Defibrillators Market Outlook:

Defibrillators Market size was valued at USD 10.8 billion in 2025 and is estimated to reach USD 23.1 billion by the end of 2035, expanding at a CAGR of 9% during the forecast timeline, from, 2026-2035. In 2026, the industry size of defibrillators is assessed at USD 11.7 billion.

The increasing mortality and severity of cardiovascular events, such as cardiac arrest (CA), are fueling demand in the market. According to a 2023 report from the American Heart Association (AHA), the annual incidence rate of CA around the globe ranged between 30 and 97 per 100 thousand. Another 2022 NLM article unveiled that approximately 20% of deaths in Western societies in the world are caused by CA. As evidence, in Australia and New Zealand alone, the yearly occurrence of this condition surpassed 26 thousand, as per the 2024 Journal of Heart, Lung and Circulation. The volume of the patient pool is further amplified by the growing burden of cardiovascular diseases (CVD). In this regard, the NLM predicted the CVD global prevalence to increase by 90.0% between 2025 and 2050.

The consistent inflation in payers’ pricing remains a hurdle to widespread adoption in the market. This can be testified by the range of a single unit lying between £0.8 thousand and £2.5 thousand, which varies according to the design and offerings. Additionally, the purchase of these tools comes along with a £20-300 pads and battery replacement charges, as per the St. John Ambulance. This testifies to the urgent need for the development and commercialization of affordable solutions that can minimize the disparity. However, the cost-effectiveness of defibrillators often gains dominance over their expense due to the growing trend of accepting value-based healthcare models. Besides, strategic placement and procurement are enhancing both the quality of life and willingness-to-pay among patients.

Key Defibrillators Market Insights Summary:

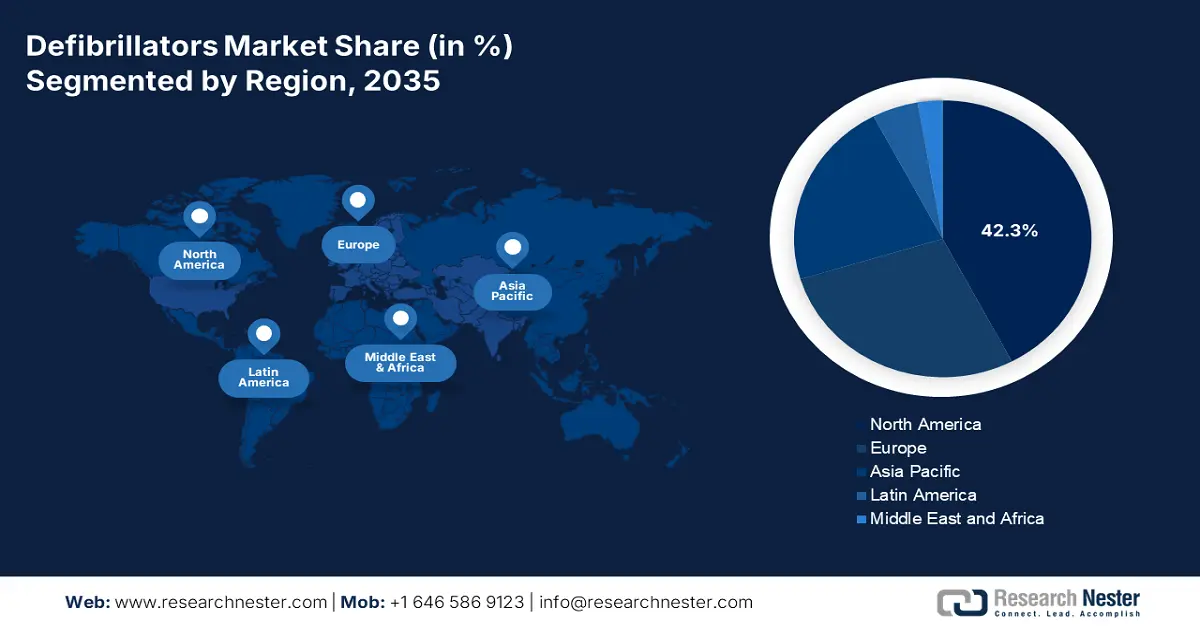

Regional Highlights:

- North America is projected to hold a 42.3% share by 2035 in the defibrillators market, owing to a well-established healthcare system and government support for emergency response systems.

- Asia Pacific is anticipated to witness the fastest growth by 2035, fueled by robust expansion in CVD demography and healthcare infrastructure.

Segment Insights:

- The implantable cardioverter defibrillators (ICDs) segment is projected to account for 54.6% share by 2035 in the defibrillators market, driven by rising CVD prevalence and aging global populations.

- Hospitals & clinics are anticipated to secure 52.8% of revenue generation by 2035, impelled by their critical care infrastructure and adoption of advanced cardiac devices.

Key Growth Trends:

- Increase in underlying comorbidities

- Clinical advantages from early usage

Major Challenges:

- Expensiveness of advanced defibrillators

- Lack of public awareness and training

Key Players: Medtronic (Ireland/U.S.), Boston Scientific (U.S.), Abbott Laboratories (U.S.), Philips (Netherlands), ZOLL Medical (U.S.), Biotronik (Germany), Schiller AG (Switzerland), Stryker (U.S.), Defibtech (U.S.), Mindray (China), CU Medical Systems (South Korea), BPL Medical Technologies (India), Metrax GmbH (Germany), Bexen Cardio (Spain), Instramed (Australia), Mediana (South Korea), Cardia (Malaysia), Metsis Medikal (Turkey).

Global Defibrillators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.8 billion

- 2026 Market Size: USD 11.7 billion

- Projected Market Size: USD 23.1 billion by 2035

- Growth Forecasts: 9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, Canada, France

- Emerging Countries: India, China, Australia, Brazil, South Korea

Last updated on : 14 August, 2025

Defibrillators Market - Growth Drivers and Challenges

Growth Drivers

- Increase in underlying comorbidities: The increasing prevalence of diabetes and hypertension and rapidly aging populations imply higher CVD occurrence, and hence enlarge the patient pool of the market. Such relevance can be testified by the results concluded by the National Cardiac Arrest Summits conducted from June 2022 to March 2023. It underscored a 100-fold rise in the incidence of sudden cardiac death (SCD) among middle-aged and elderly individuals, compared to people aged less than 30 years. These demographic trends ultimately result in a growing need for effective emergency cardiac care units to improve survival outcomes and reduce healthcare costs.

- Clinical advantages from early usage: The efficiency of products available in the market in delivering essential life-saving therapies, specifically during emergencies, makes them more desirable for both clinical settings and remote healthcare. Validating this ability, in a May 2025 article, the NLM highlighted that early defibrillation, coupled with chest compressions, is associated with markedly improved survival for people experiencing CA. Another 2024 NLM study reported survival rates as high as 50–70% in cases where defibrillation is provided within 3 to 5 minutes of collapse. Moreover, such clinical evidence is pushing emergency responders to incorporate these tools in the prompt restoration of the heart rhythm.

- Emergence of innovative technologies: Continuous innovation in the technologies used in the market is a key to enhancing device effectiveness, ease of use, and accessibility. Particularly, automated external defibrillators (AEDs) with voice prompts, real-time feedback, and connectivity are gaining traction due to their ability to enhance response time and affordability. For instance, the use of small AEDs in a 3.5% annual sudden cardiac arrest (SCA) risk delivered $53,925/quality-adjusted life-year (QALY) and $59,672/QALY incremental cost-effectiveness ratios (ICER) for both societal (SP) and healthcare (HP) perspectives. These outcomes align with public health initiatives aimed at increasing bystander intervention, expanding the range of the consumer base in this sector.

Study on Changes in the Volume and Outcomes of Usage in the Market

Comparative Presentation of AED Use and Survival after Out-of-Hospital CA in the Nijmegen area (2013-16 vs. 2008-2011)

|

Metric |

Cohort of 2013-2016 (Number of Patients = 349) |

Cohort of 2008-2011 (Number of Patients = 180) |

|

AED attached (%) |

46 |

23 |

|

Bystander CPR (%) |

78 |

63 |

|

Patients receiving AED shock (%) |

39 |

15 |

|

Number of shocks by EMS (median) |

2 |

4 |

|

Survival to discharge (%) |

47 |

33 |

Pricing Trends in the Defibrillators Market in Different Fields of Applications

Variation in Defibrillator Treatment Costs (2022-2024)

|

Treatment / Intervention |

Region / System |

Cost or ICER (per QALY or equivalent) |

|

ICD therapy for primary prevention |

China |

139,652 CNY per QALY (~1–2× GDP per capita) |

|

ICD therapy for primary prevention |

Kazakhstan |

ICER = 3,791,604 KZT per QALY (within cost-effectiveness threshold) |

|

ICD therapy for primary prevention |

Colombia, Mexico, Uruguay (Improve SCA) |

COP 46,729,026 (Colombia); MXN 246,016 (Mexico); UYU 1,213,614 (Uruguay) per QALY (approx. 1–3× GDP per capita) |

|

Hospital costs due to ICD complications |

Europe (academic hospital cohort) |

€6,876 per complication; €8,110 per patient; additional ~€1,095 per implant (2‑year horizon) |

Challenges

- Expensiveness of advanced defibrillators: Despite the clinical benefits, the heightened costs of technologically advanced devices, such as implantable cardioverter defibrillators (ICDs) and wearable defibrillators, still shrink the volume of utilization in the market. As an initial purchase, surgical implantation, post-operative care, and long-term maintenance require significant capital, both patients and small-sized healthcare settings hesitate to invest in this sector. Particularly, medical systems with limited budgets or in low- and middle-income countries (LMICs) fail to integrate such life-saving technology due to affordability barrier.

- Lack of public awareness and training: Although access to AEDs in public settings in developed countries has improved, the limitation of knowledge and skills may restrict the scale of usage and acceptance in the market. A notable proportion of bystanders are still prohibited from intervening during cardiac emergencies as they fear causing harm or legal consequences. This is often rooted in insufficient public education and a shortage of training programs. Thus, collaborative efforts are needed to unfold and promote proper utilization of the life-saving potential of this sector.

Defibrillators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9% |

|

Base Year Market Size (2025) |

USD 10.8 billion |

|

Forecast Year Market Size (2035) |

USD 23.1 billion |

|

Regional Scope |

|

Defibrillators Market Segmentation:

Product Type Segment Analysis

The implantable cardioverter defibrillators (ICDs) segment is poised to remain a dominant force in the market over the assessed period, while holding the largest share of 54.6%. The rising CVD prevalence and aging global populations are the foundational pillars of this leadership. Based on the necessity of this product, both regulatory bodies and public healthcare authorities tend to prioritize maximum deployment and utilization of ICDs through providing fast-tracked approvals and financial backing. For instance, in October 2023, Medtronic gained FDA clearance for its Aurora EV-ICD MRI SureScan, which marked a significant leap toward advancement in this category. The product soon earned a reputation and scalable procurement by offering a first-of-its-kind extravascular solution that maintains the size and longevity of traditional ICDs while reducing procedural risks.

End user Segment Analysis

Hospitals & clinics are anticipated to acquire the highest proportion, 52.8%, of revenue generation among end-users of the market during the analyzed tenure. This dominance is backed by their ability to manage and convey both emergency and long-term cardiac care, while incorporating the use of advanced devices, such as ICDs and AEDs. Additionally, the access to trained personnel and critical care infrastructure, hospitals remain the primary point of care for a majority of patients. Moreover, the central role of these facilities in the widespread adoption and deployment of defibrillation technologies attracts insurers to allocate financial backing, which ultimately solidifies their forefront position in this sector.

Technology Segment Analysis

The advanced life support (ALS) segment is expected to account for approximately 35.7% share in the market by the end of 2035. The efficacy of this technology in handling complex cardiac emergencies is the major growth driver in this category. These high-performance devices feature ECG monitoring, manual defibrillation, synchronized cardioversion, and pacing, making them suitable for both pre-hospital and in-hospital settings. Moreover, ALS defibrillators are essential to provide comprehensive resuscitation as per the advanced cardiac life support protocols enacted by the regulatory authorities, which makes their integration into emergency medical services (EMS), critical care, and cardiac catheterization labs more frequent than BLS.

Our in-depth analysis of the defibrillators market includes the following segments:

|

Segments |

Subsegments |

|

Product Type |

|

|

End user |

|

|

Technology |

|

|

Patient Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Defibrillators Market - Regional Analysis

North America Market Insights

North America is estimated to maintain its dominance over the global market with a share of 42.3% throughout the discussed timeframe. The well-established healthcare system, high prevalence of cardiovascular disease, and strong government support for emergency response systems are the primary drivers behind the region's leading augmentation in this sector. The continuous demographic expansion on account of the enlarging geriatric, obese, and diabetic populations is also fueling demand in this field. Testifying to the same, the 2022 American Heart Association Heart and Stroke Statistics revealed that more than 356 thousand OHCA occur every year in the U.S., with 90.0% of them being fatal.

The U.S. stands as the leader of the regional market, which is backed by a robust healthcare infrastructure and high CVD prevalence. According to the Centers for Disease Control and Prevention (CDC), atrial fibrillation alone contributes to approximately 454,000 hospitalizations and 158,000 deaths every year, fueling demand in this sector. Besides, the continuous capital influx from governing bodies also indicates the lucrative inflow of cash in this sector. As evidence, in March 2025, the Ventura Fire Department launched a new fleet of cardiac monitor defibrillators to empower the emergency medical care community of the country. This led to the purchase of 20 new LIFEPAK 35 devices against an investment of USD 1.28 million.

The improvement in access and cardiac emergency response is the key growth driver in the Canada market. As CA has become a national health concern for the country, bystanders are increasingly adopting the use of CPR and AED promptly to enhance survival rates. Besides, the federal government, in partnership with institutional and commercial organizations, is heavily investing to propel the availability and innovation in this sector. As evidence, in May 2025, the University of Toronto, in collaboration with Daysix, developed a new online tool, PADmap, to improve survival rates in OHCA cases by improving the placement of public access defibrillators (PADs).

APAC Market Insights

Asia Pacific is predicted to become the fastest-growing region in the global defibrillators market by the end of 2035. Robust expansion in the CVD demography, healthcare infrastructure, and access to life-saving technologies is remarkably evolving the landscape into a lucrative scope of investment for both international and local pioneers. This epidemiology can be evidenced by a 2024 journal of Heart, Lung and Circulation, which revealed that yearly financial losses due to SCA alone in Australia accounted for more than AUD$2 billion. It also mentioned that this amount was almost equal to the productivity losses from all cancers combined. Moreover, the acceleration in urbanization, emergency response timeline, and medical tourism growth is consolidating a significant position for the region in this sector.

China is establishing a strong consumer base for the defibrillators market with regional dominance, owing to its large population and increasing CVD mortality. As per the 2022 NLM article, more than 230 million people in the country were affected by these ailments, where approximately 55 thousand CA incidences occurred annually. This highlights the growing need for timely medical attention, which has become a necessity for the country's healthcare system. Besides, the gaps in emergency response and defibrillator access are attracting both MedTech leaders and public investors to engage more resources in this field. As evidence, the government of China continues to invest in public health infrastructure and emergency preparedness, including broader AED deployment and training programs.

India is emerging as a key growth engine for the Asia Pacific defibrillators market on account of the increasing awareness of cardiac emergencies and modernizing healthcare infrastructure. Following this momentum, in March 2024, Stryker unveiled its next-generation LIFEPAK CR2 AED along with an Evacuation Chair at the Criticare National Conference in Kolkata. This was aimed at capitalizing on the enhancement of the nation's cardiac care and emergency response capabilities in both public and private settings. Moreover, as India continues to invest in emergency medical services and public access programs, this sector is expected to grow steadily.

Country-wise Incidence Rates of Cardiac Arrests

|

Country |

CA Type |

Incidence Rate |

|

Australia |

Out-of-Hospital |

107.9 per 100,000 person-years |

|

South Korea |

Out-of-Hospital |

95.1 cases per 100,000 population |

|

Malaysia |

In-Hospital |

19.8 per 1,000 hospital admissions |

Source: NLM and PHWR

Europe Market Insights

In Europe, innovation and epidemiological expansion are expected to maintain the position of the second-largest shareholder in the global defibrillators market between 2026 and 2035. This can be exemplified by the collaboration of Hato Hone St John with ViVest in June 2024 to collectively develop the first-ever Hato Hone St John-branded AED. The device was designed to deliver a shock in as little as seven seconds, making it a user-friendly device that provides clear visual and verbal instructions. Such discoveries are enhancing the accessibility of this sector to individuals without prior AED training, where strong government initiatives are actively promoting AED availability and bystander intervention.

The UK attained a prominent rank in revenue generation from the Europe defibrillators market, followed by the massive government-led allocations and deployment goals. For instance, in July 2023, more than 20 thousand devices were delivered to nearly 18 thousand schools since January as part of a £19 million national rollout strategy. On the other hand, the country's emergency services performing resuscitation attempts on approximately 34 thousand people each year is also fueling demand in this sector. This also underscores the urgent need for the reinforcement of early recognition, CPR, and timely intervention measures that are crucial to improving survival rates.

Germany is a key landscape in the Europe defibrillators market, consolidated by strong healthcare system and government-led initiatives, improving cardiac arrest survival rates. The government of the country has been proactive in promoting wide accessibility and availability, which also deepens the sector's penetration. Additionally, the collaborations between nonprofit organizations and governing bodies are accelerating the pace of acceptance and adoption in this category. Such initiatives also propel innovations that enhance the functionality of AEDs in emergencies.

Country-wise Annual Count of CA Events

|

Country |

Event Type |

Annual Count (Thousand) |

|

Spain |

Incidence |

52.3 |

|

Italy |

Incidence |

60.0 (OHCAs) |

|

Switzerland |

Death |

8.0 |

Source: CAPAC, NLM, and USZ

Key Defibrillators Market Players:

- Medtronic (Ireland/U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boston Scientific (U.S.)

- Abbott Laboratories (U.S.)

- Philips (Netherlands)

- ZOLL Medical (U.S.)

- Biotronik (Germany)

- Schiller AG (Switzerland)

- Stryker (U.S.)

- Defibtech (U.S.)

- Mindray (China)

- CU Medical Systems (South Korea)

- BPL Medical Technologies (India)

- Metrax GmbH (Germany)

- Bexen Cardio (Spain)

- Instramed (Australia)

- Mediana (South Korea)

- Cardia (Malaysia)

- Metsis Medikal (Turkey)

The commercial dynamics in the defibrillators market are primarily shaped by ongoing updates in regulatory compliance, progress in product innovation, and empowerment of brand's presence. This can be exemplified by ZOLL's acquisition of compliance with the Medical Device Regulation 2017/745 from the European Union (EU) for its AED Plus and AED 3 defibrillators in October 2024. This positioned the company at the forefront of competency within Europe by reinforcing trust among healthcare providers and buyers with enhanced safety and efficacy. Moreover, as the urge to meet evolving regulatory standards amplifies among global leaders, the development of advanced, user-friendly technologies is accelerated.

Recent Developments

- In April 2025, Abbott released late-breaking data from the AVEIR Conduction System Pacing (CSP) acute clinical feasibility study on its investigational AVEIR CSP leadless pacemaker technology. The results showed enhanced safety and performance of the tool in restoring the heart’s natural electrical rhythm.

- In June 2024, Stryker launched the latest product under its monitor/defibrillator portfolio, LIFEPAK 35, offering advanced technology and built on an intuitive, modern platform to help advance patient care. This is designed to support first responders and essential healthcare professionals by enabling a more efficient workflow.

- Report ID: 4284

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Defibrillators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.