Construction Adhesives Market Outlook:

Construction Adhesives Market size was estimated at USD 12.9 billion in 2024 and is expected to surpass USD 20.7 billion by the end of 2034, rising at a CAGR of 5.2% during the forecast period, i.e., 2025-2034. In 2025, the industry size of construction adhesives is estimated at USD 13.5 billion.

In the market, sustained public infrastructure spending is still the main source of growth, and it continues to drive adhesive demand for concrete, composite assemblies, and joint sealing. Increased federal and state spending on roads, bridges, and transit shows no signs of declining. The recent Infrastructure Investment and Jobs Act (IIJA) allocated over $111 billion for transportation over the next few years, supporting adhesives. However, there are more bio-based adhesives that have also been supported by USDA Renewable Chemicals grants for FY 2023, as much as $26 million to reduce dependence on formaldehyde-based resins.

The adhesives supply chain is shifting towards epoxies and polyurethanes with vertically integrated production of epoxy resins and polyurethane resins. The USITC is currently inquiring if epoxy imports from China, India, South Korea, Taiwan, and Thailand are being dumped in the market, causing domestic damage. US manufacturers expanded production capacity between late 2022 and early 2025 to approximately 16% by rebuilding Gulf Coast facilities. According to the Bureau of Labor Statistics, the Producer Price Index (PPI), which may be for processed intermediate materials - including primary nonferrous metals and basic organic chemicals typically produced in adhesives - saw an increase of 0.5% in May 2025 and approximately a 2.7% increase in the PPI for final demand goods, annualized. Aside from continued domestic investment in adhesive production, many large adhesive manufacturers are also starting to see federal funding for adhesive research and development. The Department of Energy's Advanced Manufacturing Office has allocated $41 million in FY 2024 to low-VOC formulations and projects. We see the adhesives sector continuing to mature and becoming an investment-led sector.

Construction Adhesives Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of pre-fabricated construction: The modular and prefabricated construction market is expected to expand at a CAGR of 6.6% from 2024 to 2030 as it demonstrates reduced labour costs and faster project delivery. Construction adhesives are key in assembling prefabricated wall panels, flooring systems, and structural components. Demand for adhesives in the modular and prefabricated construction markets increases for seamless bonding, structural stability, and design flexibility, particularly in North America and Europe, where market acceptance and use of prefabrication are increasing in housing and healthcare-related infrastructure.

- Technological advancements in product formulations: Technological developments in polyurethane, epoxy, and acrylic adhesive systems have added improved bond strength, heat resistance, and substrate compatibility. For example, Henkel reports that its new polyurethane adhesives exhibit 31% greater bonding strength for wood panels and structural glazing. Ongoing research and development will continue to produce lighter, stronger, and more durable adhesives for accepted construction applications that support premium prices and market differentiation. The adhesive manufacturer community will continue to focus on hybrid technologies that will combine the mechanical properties of traditional adhesives and reactive adhesives to keep pace with construction methods and standards.

1.Emerging Trade Dynamics & Future Market Prospects

Import-Export Data (Construction Adhesives) 2019-2024

|

Year |

Global Imports (USD Billion) |

Global Exports (USD Billion) |

Top Origin Countries |

Top Destination Countries |

|

2019 |

2.9 |

3.0 |

Japan, Germany, China |

U.S., India, Indonesia |

|

2020 |

2.4 |

2.5 |

China, Germany, Japan |

U.S., Vietnam, Australia |

|

2021 |

2.7 |

2.8 |

China, Germany, Japan |

U.S., India, Malaysia |

|

2022 |

3.6 |

3.5 |

China, Japan, Germany |

U.S., India, Indonesia |

|

2023 |

3.7 |

3.6 |

China, Japan, Germany |

U.S., South Korea, Australia |

|

2024 |

3.9 (est.) |

3.8 (est.) |

China, Japan, Germany |

U.S., India, Indonesia |

Key Trade Routes (2019-2023)

|

Trade Route |

CAGR (%) |

Main Products Shipped |

|

Japan to Asia |

+6.3% |

Epoxy, PU adhesives |

|

Europe to North America |

+4.6% |

Acrylic adhesives |

Significant Trade Patterns

|

Pattern |

Evidence |

|

Construction industry growth |

+6.2% (U.S. 2022) |

|

Chemical exports (Japan to SE Asia) |

USD 9.2B (2019) to USD 11.6B (2023) |

2.Construction Adhesives Market Overview

Price History & Sales Data (2019–2023)

|

Year |

Avg. Price (USD/ton) |

Unit Sales (tons) |

NA Price Trend |

EU Price Trend |

Asia Price Trend |

|

2019 |

$1,201 |

2.2M |

+4% |

+3% |

+2% |

|

2020 |

$1,251 |

2.1M |

+6% |

+5% |

+4% |

|

2021 |

$1,401 |

2.3M |

+13% |

+11% |

+8% |

|

2022 |

$1,551 |

2.5M |

+19% |

+16% |

+11% |

|

2023 |

$1,381 |

2.6M |

-4% |

-9% |

-4% |

Key Price Influencers & Statistical Impact

|

Factor |

Statistical Impact |

|

Raw Material Costs (Crude Oil Derivatives) |

60% of adhesive production costs tied to petrochemicals. Brent crude ↑ 66% (2021) → adhesives ↑ 13%. |

|

Geopolitical Events (Russia-Ukraine War) |

2022 resin shortage (20%) → EU construction adhesive prices ↑ 16%. |

|

Environmental Regulations (VOC Limits) |

EPA 2022 standards increased compliance costs by 9% in North America. |

Challenges

- Performance limitations in extreme conditions: Adhesive performance in extreme temperature environments, or other high-moisture environments, still has a barrier. For example, adhesives can fail in marine conditions or exterior applications due to temperature cycles or UV exposure. In fact, according to the American Concrete Institute, 26% of adhesive bond failures in concrete repair applications were due to improper selection for environmental conditions. This performance deficiency restricts when and how certain products can be used in any critical structural function, thereby limiting the overall growth potential of the market.

- Limited awareness of advanced products: There are still limited adoption rates for high-performance construction adhesives among many smaller to mid-size contractors, as many do not have the same awareness as the larger contractors when it comes to knowledge of their use. For example, in a Global Construction Survey, only 38% of surveyed contractors in emerging Asia-Pacific markets were finding construction adhesives a worthy, environmentally sustainable alternative to traditional mechanical fastening systems. Inadequate knowledge and understanding of the benefits that these products could offer, such as weight savings, durability, energy efficiency, and low carbon credentials, continue to suppress market penetration, specifically in the low-cost housing and infrastructure segments, limiting growth opportunities for manufacturers of premium performance adhesives.

Construction Adhesives Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

5.2% |

|

Base Year Market Size (2024) |

USD 12.9 billion |

|

Forecast Year Market Size (2034) |

USD 20.7 billion |

|

Regional Scope |

|

Construction Adhesives Market Segmentation:

End use Segment Analysis

The residential construction segment is predicted to gain the largest market share of 42.3% during the projected period by 2034, due to a strong increase in global investment for housing and urban development programs. For example, the U.S. Department of Housing and Urban Development (HUD) has indicated a steady annual increase in the number of housing starts, thanks to infrastructure stimulus packages. In addition, energy-efficient building codes require buildings to have high-performance adhesives that are used to ensure the building stays together and has the insulation value required to comply with building codes, which has boosted demand within residential projects.

Technology Segment Analysis

The water-based adhesives segment is anticipated to constitute the most significant growth by 2034, with 38.2% market share, mainly due to their low VOC emissions, meeting EPA Clean Air Act standards, and being easy to apply on a variety of substrates. The EPA has taken a hard look at VOC limits under its National Emission Standards for Hazardous Air Pollutants (NESHAP) for surface coating, and this has benefited water-based adhesives by encouraging a switch from solvent-based to water-based. In addition, the surge of green building programs, as well as increased usage in floor and paneling applications, has all contributed to this growth.

Our in-depth analysis of the global construction adhesives market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Resin Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Construction Adhesives Market - Regional Analysis

North America Market Insights

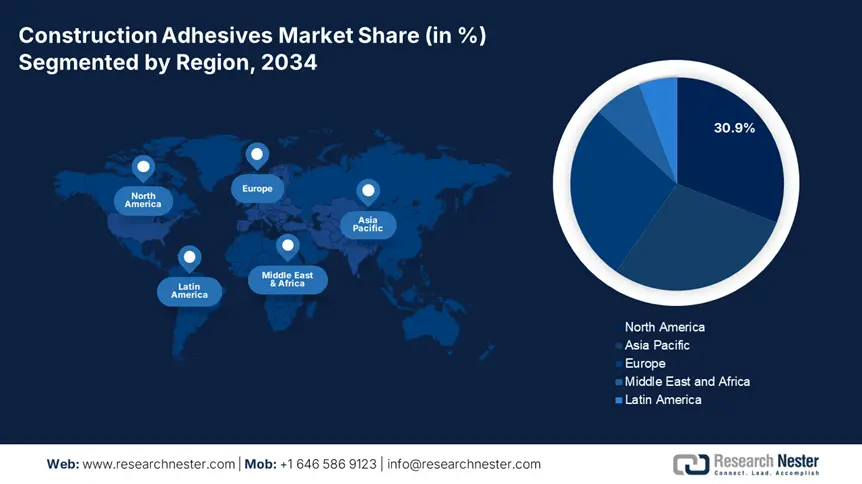

By 2034, the North America market is expected to hold 30.9% of the market share, and it is expected to grow at a ~7 % CAGR between 2024 and 2034. In 2030, it will be valued at approximately USD 8.7 billion, and the forecasts show it will be USD 21 billion by 2034. The growth will center around the demand for durable, affordable, and environmentally-friendly adhesive solutions for bonding in construction jobs.

In 2024, the U.S. represented over 76 % of the North American adhesive market, which is in synchronicity with generally rising adhesives, e.g., the U.S. Census Bureau reported that housing completions grew 12.5 %. The U.S. PPI (Producer Price Index) rose 2.7 % on a year-over-year basis as of May 2025, largely in line with all input costs for construction. In contrast, the demand for adhesives came from the activity in residential and commercial construction, supported by federal success and infrastructure programs.

Asia Pacific Market Insights

Asia Pacific market is expected to hold 28.8% of the market share, and it is expected to grow from USD 5.9 billion in 2024 to USD 10.6 billion by 2034, representing a CAGR of 5.9%. The growth of this market is being driven largely by increasing spending on infrastructure, rapid urbanization, and increased use of eco-friendly adhesives in residential and commercial construction. Significant numbers of consumption will come from major economies, including China, India, and other Southeast Asian nations. Demand will also be bolstered by government initiatives such as India’s Smart Cities Mission and Indonesia’s Nusantara development plan. Significant players in the construction adhesives market are expanding production capacity and creating hybrid adhesive formulations supported by R&D to improve market share in the growing Asia Pacific Region.

The China construction adhesives market, growth is expected to grow from USD 3.0 billion in 2024 to USD 5.3 billion by 2034 with a CAGR of 6.2%. The market growth is primarily attributed to robust residential construction and the growth of the transport and commercial construction sectors, especially driven by China's 14th Five-Year Plan focused on green building and expansion, and the creation of smart cities across the nation. Pawasil's research and development (R&D) expenditures are also expected to advance new bio-based adhesives focusing on carbon neutrality as an overall national goal per China’s commitment to carbon neutrality by 2060, and this is expected to accelerate the use of unsustainable adhesive solutions.

Country-wise Statistics Table (2024-2034)

|

Country |

Investment Trends (USD Bn) |

Growth Rate (CAGR %) |

R&D Developments |

|

Japan |

~1.3 Bn in green construction adhesives |

4.0% |

Focus on low-VOC hybrid adhesives and earthquake-resistant bonding |

|

China |

~2.4 Bn in smart city construction adhesives |

6.2% |

Bio-based polyurethane and epoxy adhesives R&D expansion |

|

India |

~0.9 Bn in infrastructure adhesives |

6.5% |

High-bond, quick-curing adhesives for roads and metro projects |

|

Indonesia |

~0.5 Bn driven by Nusantara project |

5.8% |

Moisture-curing adhesives for humid tropical environments |

|

Malaysia |

~0.4 Bn targeting industrial parks |

5.3% |

Solvent-free adhesives for industrial flooring and roofing |

|

Australia |

~0.7 Bn for green building initiatives |

4.4% |

Heat-resistant adhesives for energy-efficient construction |

|

South Korea |

~0.6 Bn in smart infrastructure adhesives |

4.9% |

Advanced epoxy R&D for high-rise and modular construction |

|

Rest of APAC |

~0.8 Bn aggregated |

5.5% |

General-purpose and hybrid R&D investments by regional players |

Europe Market Insights

Europe market is expected to hold 24.1% of the market share, and it is expected to grow from USD 4.2 billion in 2024 to USD 5.9 billion in 2034, with a CAGR of 3.6%. Demand for eco-friendly adhesives used in building renovation and repair, as part of the EU's Green Deal, is growing significantly, in addition to a strong rise in modular construction. Germany, France, and the UK dominate demand in this market. Manufacturers have increased their R&D spending on bio-based adhesives in line with ECHA regulations, and as the EU transitions to a circular economy, the market for sustainable construction across Europe is expanding.

Country-wise Statistics Table (2034 forecast)

|

Country |

2034 Market Share (%) |

Research Investment (USD million) |

|

UK |

11.9% |

46.6 |

|

Germany |

26.0% |

98.8 |

|

France |

14.3% |

54.4 |

|

Italy |

9.6% |

37.7 |

|

Spain |

7.2% |

29.5 |

|

Russia |

5.5% |

18.9 |

|

Nordic |

6.9% |

25.7 |

|

Rest of Europe |

19.4% |

66.2 |

Key Construction Adhesives Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global construction adhesives market is fiercely competitive as Henkel, 3M, Sika, H.B. Fuller, and Bostik have significant shares globally due to their extensive reach and a variety of products. Major market players are using multiple strategies in order to maintain a position and improve their status, ranging from acquisitions (e.g., Sika's acquisition of MBCC Group), regional expansion into emerging markets, and sustainable adhesive innovations to align with green construction practices and trends. On the other end of the spectrum, companies like Pidilite and KCC specialize in the domestic and regional markets with custom solutions for each. Competitors like Henkel, 3M, and Sika invest heavily in research and development to offer bio-based adhesives or low-VOC alternatives. The competitive environment of the construction adhesives market promotes the development of new products, mergers and acquisitions, partnerships, collaborations, expansions, and building their presence in emerging markets.

Some of the key players operating in the market are listed below:

|

Company Name |

Country of Origin |

Approx. Global Market Share (%) |

|

Henkel AG & Co. KGaA |

Germany |

~15.1% |

|

3M Company |

USA |

~10.6% |

|

Sika AG |

Switzerland |

~9.9% |

|

H.B. Fuller Company |

USA |

~8.4% |

|

Arkema Group (Bostik) |

France |

~7.7% |

|

Dow Inc. |

USA |

~xx% |

|

BASF SE |

Germany |

~xx% |

|

Mapei S.p.A. |

Italy |

~xx% |

|

Pidilite Industries Ltd. |

India |

~xx% |

|

Illinois Tool Works Inc. |

USA |

~xx% |

|

Huntsman Corporation |

USA |

~xx% |

|

Soudal N.V. |

Belgium |

~xx% |

|

Selleys (DuluxGroup) |

Australia |

~xx% |

|

KCC Corporation |

South Korea |

~xx% |

|

Kossan Adhesives Industries Sdn Bhd |

Malaysia |

~0.9% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In April 2024, DAP launched its HD Max Construction Adhesive in a first-of-its-kind 28-fl oz cartridge. Combining polyurethane strength with hybrid ease of use, it bonds porous and non-porous substrates across temperatures from 0–120°F. Waterproof and low-odor, it is positioned for professionals handling large-scale projects, strengthening DAP’s market presence in the premium construction adhesive segment for commercial remodels and new-build applications.

- In September 2024, Henkel introduced Pattex No More Nails Stick & Peel, a first-of-its-kind removable construction adhesive with a bonds potential of up to ~7 kg that is particularly notable for its high initial tack and clean peel attributes. Henkel's launch for the DIY & home décor market was executed throughout Europe and Mexico in 2024. Expansion into the US and Eastern Europe is planned for 2025. Henkel's product provides a solution to an ever-increasing demand for tool-free installation and reusable mounting.

- Report ID: 3388

- Published Date: Jul 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Construction Adhesives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert