Controlled Substance Market Outlook:

Controlled Substance Market size was over USD 50.58 billion in 2025 and is poised to exceed USD 83.18 billion by 2035, growing at over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of controlled substance is estimated at USD 52.9 billion.

A controlled substance is a drug or a chemical whose manufacturing or utilization is regulated by the Government, the market includes both legally prescribed pharmaceuticals and illicit drugs that are regulated due to the potential for abuse and addiction. The controlled substance market is experiencing steady growth driven by factors such as increased demand for prescription medications, particularly used in pain management, mental health disorders, and chronic diseases, and rising adoption of controlled-release drugs. In 2023 according to WHO, an estimated 280 million people worldwide suffer from depression with women 50% more affected. Over 700,000 die by suicide annually making it the fourth leading cause of death for ages 15-29.

Government regulations aimed at enhancing regulatory compliance and ensuring consumer trust play a crucial role in stabilizing the controlled substance market. For instance, in October 2024, the FDA announced its update on the Controlled Substances Program (CSP) aiming to identify emerging issues, improve scheduling assessments, and collaborate with Government agencies to reduce risks associated with controlled substances, thus enabling patient compliance.

Additionally, the Controlled Substance Act highlighted by IQVIA in April 2023 underscores strict Government regulations under the U.S. Drug Enforcement Administration (DEA) that any firm associated with controlled substances must be placed in a Suspicious Order Monitoring System and notify them if any unusual purchase patterns are detected. This regulatory update is expected to streamline the compliance processes by reducing risks to enhance the safety of controlled substances thereby fostering market expansion.

Key Controlled Substance Market Insights Summary:

Regional Highlights:

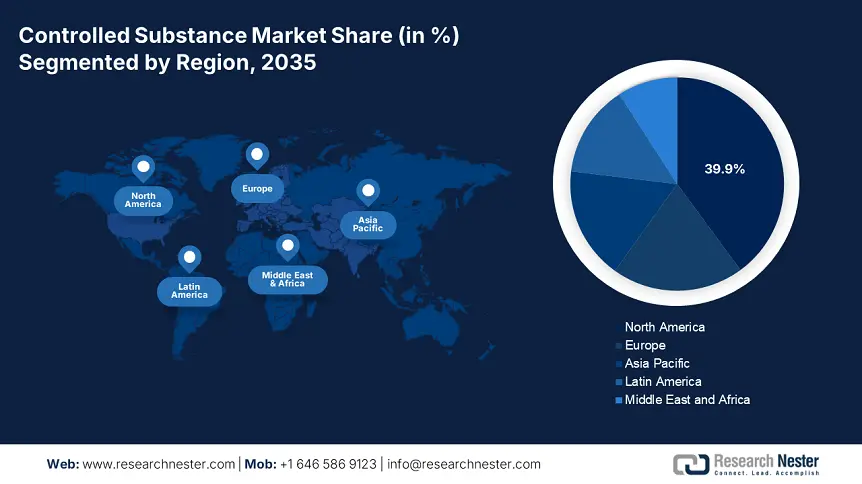

- North America holds a commanding 39.9% share in the Controlled Substance Market, fueled by rising mental health disorder cases and investments in controlled substances, solidifying its dominance through 2035.

- Asia Pacific’s controlled substance market is expected to experience rapid growth by 2035, attributed to strict prescription policies, government efforts, and innovation pathways.

Segment Insights:

- The Opioids segment is projected to hold the highest market share by 2035, fueled by the rising demand for pain management therapeutics for surgery, arthritis, and cancer-related conditions.

- Hospitals & Clinics segment are expected to hold over 49.8% of the controlled substance market by 2035, fueled by the growing need for anesthesia and critical care treatments in healthcare facilities.

Key Growth Trends:

- Rising prevalence of chronic diseases

- Drug formulation advancements

Major Challenges:

- Stringent regulatory guidelines

- Surge in illicit trade

- Key Players: Sanofi., Merck & Co., Inc., Novartis Pharmaceuticals Corporation, Novo Holdings A/S, Gilead Sciences, Inc..

Global Controlled Substance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 50.58 billion

- 2026 Market Size: USD 52.9 billion

- Projected Market Size: USD 83.18 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Controlled Substance Market Growth Drivers and Challenges:

Growth Drivers

- Rising prevalence of chronic diseases: The rising prevalence of chronic diseases, particularly cardiovascular diseases, and neuropsychiatric disorders, are key drivers for the controlled substance sector to grow. Drugs including opioids, stimulants, and sedatives play a crucial role in managing pain, anxiety, and depression. For instance, in 2023 according to research published by Our World in Data, it is estimated that 1 in 3 women and 1 in 5 men are expected to experience major depression in their lives. These conditions reflect the health disparities and increase the demand for controlled substance drugs driving the market growth.

- Drug formulation advancements: Due to the advancements in healthcare infrastructure, the frequency of innovation in the controlled substance is expected to expand the market growth. The pharmaceutical firms' proactive research initiatives & collaborations focus on mitigating issues with addiction and misuse of these substances, ensuring effective treatments. For instance, in February 2025 Wellgistics Health filed a prospectus supplement for 8888, 899 shares of common stock, with trading under the Nasdaq symbol “WLGX” starting March 6, 2025. Investors are advised to review all related risks and disclosures before making decisions.

Challenges

- Stringent regulatory guidelines: Strict regulatory guidelines and compliance barriers to avoid misemployment and addiction for a good cause are negatively impacting the market expansion. In addition, organizations must adhere to extensive documentation, licensing as well as tracking procedures to limit diversion and illegal trafficking of the controlled substances. Moreover, compliance with evolving regulations such as electronic prescription mandates, and drug serialization can make it hard for manufacturers to afford them. Furthermore, failure in compliance may result in fines and legal issues, making it a major restraint for market players.

- Surge in illicit trade: Despite having stringent supervision, growth in the controlled substance market may be hindered due to the illicit trade and replication of controlled substances. Illegal networks have the potential to take advantage of supply chain gaps to distribute illicit opioids, stimulants, etc., resulting in an opioid crisis. This may further create a hurdle for this sector, slowing down market growth and endangering patient safety. This issue requires better security and advanced tracking technologies to combat illegal trade, ensuring market expansion in the forecast period.

Controlled Substance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 50.58 billion |

|

Forecast Year Market Size (2035) |

USD 83.18 billion |

|

Regional Scope |

|

Controlled Substance Market Segmentation:

Sales Channel (Hospitals & Clinics, Pharmacies, Academic Research Institutes)

Hospitals and clinics segment is set to dominate over 49.8% controlled substance market share by 2035. This segment is pledged with the growing need for anesthesia and critical care treatments, and healthcare facilities' requirement for a steady supply of controlled substances for disease management. In November 2024, the U.S. FDA released a press notice stating that Mid-Valley Hospital and Clinic in Omak, Washington, agreed to pay a USD 15,000 Controlled Substances Act penalty for bypassing safety measures. This case reinforces the requirement for strong regulatory compliance to prevent drug misuse in medical facilities which drives demand for compliance services and strict supply chain controls shaping market conclusion.

Drug Class (Opioids, Stimulants, Depressants, Hallucinogens, Anabolic Steroids, Others)

Based on drug class, the controlled substance market is expected to anticipate the highest share for the opioids segment by the end of 2035. This drug works as an excellent solution for pain management, especially post-surgery, arthritis, and cancer-associated, boosting demand in the segment. Due to the requirement for pain relief therapeutics, for instance, in March 2025 the INCB highlighted its Narcotic Drugs 2024 report that due to the significant disparities in global opioid access, low-income countries are experiencing shortages in medications for pain management. Despite optimal production, 18% of manufactured morphine i.e. 32.5 tons is used only for pain relief, especially in developed regions, which underscores the need for increased opioid production, driving market growth worldwide.

Our in-depth analysis of the global controlled substance market includes the following segments:

|

Drug Class |

|

|

Application |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Controlled Substance Market Regional Analysis:

North America Market Analysis

The North America controlled substance market is poised to capture the largest share of 39.9% during the forecast period, 2026-2035. Rising cases of mental health disorders and investments from biopharmaceutical firms, and CROs to develop highly efficient controlled substances are key drivers for the market expansion. Additionally, mergers, acquisitions, and integrations between companies are improving drug accessibility and distribution networks. For instance, in February 2025 Ardena acquired an advanced drug product manufacturing facility from Catalent and expanded bioanalytical services in North America to strengthen its capabilities in late-stage and small-scale commercial manufacturing of oral drug products and offer integrated drug development services globally.

The U.S. has emerged as a global hub for the controlled substance market driven by its large consumer base, well-established healthcare facilities, and strong distribution channels. The country offers significant growth opportunities for pharmaceutical companies for market expansion and promoting responsible drug use. In this regard, in November 2023, Noramco announced the acquisition of the Cambrex Drug Product Business Unit to enhance its capabilities in API manufacturing, drug formulation development, and commercial drug production, which underscores how pharmaceutical companies in the U.S. are investing to improve drug availability and development.

Canada is steadily consolidating its position in the controlled substance market with proactive management initiatives and stringent government regulations. The country’s well-established pharmaceutical sectors ensure the safe production and distribution of controlled substances, raising the demand. For instance, in February 2025 Government of Canada took action to introduce new regulations on three fentanyl precursor chemicals and the drug carisoprodol to tackle fentanyl production. This step focuses on preventing illicit production and trafficking of illegal drugs.

APAC Market Statistics

Asia Pacific is expected to anticipate the fastest growth in the controlled substance market with its concern regarding drug abuse and illegal trade. The region is augmenting such growth with the innovation pathway of countries such as Japan, South Korea, and Australia. Along with strict prescription policies and tough laws for illegal drugs, the growth in this region is carried forward with Government efforts on better tracking systems, strong border controls, and global cooperation to prevent trafficking to bring innovations in the market.

For instance, in November 2024, the executive Yuvan from Taiwan FDA announced the amendment of controlled drugs scheduling, adding HHCH and HHC to schedule 2 and 4 substances to schedule 4. The update further states that the institutions handling mentioned substances must seek FDA approval, and registration certificates, and maintain periodical records which strengthen drug control, ensuring compliance and fostering a profitable environment for this sector.

India is propagating the regional controlled substance market, governed by strict regulatory frameworks such as the Narcotic Drugs and Psychotropic Substances (NDPS) Act. For instance, in June 2023, the U.S. and India commenced a joint effort with Operation Broader Sword to restrict illegal shipments of dangerous drugs and medical devices, which reflects the country’s commitment to strict enforcement and preventing illegal export of controlled substances and legitimate market growth. Further, being one of the largest producers of pharmaceutical ingredients, India plays a crucial role in the global expansion of the controlled substance market.

China is one of the largest players in the controlled substance market, serving as a major manufacturing and distribution channel in the region. China focuses on expanding its production capacity to converge global demand while maintaining complete safety and regulatory governance. In March 2025, as published in China's State Council Information Office, China took control over fentanyl-related substances with stringent drug regulations and expanded systemic governance to combat illegal manufacturing for global stability in drug governance. The country’s focus on stringent regulations makes it a key player in the market during the forecast period.

Key Controlled Substance Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson Services, Inc.

- Sanofi.

- Merck & Co., Inc.

- Novartis Pharmaceuticals Corporation.

- Novo Holdings A/S

- Gilead Sciences, Inc.

- AbbVie Inc

- AstraZeneca

With several competitors striving for market expansion and recognition, the controlled substance market competitive landscape provides dynamic and diverse environments. For instance, in February 2024, Hikma launched Fentanyl Citrate Injection, in a prefilled syringe in 25mcg/0.5mL and 50mcg/mL doses, which is indicated for multiple anesthesia concerns. These launches, in addition to other strategic activities, influence positively, and significantly bolsters the market. Below is the list of some key players in the controlled substance market:

Recent Developments

- In January 2024 Johnson & Johnson’s SPRAVATO (esketamine) was approved in the U.S. which is the first and only monotherapy for adults with treatment-resistant depression.

- In March 2023, Indivior announced its acquisition of Opiant Pharmaceuticals, Inc. to strengthen its addiction treatment and science portfolio by adding Opiant’s late-stage assets.

- In September 2022, AmerisourceBergen announced its acquisition of PharmaLex to expand its global biopharma services platform for supporting pharmaceutical manufacturers with drug development and commercialization.

- Report ID: 7360

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Controlled Substance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.