Diagnostic Imaging Services Market Outlook:

Diagnostic Imaging Services Market size was valued at USD 151.38 Billion in 2025 and is set to exceed USD 258.58 Billion by 2035, expanding at over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of diagnostic imaging services is estimated at USD 158.87 Billion.

The growth of the market can primarily be attributed to the increasing geriatric population across the globe with severe diseases and disorders. According to the World Bank’s statistics, the global geriatric population hit 747,238,580 in 2021. As a person grows older, their body weakens and organs start to deteriorate, making them vulnerable to both chronic and acute diseases which require diagnostic imaging services.

Global diagnostic imaging services market trends such as higher penetration of neurological disorders and constantly increasing R&D spending on medical imaging technology are projected to influence the growth of the market positively over the forecast period. The Pan American Health Organization (PAHO) published a report stating that nearly 533,172 men and 320,043 women lost their lives owing to some sort of neurological condition in America. Moreover, skyrocketing utilization of diagnostic imaging services in the diagnosis and treatment of cancer and booming demand in the cardiology segment are further expected to hike the growth of the market over the forecast period. As of 2018, about 15 million new cases of cancer were diagnosed while approximately 9 million people died due to cancer in a similar year worldwide. Therefore, all these factors are projected to push the growth of the market over the forecast period. In addition, the increased level of awareness about imaging procedures, and the presence of new technologically developed imaging diagnostic centers with advanced imaging technologies are also expected to fuel the global diagnostic imaging services market in the analysis period.

Key Diagnostic Imaging Services Market Insights Summary:

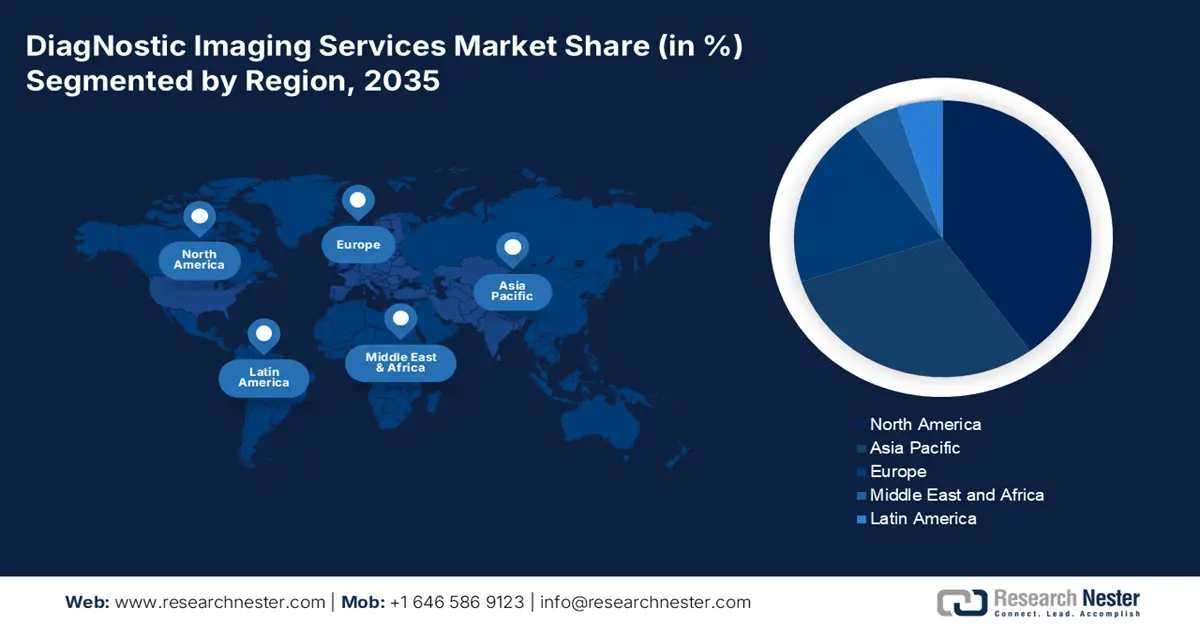

Regional Highlights:

- The North America diagnostic imaging services market will hold around 38.8% share by 2035, attributed to the rising geriatric population and advancements in diagnostic imaging systems.

Segment Insights:

- The hospitals (imaging services) segment in the diagnostic imaging services market is anticipated to secure the largest share by 2035, driven by the growing volume of hospital visits requiring imaging.

Key Growth Trends:

- Growing Inclination Toward Medical Imaging Technology

- Higher Utilization of MRI across the Globe

Major Challenges:

- Growing Inclination Toward Medical Imaging Technology

- Higher Utilization of MRI across the Globe

Key Players: Fonar Corporation, Siemens Healthcare GmbH, Shimadzu Corporation, General Electric Company, Samsung Medison Co., Ltd., Koninklijke Philips N.V., Hologic, Inc., Canon Medical Systems Corporation, Hitachi Healthcare Americas Corporation, Carestream Health.

Global Diagnostic Imaging Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 151.38 Billion

- 2026 Market Size: USD 158.87 Billion

- Projected Market Size: USD 258.58 Billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Diagnostic Imaging Services Market Growth Drivers and Challenges:

Growth Drivers

- Growing Inclination Toward Medical Imaging Technology - As of 2022, the total worth of diagnostic imaging devices was estimated to be approximately USD 45 billion globally. In the recent decade, drastic growth has been observed in medical imaging technology on the back of the launch of several new technologies. Moreover, medical imaging technology plays a vital role in the treatment and diagnosis of various diseases. Some of the major technologies used are nuclear medicine, ultrasonography, computed tomography, X-RAYs, mammography, MRI, and others. Hence such a higher penetration of associated applications is estimated to flourish the diagnostic imaging services market over the forecast period.

- Higher Utilization of MRI across the Globe – With the rising disorders and diseases among the population, MRI is an effective diagnostic imaging service that is useful in scanning a variety of conditions, from torn ligaments to tumors. Thus, rising cases of chronic and acute disorders along with accidents and injuries are expected to increase MRI utilization which in turn is projected to bring expand the market size. In 2019, the total number of MRI (Magnetic Resonance Imaging) units owned by multiple countries across the globe was estimated to be as given: USA (USD 40 million), Korea (USD 30 million), Japan (USD 50 million), France (USD 15 million), and others.

- Increasing Number of Computed Tomography Scanner Density - For instance, the highest number of CT scanners is estimated to be owned by Japan which is approximately 100 CT scanners per million people while in the USA, the number of CT scanners per million individuals was projected to be around 40.

- Rising Penetration of Bone Fractures in the Global Population - It is observed that nearly 6 million cases of bone fracture occur every year in the United States summing up to around 2 per 100 individuals.

- Noteworthy Increment in Global Healthcare Expenditure - According to the World Bank, in 2019, the global health expenditure reached USD 1,121.9 per capita.

Challenges

- Remarkably Expensive Imaging Diagnostic Procedures - The diagnostic procedure is costly and the provision of medical policies and favorable reimbursement policies are seriously lacking in low and middle-income countries considering the less access to healthcare facilities and poor healthcare coverage facilities in such regions compared to the developed countries. For instance, only 52% of Africans, or 615 million people, have access to the healthcare they require, and the quality of healthcare on the continent is often subpar. In contrast, among Americans under 65, 64.3% had private health insurance, including 56.6% with coverage based on employment and 6.7% with privately acquired insurance. Furthermore, 4.0% of people had exchange-based coverage, a kind of directly bought insurance.

- Requirement for Higher Initial Investment

- Lack of Requisite Equipment and Medical Workforce.

Diagnostic Imaging Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 151.38 Billion |

|

Forecast Year Market Size (2035) |

USD 258.58 Billion |

|

Regional Scope |

|

Diagnostic Imaging Services Market Segmentation:

Product Segment Analysis

The global diagnostic imaging services market is segmented and analyzed for demand and supply by product into MRI, SPECT, PET, X-RAY, ultrasound, tomography, and nuclear imaging, out of which, the X-RAY segment is projected to witness noteworthy growth over the forecast period. The growth of the segment can be accounted to the mounting number of medical examinations across the globe owing to the higher prevalence of multiple diseases and disorders in the modern population. Based on the data provided by the World Health Organization (WHO), it was stated that nearly 3.6 billion medical examinations are performed every year via X-RAY across the globe. Furthermore, the rising prevalence of lung diseases, dental disorders, and bone fractures is estimated to increase the adoption rate of X-ray imaging techniques in the forecast period. Also, the rapid development of advanced diagnostic X-ray system and ongoing technological advancements is anticipated to boost the revenue generation of the segment.

End-user Segment Analysis

The global diagnostic imaging services market is also segmented and analyzed for demand and supply by end-user in imaging centers and hospitals. Out of these, the hospital segment is projected to hold the largest share during the forecast period. The major factor attributed to segment growth is owing to the rising number of inpatients and outpatients visiting hospitals daily for checkups and scans which require diagnostic imaging services. Furthermore, the presence of a high number of hospitals across the world and the trust factor associated with the hospitals for consumers is also anticipated to create a positive outlook for segment growth. Massive investments to develop hospital infrastructure along with advancements made in the hospital setting are also expected to contribute positively to segment growth.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Diagnostic Imaging Services Market Regional Analysis:

North Americ Market Insights

North America region is likely to hold over 38.8% market share by 2035. The growth of the market in the region can primarily be attributed to the growing awareness of the early diagnosis of disease and the rising geriatric population which is more prone to chronic and acute diseases which require advanced diagnostic imaging services. World Bank stated that the number of geriatrics reached 56,545,938 in 2021 solely in the USA. Moreover, other factors such as ongoing advancement in diagnostic imaging systems owing to technological improvement and the presence of well-structured healthcare infrastructure are anticipated to propel the growth of the market in the region over the forecast period. Further, the presence of the flourishing medical tourism sector in the region, along with the availability of supportive policies by the regulatory bodies that promote the market players to increase the imaging procedure volume to develop efficient treatment options, are also anticipated to contribute to the market growth in the region. In addition, the region's expanding healthcare industry and rising number of plants for diagnostic imaging tools and equipment are also anticipated to boost the market growth in the region during the forecast period.

Diagnostic Imaging Services Market Players:

- Fonar Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens Healthcare GmbH

- Shimadzu Corporation

- General Electric Company

- Samsung Medison Co., Ltd.

- Koninklijke Philips N.V.

- Hologic, Inc.

- Canon Medical Systems Corporation

- Hitachi Healthcare Americas Corporation

- Carestream Health

Recent Developments

-

Shimadzu Corporation to launch LuminousQuester NI near-infrared imaging system. This imaging system is developed to contribute to drug discovery research by generating near-infrared light.

-

Siemens Healthcare GmbH to introduce mobile 3D imaging system with Endoluminal System, Cios Spin. The system is capable of sending updates to a certain location of the lesion via automated 3D image technology.

- Report ID: 4415

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Diagnostic Imaging Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.