Critical Infrastructure Protection Market Outlook:

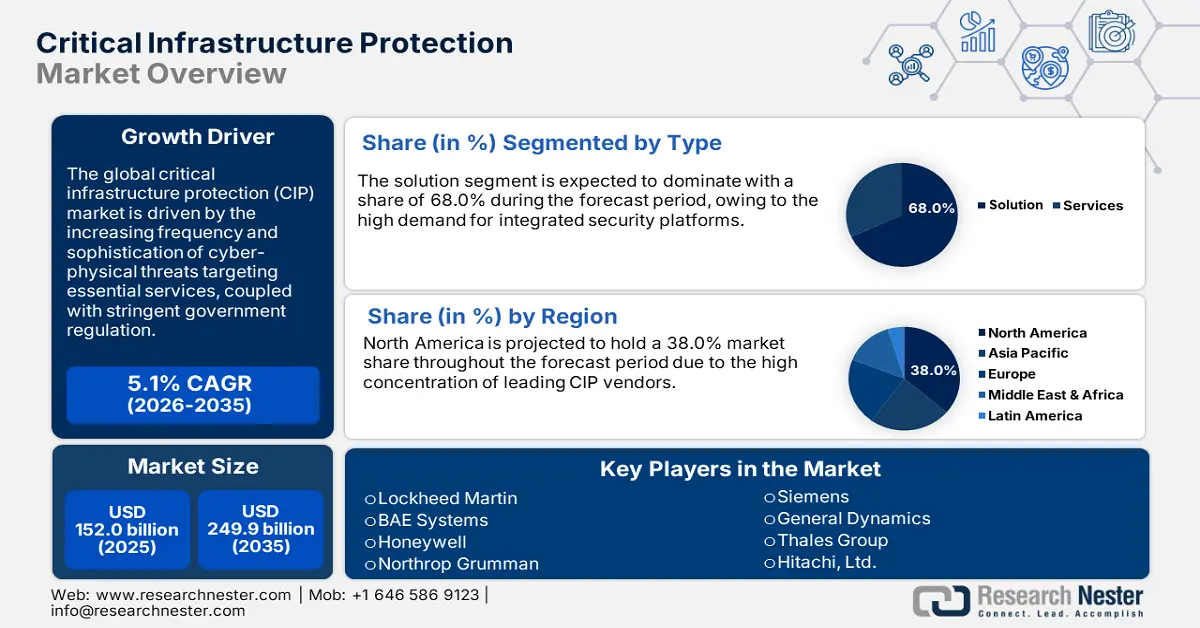

Critical Infrastructure Protection Market size was valued at USD 152 billion in 2025 and is projected to reach a valuation of USD 249.9 billion by the end of 2035, rising at a CAGR of 5.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of critical infrastructure protection is estimated at USD 159.7 billion.

The Critical Infrastructure Protection (CIP) market supply chain is an advanced global infrastructure of hardware, software, and specialist services, governed by tough national security standards. Critical components like industrial control systems (ICS), sensors, and telecoms hardware are procured from a concentrated pool of trusted international vendors, predominantly in the USA, Europe, and Japan. U.S. federal agencies like the Department of Homeland Security (DHS) and the Department of Energy (DOE) have strong control over supply chain risk management by way of guidelines framed by CISA, which ensure protection of physical and cyber assets. Import/export trade is significant, predominantly in specialist electronics and heavy machinery utilized in the energy, water, and transport sectors. Assembly of integrated protection systems is normally carried out domestically in secure facilities to minimize supply chain risks.

Key Critical Infrastructure Protection Market Insights Summary:

Regional Highlights:

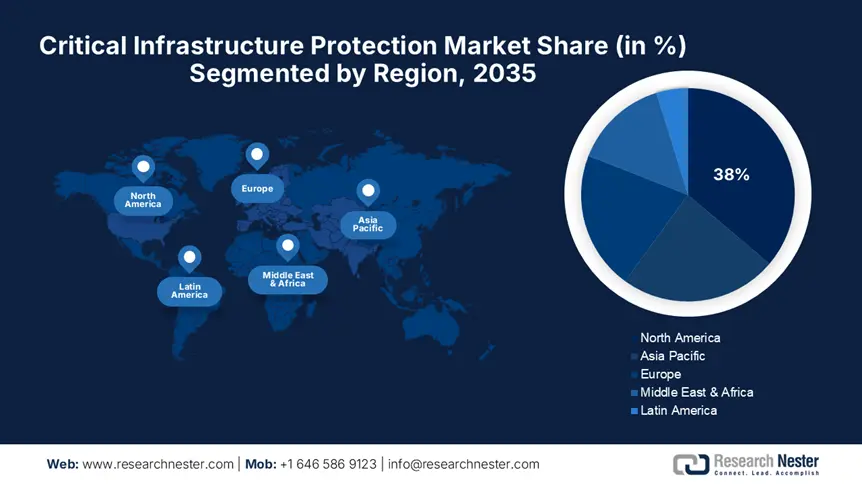

- North America is projected to secure a 38% share by 2035 in the critical infrastructure protection market, owing to sizable government spending and a strong regulatory ecosystem.

- Europe is expected to record steady progress during 2026–2035, supported by reinforced regulation and heightened cyber-risk awareness across essential infrastructure.

Segment Insights:

- The solution segment is projected to secure a 68% share by 2035 in the critical infrastructure protection market, propelled by the rising need for integrated, end-to-end security platforms that counter advanced threats.

- The cybersecurity segment is anticipated to hold a 61% share in 2035, reinforced by the rapid digitization of critical infrastructure and the deployment of highly specialized cyber-defense technologies.

Key Growth Trends:

- Emerging and advanced cyber threats

- Government mandates and strategic investments

Major Challenges:

- Securing complex and exposed global supply chains

- Industrial Control Systems (ICS) vulnerability mitigation

Key Players: Lockheed Martin (USA), BAE Systems (UK), Honeywell (USA), Northrop Grumman (USA), Siemens (Germany), General Dynamics (USA), Thales Group (France), Samsung SDS (South Korea), Larsen & Toubro (India), Telstra (Australia)

Global Critical Infrastructure Protection Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 152 billion

- 2026 Market Size: USD 159.7 billion

- Projected Market Size: USD 249.9 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region:North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 12 August, 2025

Critical Infrastructure Protection Market - Growth Drivers and Challenges

Growth Drivers

- Emerging and advanced cyber threats: The rise in frequency and sophistication of cyberattacks, particularly ransomware, is a key factor that is compelling operators to invest aggressively in state-of-the-art defensive technologies. In January 2025, a 46% hike in ransomware attacks on industrial operators was recorded, with cyberattackers increasingly targeting operational technology (OT) environments to maximize disruption. This malicious trend is compelling organizations to seek beyond traditional IT security to adopt full-spectrum, OT-centric cybersecurity solutions to protect their most valuable processes and assets from costly and dangerous intrusions.

- Government mandates and strategic investments: Governments across the globe are implementing robust regulations and strategically investing heavily to improve the resilience of their national critical infrastructure, creating a robust tailwind for the CIP market. In a groundbreaking development, the new UK government's National Cyber Strategy, published in 2022, committed more than £2.6 billion to improve the nation's cyber capabilities. One of the strategy's key objectives is to have 100% of critical infrastructure operators achieve a new, more robust cybersecurity standard by 2028, effectively requiring a material upgrade of security postures in all critical sectors.

Challenges

- Securing complex and exposed global supply chains: Among the biggest risks is securing the complex and frequently opaque global supply chains that furnish an increasingly large share of parts for critical infrastructure, providing many opportunities for malicious actors to introduce counterfeit or compromised components. As a forward-looking response to thwart that, in March 2023 BAE Systems and proteanTecs partnered to create a zero-trust supply chain for the aerospace and defense sector. The effort, designed to cut counterfeit parts by 90% in three years, is a response to imperative requirements for new security paradigms that can authenticate the integrity of parts from the point of origin to the point of ultimate installation.

- Industrial Control Systems (ICS) vulnerability mitigation: The market continues to be at risk from newly evolving vulnerabilities in the industrial control systems (ICS) that underpin modern critical infrastructure. In April 2025, the United States Cybersecurity and Infrastructure Security Agency (CISA) issued an advisory that outlined key vulnerabilities in widely used systems from Siemens and Schneider Electric. While the advisory led to a remarkable 15% increase in 30-day patching, the event provides a further reminder of the continued threat from legacy systems and the continued need for awareness, rapid response, and public-private collaboration to mitigate such threats.

Critical Infrastructure Protection Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 152 billion |

|

Forecast Year Market Size (2035) |

USD 249.9 billion |

|

Regional Scope |

|

Critical Infrastructure Protection Market Segmentation:

Type Segment Analysis

The solution segment is estimated to command a dominant 68% market share during the forecast period based on increasing demand for end-to-end, integrated security platforms capable of countering advanced threats to mission-critical infrastructure. The segment also benefits from the massive and predictable research and development expenditures of leading technology vendors. In July 2023, Siemens announced that it invested over €1 billion in cybersecurity R&D over the last five years with the sole intent of creating new technologies to protect industrial control systems. Such heavy investment is required to create the advanced, multi-layered solutions required to combat advanced persistent threats and offer the resilience mission-critical infrastructure worldwide requires.

Security Segment Analysis

The cyber security segment is to maintain a 61% market share in 2035, as the digitization of critical infrastructure has rendered it an attractive target for a broad array of cyber threats, ranging from state actors to criminal ransomware gangs. The growth of the segment is also driven by the creation of highly specialized and effective cybersecurity solutions that have been specifically tailored to the particular challenges of critical infrastructure environments. In March 2025, Thales Group highlighted its leading role in safeguarding transportation networks worldwide. Their advanced solutions protect numerous major airfields and railroad networks, contributing to a record order intake exceeding €25 billion. This capacity to roll out robust, large-scale cybersecurity measures to complex, real-world operating environments is a key contributor to the segment's robust market position and to its ongoing growth.

End use Segment Analysis

The government & defense segment is projected to account for a 32% market share through 2035, as military readiness and national security are inextricably linked with the defense of strategic infrastructure. The segment is also projected based on the sheer size and intricacy of its security needs, which drive large and persistent investment. In May 2024, GDIT secured a $185 million task order to deliver global cybersecurity services to the U.S. Air Force Civil Engineer Center, with an emphasis on protecting industrial control systems from risk at 188 facilities globally. This type of large, multi-year contract is typical of the government and defense segment and indicative of its leadership in driving the market for highly advanced CIP solutions.

Our in-depth analysis of the critical infrastructure protection market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Security |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Critical Infrastructure Protection Market - Regional Analysis

North America Market Insights

North America is projected to hold a 38% market share throughout the forecast period. This growth can be attributed to high government expenditure, a visionary regulatory framework, and the availability of large pools of CIP vendors. The area is characterized by high sensitivity to sophisticated threats against its critical infrastructure and has prioritized protection of its critical infrastructure as a national security issue, leading to a strong and developing market for advanced security solutions.

The U.S. is the leading country in North America, with a clear emphasis on public-private partnership and the innovation of security technologies. Active intervention by the government in the detection and prevention of threats was evident in July 2025, when the CISA released an advisory regarding a vulnerability in a Siemens access control system. The quick response, in which more than 75% of impacted customers implemented a patch in the first two weeks, is a reflection of the success of the U.S. model of cooperative cybersecurity and its dedication to safeguarding the assets of the private and public sectors.

Canada is investing heavily in developing its critical infrastructure protection capability, with a particular focus on public-private partnerships. In May 2025, the Canada government published its updated National Cyber Security Strategy to enhance government-private sector partnerships. The program, which will fund over 100 collaborative projects over the next five years, will be used to harness the combined knowledge of both sectors in the development and implementation of new solutions to protect the nation's most important services.

Europe Market Insights

Europe CIP industry is anticipated to garner stable growth between 2026 and 2035, owing to robust regulation, increasing cyber-risk awareness, and concerted efforts to make the continent's CIP more resilient. Europe government is at the forefront, making significant investments in new tech as well as in collaborative programs to shield their energy, transport, and healthcare infrastructures. Policy-driven, targeted investment is establishing a dynamic, rapidly expanding CIP solutions marketplace on the continent.

Germany’s key focus is the protection of its world-leading industrial backbone and critical public infrastructure from a fresh onslaught of cyberattacks. The government is responding decisively to the threat, with a significant increase in attacks in the past year revealed in a March 2025 report. This prompted the establishment of a new program to invest €2 billion in enhancing the resilience of the nation's energy and healthcare sectors, a move that will generate significant demand for next-gen cybersecurity and physical security solutions.

The UK is putting protection of critical infrastructure at the center of its national security policy, with ambitious targets and high-level new investment behind them. In September 2024, the National Cyber Security Centre (NCSC) managed 430 cyber incidents, with 89 of these being classed as nationally significant, a rate of almost two every week. The most recent iteration of the Cyber Security Breaches Survey also highlights 50% of British businesses suffering a cyber breach or attack in the last 12 months, with more than 7 million incidents being reported in 2024. By putting these critical suppliers on a more secure footing and enhancing incident reporting requirements, the government aims to avoid supply chain attacks impacting critical services.

APAC Market Insights

Asia Pacific critical infrastructure protection market is anticipated to experience a strong CAGR of 14% between 2026 and 2035. Growth is fueled by massive investment in new infrastructure developments, rapid digitalization, and mounting awareness of the requirement to protect critical services from a wide range of threats. Local governments are introducing new legislation and national strategies to improve their CIP abilities, engendering an extremely competitive market.

China dominates the APAC market, with a top-down, state-driven critical infrastructure protection model. Instead of depending on a single investment mandate, the state is implementing its national cybersecurity legislation through elaborate, sector-based rules. For instance, in July 2023, China's Ministry of Transport released the Measures for Administration of the Safety Protection of the Critical Information Infrastructure of Highways and Waterways. These regulations provide tangible security commitments for transport operators in the critical transport industry, illustrating a manifest government effort to operationalize its top-down strategy on the ground.

India is making huge strides toward protecting its vital infrastructure, driven by the national strategic priority of Aatmanirbharta (self-reliance) and robust, government-led capital spending. The country's ambitious National Infrastructure Pipeline (NIP), a massive initiative to build and modernize assets across energy, transportation, and digital sectors, serves as a primary catalyst for the domestic CIP market. This large-scale infrastructure expansion inherently requires the integration of advanced security solutions from the ground up. This drive is further supported by policies like the Production Linked Incentive (PLI) scheme, which encourages the domestic manufacturing of critical electronics and industrial components, fostering a self-sufficient ecosystem for both building and securing the nation's most vital assets on its path to becoming a developed economy.

Key Critical Infrastructure Protection Market Players:

- Lockheed Martin (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BAE Systems (UK)

- Honeywell (USA)

- Northrop Grumman (USA)

- Siemens (Germany)

- General Dynamics (USA)

- Thales Group (France)

- Samsung SDS (South Korea)

- Larsen & Toubro (India)

- Telstra (Australia)

The critical infrastructure protection market is a technology-driven and competitive market, consisting of a mix of global defense contractors, industrial automation multinationals, and specialty cybersecurity providers. The companies are competing based on the strength of their technical capabilities, their extensive domain knowledge in some critical infrastructure markets, and their ability to offer complex, large-scale, highly reliable security solutions that can meet high expectations of their customers.

One of those trends that shows the competitive dynamics is the July 2023 acquisition of SCADAfence by Honeywell. The acquisition of a cybersecurity solution provider for operational technology (OT) and the Internet of Things (IoT) further extends Honeywell's cybersecurity offerings, which are already extensive. With the company projecting the OT cybersecurity adoption to grow to more than $10 billion over the next several years, this strategic acquisition places Honeywell in a position to gain a greater share of this rapidly growing market and shows the importance of an extensive OT security offering in the competitive CIP market.

Here are some leading companies in the critical infrastructure protection market:

Recent Developments

- In June 2025, General Dynamics Information Technology (GDIT) secured a $580 million government contract to enhance security at U.S. Army bases worldwide. The company will sustain and modernize force protection systems, including advanced radars, cameras, and sensors, to protect critical military installations. This initiative is a key part of a broader effort to bolster the physical and cyber defenses of military infrastructure.

- In May 2025, Lockheed Martin announced it is pioneering the use of AI-powered threat detection systems to support the U.S. Department of Defense's Joint All-Domain Command and Control (JADC2) program. These systems analyze network traffic in real-time to identify anomalies and potential cyber threats, reducing the risk of attacks on critical infrastructure. The company's AI-driven approach is designed to provide a more proactive and effective defense against a wide range of cyber threats.

- Report ID: 7999

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Critical Infrastructure Protection Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.