Dermatophytosis Treatment Market Outlook:

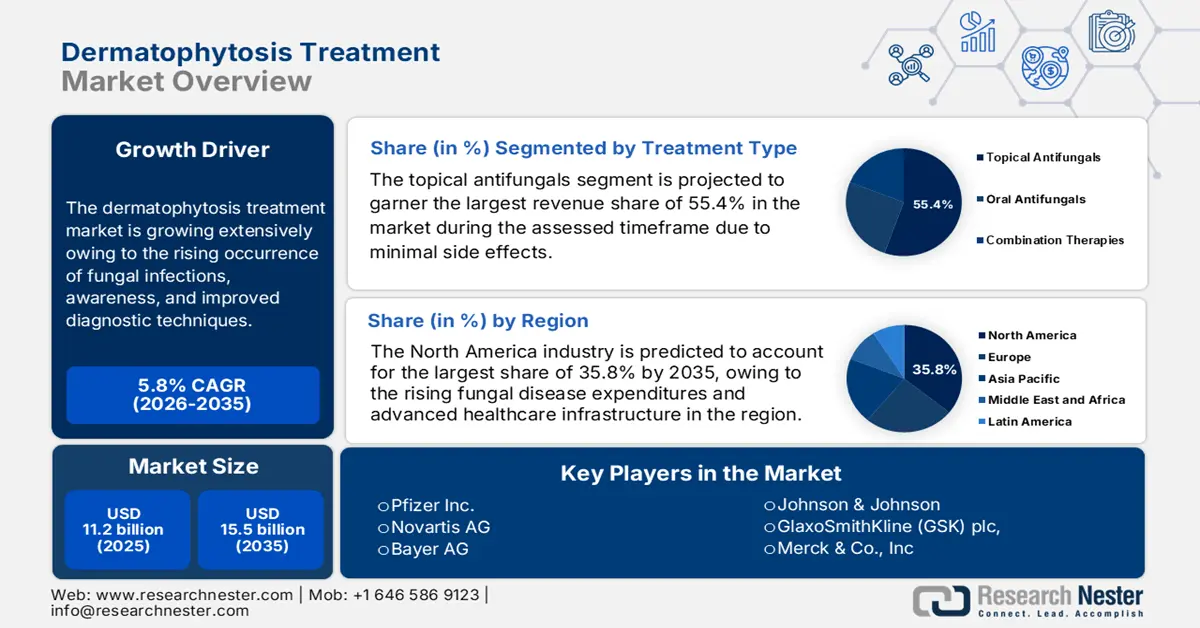

Dermatophytosis Treatment Market size was valued at USD 11.2 billion in 2025 and is projected to reach USD 15.5 billion by the end of 2035, rising at a CAGR of 5.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the dermatophytosis treatment is estimated at USD 11.4 billion.

The dermatophytosis treatment market is growing extensively owing to the rising occurrence of fungal infections, awareness, and improved diagnostic techniques. Testifying to the same World Health Organization in June 2025, it reported that ringworm, or tinea, is a widespread fungal skin infection caused by dermatophyte fungi, which accounts for over half of the estimated 650 million fungal skin infections across all nations. Also, more than 25% of children under 10 years old suffer from scalp ringworm in many regions, thereby positively impacting market progression.

Furthermore, from a pricing perspective, antifungal treatments are generally accessible, and payer support also remains considerable in managing effectively across different healthcare settings. In March 2025, the study by the Medical Journal Armed Forces India revealed that among 200 patients tracked for a period of 28 days, the average cost per one-point improvement in dermatology life quality index was INR 232 (USD 2.7), wherein 70% of healthcare expenses are self-funded, with 70% spent on medicines.

Key Dermatophytosis Treatment Market Insights Summary:

Regional Highlights:

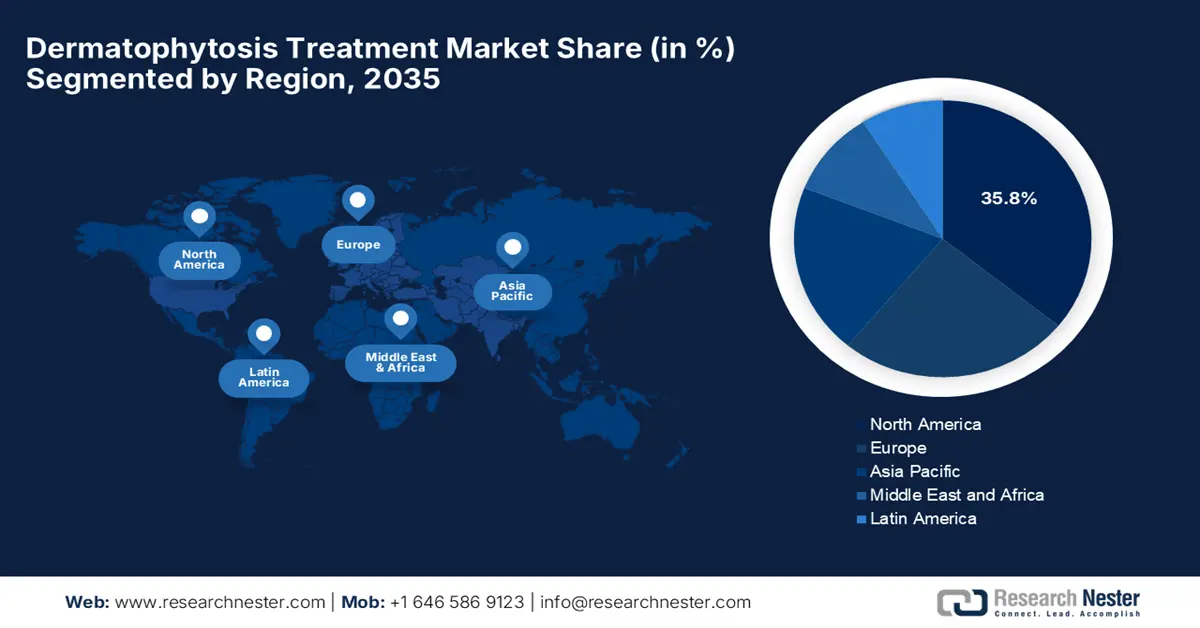

- By 2035, North America is anticipated to command a 35.8% share in the Dermatophytosis Treatment Market, supported by escalating fungal disease expenditures.

- The Asia Pacific region is projected to experience strong growth by 2035, underpinned by rising infection rates and heightened public awareness.

Segment Insights:

- The topical antifungals segment is expected to secure a 55.4% share by 2035 in the Dermatophytosis Treatment Market, propelled by increasing patient preference for self-administered therapies.

- The retail pharmacies segment is forecast to capture a 50.3% share by 2035, bolstered by growing consumer awareness.

Key Growth Trends:

- Increased awareness

- Advances in diagnostics and drug delivery formulations

Major Challenges:

- Rising antifungal resistance

- High out-of-pocket costs

Key Players: Pfizer Inc., Novartis AG, Bayer AG, Johnson & Johnson, GlaxoSmithKline (GSK) plc, Merck & Co., Inc., Sanofi S.A., AbbVie Inc., LEO Pharma A/S, Galderma S.A., Astellas Pharma Inc., Sun Pharmaceutical Industries Ltd., Viatris Inc., Perrigo Company plc, Teva Pharmaceutical Industries Ltd., Lupin Limited, Cipla Limited, Bausch Health Companies Inc., Mayne Pharma Group Ltd., Yuhan Corporation.

Global Dermatophytosis Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.2 billion

- 2026 Market Size: USD 11.4 billion

- Projected Market Size: USD 15.5 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 3 October, 2025

Dermatophytosis Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Increased awareness: Patients are highly aware and informed about skin health, prompted by the continued awareness programs, media exposure, and health education, fostering a profitable business environment for the dermatophytosis treatment market. In May 2022, Bayer reported that it had relaunched its global antifungal brand called Canesten in India, which offers improved formulations in cream and powder formats based on the original research molecule Clotrimazole. It is designed to treat a wide range of skin fungal infections and enables relief from symptoms such as itching, irritation, and redness, especially among women who often ignore early signs.

- Advances in diagnostics and drug delivery formulations: The continued advancements in terms of molecular assays, faster culture/microscopy) help with early, accurate detection will extensively support the treatment uptake in this field. As per an article published by ASM Journals in September 2024, the Novaplex dermatophyte multiplex qPCR assay was evaluated using 312 clinical samples, which displayed a sensitivity of 92.9% when compared to traditional culture methods, wherein results are available significantly faster and are highly effective for routine dermatophytosis diagnosis, especially in non-specialized labs.

- Demographic variations: The rapidly aging demographics are highly susceptible to fungal infections, whereas the rising occurrence of comorbidities such as diabetes and obesity is further increasing the exposure to the concern. The study by NIH in August 2022, which conducted a large-scale Korean cohort study of over 4.5 million people aged between 20 and 40, found that higher BMI and waist circumference increased the risk of dermatophytosis. Individuals with severe obesity (BMI ≥30 kg/m²) had a 36% higher risk (HR 1.36), while those with abdominal obesity (waist circumference >90 cm for men, >85 cm for women) also showed elevated risk (HR 1.057).

Epidemiology, Diagnosis, and Treatment Outcomes in Onychomycosis 2024 Study

|

Category |

Details / Statistics |

|

Prevalence |

1%-8% of the population |

|

Toenail vs Fingernail |

Toenails are more commonly affected than fingernails. |

|

Dermatophyte Involvement |

90% of toenail & 50% of fingernail onychomycosis |

|

Candida albicans Cases |

~2% (primarily fingernails) |

|

Complete Cure Rates (Systemic) |

Terbinafine: 38%, Itraconazole: 14-23%, Fluconazole: 21%-36% |

|

Mycological Cure Rates (Systemic) |

Terbinafine: 76%, Itraconazole (pulse): 63%, Fluconazole: 48% |

|

Mycological Cure Rates (Topical) |

Efinaconazole: 55%, Tavaborole: 36%, Ciclopirox: 36% |

|

Complete Cure Rates (Topical) |

Efinaconazole: 18%, Tavaborole: 9.1%, Ciclopirox: 8.5% |

|

Treatment Duration |

Up to 12 months or longer |

|

Hepatic Side Effect Rate (Terbinafine) |

<2% (idiosyncratic hepatic reaction) |

Source: NIH

Challenges

- Rising antifungal resistance: One of the critical problems in the dermatophytosis treatment market is the growing resistance to commonly used antifungal medications. The overuse and misuse of topical combinations can often lead to steroid-modified and treatment-resistant infections, creating a hesitancy among consumers to utilize them. Therefore, this has further forced clinicians to prescribe newer and longer-duration therapies, increasing both the complexity and cost of treatments.

- High out-of-pocket costs: The aspect of limited insurance coverage & high out-of-pocket costs is making it extremely challenging for patients from price-sensitive regions. Also, the most effective antifungal drugs are mostly not listed under the national essential medicines list and are excluded from public health insurance schemes, making them unaffordable for underprivileged populations. Hence, this lack of universal coverage for dermatophytosis and limited government reimbursement hinders expansion across different nations.

Dermatophytosis Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 11.2 billion |

|

Forecast Year Market Size (2035) |

USD 15.5 billion |

|

Regional Scope |

|

Dermatophytosis Treatment Market Segmentation:

Treatment Type Segment Analysis

Based on treatment type, the topical antifungals segment is projected to garner the largest revenue share of 55.4% in the dermatophytosis treatment market during the forecast timeline. Their direct application, minimal systemic side effects, and increasing patient preference for self-administered therapies are the key factors behind this leadership. For instance, in June 2024, Destiny Pharma reported new data on its XF Drug Platform compound, XF-70, which showcased strong antifungal efficacy against ringworm in an in vivo model.

Distribution Channel Segment Analysis

In terms of the distribution channel, the retail pharmacies segment is likely to gain a significant share of 50.3% in the dermatophytosis treatment market by the end of 2035. The increased availability of OTC antifungal products and growing consumer awareness position the subtype at the forefront of revenue generation in this field. Besides, the ease of access to antifungal treatments, especially the topical options, is boosting the retail sales across all nations. Furthermore, the convenience aspect and self-medication trends are also supporting the segment’s dominance.

Drug Class Segment Analysis

Based on the drug class, the azole segment is predicted to attain a share of 45.4% in the dermatophytosis treatment market by the end of 2035. The growth in the segment is highly subject to their broader spectrum of antifungal activity and effectiveness against dermatophytes. Besides, fluconazole and itraconazole continue to be widely prescribed due to proven efficacy and relatively favorable safety profiles. Therefore, all of these factors responsibly create a greater opportunity for players involved in this field.

Our in-depth analysis of the dermatophytosis treatment market includes the following segments:

|

Segment |

Subsegments |

|

Treatment Type |

|

|

Distribution Channel |

|

|

Drug Class |

|

|

Drug Used |

|

|

Patient Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dermatophytosis Treatment Market - Regional Analysis

North America Market Insights

The North America is anticipated to register the highest revenue share of 35.8% in the dermatophytosis treatment market by the end of 2035. The growth of the market is driven by the rising fungal disease expenditures and the rapid adoption of government-backed healthcare facilities. Testifying at the NIH in June 2025 revealed that the economic burden of fungal diseases in the U.S. is estimated at USD 19.4 billion on a yearly basis, which includes USD 13.4 billion in direct medical costs from hospitalizations and outpatient visits, highlighting the urgent need for improved fungal disease surveillance and treatment.

There has been increased awareness and exhaustive campaigns for the treatments in the U.S., which have catalyzed the growth of the dermatophytosis treatment market. In this regard, the CDC in June 2025 reported that Fungal Disease Awareness Week 2025, which took place in September, aims to raise public and healthcare provider awareness about the growing impact of fungal infections, which are often underdiagnosed and mistreated. The initiative also emphasizes the urgent need for better prevention, diagnosis, and research, hence denoting a positive market opportunity.

Canada in the dermatophytosis treatment market is experiencing steady growth backed by the presence of key pioneers and healthcare professionals in the country, who are focusing on developing and adopting innovative treatment options with the support of governing bodies. For instance, in January 2024, Medexus Pharmaceuticals notified that Health Canada has accepted for review its new drug submission for a topical terbinafine hydrochloride nail lacquer, for treating fungal nail infections, marking a significant step toward expanding treatment options for people dealing with dermatophytosis-related conditions.

Topical Antifungal Prescribing Statistics for Medicare Part D Beneficiaries - U.S., 2021

|

Category |

Statistic / Value |

|

Total Medicare Part D Beneficiaries (2021) |

48.8 million |

|

Total Topical Antifungal Prescriptions |

6.5 million |

|

Total Cost of Prescriptions |

USD 231 million |

|

Prescription Rate |

1 per 8 beneficiaries |

|

Most Common Drugs (by volume) |

Ketoconazole - 2.4 million (36.6%) |

|

Most Expensive Drugs (average per prescription) |

Efinaconazole – USD 1,035.3 |

|

Least Expensive Drugs (average per prescription) |

Nystatin – USD 25.6 |

|

Topical Antifungal Rx by Provider Type |

Primary Care - 2.6 million (40.0%) |

|

Prescriptions per Provider (average) |

Dermatologists - 87.1 |

|

% of All Prescriptions That Were Clotrimazole-Betamethasone |

0.9 million (14.7%) |

Source: CDC

APAC Market Insights

The Asia Pacific dermatophytosis treatment market is set to witness robust expansion fueled by a surge in infection rates and public awareness. The population density in the urban areas is rising, favoring the development of fungal infections. In February 2025, Kaneka Corporation declared that it is collaborating with Maruho Co., Ltd. to launch Japan’s first-ever domestic Trichophyton antigen test kit, DermaQuick Onychomycosis, targeting early and easy detection of fungal nail infections. The product is especially designed for dialysis patients who are at higher risk due to weakened immunity, thereby improving foot care and infection management.

China’s dermatophytosis treatment market is experiencing rapid growth owing to the progress in diagnostic innovations, including AI-assisted tools in rural clinics, and increasing availability of both topical and oral antifungals. In July 2024, AFT Pharmaceuticals reported that it partnered with Hainan Haiyao Co. Ltd to distribute Crystaderm cream in the country, targeting the large population base with this innovative skin infection treatment. The product reduces the risk of drug-resistant bacteria; hence, it is suitable for standard market growth.

India is also augmenting its strong upliftment in the dermatophytosis treatment market, wherein most of the cases are becoming chronic, recurrent, or severe, often involving extensive areas of skin. Most dermatologists in the country are utilizing combination therapy, performing diagnostic tests such as KOH mounts, and treating for longer durations. Meanwhile, the emergence of natural and herbal remedies as alternative treatment options is also prompting an encouraging business opportunity in the country. Furthermore, the ongoing research and development efforts and consumer preferences are shaping the landscape of dermatophytosis treatment.

Europe Market Insights

The dermatophytosis treatment market in Europe is likely to show notable growth due to growing health awareness and increased investment in antifungal research and development. Moberg Pharma in May 2024 reported that its MOB-015 has received complete national approvals in all 13 participating countries in Europe, marking a major step towards its commercialization. The firm also stated that the product is now available OTC in 7 countries, which include Sweden, Italy, and the Netherlands, and Rx-only in 6, such as France and Spain, with launch already underway in Sweden under the brand name Terclara.

The U.K. has garnered a huge opportunity in the dermatophytosis treatment market owing to the NHS initiatives that emphasize fungal infection prevention and early treatment. In July 2022, NIH reported a genome-wide association study conducted utilizing the country’s Biobank cohort, which identified a genetic link to dermatophytosis, specifically a missense variant in the TINAG gene (rs16885197). It also observed that individuals carrying the minor G allele had a 7.8 times higher risk, hence supporting the role of genetic susceptibility in chronic or recurrent fungal infections.

Spain is emerging in the dermatophytosis treatment market due to its strong focus on treatment guidelines and comparing systemic and topical therapies to better manage recurrent or difficult cases of dermatophytosis. In May 2022, Almirall notified that it successfully initiated a decentralized regulatory procedure in Europe for efinaconazole, targeting mild to moderate fungal nail infections in adults and children, thereby creating an optimistic opportunity for market progression in the country.

Key Dermatophytosis Treatment Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Bayer AG

- Johnson & Johnson

- GlaxoSmithKline (GSK) plc

- Merck & Co., Inc.

- Sanofi S.A.

- AbbVie Inc.

- LEO Pharma A/S

- Galderma S.A.

- Astellas Pharma Inc.

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc.

- Perrigo Company plc

- Teva Pharmaceutical Industries Ltd.

- Lupin Limited

- Cipla Limited

- Bausch Health Companies Inc.

- Mayne Pharma Group Ltd.

- Yuhan Corporation

The dermatophytosis treatment market is moderately fragmented, wherein there is constant competition between established pharmaceutical pioneers and generic manufacturers. The key players, such as Bayer and GSK, dominate in terms of the OTC segment through strong brand recognition, whereas companies such as Sun Pharma and Teva compete on cost-effectiveness. Furthermore, product innovation, geographic expansion into high-growth emerging markets, and acquisitions are a few strategies implemented by the players to progress in this field internationally.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In August 2024, Sun Pharma announced the launch of STARIZO (Tedizolid Phosphate), for the treatment of acute bacterial skin and skin structure infections, including infections caused by drug-resistant bacteria like MRSA.

- In January 2024, Vanda Pharmaceuticals announced that it received the U.S. FDA approval to proceed with clinical studies for VTR-297, a novel topical antifungal candidate targeting onychomycosis, which could address significant unmet needs in the dermatophytosis market.

- In June 2023, Moberg Pharma reported that MOB-015, which is a topical terbinafine formulation, received EU approval for treating mild to moderate onychomycosis, a common form of dermatophytosis.

- Report ID: 3631

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dermatophytosis Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.