Custom Virtual Router Market Outlook:

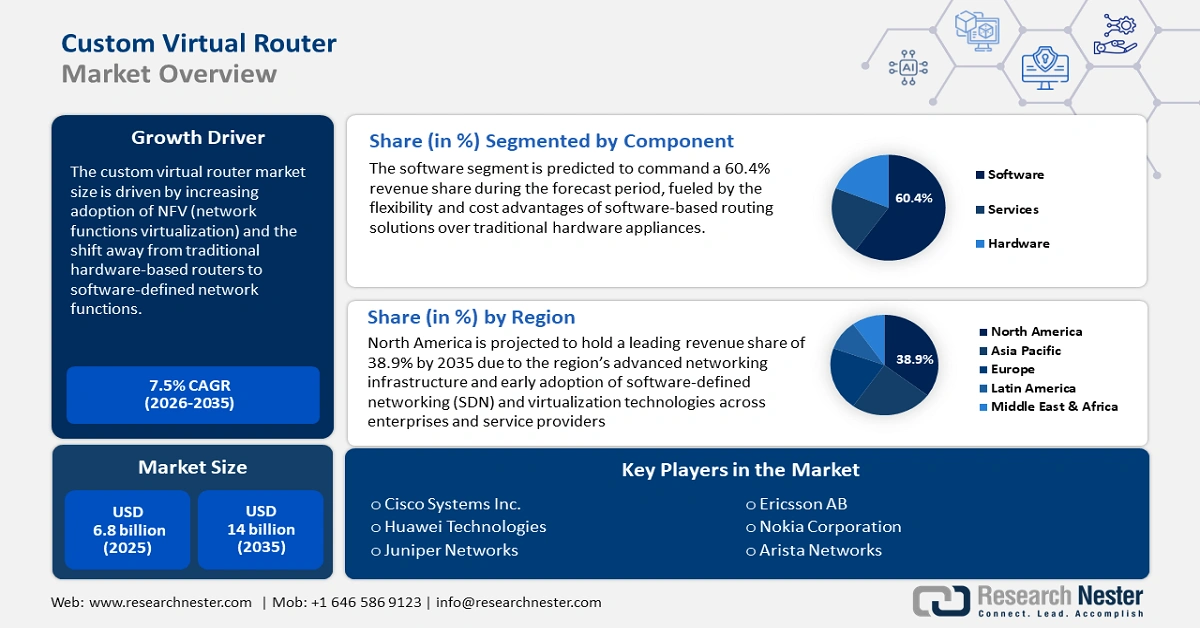

Custom Virtual Router Market size was valued at USD 6.8 billion in 2025 and is projected to reach USD 14 billion by the end of 2035, expanding at a CAGR of 7.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of custom virtual routers is evaluated at USD 7.3 billion.

The custom virtual router market is rising steadily as a consequence of increasing adoption of software-defined networking (SDN) and network functions virtualization (NFV) in enterprise as well as telecommunication markets. The driving force behind it is the imperative of scalable, cost-effective, as well as flexible networking solutions as organizations shun hardware-based offerings of routers. Custom virtual routers offer higher flexibility, allowing organizations to dynamically redeploy network resources and ease management. In November 2024, VMware introduced VeloRAIN AI networking architecture, unveiling AI-driven edge appliances that support 100 Gbps performance as well as superior threat detection. The unveiling aims at bolstering security and performance in 2025 and subsequent-year deployments of virtual routing as well as SD-WAN. The products are indicative of the market's direction toward more intelligent, higher-performing virtual networking.

Government and industry-led initiatives are also playing a crucial role in shaping the custom virtual router market by establishing security and interoperability standards. These frameworks are essential for building trust and ensuring the secure deployment of virtualized network functions in multi-tenant environments. Regulatory bodies are increasingly focused on creating a secure cyberspace, which is driving the adoption of standardized and resilient virtual routing solutions. In January 2025, the European Telecommunications Standards Institute (ETSI) published an updated version of its NFV Security specification, introducing stronger safeguards for ensuring isolation and security in multi-tenant virtualized environments. This update provides critical security standards for the deployment of custom virtual routers and other virtual network functions.

Custom Virtual Router Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing government support for network infrastructure modernization: The rising government push to bolster network infrastructure in a bid to digitalize economies is a major driver of the custom virtual router market. Modernization of network infrastructure creates a favorable ecosystem for the heightened deployment of custom virtual routers. Major such initiatives include the USD 42.5 billion commitment by the U.S. National Telecommunications and Information Administration (NTIA) under the aegis of the BEAD program. A key push by the program is to create scalable routing technologies that can support next-generation networks and mitigate dependency on traditional routers. The table below highlights recent major investments across the world in a bid to modernize network infrastructure:

|

Country

|

Initiative |

Budget/Investment |

Key Details |

|

India

|

National Quantum Mission (India) |

₹6,003.6 crore (approx. USD 60.0 billion) |

Research and development in quantum computing, communication, sensing, and materials. Implementation: Approved in April 2023 for the period 2023-24 to 2030-31. |

|

Australia

|

National Broadband Network (NBN) Upgrade (Australia) |

AUD 3 billion |

Expanding the fiber network and increasing internet speeds for eligible customers on Fibre to the Premises (FTTP) and Hybrid Fibre Coaxial (HFC) connections. |

|

India

|

Assam Digital Infrastructure Investment (India) |

₹400 crore (approx. USD 4 billion) |

Strengthening telecom and IT infrastructure, including the development of advanced data centers. Announced: This investment was confirmed at the Advantage Assam 2.0 summit in February 2025. |

Source: PIB, ABC

- Growing use of cloud-based services: The accelerating shift toward cloud computing is a major driver for the custom virtual router market. As enterprises migrate their applications and data to the cloud, the need for agile and scalable networking solutions becomes paramount. Virtual routers provide the flexibility to manage network traffic efficiently between cloud environments and on-premises infrastructure. Cloud providers are also expanding their native networking services, further boosting the adoption of virtual routing technologies. In July 2025, Microsoft Azure announced the retirement of its Basic Load Balancer service, requiring customers to migrate to the more advanced Standard Load Balancer. This change encourages the adoption of more sophisticated load balancing and routing services, reflecting the growing demand for high-performance cloud networking.

- Growing demand for network automation: Increasing network sophistication is driving automation, which facilitates easy network management and lowers the costs of operations. Automated network environments include custom virtual routers, which support programmatic configuration and management of route policies. Organizations can more rapidly adapt to shifting business needs, and network efficiency improves. Incorporation of artificial intelligence and machine learning is also improving network automation, facilitating predictive insight as well as proactive optimization of networks. In July 2023, Riverbed Technology, Inc. introduced Alluvio IQ, an AI-based observability service that complements its SD-WAN as well as virtual routing offerings to optimize traffic as well as automate network data analysis. The service facilitates organizations to diagnose performance issues proactively.

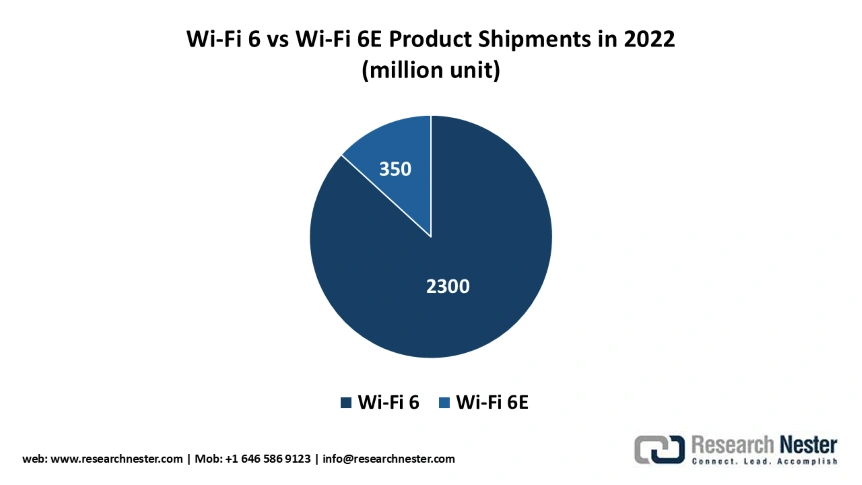

Impact of Wi-Fi 6 and 6E Adoption on the Custom Virtual Router Market

Wi-Fi 6 and 6E continue to shape the custom virtual router market by offering better capacity, efficiency, and coverage. In 2022, over 2.3 billion Wi-Fi 6 devices and 350 million Wi-Fi 6E devices were shipped worldwide. This rapid adoption is fueled by the need for seamless connectivity across enterprise and consumer environments. As Wi-Fi is projected to contribute nearly US$5 trillion to the global economy by 2025, these technologies present exceptional opportunities for companies developing next-generation virtual routers.

Source: IEEE

Technological Trends Shaping the Custom Virtual Router Market

The global custom virtual router market is bolstered by technological advancements in virtualization and network automation. For instance, network function virtualization (NFV) and software-defined networking (SDN) have enabled telecom operators to decouple network functions from hardware. An example of a successful use case is 6WIND introducing its virtual host-based router in July 2024 to provide Kubernetes integration. The table below highlights a few major advancements in the custom virtual router market.

|

Industry |

Technology Adoption |

Example |

|

Manufacturing |

5G integration for smart manufacturing and real-time data processing |

In March 2023, Cisco announced 800G innovations for its 8000 series routers, specifically touting major power and space efficiency benefits for service and cloud providers |

|

Finance |

Cloud-based virtual routers for secure and scalable network infrastructure |

Equinix's fabric cloud router facilitates multi-cloud networking with up to 25 Gbps scalability. |

|

Defense |

Secure virtual routers for rapid deployment over various communication networks |

In July 2024, Persistent Systems announced its Cloud Relay Virtual Hub Router for enabling mobile ad hoc networking (MANET) for military, government, and commercial users. |

Source: CISCO, Equinix, Persistent Systems

Challenges

-

Security vulnerabilities in virtualized environments: With a number of organizations proactively adopting virtualized networking solutions, the attack surface of cyber threats has expanded. Custom virtual routers introduce additional layers of complexity that can cause challenges if proper configuration solutions are not accessible. Additionally, the dual challenge of securing virtualized infrastructure and meeting compliance mandates has pushed vendors in the custom virtual router market to inculcate cybersecurity features in their offerings.

-

Interoperability and integration challenge: Achieving interoperability across varying virtual routing solutions, as well as with preexisting physical network infrastructure, can prove to be a daunting task. The absence of industry-standard interfaces and protocols can cause integration headaches, as it might become challenging to develop a seamless and efficient networking aspect. Organizations might also struggle in regard to managing a hybrid network that incorporates both physical and virtual routers from varying vendors. In January 2025, the U.S. Department of Justice sued to stop HPE's planned $14 billion purchase of Juniper Networks over fears it would reduce competition in the networking industry. The lawsuit highlights the networking industry's complicated nature as well as custom virtual router market consolidation, having a positive impact on interoperability as well as customer choice.

Custom Virtual Router Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 6.8 billion |

|

Forecast Year Market Size (2035) |

USD 14 billion |

|

Regional Scope |

|

Custom Virtual Router Market Segmentation:

Component Segment Analysis

The software segment is predicted to command 60.4% revenue share by 2035 as networking shifts further in favor of software-defined networking. In reaction to organizations embracing virtualization and cloud deployments, there is an increasing need for agile and scalable routing software. The virtual router software is more agile and economical than hardware, providing dynamic resource allocation and simplicity in management. In April 2024, Nokia Corporation commercially launched its Virtualized Service Router (VSR) in the AWS marketplace, allowing customers to deploy carrier-class routing software directly onto the cloud. The launch provides scalable edge routing of IP and supports heterogeneous services with up to 400 Gbps of proven throughput.

Deployment Mode Segment Analysis

The cloud-based deployment segment is projected to hold a share of 57% through 2035, driven by worldwide adoption of cloud computing and demand for dynamic, scalable networking services. The cloud deployment is also extremely flexible, as it will allow organizations to provision and manage virtual routers without hardware deployment at customers' sites. The strategy is of particular attraction to organizations that require cost savings in capital expenditure as well as simplicity in networking management. Amazon Web Services (AWS) supported Gateway LoadBalancer endpoints as a next-hop in August 2023 in the virtual private gateway route table. The cloud-based feature will allow customers to inspect incoming traffic in AWS with virtual appliances, simplifying security services deployment at networking edges.

End user Segment Analysis

The telecommunications segment is anticipated to garner a 45% custom virtual router market share by 2035, owing to 5G network deployment as well as NFV adoption. Telecom service providers are employing virtual routers in order to develop more efficient and agile networks that will support a wide variety of services, such as mobile broadband to IoT. The dynamic allocation of network resources, as well as automated provision of services, must be fulfilled to sustain 5G-era requirements. In February 2024, Samsung Electronics Co., Ltd. introduced its virtualized RAN (vRAN) 3.0, composed of a new robust baseband unit as well as software-enabled intelligent automation. The market launch aims to support 5G network advancements, enabling operators to deploy, manage, and scale network functions, such as virtual routing, in a more dynamic manner.

Our in-depth analysis of the global custom virtual router market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment Mode |

|

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

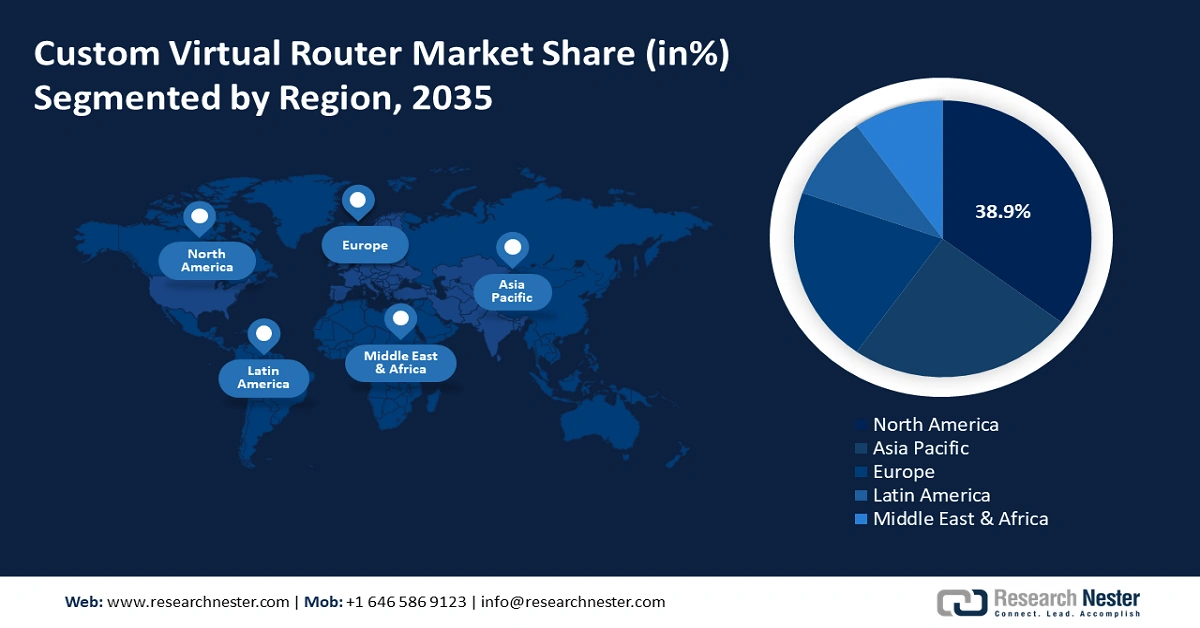

Custom Virtual Router Market - Regional Analysis

North America Market Insights

North America custom virtual router market is projected to record a revenue share of 38.9% through 2035. Multiple factors have converged to ensure a sustained growth of the sector in North America, such as the heightened adoption rates of both SDN and NFV, and nationwide 5G infrastructure development. Trends indicate that in both the U.S. and Canada, two premier regional markets in North America, investments will remain high on improving the broadband infrastructure, which ties up with the growth of virtual routers.

The U.S. custom virtual router market is positioned to expand significantly by 2035. The U.S. market's growth curve is supported by a surge in demand for flexible networking solutions across a number of industries. Moreover, proactive investments from the government to modernize network infrastructure boost the sector. In May 2024, the U.S. released a revised international cybersecurity strategy, which is expected to converge with the heightened demand for flexible networking solutions in the region.

Canada market is expanding as a result of initiatives by the government to upgrade its digital infrastructure. A secure and resilient digital future is also witnessing private and public spending in world-class networking technologies, such as custom virtual routers. In February 2025, the Government of Canada introduced its new National Cyber Security Strategy. The strategy is based upon a whole-of-society approach, implementing a long-term plan of engaging provinces, territories, Indigenous communities, academia, and the private sector to build a secure and resilient digital future for Canadians.

APAC Market Insights

Asia Pacific custom virtual router market is projected to register expansion at a CAGR of 11.4% throughout the forecast period. The regional market’s growth curve is heightened by the accelerated adoption of 5G, NFV, and SDN across APAC in established economies such as China and in emerging economies ranging from India to Vietnam. In September 2024, the Asia-Pacific Network Information Centre (APNIC) outlined its strategic initiatives for the 2024 Activity Plan and Budget, detailing a commitment to bolstering digital infrastructure across the region. Such proactive initiatives are expected to create a rise in demand for network optimization.

China custom virtual router industry is projected to maintain steady growth. The Made in China 2025 initiative is a major factor in the regional market’s growth curve, as China seeks to improve digital connectivity across the nation. The demand for virtual routers has also increased against the backdrop of nationwide 5G deployment and widespread adoption of cloud-based services. The Ministry of Industry and Information Technology (MIIT) of China announced in January 2023 its intention to push the onset of 6 G. The advent of next-generation communication technologies is slated to ensure sustained demand for custom virtual routers.

India is another thriving custom virtual router market, primarily due to its large, youthful population and the government's "Digital India" initiative. The rise in use of cloud services and the availability of escalating high-speed internet connectivity are demanding new networking solutions. In August 2023, the Government of India implemented the Digital Personal Data Protection (DPDP) Act, establishing a sound legal basis for processing digital personal data and bolstering the cyber-legal infrastructure of the nation. This robust digital infrastructure and a tech-savvy population position India as a significant player in the evolving global digital landscape. The government's continued focus on digital transformation is expected to further accelerate the adoption of new technologies and digital services.

Europe Market Insights

The custom virtual router market in Europe is expanding at a steady pace, bolstered by robust data protection regulations and greater use of cloud solutions. Organizations have been made to think about more secure and compliant network solutions due to the General Data Protection Regulation (GDPR). The region's great focus on digital sovereignty and developing its own cloud infrastructure is also propelling this market.

Germany is a key market in Europe, with its strong industrial base and high adoption of advanced technologies. The German government's focus on Industry 4.0 and the increasing demand for secure and reliable connectivity in the manufacturing sector are driving the demand for virtual routing solutions. In 2024, the German Government reaffirmed the central role of its Federal Office for Information Security (BSI) in working with the private sector to facilitate threat intelligence sharing and coordinate a national response to cyber incidents.

UK is also a core custom virtual router market, focusing on cybersecurity and digital innovation. The Government actively promotes secure networking technology use to protect critical national infrastructure while facilitating digital economy development. In April 2023, the UK Government launched GovAssure, a new cyber assurance scheme that will closely examine the cybersecurity of all Government departments and select arm's length bodies annually. The initiative is included in the Government's larger Cyber Security Strategy to ensure key Government IT systems are secure against cyber attack.

Key Custom Virtual Router Market Players:

- Cisco Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Ericsson AB

- Nokia Corporation

- Arista Networks, Inc.

- Dell Technologies, Inc.

- ZTE Corporation

- NEC Corporation

- Samsung Electronics Co., Ltd.

- HPE (Hewlett Packard Enterprise)

- Riverbed Technology, Inc.

- TP-Link Technologies Co., Ltd.

- Extreme Networks, Inc.

- Radwin Ltd.

The custom virtual router market is competitive, as both new as well as established networking firms are fighting to secure market share. Strong market presence is secured by key players Cisco Systems, Inc., Juniper Networks, Inc., and Huawei Technologies Co., Ltd. as a result of rich portfolios of products as well as global presence. The players are further developing and enhancing virtual routing solutions to meet customers' shifting needs. The market remains competitive in view of strategic partnerships, acquisitions, as well as importance gauged by firms in terms of research and development.

New market entrants and open-source solutions are also becoming popular in the market, offering more cost-effective and flexible solutions compared to legacy vendor solutions. The increase in open networking standard adoption and rising interest in disaggregated networking solutions is creating new opportunities for new vendors as well as new market entrants. The market also experiences more competition due to cloud service providers, establishing native networking services, and offering integrated virtual routing functions. In November 2023, Ericsson AB expanded its Router 6000 family by releasing a high-capacity, compact router that works best while being deployed in 5G RAN. The hardware launch contains innovative connectivity along with more efficient transport, and it is intended to support network slicing and AI/ML-based automation.

Here are some leading companies in the custom virtual router market.

Recent Developments

- In June 2025, Broadcom released a significant software update for its VMware VeloCloud SD-WAN solution (version 5.2.5). The update enhances security and performance by integrating the Symantec Web Security Service for advanced threat protection and improving high-availability features for greater network resilience in enterprise and cloud-based deployments.

- In March 2025, Juniper Networks announced a strategic partnership with Saudi Telecom Company (stc) to upgrade its core network. Under the agreement, Juniper will supply its high-performance 400G routers to enhance the capacity and performance of stc's 5G network, supporting the digital transformation goals of Saudi Vision 2030.

- In February 2025, Palo Alto Networks introduced multi-virtual-router support for its Prisma SD-WAN hub devices. This software enhancement allows enterprises to create multiple, isolated routing instances on a single hub, enabling complex network segmentation and the use of overlapping IP subnets, which is critical for large, multi-tenant financial services and healthcare environments.

- Report ID: 2921

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Custom Virtual Router Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert