Morphine Market Outlook:

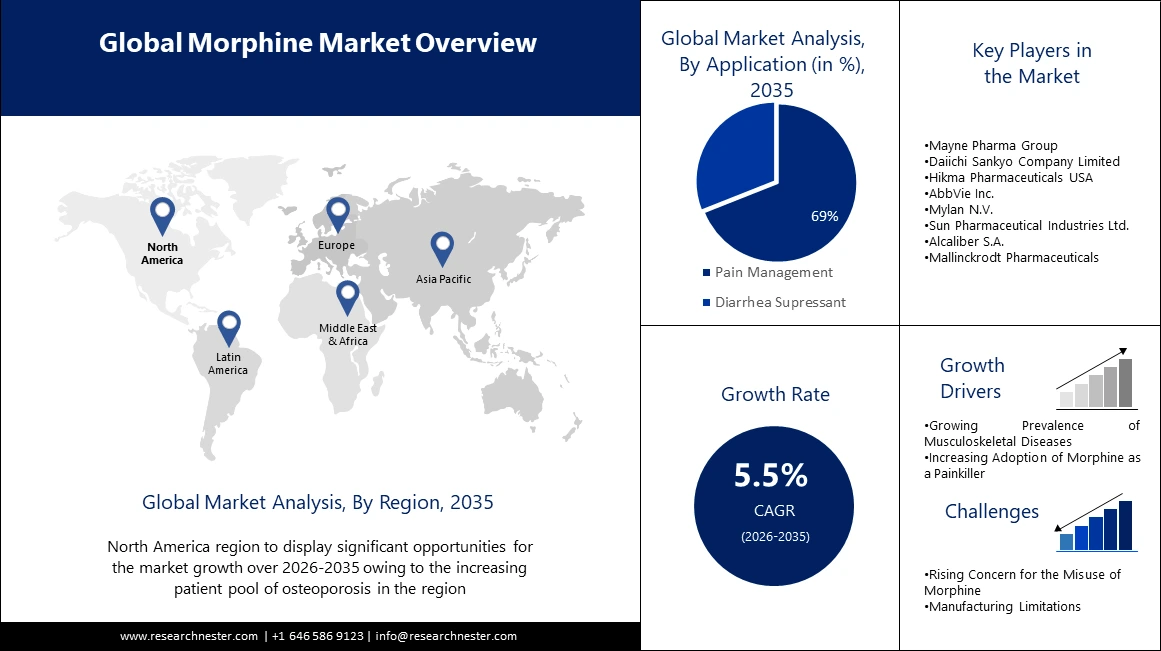

Morphine Market size was over USD 20.88 billion in 2025 and is poised to exceed USD 35.67 billion by 2035, witnessing over 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of morphine is estimated at USD 21.91 billion.

The growth of the market can be attributed to the increasing prevalence of chronic diseases. Morphine has been extensively used in pain management and provides major relief to patients afflicted with pain. For instance, during the sickle cell crisis, doctors are using morphine to alleviate pain. According to the National Institutes of Health in 2024, there was a total of 8 million people suffering from sickle cells globally and 800,000 people in the U.S. These factors are augmenting the morphine market growth during the assessed time. World Health Organization released a report in June 2023, emphasizing on equal distribution of morphine as a vital medicine.

Other than this, extemporaneous opium tincture drops containing morphine are proven to be antidiarrheals and have fecal control properties. Morphine is effective in slowing down the digestion. Diarrhea is common among adults as well as children due to a shortage of adequate sanitation, hygiene, and safe water. However, doctors are finding effective ways to handle the diseases such as introducing morphine in the treatment. According to the Institute for Health Metrics and Evaluation in 2024, there is a 60% drop in global mortality from diarrheal diseases.

Key Morphine Market Insights Summary:

Regional Highlights:

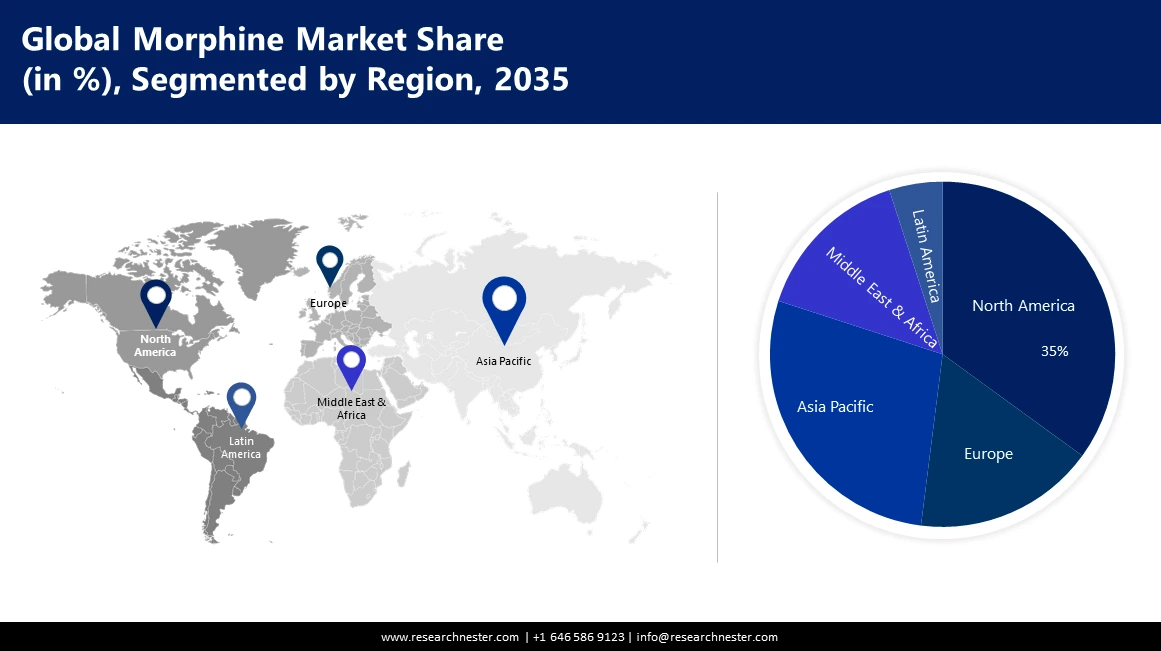

- The North America morphine market will hold around 35% share by 2035, driven by increasing patient pool of osteoporosis, high geriatric population, and growing healthcare investments and awareness.

- The Asia Pacific market is projected to achieve a 28% share by 2035, driven by increasing investment in healthcare, rising awareness about palliative care, and well-developed healthcare infrastructure in countries like India and China.

Segment Insights:

- The pain management segment in the morphine market is projected to secure a 69% share by 2035, driven by rising prescription rates of morphine for severe pain management and postoperative analgesia.

- The pain management segment in the morphine market is expected to capture a 69% share by 2035, driven by rising prescription rates of morphine for severe pain management and postoperative analgesia.

Key Growth Trends:

- Surge in musculoskeletal conditions

- Rising number of surgical procedures

Major Challenges:

- Concerns regarding the misuse of morphine

- Stringent policies of government

Key Players: Verve Health Care Ltd., Mayne Pharma Group, Daiichi Sankyo Company Limited, Hikma Pharmaceuticals USA, AbbVie Inc., Mylan N.V., Sun Pharmaceutical Industries Ltd., Alcaliber S.A., Mallinckrodt Pharmaceuticals, AstraZeneca plc.

Global Morphine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.88 billion

- 2026 Market Size: USD 21.91 billion

- Projected Market Size: USD 35.67 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Morphine Market Growth Drivers and Challenges:

Growth Drivers

-

Surge in musculoskeletal conditions: Intrathecal morphine or ITM is used as optimal postoperative analgesia in patients who are suggested for total hip and knee operation. The data published by the World Health Organization in 2022 states that almost 1.71 billion people have musculoskeletal conditions globally. Also, there are more than 100 types of arthritis and osteoarthritis is the most common form, affecting almost 32.5 million adults in the U.S.

-

Rising number of surgical procedures: Morphine is a commonly used intravenous opioid for postoperative pain. Doctors consider morphine to be the standard choice for post-operative pain control. National Institutes of Health in 2023 stated that 300 million major surgeries are annually performed in the U.S. alone. In order to prevent pain after major surgery, the usage of intrathecal morphine has become common.

- Rising usage in cancer treatment: Anti-cancer drugs and morphine have been simultaneously given to patients, particularly with metastasis. Morphine is used as the most potent analgesic used for the management of cancer pain. According to World Health Organization in 2024, over 35 million new cancer cases are predicted in 2050. There more be more demand for morphine-like solutions to relieve patients' pain.

- High demand from the pharmaceutical sector: Morphine is used in the pharmaceutical industry to develop new drugs due to its multiple properties such as appetite stimulation, inflammation relief, nausea relief, epileptic seizure control, and treatment of psychiatric disorders. In 2023, the U.S. Food and Drug Administration promulgated that they have approved 37 new drugs in the country.

Challenges:

-

Concerns regarding the misuse of morphine: Morphine is a type of drug that can become addictive if used for a long period or in high quantity. Few individuals might use morphine as the mode of addiction and it becomes difficult to get over this addiction. Therefore, when it becomes an addiction people start misusing morphine medication. It becomes harmful to an individual’s health.

-

Stringent policies of government: The manufacturing process, sale, and distribution of morphine are controlled by governments. The laws are passed to stop the trafficking and abuse of drugs.

Morphine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 20.88 billion |

|

Forecast Year Market Size (2035) |

USD 35.67 billion |

|

Regional Scope |

|

Morphine Market Segmentation:

Application Segment Analysis

In application segmentation, the pain management segment is projected to capture morphine market share of over 69% by 2035. If the patient's pain cannot be managed with regular pain relievers, then the patient is prescribed morphine sustained-release tablets to relieve severe pain. Opioids play an important role in ensuring adequate analgesia in acute postoperative situations. According to the Centers for Disease Control and Prevention in 2022 physicians prescribed approximately 37% of all opioid prescriptions in the U.S.

Mode of Administration Segment Analysis

In terms of mode of administration, the oral segment in the morphine market is expected to observe the highest CAGR during the forecast period. The oral segment includes morphine in oral tablet and pharmaceutical form. Orlando Clinical Research Center found that 30 minutes for most oral medication to dissolve in the bloodstream. Oral medicines are considered one of the easiest ways that can be taken by the patients themselves without anyone’s help.

Our in-depth analysis of the global morphine market includes the following segments:

|

Application |

|

|

Mode of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Morphine Market Regional Analysis:

North America Market Insights

North America morphine market is projected to account for revenue share of more than 35% by the end of 2035. This can be ascribed to the increasing patient pool of osteoporosis. U.S. Food and Drug Administration in 2024 stated that in the U.S., osteoporosis affects 1 in 4 women aged 65 or older. Moreover, a high share of the geriatric population in countries, such as the United States and Canada, is estimated to propel the regional morphine market growth. For instance, data published by the government of Canada in 2022, currently 2.3% of the population in the country is aged 85 and older.

Asia Pacific Market Insights

By the end of 2035, Asia Pacific morphine market is expected to hold over 28% revenue share. The increasing investment in the healthcare sector and rising awareness about palliative care medication in the region are major growth-propelling factors. Countries such as India, and China have well-developed healthcare infrastructures with proper pain management medications such as morphine use. For instance, in January 2025, an article published by DD News in India stated that the healthcare market is projected to reach USD 5 trillion by 2030. The burgeoning health industry is leading to increased demand and widespread availability of effective pain suppressants such as morphine.

Morphine Market Players:

- Verve Health Care Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mayne Pharma Group

- Daiichi Sankyo Company Limited

- Hikma Pharmaceuticals USA

- AbbVie Inc.

- Mylan N.V.

- Sun Pharmaceutical Industries Ltd.

- Alcaliber S.A.

- Mallinckrodt Pharmaceuticals

- AstraZeneca plc

The competitive landscape of the morphine market is rapidly evolving as established key players, pharmaceutical giants and new entrants are investing in discovering novel medicines. Key players in the market are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global morphine market:

Recent Developments

- In September 2024, Pharmascience Canada launched a new medication for patients named pms-Morphine Sulphate for treating symptomatic relief of severe chronic pain in adults aged 18 to 65. It relieves pain by acting on particular nerve cells of the spinal cord and brain.

- In May 2022, Oklahoma State University and University joined hands with the University of Arizona Health Sciences for health sciences and entered into a deal for managing the crisis of opioids.

- Report ID: 3602

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Morphine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.