Composite Process Material Kits Market Outlook:

Composite Process Material Kits Market size was valued at USD 156.3 million in 2025 and is projected to reach approximately USD 280.6 million by the end of 2035, growing at a CAGR of 6.4% during the forecast period from 2026 to 2035. In 2026, the industry size of composite process material kits is assessed at USD 166.8 million.

The global composite process material kits market is anticipated to grow significantly over the projected years, primarily attributed to the strategic strengthening of supply chains in high-end materials, especially carbon fiber and associated composites, vital to energy, aerospace, and transportation. The research and demonstration projects funded by the U.S. Department of Energy's Advanced Materials and Manufacturing Technologies Office (AMMTO) under the Office of Energy Efficiency and Renewable Energy (EERE) aim to diversify and secure the supply of materials by recycling, reusing, and recovering polymers, composites, and fibers. These R&D activities are scalability and resilience-focused, which meet the increased demand and supply limits of key inputs such as carbon fibers and thermoplastic resins. The Manufacturing Demonstration Facility (MDF) of Oak Ridge National Laboratory, in collaboration with the Carbon Fiber Technology Facility (CFTF), is exploring developing precursors made of nontraditional feedstocks (e.g., lignin, textiles) and developing manufacturing processes, large-scale additive manufacturing and continuous fiber printing to wind blades and structural parts. The presence of these government-focused R&D programs showcases the fundamental support of the expansion of the composite production environment.

Government studies highlight action on the composite supply chain, recovery of raw materials, and precursor development to global manufacturing facilities and end-use assembly lines. Circular economy practice at ORNL focuses on reprocessing composite waste, reducing it to feedstock used in injection molding, sheet molding compounds, and thermoset additive manufacturing, all needed to produce volumes of assemblies and components at an industrial scale. DOE indicates that 5.7 billion metric tons of plastic waste or discards have never been recycled, and EPA statistics show that 75% of plastic waste is in landfills, serving as one more indicator of the necessity to use advanced recycling technologies. Another project undertaken by ORNL is to turn recycled carbon fiber into automotive panels and reclaimed polyglycan with bamboo on additively manufactured structures. The U.S. Bureau of Labor Statistics monitors plastic resins and materials, the index value of which stood at about 101.11 in the middle of 2023, which is a slight increase in prices on a year-by-year basis. From the trade perspective, the investments in infrastructure enabled by DOE and national labs, including large-format printing facilities at ORNL and the modular wind blade components, indicate a proactive move into exportable production capacity and assembly capacity. A combination of these factors, including simplified supply chains, vertical integration, which is driven by R&D, and new trade capacity, points to a maturing industry foundation, which is financed by government and standard-setting organizations.

Key Composite Process Material Kits Market Insights Summary:

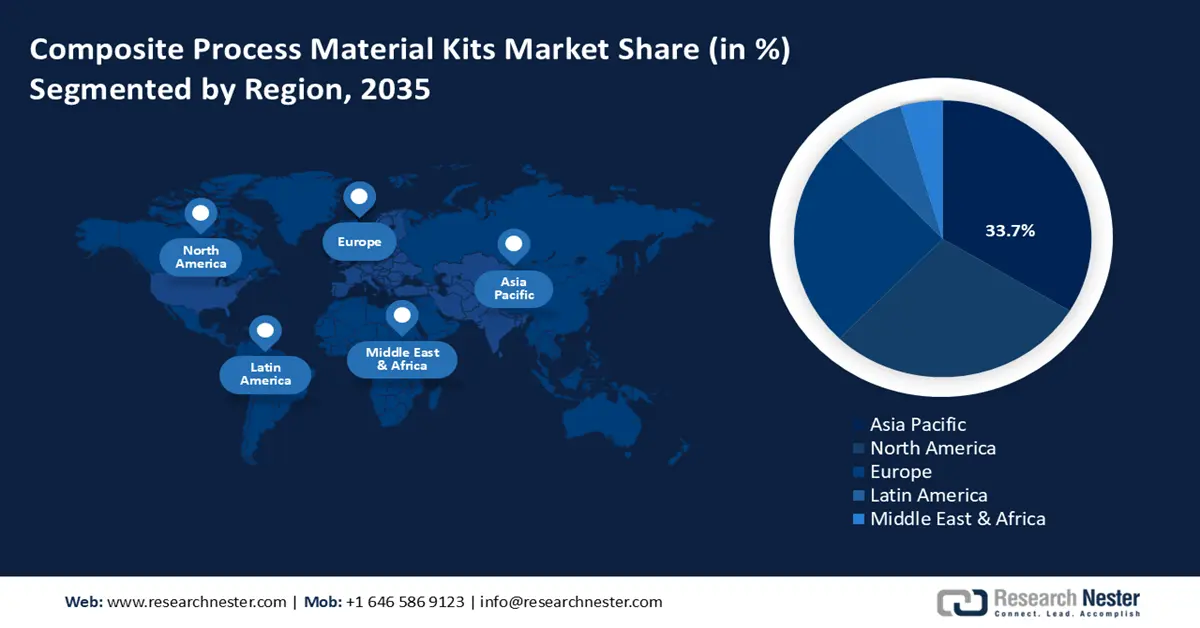

Regional Highlights:

- Across 2026–2035, the Asia Pacific composite process material kits market is anticipated to command a 33.7% share, upheld by enhanced industrialization and geographical convergence in eco-friendly production.

- By 2035, the North America composite process material kits market is set to secure a 28.5% revenue share, bolstered by rising industrial demand for sophisticated materials.

Segment Insights:

- By 2035, the prepreg lay-up segment in the composite process material kits market is projected to hold a 45.6% revenue share, sustained by its high material consistency and performance advantages.

- From 2026–2035, the Aerospace & Defense segment is anticipated to capture a 40.2% share, supported by rising performance, safety, and sustainability requirements.

Key Growth Trends:

- Renewable chemicals in composite kits

- Research into catalytic efficiency

Major Challenges:

- Excessive regulatory compliance costs on small businesses

- Capital & operating costs from EPA’s Emissions Standards

Key Players: Hexcel Corporation (U.S.), Owens Corning (U.S.), Huntsman International LLC (U.S.), Solvay S.A. (Belgium), SGL Carbon SE (Germany), Gurit Holding AG (Switzerland), 3M Company (U.S.), Airtech Advanced Materials Group (U.S.), Aerovac Composites One (U.S.), Metyx Composites (U.S.), Shanghai Leadgo-Tech Co., Ltd. (Malaysia), Toray Industries, Inc. (Japan), Mitsubishi Chemical Holdings Corp. (Japan).

Global Composite Process Material Kits Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 156.3 million

- 2026 Market Size: USD 166.8 million

- Projected Market Size: USD 280.6 million by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, France, Italy

Last updated on : 5 December, 2025

Composite Process Material Kits Market - Growth Drivers and Challenges

Growth Drivers

- Renewable chemicals in composite kits: The Industrial Efficiency & Decarbonization Office of the U. S. DOE drives a strategic investment to decarbonize chemical manufacturing, including the deployment of renewable chemical production technologies. For example, DOE has invested USD 40 million over five years via the RAPID Institute to speed up lower-carbon-intensive chemical processes, directly aiding the development of greener feedstock like bio-based resins and composite additives. In addition, within EU, Horizon Europe-based initiatives such as FIREFLY, funded by more than 11 million euros, are pioneering renewable-based catalysts, supporting the concept of circular chemistry in terms of recyclable materials as inputs to composites. These programs are the biggest source of compulsion on utilizing composite kits with renewable chemical elements that allow the companies to comply with the increasing environmental requirements and to decrease the overall carbon footprint and risk of a chemical supply.

- Research into catalytic efficiency: Public-sector innovation is providing steep efficiency improvements in chemical manufacture- critical upstream feedstock into composite process kits. According to the DOE Industrial Efficiency & Decarbonization Office, the INL-directed DIAdEM project has facilitated catalyst data through TAP reactors, which allowed production of ethylene with 85% yield growth, drastically reducing energy input and emissions. Additionally, a partnership between Lawrence Livermore Lab, TotalEnergies, and Twelve led to the creation of a copper-based electrochemical catalyst that enhanced the energy efficiency of ethylene synthesis by 15%. These efficiency innovations minimise the raw material and energy expenses used in resin and polymer manufacture, reducing composite kit manufacturing expenses. As manufacturers seek high-performance, cost-optimized inputs, the increasing use of chemical technologies results in significant gains, driving the increased application of composite process material kits in the industrial sectors.

- Packaging and textiles sustainability mandates: Increasing sustainability requirements in packaging and textiles are driving the need in the world to shift to composite process material kits that meet the requirements of recyclability and biodegradability. The Packaging and Packaging Waste Regulation (PPWR) of the European Union, which came into effect on February 11, 2025, mandates that all packaging on the EU market should be recyclable in an economically viable manner by 2030, and that recycled content will rise, and that the use of virgin materials should be reduced. This regulation will reduce the amount of waste packaging, such as the ban on single-use plastics, and promote the creation of a circular and sustainable economy to be climate-neutral by 2050. The programs that contribute to these objectives are the extended producer responsibility schemes that guarantee the reduction of packaging waste and the reuse of resources throughout the entire packaging life cycle. Manufacturers are required to re-engineer their material inputs to be life cycle compliant. For composite kit manufacturers, it means a greater demand for kits that fit bio-based or recyclable materials.

Challenges

- Excessive regulatory compliance costs on small businesses: Small chemical producers in the U.S., such as suppliers of Composite Process Material Kits (CPMK), face unwarrantedly high costs of regulatory compliance. The National Association of Manufacturers estimates the federal compliance with regulations to cost small manufacturing firms USD 50,100 per year per employee, which is more than twice the cost incurred by manufacturing firms as a whole. A small company that has 20 workers might spend about 1 million dollars in a year to comply with the regulations. The cumulative financial pressure hinders competitiveness, forcing many to delay product development or exit the composite process material kits market. Such a dynamic is crucial as small and medium enterprises constitute a significant percentage of specialty chemical supply chains. To overcome these dilemmas, the regulators need to be flexible and depend on the size of a firm without undermining the environmental objectives.

- Capital & operating costs from EPA’s Emissions Standards: The National Emissions Standards of Hazardous Air Pollutants (NESHAP) introduced by the EPA impose substantial compliance expenses on the chemical manufacturers, including those of their suppliers of raw materials to CPMKs. It is estimated that compliance with revised NESHAP rules will add USD 1.8 billion in capital investments and USD 150 million in annual operating costs to chemical facilities in the US. These strict requirements influence the emissions of dangerous pollutants in the course of resin and polymer production, which is instrumental in CPMK production. This, in turn, exposes manufacturers to high production costs, which could be transferred to consumers in terms of prices, which may impact competitiveness in the composite process material kits market. Businesses face a challenge of ensuring regulatory compliance with the requirements, a practice that might encourage them to invest in cleaner technologies to reduce expenses.

Composite Process Material Kits Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 156.3 million |

|

Forecast Year Market Size (2035) |

USD 280.6 million |

|

Regional Scope |

|

Composite Process Material Kits Market Segmentation:

Process-Type Segment Analysis

The prepreg lay-up segment in the composite process material kits market is projected to grow with the largest revenue share of 45.6% during the forecast years, owing to its high material consistency and performance advantages. This method sees pre-impregnated fibers with resin and has high fiber volume fractions and outstanding mechanical properties that are important in the aerospace and defence sectors. The U.S. Department of Energy claims that prepreg composites can help to reduce structural weight by 30%, which has a direct effect on the fuel efficiency and the carbon footprint. Large-scale production is being sped up and made more quality-controlled through automated procedures such as Automated Fiber Placement (AFP), and prepreg lay-up is becoming the preferred production technique. All these indicate the preeminent market share of the segment by 2035.

Application Segment Analysis

The Aerospace & Defense segment is expected to grow substantially, with a composite process material kits market share of 40.2% from 2026 to 2035, attributed to its high performance, safety, and sustainability requirements. The U.S and Europe governments are still heavily investing in lightweight composite materials to enhance the fuel efficiency of the aircraft and decrease greenhouse gas emissions. Policies of the European Commission on climate highlight the challenge to develop advanced composites in the aviation industry and to develop carbon-neutral growth by 2050. These motivations continued to require composite process material kits that fit stringent regulatory and operating standards. Moreover, expansions of military modernization initiatives drive the segment growth further, with aerospace and defense becoming the key drivers in the global market by 2035.

Kit-Type Segment Analysis

Combinations kits are likely to expand steadily over the forecast years, driven by their versatility and better performance. Such kits often combine several types of materials, like carbon and glass fiber with resins, to achieve customized properties to match a given industrial use, including aerospace and automotive. According to the U.S. Department of Energy, hybrid composite materials have the potential to increase the strength-to-weight ratios by 50%, resulting in tremendous fuel economy and decreased emissions. This flexibility promotes the use of combination kits where manufacturers are demanding the best balance of cost, weight, and durability. One of their major growth drivers is their increasing adoption in the high-performance industries, with the ability to record a growing composite process material kits market share.

Our in-depth analysis of the composite process material kits market includes the following segments:

|

Segment |

Subsegment |

|

Kit-Type |

|

|

Process-Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Composite Process Material Kits Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific composite process material kits market is anticipated to dominate with the highest revenue share of 33.7% from 2026 to 2035, attributed to the enhanced industrialization and geographical convergence in eco-friendly production. The United Nations Conference on Trade and Development (UNCTAD) has postulated that the trade facilitation agreements in the region have enhanced supply chain logistics, where import-export delays of raw materials needed in the production of composite kits have been reduced. Regulations by regional authorities are favoring environmentally friendly chemical manufacturing processes, which favors the approximate annual growth rate of about 8% in the industry market. Infrastructural development and technological advances also contribute to an increase in production capacity and efficiency in the region. Through the activities and engagements of the regional economic forums, sustainable development and digital manufacturing technologies are being prioritized and enhanced, which increases the demand for sophisticated composite materials. This integrated strategy of developing and controlling the market creates a positive climate towards the growth of the composite process material kits market across the Asia Pacific.

The composite process material kits market in China is predicted to lead the Asia Pacific region, primarily due to the government funding towards high-level manufacturing and environmental standards. In 2023, China’s new materials increased its output value to ¥7.6 trillion, according to MIIT, and the growth rate was about 15% per annum, a steady rise per year on average. This expansion reflects a strong momentum in materials development, such as composites, although not necessarily research-and-development-intensive. Moreover, in March 2024, the central government of China, through a combined policy issued by seven departments, one of which is the Ministry of Industry and Information Technology (MIIT) and the National Development and Reform Commission (NDRC), announced that it intends to speed up the process of greening and low-carbonizing the transformation of traditional industries. The project targets that green factory production should reach above 40% of the total manufacturing production by 2030, which encourages manufacturers to restructure energy and raw materials, reduce coal consumption, and embrace clean production technologies. This dynamic expansion is being fueled by innovation funding, regulatory pressure, and growth in exports.

India composite process material kits market is likely to grow steadily over the forecast years. This growth is particularly supported by government incentives in the field of clean technology and the modernization of production. The Government of India allocated ₹1,91,836 crore to the fertilizer and chemical sectors in 2024-25, to manufacture fertilizers and increase subsidies on phosphatic and potassic fertilizers, reflecting the emphasis on sustainable chemical manufacturing and material innovation in the country. These investments also contribute to advanced materials such as composites through the promotion of the availability of raw materials, research and innovation, and increasing supply chain resiliency necessary to expand manufacturing industries in the country. Similarly, in 2024, the composite materials industry in India accounted for around ₹15,577 crore (US 1.8 billion) and is expected to grow with a compound annual growth rate (CAGR) of 7.8% to ₹24,231 crore (US 2.8 billion) by 2030 due to demand, especially in electric vehicles, renewable energy, transportation, construction, and consumer goods. Together with increasing domestic demand in the automotive and aerospace markets, these actions support aggressive growth in composite process material kits markets.

North America Market Insights

North America composite process material kits market is projected to grow substantially with a revenue share of 28.5% over the forecast year, mainly due to the rising industrial demand for sophisticated materials in the aerospace, automotive, and energy industries. Government efforts help create sustainable chemical production, such as the Department of Energy’s commitment of USD 2.5 billion in 2022, to clean chemical production of energy, with a 20% increase over 2020 disbursements. In 2021, the Environmental Protection Agency Green Chemistry program enabled various new processes that were sustainable and generated significantly less hazardous waste than in 2020. The investments in new manufacturing technologies and strict safety rules by OSHA also contribute to the development of the composite process material kits market, as these requirements guarantee observance of the rules and encourage innovations. All in all, powerful regulatory and targeted government expenditure are the cornerstones of the healthy growth of the composite process material kits market.

The composite process material kits market in the U.S. is expected to dominate the North American region with the largest share by 2035, due to high federal investments in chemical safety and innovations. In 2023, the U.S. Environmental Protection Agency (EPA) has USD 124 million and 449 FTE for implementing the Toxic Substances Control Act (TSCA), and USD 126 million to address PFAS pollution, including enhancing chemical risk assessment, regulation, and remediation. Furthermore, the National Institute of Standards and Technology (NIST) in July 2022 announced USD 3.7 million grants to fund metals-based additive manufacturing (AM) research. The area of these grants is to overcome the obstacles to large-scale AM adoption by measurement science, such as process qualification, material characterization, and data exchange standards. The office of advanced manufacturing at the U.S Department of Energy assists pilot projects that are likely to enhance production efficiency, boosting the use of composite kits in the energy and defense sectors.

Canada’s composite process material kits market is likely to expand steadily by 2035, owing to government incentives based on green chemistry and clean technology. In 2023-24, ISED continued to implement the USD 750 million recapitalization of the Sustainable Development Tech Fund of Sustainable Development Technology Canada (SDTC), declared in the 2020 Fall Economic Statement. This funding helps finance clean technology, such as sustainable manufacturing, as part of Canada's climate efforts and the shift to a net-zero economy. Additionally, in 2024, the Canadian Centre of Occupational Health and Safety (CCOHS) published the second edition of the manual on Implementing a Chemical Safety Program to assist the workplaces in minimizing the health and safety hazards, environmental impact, and the costs of operation through an integrated chemical safety program that considers the total lifecycle of the chemicals such as purchasing and inventory, use, storage, and disposal of chemicals. Moreover, the federal initiatives in Canada promote the industry-academic partnership in developing low-emission composite manufacturing procedures, which continue to meet the demand in CPMKs. These projects make Canada a rising center of sustainable composite materials.

Europe Market Insights

Europe composite process material kits market is expanding progressively, backed by strict environmental laws and heavy investments in sustainable production. According to the European Chemicals Agency (ECHA), the new stricter REACH regulations in 2022 added to compliance costs as a motivator to manufacturers to develop materials that were eco-friendly. Through Horizon Europe (2021-2027), the European Commission has funded more than 500 million Euros in green chemistry research, including the development of innovative composite materials. In addition, the EU-wide campaigns on the practices of a circular economy promote the recycling and reusing of composite materials, which boosts the sustainability of the composite process material kits market. For instance, the European Composites Industry Association (EuCIA) and JEC introduced the European Circular Composites Alliance (ECCA), a regional platform to encourage circular utilization of composite products by repair, reuse, re-manufacturing, and recycling, supported by policies to facilitate free movement of waste and create markets based on recycled composite products.

In the UK, the budget allocated by the government in 2023 to promote research on composite manufacturing reached up to 95 million pounds, which supports the development of the composite process material kits market. Furthermore, rising demand from sectors including automotive, aerospace/defense, wind energy and advanced manufacturing is likely to drive modest growth in the kit-related demand.

In 2022, the Chemical Industry Association (VCI) of Germany recorded an increased investment in the production of green chemicals, which further strengthens its domination on the composite process material kits market. In addition, demand for carbon-fiber composites alongside traditional glass-fiber composites is also growing.

Key Composite Process Material Kits Market Players:

- Hexcel Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Owens Corning (U.S.)

- Huntsman International LLC (U.S.)

- Solvay S.A. (Belgium)

- SGL Carbon SE (Germany)

- Gurit Holding AG (Switzerland)

- 3M Company (U.S.)

- Airtech Advanced Materials Group (U.S.)

- Aerovac Composites One (U.S.)

- Metyx Composites (U.S.)

- Shanghai Leadgo-Tech Co., Ltd. (Malaysia)

- Toray Industries, Inc. (Japan)

- Mitsubishi Chemical Holdings Corp. (Japan)

- Hexcel Corporation (U.S.) has established a leading position in the composite process material kits market by focusing on high-performance materials for the most demanding applications. The company leverages its deep expertise in advanced carbon fibers and aerospace-grade composites to provide kits that are synonymous with reliability and strength. By catering to critical industries like aerospace and defense, Hexcel uses its technical authority and stringent quality standards to drive adoption, making its kits a benchmark for performance in the composite process material kits market.

- Owens Corning (U.S.) has strongly advanced its standing by pioneering glass fiber and non-woven material technologies. The company's strategy revolves around providing comprehensive, insulation-focused material kits that enhance thermal and acoustic management. Through a commitment to sustainability and energy efficiency, Owens Corning embeds its material solutions directly into the core of construction and industrial processes, positioning its kits as essential for modern building standards.

- Huntsman International LLC (U.S.) has carved out a significant role in the composite process material kits market through its specialized focus on advanced polymer formulations and epoxy-based systems. The company's strategic advancement is based on developing high-performance resin kits that offer superior processing characteristics and final material properties. By providing tailored chemical solutions that meet specific manufacturing needs, Huntsman ensures its kits are integral to achieving desired performance outcomes in the final composite product.

- Solvay S.A. (Belgium) distinguishes itself as a key global player through a strategy of deep material science innovation and a diverse portfolio of specialty chemicals. The company's approach involves offering sophisticated material kits that combine high-performance resins, adhesives, and specialty additives for complex applications. By continuously introducing novel material chemistries and forming strategic alliances across the aerospace and automotive sectors, Solvay ensures its composite kits are at the forefront of technology, providing customers with versatile and high-value solutions.

Below is the list of some prominent players operating in the global composite process material kits market:

The global composite process material kits market is highly competitive due to innovations, expansions, and alliances. The major participants, such as Toray, Hexcel, and Mitsubishi Chemical, use technological variations to launch bio-based resin and digital process controls. Vertical integration by industry leaders is also aimed at having specialized resin formulators and fiber extrusion facilities to improve the industry supply chain's resilience. Cooperation with automotive and aerospace OEMs makes it possible to co-develop specific kits, tuned to specific applications. Strategic response to the effects of tariffs and supply chain disruption, especially in the U.S., is regional diversification and reshoring, which underscores a competitive arena that is dynamic and innovation-driven.

Corporate Landscape of the Composite Process Material Kits Market:

Recent Developments

- In May 2025, Toray Industries presented a new bio-based composite material, EcoTerra, at the 2025 SAMPE Conference in Indiana. EcoTerra is a combination of woven flax-based on a biobased thermoplastic resin based on renewable resources, aiming at the sustainable consumer products market. This introduction justifies the strategic focus of Toray on sustainability and lightweight mobility solutions. The certified USDA Biobased Product, EcoTerra material, possesses better flexural strength and environmental performance as it does not depend on components made out of fossils. After the launch, Toray announced that its sales of the green composite segment grew by 15-20% in Q2 2025, and this indicated that the composite process material kits market was taking off and the demand was high.

- In May 2025, Hexcel Corporation introduced Hy-Bor, a hybrid boron fiber-infused high modulus carbon fiber prepreg in partnership with Specialty Materials. This product has over twice the compression strength of conventional carbon fibers and is aimed at aerospace and defense applications. Hy-Bor with a U.S. Defense Logistics Agency SBIR contract assures considerable weight reduction and enhanced design capability. The introduction is propelling the growth of Hexcel in the aerospace high-performance composite industry. Market forecasts reveal that by the end of 2025, Hy-Bor will have a market share that has improved by 10 percent in the progressive aerospace industry, signaling quick adoption of the company in the most demanded composite process material kits market segments.

- In June 2025, Sumitomo Chemical developed a new way of producing liquid crystal polymer (LCP) by mass production using biomass-based monomers. This development enables an effective regulation of the biomass content of the end product. The firm intends to have customer certification towards the close of fiscal 2026 and start providing products in fiscal 2027. LCPs are high-performance plastics that are employed in different practices, such as in electronics and vehicle parts. The program is in line with the international drive to minimize the use of fossil resources and encourage sustainability in industrial materials.

- Report ID: 8276

- Published Date: Dec 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.