Automotive Business Process Management (BPM) Market Outlook:

Automotive Business Process Management (BPM) Market size was valued at USD 7.7 billion in 2025 and is set to exceed USD 16.62 billion by 2035, expanding at over 8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive BPM is estimated at USD 8.25 billion.

The growing demand for advanced application lifecycle management and systems engineering is accelerating the efficiency of business process management solutions in the automotive industry. Companies are strengthening and incorporating enhanced capabilities in lifecycle operations. For instance, in July 2024, Capgemini SE acquired Lösch & Partner GmbH to accelerate its potential in systems engineering and application lifecycle management. This technology enables automotive companies to enhance the development and management of software-defined products, ensuring seamless integration of physical and virtual systems. By utilizing these technologies, the automotive companies can optimize their business operations in real-time. The trend is driving efficiency in operations and fueling the market growth.

Key Automotive Business Process Management (BPM) Market Insights Summary:

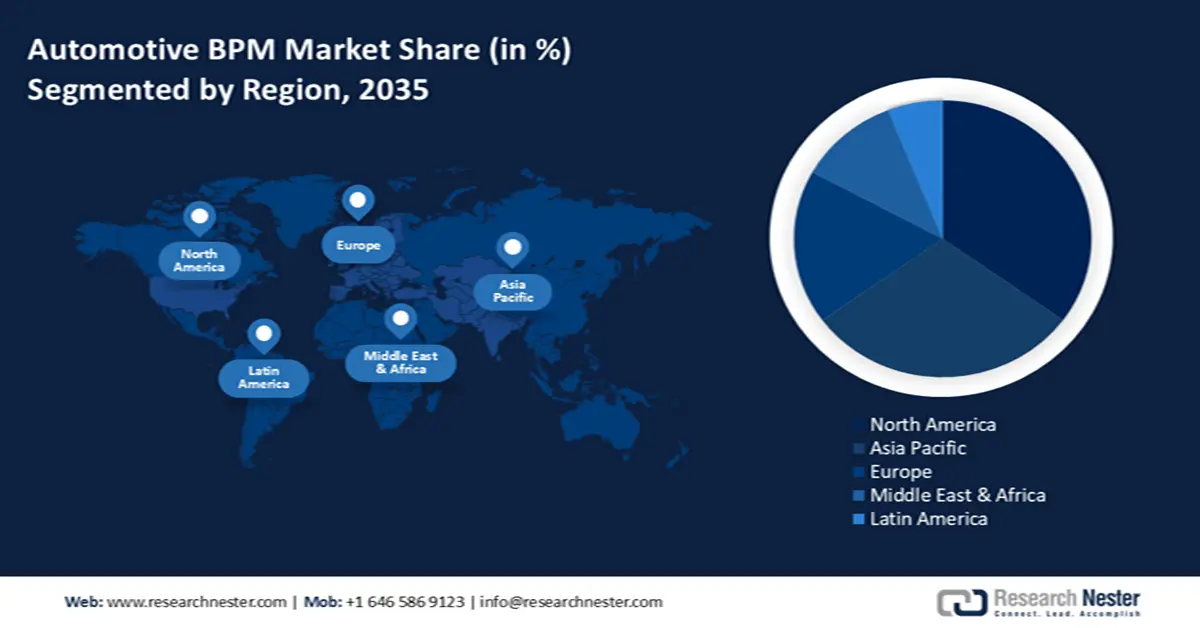

Regional Highlights:

- By 2035, North America is expected to capture the largest revenue share in the automotive business process management (bpm) market, attributable to the rising adoption of connected car technologies and advanced BPM platforms.

- Through 2026–2035, the Asia Pacific region is poised to accelerate strongly in share expansion, spurred by rapid digital transformation across automotive manufacturing.

Segment Insights:

- By 2035, the cloud segment in the automotive business process management (bpm) market is set to secure the highest revenue share during 2026–2035, bolstered by its cost-effectiveness and operational flexibility.

- By the end of 2035, the workflow automation segment is anticipated to hold the largest revenue share, fueled by the increased integration of AI and cloud technologies to optimize automotive operations.

Key Growth Trends:

- Digital transformation and industry 4.0

- Adoption of software defined factories

Major Challenges:

- Complex integration with legacy systems

Key Players: SAP SE, Peoples Soft, Oracle, International Business Machines Corporation, Capgemini Group, Infosys Ltd., Wipro Ltd., Larsen & Toubro InfoTech.

Global Automotive Business Process Management (BPM) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.7 billion

- 2026 Market Size: USD 8.25 billion

- Projected Market Size: USD 16.62 billion by 2035

- Growth Forecasts: 8%

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Thailand

Last updated on : 19 November, 2025

Automotive Business Process Management (BPM) Market - Growth Drivers and Challenges

Growth Drivers

-

Digital transformation and industry 4.0: The Tier 1 vehicle suppliers and OEMs are significantly integrating technologies, including analytics, AI, and IoT, with BPM to handle complex administrative production and workflows. Technology players are introducing cloud solutions to manage mobility, operational efficiency, and visibility. For instance, in April 2025, Rober Bosch GmbH launched its Supply Chain Studio, a cloud-based platform designed to digitalize transport, warehousing, and B2B commerce in India’s fragmented supply chain ecosystem. The platform integrates BPM tools to optimize transportation booking, warehouse management, smart warehouse operations, and last-mile logistics.

-

Adoption of software-defined factories: The automakers are inclining towards software-defined factories to reduce costs, digitize production cycles, and increase flexibility with the integration of AI and BPM. This trend is reinforced by major automotive manufacturers to incorporate real-time innovations in software-driven manufacturing ecosystems. In October 2024, Hyundai Motor and Kia Motors unveiled over 200 advanced manufacturing technologies at including AI-based assembly, autonomous logistics, and digital twin solutions. These are designed to enhance data-driven decision-making and optimize BPM operations across facilities. This surging dependence on the factories is propelling the automotive business process management market growth.

Challenge

-

Complex integration with legacy systems: The automotive manufacturers increasingly rely on legacy and complex IT systems for key operations such as supply chain logistics, inventory management, and production scheduling. The integration of BPM in legacy systems requires personalization, which results in challenges including delays in deployment, disruption in operations, and increased costs during the phase of transition. The parallel arrangements of multiple systems in real-time become difficult, further restraining the market growth.

Automotive Business Process Management (BPM) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8% |

|

Base Year Market Size (2025) |

USD 7.7 billion |

|

Forecast Year Market Size (2035) |

USD 16.62 billion |

|

Regional Scope |

|

Automotive Business Process Management (BPM) Market Segmentation:

Deployment Segment Analysis

The cloud segment in automotive business process management market is expected to hold the highest revenue share between 2026 and 2035, owing to the ability of the cloud platforms to offer cost-effectiveness and flexibility in operations. Providers are coming out with new technologies for vehicles, allowing them to deliver a better experience. For instance, in August 2024, Salesforce, Inc. introduced connected vehicle, a new cloud application that is capable of offering a faster and safer personalized driver experience. The application assists the vehicle makers to roll out new services and features to drivers faster with bidirectional, over-the-air capabilities. Such innovations are creating lucrative avenues for the segment’s growth.

Solution Type Segment Analysis

By the end of 2035, the workflow automation segment in automotive business process management (BPM) market is projected to account for the largest revenue share for its ability to increase productivity, decrease errors, and streamline operations across the automotive industry. Businesses are focusing more on the integration of AI and cloud technologies in operations to automate tasks such as paint matching and quality control. There is an increased adoption of workflow automation with the introduction of AI-based tools for document automation and process modeling.

Our in-depth analysis of the automotive BPM market includes the following segments:

|

Segment |

Subsegment |

|

Component |

|

|

Functionality |

|

|

Solution Type |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Business Process Management (BPM) Market - Regional Analysis

North America Market Insights

North America market is expected to account for largest revenue share during the forecast period, owing to the growing preference for connected car technology. Automakers are using real-time vehicle data, including service logs, telematics, and customer preferences, to develop tailored in-car experiences. Following this, the automotive giants are incorporating advanced BPM platforms to provide better driver experiences. For instance, in November 2023, Toyota Motor Corporation integrated Salesforce Inc.’s Automotive Cloud to provide better customer engagement and improve connected vehicle services. With real-time actionable insights and AI-powered automation, companies are optimizing fleet management, predictive maintenance, and customer interactions. Such innovations are creating immense opportunities for the market.

The automotive BPM market in the U.S. is rapidly expanding, with an increasing focus on cloud-native software platforms for enhanced automotive development. For instance, in January 2025, Valeo SA, in collaboration with Amazon Web Services, introduced the Valeo Virtualized Hardware Lab, which enables automotive manufacturers to accelerate electronic control unit software development by up to 40%. Other factors, such as rising demand for connected vehicles and increasing integration of IoT, AI, and blockchain within BPM systems, are expected to fuel market growth going ahead.

APAC Market Insights

The rapid digital transformation in manufacturing description is accelerating the growth of the automotive BPM market in the Asia Pacific. Local companies are adopting BPM solutions to improve quality management and supply chain planning. For instance, in October 2023, Infosys Limited signed an agreement of five years with Smart Europe GmbH to upgrade its direct-to-customer business model in Europe and provide enhanced customer experience, data-driven personalization, and engagement for the existing model.

The emphasis on automated driving in autonomous driving and infotainment systems is escalating the growth of the India automotive BPM industry. Various automakers are forming strategic partnerships with software companies and are opening joint ventures. In October 2024, the BMW Group and Tata Technologies announced the launch of their venture, BMW Techworks India, which is located in Bengaluru, Chennai, and Pune. This is resulting in various opportunities for young professionals. The partnership is encouraging local companies to contribute to the automotive value chain through BPM-driven automation and system integration.

Automotive Business Process Management (BPM) Market Players:

- SAP SE

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Peoples Soft

- Oracle

- International Business Machines Corporation

- Capgemini Group

- Infosys Ltd.

- Wipro Ltd.

- Larsen & Toubro InfoTech

The automotive BPM market is highly competitive and evolving, driven by the need for operational efficiency, digitization, and customer-centric solutions. Players are increasingly investing in AI, cloud computing, and automation to streamline workflows across manufacturing, sales, supply chain, and after-sales. Market competition intensifies with the integration of advanced analytics, IoT, and machine learning for real-time process optimization. Companies are also focusing on cybersecurity and regulatory compliance. Strategic alliances, M&A, and innovation-driven differentiation are shaping market dynamics, as participants strive to support digital transformation initiatives and maintain agility in a rapidly changing automotive ecosystem. Here are some key players operating in the global market:

Recent Developments

- In April 2025, Volkswagen Group introduced a new self-developed, AI-powered ADAS system to advance electric vehicles. The system is aimed at offering highly precise and fully safety-focused driving functions up to Level 2++.

- In May 2024, Automotive Grade Linux announced that the company is developing an open-source platform for all software-defined vehicles. The new system is aimed to be utilized for telematics, infotainment, and instrument cluster applications.

- Report ID: 690

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Business Process Management (BPM) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.