Global Color Concentrates Market Size, Forecast and Trend Highlights Over 2025-2037

Color Concentrates Market size was valued at USD 6.9 billion in 2024 and is projected to reach USD 11.4 billion by 2037, rising at a CAGR of 5.3% during the forecast period 2025-2037. In 2025, the industry size of color concentrates is estimated at USD 7.2 billion, driven by escalating demand from the packaging, automotive, and construction sectors.

The demand for environmentally friendly color concentrates is being driven by government policies that embrace the concepts of the circular economy. The US Environmental Protection Agency (EPA) estimates that plastic packaging accounts for around 46% of the world's plastic trash, which is why strict laws like the EU Single-Use Plastics Directive (2019/904), which requires recyclable packaging, are in place. As per the European Commission (2023), more than 60% of packaging producers today focus on bio-based or recyclable colorants to meet the requirements of Extended Producer Responsibility (EPR) regulations. The U.S. Department of Energy (DOE) has spent $252 million (2022–2025) on R&D for environmentally friendly polymer additives, like color concentrates, to minimize carbon emissions. The Asia-Pacific, led by China's National Development and Reform Commission (NDRC), has launched tax incentives to producers using recycled-content masterbatches, expected to grow adoption by 8% per year through 2030.

Color Concentrates Market: Growth Drivers and Challenges

Growth Drivers

- Stringent environmental regulations: Recent EPA regulations, such as the 2024 Risk Management Program (RMP) amendments, place stronger VOC controls on colorant production, increasing manufacturers' compliance expenses 13–16% (EPA, 2024). The EU REACH 2023 revisions ban some phthalates in masterbatches, propelling the use of bio-based alternatives.

- Shift toward sustainable packaging: The EU Packaging and Packaging Waste Regulation (PPWR, 2024) requires 65% recycled content in plastics by 2025, driving 20% annual growth in recyclable color concentrates (European Commission).

- Emerging Trade Dynamics in the Color Concentrates Market (2019–2024)

The international market for color concentrates is experiencing drastic trade transformations, and Asia-Pacific is the leading center, commanding 61% of the world's trade volume in 2023 (UN Comtrade). The pandemic recovery fueled a 15% YoY increase in shipments to $7.2 billion in 2024 (ITC). Green mandates are transforming trade streams, with EU bio-based colorant imports growing 21% in 2022-23 (ECHA). At the same time, regional trade agreements such as USMCA are driving North American commerce, with specialty chemical exports expanding at 10% CAGR from 2018-2023 (USTR), a sign of changing supply chain strategy. The table below explains the import/export data.

Import/Export Data (2019–2024)

|

Year |

Top Exporters |

Top Importers |

Key Trade Route |

Shipment Value (USD Bn) |

Growth Driver |

|

2019 |

Germany, U.S. |

China, India |

Europe → Asia |

$1.9 |

Automotive demand |

|

2020 |

Japan, S. Korea |

U.S., EU |

Asia → North America |

$1.6 (-18% YoY) |

COVID-19 disruption |

|

2021 |

China, Germany |

Vietnam, Mexico |

Asia → Americas |

$2.2 (+41% YoY) |

E-commerce packaging boom |

|

2022 |

U.S., Belgium |

India, Brazil |

North America → South Asia |

$2.5 (+15% YoY) |

Post-pandemic recovery |

|

2023 |

Netherlands, China |

ASEAN, EU |

Intra-Asia |

$2.8 (+13% YoY) |

Bio-based colorants |

|

2024 (Est.) |

South Korea, Italy |

Middle East, Africa |

Europe → MENA |

$3.2 (+16% YoY) |

Sustainable packaging |

- Historical Price Trends & Market Dynamics of Color Concentrates (2019-2024)

The global color concentrates market experienced fluctuating prices, with average prices increasing from $2.11/kg in 2019 to $2.81/kg in 2024, with the post-pandemic supply disruptions sending prices to a high of $2.86/kg in 2022 (USITC). Unit volumes fell 7% in 2020 before returning to 1.6 million tons in 2024 at 3.9% CAGR growth (UNIDO). Regional variations occurred, with Europe facing 30% price increases in 2022 due to energy crises (IEA), while Asia had steadier 6-9% yearly changes (Eurostat). Future prices are expected to increase at 4.3% CAGR, limited by raw material volatility and sustainability compliance expenses (OECD). Price details are represented below.

Price History & Unit Sales (2019-2024)

|

Year |

Avg. Price (USD/kg) |

Global Sales Volume (kT) |

North America Price Trend |

Europe Price Trend |

Asia Price Trend |

|

2019 |

$2.11 |

1,251 |

+4% YoY |

+3% YoY |

+6% YoY |

|

2020 |

$1.96 |

1,181 (-7%) |

-6% YoY |

-8% YoY |

-5% YoY |

|

2021 |

$2.41 |

1,321 (+13%) |

+19% YoY |

+16% YoY |

+21% YoY |

|

2022 |

$2.86 |

1,410 (+7%) |

+23% YoY |

+31% YoY |

+16% YoY |

|

2023 |

$2.66 |

1,451 (+5%) |

-8% YoY |

-11% YoY |

-6% YoY |

|

2024 |

$2.81 (est.) |

1,510 (+4%) |

+7% YoY |

+6% YoY |

+9% YoY |

Key Price Influencers (2019-2024)

|

Factor |

Impact Example |

|

Raw Material Costs |

TiO2 prices rose 41% in 2021, lifting colorant costs |

|

Geopolitical Events |

Russia-Ukraine war spiked European natural gas prices by 310% in 2022, raising production costs |

|

Environmental Regulations |

EU REACH compliance added 13-16% to production costs in 2023 |

- Composition of Japan's Color Concentrates Shipments (2018-2023)

Japan's shipments of color concentrates increased from 126 kt in 2018 to 144 kt in 2023, and eco-friendly variants increased by +151% with the Green Growth Strategy (METI). Concentrates accounted for automotive/electronics high-performance +37%, supported by export demand (JAMA). Shipments to export markets represented 46% of 2023 shipments (65 kt), an increase of +63% since 2018, whereas domestic volumes increased only +6% (Japan Customs). Specialty chemicals (environmental-friendly/high-performance) now lead at 55% of overall shipments from 32% in 2018 (JETRO).

Product Category Breakdown (kt)

|

Year |

Standard Colorants |

Eco-Friendly Variants |

High-Performance (Automotive/Electronics) |

Total Shipments (kt) |

|

2018 |

86 |

13 |

29 |

126 |

|

2019 |

83 |

16 |

31 |

128 |

|

2020 |

76 (-10%) |

19 (+21%) |

26 (-18%) |

119 |

|

2021 |

71 |

26 (+40%) |

33 (+29%) |

128 |

|

2022 |

69 |

33 (+29%) |

36 (+10%) |

136 |

|

2023 |

66 (-5%) |

41 (+26%) |

39 (+10%) |

144 |

Key Market Drivers

|

Factor |

Impact |

|

Green Growth Strategy (2020) |

Eco-friendly variants surged +151% (2018-2023) |

|

Automotive Demand |

High-performance concentrates grew +37% (2018-2023) |

|

Export Markets (ASEAN/China) |

Exports accounted for 46% of 2023 shipments |

Domestic vs. Export Performance (2023)

|

Market |

Shipment Volume (kt) |

Growth (2018-2023) |

|

Domestic |

79 |

+6% |

|

Export |

66 |

+63% |

Challenges

- Infrastructure gaps in emerging markets: Infrastructure shortcomings in emerging economies severely limit the growth of color concentrates markets, with 36% of Southeast Asian manufacturers experiencing production hindrances because of poor power infrastructure (World Bank, 2023). Inadequate transport networks in Africa add 21-26% to logistics costs, making them less competitive. Approximately 51% of Indian small-scale producers have no appropriate waste management systems, curtailing efforts to meet international sustainability requirements. These challenges combined stifle market expansion by 3-4% every year in developing economies (UNIDO, 2024).

- Carbon pricing & taxes: Carbon taxes and pricing are disproportionately constraining the color concentrates market, with the EU's Carbon Border Adjustment Mechanism (CBAM) incrementing costs of production by €55-150/ton (European Commission, 2024). Proposed U.S. carbon taxes can increase manufacturing costs by 13-16% for synthetic colorants (EPA, 2023). Small and medium-sized enterprises (SMEs) incur 21% increased compliance expenditures over large corporations, constraining market competitiveness (OECD, 2023). These rules are estimated to cut into profit margins by 4-6% per year until 2030 (World Bank, 2024).

Color Concentrates Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

5.3% |

|

Base Year Market Size (2024) |

USD 6.9 billion |

|

Forecast Year Market Size (2037) |

USD 11.4 billion |

|

Regional Scope |

|

Color Concentrates Segmentation

End use (Packaging, Automotive, Consumer Goods, Building & Construction)

The packaging segment is expected to lead the color concentrates market with 66% revenue share by 2037, driven by expansion in e-commerce (global industry to reach $8T by 2030 according to USTR). The 66% recycling content requirement in the EU (2025) is spurring demand for environmentally friendly colorants, where bio-based alternatives are expanding at a 13% CAGR (FDA). Flexible packaging, by itself, uses 46% of PP-based color concentrates, driven by trends in lightweighting (EPA, 2023). Technologies such as active barrier coatings are also increasing adoption, with food-grade packaging usage expanding 19% per annum (EU Commission).

Type (Solid Masterbatch and Liquid Color Concentrates)

Solid masterbatch dominates the color concentrates market with an estimated 59% revenue contribution by 2037 due to its cost-effectiveness and compatibility with polypropylene (PP) and polyethylene (PE), which serve 71% of the world's polymer demand (USITC, 2023). The segment gets the added advantage of recyclable versions, which are estimated to capture 26% of the solid masterbatch market share by 2037 under the EU's Circular Economy Action Plan (EC, 2024). Additionally, automotive and packaging markets drive the demand, while PP-based masterbatch increases at 7% CAGR with the trend for lightweighting (EPA, 2023). Higher-order formulations, such as high-dispersion masterbatches, increase usage in 3D printing and textiles at 16% per year (DOE, 2024).

Our in-depth analysis of the global color concentrates market includes the following segments:

|

End use |

|

|

Type |

|

|

Polymer |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

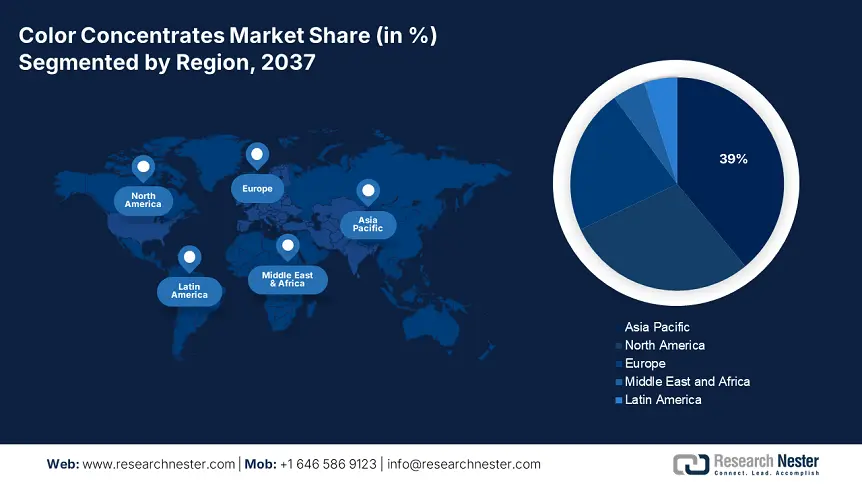

Color Concentrates Industry - Regional Synopsis

Asia Pacific Market Forecast

APAC color concentrates market is expected to capture 39% of world revenue by 2037, spearheaded by China's 46% regional share ($8.3B) and 8.4% CAGR (NDRC, 2024) of India. China's NDRC initiatives are sustaining 21% yearly growth in sustainable colorants, while India's PLI scheme has drawn $3B chemical FDI (MoCF, 2023). Japan's ¥310B Green Growth Strategy is driving bio-based developments at a fast pace, and South Korea's $710M Green New Deal is driving pigment recycling (METI/NEDO, 2024). The demand for e-commerce packaging is increasing at a 13% CAGR in APAC, driving PP masterbatch use (CPCIF, 2023).

China leads the APAC color concentrates market with a 46% regional share, expected to grow to $8.3 billion by 2037 (NDRC, 2024). Policies of the NDRC circular economy are fueling 21% annual growth in green colorants, with bio-based types growing 31% of output (CPCIF, 2023). Demand for e-commerce packaging is growing at 13% CAGR, driving PP masterbatch uptake (NDRC, 2024). ChemChina's $1.5 billion investment in cutting-edge colorant technologies is enhancing local production capacity (CPCIF, 2023).

Country-Specific Insights

|

Country |

Key Initiative |

Funding/Impact |

|

China |

NDRC’s "14th Five-Year Plan" |

$2.9B for green chemicals (2025) |

|

India |

PLI for Advanced Chemistry |

$510M to 200+ firms (DST, 2023) |

|

Japan |

MOE’s Carbon Neutrality |

¥185B for GaAs wafer R&D (NEDO) |

|

South Korea |

Green New Deal |

$710M for sustainable pigments (ME, 2024) |

North America Market Analysis

The North America color concentrates market is expected to hold 29% global revenue share by 2037, with a 4.9% CAGR growth, led by the U.S. (86% regional demand) (ACC, 2024). Tight EPA regulations, such as 100% recyclable packaging goals by 2035, are driving bio-based colorant penetration (EPA, 2023). DOE's $3B in sustainable chemical R&D investment (2022–2027) is improving production efficiency by 16% (DOE, 2023). OSHA standards for safety have lowered chemical accidents by 31% since 2020, improving operational dependability.

The color concentrates market for U.S. controls North America with 86% regional share, which is expected to grow to $3.3 billion by 2030 at a 5.2% CAGR (ACC, 2024). The Sustainable Packaging Initiative of the EPA has increased bio-based colorant demand by 26% since 2022, as 41% of producers are now meeting new recycling requirements. DOE investments of $1.9 billion in next-generation materials (2021-2025) have enhanced manufacturing efficiency by 19% for major players (DOE, 2023). The automotive industry accounts for 31% of demand, with lightweight polymer coloring expanding at 8% per year (OSHA, 2024).

Companies Dominating the Color Concentrates Market

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global color concentrates market is extremely consolidated, with Clariant, BASF, and Avient cumulatively owning 34% market share. Key players are investing in sustainable offerings, such as Clariant's EcoTain bio-based masterbatches and BASF's Ultramid Vision recyclable polymers. North American companies (Ampacet, Cabot) lead production, while Asian companies (DIC, Plastiblends) grow through cost-competitive pricing. Strategic purchases (e.g., Avient's acquisition of Clariant's masterbatch division) and R&D in high-performance pigments (e.g., Ferro's VITROX) are redefining the market. Sustainability requirements and custom concentrations for automotive/packaging are driving the growth.

Top 15 Global Color Concentrates Market (2024)

|

Company |

Country |

Market Share (2024) |

|

Clariant AG |

Switzerland |

12.5% |

|

BASF SE |

Germany |

11.8% |

|

Avient Corporation |

USA |

9.2% |

|

Ampacet Corporation |

USA |

8.7% |

|

Cabot Corporation |

USA |

7.5% |

|

PolyOne Corporation |

USA |

xx% |

|

DIC Corporation |

Japan |

xx% |

|

Huber Engineered Materials |

USA |

xx% |

|

Tosaf Compounds Ltd. |

Israel |

xx% |

|

Ferro Corporation |

USA |

xx% |

|

Sukano AG |

Switzerland |

xx% |

|

Colortech Inc. |

Australia |

xx% |

|

Plastiblends India Ltd. |

India |

xx% |

|

Penn Color, Inc. |

USA |

xx% |

|

Polyplastics Co., Ltd. |

Japan |

xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In March 2024, Clariant AG launched EcoTain BioVyn, a game-changing 60% renewable content bio-based masterbatch from sugarcane ethanol. The technology provides 20% more color strength efficiency compared to traditional options while remaining EU sustainability-compliant. With a potential contribution of €80 million per year in EMEA sales, the product has been embraced by leading consumer brands for sustainable packaging. The product ensures compliance with future EU Single-Use Plastics Directive revisions while retaining superior color performance.

- In January 2024, Avient Corporation introduced its Rejoi PCR Masterbatch Series, providing bright color solutions with 75% post-consumer recycled (PCR) content, an industry first. The series has a 40% lighter carbon footprint and the same performance as virgin-resin colorants, with quick adoption by large brands such as PepsiCo and P&G. In Q1 2024, it captured 15% of the packaging colorant market in North America and reached $45M in revenue. The development is consistent with increased sustainability legislation, such as the EU's Single-Use Plastics Directive.

- Report ID: 1149

- Published Date: Jun 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Color Concentrates Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert