Concentrated Nitric Acid Market Outlook:

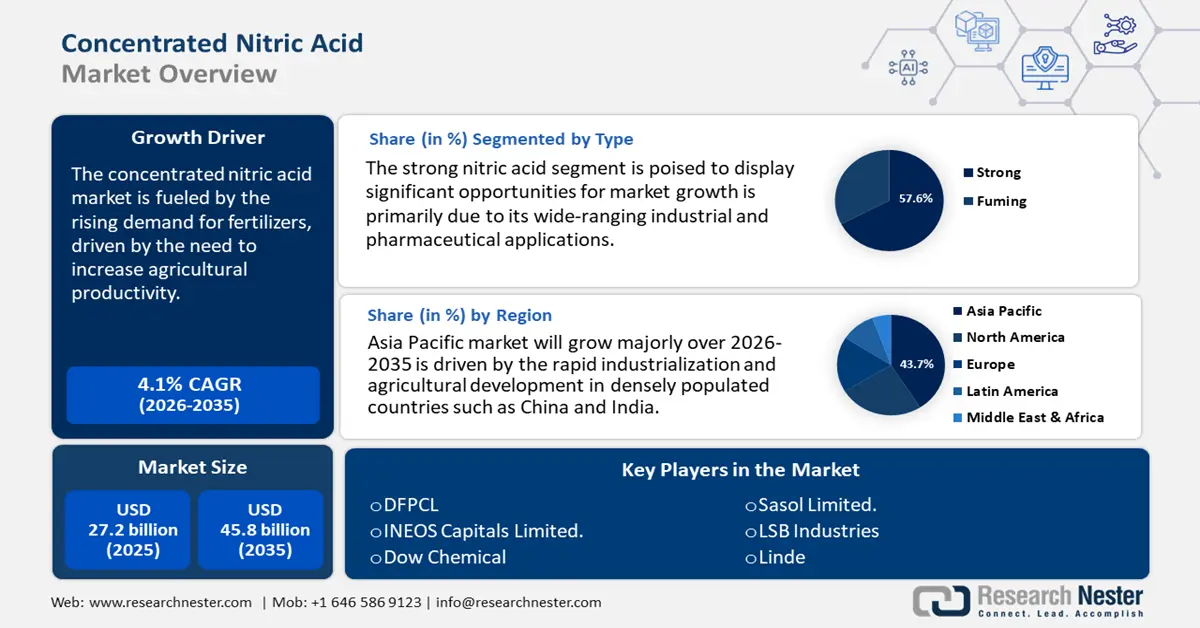

Concentrated Nitric Acid Market size was USD 27.2 billion in 2025 and is estimated to reach USD 45.8 billion by the end of 2035, expanding at a CAGR of 4.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of concentrated nitric acid is assessed at USD 28.3 billion.

The market is experiencing substantial growth, driven by the rising demand for fertilizers due to the need to increase agricultural productivity. As global food demand intensifies, concentrated nitric acid, particularly in the form of ammonium nitrate, plays a critical role in enhancing crop yields through nitrogen-based fertilizers. This trend is especially pronounced in developing regions, where agricultural intensification is key to economic growth and food security.

In addition to agriculture, the defense and military sectors are significant contributors to market expansion, as ammonium nitrate is widely utilized in explosives for mining, construction, and national defense purposes. Furthermore, the importance of nitric acid as a primary oxidizer in aerospace propulsion is on the rise, driven by a surge in satellite launches and space missions, bolstered by the increasing involvement of government and private space initiatives. The U.S. International Trade Administration indicates a growing demand for high-purity oxidizers in sophisticated propulsion systems. This diversification highlights the changing industrial importance of nitric acid.

A leading instance is Yara International, a global chemical company known for its expertise in nitrogen solutions. Yar produces high-quality nitric acid used across agricultural, industrial, and technical applications. Through sustainable practices and technological innovation, the company is well-positioned to capitalize on emerging opportunities in both conventional and high-performance nitric acid markets.

Key Concentrated Nitric Acid Market Insights Summary:

Regional Insights:

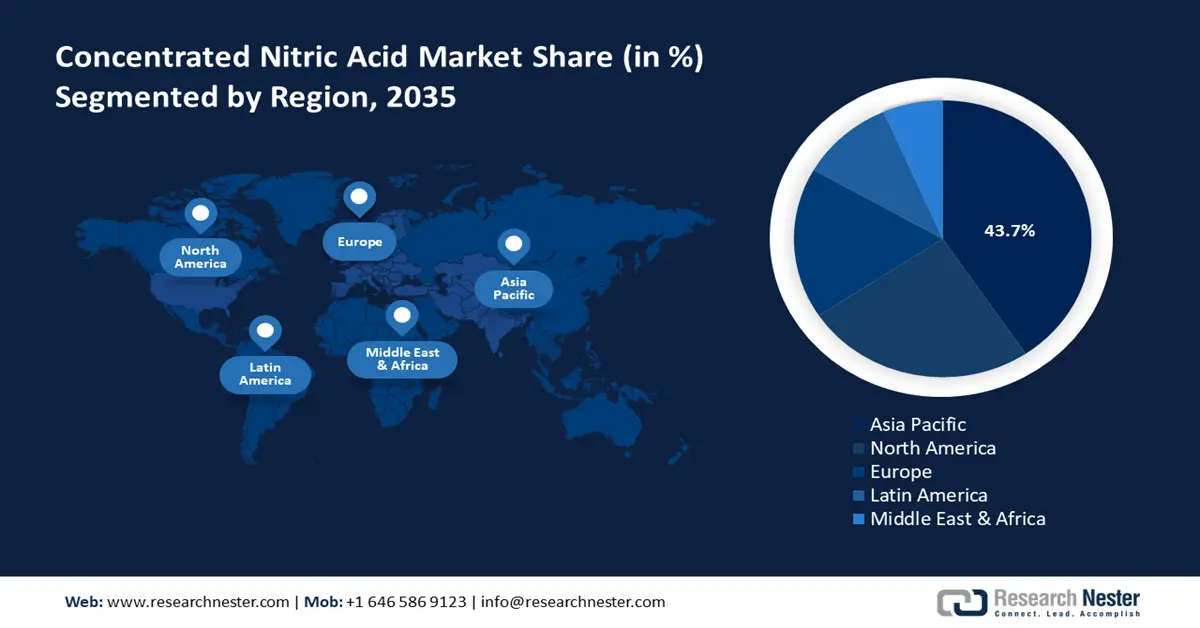

- The Asia Pacific Concentrated Nitric Acid Market is anticipated to command a 43.7% share by 2035, attributed to the region’s vast agricultural base and elevated demand for nitrogen-based fertilizers.

- North America is projected to capture a notable portion of the market by 2035, owing to its advanced industrial infrastructure and strong utilization of concentrated nitric acid across polymers, foams, and agrochemicals.

Segment Insights:

- The strong nitric acid segment in the Concentrated Nitric Acid Market is projected to hold a 57.6% share by 2035, propelled by its extensive use in industrial and pharmaceutical applications.

- The agricultural industry segment is anticipated to secure a notable share by 2035, impelled by the increasing adoption of nitric acid-based fertilizers to improve crop yields.

Key Growth Trends:

- Increasing demand across various sectors

- Chemical intermediate production

Key Players:

- High production costs

- Storage and transportation risk

Key Players: Yara International ASA,BASF SE,CF Industries Holdings, Inc.,Deepak Fertilizers and Petrochemicals Corporation Ltd. (DFPCL),The Chemours Company,INEOS Capital Limited,The Dow Chemical Company,Sasol Limited,LSB Industries, Inc.,UBE INDUSTRIES, LTD.

Global Concentrated Nitric Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.2 billion

- 2026 Market Size: USD 28.3 billion

- Projected Market Size: USD 45.8 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, India, United States, Germany, Japan

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, Turkey

Last updated on : 30 September, 2025

Concentrated Nitric Acid Market - Growth Drivers and Challenges

Growth Drivers

- Increasing demand across various sectors: The rising demand for concentrated nitric acid across a diverse range of industries is significantly driving global market growth. In the pharmaceutical sector, concentrated nitric acid is vital in the synthesis of active pharmaceutical ingredients (APIs) and intermediates, contributing to the deployment of essential medications. In chemical laboratories, it is widely used for analytical and preparative procedures due to its strong oxidizing properties. Furthermore, concentrated nitric acid plays a crucial role in the dye, colorant, and pigment industries, where it serves in the nitration process of aromatic compounds, supporting the production of various colorants used in textiles, printing inks, and coatings. In metal refining and etching, nitric acid is instrumental in purifying precious metals and preparing surfaces for electroplating and microfabrication, making it indispensable in the electronics and metallurgical sectors.

Additionally, the compound remains foundational in the fertilizer and explosive industries, particularly producing ammonium nitrate, an essential component in both agriculture and mining operations, where it functions as a chemical doping agent in battery and semiconductor research. A notable instance is LSB Industries, Inc., a key producer of nitric acid, supplying high-grade acid to sectors such as agriculture, mining, and specialty chemicals. The company’s commitment to quality and innovation enables it to meet the growing multi-industry demand effectively. - Chemical intermediate production: High demand for concentrated nitric acid in manufacturing key chemicals like adipic acid, nitrobenzene, and TDI used in plastics and dyes. These intermediates are essential in the production of nylon, polyurethane foams, and industrial dyes, which are widely used in the automotive, textile, and construction industries. Concentrated nitric acid’s strong nitrating and oxidizing properties make it indispensable in the controlled synthesis of aromatic compounds and specialty chemicals. As global demand for performance materials and plastics continues to rise, particularly in emerging economies, the consumption of concentrated nitric acid is expected to grow accordingly. An exemplary case is LANXESS AG, a prominent German specialty chemicals firm, which heavily utilizes nitric acid in the manufacturing of chemical intermediates for plastics and coatings. The company emphasizes process efficiency and environmental sustainability, positioning itself as a key player in meeting the growing market needs. This alignment between industrial demand and chemical innovation underscores the strategic value of concentrated nitric acid in the global chemicals supply chain.

- Expansion in fertilizer production: The market for concentrated nitric acid is largely propelled by its essential function in the production of nitrogen-based fertilizers, especially ammonium nitrate. With the increasing global demand for food, the utilization of fertilizers is on the rise. The FAO anticipates that to adequately nourish the population, worldwide consumption of nitrogen fertilizers will approach almost 120 million tons by 2023. This trend directly stimulates the demand for concentrated nitric acid, which serves as a vital feedstock in the manufacturing processes of these fertilizers.

Trade Dynamics

Nitric acid; sulphonitric acids exports by country in 2023

|

Region |

Trade Value (1000) USD |

Quantity Kg |

|

Germany |

80,796.86 |

272,751,000 |

|

U.S. |

15,737.88 |

28,637,100 |

|

China |

12,196.65 |

35,251,100 |

|

Canada |

5,918.75 |

- |

|

Japan |

4,561.29 |

- |

|

UK |

4,407.23 |

- |

Source: WITS

Challenges

- High production costs: The manufacturing is highly energy-intensive, requires substantial inputs of electricity and natural gas, particularly during the catalytic oxidation of ammonia. In regions with volatile or high energy prices, this directly impacts operational costs and profit margins. Moreover, the requirement for specialized materials and equipment that resist corrosion significantly increases both capital and maintenance costs. These cost pressures can hinder competitiveness, especially for small- and medium-scale manufacturers, and may limit capacity expansion in price-sensitive markets. As a result, cost-efficiency remains a critical focus for industry players seeking long-term sustainability.

- Storage and transportation risk: The concentrated nitric acid is highly corrosive and reactive. Moreover, the chemical must be handled using specialized corrosion-resistant containers and transport systems, such as stainless steel or Teflon-lined tanks, to ensure safety and compliance with hazardous materials regulations. These stringent requirements increase logistical complexity and operational costs for manufacturers and distributors. Additionally, accidental leaks or improper handling can lead to severe health hazards, environmental contamination, and regulatory penalties. As a result, the need for meticulous handling protocols and investment in specialized infrastructure significantly impacts the overall supply chain efficiency and cost structure.

Concentrated Nitric Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 27.2 billion |

|

Forecast Year Market Size (2035) |

USD 45.8 billion |

|

Regional Scope |

|

Concentrated Nitric Market Segmentation:

Type Segment Analysis

The strong nitric acid segment is predicted to gain the largest market share of 57.6% during the projected period, driven by its wide-ranging industrial and pharmaceutical applications. Produced by dissolving additional nitrogen dioxide into 68% nitric acid within an absorption tower, strong nitric acid is a key raw material in the synthesis of various chemical intermediates. It is extensively employed in the production of ammonium nitrate, toluene diisocyanate, nitrobenzene, TNT, nitro chlorobenzene, and adipic acid. The growing demand for explosives, particularly from the mining and construction sectors, has significantly boosted the consumption of strong nitric acid. Additionally, its role in manufacturing high-performance polymers and synthetic fibers contributes to its market dominance. A notable player in this segment is Mitsubishi Chemical, a manufacturer that supplies high-purity nitric acid for industrial applications. The company’s robust production infrastructure and commitment to safety and environmental standards enable it to meet rising domestic and global efficiency.

End use Segment Analysis

The agricultural industry is expected to hold a substantial share in the global concentrated nitric acid market during the forecast period. This expansion is mainly due to the rising recognition and utilization of chemical fertilizers to enhance agricultural productivity. As the global population continues to rise, the demand for food is leading to greater reliance on concentrated nitric acid-based fertilizers such as calcium ammonium nitrate and urea ammonium nitrate.

Nitric acid is also a key ingredient in the production of nitrobenzene, which is used in manufacturing pesticides that protect crops and improve productivity. Additionally, increased research & development in chemical fertilizers is driving innovation in formulation and efficiency, further strengthening market demand for concentrated nitric acid in agriculture. Toyo Engineering, a Japanese agrochemical company, uses concentrated nitric acid in the formulation of high-efficiency fertilizers, supporting Japan’s sustainable agriculture initiatives and contributing to enhanced crop productivity.

Fertilizers Segment Analysis

The fertilizers segment is expected to hold a substantial share of the concentrated nitric acid market, primarily propelled by the increasing demand for nitrogen-rich fertilizers like ammonium nitrate. This demand is driven by the necessity to enhance agricultural productivity in response to escalating global food needs. As reported by the Food and Agriculture Organization (FAO), global fertilizer usage has risen by 3% annually over the past decade to maintain crop yields. Concentrated nitric acid plays a crucial role in the production of high-quality fertilizers, particularly in developing areas that prioritize food security and sustainable agricultural practices.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

End-use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Concentrated Nitric Acid Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific concentrated nitric acid sector is poised to hold a 43.7% share by the end of 2035. This dominance is primarily influenced by its significant agricultural sector. In the year 2022, Asia represented 55% of the worldwide total agricultural consumption of inorganic fertilizers, with China and India emerging as the top consumers. This preeminence is linked to the elevated demand for nitrogen-based fertilizers, such as ammonium nitrate, which are crucial for improving crop yields and securing food availability in the region.

China is expected to sustain the largest revenue share in the APAC concentrated nitric acid market by the year 2035. As the leading global consumer of inorganic fertilizers, China's vast agricultural operations require a considerable supply of concentrated nitric acid. The nation's dedication to enhancing fertilizer application to elevate crop yields further emphasizes its critical position in the regional market.

Top Exporter/Importer of China’s Nitric Acid (2024)

|

Region |

Exporter Value ($) |

Region |

Importer Value ($) |

|

Indonesia |

$4.36M |

South Korea |

$26.9M |

|

Vietnam |

$2.99M |

Chinese |

$1.46M |

|

China Taipei |

$2.58M |

Taipei |

$1.46M |

|

Singapore |

$998k |

Japan |

$617K |

|

Suriname |

$396k |

U.S. |

$588k |

|

UK |

4,407.23 |

Germany |

$259k |

Source: WITS

India is projected to capture a significant revenue share in the APAC concentrated nitric acid market by 2035. With a population surpassing 1 billion and an anticipated need for 300 million tonnes of food grains by 2025. This calls for an increase in fertilizer usage, particularly nitrogen-based fertilizers, to attain greater yields and ensure food security. A leading contributor to this growth is Deepak Fertilizers and Petrochemicals Corporation Ltd, one of India’s largest nitric acid producers. The company’s integrated production capabilities and focus on high-purity chemicals position it as a key player in the region’s evolving market landscape.

North America Market Insights

North America’s concentrated nitric acid market is expected to retain a substantial share of the global market during the forecast period, driven by advanced industrialization and strong demand across key sectors. Both countries have established manufacturing bases for polyurethane foams, explosives, fertilizers, and agrochemicals, which are significant consumers of concentrated nitric acid. The growing demand from different sectors is driving market growth. In the U.S., the chemical industry’s growing focus on polymers, particularly polyamides and polyurethanes, continues to drive nitric acid consumption in synthetic processes.

Meanwhile, Canada benefits from rising investments in agrochemical production and industrial chemicals, supporting regional market growth. Nutrien Ltd., a leading Canadian fertilizer company, plays a vital role in the region’s nitric acid supply chain. Through its extensive production and distribution network, Nutrien supports agricultural productivity and industrial applications, reinforcing the strategic importance of nitric acid in North America’s economic landscape. The U.S. leads in the production of nitric acid within North America, generating around 1.8 million tons each year, accounting for roughly 91% of the total output in the region. With the utilization of nitrogen in fertilizers reaching 11.5 million metric tons and ammonium nitrate making up 5%, the U.S. sustains a robust demand for nitric acid, bolstered by its extensive capacity for nitrogen fertilizer production.

Europe Market Insights

The market for concentrated nitric acid in Europe is witnessing consistent growth, primarily due to its crucial function in the production of fertilizers, especially ammonium nitrate. The focus on agricultural efficiency and sustainable methods in the region is propelling this demand. Germany, France, and the Netherlands stand out as significant producers and consumers, with Germany leading as the largest importer of nitric acid in Europe, having received more than 203 million kg in 2023.

The UK is expected to capture a considerable portion of the revenue in the European concentrated nitric acid market by the year 2035. In 2023, the UK imported around 496,897 kg of nitric acid from France. This level of import highlights the substantial demand for nitric acid within the UK, which is fueled by its agricultural and industrial sectors. The UK's dedication to improving agricultural efficiency and fostering industrial development establishes it as a significant contributor to the regional market.

Germany is projected to retain the largest revenue share in Europe's concentrated nitric acid market by the year 2035. This projection is supported by its extensive and technologically sophisticated chemical industry, which utilizes substantial amounts of nitric acid as a fundamental chemical for downstream applications. The robust agricultural sector of the country sustains a consistent demand for nitrogen-rich fertilizers. Furthermore, Germany's considerable industrial foundation in explosives for both mining and construction, coupled with its manufacturing of specialty chemicals and plastics, guarantees its ongoing leadership as the most significant and vital market for concentrated nitric acid within the region.

Key Concentrated Nitric Acid Market Players:

- Yara International ASA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- CF Industries Holdings, Inc.

- Deepak Fertilizers and Petrochemicals Corporation Ltd. (DFPCL)

- The Chemours Company

- INEOS Capital Limited

- The Dow Chemical Company

- Sasol Limited

- LSB Industries, Inc.

- UBE INDUSTRIES, LTD.

Key players in the market for concentrated nitric acid leverage technologies like low-NOx burners, high-pressure mono-pressure systems, advanced ammonia oxidation catalysts, and integrated production units. These innovations enhance energy efficiency, reduce emissions, and ensure high-purity output, enabling companies like GNFC to lead competitively.

Here are a few areas of focus covered in the competitive landscape of the concentrated nitric acid market:

Recent Developments

- In June 2022, Gujrat Narmada Valley Fertilizers and Chemicals, a collaborative enterprise formed by Gujrat State Fertilizer and Chemicals (GSFC) and the Government of Gujrat, was set to become the foremost manufacturer of concentrated nitric acid (CNA) by the end of the 2022 calendar year.

- In January 2023, Grupa Azoty S.A. inaugurated a new facility for the manufacturing of concentrated nitric acid (CNA), with an anticipated annual capacity of 40,000 tons, effectively doubling its production capabilities. This marks the second production line for the over 98% concentrated nitric acid currently in operation in Tarnow.

- Report ID: 4913

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Concentrated Nitric Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.