaS platform especially designed to enhance global process automation by processing tasks such as document processing, data extraction, and system integration. The platform also combines intelligent document processing and integration with core systems, supporting more than 200 languages and features such as handwritten text recognition and AI-assisted data capture.

Functionality Segment Analysis

The workflow automation is anticipated to lead this segment to grab a significant revenue share in the business process management market over the analyzed timeframe. The sub-type capability to directly address the core need, such as streamlining business operations, is the key factor propelling this leadership. Meanwhile, the need for faster decision-making, reduction of manual overhead, compliance, and auditability, combined with digital transformation initiatives, pushes organizations to choose automation-centric BPM modules. In addition, the BPM platforms are increasingly opting for low-code/no-code process design, and automation becomes both more powerful and accessible. Machine learning within workflow automation enhances predictive analytics, process optimization, and intelligent decision-making, further boosting its adoption. Furthermore, the rising demand across industries for digitally transformed operations is expected to sustain the growth of workflow automation in this market.

Our in-depth analysis of the business process management market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Type |

|

|

Component |

|

|

Functionality |

|

|

Organization Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Business Process Management Market - Regional Analysis

North America Market Insights

In the business process management market, North America is expected to lead, capturing the largest revenue share of 37.5% over the analyzed time frame. The region’s progress in this field is effectively attributable to the organizations that are increasingly opting for digital transformation strategies to improve operational efficiency. The region also benefits from a mature technology ecosystem, high enterprise IT spending, and a strong presence of BPM software vendors who are constantly putting efforts to solidify the BPM landscape. In July 2025, SER announced that it had launched AI-based purchase-to-pay and order-to-cash (o2c) solution bundles for SAP, which combine intelligent document processing, workflow automation, and SAP integration to enhance operational efficiency. It also underscored that these solutions streamline document-intensive workflows and enable end-to-end automation across sectors such as finance and procurement functions, hence making it suitable for overall business process management market growth.

The U.S. is gaining enhanced momentum in the regional business process management market due to the need to streamline enterprise operations and support large-scale business processes. Industry-specific BPM solutions are gaining traction in the country, wherein the sectors such as healthcare, financial services, and manufacturing are choosing operational compliance as a critical necessity. To evidence such factors, a white paper from the Federal CIO Council in December 2024 reported that robotic process automation is a strategic, low-risk entry point for modernizing the majority of the government business processes. It also highlights RPA's ability to automate high-volume, repetitive tasks in functions such as procurement, finance, and HR, which in turn leads to significant cost savings and improved compliance. Furthermore, this will free federal employees, and it serves as a major step in the government's digital transformation journey.

Canada has a strong scope to capitalize on the business process management market, which is supported by organizations that are striving to improve service delivery and operational productivity across both public and private sectors. In December 2024, BDC, Canada’s bank for entrepreneurs, announced that it has launched the data to AI program to help SMEs readily adopt artificial intelligence and enhance competitiveness. Besides, the initiative provides suitable AI solutions, cybersecurity support, and data strategy roadmaps, thereby enabling businesses to integrate automation and AI into daily operations while improving efficiency and customer service. Furthermore, with multiple offerings such as training and financing options, the firm encourages companies in the country to modernize processes, implement AI-driven tools, and drive growth in a very structured manner.

APAC Market Insights

The business process management market is expected to grow at a rapid pace from 2026 to 2035. The region’s pace of progress in this field is positively influenced by governments investing in digital infrastructure, encouraging enterprises to adopt automated and cloud-based BPM systems. Strategic activities by global BPM vendors and regional players further facilitate business process management market penetration in the years ahead. In August 2025, Tech Mahindra announced that it had been recognized with Frost & Sullivan’s 2025 Asia-Pacific Technology Innovation Leadership award for its strong excellence in business process management, thereby highlighting its achievements in digital transformation, AI-based service delivery, and intelligent automation. The company, through its Navixus business unit and genAI-powered solutions, efficiently streamlines workflows, enhances operational efficiency, and enables decision-making across industries. Hence, these solutions set benchmarks for process automation in the Asia-Pacific, contributing to overall market growth.

China has established itself as the dominating player in the business process management market due to industrial automation and the heightened adoption in state-owned and private companies. Meanwhile, businesses in the country are also choosing BPM to align with strict regulatory requirements and quality standards across numerous sectors such as manufacturing, logistics, and finance. In November 2025, Volkswagen Group announced that it had completed its Hefei, China, test workshops, enabling full development and validation of new vehicle platforms domestically. Besides, the facility integrates more than 100 laboratories for software, hardware, battery, and full-vehicle testing, reducing development time by around 30%. Furthermore, this expansion supports the rollout of China-specific technologies, which include digital cockpits, ADAS functions, and over-the-air updates.

India is readily emerging in the regional business process management market owing to the rising competitiveness among both traditional businesses and fast-growing startups. The country hosts a rapidly progressing IT services sector and the availability of skilled professionals who contribute to the increased deployment and continuous evolution of BPM solutions. In November 2025, ABB India and Deloitte India together announced that they had entered into a strategic alliance to accelerate digital transformation for manufacturing enterprises in the country, with a prime focus on AI-enabled, autonomous, and secure operations. The collaboration combines the firm’s industrial process automation solutions, including ABB Ability Genix Industrial Analytics, with Deloitte’s expertise in transformation and cybersecurity, wherein enterprises can achieve smarter and more future-ready industrial operations.

Emerging Trends and Market Opportunities in Business Process Management 2025

|

Company |

Details |

BPM Market Opportunity |

|

TCS & NHS Supply Chain |

TCS selected to modernize NHS Supply Chain IT systems using cloud and AI, enhancing efficiency and service delivery |

Modernizing large-scale healthcare operations with ERP and cloud solutions creates BPM opportunities in process optimization and digital workflow management |

|

OMRON Automation India |

OMRON launches Bengaluru Automation Center to advance smart manufacturing, provide PoC labs, and support Industry 4.0 adoption |

Automation and industrial IoT solutions enhance process workflows and operational efficiency, relevant to manufacturing BPM |

|

TCS & ALDI SOUTH |

TCS extends partnership with ALDI SOUTH to manage IT infrastructure globally, deploying AI-enabled cloud operations for operational efficiency |

Streamlining retail IT operations and automating workflows supports BPM initiatives across multi-national supply chains |

Source: Company Official Press Releases

Europe Market Insights

Europe has acquired the most prominent position in the business process management market, primarily shaped by the presence of organizations that are leveraging BPM to standardize processes across multiple locations while aligning with stringent regional regulations in finance, healthcare, and manufacturing. In March 2025, GBTEC Software AG announced that it had launched its BIC EAM solution by integrating Enterprise Architecture Management with Business Process Management and Governance, Risk & Compliance on a single platform. It also stated that this AI-powered platform helps companies optimize IT and business processes, break down silos, and drive holistic digital transformation. Furthermore, the solution aims to support consistent transformation strategies, prompting sustainable growth and operational efficiency, hence denoting a positive business process management market outlook.

Germany holds a strong position in the business process management market owing to the presence of a strong industrial base and focus on Industry 4.0 initiatives, which are encouraging the adoption of automated process management solutions. In addition, integration with enterprise resource planning systems and IoT devices also enables real-time process monitoring, predictive analytics, and continuous improvement across complex operations. In October 2025, Valantic and Almato announced that they had entered into a strategic partnership to advance AI-based business intelligence. Besides, the key component of this collaboration is Almato’s bardioc platform, which enables secure, transparent, and semantically enriched data management. Furthermore, Valantic will integrate Bardioc into its technology portfolio, supporting companies in strategic planning, implementation, and operations.

The business process management market in the UK is driven by the presence of organizations, particularly in banking, insurance, and public services, that are leveraging BPM for enhanced transparency, auditing, and workflow efficiency. Additionally, the introduction of the most advanced technologies helps enterprises deploy suitable BPM solutions. In February 2025, DataGlobal Group announced that it had introduced Windream 9, which is an upgraded document management system integrating AI support for a much smarter, faster content handling. The firm also reported that this system comprises a modern, dynamic workspace for intuitive navigation, enhanced collaboration, and customizable interfaces across most devices. Furthermore, the improved performance and security, which includes VFS-X technology and Microsoft Entra ID support, ensure a flexible and secure digital workplace.

Key Business Process Management Market Players:

- IBM Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Software AG (Software GmbH) (Germany)

- Oracle Corporation (U.S.)

- Red Hat, Inc. (U.S.)

- Kissflow Inc. (U.S.)

- Tibco Software Inc. (U.S.)

- OTRS AG (Germany)

- Infosys Limited (India)

- HCL Technologies Limited (India)

- Newgen Software Technologies Limited. (India)

- PolariseMe (UAE)

- Appian Corporation Inc. (U.S.)

- Opentext, Inc. (Canada)

- Microsoft Corporation (U.S.)

- Accenture (Ireland)

- Persistent Systems (India)

- Centric Consulting (U.S.)

- CMW Lab. (U.S.)

- Bizagi (U.S.)

- Pegasystems Inc. (U.S.)

- IBM is considered to be one of the widely recognized global technology and consulting powerhouses that offers a portfolio of BPM solutions under its IBM automation platform for digital business across all nations. The company combines artificial intelligence, workflow automation, and analytics to help enterprises optimize end-to-end business processes. The company’s offerings also integrate AI-based decision-making, robotic process automation, and cloud-native capabilities, with a prime focus on industries such as finance, healthcare, and manufacturing.

- Software AG is one of the most prominent providers of BPM, integration, and process intelligence solutions through credible platforms such as ARIS. This ARIS enables organizations to model, optimize, and monitor business processes by supporting process governance, compliance, and transformation initiatives. Furthermore, the company also focuses on integrating BPM with IoT, cloud, and analytics solutions, by helping enterprises across major regions to enhance both operational efficiency and agility.

- Oracle is a multinational technology leader that has been offering a wide range of enterprise solutions, including Oracle BPM Suite and Oracle Cloud Infrastructure. The company has solutions or tools for process modeling, automation, monitoring, and analytics, thereby enabling organizations to improve operational efficiency and accelerate digital transformation. In addition, the company is integrating BPM solutions with ERP, CRM, which further allows businesses to optimize workflows and achieve scalable process management.

- Red Hat is a subsidiary of IBM, specializing in open-source software solutions that encourage enterprises to automate business processes. The company’s solutions are primarily delivered through Red Hat Process Automation Manager, which is a platform that supports business rules management, workflow automation. Furthermore, the firm is also emphasizing containerization, cloud-native deployment, thereby helping organizations improve scalability and operational efficiency.

- Kissflow is a cloud-native BPM and workflow automation platform that is especially designed for simplicity, agility, and low-code or no-code deployment. The platform also enables organizations to design, automate, and optimize workflows across various departments, including HR, finance, and operations, without heavy IT involvement. Furthermore, the company focuses on democratizing process management, making it accessible to business users by integrating with popular SaaS applications, cloud services, and analytics tools.

Below is the list of some prominent players operating in the global business process management market:

The business process management market is extremely competitive, which hosts established leaders such as IBM, Oracle, Software AG, Red Hat, along with emerging entities such as Kissflow. Digital transformation, cloud adoption, AI integration, and low-code/no-code platforms are a few focus areas of these players to secure their business process management market positions. Meanwhile, the players are also opting for strategic initiatives such as mergers and acquisitions, partnerships, platform enhancements, and geographic expansion to strengthen their service portfolios. In November 2023, Celonis announced that it had acquired Symbioworld GmbH, which is a provider of AI-based BPM software, enhancing its process intelligence capabilities. The collaboration launched an upgraded process cockpit by merging real-time process insights with Symbio’s modeling data to deliver a unified, end-to-end process experience. Furthermore, Celonis’ mining-first approach allows organizations to analyze actual workflows before designing optimized processes.

Corporate Landscape of the Business Process Management Market:

Recent Developments

- In November 2025, Datamatics announced that it has partnered with Trinium AI to accelerate enterprise AI transformation by combining strategy, advisory expertise, and AI-powered execution for extremely faster, measurable business impact.

- In July 2025, Capgemini announced that it would acquire WNS for USD 3.3 billion in cash to create a global leader in Agentic AI-powered Intelligent Operations, combining Capgemini’s global reach with WNS’s expertise in Digital Business Process Services.

- In May 2025, Infosys BPM announced the launch of AI agents within its Accounts Payable on Cloud solution, transforming invoice processing from a human-driven, AI-supported model to an autonomous Agentic AI-first approach that enables end-to-end workflow management, handling complex processes.

- Report ID: 5037

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Business Process Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.