Acid Orange Market Outlook:

Acid Orange Market size was over USD 223.32 million in 2025 and is poised to exceed USD 495.69 million by 2035, growing at over 8.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acid orange is estimated at USD 240 million.

The reason behind the growth is due to the growing production of chemicals across the globe. Between 2024 and 2031, the production chemicals market is expected to develop significantly since the production and consumption of chemicals play a significant role in worldwide employment, commerce, and economic growth. For instance, the output of chemicals is expected to increase globally at a rate of more than 2% annually.

The growing demand for water-soluble dyes is believed to fuel the acid orange market growth. Among the earliest water-soluble dyes water-soluble dyes, which are high-quality colorants that dissolve readily in water, are often used on fabrics including silk, wool, nylon, and modified acrylic fibers is Acid Orange 20 (also known as Orange I).

Key Acid Orange Market Insights Summary:

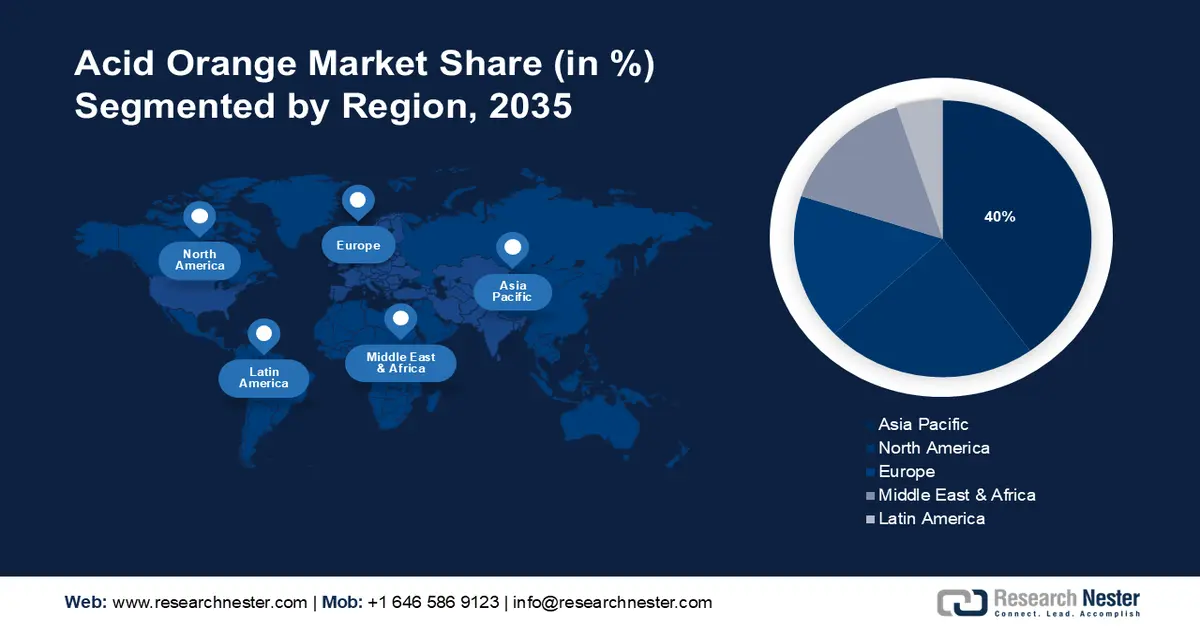

Regional Highlights:

- Asia Pacific industry is expected to hold a 40% share by 2035, impelled by the growing production of dyes.

- North America market is projected to secure the second-largest share by 2035, driven by rising personal disposable income.

Segment Insights:

- The soluble in water segment is projected to account for 66% share of the global acid orange market during the forecast period 2026–2035, owing to the growing demand for Acid Orange 7.

- The textiles segment is anticipated to capture a significant share by 2035, propelled by its ability to form strong bonds with fibers such as nylon, silk, and wool.

Key Growth Trends:

- Rising Demand in Paper Industry

- Growing Demand for Cosmetics

Major Challenges:

- Side effects of acid orange

- Stringent environmental regulations associated with the manufacturing of dyes

Key Players: Krishna Dyestuff Company, Aeromax Industries, MAGNIL DYE CHEM, Henan Tianfu Chemical Co., Sterling Pigments & Chemicals, Merck KGaA, MAGNIL DYE CHEM, Ciech S.A., Kanto Corporation, Megha International, MAYUR DYE CHEM.

Global Acid Orange Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 223.32 million

- 2026 Market Size: USD 240 million

- Projected Market Size: USD 495.69 million by 2035

- Growth Forecasts: 8.3%

Key Regional Dynamics:

- Largest Region:Asia Pacific (40% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, India, Japan

- Emerging Countries: Brazil, South Korea, Mexico, Indonesia, Turkey

Last updated on : 28 November, 2025

Acid Orange Market - Growth Drivers and Challenges

Growth Drivers

-

Rising Demand in Paper Industry - Acid Orange Dye has many applications, including paper coating, and molding powders, and also works well for coloring pulp and paper.

-

Growing Demand for Cosmetics- A synthetic pigment known as acid orange 7 is occasionally referred to as a monoazo color in general, which is utilized as a dye in semi-permanent hair coloring solutions, and as a direct hair coloring agent in both non-oxidative and oxidative hair dye formulations.

Challenges

-

Side effects of acid orange - A carcinogen and chronic irritant, Acid Orange 7 is one of the acidic azo dyes that harms skin and eyes since it is known that certain azo dyes can decompose generating hazardous aromatic amines. Moreover, owing to their poisonous or carcinogenic properties, acid dyes, which are commonly employed in the textile industry, may have negative consequences on both human health and the environment, which is expected to hamper the acid orange market growth in the coming years.

- Stringent environmental regulations associated with the manufacturing of dyes- Most industrialized nations have strict laws governing the handling of all known carcinogens, which has led almost all dye companies to stop producing these compounds since the metabolites of benzidine and 2-naphthylamine, rather than the colors themselves, caused bladder cancer in the workers who handled dyes based on these compounds.

- Fluctuating prices of raw materials may impact the production

Acid Orange Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 223.32 million |

|

Forecast Year Market Size (2035) |

USD 495.69 million |

|

Regional Scope |

|

Acid Orange Market Segmentation:

Solubility Segment Analysis

The soluble in water segment is predicted to account for 66% share of the global acid orange market during the forecast period. owing to the growing demand for acid orange 7. Red-yellow in water, Acid Orange 7 (Acid Orange II) dissolves in orange and is a type of acid dye that is soluble in water, enabling a strong connection to form with the fibers. Owing to its brilliant color, Acid Orange 7 is frequently used to dye leather, paper, and textiles, and it is also known to possess good light and wash fastness qualities, making it appropriate for a variety of uses such as an indicator in analytical chemistry.

Application Segment Analysis

The textiles segment in acid orange market is set to garner a notable share shortly. Anionic and water-soluble, acid orange dyes belong to a class of artificial acid dyes that yield orange to reddish-orange hues, which are frequently used to color fibers including nylon, silk, and wool. Acid orange is a synthetic dye with a vivid orange hue and the capacity to form a strong bond with many fabrics making it suitable for several applications. Acid Orange, often referred to as 2-naphthol orange, is created through the azo coupling of sulfanilic acid's diazonium derivative and β-naphthol which is applied for dying wool, and can also be used for both biological and leather dyeing.

Color Index Number (Acid Orange 3, Acid Orange 7, Acid Orange 10, Acid Orange 24, Acid Orange 67, Acid Orange 74, Acid Orange 80, Acid Orange 86)

The acid orange 7 segment in the acid orange market is poised to gain a noteworthy share. Acid Orange 7 belongs to the naphthalene family, which finds extensive application in the detergent, wool, paper printing, nylon, and cosmetic sectors, and can also be utilized for biological shading and indication purposes.

In addition, chemically, Acid Orange 24 is categorized as a disazo color, which is an analytical reagent that, when added to a sample, modifies and changes the sample's hue.

Our in-depth analysis of the global acid orange market includes the following segments:

|

Color Index Number |

|

|

Solubility |

|

|

Application |

|

|

Packaging |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acid Orange Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share of 40% by 2035, impelled by the growing production of dyes. China is the world's largest producer and exporter of textiles, and throughout the past ten years, the country's need for dyes and pigments has increased rapidly owing to the presence of plentiful plant resources in the country. For instance, China can supply the majority of the local market demand for dyes with over 500 different varieties of dyes. In addition, China has the greatest textile industry in the world, producing more textiles than any other nation, which may drive the demand for acid orange.

According to estimates, China manufactured over 2 billion meters of apparel fabric as of December 2023.

North American Market Insights

The North America acid orange market is estimated to be the second largest, during the forecast timeframe led by the growing personal disposable income. As a result, people in the region are spending more on cosmetic products and fashion products, leading to a higher demand for acid orange. For instance, the United States' disposable personal income rose by more than 0.1% in December 2023 compared to the same month the previous year.

Acid Orange Market Players:

- Vinayak Ingredients (India) Pvt. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tokyo Chemical Industry Co. Ltd.

- Shramik Chemicals

- Krishna Dyestuff Company

- Aeromax Industries

- MAGNIL DYE CHEM

- Henan Tianfu Chemical Co.,

- Sterling Pigments & Chemicals

- Merck KGaA

- MAGNIL DYE CHEM

- Ciech S.A.

- Kanto Corporation

- Megha International

- MAYUR DYE CHEM

- JD Orgochem Limited

- Asim Products

- Nitin Dye Chem Pvt. Ltd.

- Fuji Pigment Co., Ltd.

- Pola Inc.

Recent Developments

- JD Orgochem Limited engaged in the manufacturing and marketing of dye pigments, and dye intermediates announced the acquisition of Jaysynth Dyestuff (India) Limited and Jaysynth Impex Private Limited.

- IMCD Group announced the acquisition of Parkash Dye Chem one of the top wholesalers of specialty chemicals serving the coatings and construction segments.

- Report ID: 5877

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acid Orange Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.